Limits On Annual Spending

Its important to note that not all plans have deductibles, but all plans do have out-of-pocket maximums, which is a requirement of Obamacare.

Obamacare also requires the federal government to set annual limits on out-of-pocket maximums that apply to every health plan sold in America. There are different out-of-pocket maximums for individuals and family plans that have two or more members. In 2016, your out-of-pocket maximum can be no more than:

- $6,850 for an individual plan.

- $13,700 for a family plan.

Starting in 2016, individual limits apply to everyone with coverage, even those who are part of a family plan. For example, if you have three people on a family plan, the total the family spends on medical costs out-of-pocket cannot exceed $13,700. However, if one person on the plan incurs covered costs that year amounting to more than $6,850, the individual limit applies.

How Do Gap Plans Work

Gap plans cover a set amount of your deductible for medical expenses. They bridge the gap between your deductible and what you can afford out-of-pocket. For example, if your deductible is $1,500 and your Gap plan deductible is $750, then you will only have to pay $750 in out-of-pocket costs. While you will have to pay a monthly premium for Gap insurance plans, they can still reduce your overall out-of-pocket costs.

Gap plans are not unique to the healthcare industry. Gap plans are found in many types of insurance, but theyve become increasingly popular for health insurance as deductibles and policy premiums have become more expensive.

Since Gap health coverage policies are not major insurance policies, theyre not regulated the same way as other plans under the ACA. Because of that, you should make sure that a gap plan will cover your medical needs before opting in. For example, gap plans may not cover pre-existing conditions or certain medical procedures. Make sure when shopping for an affordable health insurance plan you are protected from high deductibles in the event of a medical emergency.

Popular Articles

Whats The Right Deductible For Me

The answer to this question depends largely on how many people youre insuring, how active you are, and how many doctor visits you anticipate in a year.

A high-deductible plan is great for people who rarely visit the doctor and would like to limit their monthly expenses. If you choose a high-deductible plan, you should begin saving money so that youre prepared to pay any medical expenses up front.

A low-deductible plan may be best for a larger family who knows theyll be frequently visiting doctors offices. These plans are also a good option for a person with a chronic medical condition.

Planned visits, such as wellness visits, checkups on chronic conditions, or anticipated emergency needs, can quickly add up if youre on a high-deductible plan. A low-deductible plan lets you better manage your out-of-pocket expenses.

Recommended Reading: Can You Have Double Health Insurance

How Much Do I Have To Pay For A Procedure If I Havent Meet My Health Insurance Deductible

