Can Adjusting Your Health Insurance Deductibles Save You Money

The answer is yes! Adjusting health insurance deductibles can have benefits when it comes to how much youre paying in monthly premiums and how much youre paying out of pocket.

First, you should track how many times youve needed to see a doctor or buy prescription drugs in the past few years. If youre in a family plan, this also goes for each member of your family.

How much health care do you need on average each year? Could you cover the cost of a higher deductible if you were faced with a large medical bill at any time?

What Is Your Best Deductible Amount

When shopping for car insurance, your rates will vary greatly depending on your coverage and the monetary amount of that coverage. Likewise, your car insurance deductible will vary based on that coverage and the cost of your premium. Generally speaking, if you choose a policy with a higher deductible, your premium will be lower. This can be a great option as long as you can pay that higher deductible in the event of an accident.

Raising your deductible is a great way to save money on your car insurance. In fact, you can save an average of $108 per year by increasing your deductible from $500 to $1,000. For those with tight budgets, choosing a lower premium and a higher deductible can be a way to ensure you can pay for your car insurance. However, if you can afford it, paying a higher premium could mean you dont have to come up with a lot of cash to pay a lower deductible in the event of an accident.

How Premium Costs Have Changed In Recent Years

In recent years, healthcare costs have kept rising for both individuals and families in the U.S. This is also true for monthly and annual insurance premiums. The average yearly premium for a family has increased by 22% since 2015 it’s increased by 55% since 2010.

Healthcare spending in the U.S. grows each year. Projections estimate yearly annual spending of nearly $6 trillion by 2027, compared to $3.8 trillion in 2019.

Recommended Reading: What Are The Different Types Of Health Insurance Coverage

What Should You Consider When Choosing Insurance Without A Deductible

No-deductible health insurance plans are generally a great fit for individuals that have high expected medical costs for the year. However, they’re usually not the cheapest health insurance plans on the market. Below we have outlined some factors to consider and to help you decide if a no-deductible plan is the best option for you:

Take Advantage Of Your Hsa

An HSA is a great way to save for your health care.

Try to contribute the max, so youll have tax-free money set aside for your health care. Remember that you can carry over money to the next year, so theres no need to spend everything in one year.

In fact, its a good idea to save money for your later health care costs. If youre 55 or over, you can chip in even more to your account. Putting aside more money can help you as you reach your senior years.

HDHPs are a low-cost solution for a health plan. However, these plans come with a downside — namely, more out-of-pocket costs. They can be an excellent choice for younger people who dont have families. However, if you have a family or any health issue, you may want to decide on a plan with lower out-of-pocket costs like a PPO or HMO.

Methodology: Insure.com commissioned OP4G to ask 1,000 people in October 2020 about their health insurance, including high-deductible health plans.

Also Check: How Much Is Insurance For Health

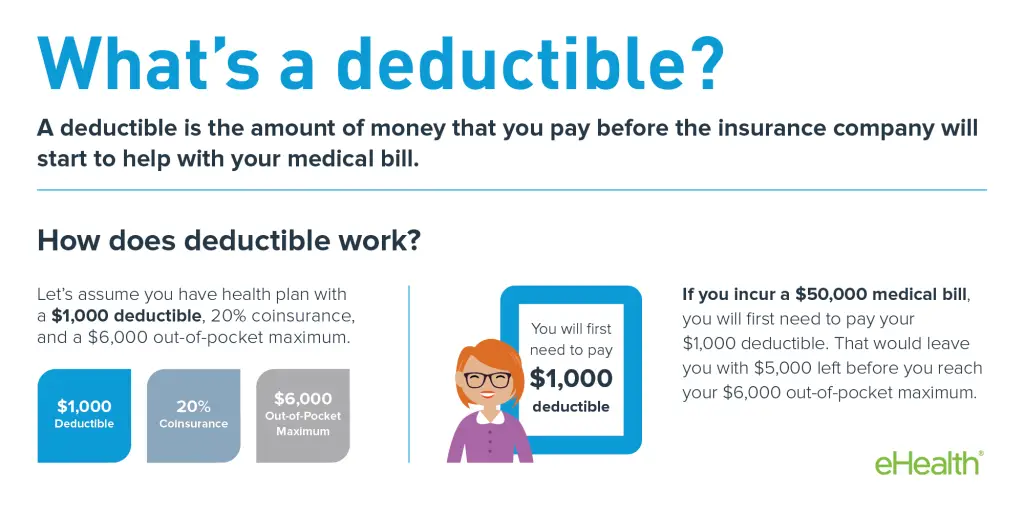

What Does Annual Deductible Mean

A health insurance deductible is the amount of money you pay out of pocket for health care services before your insurance plan starts contributing to the cost.

