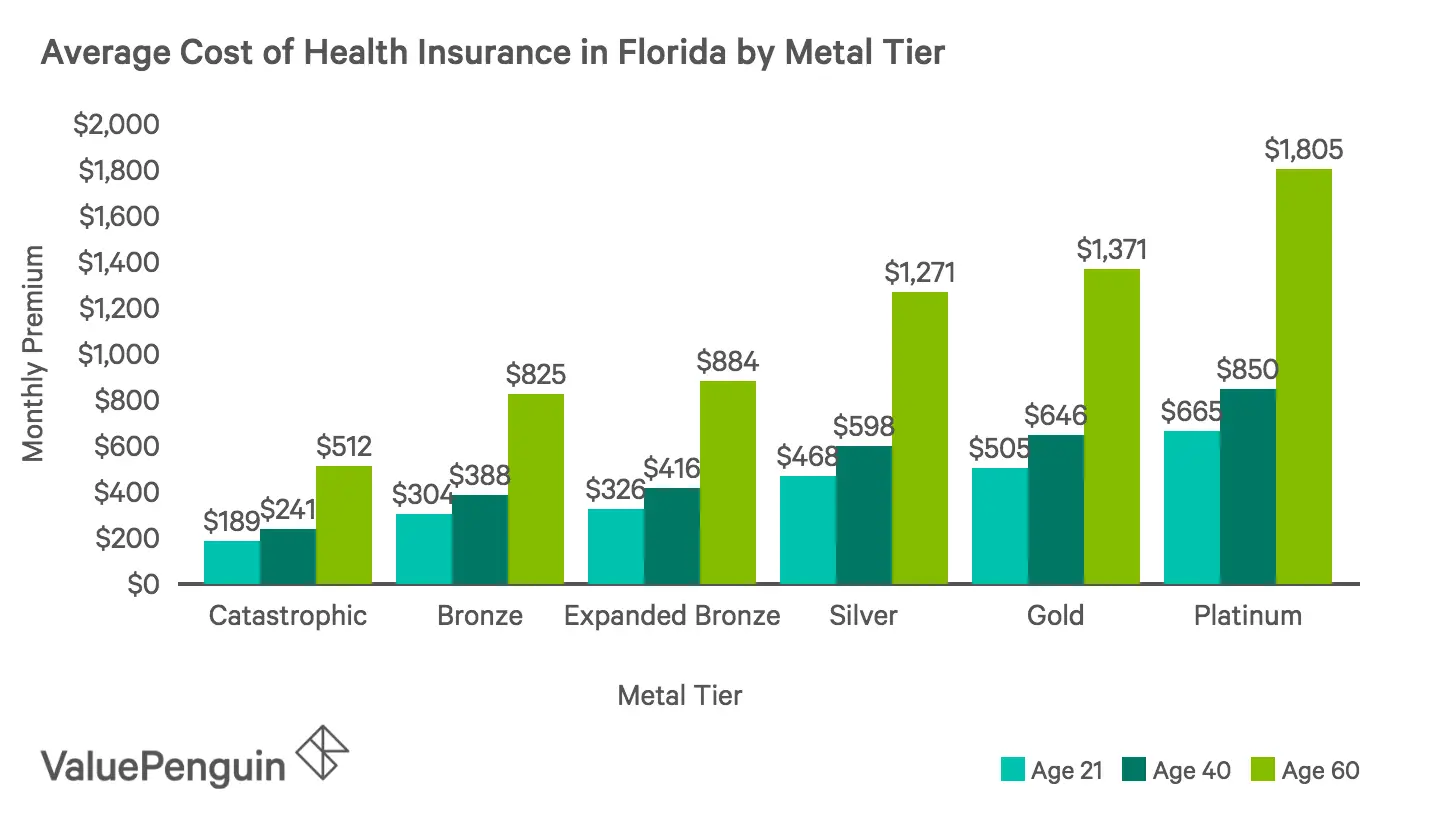

Cheapest Health Insurance By Metal Tier

We compared the health insurance plans available on the Florida marketplace and identified the cheapest policy in each metal tier to help you find the best option for your chosen level of coverage. Aside from the level of coverage you choose, one of the most significant factors in determining health insurance rates is the age of each person insured.

Is It Cheaper To Get Health Insurance Through Employer

Workplace health insurance is usually cheaper than an individual health plan. Employer-sponsored plan premiums have increased 3% annually for single coverage plans and about 5% for family plans. Those increases are much more modest than what youll find for individual health plans most years.15 oct. 2020

Best Pet Insurance Companies In Florida 2021

Whether you live in Tampa or Miami, a Florida pet insurance policy can prevent you from paying expensive vet bills and get treatment for your pet when it has an accident. Read our review of the top pet insurance companies in the Sunshine State and pick a pet insurance plan thats best for you and your furry friend.

