No Aca Coverage Penalty

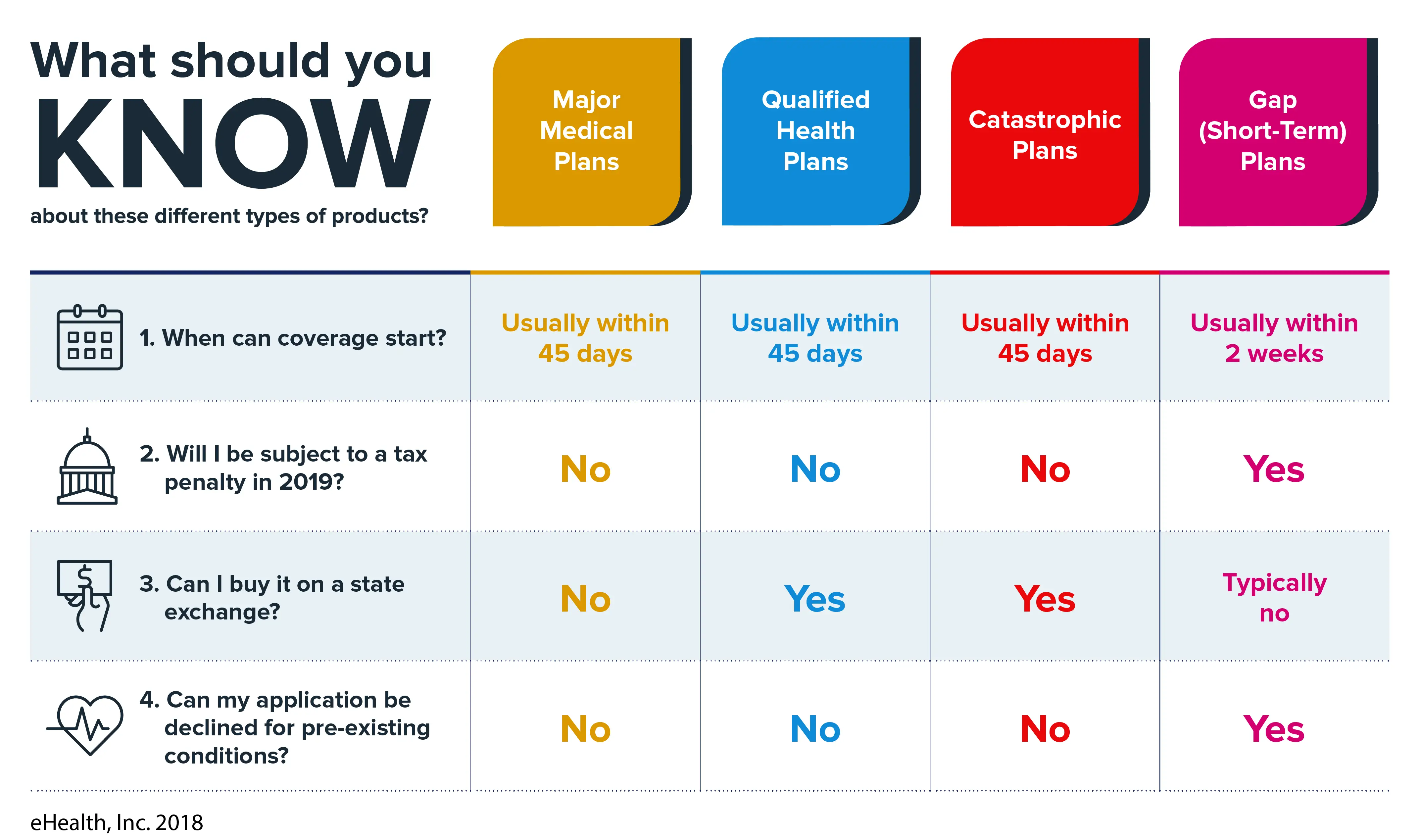

Short-term health plans are a legit health insurance option that has been around for years. But, unfortunately, these plans can be less attractive since the passage of the Affordable Care Act because these plans didnt satisfy the individual mandate. If you went too long without an ACA-compliant health care plan or have a qualifying exemption, you would pay a Shared Responsibility Payment fee on your federal tax return.

