Ways To Avoid Paying The Medical Gap

If you have private health cover, contact your health fund for a list of healthcare professionals with gap cover arrangements. If youre treated by anyone on the list and they agree to participate, therell either be low or no medical gap cost involved.

The gap shouldnt be confused with excess or co-payments . Depending on your policy, these payments may also be required.

There are three ways you may be eligible for access to gap cover doctors participating in the Medical Gap cover scheme.

Explaining Why Your In

If there are any in-network providers of the same specialty as the out-of-network provider youre requesting a network gap exception for, you will need to explain to your health insurance company why you cant use the in-network provider.

Heres an example. Lets say you need ear surgery and are requesting a network gap exception to cover an out-of-network otolaryngologist doing the surgery. However, theres an in-network otolaryngologist within your geographic area.

The in-network otolaryngologist is elderly, has a hand tremor, and thus no longer performs surgery. If youre not proactive in explaining to your health plan why the in-network otolaryngologist cant provide the service you need, your request is likely to be denied.

The Best Gap Health Insurance Options

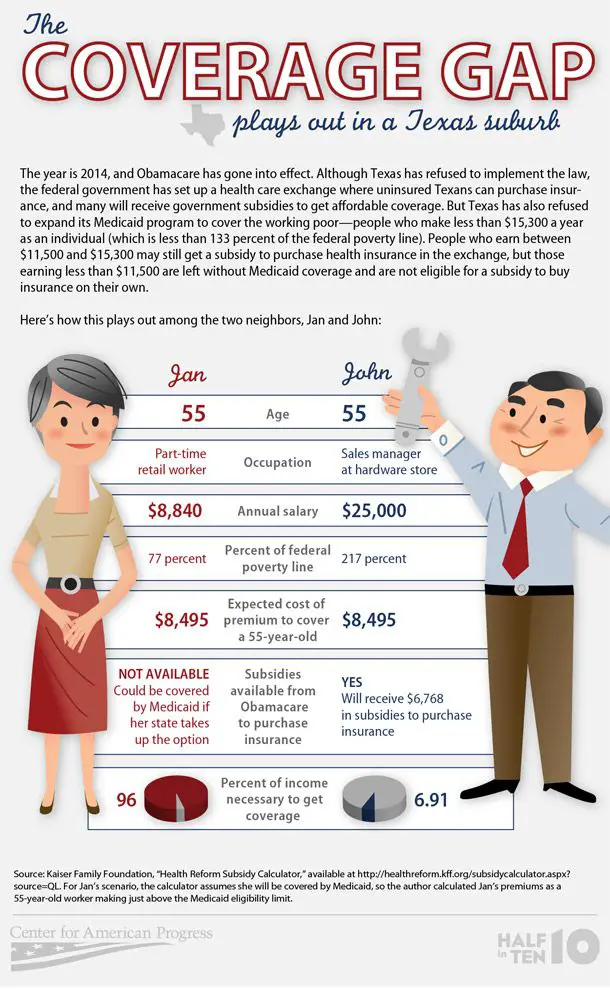

According to a study conducted by Commonwealth Fund Health Insurance, one-quarter of adults aged 19 to 64 have experienced a gap in their health insurance, with the majority remaining uninsured for greater than one year.

The financial and psychological stress from uncovered health expenses can be scary, but you have several options to protect yourself from the financial stresses of being uninsured.

Through these options, you may be able to continue access to affordable healthcare.

Recommended Reading: What Does Health Insurance Cost In Retirement

What Is Access Gap Cover

Frank has partnered with the Australian Health Service Alliance to give members access to Access Gap Cover. Access Gap Cover is a billing system that provides higher benefits than the Governments scheduled fee in most cases. It can reduce or even eliminate any gap for medical fees when treated as an inpatient in hospital.

Specialist doctors who are registered for, and use, the Access Gap Cover scheme will get a higher benefit from Frank , in exchange for limiting the out of pocket cost they charge to you.

There are two scenarios for how you may be billed by your specialist doctor when they use the Access Gap Cover scheme:

- No Gap this is where there will be no gap for you to pay following the procedure

Known Gap this is where you will be charged a maximum gap of $500 per specialist, per admission to hospital or a maximum of $800 for obstetrics services.

Who Files Gap Insurance Policy Claims

When you use your health insurance card at a doctors office or hospital, the provider or facility usually files the claim on your behalf. Shortly after the claim is submitted, you will receive an Explanation of Benefits showing how much the insurance paid towards your claim and what your out-of-pocket expenses, including deductibles, coinsurance, and co-payments could be.

To file a GAP policy claim, the insurer will take the EOB and submit it to the provider. When the insurer signed up with the provider, they should have been told when and where to access required paperwork for claim submission.