Taking your pet to the vet when it comes down with a fever or breaks a bone is never cheap. In fact, simple procedures or exams can cost thousands of dollars out of pocket unless you have pet health insurance.

The This Old House Reviews team received sample quotes, researched policies, and read customer reviews of the best pet insurance companies in Florida to help you find a provider thats right for you and your pet.

We included sample quotes for plans with a $500 deductible for various breeds of cats and dogs living in Miami. However, we ultimately recommend getting your own quotes to compare prices since premiums can vary depending on your pets age, breed, and location within the state.

Recommended Reading: Can Aflac Replace Health Insurance

Florida Health Insurance Enrollment In The Marketplace

Florida uses the federal exchange at Healthcare.gov for Obamacare open enrollment that takes place from .

Despite opposition to the federal healthcare law by state legislators, Florida has had the highest number of sign-ups for individual Obamacare plans since 2015.

Florida saw enrollments climb from about 1.7 million in 2018 to almost 1.8 million in 2019 to more than 1.9 million in the 2020 plan year.3

The vast majority of Floridians who enroll in Marketplace coverage are under age 65, which shouldnt be a surprise given that the 65-and- older age group are better suited for Florida Medicare plans. As of 2020, total ACA enrollment for the under-65 market in Florida is nearly 1.9 million compared to nearly 36,000 for those 65 and older.4

Aarp Health Insurance Says

AARP offers quality comprehensive and supplemental health insurance plans for members ages 50-65:

- Hence, Essential Essential Health Insurance Specially selected individual health insurance plans offering quality coverage for clients and their families.

- Very Essential Health Insurance Basic fixed-cash hospital compensation plans that offer some coverage at a significantly lower premium.

- Essential plus health insurance over 65 Enhanced fixed cash hospital compensation plans that offer a lower cost option to higher health insurance.

- Hospital Indemnity Insurance Competitively priced indemnity plans with fixed cash benefits payable in addition to other senior health insurance over 62 to 65 clients may have.

- For members age 65 and older, AARP has a variety of quality Medicare insurance, Medicare supplement, and Medicare prescription drug plans specially designed for people eligible for Medicare.

- Full Medicare Comprehensive plans that offer all Medicare-covered benefits and more. This includes prescription drug coverage, without limitations on pre-existing conditions and fitness benefits.

- MedicareRx Medicare prescription drug coverage plans to help protect against rising drug costs and unexpected changes in drug needs.

- Medicare supplement plans that help cover some of the expenses not covered by Medicare and help limit yearly out-of-pocket expenses.

Also Check: Can You Get Supplemental Health Insurance Anytime

Group Coverage Also Known As Employer

Companies that provide health insurance to employees as a benefit provide an insurance type known as group insurance. The cost of this type of health plan is based on total premiums paid to the insurance company. Premiums include payments from both employers and employees. Premiums do not include payments for services such as deductibles, co-pays or other out-of-pocket costs. Group coverage includes: Health Maintenance Organizations , Preferred Provider Organizations , Point-of-Service Plans and High-Deductible Health Plans.

Which Pet Insurance Provider In Fl Is Best For You

As a pet parent in Florida, you can receive peace of mind that your furry friend gets the medical attention it needs after an unexpected incident with a pet insurance policy.

Whether Prudent Pet has your attention for its impressive Ultimate Plan or youre fascinated by Pawps unique digital clinic, our recommendation to readers is to get quotes from a few different companies based on your location and pets information to compare offers.

Read Also: Can I Get Health Insurance In Another State

Florida Health Insurance Exchange Links

Assists consumers who have purchased insurance on the individual market or who have insurance through an employer who only does business in Florida. / Out of State: 413-3089

Serves residents enrolled in managed care helps resolve grievance between managed care entities and their subscribers. 1-888-419-3456

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

About our health insurance quote forms and phone lines

We do not sell insurance products, but this form will connect you with partners of healthinsurance.org who do sell insurance products. You may submit your information through this form, or call to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

The mission of healthinsurance.org and its editorial team is to provide information and resources that help American consumers make informed choices about buying and keeping health coverage. We are nationally recognized experts on the Affordable Care Act and state health insurance exchanges/marketplaces. Learn more about us.

If you have questions or comments on this service, please contact us.

