Health Insurance Coverage For Spouses/partners

The Affordable Care Act has opened up a world of options for many Americans that either paid for expensive, insufficient health insurance or who were shut out of the health care system entirely. Likewise, the legalization of same-sex marriage has impacted how couples can meet eligibility requirements for their spouses employer-sponsored health insurance plans. With these newfound benefits have come added complexity in how health insurance is managed by employers and offered on the private market, and it is important to understand how they work so that you can make the best choice for yourself and your family.

Spousal health insurance plans

Before you automatically jump on one anothers health insurance plans, be sure to do the math and compare features. If you each have an individual policy at your respective jobs, the cost of those two plans might actually add up to be less than one family plan at either of your jobs. You may also be subject to the spousal surcharge, where an employer will charge more for a family health insurance plan if it knows that a spouse has a health insurance plan available at his or her own employer. This fee may eliminate any cost savings that you might have experienced by combining plans. At the same time, you should review the features of your existing health insurance plans to make sure that they meet your needs.

Domestic partnership health insurance plans

Additional Information & Resources

What You Can Do Right Now

Add/remove A Spouse Or Child Online

Requests to add or remove a spouse and/or children from an MSP account may be submitted using an online form, including the submission of supporting documentation.

The MSP Account Change Request online form takes about 15 minutes to complete. No login or password is required: the Account Holders Personal Health Number will be used to verify your account.

If you are covered under a group plan administered by your employer, union or pension office, please do not use this application. Contact your Group Plan Administrator to complete a Group Change Request .

An Employer Offer To Help With The Cost Of Coverage

You may qualify for a Special Enrollment Period if you or anyone in your household newly gained access to an individual coverage HRA or a Qualified Small Employer Health Reimbursement Arrangement in the past 60 days OR expects to in the next 60 days.

Note: Your employer may refer to an individual coverage HRA by a different name, like the acronym ICHRA.

Generally, youll need to apply for and enroll in individual health insurance before your individual coverage HRA or QSEHRA starts. However, your employer may offer different options for when your individual coverage HRA or QSEHRA can start so you have more time to enroll. Contact them or check the notice you got from your employer for more information. If youre currently enrolled in a Marketplace plan with savings, these savings may change because of the help you get through a job. Get more information on how your savings may change if you have an individual coverage HRA or QSEHRA offer.

If you qualify to enroll in Marketplace coverage through this Special Enrollment Period, call the to complete your enrollment. You cant do this online.

Recommended Reading: Does Cigna Health Insurance Cover International Travel

Five Tips To Get You Started

Nothing says togetherness like a family deductible. While its not the most romantic notion, your marriage nuptials are considered a qualifying life eventand that means you and your new spouse can get or change health coverage as soon as youre married. This eligibility applies to any kids you might already have, too.

So how best to plan for the big life changing leap into the health coverage pool after getting married? Start with these five considerations:

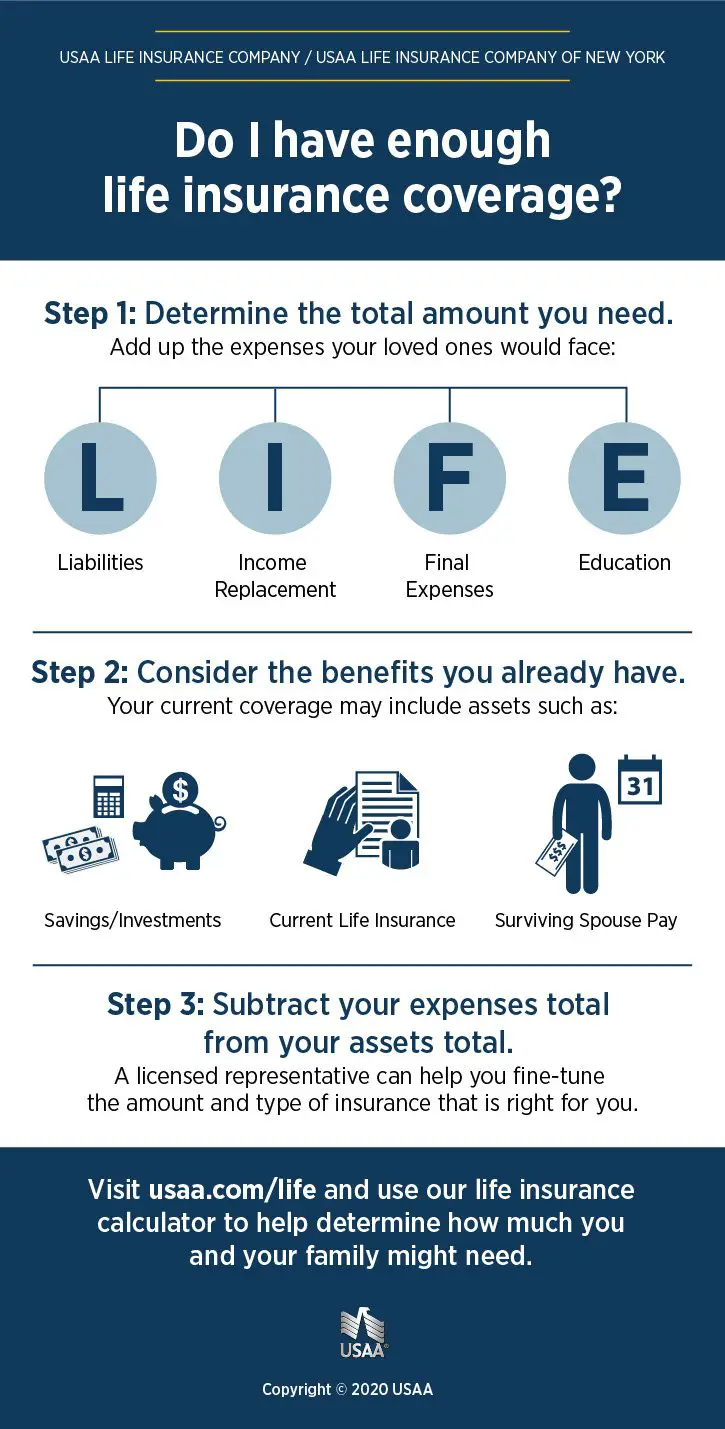

Reasons To Buy Life Insurance On Your Spouse

Just as there are a number of reasons why you should buy life insurance on yourself, there are several good reasons to buy life insurance on behalf of or with your spouse and name yourself as the beneficiary.

Connect with a licensed life insurance agent today for any additional questions you may have about buying life insurance with your spouse. You can reach out online or by calling 1-855-303-4640.

Don’t Miss: How Does Health Insurance Work Through Employer

Can I Add A Domestic Partner As A Dependent

Even if your state doesnt recognize domestic partnerships or common law marriages, it is possible to cover a domestic partner under your insurance policy by listing your spouse as a dependent.

As in most other cases, a lot will depend on the insurance company and the specifics of the policy.

Unless the term domestic partner is used and defined by the insurance company, then your insurance company can easily prohibit coverage for a spouse of the same gender.

If there is a domestic partnership registry in any given state, the insurer and employer may require that same-sex couples are registered to provide evidence of the relationship.

Your health insurance company will also probably need a signed affidavit from you that satisfies the companys definition of a spouse and establishes a history of a shared household.

In the eyes of an insurance company or employer, a domestic partner may be considered a dependent. However, the same cannot be said of the Internal Revenue Service.

For income tax purposes, a dependent must be a child or a qualifying relative, and domestic partners are specifically excluded.

Under the Defense of Marriage Act of 1996, federal government agencies are prevented from recognizing any same-sex marriages that have taken place in the states of New York, New Hampshire, Maine, Connecticut, Massachusetts, California, Vermont, and Iowa.

Use our FREE online comparison tool to find affordable health insurance in your area!

Your Rights To Continue Health Insurance After Divorce

Continuing healthcare after divorce will depend on your situation.

You have many options when it comes to health insurance. Here are a few of the more common:

- Employer-sponsored plans

- Medicaid

- Tricare

One of the things I get asked about all time is whats the difference between an HMO, PPO, and POS.

Heres a quick overview:

State laws may also come into play. For example, in some states, it is illegal for a spouse to drop the other person from healthcare coverage while a divorce is in progress.

