Hmo Vs Ppo Vs Epo Vs Pos

Another factor to consider when it comes to how to get health insurance is the plan type. Here are the 4 most common types of plans:

- HMO: An HMO is a health maintenance organization. With an HMO, you choose a primary care doctor. If you need to see a specialist, you typically need to get a referral from your primary care provider. HMOs have a provider network. You may not be able to see providers outside of your network. If your plan allows you to see out-of-network providers, you will have to pay more.

- PPO: A PPO is a preferred provider organization. It allows you more flexibility than an HMO. You typically dont need a referral to see a specialist. You can see providers outside of the provider network, but you will pay a bit more.

- EPO: An EPO is an exclusive provider organization. It combines aspects of an HMO and a PPO. You have the more restrictive network associated with an HMO. If you see an out-of-network provider, you pay significantly more. You also have the freedom to see specialists without a referral.

- POS: A POS is a point-of-service plan. You can see any provider in your network without getting a referral. If you want to see an out-of-network provider, you do need a referral.

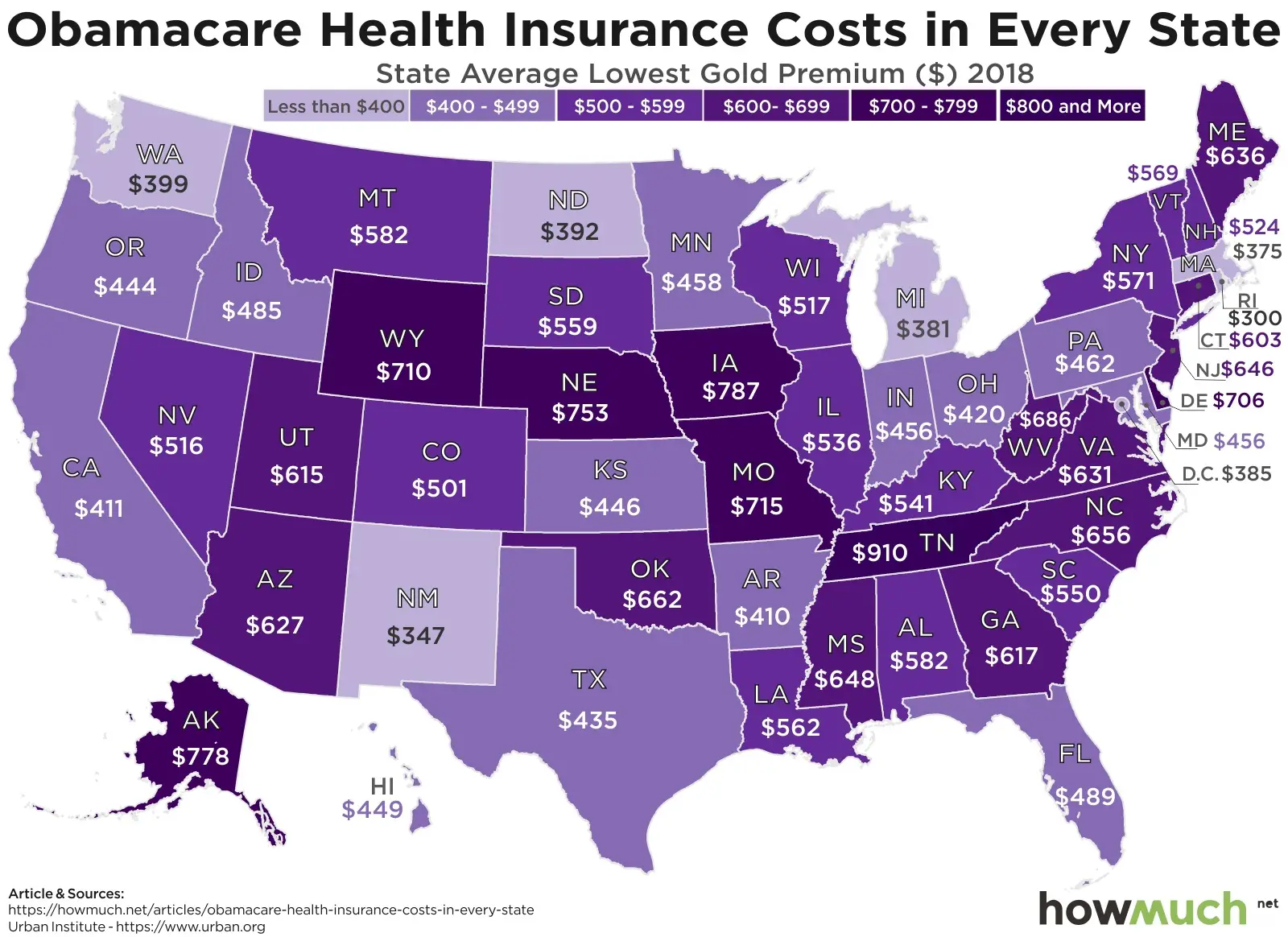

States With The Cheapest Obamacare In 2021

At $292 per year, Minnesota has the cheapest average benchmark premium in 2021.

