Gaining Access To A Qsehra Or Individual Coverage Hra

This is a new special enrollment period that became available in 2020, under the terms of the Trump Administrationss new rules for health reimbursement arrangements that reimburse employees for individual market coverage. QSEHRAs became available in 2017 and allow small employers to reimburse employees for the cost of individual market coverage . But prior to 2020, there was no special enrollment period for people who gained access to a QSEHRA.

As of 2020, the Trump administrations new guidelines allow employers of any size to reimburse employees for the cost of individual market coverage. And the new rules also add a special enrollment period listed at 45 CFR 155.420 for people who become eligible for a QSEHRA benefit or an Individual Coverage HRA benefit.

This includes people who are newly eligible for the benefit, as well as people who were offered the option in prior years but either didnt take it or took it temporarily. In other words, anyone who is transitioning to QSEHRA or Individual Coverage HRA benefits regardless of their prior coverage has access to a special enrollment period during which they can select an individual market plan , on-exchange or outside the exchange.

This special enrollment period is available starting 60 days before the QSEHRA or Individual Coverage HRA benefit takes effect, in order to allow people time to enroll in an individual market plan that will be effective on the day that the QSEHRA or Individual Coverage HRA takes effect.

If The Employer Has 20 Or More Employees

As long as you have group health insurance from an employer for which you or your spouse actively works after you turn 65, you can delay enrolling in Medicare until the employment ends or the coverage stops , without incurring any late penalties if you enroll later. When the employer-tied coverage ends, youre entitled to a special enrollment period of up to eight months to sign up for Medicare.

Note that “active employment” is the key phrase here. You cant delay Medicare enrollment without penalty if your employer-sponsored coverage comes from retiree benefits or COBRA by definition, these do not count as active employment.

Nor does it count if you work beyond 65 but rely on retiree benefits from a former employer. You must be actively working for the employer that currently provides your health insurance in order to delay Medicare enrollment and qualify for a special enrollment period later on.

The law requires a large employer one with at least 20 employees to offer you the same benefits that it offers to younger employees . It is entirely your choice whether to:

- accept the employer health plan and delay Medicare enrollment

- have the employer coverage and Medicare at the same time

How To Enroll And Get Answers To Your Questions

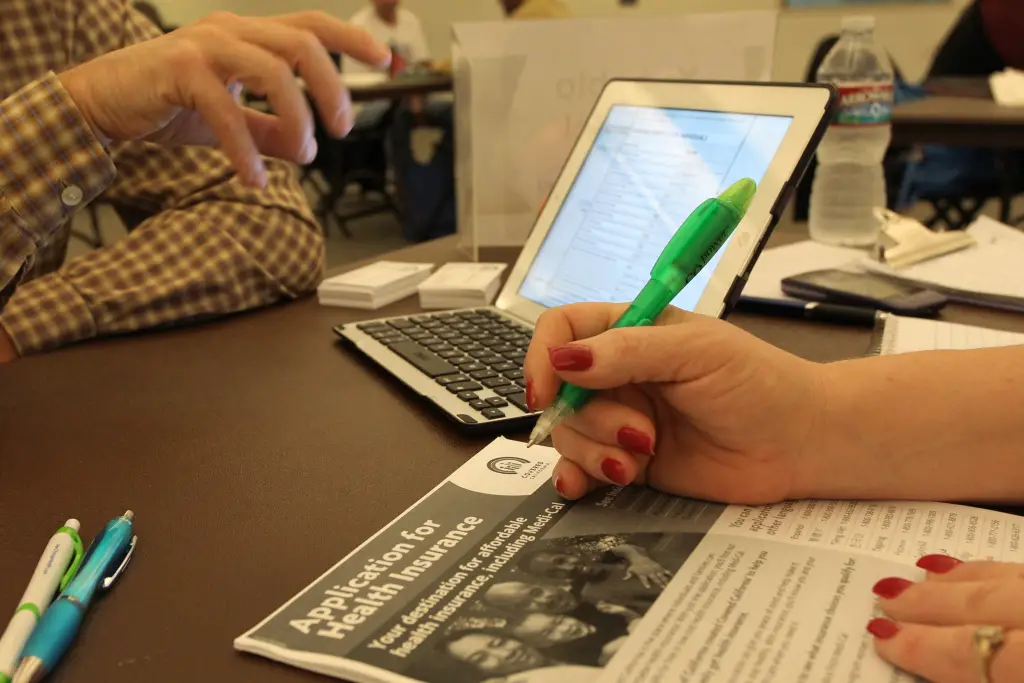

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you’ll be directed to your state’s health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

Also Check: How Do I Get A Health Insurance Card

Moving From Within Canada

If you have moved to Alberta from another province or territory and intend to live here for 12 months or more, you must apply for Alberta Health Care Insurance Plan health care coverage within 3 months of establishing residency in Alberta.

In Alberta, your coverage begins on the first day of the third month following your date you established residency in Alberta. If you apply later, the effective date of your coverage is determined when you register.

- For example, if you establish permanent residency in Alberta on July 12, your coverage is effective October 1.

While waiting to receive your Alberta personal health card, continue to use your health card from your previous province or territory when accessing insured health services.

The 3 month waiting period for health benefits is waived for military families in Alberta.

Not all health services are covered outside your original province or territory and not all insured services are the same. You may have to pay out of pocket for some health services and submit a claim for reimbursement to your original province or territory.

Contact your current health insurance office to find out which services are covered after you move and to confirm how to receive reimbursement for services paid.

How Soon Can I Start To Use Health Insurance When I Buy It

You are covered once the policy becomeseffective, except for those that come with a waiting period. As for insurancethat is sponsored by your employer, you can actually be covered as soon as yougive the HR department authorization to deduct your share of the premiums fromyour salary. We advise you to check on this, however, because this also dependson the HR policies of your employer.

For those who are buying individual healthinsurance, the coverage may be effective once the results of your health examcome in.

That means that you can get almost immediatecoverage with your health insurance, once all the paperwork and payments havebeen ironed out.

However, being able to use your healthinsurance may be another story. Most health insurance plans have a waitingperiod before you can use your insurance. That means any indicated illnessesthat occur within the waiting period will not be paid by the insurancecompany. This prevents instances whereyou sign up for insurance knowing that you’ll get sick the next day or while onyour way to the hospital. Waiting periods may range from 3 months, 6 months to1 year.

For instance, there is a waiting period of 6months for heart diseases. If you need a heart bypass three months into yourpolicy, the insurance will not pay for any of the expenses because the medicalprocedure is still within the waiting period as stipulated in the insurancepolicy.

| Not a bit |

Recommended Reading: Can You Put Boyfriend On Health Insurance

Cms Extends Open Enrollment Period And Launches Initiatives To Expand Health Coverage Access Nationwide

The Biden-Harris Administration, through the Centers for Medicare & Medicaid Services , is taking a number of steps that will make it easier for the American people to sign up for quality, affordable health coverage and reduce health disparities in communities across the country. Beginning this year, consumers will have an extra 30 days to review and choose health plans through Open Enrollment, which will run from November 1, 2021 through January 15, 2022, on HealthCare.gov. CMS is also expanding services provided by Federally-facilitated Marketplace Navigatorsexperts who help consumers, especially those in underserved communities, understand their benefits and rights, review options, and enroll in Marketplace coverage. Additionally, CMS will re-launch its Champions for Coverage program. The program currently includes more than 1,000 local organizations that are active in providing outreach and education about the Health Insurance Marketplace and how consumers can enroll in coverage through HealthCare.gov, Medicaid, or the Childrens Health Insurance Program .

When Is Open Enrollment If I Get Health Insurance Through My Work

If you get health insurance through work, your employer sets the open enrollment period. Its typically in the fall so that your benefits can start at the beginning of the calendar year. Choosing a health care plan for the year ahead is an important decision during open enrollment. Take some time to explore your options to help you decide what coverage is best for you before you enroll.