When filling out a GAP claim form, the insured can opt to have the reimbursement check to the provider or directly to themselves. When a reimbursement check is mailed to the insured and not the provider, it is the insured persons responsibility to pay any outstanding balances.

Ideally, after all the information above is considered, its obvious premium efficiency is the best way to develop a cost-effective strategy for your budget. To determine what policies will meet your medical and financial budgets, its necessary to combine the cost of a high deductible and compare it to the cost of a gap insurance plan.

If the gap insurance plan premiums are less than a high deductible, it makes sense to add the additional coverage to avoid the burden of high medical bills.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Is Gap Health Insurance Worth It

For employees, this will depend on their situation. Employees with extensive or on-going medical issues and high out-of-pocket costs will find the merit in a low-cost gap plan. On the other hand, healthy employees with no planned medical expenses in the future may not see the value in gap insurance. While employees will have to pay a monthly premium for the gap insurance plan, they still reduce their overall maximum out-of-pocket costs. This is important since, as the cost of healthcare continues to rise, employees salaries may not be enough to cover the cost of their monthly health premium and their health insurance deductible.

For employers, particularly those looking to keep or improve the benefits they offer, a gap plan can save them 10-20% on their group medical premium. With a gap plan, a business can offer gap health insurance that keeps out-of-pocket expenses for employees down while spending less than they would if they had a higher priced plan with lower deductible. If your major medical deductible is $1,000 and your gap plan deductible is $500, then the employee will only have to pay $500 in out-of-pocket costs.

Choosing A Health Insurance Plan

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

Read Also: How Much Is Private Health Insurance In New York

How Does Secondary Insurance Work

Secondary insurance plans work along with your primary medical plan to help cover gaps in cost, services, or both.

- Supplemental health plans like vision, dental, and cancer insurance can provide coverage for care and services not typically covered under your medical plan. Supplemental plans often have a deductible, copay, and coinsurance. When you meet the deductible then your plan starts sharing part of the costs with you. When you see a provider you may have to pay a small fee, or copay, at the time of the visit.

- Lump sum insurance plans pay you a cash amount, should you suffer a covered illness or injury. You can typically use the money however you’d like. You can pay off medical bills, pay your deductible, or even use it to cover everyday expenses like childcare, groceries, rent, and utilities.

- Gap insurance plans help you cover out-of-pocket costs related to your health care. For example, you can use a gap insurance plan to help pay your medical plan deductible or the deductible for a dental or vision plan. It can also help pay copays and any payments you make toward coinsurance.

- You may be required to pay a monthly premium for some secondary insurance plans. The premium cost depends on the type of plan and the coverage you choose.

- You may choose to have more than one type of secondary health insurance. These can provide benefits for different types of care and costs, should you need it.

Know How Long Youll Need Coverage

After you figure out when your current health insurance ends, you can figure out how long youll need coverage to fill your health insurance gap.

If you know when youll start getting health insurance again, this is easy. Simply calculate the time between when your current insurance ends and your new insurance begins to figure out how long your gap coverage needs to be.

Unfortunately, if you have no clue when youll get health insurance again, youll either have to guess or find a way to get permanent health insurance coverage. Some people may only need insurance for a few days between jobs. Others may need insurance for a few months until their benefit waiting period ends at their new employer.

You May Like: Is Cigna Health Insurance Any Good

How Does Gap Insurance Work

Let’s say your insurer determines if your vehicle is worth $12,000. After you pay your deductible they compensate you $11,500 to cover the loss.

Based on your financing, you still owe $15,000. This means $3,500 is still required to pay off your loan. Without it, you would be required to pay the difference.

If your insurer provides you with a compensation amount equal to your vehicle’s value, gap protection is not needed.

Keep in mind the costs for adding it will vary. Its estimated to be about 5% of your collision and comprehensive.

What You Should Know About Having Temporary Health Insurance

A short-term health insurance plan may work for your needs if you are generally healthy, between comprehensive health insurance options, and need affordable gap insurance. But its important to understand the advantages and disadvantages that come with temporary medical insurance.

Here are four major things you should know about short-term health insurance before buying a policy:2

Don’t Miss: How Much Is Travel Health Insurance

Reasons You May Get A Network Gap Exception

Youre unlikely to be granted a network gap exception unless the following are true:

If your situation fits the above requirements and youve located an out-of-network provider that meets all of your needs, you may submit a request to your health insurance company for a network gap exception. In some cases, the out-of-network provider may be willing to do this for you in other cases, youll have to do it yourself.

