Thank You For Sharing

Californians, be warned: A new state law could make you liable for a hefty tax penalty if you do not have health insurance next year and beyond.

But some of you need not worry: The law contains several exemptions that will allow certain people to avoid the penalty, among them prisoners, low-income residents and those living abroad.

Not Addressing Care Issues

Similarly, many Americans postpone receiving healthcare or avoid seeing their doctor because they dont want to pay for the visit.

According to the Kaiser Family Foundation, almost 24% of uninsured people hesitate to seek needed healthcare due to the high cost of uninsured care. One study on trauma care and mortality among insured and uninsured adults who had suffered unexpected health shocks concluded that:

Uninsured crash victims received 20% less care, particularly costly procedures and services, than did privately insured patients, and had a substantially higher mortality rate: 1.5 percentage points above the mean rate of 3.8%.

Instead of addressing a health concern, you run the significant risk of it becoming worse over time. Like preventative care, taking steps to strengthen your health early on saves you in the long run. Thats why healthcare coverage is an absolute necessity for all individuals.

Individual Mandate Penalty Repeal

Former President Trump campaigned on a promise to repeal the ACA and replace it with something else. Republicans in the House passed the American Health Care Act in 2017 but the legislation failed in the Senate, despite repeated attempts by GOP Senators to pass it.

Ultimately, Republican lawmakers passed the Tax Cuts and Jobs Act and President Trump signed it into law in December 2017. Although the tax bill left the rest of the ACA intact, it repealed the individual mandate penalty, as of 2019 .

Although Congress did not repeal anything other than the mandate penalty , a lawsuit was soon filed by a group of GOP-led states, arguing that without the penalty, the mandate itself was unconstitutional.

They also argued that the mandate was not severable from the rest of the ACA, and so the entire ACA should be declared unconstitutional. A federal judge agreed with them in late 2018.

An appeals court panel agreed in late 2019 that the individual mandate is not constitutional, but sent the case back to the lower court for them to decide which provisions of the ACA should be overturned.

The case ultimately ended up at the Supreme Court, where the justices ruled in favor of the ACA. So although there is still no federal penalty for being uninsured, the rest of the ACA has been upheld by the Supreme Court .

Recommended Reading: How Can A College Student Get Health Insurance

What Are The Penalties Of California Individual Mandate

The penalties of California Individual Mandate who failed to obtain health coverage during the 2020 tax year are:

- This year, residents will face a penalty of $750 per adult and $375 per child – multiplied by the cost-of-living adjustment.

- A married couple can be fined up to $1,500 and a family of four can face a penalty above $2,250.

The California Individual Shared Responsibility Penalty is either 2.5% of gross household income exceeding California’s filing threshold or a flat penalty per family member.

How Is The Tax Penalty Calculated If I Only Had Health Insurance For Part Of The Year

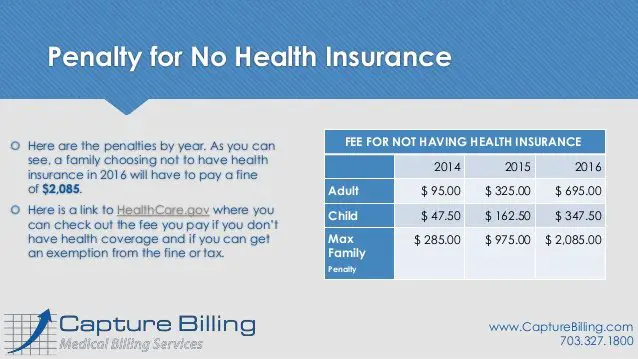

The tax penalty is assessed for each month that a person is not covered. It is pro-rated, so that a person who is not covered for only a single month would pay 1/12th of the tax that would be due for the full year. For example, the minimum tax per person for failing to get coverage would be $7.92 for each month of 2014, $28.75 for each month of 2015, and $57.92 for each month of 2016, when fully phased in.

Read Also: How To Apply For Low Cost Health Insurance

Penalty For No Health Insurance 2020 In California

There are lots of reasons to consider investing in health insurance. Health insurance can:

- help pay for expenses from unexpected accidents and injuries

- make regular and long-term care more affordable

- promote well-being as trips to the doctor are often covered

But this year Californians have a new reason to add to that list the upcoming health insurance penalty. 2020 marks a change in Californias laws that could impact you if you dont have health coverage. Know your options to avoid facing a penalty for not having insurance.