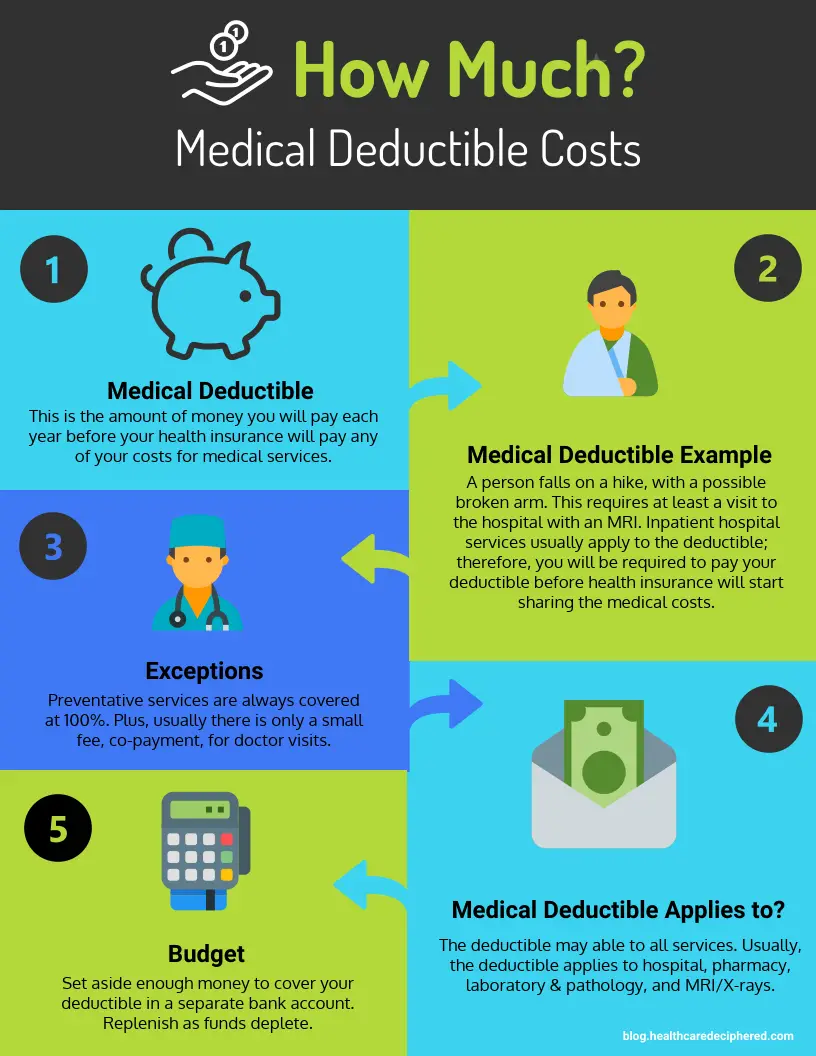

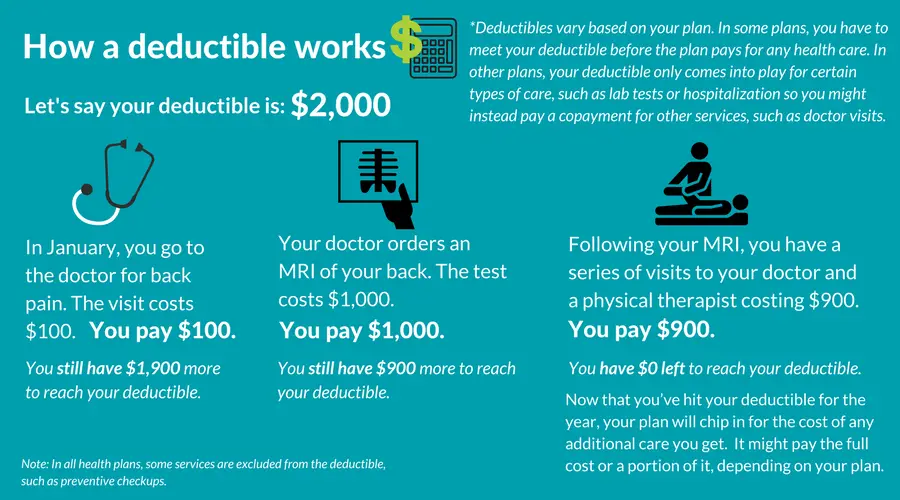

Believe it or not, this is very easy to explain. All the hospital will do is take the amount you have accrued towards your health insurance deductible and subtract it from your health insurance plans $2,000 deductible. Below are three examples of how that plays out.

______________________________________________________________________________________

Will You Always Have A Copay

No. It will depend on your plan, and the service youre using. Some plans use them to cover shared costs, but others dont. And sometimes the service youre using will be paid for with a mix of a copay and/or your deductible and coinsurance obligation. Plus, as well discuss more below, some plans offer certain services at no cost to you, such as annual exams or other preventive care.

You May Like: Are Health Insurance Companies Open On Weekends

Payments Of Premiums For Private Health Services Plans

As a rule, premiums that are paid to private health services plans including medical, dental and hospitalization plans are considered to be eligible medical expenses by the Canada Revenue Agency. Furthermore, any premium, contribution or other consideration including sales and premium taxes that you pay to a private health services plan for yourself, your spouse or your minor children, is an eligible medical expense.

However, the plan you make the payments to must qualify as an eligible private health services plan. When changes were made a few years back, the CRA adopted a less restrictive position regarding which plans are considered eligible. They now consider a plan to be eligible as long as all or substantially all of the premiums paid under the plan relate to medical expenses that are themselves eligible for the Medical Expense Tax Credit. The plan must also be an insurance plan, instead of another form of contract. To be considered as substantial, the CRA refers to approximately 90 percent or more.

Previously, the CRAs position was that 100 percent of the premiums had to be paid to be considered as eligible medical expenses. The rule now means that plans that offer some non-eligible benefits can still be considered eligible, if these benefits are less than 10 percent of the total benefits.

Plans that are paid by an employer and most mandatory provincial health plans are not eligible to be claimed as health expenses.