For example, if your deductible is $1,000, you’ll pay in full for the first $1,000 of your health care. Your insurer will keep a running total of how much you pay, and when you hit $1,000, the cost-sharing benefits of your health insurance plan begin. This could mean, for example, that instead of paying the full price of $250 for an X-ray, you could pay $50, and the insurance company will pay $200.

In health insurance, the deductible works on an annual basis, and after your new policy year begins, the running total of what you’ve paid will reset to zero. This could mean that your health care costs will be higher in the first part of the calendar year until you hit your deductible amount. Then for the rest of the year, you’ll get the cost-sharing benefits of your insurance plan, and you’ll pay less for covered health care services.

Costs That Count As Deductibles

Even health insurance policies that impose deductibles exempt some medical services from the deductibility requirement. The Affordable Care Act, or Obamacare, contains a list of preventative healthcare procedures that are part of polices at no additional cost beyond your premium. But you have to pay out of pocket for other services. Here are some examples of what does and doesnt apply to a deductible.

Apply to Deductibles:

- Doctor costs that exceed copays

Often dont Apply to Deductibles

- Copays

- Costs not covered by your plan

Don’t Miss: How Much Is Average Health Insurance A Month

Find Cheap Health Insurance Quotes In Your Area

No-deductible health insurance policies are health care plans with a deductible of zero that allow coinsurance and copay benefits to begin immediately. These plans may be a good fit if you are expecting high medical expenses during the policy year. Zero-deductible health insurance typically costs more to purchase, but it allows you to avoid some out-of-pocket expenses and may help you save money on total annual expenses.

How Much Money Does The Average American Spend On Entertainment A

In the United States, only 49 percent of Americans have health insurance from their employers, according to 2016 data from the Kaiser Family Foundation. Those who do enjoy employer-provided coverage likely don’t enjoy the bite it takes out of their weekly paycheck. With wages stagnating and health insurance costs inflating, health insurance costs are rapidly closing in on the average American’s paycheck gains.

Also Check: Does Health Insurance Cover Birth Control Pills

Will You Always Have A Copay

No. It will depend on your plan, and the service youre using. Some plans use them to cover shared costs, but others dont. And sometimes the service youre using will be paid for with a mix of a copay and/or your deductible and coinsurance obligation. Plus, as well discuss more below, some plans offer certain services at no cost to you, such as annual exams or other preventive care.

After Meeting The Deductible

The next time you have a medical expense, you will only be responsible for coinsurance, having already met the deductible in full. The deductible resets every year, so each year youâll need to repeat the process and pay out of pocket again before your health insurance covers your medical expenses.

Read Also: Does Farmers Insurance Sell Health Insurance

Can I Combine A High

HDHPs are the only plans that allow an enrollee to contribute to a health savings account . High-deductible insurance is considered a type of consumer-driven health plan, so you may hear the term CDHP used in conjunction with these plans. The idea is to give patients control over how to spend and invest their money.

HDHPs cover preventive care before the deductible the ACA requires this of all plans but under an HDHP, no other services can be paid for by the health plan until the insured has met the deductible. That means HDHPs cannot have copays for office visits or prescriptions prior to the deductible being met . But in 2020, to address the COVID-19 pandemic, the IRS issued guidelines that allow HDHPs to pay for COVID-19 testing and treatment before the member has met the deductible. Federal rules require virtually all health plans, including HDHPs, to cover COVID-19 testing with no cost-sharing. But its optional for insurers to cover treatment with no cost-sharing, so this varies from one insurer to another.

And the IRS also issued new guidelines in mid-2019, expanding the list of preventive services that can be covered pre-deductible on an HDHP, with enrollees retaining their HSA eligibility. The new rules allow certain treatments related to certain chronic conditions to be classified as preventive care for HDHP purposes. These include:

Can I Lower My Health Insurance Rates

The short answer is yes. You can decrease your health insurance rates by raising your deductibles and choosing a lower tier.

Also, the Affordable Care Act allows you to get cheaper insurance rates if you qualify for credits toward your health insurance policy. And in some cases, youll pay no money at all for health insurance.

If your health insurance company is still too expensive, start shopping at other health insurance companies.