Understanding California Individual Mandate

With the Biden administration now in office, there is speculation that the penalty of California Individual Mandate will be reinstated. This move would force everyone in the United States to obtain health coverage that meets the affordability standards, otherwise face a penalty. Reinstating the California Individual Mandate Penalty would cause more Americans to enroll in health coverage, and it can have two effects on employers:

- It could lead more employees to opt for enrolling in employer-sponsored healthcare coverage plans.

- It may force employees to go to a state or federal healthcare exchange and apply for Premium Tax Credit to obtain healthcare coverage.

When a resident applies for a PTC through a federal or state healthcare exchange, the employer will be flagged to the IRS. It results in the issuance of Letter 226J penalty notices to employers who failed to comply with the ACA’s Employer Mandate for a specific tax year. The IRS is currently issuing letter 227J penalty assessments for the 2018 tax year.

Read Also: Who Pays First Auto Insurance Or Health Insurance

What If I Want To Enroll In Health Insurance Outside Of Open Enrollment

If you missed the Open Enrollment Period for the year but want to enroll in health insurance, there are generally two options available to you.

First, you might be able to enroll in health insurance coverage if you qualify for a Special Enrollment Period . You may qualify for an SEP if you had a change in your household. This includes marriage, divorce, giving birth to a baby, or adopting a child. You can also qualify for an SEP if you have a change in residence, like a move to a new zip code, new county, new state. Or if youre a student moving for school. If you lose your existing health insurance coverage, you might also be able to qualify for an SEP. You can learn how else you might qualify for a SEP and how to apply for one here.

Second, depending on your income level, you might be able to qualify for Medicaid. Medicaid is the federal insurance program that provides health insurance, and thus medical care, to low-income Americans. Another critical part of Obamacare was that it allowed states the option of expanding their Medicaid programs. They did this by upping the percentage of the federal poverty level a person must earn annually to qualify. If your income level lets you qualify for Medicaid, you can enroll outside of the Open Enrollment Period. And if you qualify, your coverage will start immediately and so will your access to health services.

Is There A Penalty For Not Having Health Insurance In 2019 2020 Or 2021

As of Jan. 1, 2019, there is no penalty for not having health insurance. You wont need to qualify for an exemption to not pay a penalty when you pay your federal taxes.

However, some states still require you to be enrolled in health insurance coverage. California, the District of Columbia, Massachusetts, New Jersey, Rhode Island, and Vermont have their own individual mandates. If you decide not to enroll in coverage in one of these states, you may owe a penalty fee when you file your taxes for the 2019 plan year.

Don’t Miss: Can I Buy Dental Insurance Without Health Insurance

How Do I Know If I Qualify For A Subsidy

Typically,you qualify for a subsidy to offset the cost of Californias health insurancemandate if you earn between 100% and 600% of the FPL. If you make less than100% of the FPL, you may qualify for Medi-Cal. If you make more than 600% ofthe FPL, you probably arent eligible for government subsidies to help pay yourhealth insurance costs. To learn more, you can read All About the CoveredCalifornia Income Limits.

Subsidies are based on the estimated amount of income that you expect to make during the upcoming coverage year. To find out if you qualify for subsidies under the new California subsidy program, you can use eHealths subsidy calculator while shopping for health insurance. Visit our individual and family health insurance page, enter your zip code, complete a quick questionnaire and click See if I Qualify. The eHealth calculator will estimate and report to you if the government could help lower your costs through subsidies.

Keep in mind that you should report changes in income throughout the year. This way if youve received a subsidy and experience an increase in income that disqualifies you for the subsidy, you wont have to pay the unqualified amount back at the end of the year. Conversely, if you believe that you experienced a change in income that could qualify you for a subsidy, make sure to report it so that you dont miss out on savings.

Is There A Penalty For Not Having Health Insurance

Too often, people learn that the personal penalty for not having health insurance is the exorbitant healthcare bills. If you fall and break your leg, hospital and doctor bills can quickly reach $7,500for more complicated breaks that require surgery, you could owe tens of thousands of dollars. A three-day stay in the hospital might cost $30,000. More serious illnesses, such as cancer, can cost hundreds of thousands of dollars. Without health insurance, you are financially responsible for these bills. Two-thirds of people who file for bankruptcy indicate that medical bills contributed to their financial situation, according to a 2019 study.

The Affordable Care Act increased the number of people with insurance and lowered those who couldnt afford to pay their health bills. While the federal health insurance coverage mandate and shared responsibility payment was in effect, from 2014 through 2018, the number of people in the United States who got health insurance increased by around 20 million.