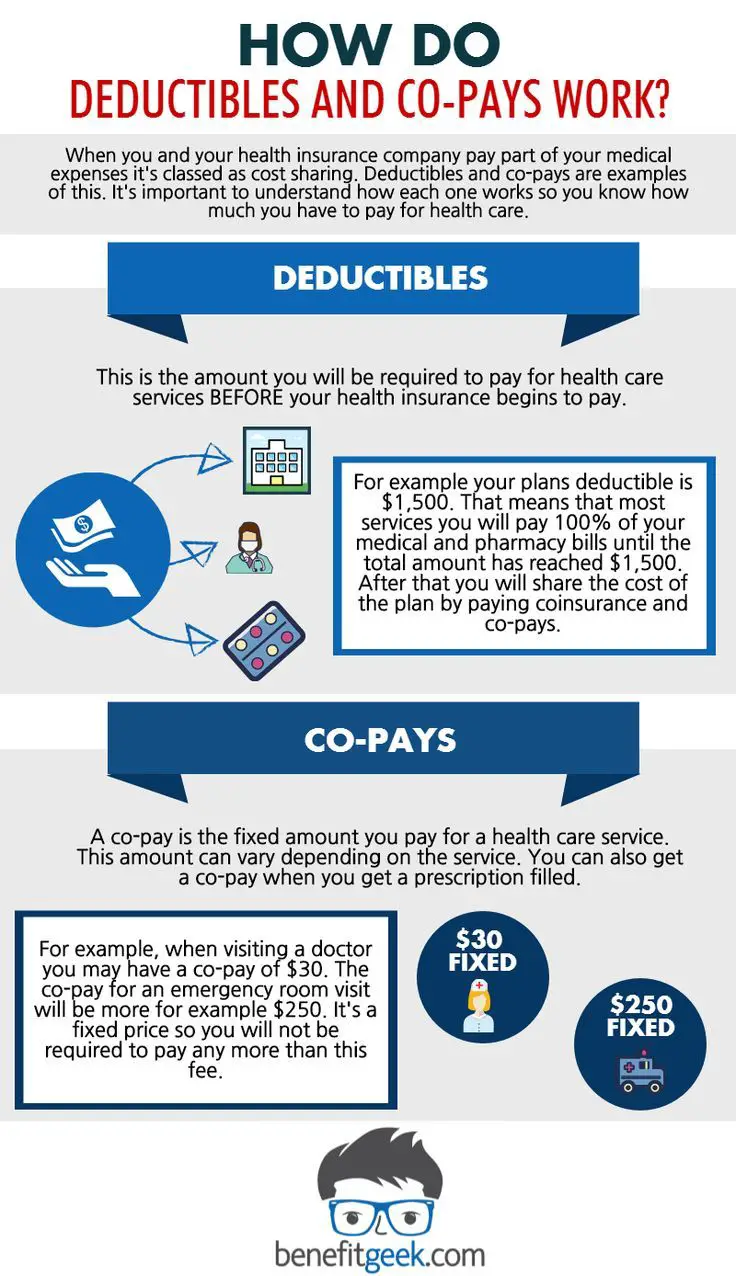

What Is A Copay

A copay is a fixed amount you pay for a health care service, usually when you receive the service. The amount can vary by the type of service.

How it works: Your plan determines what your copay is for different types of services, and when you have one. You may have a copay before youve finished paying toward your deductible. You may also have a copay after you pay your deductible, and when you owe coinsurance.

Your Blue Cross ID card may list copays for some visits. You can also log in to your account, or register for one, on our website or using the mobile app to see your plans copays.

Recommended Reading: Does Colonial Life Offer Health Insurance

How Should I Choose A Health Insurance Deductible

Every persons situation is different, and what works for your needs will depend on your health needs, budget, and more. As youre considering your options, its important to take the time to shop around and compare costs. As mentioned, deductibles and other out-of-pocket costs may vary quite a bit from plan to plan. Comparing costs is easy and could save you money.

If youre interested, an eHealth licensed insurance agent would be happy to walk you through your options to find a health plan that might fit your needs. You can also start shopping on eHealth at your own convenience and compare all health insurance options in your state!

Related Articles

Do Health Plan Deductibles Reset Year After Year

Read Also: How To Qualify For Government Health Insurance

The Trend Toward High

High deductibles usually come with lower monthly premiums. People who are relatively young and healthy often decide to opt into a less expensive policy with a high health insurance deductible that just covers the bare minimum.