Don’t Miss: Can You Have Double Health Insurance

What Are The Types Of Health Insurance Deductibles

Okay, so deductibles can come in different forms depending on the type of insurance plan you have! And your plan could have more than one type of deductible, which is another reason to check to see if theyre the right ones for you.

Here are the different types of health insurance deductibles:

Comprehensive deductible: A comprehensive deductible is a deductible amount that applies to and includes all of the medical coverages in your health insurance plan. Once youve met this comprehensive deductible, your plans coinsurance will take effect.

Non-comprehensive deductible: A non-comprehensive deductible means that not all of the medical coverages in your insurance plan will have a deductible applied to them. Your plan could provide some health services without you having to eat into your deductible. Woo-hoo! Again, check to see if the coverages without a deductible are beneficial to you.

Individual or family deductibles: Your family members might have individual deductibles, or the plan could just have one family deductible. This type of deductible can be met by all or just one member of your family. And once you meet this deductible, coinsurance kicks ineven if its for a family member who didnt need health care up until this point.

Okay, you may be confused about all these different deductibles! But heres the takeaway: Look at the fine print of your health insurance plan to see what types of deductibles apply to it and decide if they work best for your situation.

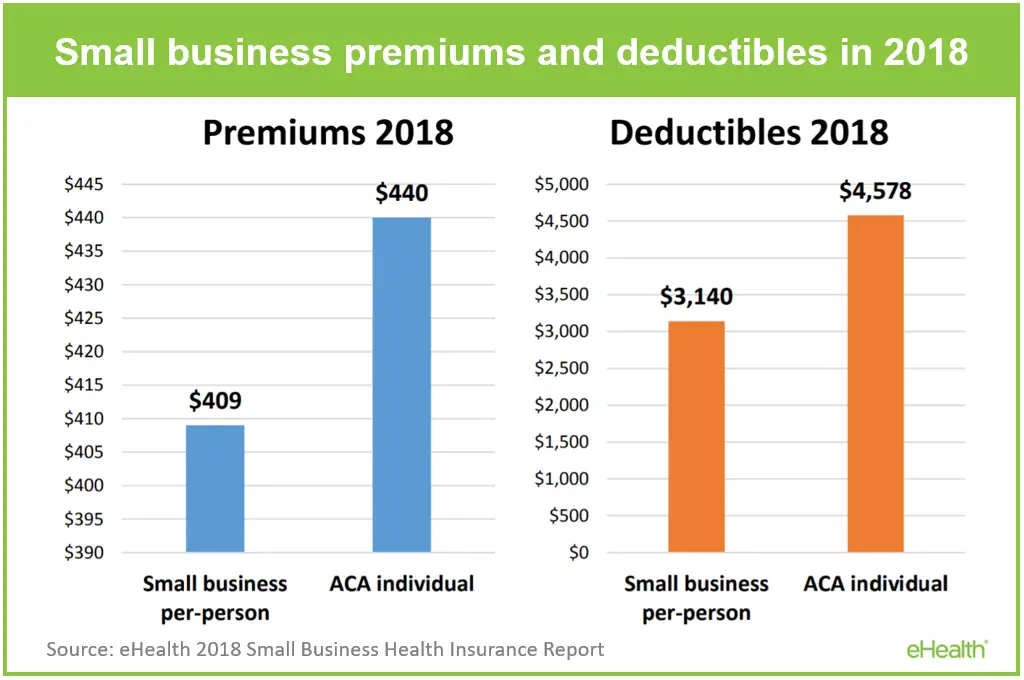

Comparing Health Insurance Deductibles

As you can see, there’s a substantial difference in the monthly premiums of high deductible versus low deductible healthcare plans. However, the real out-of-pocket costs of any plan include the premium, the deductible, and any coinsurance.

The amount anyone pays in out-of-pocket expenses depends on the individual’s health profile. A young and healthy person who rarely goes to a doctor might gamble on a high deductible plan with high coinsurance costs. Someone who requires regular treatment for a chronic condition might go for a higher-level plan to minimize deductible and coinsurance costs.

Don’t Miss: How To Apply For Health Insurance In Texas

Why Do I Have More Than One Deductible

Health insurance plans may have multiple deductibles. For example, your policy may have both individual and family deductible limits. Most plans also have a separate deductible if you use medical providers who are outside the plans provider network. Your deductible will generally be higher if you use an out-of-network provider. Your plan may also have separate deductibles for medical and prescription drug benefits.

