What Kind Of Healthcare System Does The Uae Have

The UAE has a mixture of public and private healthcare, although its certainly not a 50/50 balance. While each Arab Emirate has its own ratio, Dubais is the most extreme according to a 2018 report from the Dubai Health Authority, health services provision is 20% public and 80% private.

Did you know?

In 2018 there were 25 private hospitals in Dubai, compared to only two public hospitals.

Dubais public healthcare is mainly used by Emirati nationals, who receive treatment for free . Public services include emergency care, appointments with GPs and specialists, diagnostic tests, physiotherapy, prescription medicine, and maternity care.

Meanwhile, public services typically exclude dental care, ear care, and eye care.

Expats are able to use the public system too, although the services are not free for expats. Youll first need to acquire a health card from the Ministry of Health, which you can apply for online.

It makes sense to apply for the health card, as there may be treatments that your private medical insurance wont cover, which you can only get via the public system.

However, there are some fairly compelling reasons why Dubais public healthcare services shouldnt be your first port of call as an expat:

Heres how the key aspects of healthcare can differ in Dubai, compared to what you may be used to at home

Do Us Citizens Living Abroad Have To Buy Health Insurance

Americans who live abroad, or who spend a large proportion of their time overseas, often find theyll need a separate health insurance policy for this.

One option is to buy local insurance, but this wont cover you for trips home and you may find there are language barriers if you need to make a claim.

International health insurance is a popular alternative for American expats living overseas. With William Russell, English-speaking customer service representatives handle every stage of your claim from our UK offices, so youre in safe hands.

Read more about the difference between travel, local and international health insurance with our FAQ guide.

The Cost Of Adding 1000 Outpatient Cover

From a basic plan the next step is to decide whether you want to include any outpatient cover.

If you wanted to have any outpatient treatment included in your policy, such as Diagnostic tests and scans e.g. x-rays, MRIs, CT scans, blood tests etc, consultations or treatment such as physiotherapy, you would need to a level of outpatient cover.