Federal lawmakers repealed the individual mandate starting with the 2019 tax year so you can have a short-term policy without worrying about an IRS penalty. While the federal government no longer requires having minimum health insurance coverage, your state may have a mandate. If so, having a short-term policy for too long can result in a fee.

What’s Important To Know About Short Term Medical Insurance Today

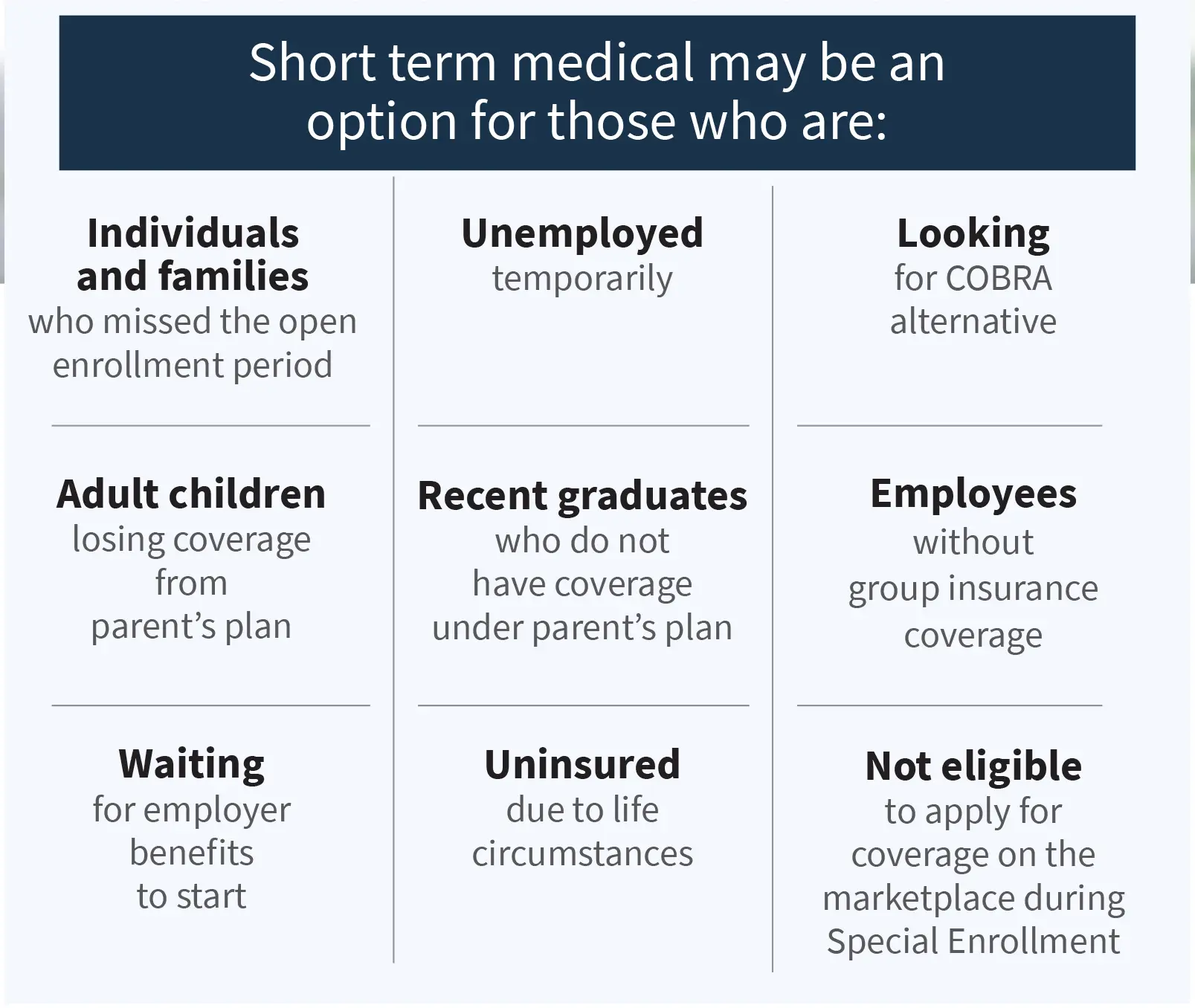

Short Term Medical Insurance is a great choice for many consumers, but there are certain elements to consider if youre looking into this type of plan.

