Health Insurance Portability Works In The Following Ways:

- You can opt to switch between health insurance providers. Hence you can take a new policy with a different provider while retaining the credits earned from your existing policy.

- You can also switch health insurance policies by sticking with the same insurance provider.

- You can choose to switch from an individual policy to a family floater and vice versa.

- You can apply for a revised sum insured amount with your new insurer.

- Portability also includes enhancing the range of coverage you receive from health plans. You can enhance this range with the same insurance policy. To do so there may be medical testing and new waiting periods.

The novel coronavirus is highly contagious and lethal which has caused it to trigger a widespread global pandemic. The symptoms caused by exposure to coronavirus requires continuous and extensive treatment that can exhaust your financial reserves. It is crucial to exercise caution against COVID-19 and health insurance can be one way of protecting your finances against it. Rest assured, with the comprehensive coverage offered by Max BupaHealth insurance plans, you get full coverage against any COVID-19 related claims.

- All Max Bupa Family Health Insurance Plans

- All Max Bupa Wellness Health Insurance Plans

- All Max Bupa Top Up Health Insurance Plans

Safeguard you and your family with Health Insurance Plan.

Health insurance:

Mediclaim:

Here are the key differences between health insurance and mediclaim at a glance:

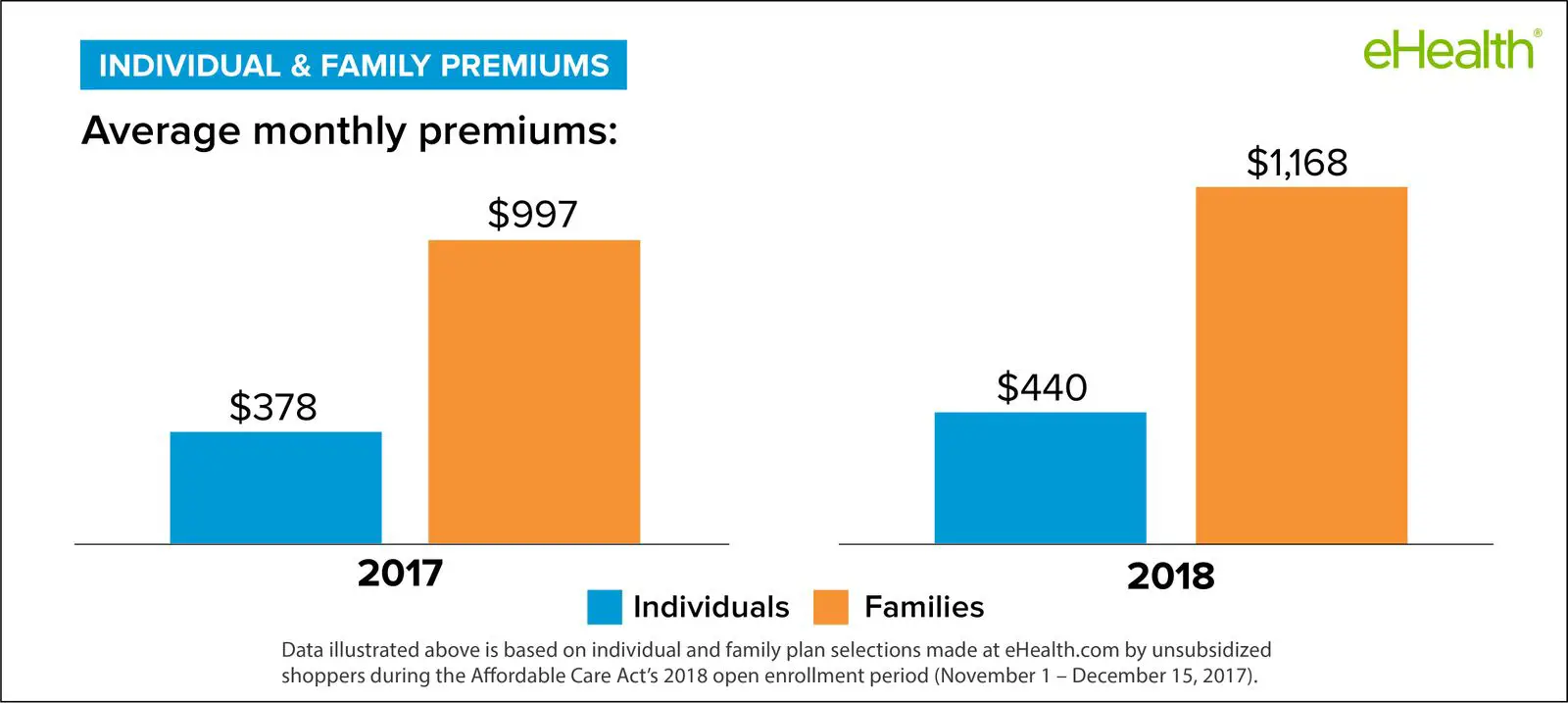

Can I Get An Aca Subsidy To Help Cover The Cost Of My Health Plan

Premium subsidies are available in every state to make individual/family health insurance affordable. Eligibility is based on the applicants household income. Heres a detailed overview of how premium subsidies work, and a calculator you can use to see if youre eligible for a subsidy.

