How Much Does Health Insurance Cost Per Month In Each State

The national average health insurance premium for a benchmark plan in 2021 is $452, according to the Kaiser Family Foundation. A benchmark plan is the average premium for each states second lowest cost silver plan.

The following data reflects the national average, and each states average, but does not include any reduction in cost from subsidies. Rates will vary by area.

Health Insurance In Alberta Cost: Explained

Canada spent 11.4 percent of the total Gross Domestic Production health care in 2009. This put it on the higher end of the OECD countries. This likely has to do with the lower unit cost of health care in this country.

On average, $1,200 is paid for an MRI in the US, while in Canada it costs $824. It also has to do with the lower administrative costs. For example, Alberta doctors spent approximately $22,205 annually dealing with single payer agencies, compared to $82,975 spent by American doctors dealing with the private insurance companies, Medicaid and Medicare.

Average Monthly Obamacare Premiums Per State

While $612 was the national average monthly premium for ACA plans, its important to understand that the majority of people enrolled get subsidies in the form of advance premium tax credits .

The table below shows the state-by-state average premium for Obamacare plans in 2019, the most recent year for which data is available. It also gives the average monthly premium after the average advance premium tax credit is applied, as well as the average monthly premium after APTC for consumers who received an APTC.

| Obamacare Average Premiums for 2019 |

|---|

| Location |

| $62 |

Recommended Reading: Can A Significant Other Be Added To Health Insurance

Buying Your Own Health Insurance Just Got A Lot Less Expensive

If youve already bought a plan on Healthcare.gov, or you didnt because it was too pricey, act now to save money.

Last month, hundreds of millions of Americans got a cash infusion from the government as part of the American Rescue Plan.

But starting this month, another part of that law could have an even bigger effect on the wallets of tens of millions of Americans.

Thats because starting April 1, the law makes health insurance much less expensive for people who dont get it from their job, Medicare, Medicaid, or military and veterans programs.

The program, which will last through 2022, increases the financial help thats available to people who buy their own insurance through the national Marketplace at Healthcare.gov.

That includes both people who already bought a plan for this year, and people who dont have insurance right now.

That means the monthly premium for a particular plan will be lower than before for many people, much, much lower. Or, you might be able to get an even better insurance plan for what a lower-level one used to cost.

And thats on top of the fact that having health insurance can save you hundreds or thousands of dollars if you get sick or injured.

The Open Enrollment period for anyone who wants to take change or choose their plan through Healthcare.gov for this year runs through August 15. Changes to cost and coverage take effect soon after approval. You will still have to pay any co-pays, co-insurance and deductibles that a plan has.

What Is Individual Health Insurance

While many people get their health insurance through a group plan sponsored by their employer or union, others buy it themselves. If you are buying your own health insurance, you are purchasing an individual plan, even if you include family members on the plan. If this sounds like what you need, let eHealth show you all of your individual and family health insurance options, and use our free quote comparison tool to find an affordable plan that meets your needs.

Asa result of the Affordable Care Act , people can purchase individualhealth insurance through a government exchange or marketplace , or they can buy health insurance from privateinsurers. You may be restricted to purchasing health insurance through agovernment exchange to certain times of the year. Usually you can purchasehealth coverage from a private insurance company anytime.

ACAplans are a good starting place to understanding individual health insuranceoptions. ACA health plans are categorized by metals. You can learn more aboutthe metallic plans: Bronze, Silver, Gold, and Platinum.

Read Also: Who Qualifies For Health Insurance Subsidies

Medicare Advantage And Part D Commissions

Medicare Advantage commissions are paid per application. Initial commissions and renewal commissions are how they get it. Typically, both Medicare Advantage commissions and Medicare Part D plan commission payments are paid one year in advance.

In other words, the companies pay the full years commission upfront.

When an agent creates a new sale or the beneficiary enrolls in a new, unlike plan, carriers payout first commissions .

Carriers pay renewal commissions to insurance agents every year and beyond if the beneficiary remains enrolled in the plan or enrolls in a new, similar plan .

The maximum broker compensation for Medicare Advantage in 2022 will be $715 for original sales and $358 for renewals.

According to the PDP, the nationwide maximum broker compensation for original sales in 2022 is $87 and $44 for renewals.

Keep in mind that you may be eligible for commissions on both the MA and PDP plan types if you sell a Medicare MSA plan!