Since 2019, there is no federal penalty for not having health insurance, says Brad Cummins, the founder and CEO of Insurance Geek. However, certain states and jurisdictions have enacted their health insurance mandates. The states with mandates and penalties in effect are:

- California

- Preventive and wellness services

- Pediatric services

There are a variety of health plans that meet these requirements, including catastrophic and high deductible plans.

Recommended Reading: Where Do You Go If You Have No Health Insurance

In 2021 Tax Year California Individual Mandate Penalties Will Be Issued

California Individual Mandate came into effect in January 2020 and requires citizens and dependents to obtain health coverage or be subject to penalty. California residents who did not obtain health coverage in 2020 can receive a penalty notice from the state as a part of the California Individual Mandate. When California residents file this year, they must include their health coverage information on their 2020 tax return.

If I Dont Qualify For An Exemption How Do I Avoid The Penalty For No Health Insurance 2020

The best way to avoid the health insurance penalty is to obtain coverage as soon as possible during the open enrollment period, which began on October 15, 2019 and will continue through January 15, 2020.

If you already have a plan, the open enrollment period is still a good time to review your current policy and compare coverage options in case you discover an option that better suits your needs.

You May Like: Where To Go To Apply For Health Insurance

When Is California Open Enrollment

The open enrollment period to sign up for health care coverage with Covered California is Oct. 15, 2019, through Jan. 15, 2020. If you dont have health insurance, this is the time to sign up to avoid having to pay the health insurance penalty.

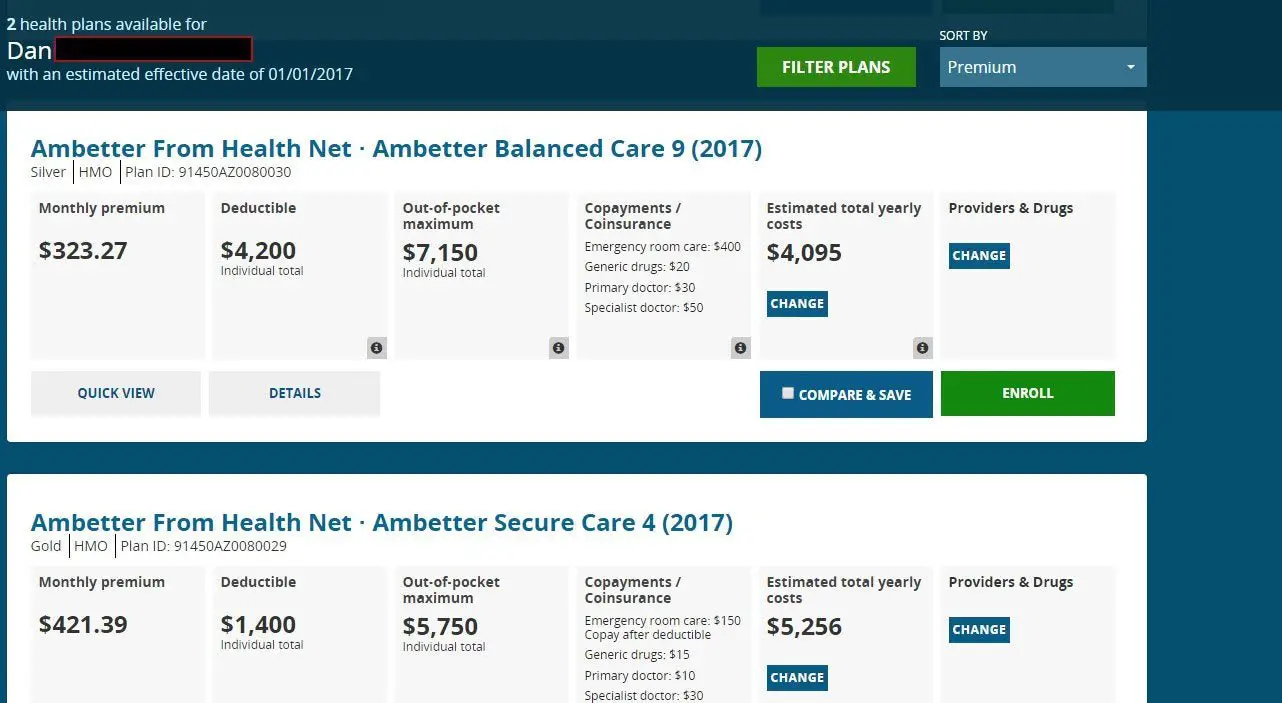

If you are currently uninsured, you can use Covered California to compare plans and enroll in a plan that meets your needs.

If you already have health insurance, you will be automatically re-enrolled in your existing plan if it is still available. If your plan is discontinued, you will be enrolled in a plan deemed similar by Covered California. Open enrollment is a time for you to review your coverage, compare plans, and switch to a new health insurance plan if you find a better option.