Minnesotas premium is more than $150 less than the average national benchmark premium of $443 per month .

The five cheapest states for premiums in 2021 are:

- Minnesota: $292

- South Dakota: $575

In total, average premiums for health insurance throughout the country fell in 43 states in 2021.

The Urban Institute says that premiums tend to be lower in states with higher numbers of competing insurers, states that expanded Medicaid and adopted reinsurance, and those with less hospital consolidation.

Types Of Health Insurance Plans

When purchasing health insurance, your choices typically fall into one of three categories:

- Traditional fee-for-service health insurance plans are usually the most expensive choice. They offer the most flexibility in choosing health care providers.

- Health maintenance organizations offer lower co-payments and cover the costs of more preventive care. Your choice of health care providers is limited to those who are part of the plan.

- Preferred provider organizations offer lower co-payments like HMOs but give you more options when selecting a provider.

Read Also: Are Abortions Covered By Health Insurance

How To Save On Car Insurance

There are some standard guidelines for buying car insurance that will keep costs down. They include the following:

- Compare car insurance quotes at least once a year, and also if you move, buy a car, add or drop a driver, get married

- Maintain good credit

- Ask for discounts

- Choose a high deductible if you can afford to pay toward the repair of your car

- Don’t buy comprehensive and collision if your car is more than 10 years old or worth less than $3,000

Health Insurance Coverage For Multiple Years

TriTerm Medical Insurance,2 underwritten by Golden Rule Insurance Company, is short term health insurance that offers coverage for preventive care, doctor office visits, and prescriptions.

- Apply once for insurance coverage terms that equal one day less than 3 years.

- $2 million lifetime maximum benefit per covered person on most plans.

- Eligible expenses for preexisting conditions are covered after 12 months on the plan.

Also Check: Does Health Insurance Cover Breast Pumps

Finding Your Best Health Insurance Coverage In California

The best health insurance coverage for you will depend on the availability of plans in your county as well as your medical and financial situation. For example, California has approved expanded Medicaid coverage under the Affordable Care Act. Therefore, anyone with a household income below 138% of the federal poverty level would likely be better served by Medicaid.

When evaluating plans and your needs, you should carefully review the premiums and deductibles for private health insurance to determine what’s affordable. Typically, if you expect moderate to high medical costs, then choosing a higher metal tier plan with more expensive premiums but lower cost-sharing rates would make more financial sense.

Gold and Platinum: Best if you expect high medical costs

Platinum and Gold health plans are the highest tiers offered by the Covered California exchange. These policies have the highest premiums but come with lower deductibles and out-of-pocket maximums. Due to these lower limits, Gold and Platinum plans can be the most cost-effective for those with higher medical bills, as you would reach the deductible quickly and then have access to coinsurance through your provider.

Silver: Best for people with low income or average medical costs

On the other hand, if you know you will have high medical costs, then a Gold plan may be better.

Bronze: Best for young, healthy individuals

The 10 Worst States For Healthcare 2021

Here are the states that didnt fare as well in this years study, listed from the worst on up to the tenth-worst:

1. South Carolina

This was the second consecutive year South Carolina ranked as the worst state for healthcare, and the year before that it was next to last. South Carolina performed worse than the median state in six out of eight categories, including ranking second to last for child immunization.

2. Oklahoma

This is the third year for this study, and Oklahoma has been in the bottom ten all three years. With rankings among the bottom ten in five different categories, its easy to see why.

3. Alaska

With its extremely cold temperatures and far-flung population, Alaska faces special healthcare challenges. Not surprisingly then, its been among the bottom ten in all three years of this study. It ranks worst out of all states for both the amount of nursing care staff relative to its elderly population and health insurance affordability.

4. New Mexico

Healthcare staffing seems to be a particular problem in New Mexico. The state ranked 49th for both the level of nursing care staff relative to its elderly population and the level of doctors office staff relative to the overall population.

5. Texas

This state has the lowest percentage of health insurance coverage and performed worse than the median state in six other categories.

6. Georgia

7. Arizona

Bottom ten rankings in three categories were enough to drag Arizona into the bottom ten overall.