The Centers for Medicare & Medicaid Services establishes yearly maximum broker commissions for Medicare Advantage and Medicare Part D, but insurance companies are not compelled to pay these amounts.

The amount you receive from Medicare Advantage and PDP sales may depend less on the carrier and your contract with them.

How Much Does An Insurance Agent Make From Medicare Products

How much an insurance agent makes on Medicare sales depends not only on how many beneficiaries you enrolled, take the following into consideration.

- Ad cost

- AHIP Certification

With the right strategy and FMO agency like Team Alvarez giving you admin support, leads, and training, selling Medicare products is a very rewarding business model.

Generally, insurance agents often earn two types of commissions when selling Medicare plans: A dollar amount per application or a percentage of the premium sold .

Recommended Reading: Where To Shop For Health Insurance

How Does The Size Of My Family Impact My Insurance Cost

Who is this for?

If you purchase your own health coverage, this explains how the number of people covered by your insurance affects your monthly payment and other costs.

The size of your family doesn’t necessarily determine what you spend on doctors and prescriptions. A healthy family of six could spend less than a married couple with chronic conditions. But when it comes to your health insurance costs, the number of people on a plan does affect what you pay. We’ll show you how.

Coinsurance And The Metal Tiers

Your coinsurance percentage depends on the details of your individual insurance policy. If you got a plan through the, then your plan falls into one of four tiers â Bronze, Silver, Gold, Platinum. These are called the metal tiers. The tier a plan falls into depends on how the insurer will split all costs with you, which isnât the same as your coinsurance split.

With aBronze plan, for example, insurers cover an average of 60% of your medical costs, leaving you to pay 40%. The 60/40 cost sharing factors in copays, coinsurance, and the costs you will pay before and after hitting your deductible. So the average cost-sharing value for the tier of your insurance plan may not be the same as your coinsurance percentage. In fact, itâs possible to have a plan with 0% coinsurance, meaning you pay 0% of health care costs, or even 100% coinsurance, which means you have to pay 100% of the costs.

Further reading: How metal tiers work

The following table lists the general cost-sharing percentages for each of the metal tiers. Bronze plans require you to pay the most while the Platinum plans require you to pay the least. At the same time, Bronze plans usually have the lowest monthly premiums and Platinum plans usually have the highest premiums.

| METAL TIER |

|---|

Also Check: Is Health Insurance Really Worth It

Health Insurance For $10 Or Less A Month You May Qualify For New Discounts

If you have a chronic medical condition or are simply more risk averse, you might instead choose a plan that has dialed up the amount of the premium. You’ll be forking over quite a bit more than for the other plan every month, but your costs will be more predictable you’ll likely have a lower deductible and lower coinsurance rate. That way, you can go to a lot of appointments and pick up a lot of prescriptions and still have manageable monthly costs.

Which plans are available and affordable to you will vary a lot depending on where you live, your income and who’s in your household and on your insurance policy. With the pandemic, Congress passed new temporary funding to cover more out-of-pocket costs for people depending on your income, you may qualify for plans with premiums of $10 or less per month on HealthCare.gov or onyour state’s ACA insurance exchange.