You should ask for the network gap exception prior to getting the care. If you wait until after youve gotten the care, your health plan will process the claim as out-of-network and youll pay more.

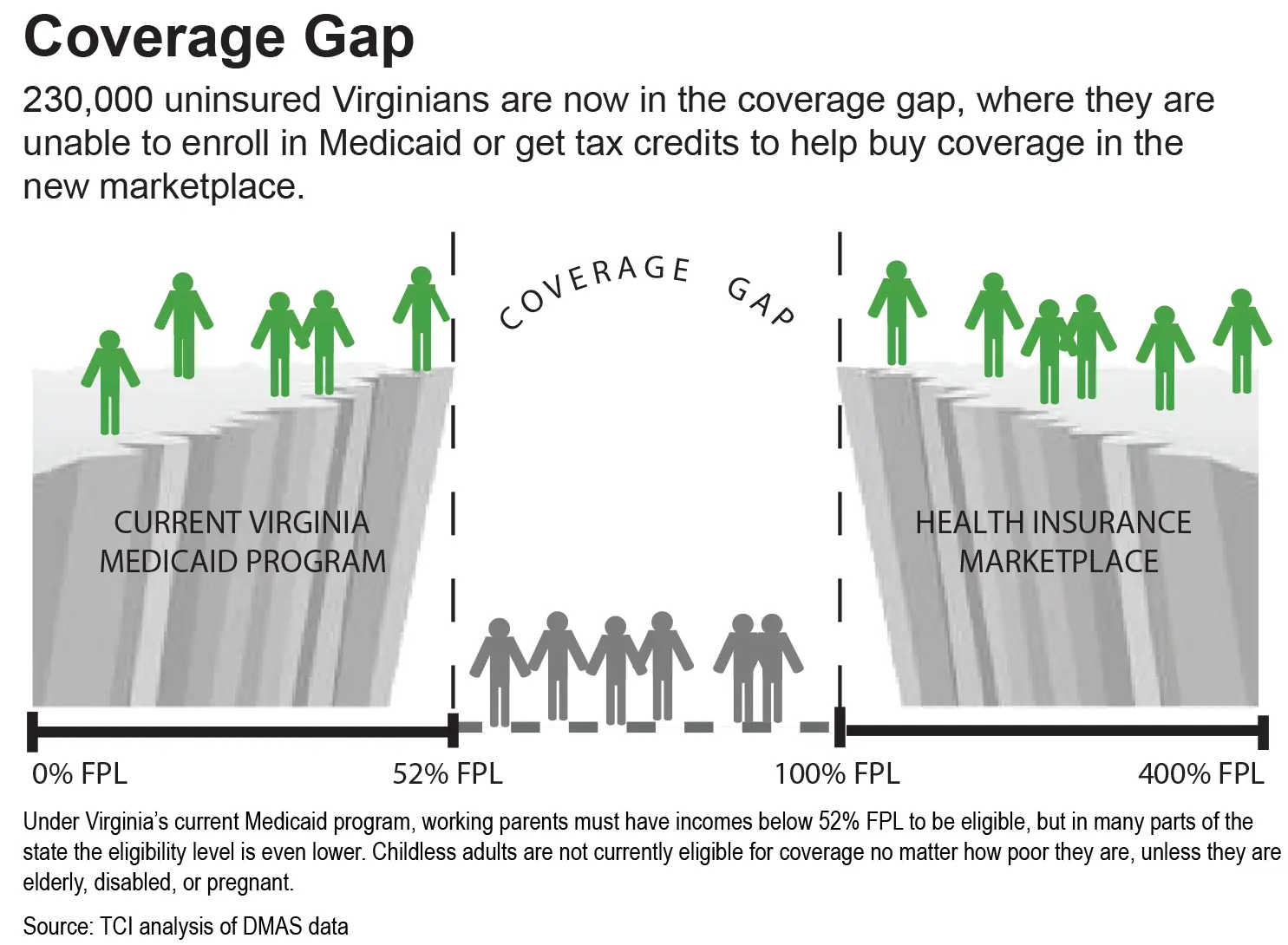

Leveraging Federal Hospital Funding For Medicaid Expansion

A more aggressive policy option would be to redirect existing federal spending rather than new federal funding in response to a states lack of a Medicaid expansion. This option could take the form of changes to Medicaids disproportionate share hospital payment program. Created to support hospitals that disproportionately care for Medicaid enrollees and uninsured patients, the optional DSH program has come under increasing federal oversight since the 1990s. In part, this results from evidence that states have not targeted DSH spending toward its original purpose for example, in 2012, about one-third of DSH payments were made to hospitals that did not meet program standards.