People also opt for high-deductible plans to save money. NPR reported that in 2016 more than 9 in 10 people buying healthcare insurance under the Affordable Care Act chose a plan with a deductible of $3,000 or more. Employers often switch to a higher deductible plan to regulate costs when policies become more expensive. This has the same effect of leaving policyholders to pay more out-of-pocket for their healthcare.

The problem is the price tag for well-care/preventative or emergency services under these plans often ends up being too expensive for the policyholder. People commonly dont get the care they need as a result. That is why Gap insurance comes in handy.

The Importance Of Understanding How Deductibles Work For Health Insurance

Saving money is an incredibly important part of life. Never is that more important than when it comes to your healthcare. Before you choose a health insurance plan, understanding how deductibles work for health insurance is a great way to prepare for the inevitability of utilizing the protections of your health insurance policy.

You May Like: Does Health Insurance Cover Pre Existing Conditions

Keep Costs Down Stay In Network With Provider Finder

One way to help keep your health insurance costs down is to use only doctors, hospitals and other health care professionals in your plan’s network. If you go out of network, you might have to pay the entire bill. Not all plans have the same network. The best way to find in-network providers is byregistering or logging into Blue Access for MembersSM, our secure member website, for a personalized search based on your health plan and network using our Provider Finder®tool.

Primary Insurance Vs Secondary Insurance: Who Pays First

Coordination of benefits isnt always standard. Plans can differ, so its vital to talk to your employers benefits department and health plan if you have two health plans.

That said, here are situations when you may have more than one health plan and which one would likely be the primary insurer and which would be secondary:

| Situation |

|---|

Recommended Reading: How Much Health Insurance Do You Need

Understanding Health Insurance Premiums

Health insurance premiums, the amount paid upfront in order to keep an insurance policy active, have been steadily increasing as the cost of healthcare has increased in the United States. Premiums can be thought of as the “maintenance fee” for a healthcare policy, not including other payments that consumers have to pay such as deductibles, co-pays, and other out-of-pocket costs.

When the Affordable Care Act was passed by President Barack Obama in 2010, it allowed certain families to access premium tax credits on their health insurance plans, relieving some of the burdens of skyrocketing health insurance premiums.

According to research by the Kaiser Family Foundation, a non-profit organization that focuses on healthcare issues in the U.S., roughly half of Americans receive health insurance through an employer-based plan.

If your medical premiums are deducted through a payroll deduction plan, it’s more than likely that youre covering your share of your insurance premium with pre-tax dollars. So, if you deducted your premiums at the end of the year, youd effectively be deducting that expense twice.

Negotiate A Payment Plan

While your healthcare provider cant waive or discount your deductible because that would violate the rules of your health plan, he or she may be willing to allow you to pay the deductible you owe over time. Be honest and explain your situation upfront to your healthcare provider or hospital billing department. Explain that youre not trying to get out of paying but that youd like the privilege of setting up a payment plan.

Although its aimed at asking for discounts rather than setting up a payment plan, How To Negotiate With Your Provider gives tips on how to have a conversation like this with your healthcare provider.

Recommended Reading: What’s The Penalty For Not Having Health Insurance In California

Choosing The Right Deductible Amount

The best health insurance coverage for you depends on your budget and your health history. When buying an insurance policy, youâll be able to choose your deductible amount. Many people only look at the insurance premiums when comparing health plans. But this monthly price only represents one of the expenses that contributes to how much you’ll spend on health care in a given month.

Other expenses, including your health insurance plan’s deductible and the copay and coinsurance costs, directly contribute to how much you’ll be spending overall on health insurance, as weâve seen in the example above.

Generally, individually purchased plans with a lower monthly premium will have a higher deductible, copay, and coinsurance percentage, which increases the amount you’ll spend out of pocket for medical expenses.

When choosing a health insurance company and plan, make sure to look closely at these costs. If you think you will utilize your health insurance plan frequently â because you’re managing a chronic condition or otherwise â the plan with the lowest monthly premium may not actually be the cheapest in the long run because of the high deductible.

Health insurance and life insurance work together to offer financial protection.

Health insurance can pay your medical expenses. Life insurance keeps your loved ones whole after you die.