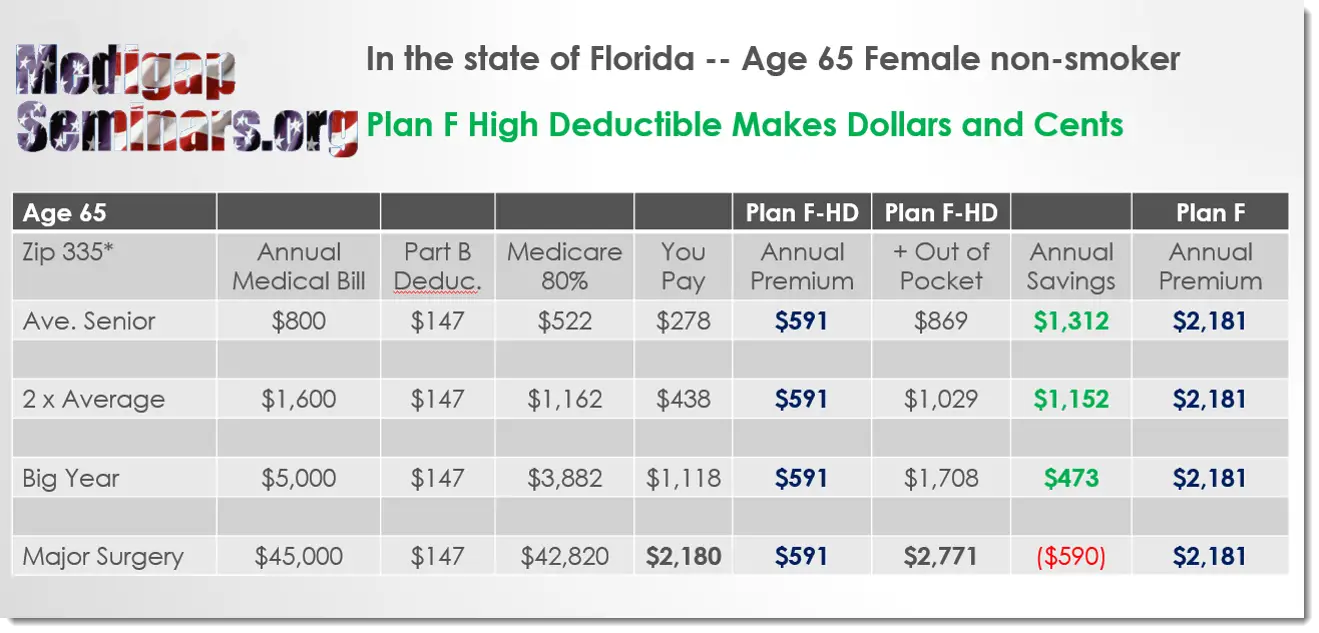

Health Insurance For Seniors Over 65

AARP acts as a nonprofit advocate for its members and one of the most powerful lobby groups in the United States.

It also sells no exam insurance for seniors over 65, investment funds, and other financial products. AARP has more than 35 million members, making it one of the largest membership organizations for people 50 and older in the United States.

Recommended Reading: Do Real Estate Brokers Offer Health Insurance

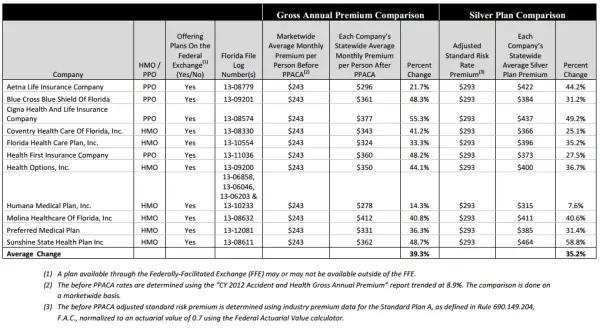

Florida And The Affordable Care Act

As of 2019, Florida is among the 18 states that have sued the federal government to challenge the Affordable Care Act as unconstitutional. The lawsuit was filed by Texas in 2018 and is known as Texas v United States.1

The Sunshine State is no stranger to challenging the ACA. As early as March 23, 2010, the day the ACA was signed into law, Florida filed a lawsuit against the federal government challenging the validity of Medicaid expansion and the individual mandate.2

Although there are attempts to repeal the ACA, or at least some parts of it, you can still sign up for Florida health insurance, apply for subsidies to lower your monthly costs, or get coverage through Medicaid if eligible.