Under this option, Congress would replace federal Medicaid DSH allotments with a new, fully federal, highly targeted payment program for hospitals in such stateswithout reducing federal funding for these states hospitals. Congress would set a funding formula for these states hospitals based on uninsured patients costs, and pay them via the Medicare program . Federal DSH allotments and states uses of them would remain unchanged for states that have expanded Medicaid. States that want to maintain control of federal DSH allotments would have an incentive to expand Medicaid.

Table 2

|

Note: For fiscal year 2019. |

Also Check: How Do I Get A Health Insurance Card

Get Gap Cover From Only R109 A Month

Starting at R80 a month for Supplementary Illness Benefit and R109 a month for Discovery Gap Cover. Discovery’s Gap cover options supplement and extend certain health insurance options at a cost-effective premium.

Premiums are based on the individual’s circumstances and is in line with short-term insurance and long-term insurance pricing principles. There are certain requirements on application, and waiting periods may apply based on the health plan at the time of activating the cover.

For more information speak to your financial adviser or

For more information, speak to your financial adviser or download the application form. Gap cover products are available to members of Discovery Health Medical Scheme excluding members on KeyCare plans. Discovery Gap Cover is a non-life insurance product, underwritten by Discovery Insure Ltd. Supplementary Illness Benefit is a life insurance policy, underwritten by Discovery Life Limited and is a separate product that is not conditional on the purchase of Discovery Gap Cover.

This is not a medical scheme and the cover is not the same as that of a medical scheme. These policies are not a substitute for medical scheme membership. This is a summary of the key benefits and features of Discovery Gap Cover and Supplementary Illness Benefit

About us

Increasing Federal Funding For The Medicaid Expansion

A straightforward approach to encouraging the remaining states to expand Medicaid is to increase federal financial support for doing so. In his fiscal year 2017 budget, President Obama proposed to provide states that newly expand Medicaid the same higher federal matching rate and six-year phase-down as those that expanded in 2014 .23 Senators Warner and Kaine introduced this proposal, called the SAME Act .24 The Congressional Budget Office projected that this policy would cost $31 billion over ten years.25 Congress could also vary increased federal financial incentives, such as extending the number of years that a newly expanding state gets 100 percent federal funding, or increasing the federal matching rate for such states from 90 percent to 95 percent, for example, for some extended length of time or in perpetuity.

Read Also: How Do I Know If I Have Private Health Insurance

Our Gap Cover Products

“I’ve had gap cover before with another company. With them it took me up to three months after I’ve been hospitalised to get my claim submitted. I’ve been on Discovery Gap Cover for less than a month. I was hospitalised in September. I didn’t even submit an additional claim and I already received my money. Thank you very much. After an operation the last thing you want is to struggle with documents.” – Discovery Gap Cover client, Nienke Nieuwenhuizen

The Pros And Cons Of Gap Insurance

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

More Americans are switching to high-deductible health plans to lower their monthly premium costs. But the lower sticker price can eventually come back to bite you. The average annual deductible for an employer-provided individual health plan is $1,478 and even higher for families.

To help deal with increasing out-of-pocket costs, more Americans may turn to gap insurance plans . According to a report released this year by insurance company Aflac, 79% of workers said they saw a growing need for supplemental insurance plans to help cover expenses their primary insurance does not cover compared to 64% a year ago, and 60% of those said it was because of rising medical costs.

There has been buzz around gap plans for more than a decade, says Rhett Bray, president of BeaconPath, a Mission Viejo, Calif.-based employee benefit consulting firm. But interest really boomed around 2013, with the rollout of the federal health care marketplace and growing popularity of high-deductible plans.

Also Check: How To Apply For Health Insurance In Wisconsin

Now You Know You Need Affordable Gap Health Insurance Now

With the rising deductibles, copays, and coinsurance on nearly all ACA health insurance, we feel a gap health insurance plan helps families save money. Are these plans right for you? Contact us or use the form below for our help. We only work in your best interest for you and your family. With your help, we will analyze your situation and determine if a gap health insurance plan is right for you. If not, then we will offer alternatives. It is that simple. There is no risk to using our services or asking us for assistance.

Who Might Benefit From Gap Insurance

Whether or not a medical gap plan is worth it for you depends on your healthcare needs and your financial situation. You may benefit from a gap health plan if you:

- Have a major medical plan with a high deductible and other out-of-pocket costs, whether from an employer or the ACA Marketplace

- Dont have access to funds from a regular savings account or health savings account

- , which increases the chances you may need to obtain healthcare services outside of your plans network and pay more

- Copayments

A Medigap policy is sold by private companies. Learn more about Medigap coverage.

Read Also: How Much Is Health Insurance In Costa Rica