You May Like: How To Apply For Kaiser Health Insurance

Enrollment Options And Procedures

Once you have your health plan in place, youll need to manage all the details of signing up and dropping employees. Below, we explain how to do this and the rules you need to understand.

Adding and Dropping Employees

You can add employees to the medical plan when they are hired, usually on the first of the month following date of hire, or the first of the month after completing a waiting/probationary period. Once the employee chooses a plan, it stays in effect until one of two things happens:

- Open enrollment. See below for more information.

- Qualifying status change. Go to Making Enrollment Changes below for more information.

You can drop employees from the plan at any time during the year due to:

- Termination. Layoff, firing, retirement or quitting.

- Change in hours or classification. Employees who reduce their hours so that they are no longer eligible for insurance, or who move into a classification that is not offered insurance . Employees who lose coverage must be offered the opportunity to continue their medical coverage at their own expense.

Laws such as COBRA govern how employers may extend medical benefits to employees after termination in the tool box see Laws Related to Health Insurance for more information.

Open Enrollment

Making Enrollment Changes

Employees generally can make changes to their benefit elections during the year only if they have a qualifying status change. Events that qualify as a status change include:

Waiver of Coverage

Act Now: Log In To Update Compare Plans & Enroll

If you’ll be automatically enrolled, we strongly recommend you log into your Marketplace account as soon as November 1, 2021.

- Update your application with your expected 2022 income and household information, and compare the plan youre being offered with other 2022 plans.

- You can enroll in any plan available to you through the Marketplace the one you were expecting to be automatically enrolled in or any other.

- Enroll by December 15, 2021 for coverage that starts January 1, 2022.

- The final deadline for 2022 coverage is January 15, 2022.

Also Check: How To Get Life And Health Insurance License In Texas

Got A Qualifying Event Youll Need Proof

Its important to note that HHS began ramping up enforcement of special enrollment period eligibility in 2016, amid concerns that enforcement had previously been too lax.

In February 2016, HHS confirmed that they would begin requiring proof of eligibility in order to grant special enrollment periods triggered by birth/adoption/placement for adoption, a permanent move, loss of other coverage, and marriage .

The new SEP eligibility verification process was implemented in June 2016. In September 2016, HHS answered several frequently asked questions regarding the verification process for qualifying events, and noted that SEP enrollments since June were down about 15 percent below where they had been during the same time period in 2015 .

But HHS stopped short of issuing an explanation for the decline: it could be that people were previously enrolling who didnt actually have a qualifying event, but it could also be that the process for enrolling had become more cumbersome due to the added verification step, deterring healthy enrollees from signing up. The vast majority of people who are eligible for SEPs do not enroll in coverage during the SEP, and this could simply have been heightened by the new eligibility verification process.

Nevertheless, the eligibility verification process was further stepped-up in 2017, thanks to market stabilization rules that HHS finalized in April 2017.

But as a general rule, be prepared to provide proof of your qualifying event when you enroll.

Individual Plan Renewing Outside Of The Regular Open Enrollment

HHS issued a regulation in late May 2014 that included a provision to allow a special open enrollment for people whose health plan is renewing but not terminating outside of regular open enrollment. Although ACA-compliant plans run on a calendar-year schedule, that is not always the case for grandmothered and grandfathered plans, nor is it always the case for employer-sponsored plans.

Insureds with these plans may accept the renewal but are not obligated to do so. Instead, they can select a new ACA-compliant plan during the 60 days prior to the renewal date and 60 days following the renewal date. Initially, this special enrollment period was intended to be used only in 2014, but in February 2015 HHS issued a final regulation that confirms this special enrollment period would be on-going. So it continues to apply to people who have grandfathered or grandmothered plans that renew outside of open enrollment each year. And HHS also confirmed that this SEP applies to people who have a non-calendar year group plan thats renewing they can keep that plan or switch to an individual market plan using an SEP.