What Ourclient Think About Us

The process was easy and seamless. My contact person was very supportive and patient with me. He took time to respond to all my queries, and explained the options at my disposal. I got all the information I needed to choose and sign up for my current insurance plan. I would definitely recommend National Health Connect!

Linet W.

Finding the right plan for you doesnt have to be complicated. Get an affordable insurance solution for you in just a few clicks. Just fill in the form with details of the health plan you need and well offer you a quote that matches those details.

You May Like: Which Health Insurance Company Has The Highest Customer Satisfaction

Health Insurance Florida Help From Healthmarkets

If youre ready to purchase a health insurance plan in Florida, or are just curious about whats available, shop and compare plans now. The HealthMarkets FitScore® can take your preferences and find plans that matchthe higher the FitScore, the closer the match. Shop, compare, and apply all in one place.

46955-HM-0121

Hospital & Doctor Insurance

Health ProtectorGuard fixed indemnity insurance,3 underwritten by Golden Rule Insurance Company, can supplement your major medical plan by paying cash for eligible, covered medical services, like a doctor visit, a trip to urgent care or a surgical procedure.

- No deductibles or copays to pay first

- Benefits paid regardless of other insurance

- Money to pay costs not covered by major medical plans, like a deductible

You May Like: How Much Is Private Health Insurance In New York

Health Insurance For Senior Citizens Above 70

The World Wide Web is the best place to discover AARP health insurance rates age 62 no waiting period plan. To be more specific, several quotation evaluation sites are the best place to discover cost-effective health insurance plan reports.

You need to understand that run after various health insurance offers. Rather, you should try to get health insurance for seniors over 70. Logs in to your screen without leaving your home. There are many ways to do this. Most convenient and effective. The way is to use multiple websites for bid evaluation. You must provide the information required for the website online. And receives the UnitedHealthcare offer for it.

Accident & Critical Illness Insurance

Accidental injuries and critical illness happen when you least expect them. Those unexpected expenses can strain any budget. Accident insurance3 and critical illness insurance3 can help by paying cash benefits for covered injuries or illnesses.

The Accident Pro series of products, underwritten by Golden Rule Insurance Company, combines accident insurance with critical illness, hospitalization, and accidental death and dismemberment coverage all in one. Some plans are guaranteed issue, meaning your application wont be turned down for preexisting conditions.

Read Also: What Does Health Insurance Cost In Retirement

How Can I Save Time

Youre probably more interested in keeping up with your grandchildren or improving their golf game than you are in health insurance. Save time for the things that matter. Help choose a plan with an easy-to-use, personalized online website and mobile app so you can manage your health anywhere.

Accordingly, Get health information, find network providers, pay your health insurance premiums, view your health insurance claims, and print temporary ID cards.

Talk to a doctor 24 hours a day, 7 days a week for information and answers to your health-related questions.

Finding Your Best Health Insurance Plans In Florida

Remember, premiums are not the only cost component when it comes to your health care. Out-of-pocket costs in the form of deductibles, copays and coinsurance are just as important to compare when you shop.

The best cheap health insurance plan for you and your family will depend on your income level and expected health care needs.

Households with higher expected medical costs should opt for plans with higher cost-sharing benefits, while those who expect to be relatively healthy or to need little to no routine care should look toward cheaper plans.

Average consumers should start by browsing Silver plans

Unless youre extremely healthy or know youll have significant medical expenses, we advise that you begin your shopping process by looking at the Silver metal tier health insurance plans. These are the plans that the exchange offerings are generally benchmarked off of, and they occupy a good middle ground between premiums you are guaranteed to pay and cost-sharing responsibilities that you will incur if you have any medical expenses.

The Silver plans are also the only plans on the Florida exchange that make you eligible for cost-sharing reductions that further reduce your copays, coinsurance and deductibles if you have a household income under 250% of the federal poverty level.

In such a case, these plans can actually offer more benefits than higher-priced Gold and Platinum plans but at a much lower premium.

Read Also: What Is The Best Health Insurance In Philippines

How Much Is Pet Insurance In Florida

Based on the sample quotes we received for a variety of dog and cat breeds in a few different ZIP codes in Florida, standard accident and illness plans average around $30$60 per month for dogs and $15$30 per month for cats.

Here are a few factors that can affect monthly premiums and tips on how to decrease them:

Florida And Obamacare Subsidies

Previously, if your income was between 100 and 400% of the federal poverty level , you qualified for Obamacare subsidies to get low-cost coverage through Floridas Health Insurance Marketplace. This means that for 2021, you would have had to earn between $12,760 and $51,040 for a single-member household and $26,200 and $104,800 for a family of four.

