Additional Subsidy For 200% 400% Fpl

Now we look at the small additional premium subsidy from the state of California to those who already receive the federal premium tax credit. The additional subsidies from the state are calculated by lowering the applicable percentages of income you are expected to pay toward a second lowest-cost Silver plan.

| 2021 Income |

|---|

| $104,800 | $13/month |

As you see from the tables, the additional subsidy from California first increases as your income goes from 200% FPL to 300% FPL. Then it drops down as your income goes from 300% FPL to 400% FPL. I guess the theory is that at the lower incomes your premium after the federal premium tax credit is already low enough. Therefore you dont need much additional subsidy from the state. As your income goes past 300% FPL, you can afford more of the premium yourself. So again you dont need as much additional subsidy from the state.

Reference:

- Resolution 2020-41 State Subsidy Program Design for PY 2021, Covered California

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

Will I Qualify For The Subsidy

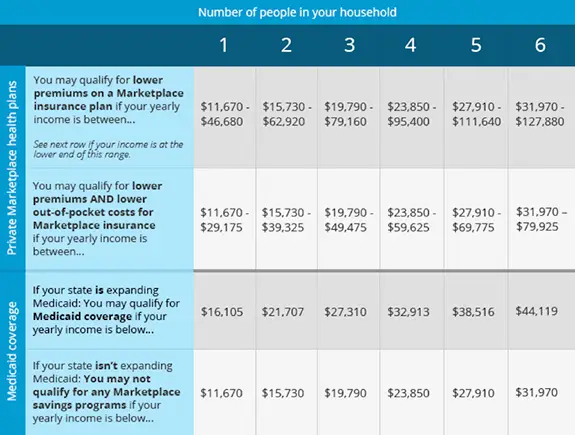

Prior to 2021, the rule was that households earning between 100% and 400% of the federal poverty level could qualify for the premium tax credit health insurance subsidy . Federal poverty level changes every year, and is based on your income and family size.

You can look up this years FPL here, and this article explains how income is calculated under the ACA.

But the American Rescue Plan has changed the rules for 2021 and 2022 : Instead of capping subsidy eligibility at an income of 400% of the poverty level, the ARP ensures that households with income above that level will not have to pay more than 8.5% of their income for the benchmark plan.

If the benchmark plan costs more than 8.5% of income, a subsidy is available, regardless of how high the income is. So the ARP accounts for the fact that full-price health insurance premiums are much higher in some areas than in other areas, and are higher for older enrollees. Subsidies are available in 2021 and 2022 to smooth out these discrepancies. But if a household earning more than 400% of the poverty level can pay full price for the benchmark plan and it won’t cost more than 8.5% of their income, there is still no subsidy available.

- Household of one: 138% of FPL is $17,774, and 100% of FPL is $12,880

- Household of four: 138% of FPL is $36,570, and 100% of FPL is $26,500

But even if you meet the income qualifications, you may still be ineligible for a subsidy. That would be the case if:

What Happens At Tax Time

Unless you have a supernatural ability to predict the future, theres a good chance you wont perfectly estimate your annual income on your application. Dont worryeverything gets sorted out at tax time. If you make more money during the year than you expected , youll repay a portion of your subsidy. If you make less, youll receive a refund.

You May Like: Does Health Insurance Cover Transplants

Federal Health Care Aid At A Glance

| Am I eligible? | You may be eligible if:

|

You may be eligible if:

|

|---|---|---|

| Where can I use it? | Any qualified Marketplace health plan, including eligible health plans purchased directly from Cigna. | Only on Silver-level qualified Marketplace health plans |

| How much can I get? | Varies based on the number of people in your house and how much they make | Varies based on the number of people in your house and how much they make |

| How does it work? |

More In Coronavirus News

We still dont know why the coronavirus ravaged some countries but not others.

The usual trend of death from infectious diseases malaria, typhoid, diphtheria, H.I.V. follows a dismal pattern. Lower-income countries are hardest hit, with high-income countries the least affected, Siddhartha Mukherjee writes in the New Yorker. But if you look at the pattern of covid-19 deaths reported per capita deaths, not infections Belgium, Italy, Spain, the United States, and the United Kingdom are among the worst off.

For many statisticians, virologists, and public-health experts, the regional disparities in covid-19 mortality represent the greatest conundrum of the pandemic, Mukherjee writes.

When researchers at Imperial College London built coronavirus models that accounted for age, virus contagiousness, interpersonal contact and a range of demographic factors, their predictions were reasonably close to reality when it came to wealthy countries. For poor countries, not so much. Nigeria was predicted to have between two hundred thousand and four hundred and eighteen thousand covid-19 deaths the number reported in 2020 was under thirteen hundred, Mukherjee writes.