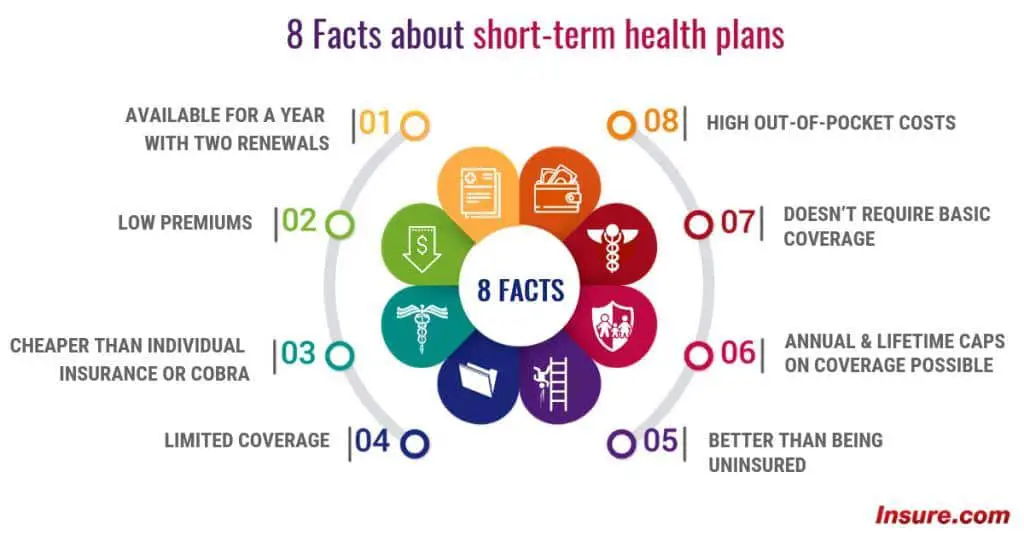

1. Temporary Health Insurance plans are not renewable. Instead, they require you to reapply if you wish to add another period of coverage.

Short Term Medical Insurance plans cannot be automatically renewed, and you will need to submit a new application.

2. You can be denied coverage due to pre-existing conditions.

Like medical insurance before the ACA, Temporary Health Insurance plans can deny your application based on your current and past health conditions. Insurers will often review up to five years of your health history.

3. Short Term Medical Care plans are not required to have the same coverage benefits as Affordable Care Act plans.

The Affordable Care Act established a very clear set of minimum coverage benefits called the 10 essential health benefits. Short Term Medical Insurance offers major medical type benefis, but does not cover all of the ACAs essential health benefits such as maternity or mental health.

As a result, the premiums for Temporary Medical Insurance are often significantly less expensive but still provide medical coverage for illnesses and injuries and include services such as emergency room, hospitalization, doctors, specialists, labs, and other important benefits.

4. You can cancel your policy anytime you want.

Who Qualifies For Short

To qualify for short-term health insurance, you will likely have to fill out a health questionnaire and you may need to disclose any pre-existing conditions, which can disqualify you from obtaining coverage with a temporary health insurance plan. You may also be disqualified by some insurance companies if you:

- are pregnant

- are currently insured under another policy

- are a man who weighs more than 300 pounds or a woman who weighs more than 250 pounds

- have been diagnosed with, or treated for, HIV or AIDS

- qualify for Medicaid

- aren’t a U.S citizen

Please note this is not an inclusive list of all reasons you may be disqualified for a short-term plan. Plan qualifications will vary based on the carrier.