But for 2021 and 2022 the federal government changed the subsidy income limits, doing away with that 400% cap, or subsidy cliff. Instead, families now are expected to pay no more than 8.5% of their annual income toward health insurance costs.

Florida is one of the best states to get financial assistance for individual and family health plans under the Affordable Care Act or Obamacare. As of 2020, 95% of Florida Marketplace enrollees receive subsidies that lower their monthly premiums. Another 66% receive cost-sharing reductions that help reduce out-of-pocket expenses, such as copays and prescription drug costs.11

Keep in mind that subsidies are only available on metal-tiered plans sold through the Marketplace, which are bronze, silver, gold, and platinum. And only silver plans qualify for cost-sharing reductions.

Recommended Reading: What Is A Gap Plan Health Insurance

Affordable Health Insurance In Florida

According to eHealth data, the average national price of an individual health insurance premium in 2017 was $393 with a $4,328 deductible. This price is almost triple what the average premium cost ten years ago in 2008.

The rising prices in the individual market may have some feeling that affordable health insurance in Florida is unattainable. Luckily for you, affordable health insurance is still possible.

How Do I Get Health Insurance In Florida

If you do not have Florida health insurance benefits through an employer, you have options for where you can purchase health coverage:

Recommended Reading: What Is Average Cost Of Health Insurance For A Family

Hmo Health Insurance Plans

HMO stands for Health Maintenance Organization. HMO plans offer a wide range of health care services through a network of providers that contract exclusively with the HMO, or who agree to provide services to members. Employees participating in HMO plans will typically need to select a primary care physician to provide most of their health care and refer them on to HMO specialists as needed.

How Do You Get Health Insurance In Florida

Florida residents can purchase plans from private providers or the federal exchange during open enrollment. Outside of open enrollment, you may qualify for a special enrollment period due to a qualifying life event, like getting married or losing coverage. Floridians can also enroll in short term plans without a qualifying life event for quick coverage outside of open enrollment.

You May Like: Where To Go If You Have No Health Insurance

What Does Health Insurance Cover

Every health insurance plan could essentially include or exclude any type of coverage they wanted before the introduction of the Affordable Care Acts . This made it incredibly tedious to compare plans because there was little standard of coverage between dozens of options. Now the ACA dictates that every permanent health insurance plan must include at least the following ten essential benefits:

Your plan must also include the following benefits for women:

- Breastfeeding support: This includes counseling and equipment for nursing mothers.

- Birth control: ACA-compliant plans must include prescribed FDA-approved contraceptive methods. This includes emergency contraceptives but does not include drugs intended to terminate an already viable pregnancy.

Your employer may be exempt from covering certain contraceptives if you work for a house of worship or a religious non-profit.

Florida Health Insurance Marketplace

Florida doesnt have its own state marketplace and relies on the federally run Affordable Care Act marketplace. Typically, using the marketplace and enrolling through Healthcare.gov is best for those who dont have employer-sponsored coverage, such as the self-employed, retired people who arent eligible for Medicare or low income residents looking for financial support for their individual health insurance.

As of 2021, more than 2 million people are enrolled in coverage through the Florida health insurance marketplace during Open Enrollment and the American Rescue Plan Special Enrollment Period, which was enacted in response to the COVID-19 pandemic.

Don’t Miss: Is Eye Surgery Covered By Health Insurance

Floridas Other Exchange: 712 Customers By 2016 No Longer State

Florida Health Choices is the states own version of an online marketplace, but it does not offer any premium subsidies. While Florida Health Choices was established by 2008 legislation sponsored by Marco Rubio, who was the Florida House Speaker at that point, it faced many delays and did not go live until March 2014. The states pseudo-exchange was engaged in a legal battle with HHS over efforts to trademark Healthchoices, The Health Insurance Marketplace.

Florida Health Choices initially offered discount-only plans for some health services, such as dental services and prescription drugs. These plans were not true health insurance, and consumers largely ignored the state-sponsored exchange. Just 49 people purchased plans through Florida Health Choice during 2014 .

In early January 2015, Florida Health Choices began offering health plans that were compliant with the ACA and covered the ACA s ten essential health benefits. Policies from four insurers were available in 2015: Assurant, Cigna, Humana, and UnitedHealthCare.

For 2016, Assurant exited the health insurance market nationwide, but Cigna, Humana, and UnitedHeathcare continued to offer plans through Florida Health Choices .

The Florida Health Choices board of directors approved an $852,000 budget for 2015. Heading into the year, Naff was quoted in the Miami Herald saying, Id be tickled pink if we got 1,000 people.