Exemptions From California Health Care Mandate Penalty

The health care mandate penalty will be reconciled on your California income tax return and administered by the Franchise Tax Board. The penalty for a full twelve months of no minimum essential health insurance coverage will either be a flat amount of $750 per adult or 2.5 percent of the gross income that exceeds the filing threshold, whichever is higher. The penalty applies to those months in which you or your family did not have health insurance coverage.

There are several conditions that will exempt you from having to pay the penalty on your California income tax return. Certain conditions will be process by the Franchise Tax Board such as

- Federally recognized Indian tribe and Alaska native members

- Short coverage gap resulting in no penalty

- Members of health care sharing ministries

- Income is below the tax filing threshold

- Enrollment in limited scope Medi-Cal

- Certain citizens living abroad

- Incarceration

FTB lists other conditions claimed on the State tax return that can also be used for an exemption.

- Health coverage considered unaffordable

- Families self-only coverage combined cost is unaffordable

Read Also: How To Enroll In Health Insurance

No Longer A Question On Federal Tax Return About Health Coverage

From 2014 through 2018, the federal Form 1040 included a line where filers had to indicate whether they had health insurance for the full year .

But since 2019, Form 1040 has no longer included that question, as theres no longer a penalty for being without coverage.

But state tax returns for DC, Massachusetts, New Jersey, California, and Rhode Island do include a question about health coverage. , in order to try to connect uninsured residents with affordable coverage. Colorados tax return will have a similar feature as of early 2022 .

In addition, nothing has changed about premium subsidy reconciliation on the federal tax return. People who receive a premium subsidy will continue to use Form 8962 to reconcile their subsidy. Exchanges, insurers, and employers will continue to use Forms 1095-A, B, and C to report coverage details to enrollees and the IRS.

The Fee For 2018 Plans And Earlier

- You may owe the fee for any month you, your spouse, or your tax dependents don’t have qualifying health coverage . See all insurance types that qualify.

- You pay the fee when you file your federal tax return for the year you dont have coverage.

- In some cases, you may qualify for a health coverage exemption from the requirement to have insurance. If you qualify, you won’t have to pay the fee. Learn about health coverage exemptions.

Don’t Miss: Is It Legal To Marry For Health Insurance

Complete Your Profile To Continue Reading And Get Free Access To Benefitsprocom Part Of Your Alm Digital Membership

Your access to unlimited BenefitsPRO.com content isnt changing.Once you are an ALM digital member, youll receive:

- Critical BenefitsPRO.com information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events.

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Qualifying For An Exemption

If you were not able to afford insurance in 2020, you can get an exemption and you will not have to pay the state penalty. Some exemptions require that you apply for them through Covered California, including general hardship, affordability hardship, and religious conscience exemptions. The full list can be found at Covered California, here. Note that you can only apply for a Covered California exemption for tax years 2020 and later. Other exemptions can simply be claimed when you file your state income tax return.

Also Check: How Much Does It Cost For Health Insurance

Helping You Get Insured Affordably

The risks of being an uninsured person are high. Without an insurance plan, both your health and your bank account are put in jeopardy. But by protecting yourself, you can make sure that an unexpected accident wont derail your life.

If youre self-employed and wondering about the costs associated with health insurance, check out this article: How much is health insurance for the self-employed?

KFF. Key Facts about the Uninsured Population.

Healthcare.gov. Read the Affordable Care Act.

Congress.gov. Tax Cuts and Jobs Act.

HealthCareInsider. 5 States Are Restoring the Individual Mandate to Buy Health Insurance.

KHN. The Cost Of Unwarranted ER Visits: $32 Billion A Year.

Bankrate. Survey: Fewer than 4 in 10 Americans could pay a surprise $1,000 bill from savings.

NCBI. Health Consequences of Uninsurance among Adults in the United States: Recent Evidence and Implications.

California Has Its Own Affordable Care Act Tax Penalty

- Not all states have expanded Medicaid coverage under the Affordable Care Act. Learn where California stands.

- The Affordable Care Act tax penalty has been set to zero, but some states have enacted their own health insurance requirements.

- If you miss the Affordable Care Act deadline in California, you may still be able to get covered.

- Three ways California residents can reduce the costs of health care coverage under the Affordable Care Act .

- Four ways students who need health insurance can get covered under the Affordable Care Act .

- When you have homes in two different states, it may be tricky to decide if you need one health plan or two.

You May Like: How Much Does Usps Health Insurance Cost