Don’t Miss: Minnesotacare Premium Estimator

Denial Of Coverage To People With Pre

Short-term plans generally limit coverage of pre-existing conditions in two ways: by denying insurance altogether to people with pre-existing conditions, and by excluding coverage of pre-existing conditions for people who are offered a policy. By covering primarily people who are healthy at the time they apply, short-term plans have much lower claims costs than ACA-compliant plans and can charge substantially lower premiums.

We estimate conservatively that excluding coverage of pre-existing conditions results in 38% lower premiums relative to ACA-compliant plans.

You May Like: Starbucks Insurance Benefits

What Should I Do If I Am Not Eligible For A Short Term Plan

It is very easy to find out if you are eligible for short term health insurance, and the vast majority of consumers who apply for short term coverage are accepted for coverage. Short term health insurance applications generally have five to seven medical knock-out questions that determine eligibility, so it will take a minute or two to review and answer those questions. Insurance companies have different application requirements, so we recommend calling to speak with a licensed health insurance agent if you have questions regarding your eligibility.

Recommended Reading: Starbucks Part Time Health Insurance

Pros And Cons Of Short

Short-term medical insurance can be a good option when you need to fill a gap while waiting for other coverage, such as Medicare, to begin. Short-term insurance is not meant to be your sole insurance over the long term or to cover you for extended periods.

Pros

- Less coverage compared to full-benefit plans such as individual or employer health insurance

- Although premiums are generally low, deductibles and coinsurance can be high

When comparing temporary plans, carefully review the benefits and plan details to ensure you are getting the coverage you need.

Best For Longest Policy Options: Unitedhealthcare

UnitedHealthcare

- Coverage Limit : $500,000 to $2 million

- No. States Available: 24

UnitedHealthcare was our top choice for the longest policy options because it is the only provider with up-to-36-month coverage where allowable by state law.

-

Up to three-year policy available

-

$5,000 prescription coverage available

-

Preventive care wellness checks covered

-

Some pre-existing conditions covered after 12 months

-

Issue ages 19 to 65

-

Reduced out-of-network coverage that can vary

-

Required to join FACT in some plans

-

Only available in 24 states

UnitedHealthcare underwrites its policies through Golden Rule Insurance Company, a part of UnitedHealthcare since 2003. The company has been selling short-term health insurance for over 30 years, and policies are available in 24 states. UnitedHealthcare has a Moodys insurer financial strength rating of A1.

You can request a quote on United’s website to see what they would charge in your case. In some states, you must join the Federation of American Consumers and Travelers , and there will be an additional charge of $4 per month as a result. The FACT is a consumer organization that provides savings to members on 20 different benefits and coverages. The length of policies varies from one month to 12 months, with options to renew up to 36 months on the TriTerm Medical plan.

Also Check: Does Uber Offer Health Insurance

Is Preventive Care Covered Under Short Term Health Insurance

Unlike health plans governed by the Affordable Care Act, short-term health plans decide what they will and wont cover. You may find one short-term plan that covers some preventive care, while another plan doesnt.

Its vital that you read the fine print before signing up for short-term health insurance to know exactly what the plan will cover.

That puts more pressure on the consumer to determine whether a particular short-term health plan is a wise choice.

Is Short Term Health Insurance Available For Families

Yes, you can sign up for family coverage with a short-term health plan.

However, remember that short-term health insurance has limited coverage. You may not be able to find a plan with mental health, prescription drug and maternity care, which means you would have to pay for all of the costs for that care.

Short-term plans can also exclude pre-existing conditions.

So, you want to review your familys health history, prescriptions, likely doctor visits and what a short-term plan would cover before signing up for one.

Read Also: Starbucks Open Enrollment

Some Other Weird Things

There may be other strange rules. A review of some plan documents from Families USA found an Illinois plan that would cover only hospitalizations beginning during the week inpatient stays that began on the weekend would not be allowed except in rare circumstances.

Some plans had waiting periods for care. Cancer treatment, for example, is not covered in certain plans during the first month a person is enrolled in a plan, and no treatment for illness is covered in the first five days. Thats the kind of detail that might be easy to overlook when signing up for a plan if you arent expecting a cancer diagnosis.