If you switch plans part way through the year, youll generally have to start over with a new deductible on your new plan. This is common, for example, if you leave a job where you had employer-sponsored health coverage, and switch to an individual market plan or a new employers health plan mid-year.

How Much Are Health Insurance Deductibles

Deductibles are the amount of money you pay before a health insurance company provides a claim payout. But how much are deductibles for each tier?

- Bronze Deductibles $7,000

- Gold Deductibles $1,500

- Platinum Deductibles $100

These deductibles are rough estimates. Deductibles vary for each company, but lower metal tiers correlate to higher deductibles.

Read Also: How To Check If You Still Have Health Insurance

Paying The Costs Of Health Insurance

Premiums, deductibles, co-pays and co-insurance are costs that must be borne by the consumer. Employees enrolled in ESI plans generally have their premium costs taken out of their paychecks on a pre-tax basis. Medicare recipients have their premiums deducted from their Social Security checks, and self-insured individuals must pay their premiums to their insurance companies directly. All other out-of-pocket costs must be paid to health care providers at the time of service, or when billed.

Any taxpayer who is enrolled in a high-deductible health plan can open a Health Savings Account . Funds contributed to an HSA are not subject to federal income taxes if used for qualified medical expenses, including co-pays, deductibles, co-insurance or many other costs like dental, vision and chiropractic care. HSAs were created in 2003, replacing Medical Savings Accounts, a similar program used earlier.

People who are having trouble covering their medical expenses should speak to a debt relief professional about their options. Debt settlement can reduce credit card debt, freeing up funds for health insurance costs. In addition, medical debt can be settled for less than what is owed.

9 Minute Read

How Much Does Health Insurance Cost Across The United States

The state where you live is also a major factor when determining health insurance. But which state has the cheapest health insurance rates? Lets review.

Average Monthly and Annual Health Insurance Rates by State

| States |

|---|

- Gold $594/mo

- Platinum $709/mo

Catastrophic tiers are cheaper because they have the highest deductibles. Higher metal tiers have lower deductibles but more expensive health insurance rates.

Also Check: Does Health Insurance Cover Gynecologist

What Is Individual Health Insurance

While many people get their health insurance through a group plan sponsored by their employer or union, others buy it themselves. If you are buying your own health insurance, you are purchasing an individual plan, even if you include family members on the plan. If this sounds like what you need, let eHealth show you all of your individual and family health insurance options, and use our free quote comparison tool to find an affordable plan that meets your needs.

Asa result of the Affordable Care Act , people can purchase individualhealth insurance through a government exchange or marketplace , or they can buy health insurance from privateinsurers. You may be restricted to purchasing health insurance through agovernment exchange to certain times of the year. Usually you can purchasehealth coverage from a private insurance company anytime.

ACAplans are a good starting place to understanding individual health insuranceoptions. ACA health plans are categorized by metals. You can learn more aboutthe metallic plans: Bronze, Silver, Gold, and Platinum.

Why Is An Out

An out-of-pocket maximum is always higher than a deductible. The deductible is the first threshold you reach at the beginning of the policy year, and after you reach your deductible, the cost-sharing benefits of the insurance policy begin. The out-of-pocket maximum is the next threshold, and when your total spending reaches the out-of-pocket maximum, your plan begins covering the full cost for included health services.

Don’t Miss: Can You Buy Health Insurance Any Time Of The Year

Other Types Of Deductibles

So far, this article has covered annual deductibles, which are the most common. However, some health plans have more than one type of deductible. These may include:

- Prescription deductible: This applies to prescription drugs and is in addition to whatever deductible the plan has for other medical services. After it is met, the coverage usually switches to copays for lower-tier prescriptions, and coinsurance for the more expensive, higher-tier prescriptions.

How Do Deductibles Impact Your Costs

A health plan with a lower deductible generally carries a higher monthly payment, and vice versa.

If you prefer to pay a higher amount monthly for the security and predictability of low out-of-pocket expenses for high-cost medical care, you may want a low deductible in your healthcare plan. This can be a good option if you have a chronic health condition or high risk of sports injuries.

If you prefer a high one-time expense in the event you need high-cost medical care rather than a smaller monthly payment, a high deductible health plan may be the right choice for you. This can be a good option if you are younger and generally healthy, or if you have a health savings account , which you can use to pay your deductible with money that is not taxed as income. You may also have a health reimbursement account through your employer that can pay your deductible, which can also make a high deductible health plan an advantageous choice.

Don’t Miss: Does Starbucks Pay For Health Insurance