8. California

You May Like: What Causes Health Insurance Premiums To Increase

Health Insurance For Seniors Over 65

AARP acts as a nonprofit advocate for its members and one of the most powerful lobby groups in the United States.

It also sells no exam insurance for seniors over 65, investment funds, and other financial products. AARP has more than 35 million members, making it one of the largest membership organizations for people 50 and older in the United States.

Florida Dental And Vision Plans

Dental and vision insurance plans, underwritten by Golden Rule Insurance Company, have no age limit restrictions.4 They offer coverage for the dental and vision services many medical insurance plans dont include.

From Miami to Orlando, Tampa to Jacksonville, explore these Florida health insurance options and more that may be available now.

You May Like: How Much Is Travel Health Insurance

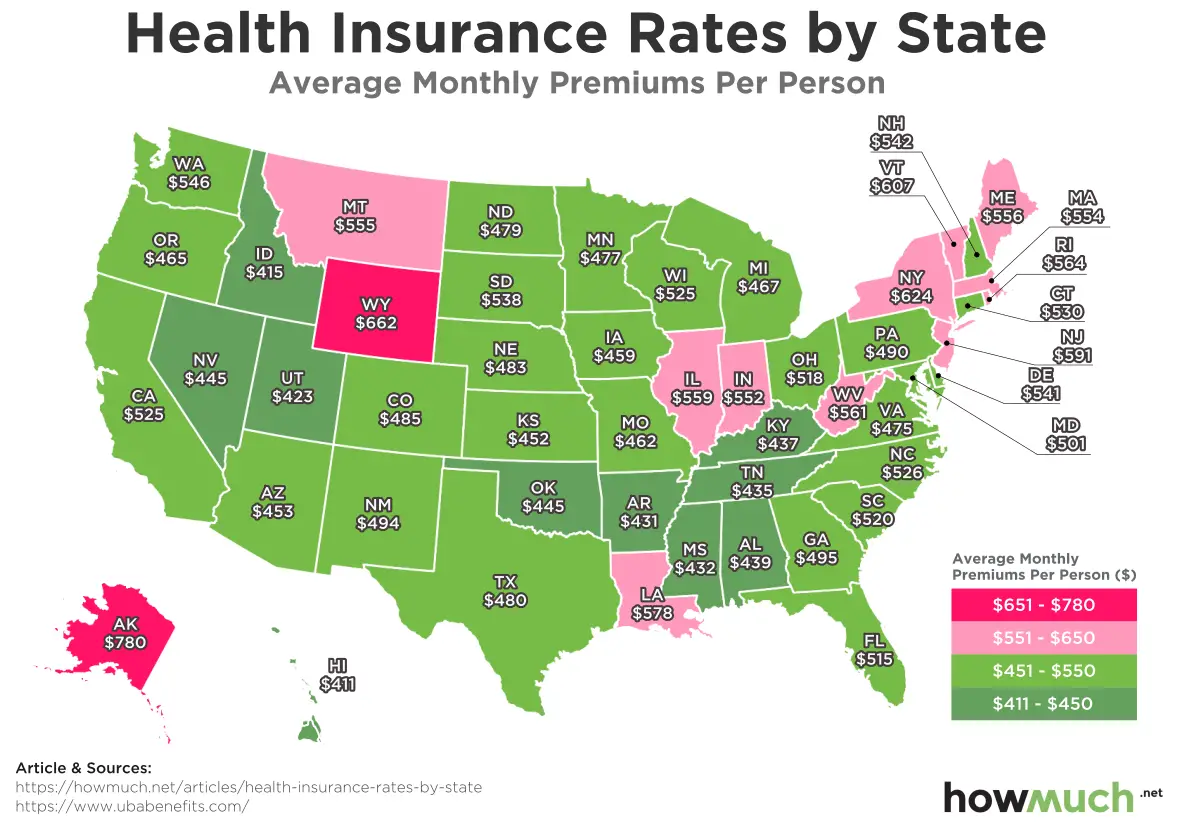

The 10 States With The Highest Health Insurance Costs

To find the states with the highest costs, GOBankingRates compared the lowest-cost plan at the ACA’s silver tier in each state. Comparing monthly premiums, deductibles and copays based on a single, 40-year-old, non-smoking male with an annual income of $40,000, the study highlighted the 10 states with the highest health insurance costs.

If you live in one of these states, you should expect to pay more each month for your insurance. Unfortunately, you’ll also be paying more for each doctor or emergency room visit, as the worst plans charge higher co-insurance rates and copays. Starting with the 10th-worst to the No. 1 worst state for health insurance costs, these are the states where residents pay more for coverage.