I would encourage someone who is looking for coverage just for a catastrophic need to really read the fine print, said Claire McAndrew, the director of campaigns and partnerships at Families USA. They often contain complicated exclusions that your average consumer could never predict.

What Is Disability Insurance

Someone once said if youre not sure where to start, start at the beginning. And its a good thing to know what disability insurance is before getting into the nitty-gritty of the costs.

Simply put, disability insurance replaces your lost income due to a disability, illness or injury, normally covering between 40% and 70% of your salary. There are several different types of disability insurance that may apply to you, like:

Government-backed disability programs:

- Social Security Disability Insurance: This is offered by the federal government and is a federally funded disability benefits program. Sounds like a big deal doesn’t it?

- State disability programs: State disability programs are in just a few states across the country and offer temporary disability insurance.

For this article, though, everything will be focused on individual short-term disability insurance, the kind you get outside of your employer that can last up to twelve months.

Save on Disability Income Insurance

Our independent agents shop around to find you the best coverage.

Also Check: Does Starbucks Offer Health Insurance

Pediatric Dental Benefits In Idaho

The stand-alone pediatric dental plans available in Idaho will comply with the ACAs pediatric dental coverage rules. This means out-of-pocket costs for pediatric dental care will not exceed $375 per child in 2022 , and there is no cap on medically-necessary pediatric dental benefits.

As is the case for all essential health benefits, the specific coverage requirements for pediatric dental care are guided by the states essential health benefits benchmark plan.

You can see details here for the Idaho benchmark plan, which does include coverage for both basic and major dental services for children.

Best For Longest Policy Options: United Healthcare/golden Rule Insurance

United Healthcare

Why We Chose It: As the only provider that offers 36-month coverage , UnitedHealthcare won top choice for the longest policy options.

-

Up to three-year policy available in some states

-

$3,000 prescription coverage available

-

Preventative care wellness checks covered

-

Some pre-existing conditions may be covered after 12 months

-

May need to purchase supplemental insurance to cover accidents and critical illness

-

TriTerm only available in 18 states

-

Reduced out-of-network coverage that can vary

-

May be required to join FACT

UnitedHealthcare underwrites its policies through Golden Rule Insurance Company, a part of UnitedHealthcare since 2003. The company has been selling short-term health insurance for over 30 years, and policies are available in 24 states. UnitedHealthcare has a Moodys insurer financial strength rating of A1.

Quotes and comparisons are easily available on the UnitedHealthcare website. In some states, you must join a consumer organization, the Federation of American Consumers and Travelers , for an additional $4 per month charge. Policies vary in length from one month to 12 months, with the option for 36 months on the TriTerm Medical plan that is available in 18 states.

Some STM plans cover 100% of medical costs once you meet the deductible or there are options where you pay 20%, 30%, or 40% coinsurance until you reach the annual maximum. You can also add prescription coverage.

Read Also: Starbucks Insurance For Part Time Employees

Dental Insurance In Idaho

Idaho uses a state-run health insurance marketplace called Your Health Idaho for the sale of certified individual/family dental plans.

Not all insurers who offer medical plans through the Idaho exchange include dental coverage with their health plans, but stand-alone dental plans are available for purchase that cover both adults and children.

Short Term Health Plans Vs Aca Health Plans

Short term plans were created to help fill temporary gaps in coverage that can occur in certain situations. These types of plans are typically not good substitutes for traditional health plans. They do not have to adhere to ACA standards. They provide limited benefits with generally much higher costs.

ACA health plans, on the other hand, must provide certain types of coverage as mandated by the government. They must offer coverage for essential health benefits like maternity and preventive care at 100%, mental health and substance use benefits, and more. Before you decide to purchase a short term health plan, make sure you fully understand what types of care and services are covered and not covered. Read the exclusions and limitations information carefully.