|

Mid Range Health Insurance Policy |

|---|

|

Inpatient Cover |

Recommended Reading: What Do You Need To Get Health Insurance

How Much Does Individual Health Insurance Cost

BY Anna Porretta Updated on November 24, 2020

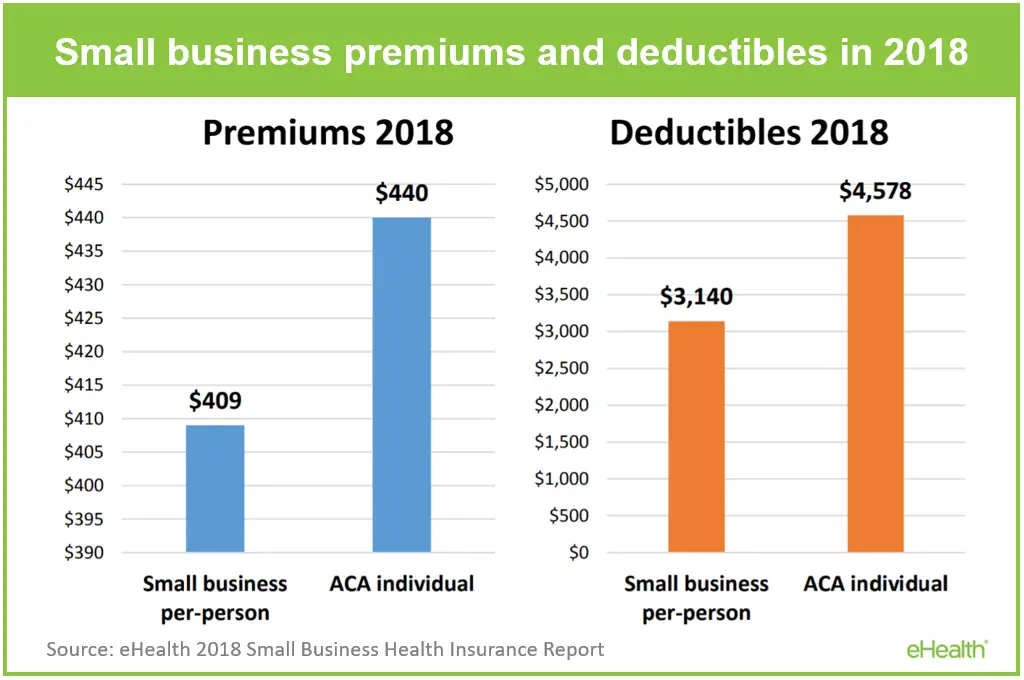

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

To see personalized quotes for coverage options available in your area, browse health insurance by state. If you already know which health insurance carrier youd like to purchase from, check out our list of health insurance companies.

Save On Your Premiums By Reviewing Your Health Insurance Annually

One of the biggest mistakes to make is becoming complacent with your existing policy. Even if you initially purchase a Health Insurance policy at a competitive price, there is no guarantee that your premiums will be as competitive the following year as markets and personal circumstances change.

How We Helped Hayden Half His Health Insurance Costs

We were able to help 69 year old, retiree Hayden, halve the cost of his Health Insurance by simply reviewing his existing policy. You can read more about Haydens story here.

Also Check: What Is A Gap Plan Health Insurance

Do You Qualify For A Subsidy To Lower The Average Cost Of Health Insurance For Yourself And Your Family

To qualify for a federal tax subsidy in 2020, your income for the year must be between 100% and 400% of the federal poverty level . This means you earn between:

- $12,490 to $49,960 if youre single

- $16,910 to $67,640 for a couple

- $25,750 to $103,000 for a family of four

The subsidy is based on your income for the full year, so you need to estimate how much youll earn during the coverage year. Learn more about how to calculate your Subsidy Eligibility here

How Do Health Insurance Subsidies Work In The Usa

A health insurance subsidy provides government assistance to contribute to the cost of cover in the USA, the Affordable Care Act provides a sliding scale of support to US citizens and legal residents earning four times the federal poverty level or less.

In 2021, the federal poverty level is $12,880 for an individual, so individuals earning less than $51,520 may be entitled to subsidised health insurance.

Applications are made through the government-run health insurance marketplaces in each state. Changes to incomes may affect eligibility, so applicants sometimes need to pay subsidies back if circumstances change.

Also Check: What Does Cobra Health Insurance Cover

What Is The Average Cost Of Non

What do you pay if your income exceeds the 400% FPL ? The average national monthly non-subsidized health insurance premium for one person on a benchmark plan is $462 per month, or $199 with a subsidy. Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. Actual cost varies based on your age, location, and health plan selection,

Take a closer look. In a recent eHealth ACA Index report, we tracked costs and shopping trends among ACA plan enrollees who bought non-subsidized health insurance at ehealth.com during the nationwide open enrollment period for 2020 coverage.

The Effect Of Different Hospitals On The Cost Of Private Health Care Insurance

The amounts a UK hospital charges to treat you can vary by hospital – use of their equipment, facilities and accommodation can be charged at different rates. As with the price of many services, it is typical for hospitals in larger UK cities to be more expensive than rural hospitals.

Insurers try to keep this situation fair for all concerned.

First, they negotiate with hospitals to ensure that prices do not rise out of control – they may even do deals to get preferential rates that should then result in lower premiums.

Second, they put the hospitals into different groups – each insurer calls their groups different things but they amount roughly to a group of the cheapest hospitals, a middle set and a group of the most expensive hospitals.

You then choose which set you want to be treated at, paying more if you want to be covered at the more expensive hospitals. This ensures that people living near cheaper hospitals are paying less for their health cover.

The flip side to this is that if you live near a large city, you might find your closest hospital is in your insurer’s most expensive category. This can have an effect on the amount you pay.

For example, Vitality’s lowest category includes “all of the hospitals in the UKs largest hospital groups, BMI Healthcare, Nuffield Health, Spire Healthcare, Aspen and Ramsay Health Care”.