Other states view legal separation the same as divorce, and a spouse may be dropped from coverage just as they would if they were divorced.

In all cases following a divorce, an employer will no longer cover a spouse under an employees healthcare policy.

However, a spouse does have rights under COBRA to continue coverage. A spouse will have 60 days to notify the employees health plan administrator that they would like to continue coverage. They will be able to do so as long as they pay the healthcare plan premium.

Also, during a divorce, temporary orders by the court may mandate that a spouse continue to provide health insurance until a divorce is finalized.

If a spouse violates that order and drops a spouse anyway, the spouse that loses coverage can file a petition for a violation of the court order. The spouse will be required to add the person back on to the policy and incur any additional costs to do so.

Don’t Miss: Can Aflac Replace Health Insurance

Ad& D: Accidental Death And Dismemberment

This accidental death and dismemberment policy covers you if you lose a limb or die accidentally

If you already have a life insurance policy that covers accidental death, death by disease, death by chocolate, whatever kind of death you can come up with, why would you need additional coverage for an accidental death?

Hint: You dont. Not only are these policies cheap, theyre also worthless because of the long list of conditions the insurance company says it wont payout for. Buyer beware: The devil is in the details, and AD& D policies are chock-full of those details!

And dont be fooled into AD& D even if the insurance rep says youre covered if you dont die but just lose a limb or something. If you have long-term disability insurance in placeand we hope you do because its just as important as getting term life insuranceyoud be covered for income lost because of an injury or disability anyway.

How much long-term disability insurance do you need? We say get as much coverage as you canaround 6070% of your income. Because this is the amount of your salary you bring home on a normal day

Aging Out: Max Looks Forward To His 26th Birthday

Max is a graphic designer at a Philadelphia magazine. Though his employer offers health coverage, Max found it easier to remain on his parents’ health plan. But after he turns 26 in several months, he wont be eligible for his parents’ coverage anymore. Because aging out of your parents’ plan is a qualifying life event, Max can enroll in his employer’s plan the day after his parents coverage ends . He’ll now have to pay for his own coverage, but he’s glad he has access to quality health care.

Other types of health coverage loss include:

- Losing existing health coverage, including job-based, individual, and student plans

- Losing eligibility for Medicare, Medicaid, or CHIP

Read Also: How To Get Cheap Health Insurance In Texas

Can I Add My Girlfriend Or Boyfriend To My Health Insurance

Today, finding health insurance coverage can seem like a grueling process. While many employers do still offer policies that provide adequate coverage, the cost for such coverage has become astronomical. As a result, many people are investigating non-traditional approaches to obtain the health insurance that they need so that they can avoid jeopardizing their health and well-being. One option that a lot of individuals are exploring is the possibility of obtaining coverage via their boyfriend or girlfriend.

If youre wondering if you can add your boyfriend or girlfriend to your health insurance plan, the best advice is to speak to your provider however, if youre curious if adding your other half to your policy despite the fact that you arent married is a possibility, below, youll find some useful information about your options.

Adding An Internationally Adopted Child

If you are covered under a self-administered account, you need to complete an MSP Account Change Request .

If you are enrolled under a group plan administered by an employer, union or pension office, you need to complete a Group Change Request .

Your form must be submitted with photocopies of documents that support the childs name and immigration status in Canada. If the child has been granted Canadian citizenship, provide a copy of his/her Canadian citizenship card or Canadian passport. Otherwise, if Citizenship and Immigration Canada has issued the child a Confirmation of Permanent Residence document that indicates the adoptive parents names, a copy of this document is usually sufficient. If the child either holds a Confirmation of Permanent Residence document that does not include this information, or holds a different immigration document, two items are required:

- A copy of the childs current immigration document, for example his/her Confirmation of Permanent Residence, Permanent Resident Card , or Temporary Resident Permit, and

- A letter from the Director, Adoption Branch, Ministry of Children and Family Development, to Immigration, Refugees and Citizenship Canada, stating that the Ministry has no objection to the adoption .

If the child is being adopted from the United States and arrives in B.C. before an immigration document has been issued, include a note to this effect and a copy of the letter described previously, with your completed form.