You May Like: What Benefits Does Starbucks Offer Employees

Youll Still Owe The Penalty For Buying One In 2018

Short-term plans are not considered qualifying health plans under the Affordable Care Act. That means youll still owe the penalty for going uninsured if you buy one this year, unless you qualify for a limited number of exemptions. That penalty is $695 for each adult and $347.50 for each child without insurance. The fee is capped at $2,085 per family, or 2.5% of your family income in excess of tax filing thresholds, whichever is higher.

However, this math changes in 2019, when the tax penalty goes away. . Today, you have to add the cost of the penalty to the overall bill for a short-term plan to compare its price to Obamacare coverage, but starting next year you wont.

Important Benefits Of Short Term Medical Insurance:

Read Also: Does Insurance Cover Chiropractic

Unitedhealthcare: Best Overall Plan

Insurer details

- AM Best financial strength rating: A+

- NAIC complaint index: 1.13

- Unique value: UHC provides multiple plan options, flexible term lengths and a large health network.

UnitedHealthcare short-term health insurance is the best option if you are looking for multiple plan choices that offer benefits not always found in short-term plans, such as preventive care and optional dental coverage where available. While some UHC plans restrict your care to network health care providers, UHC has a sizable network of more than 1.4 million medical providers and 6,500 hospitals.

Short-term policies offered by UHC are underwritten through a subsidiary, Golden Rule Insurance Co. Both companies have strong financial strength ratings, meaning they have a high ability to pay out policy claims.

Pros

- Option to cancel coverage with no penalty

- Dental add-on coverage available depending on your state

- Coverage for preventive care

- Multiple plan options with varied cost-sharing and coverage levels

Cons

- Only available in 24 states

- Level of out-of-network coverage can vary by plan

- Limited to ages 19 to 65

Why Is Individual Short

Well, because accidents happen and no one ever expects the unexpected. It’s safe to say that the majority of folks out there depend on their income to maintain their lives. And if you can’t work due to a disability or illness, you still need some sort of cash to come in, because those bills aren’t going to just go away.

With disability insurance, a percentage of your salary is paid out to you to serve as income replacement and keep those bills at bay.

So really any disability insurance is important to have. Many employers offer some sort of group disability, but there are often holes in coverage and limitations, which is why an individual policy should often enter the mix, to help keep you going strong.

Of course, many who have group disability don’t know about their potential coverage gaps and just assume it’s good enough, but an independent insurance agent can take a look at your existing coverage and help find you the right mix of protection to prep for the unthinkable.

Another important factor to consider is if you have long-term disability insurance, there’s what’s called an elimination period, which is the time between the injury or diagnosis and your payout. In some cases, it can be a few months before you’re paid out any sort of money for bills.

This is where a short-term policy can help close up that period where you aren’t bringing in any money.

Read Also: Asares Advanced Fingerprint Solutions

Ways To Reduce The Cost Of Short

- Through employers’ programs: Short-term disability insurance is often best through your employer, because it’s typically free or for a low cost. Just know, with your employer, you only get one choice. With an independent insurance agent, you can shop multiple carriers at once to find the coverage and price that’s right for you.

- Reduced coverage: Reducing the policys benefits coverage, extending the elimination period, and shortening the benefit period can help reduce your STDI premiums.

- Purchase a policy earlier: The younger you are when you purchase an STDI policy, the more likely it is that your premiums will be lower than if you purchase it in later years.

What Does Short Term Health Insurance Usually Cover

Short-term plan benefits vary from plan to plan. Its likely that a short term plan will cover some healthcare costs related to emergencies, but wont provide the same level of coverage as an ACA-compliant plan. Additionally, you will not need a referral to see a specialist.

Unlike ACA plans, short term plans can deny you coveragebased on your health or preexisting conditions. Additionally, if you have ashort term plan and you receive care for a preexisting condition your plan maynot cover that care. You may find that you will have to pay more for coveragethrough a short term medical insurance plan.Therealso may be a cap on how much a short term medical insurance plan will coverannually or in your lifetime. For instance, if your plan covershospitalizations but only u to $5,000 you may have to pay for the rest of yourin hospital care out-of-pocket.

Also Check: Do Substitute Teachers Get Health Insurance