Where You Live Impacts Auto Insurance Rates

If youve ever purchased car insurance in more than one state, you know just how significantly the rates can vary. And its not just the state that impacts the cost of car insurance. Your specific zip code can also increase or decrease the amount of money you spend on coverage.

Why do car insurance rates fluctuate so much? Ultimately, its because drivers face certain risks based on where they live. The riskier the location, the more insurance companies charge for insurance. Risks include everything from the number of uninsured drivers in a state, to the crime rate in a certain neighborhood.

Don’t Miss: Where To Go To Apply For Health Insurance

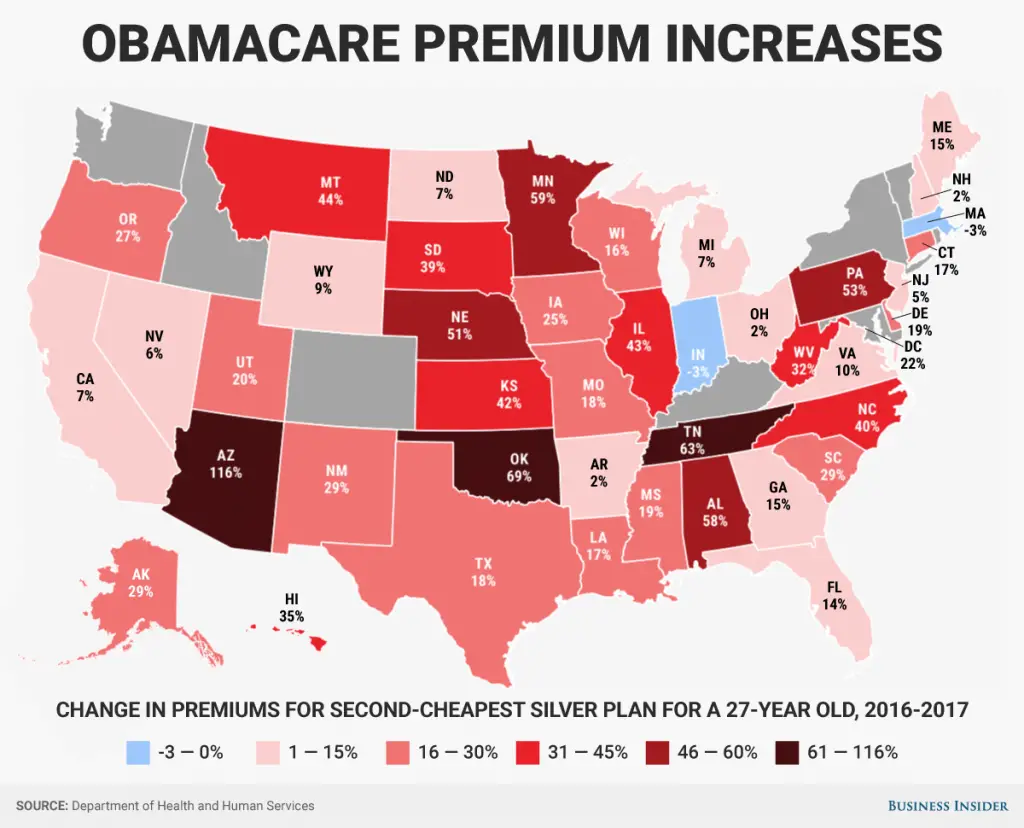

Premiums Shaped By Market Competition And Local Policies

Rising competition helped to slow premium growth.

In both 2020 and 2021, the Urban Institute says insurers boosted their participation in Marketplaces and added plans in new states.

The analysis shows the number of insurers participating in the Marketplace grew from 166 in 2017 to 224 in 2021.

State policy moves like reinsurance programs also helped to slow the rise in premiums, as did the expansion of Medicaid.

The effect of the COVID-19 pandemic on the Marketplace remains to be seen. But the Urban Institute says it left insurers with surpluses as Americans put off non-essential medical care.

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for

Recommended Reading: Is Eye Surgery Covered By Health Insurance

How To Change Car Insurance When Moving Out Of State

If youre moving out of state, you have two options for car insurance. You can either call your insurance company and ask to get a new policy written in your new state, or switch providers. Remember that even if you stay with your existing provider, your rate may increase.

Shopping around for a new provider can help keep the cost low. If you decide to switch, heres what to do:

- Collect the information youll need to switch providers, including your license, insurance history, annual mileage, and the names of other drivers who will be on your policy.

- Research providers in your new state, and pay attention to coverage options, discounts and customer service reviews.