Also Check: Can A Significant Other Be Added To Health Insurance

I Just Lost My Employer Coverage Can I Get A Subsidy For My New Plan

Its very likely that you can. To see how much of a subsidy youll receive, follow the steps above by first estimating your annual income. This can be hard to do after just losing a job, but remember, you can always update it throughout the year as your income changes. Just make sure you meet the requirements listed above to make sure you can receive your subsidy.

Applicable Percentages Decreased For 2018

For 2018, the applicable percentages slightly when compared with 2017, meaning that the percentage of income that people had to pay for their coverage was slightly lower at all income levels than it was in 2017.

This means that before accounting for other factors , people buying coverage for 2018 had to pay a slightly smaller portion of their income for the second-lowest-cost Silver plan than they paid in 2017.

In 2018, people who were eligible for premium subsidies had to pay between 2.01% and 9.56% of their income for the benchmark plan in their area. Of course, people dont have to pick the benchmark plan they can pick a higher-cost plan and pay more, or they can pick a lower-cost plan and pay less.

Also Check: How To Understand Health Insurance Plans

Affordable Health Care For All

The charts demonstrate that income plays the key role in how much subsidy an individual or a family gets. Together, we are helping subsidize lower income groups to gain health care access that they deserve. Helping others is what being a good citizen is all about.

Those with pre-existing conditions and who are considered of lower health can no longer be denied health care or discriminated against. Yes, Obamacare creates somewhat of a moral hazard when it comes to exercising and eating healthy. Perhaps youll eat one more donut and watch TV for a couple hours longer instead of work out.

However, just as the rich help subsidize the poor through a progressive tax system, the healthy will subsidize the less healthy through the Affordable Care Act. Life is easier with the ACA, which also means our health will unlikely improve.

The largest point of contention will likely be how the government determines what income levels are poverty levels. Such determination will decide on subsidy amounts. Its difficult to live on less than $20,000 a year as an individual in San Francisco for example. Yet the poverty level is only $12,140 and below.

The greatest benefit from the Affordable Care Act is that if you or your family are experiencing hard times, you will be highly subsidized until income improves.

Am I Eligible For A Health Insurance Subsidy

Who is this for?

If you need to buy your own health insurance, this explains how to find out if you can get help paying for it.

With few exceptions, the Affordable Care Act requires everyone to have health insurance. If you’re insured through your employer, or eligible for programs like Medicare or Medicaid, you’re covered.

If not, you’ll need to buy your own health insurance. Otherwise you’ll have to pay a penalty.

Do you already pay for your own insurance? Are you shopping for the first time? Either way, the good news is you may be able to get help paying for individual health insurance. This help is called a subsidy.

You May Like: Can You Go To The Health Department Without Insurance

What Is The Average Cost Of Non

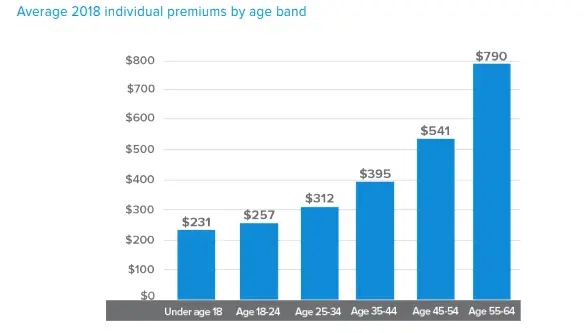

What do you pay if your income exceeds the 400% FPL ? The average national monthly non-subsidized health insurance premium for one person on a benchmark plan is $462 per month, or $199 with a subsidy. Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. Actual cost varies based on your age, location, and health plan selection,

Take a closer look. In a recent eHealth ACA Index report, we tracked costs and shopping trends among ACA plan enrollees who bought non-subsidized health insurance at ehealth.com during the nationwide open enrollment period for 2020 coverage.

Why Chooseinsuranceonlinecomcom

You can easily find the latest and accurate insurance information from ChooseinSuranceOnlinecom.com.

Most of the time, you need it to save your time and avoid being deceived!

How? When you are looking for can i get a subsidy for health insurance.There are too many fake insurances that have not been verified on the Internet. How long does it take to find a truly reliable official insurance?

But with us, you just type can i get a subsidy for health insurance and we have listed all the verified insurance pages with one click button to Access the Page.

Not just for this one, but we have created database of 1,00,000+ insurances and adding 50 more every day!

Read Also: What Is New Health Insurance Marketplace Coverage

Estimate Your Household Income

Household income includes the household income of the taxpayer & spouse, and dependents if the dependents earned enough to file a tax return.

To estimate your household income, add the total income from the sources below for you and your spouse and any dependents who make enough money to be required to file a tax return:

DO Include: Wages, Salaries & Tips, Net income from self-employment or business, Unemployment compensation, Social Security payments, including disability payments, Income from investments, retirement, pensions & rental income, Other taxable income such as prizes, awards, and gambling winnings.