Their top level includes all private hospitals in the UK and all NHS private patient units.

You May Like: How To Buy Pet Health Insurance

Do You Need Private Health Insurance In Dubai

In short: unless you are an Emirati national, you will need private medical cover in Dubai. Your employer in Dubai is legally required to provide you with basic health insurance, but not any of your dependents . Every resident of Dubai is legally required to have some form of private medical cover.

If youre bringing any family with you to Dubai, and/or your employer isnt providing you with what you feel is adequate cover, its a very sensible idea to take out some private medical insurance.

Thats why weve partnered with Cigna for private medical insurance in the UAE. With four levels of annual cover to choose from and extra modules for more flexibility, Cigna will sort you out with a plan that suits your needs.

Start building a customised plan with a free quote to protect your most important assets you and your family.

A stunning view of Palm Jebel Ali archipelago in Dubai

Get Medical Coverage Without Breaking The Bank

If youre worried about the high cost of traditional health insurance, catastrophic health coverage can offer you peace of mind for a fraction of the cost. Be sure to look into catastrophic health insurance requirements, and if you meet them, shop around for a provider that best meets your needs. If you want to get a customized quote on catastrophic health insurance, Benzinga can help.

You May Like: How To Find Health Insurance For Self Employed

Who Are The Top Uk Private Health Insurance Companies

When it comes to Health Insurance there are a range of providers and policies to choose from which of course will bring varying costs. However rather than focus on getting the cheapest deal, Its important to look for cover that gives you the best protection and that meets your particular circumstances.

There are also a number of smaller boutique providers who specialise in niches including covering the self employed and providing international cover.

It is important to obtain quotes from all of the top UK providers when doing your research as premiums can vary considerably based on your age and your current circumstances. To compare the top UK providers in seconds use our handy health insurance quote tool

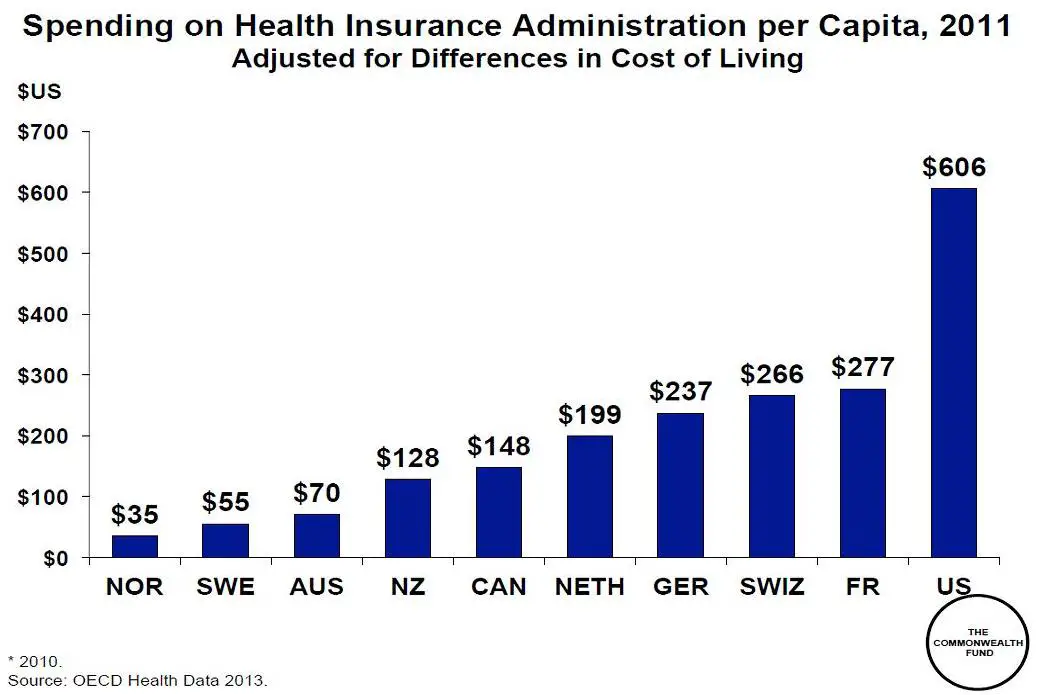

Why Is Life Expectancy In The Us Lower Than In Other Rich Countries

The graph below shows the relationship between what USA as a country spends on health per person and life expectancy in that country between 1970 and 2015 for a number of rich countries.