How To Choose Your Premium And Deductible

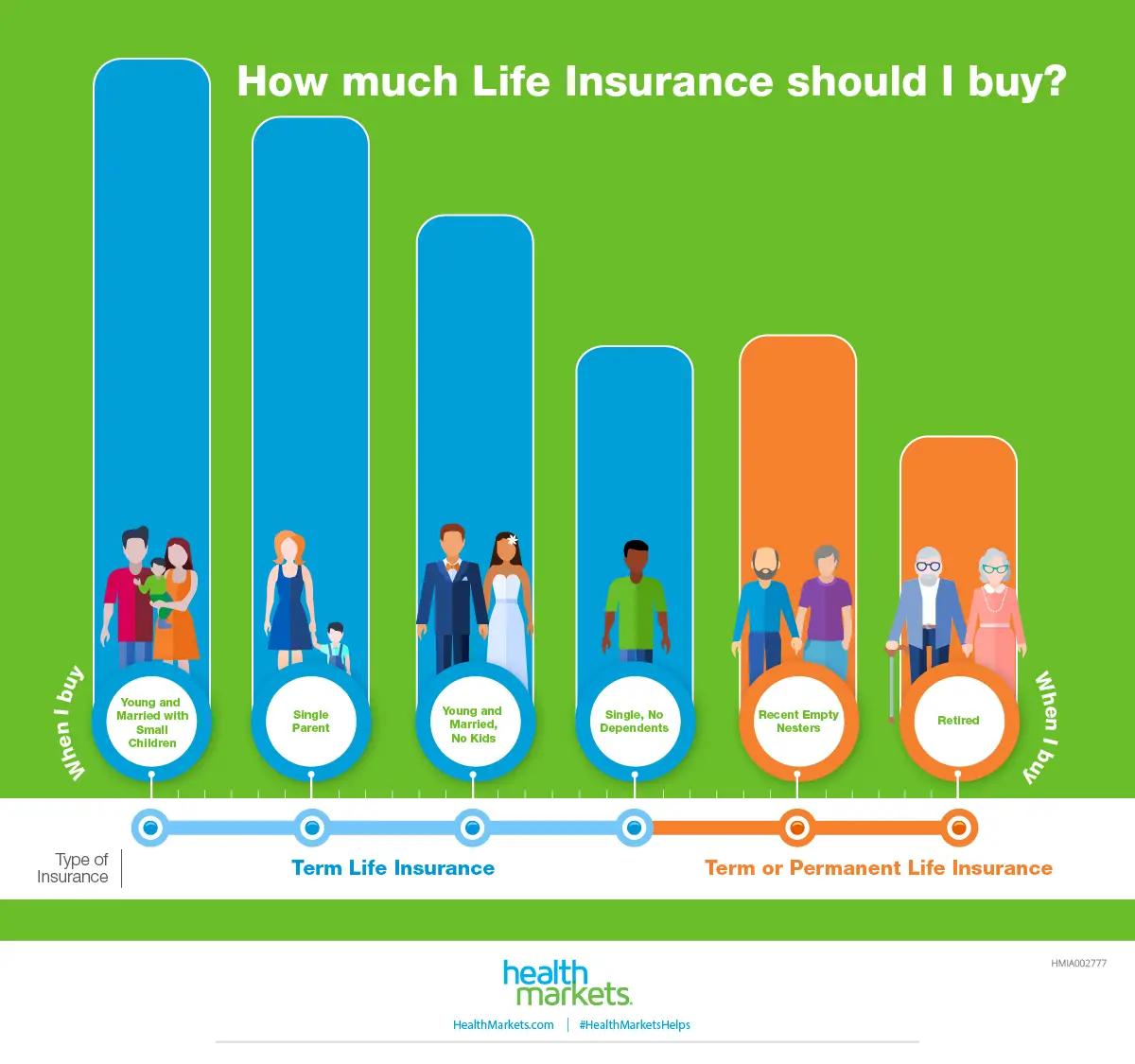

Premiums and deductibles work together. Plans with higher deductibles usually have lower premiums, while plans with lower deductibles often have higher premiums. One thing to consider when choosing a plan is how much you think you will use your insurance.

- I will use my insurance often: Do you have small children? Or do you or a family member get sick often or have an ongoing illness or disability? If you think you’ll need to see doctors regularly, you may want to consider a plan with a higher premium and lower deductible. You’ll pay more each month, but you’ll also meet your deductible faster which means lower total out-of-pocket costs.

- I will not use my insurance often: If you’re healthy and don’t go to the doctor often, you may want to consider a plan with a lower monthly premium and higher deductible. If you don’t think you will meet your deductible with the amount of health care services you may use, a lower premium may be the best way to keep your overall annual costs down.

Don’t Miss: What Does Health Insurance Cost For An Individual

Small Business Health Insurance Requirements

Small business owners do not have to provide health insurance benefits to employees. Should they choose to do so, they must meet certain requirements set by the ACA below. These requirements can vary by state.

- Inclusivity: Health insurance must be offered to all employeesnot just managers or any other subgroup.

- Coverage of essential health benefits: Under the ACA, a health plan offered by a small business owner must include coverage for basics, such as emergency services, pregnancy-related care and services, maternity and newborn care, outpatient care, prescription drugs and more.

- Minimum contribution: The ACA requires small businesses to contribute at least 50% of the monthly premium cost of the plans they offer to qualify for the Small Business Health Care Tax Credit, says Jugan, and states have their own variations of this rule. New Jersey, for instance, requires small business owners to pay at least 10% of the total cost of the plan. The less an employer pays, the more the employee has to pay, notes Jugan, which can be a downside for some workers, who may decide to seek another job with a less expensive health plan.