Don’t Miss: Where Can I Purchase Affordable Health Insurance

Should I Let My Existing Aca

If youre already enrolled in an ACA-compliant health plan through your states marketplace, can you just let that plan automatically renew for 2022? In most cases, yes, assuming your plan will still be available next year.

Auto-renewal is an option for nearly all exchange enrollees, although Maine, Kentucky, and New Mexico residents will need to claim their new accounts at their state-run exchanges, as those states are transitioning away from HealthCare.gov and enrollee data will be migrated to the new exchange platforms.

But relying on auto-renewal is not in your best interest. No matter how much you like your current plan, it pays to shop around during open enrollment and see if a plan change is worth your while.

Here is why:

Health Coverage For People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply.

-

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease . Learn about eligibility, how to apply and coverage.

-

Affordable Care Act Marketplace offers options to people who have a disability, dont qualify for disability benefits, and need health coverage. Learn about the .

Read Also: Can I Cancel My Health Insurance

What Happens If I Don’t Have Health Insurance

The Affordable Care Act was set up to make it easier for people who couldn’t afford health insurance to get it. It was an attempt to make health care more affordable for everyone by reducing the number of people who can’t pay their medical bills, which drives costs up for everyone else.

The ACA set up penalties for not having health insurance, in order to try to keep people from not being able to pay their medical bills. This portion of the ACA was repealed in 2019, with the authority to enforce health care transferred to the states. Depending on the state where you live, you may be required to pay a fee when you file your state taxes if you do not have health insurance. Check your state health care regulations to be sure.

If you are fined by your state for not having insurance, it could be a significant amount, so if you decide to take the chance of not having health insurance, you should be ready to pay this amount and factor it into your budget.

Keep in mind that there are other financial risks associated with forgoing health insurance, such as not being able to pay for health care. This can turn into large amounts of debt should you need more than minor care. Some 17.8% of Americans with credit reports have medical debts in collections. This is why you should consider health insurance a necessity instead of a nice-to-have.

Tip #: Know Your Deadlines

Usually you only get a few weeks in the fall to sign up. This year, the sign up period for the HealthCare.gov marketplace plans that go into effect in January 2022 starts Nov. 1, 2021 and runs until Jan.15, 2022. If you’re signing up for an employer-sponsored plan or Medicare, the deadlines will be different, but probably also in the fall. For Medicaid, you can enroll at any time of the year.

DeLaO, the health navigator, says even if you’re already enrolled in a plan that seems fine and it’s tempting to just let it automatically renew, it’s always a good idea to annually check what else is available.

“Are you eligible for additional subsidies to lower the cost of your monthly premium?” he says. “Is there a plan that with those increased subsidies you can now get a silver plan as opposed to a bronze plan, which lowers your deductible your copayments?”

Figuring out the right plan for you doesn’t have to require a huge time commitment, he says. His team aims to get people in and out enrolled in a plan in an hour and a half. And those appointments don’t have to be in person customers can get help by phone and can often do everything they need to do to get signed up virtually.

Though signing up for health insurance can be confusing at first, it’s also very important for your wallet and your health. Hang in there and know there are people out there eager to help you make sure you get covered.

Copyright 2021 NPR. To see more, visit .

Don’t Miss: How To Get Gap Health Insurance

An Income Increase That Moves You Out Of The Coverage Gap

There are 13 states where there is still a Medicaid coverage gap, and an estimated 2.3 million people are unable to access affordable health coverage as a result. .

For people in the coverage gap, enrollment in full-price coverage is generally an unrealistic option. HHS recognized that, and allows a special enrollment period for these individuals if their income increases during the year to a level that makes them eligible for premium subsidies .

As mentioned above, the new market stabilization rules only allow a special enrollment period triggered by marriage if at least one partner already had minimum essential coverage before getting married. However, if two people in the coverage gap get married, their combined income may put their household above the poverty level, making them eligible for premium subsidies. In that case, they would have access to a special enrollment period despite the fact that neither of them had coverage prior to getting married.