Use our calculator to estimate how much you could save on your ACA-compliant health insurance premiums.

For people with lower income, the American Rescue Plan also reduces the percentage of income they have to pay for the benchmark plan, as illustrated in this comparison. .

Heres how household income is calculated under the Affordable Care Acts rules. Its referred to as MAGI, for modified adjusted gross income, but its not the same as the general MAGI calculations you may be familiar with in other circumstances. There are also steps you may be able to take to reduce your MAGI and thus increase the amount of subsidy for which youre eligible.

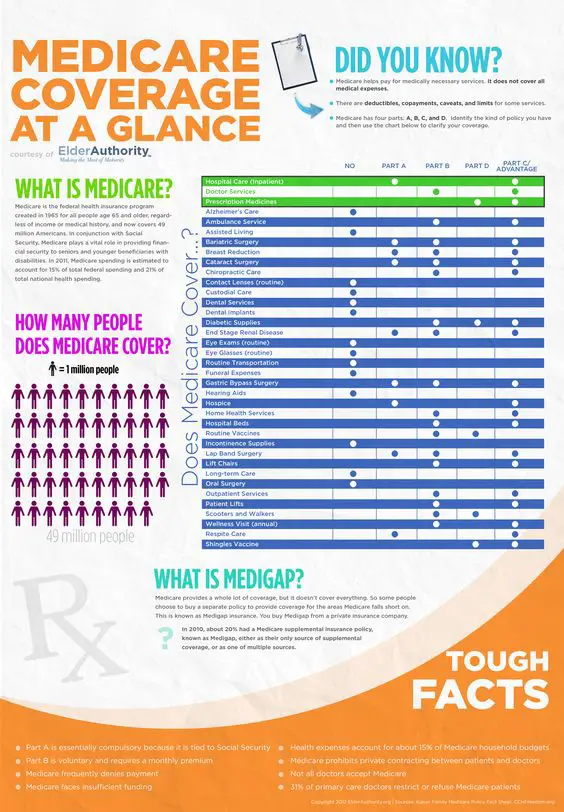

Why Are Some Medicare Advantage Plans Free

Many Medicare Advantage plans dont charge a premium. However, its a mistake to assume a Medicare Advantage plan is truly free.

For example, you may still be responsible for paying copays and deductibles associated with these plans. In addition, you will still have to pay the Medicare Part B premium.

Often, health plans with low or no premiums have much higher out-of-pocket costs than other health insurance options. So, make sure to compare both premiums and out-of-pocket costs when deciding on a health plan.

You May Like: Do You Have Health Insurance

Senior Citizens Health Insurance Plans

Senior citizen health insurance plans are tailor-made for people aged between 60 years and 75 years to cater to their respective insurance-related needs. It is recommended to get a senior citizen health insurance policy as most individual or family floater health insurance plans do not offer coverage to people aged above 65 years. Beyond 65 years, they only allow renewals. Some of the unique coverage benefits of senior citizen health insurance plans include daycare expenses, domiciliary hospitalisation expenses, cashless hospitalisation, cover for pre-existing diseases, and cover for specific diseases.

Some popular senior citizen health insurance plans available in the market are:

- My Health Suraksha offered by HDFC Ergo General Insurance

- Care Plan offered by Care Health Insurance

- Senior Citizen Red Carpet Policy offered by Star Health & Allied Insurance

What Is An Open Enrollment Period

Open enrollment when you can make changes to your health insurance plan. You can also sign up for a new plan during open enrollment.

Youre able to enroll in a plan through:

- Your employer

- An individual health plan through your state’s or the federal government-run insurance marketplace or directly through an insurance company

- Medicare

During the annual open enrollment period, you can change your current plan or obtain new coverage. Its important to make these choices carefully, says Gretchen Jacobson, vice president, Medicare, for The Commonwealth Fund.

The best plan for your friend may not be the best plan for you, she says. Each plan has different benefits, different drug coverage and different health care providers in their networks.

Selecting the right health insurance plan can be challenging. Each year, millions of Americans have the opportunity to choose a new plan, or to tweak their existing coverage. But with so many options available, how can you know if you are making the right choice?

Get educated, says Paul Fronstin, director of the health research and education program at the Employee Benefit Research Institute. There are potentially options out there for you.