Can Adjusting Your Health Insurance Deductibles Save You Money

The answer is yes! Adjusting health insurance deductibles can have benefits when it comes to how much youre paying in monthly premiums and how much youre paying out of pocket.

First, you should track how many times youve needed to see a doctor or buy prescription drugs in the past few years. If youre in a family plan, this also goes for each member of your family.

How much health care do you need on average each year? Could you cover the cost of a higher deductible if you were faced with a large medical bill at any time?

Don’t Miss: Is Dental Insurance Included In Health Insurance

Can An Llc Deduct Health Insurance Premiums

Getting a health insurance LLC deduction depends on whether the deduction is being taken out for non-member employees or members of the LLC, as well as the legal and tax status of the LLC and whether the LLC is classified as a sole proprietorship, partnership, or corporation. According to LegalZoom:

- For non-member employees An LLC can deduct the cost of medical insurance for all employees who are not members of the LLC. This deduction can also include the amount the LLC pays for employees to have qualified long-term health coverage.

- For the self-employed Members of an LLC are considered self-employed if their LLC is a sole proprietorship or partnership. While self-employed business owners can deduct the cost of acquiring health insurance for themselves, a spouse, and qualified dependents, they may or may not be able to qualify for small business health insurance. For example, sole proprietors usually would not qualify for a group plan unless they have employees, but a sole proprietor could still enroll in an individual health insurance plan.

- For corporations If shareholders of an LLC receive corporate tax treatment, they would not be considered eligible to receive health insurance from the business unless they are bona fide employees. If a corporation provides health insurance to non-employee shareholders, then the company could not take this deduction on their corporate tax return.

Are There Health Insurance Plans With No Deductibles

Yes. In fact, there are many health care plans that have zero deductible or no deductible options. HMOs typically offer zero deductible health insurance options. Some of the plans include minimum essential benefits such as annual checkups, prescription medication and/or preventative care. These services are provided without a deductible instead they may require a co-pay fee.

If youre in good health and dont see any major medical needs for the foreseeable future, it is recommended to try a health plan with a high deductible plan with low monthly premiums. Remember that good health can be fleeting, so try to set money aside in the case of a medical emergency. If you arent sure if you should purchase a no deductible insurance plan, contact an insurance agent that is licensed and can guide you to make the right choice.

Also Check: What Is The Donut Hole In Health Insurance

What Is An Out

Out-of-pocket maximum is the most you could pay for covered medical expenses in a year. This amount includes money you spend on deductibles, copays, and coinsurance. Once you reach your annual out-of-pocket maximum, your health plan will pay your covered medical and prescription costs for the rest of the year.

Heres an example.** You have a plan with a $3,000 annual deductible and 20% coinsurance with a $6,350 out-of-pocket maximum. You havent had any medical expenses all year, but then you need surgery and a few days in the hospital. That hospital bill might be $150,000.

You will pay the first $3,000 of your hospital bill as your deductible. Then, your coinsurance kicks in. The health plan pays 80% of your covered medical expenses. You’ll be responsible for payment of 20% of those expenses until the remaining $3,350 of your annual $6,350 out-of-pocket maximum is met. Then, the plan covers 100% of your remaining eligible medical expenses for that calendar year.

Depending on your plan, the numbers will varybut you get the idea. In this scenario, your $6,350 out-of-pocket maximum is much less than a $150,000 hospital bill!

Can You Have Two Health Insurance Plans

Yes, you can have two health plans.

The most common example of carrying two health insurance plans is Medicare recipients, who also have a supplemental health insurance policy, says David Mordo, former national legislative chair and current regional vice president for the National Association of Health Underwriters.

Its also possible that a married couple could have two health insurance plans, even if each spouse is covered through a health insurance plan at their workplace.

Theyre both covered under their own policies with their companies, but one of the spouses decides to jump on their spouses plan, Mordo says.

You also might have two health insurance plans if you have health insurance but also receive Medicaid coverage. Or, perhaps you are under the age of 26 and have group coverage both through an employer and your parents’ health insurance.

Other examples of when you might have two insurance plans include:

- An injured worker who qualifies for worker’s compensation but also has his or her own insurance coverage.

- A military veteran who is covered by both Veterans Administration benefits and his or her own health plan.

- An active member of the military who is covered both by military coverage and his or her own health insurance.

Recommended Reading: Can I Get Health Insurance In Another State