Read Also: How Much Is Temporary Health Insurance

Can I Add My Wife To My Health Insurance At Any Time

Should i add my spouse to my health insurance. Medicare Part A is free for most people and it doesnt hurt to enroll even with other coverage. But according to the Kaiser Family Foundations annual survey of employer-sponsored coverage 95 percent of employers that offer health benefits extend that offer to employees spouses. Either qualifying event might require documentation such as your marriage certificate or a letter from your spouses employer detailing the change in his or her health insurance coverage.

So based on premium alone its generally more economical for each spouse. Also some couples may have no choice but to enroll in separate health insurance plans as the Affordable Care Act rolls out. Often an employer will cover a portion of this and will typically contribute more toward the employees plan than the spouses.

After getting married you usually have up to 60 days to enroll in a new plan or add your spouse as a dependent. This means that the individual when progressing through employee orientation and signing up for health insurance can sign up a spouse for the insurance at the same time he is completing the application. Yes it is legal.

Should I add my spouse to my health insurance. Once you decide to add a spouse you usually need specific documentation to prove eligibility. In most cases adding a spouse to your health insurance plan is acceptable.

How To Add A Wife To Health Insurance Health Insurance Humor Health Insurance Supplemental Health Insurance

Both Spouses On One Plan

This is probably the most common choice for couples, even if both can get coverage from their employers. Since you are paying for only one plan, this could be the cheapest option. In some cases, the spouse who declines their companys coverage may even get a small financial bonus, since they are saving the company money by not taking the companys insurance.

Be sure to study each companys health plan offerings carefully. Different companies may offer very different levels of coverage and benefits. And they may differ in how much their employees must pay for their health insurance.

For example, your company may pay all or most of the cost for your own coverage, but charge you much more to add your spouse and children to your plan. Meanwhile, your spouses company may allow you to cover the whole family for less. So first, check the cost of each option.

Next, carefully compare the benefits offered by each spouses company. The company plan that is cheapest that is, that has the lowest monthly premium for the whole family may offer less coverage. The cheapest plan may have high deductibles or high copays, so if one or more member of your family has many medical problems, it could end up costing you more in the end.

Finally, be sure to check out each companys provider network. This is the list of doctors the plan will cover at the lower in-network price, meaning you pay less for your medical care.

Also Check: Is It Legal To Marry For Health Insurance

Can I Tap Into My Spouses Healthcare Resources In Other Ways

Yes. To qualify for Medicare, you must work at least ten years by age 65. If you do not have ten years of work history, but you were married for at least ten years to someone who does qualify for Medicare, you may still qualify through your former spouses benefits.

Some conditions that must be met for qualification:

- You must be unmarried

- If you were not married for at least ten years, you would need to have been married for at least one year before the date of your spouses death

- You need to be 62 years old or older

- Your former spouse must be entitled to Social Security retirement or Disability Benefits

- Your entitled benefit is less than that of your former spouses benefit.

Figure Out Your Next Step

Unless youre financially independent and dont need a job to afford your lifestyle, youll need a plan for earning money after you quit your job. Its better to review your options before losing your current income stream.

Consider applying for jobs prior to putting in notice of your resignation. You might avoid having a lapse in income if you can start working in your new role as soon as your old one ends.

If you have entrepreneurial dreams and dont care to work for another boss, see our ultimate guide to starting a business. This list of home business ideas can help you get started with little capital.

You might decide you really just want to take some time off before jumping into your next employment pursuit. Taking a career sabbatical may mean you wont be seeing a paycheck coming in, but the time off can be energizing and might help you better concentrate on what youd like to do next.

Recommended Reading: Does Health Insurance Pay For Abortions

Special Enrollment Period And Qualifying Life Events

Following a divorce, those left without an insurance plan can try to enroll in a Marketplace health plan during a Special Enrollment Period. Special Enrollment periods allow individuals or families to enroll in a health plan outside of the designated Open Enrollment period, which typically falls between November 1st and December 15th each year. To qualify for a Special Enrollment period, applicants must have recently experienced a Qualifying Life Event . These are defined as significant life changes that may have prevented you from enrolling during Open Enrollment. There are many situations that can be considered QLEs, but they each fall into one of four basic categories.