Fronstin adds that such alternatives may or may not be better than the plan you already have. But that is something you have to figure out, he says.

Read Also: Is It Legal To Marry For Health Insurance

Two States With Different Special Enrollment Period Effective Dates

There are two states Massachusetts and Rhode Island where the exchanges allow people to enroll as late as the 23rd of the month and still have a first-of-the-following month effective date. So May 17 enrollment in one of those states would result in a June 1 effective date .

Washington used to have a 23rd-of-the-month deadline as well, but they changed that in 2017, and now use the same 15th of the month enrollment deadline thats used in most other states.

Q What Immigration Documents Must I Present To Confirm My Immigration Status As An Applicant For Permanent Residence When Applying For Ontario Health Insurance Coverage

If you are applying for Ontario health insurance coverage as an Applicant for Permanent Residence, you are required to present written confirmation from Citizenship and Immigration Canada that you are eligible to apply for permanent residence in Canada, which may be one of the following :

- CIC Confirmation Letter letter on CIC letterhead addressed to the Applicant for Permanent Residence that confirms that the applicant is eligible to apply for permanent residency in Canada

- CIC Immigration document such as a Work Permit, Visitor Record, Temporary Resident Permit or Study Permit with note in the “Remarks Section” that indicates that you have applied for permanent residence and the CIC has confirmed that you meet the eligibility requirements to apply for permanent residence in Canada.

Recommended Reading: How To Enroll In Health Insurance

How Much Will The Tax Changes Cost Me

The increase will see an employee on £20,000 a year pay an extra £130. Someone on £50,000 will pay £505 more.

People earning under £9,564 a year, or £797 a month, don’t have to pay National Insurance and won’t have to pay the new levy.

National Insurance is a UK-wide tax – and while Boris Johnson’s announcement focused on funding health and social care in England – Scotland, Wales and Northern Ireland will also receive an additional £2.2bn to spend on their services.

Best Health Insurance Plans In India 2021

Health insurance plans cover the insured for several healthcare expenses as per the sum insured opted for and the premium paid. Some best health insurance plans in the market are offered by popular insurance companies which have an impressive claim settlement ratio.

- Tax Benefit

*Standard Terms and Conditions Apply.

**Tax benefits are subject to changes in Income Tax Act.

- Male

Falling sick is bad enough, but it becomes worse when medical bills follow the suffering. You might not be able to avoid health issues, but you can definitely protect yourself from financial losses arising due to it, with a health insurance plan. A reliable health insurance plan protects you against healthcare expenses in case you fall sick.

Don’t Miss: Does Health Insurance Pay For Abortions

What Can I Do If I Cant Afford Health Insurance

If you cant afford health insurance, you might qualify for free or low-cost programs, such as Medicaid. This program is available to those whose incomes are low enough that they qualify. However, others also might be eligible, including pregnant women, the elderly and people with disabilities.

If you dont qualify for Medicaid, you may still be eligible to purchase marketplace coverage with subsidies that can dramatically reduce your costs.

You could also be added to your spouses health insurance or find some coverage through a short-term health insurance plan. Just be aware that short-term plans have coverage limitations.

Q Doesn’t The Government Already Know About This Death A Death Certificate Has Been Issued

It is important to notify the ministry as soon as possible when an insured person dies. The attending physician forwards this information to the ministry but this may take some time and the doctor is not responsible for the collection and return of the health card. The person who is looking after the affairs of the deceased must return the health card to the ministry.

Recommended Reading: What Health Insurance Is Available In Nc

Here Are Our Family Health Insurance Plans Which Provide You Comprehensive Hospitalization Coverage

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

AccidentCare provides cover for accidental death and also permanent total or partial disability, and other benefits

Rate And Comment On The Answer

This site uses Akismet to reduce spam. .

I work in the HR Dept and my employer had just changed the waiting period for a full-tilme worker as a new hire from 90 days to one year as of April 20, 2016. Can my company do this to new employees?

No they cant do that as far as I understand it. They can choose a retrospect period of up to a year when offering coverage as an employer for the first time, but they cant make new-hires wait a year . Anytime there is a specific legal question like this the best we can offer is general advice.

I had the same issue with the corner store company when I applied I asked about benefits they told me I believe 6 months I transferred to a different location only for them to tell me I had to wait be employed for one year. Only today that I discovered that according to my tax agent that this was highly illegal according to her for them not to provide me with insurance.

So is it illegal for my employer to have a mandatory 12 month waiting period for insurance coverage because I have been with them for 7 months and still not eligible.

Yeah, in general the waiting period cant be more than 90 days . If you were hired as full-time, that is 90 days from your start date if you were hired as part-time, but your hours have become full-time, there is more wiggle room for the employer. I dont think there is one simple answer .