The US clearly stands out as the chart shows: Americans spend far more on health than any other country in the world, yet the life expectancy of the American population is shorter than in other rich countries that spend far less.

What are the best places for healthcare globally?

You May Like: How Much Is Health Insurance Through Work

Does My Us Health Insurance Cover Me Abroad

Most of the time, your domestic health insurance plan doesnt provide cover abroad, but there are some cases it will for instance, for emergencies, medical evacuations or during short trips. Contacting your provider is usually the best way to find out. Sometimes, even if your insurer will cover care in such cases, you may need to pay out-of-pocket and apply for reimbursement.

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates for instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

You May Like: Does Burger King Offer Health Insurance

Cobra Insurance In California

In California, COBRA insurance is available and required to be offered by employers. COBRA insurance allows for the continuation of group insurance benefits for a specified time if you were fired or quit your job. This insurance only allows for the extension of coverage if the employee and their dependents have experienced a qualifying life event.

Average Cost Of International Health Insurance For Singaporeans Abroad

A 45-year old Singaporean who is considered a global citizen can expect to pay S$4,162 for worldwide coverage. Premiums for international health insurance plans change depending on gender, age, location and coverage. Females pay 11% more on average than males, with 45-year old females paying S$4,042 per year compared to S$3,643 per year for 45-year old males. Additionally, an increase in age means an increase in premiums, with prices increasing 40% for every 10 year increase in age.

In terms of geographical coverage, premiums can be 30% cheaper if you limit your coverage to the ASEAN region instead of worldwide coverage. Additionally, worldwide plans that exclude the United States in their coverage cost on average 75% less than plans that include it.

Lastly, your premium changes depending on how much coverage you need. Top-tier plans with high coverage limits cost an average of S$5,941 for 45-year old males160% higher the average cost of S$2,104 for the same person buying a basic plan with lower benefit limits. This change in pricing remains fairly constant regardless of age or gender. However, you can shave a minimum of 10%-20% off your annual premium if you opt to have a deductible, making higher tiered plans more affordable.