Excess Administrative Costs Burden The Us Health Care System

Anyone interacting with the U.S. health care system is bound to encounter examples of unnecessary administrative complexityfrom filling out duplicative intake forms to transferring medical records between providers to sorting out insurance bills. This administrative complexity, with its associated high costs, is often cited as one reason the United States spends double the amount per capita on health care compared with other high-income countries even though utilization rates are similar.1

Each year, health care payers and providers in the United States spend about $496 billion on billing and insurance-related costs, according to Center for American Progress estimates presented in this issue brief. As health care costs continue to rise, a logical starting point for potential savings is addressing waste. A 2010 report by the National Academy of Medicine estimated that the United States spends about twice as much as necessary on BIR costs.2 That administrative excess currently amounts to $248 billion annually, according to CAPs calculations.

Read Also: How To Get Health Insurance As A Real Estate Agent

Other Factors That Can Affect The Premiums

As discussed above are the factors that can affect the premiums. Heres an understanding of them.

- Federal & state laws dictate the coverage of health insurance. This also includes the amount the insurers will charge.

- This is whether you have purchased it on your own or insured a group plan to be paid by an employer.

- Your income. You will pay more if you belong to a low-wage worker. This is through the employers. You may still pay less by a state or federal exchange because of subsidies.

- The size of your employer. Insurance is often cheaper with most large companies.

- The state that you are residing.

- The county of your residence. Other counties have only a single plan. Others also have lots of competition. These will help in reducing the prices.

- The plan type to choose. The provider organizations preferred including the platinum plants under the federal health insurance are more likely to cost.

- Your age. If youre an older individual, youll have to pay three times or more.

- Your use of tobacco. The premiums to pay can reach 50% more.

How To Get Health Insurance For A Small Business

You have several options when it comes to searching for the right plan options for your small business:

- Do your own footwork. Small business owners can sort through options from different insurance companies to compare prices and services and enroll in a plan that meets their needs. Most health insurance companies offer a number of plans for small businesses. By plugging a minimal amount of information into forms on their websites , you can see plan choices and costs.

- Work with an insurance broker. Insurance brokers know the ins and outs of health insurance plans, as well as state and federal requirements. We can compare the plans and figure it all out for you, says Jugan. Its an administrative burden and we can alleviate that. Insurance is complicated, and a lot of small business owners dont want to think about it. He adds that you dont pay any fees for using insurance brokers, as their costs are covered by insurance companies. Just be sure youre working with an independent or agnostic broker who will show you all plans available to you to best meet your needs.

- Explore the SHOP Marketplace at healthcare.gov for expert guidance, helpful calculation tools and clear choices for high-quality group insurance plans.

Don’t Miss: What Is Employer Group Health Insurance

How Us Health Insurance Works

Health care in the United States can be very expensive. A single doctors office visit may cost several hundred dollars and an average three-day hospital stay can run tens of thousands of dollars depending on the type of care provided. Most of us could not afford to pay such large sums if we get sick, especially since we dont know when we might become ill or injured or how much care we might need. Health insurance offers a way to reduce such costs to more reasonable amounts.

The way it typically works is that the consumer pays an up front premium to a health insurance company and that payment allows you to share “risk” with lots of other people who are making similar payments. Since most people are healthy most of the time, the premium dollars paid to the insurance company can be used to cover the expenses of the small number of enrollees who get sick or are injured. Insurance companies, as you can imagine, have studied risk extensively, and their goal is to collect enough premium to cover medical costs of the enrollees. There are many, many different types of health insurance plans in the U.S. and many different rules and arrangements regarding care.

Following are three important questions you should ask when making a decision about the health insurance that will work best for you:

How Much Do You Pay For Health Insurance Reddit 5 Awesome Tips

How much do you pay for health insurance Reddit? Its answerable by $456 on the average just for an individual & $1,152 for a family every month.

The cost still would differ considering the different health plan selections. Itll be better to understand the relationship between the cost and the health coverage. This is to end up with the right health insurance needed.

Nonetheless, other factors can impact the amount to pay for health insurance. Lets explore more below for your understanding. But be ready since these factors may not fall within your control. Here is essential information on the cost of health insurance & more.

Also Check: How Much Is Temporary Health Insurance

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for