You May Like: How Much Does Usps Health Insurance Cost

How To Cancel Health Insurance

Unlike enrolling in health insurance, you can cancel your health insurance at any time. You may choose to cancel your existing plan if you become eligible for health coverage in another way, like through your job.

To cancel, contact your insurance provider or the health insurance marketplace where you purchased your plan. You can usually either cancel immediately or choose a specific date to end your coverage. You may need to fill out some forms to make the cancellation official.

However, its very important to make sure you have other plans in place for your medical care. Remember while you can usually cancel your health insurance anytime, you cant usually enroll anytime: only during annual open enrollment or a special enrollment period.

Before canceling your health insurance plan, make sure youve thought through what youll do if you need medical care and how youll pay for it.

What Are Theexceptions To Open Enrollment

Unless you experience a qualifying life event, you will haveto enroll for health insurance during the open enrollment period.

Some qualifying life events that will qualify you for a special enrollment period are loss of coverage through an employer, loss of coverage through a covered employee, and major family changes.

Keep in mind that if you lose coverage because of failure topay insurance premiums, you will not qualify for a special enrollment period.

You May Like: What Is The Health Insurance For Low Income

Q What If My Baby Wasn’t Born In Hospital Or Attended At Home By A Registered Midwife

You will need to visit a ServiceOntario centre to register your child for Ontario health coverage.

If you visit a ServiceOntario centre within 90 days of the birth of your child you need to bring :

- confirmation of the baby’s birth, through either a letter from the hospital or attending physician, or a Certified Statement of Live Birth from a provincial office of the Registrar-General

- your residency document

- your identity document

If you visit a ServiceOntario centre more than 90 days after the birth of your child you need to bring :

- your child’s citizenship document

Refer to the question or to the Ontario Health Coverage Document List for a complete listing of approved documents.

Health Insurance Plans: Best Medical Insurance Policy In India

Our feature packed, best selling, comprehensive health insurance plan.

SeniorFirst

A tailor-made health insurance plan for Senior Citizens

Health Recharge

A top-up plan to go that extra mile for your loved ones!

MoneySaver

Combination of Base and Top-up plan to offer stronger protection for your familys health.

Health Premia

An all round coverage for you and your family as per your needs.

Arogya Sanjeevani

You May Like: Can I Go To The Er Without Health Insurance

Family Floater Health Insurance Plans

Unlike individual health insurance plans, a family floater health insurance plan extends coverage to the entire family, on a floater sum insured basis. One of the best advantages of family floater health insurance plans is that it allows an individual to cover him/herself as well as their family members under a single health insurance plan, thereby making it easier for the insured to manage. When it comes to covering your parents under a health insurance policy, a family floater health insurance policy is an affordable option as compared to a senior citizen health insurance policy. A family floater health insurance policy covers your family members including legally wedded spouse, dependent children, parents, parents-in-law, brother, sister, and other relations varying from plan to plan, at affordable premiums. These plans are recommended for young families as then the chances of making more than one claim are lesser. This allows the member making a claim to get greater coverage at lesser premiums.

Some popular family floater health insurance plans available in the market are:

- Family Health Optima offered by Star Health & Allied Insurance

- Optima Restore offered by HDFC General Insurance

- Reassure Policy offered by Max Bupa Health Insurance

Can You Recoup The Money If You Have To Pay Twice In One Year

Theres no way to recoup all of the additional money you spent toward your health insurance deductible when you switch plans mid-year after paying the first plans deductible. However, cost-sharing expenses like deductibles, copays, and coinsurance can sometimes be used as a tax deduction resulting in lower income taxes.

And if you have a health savings account, you can use the tax-free money in the account to cover your out-of-pocket costs, including the potentially higher costs you might face if you end up having to switch plans mid-year.

Recommended Reading: Where Do You Go If You Have No Health Insurance

Q How Do I Change My Name On My Health Card To My Married Name

To change your name on your health card to reflect your married name, you must visit a ServiceOntario centre , complete a Change of Information and present the original of one of the following:

- Certificate of Marriage

- Certified copy of Statement of Marriage

- Original marriage document issued outside of Ontario which contains the names of both spouses

- A record of marriage form

- Change of name certificate

If you are changing your name to reflect a ‘common-law’ marriage, you must visit a ServiceOntario centre, complete a Change of Information and present the original of one of the following:

- Change of Name certificate

- Certified copy of the court order for a change in surname

- Notarized affidavit of the facts supporting the use of the ‘common-law’ surname

If you do not already have a photo health card, you must switch to a photo health card in order to change your name. You will be required to provide three original documents to prove citizenship, Ontario residence and identity.

If you have any questions regarding your own specific situation, call the ServiceOntario INFOline at 1-866-532-3161.