Read Also: Is Family Health Insurance Cheaper Than Individual

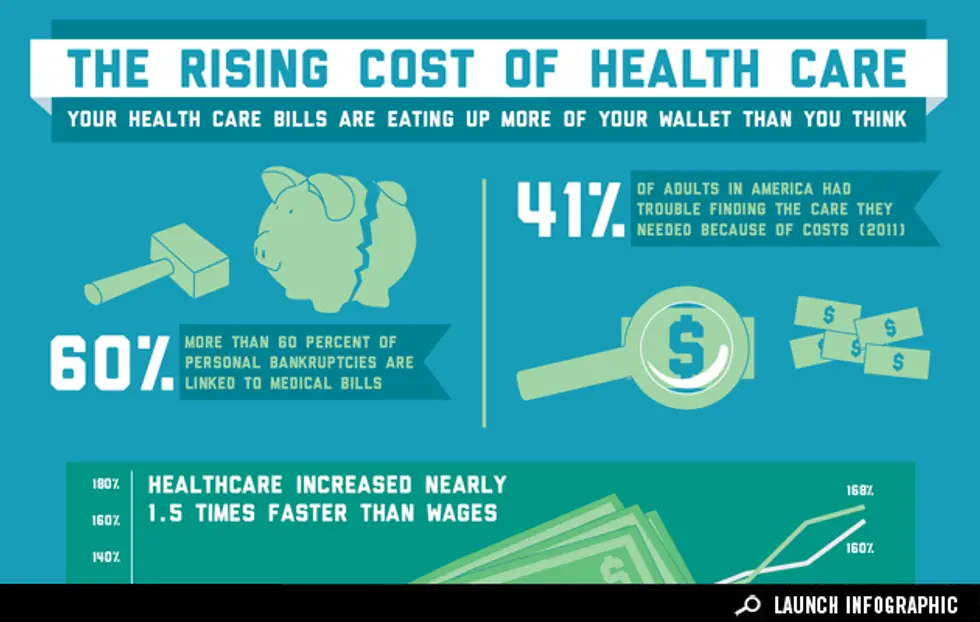

Health Insurance Costs Rising

All the noise pointed people away from the real meat of the Fraser studies. That was how much health costs had increased and how fast they were increasing.

For that average family, the cost of health insurance rose 1.4 times faster than their incomes did between 2006 and 2016. Incomes were up 26% in that time, but health insurance was up 37%.

To put it in perspective, the cost of shelter rose 36% during that time and the cost of food rose 30% during that time. Insurance costs rose 1.3 times as fast as these basic costs.

How Age Factors In

Young people, who are expected to benefit from lower premiums should the GOP repeal-and-replace efforts succeed, already pay the least. But even their costs can be considerable, depending on where they live. In 2016, the financial data siteValuePenguin found that the average costs for coverage for a 21-year-old go from $180 a month in Utah, plus a $2,160 deductible , to $426 a month in Alaska, with a $5,112 deductible .

As a reminder, 72 percent of young millennials, aged 18-24, have less than $1,000 in their savings accounts and 31 percent have nothing saved at all.

Recommended Reading: What Is Expat Health Insurance

Find Cheap Health Insurance Quotes In California

We compared quotes for health plans and concluded that the Silver 70 EPO and Silver 70 HMO were the most affordable Silver plans in most counties of California. Note that in California, there are many companies where you can buy individual health insurance, but they may not all be available in your county.

Is Health Insurance Getting More Expensive

It certainly feels like it. And its true that over the last decade, health care costs have risen significantly. The average family is paying 55% more in their premium in 2020 versus 2010 according to the Kaiser Family Foundation.5 And that number is up 22% since 2015.6 But premiums have only risen 4% when comparing 2020 against 2019.7

Health care costs also change based on where you live. In some states theyre up, in other places theyre lower.

If you feel like youre drowning in sky-high health insurance costs, there are some ways to save money on health insurance. Dont give up hope. You always have options, even if it just helps your budget a little. There are also some ways to save on health care costs your insurance doesnt cover.

And if youre trying to cut costs while paying off debt, or youre just starting to budget and barely making ends meet, you might want to choose a high-deductible and lower-premium plan that will kick in if you have serious medical issues or an accident. This allows you to focus on your necessities before you tackle an expensive health care plan.

Recommended Reading: What Health Insurance Is Available In Nc

How Changing Your Excess Affects The Price Of Private Health Cover

As with every type of insurance, UK private health insurance policies use an excess to help control claims.

The insurer’s thinking is that if you have to pay the first part of a claim, then you’ll be more careful about incurring a claim at all and only really do it when you have to. Their fear without an excess would be that people would claim regularly as there would be no cost to them.

Excesses are typically charged either per year or per claim . Make sure you know which you have as the per claim excess will often work out more expensive.

All insurers give some degree of flexibility on the excess you have on your policy – for example, Vitality let you choose whether you have a per year or a per claim excess and what amount you’d like.

The excess can also have a material impact on cost – a high excess makes things cheaper.

For example, BUPA health insurance costs roughly £34 per month with a £500 excess for our 33-year-old example, but it leaps up to £52 per month for a zero excess. Read a review of Bupa health insurance here.

While hiking up the excess can make for attractive premium levels, buyers should remember that adding a high excess not only means more to pay when you have a big claim, it also means that you will be wholly responsible for claim amounts under the excess you choose.

You can compare UK prices for private health policies, and compare their excess levels, using Activequote.com, which allows a detailed comparison of health policies online.