- Get quotes from a few different companies to compare rates.

Choosing A Health Insurance Plan

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

Read Also: What Is The Best Health Insurance In Alabama

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

What Are The Cheapest States For Car Insurance

Everyone hopes they live in a state with cheap car insurance. Check to see if you live in the top 10 cheapest states for full coverage insurance:

In the U.S., the average cost among the top 10 least expensive states is about 30% lower than the national average. This means that car insurance in the 10 cheapest states is significantly more affordable, especially for people with a good driving history.

There are a few reasons why these states offer the least expensive car insurance. A few statesMaine, Vermont and North Dakotahave very few uninsured drivers, according to the Insurance Information Institute . Additionally, many of these states are located in regions that are not prone to severe weather, like hurricanes, which can easily damage a vehicle.

Don’t Miss: How To Become A Health Insurance Broker In California

Get The Best Rates On Health Insurance

We all know the symbolic features of Canada maple leaves, hockey, crimson-clad Mounties, and, of course, public healthcare. But just because Canadians enjoy basic health coverage, doesn’t mean they should rule out a private health insurance plan altogether. Make your health a priority and get insured. To get started, click the button above or send us an email at .

Regulating The Availability Of Coverage Options Outside The Aca Marketplaces

Health coverage that does not meet ACA consumer protection requirements is available outside of the marketplaces in many states. This coverage can take several forms, including short-term limited duration insurance, transitional plans, also referred to as grandmothered plans, and Farm Bureau health plans. Because these plans can refuse to sell coverage to people with pre-existing conditions and are not required to cover the ten essential health benefits, they are cheaper than plans that must meet these and other ACA requirements. The Trump administration and a number of states view this coverage as a more affordable alternative for some consumers, especially those who do not qualify for subsidies or who qualify for only limited subsidies in the marketplaces, and seek to make them more available. In contrast, other states view these plans as a threat to the stability of the marketplaces and the affordability of coverage for people with health conditions, and restrict their availability.

Availability of Alternative Coverage

State Regulation of Short-term and Grandmothered Plans

Figure 2: State Regulation of Non-ACA-Compliant Plans

Farm Bureau Plans

Also Check: How Much Do Health Insurance Agents Make

How Do I Choose The Best Affordable Health Insurance Company

The most affordable health insurance company primarily depends on where you live. Companies vary the plans that they offer by state, and thus it is important to start by finding the available companies in your region. Once you have this list, you can get quotes and compare the monthly premium, deductible and out-of-pocket maximum to choose the most affordable option.

Mapped: Average Homeowners Insurance Rates For Each State

If youre looking for ways to save money right now, you might start by looking at how much youre spending each year on homeowners insurance. According to our latest map, how much it costs for homeowners insurance depends entirely on where you live.

- The most expensive states for homeowners insurance tend to be located in Tornado Alley and along the Gulf Coast, led by Oklahoma with an average annual premium of $4,445, well over 60% higher than the national average.

- Hawaiians enjoy the cheapest rates for homeowners insurance at just $499 per year, thanks in large part to the relatively rare occurrences of insurable natural disasters.

- The Northeast and Northwest have below-average rates for insurance, including some states with major metro areas like New York, where it costs just $1,840.

- The national average is $2,305, but most people pay somewhere between $1,500 and $3,000 each year on homeowners insurance.

Don’t Miss: Can A Child Have 2 Health Insurance Plans

Can I Combine Health Plans

You can try mixing indemnity insurance, designed to pay a set daily benefit if youre hospitalized or in an accident, with a short-term medical plan that can let you get to the doctor a few times a year for more minor ailments.

In her former role as senior vice president of advisor services at Manning & Napier, Shelby George noticed people trying to rig these set-ups on their own, sometimes with poor results. They had to file every claim with all insurers so that every dollar could be recouped. That was complex, so the company rolled out combo plans with single insurers to make the claims process smoother.

Still, eHealth’s Nate Purpura notes that you have to take heed of two things when choosing health plans. Is the plan underwritten based on your health, or is it guaranteed issue so it must enroll you regardless of your age, health status, or other factors? What does the plan cover if you have to be hospitalized?

Always make sure you know what youre getting for what youre paying before choosing a health plan.

Best For Availability: Cigna

Some insurance companies can be a challenge to contact. They might only be available during business hours, which is when most of us work.

Cigna is available 24/7, which makes it easy to talk to someone when you need to. It also offers a user-friendly mobile app so that you can access your insurance info on the go. Cigna offers affordable copays and low-cost preventive care.

Don’t Miss: How Do You Get A Tax Credit For Health Insurance