DONT Include: Child support, Alimony, Gifts, Supplemental Security Income , Veterans disability payments, Workers compensation.

Keep in mind that federal subsidies are Advance Premium Tax Credits based upon your households Modified Adjusted Gross Income. The tax credits will be reconciled when you file your federal income taxes, so try to be as accurate as possible. Significant mid-year changes in income should be reported to Connect for Health Colorados customer service department.

Get free professional assistance and quotes on all the plans both through Connect for Health Colorado and directly from insurance carriers.

Get a quote and more information about ACA plans in Colorado.

You can also use the subsidy calculator to give you a rough estimate.

Get a quote and more information about ACA plans in Colorado.

A Review Of The Metal Tiers

As a quick review, health care plans available through a health insurance marketplace are categorized into four levels, each of which is named after a metal: Bronze, Silver, Gold, Platinum. Bronze plans usually have the lowest premiums, followed by Silver plans.

The level of the plan is unrelated to the quality of the planâs coverage. The difference is in how the insurance company splits the costs with you. So if you have a Bronze plan, the insurance provider will generally cover 60% of your insurance costs, which mostly applies after you hit your deductible.

Which type of subsidy you are trying to get will determine which of the metal tiers you can use. The advance premium tax credit is available for any metal tier, but cost-sharing reductions require you to use a Silver plan, as we will discuss in the next sections.

Recommended Reading: Is It Too Late To Change Health Insurance

How To Apply For Health Care

Whether or not you get a subsidy, signing up for a plan from the marketplace is the same. You have to wait until Open Enrollment in order to choose a new plan. For 2021 plans, thatâs the period from Nov. 1, 2020, to Dec. 15, 2020 . Whichever plan you choose will go into effect starting on Jan. 1 of the next calendar year.

The only way to sign up for a health plan outside of Open Enrollment is if you qualify for Special Enrollment. Special Enrollment is available to people who experience a qualifying life event . This is a major change to your life, such as getting married or divorced, having a baby, or starting work for a new employer.

Learn more about Special Enrollment and how you can qualify.

How Much Will My Subsidy Be

Most of the online subsidy calculators are only designed to tell you IF You Qualify For A Subsidy, and estimate how much you may be eligible for. The only calculator that gives actual subsidy amounts is the calculator inside the Covered California application .

The subsidy amount you can qualify for is based on your MAGI and the 2nd lowest cost Silver plan for you and/or your family. If your MAGI is less than 600% of the FPL for your familys size, then you may be able to qualify for premium assistance. By running an On-Exchange Quote here at SPF Insurance you can find out how much subsidy or premium assistance you can qualify for.

To see what amount of subsidy you can qualify for, click Get Health Insurance Quote in the Quote Center in the upper right corner. Or you can Get CoveredCA Health Insurance Quotes here.

At the bottom of the second page, you will enter your expected AGI for 2020. This is your best estimate. Then click the green Continue button.

Now you will see the quote results with all the health plans listed from lowest cost at the top, to the most expensive plans at the bottom.

If you have any questions please call us.

Don’t Miss: Does Mcdonald’s Have Health Insurance

How Does The Calculation Work

If you’re familiar with the concept of MAGI that’s used in other settings, you know that it requires you to start with your adjusted gross income and then add back in various things, such as deductions you took for student loan interest and IRA contributions. But when it comes to ACA-specific MAGI, you don’t have to add back either of those amountsor most of the other amounts that you’d have to add to your income to get your regular MAGI.

Instead, the ACA-specific MAGI formula starts with adjusted gross income and adds back just three things:

- Non-taxable Social Security income .

- Tax-exempt interest

- Foreign earned income and housing expenses for Americans living abroad

For many people, the amounts of these three things are $0, meaning that their ACA-specific MAGI is the same as the AGI listed on their tax return. But if you do have amounts on your tax return for any of those three items, you need to add them to your AGI to determine your MAGI for premium subsidy and cost-sharing reduction eligibility.

For Medicaid and CHIP eligibility determination, some amounts are either subtracted or counted in a specific manner:

How The Affordable Care Act Helps Freelancers And Self

The Affordable Care Act, also called the ACA or Obamacare, created a health insurance marketplace where individuals can get insurance coverage for themselves and their families. This is an option no matter what kind of employment you have.

In order to get a health plan through the ACA, you need to get a plan during the Open Enrollment period. Federal Open Enrollment lasts from Nov. 1 to Dec. 15 each year. You can sign up for a plan during that time and then your coverage will begin on Jan. 1 and cover you for the calendar year. Hereâs a state-by-state guide to Open Enrollment no matter where you live so you can familiarize yourself with the process for getting covered next year.

Health insurance plans available through the marketplace all offer the same essential health benefits, but your monthly premium and other prices may vary depending on where you live.

You may also qualify for Special Enrollment if you experience a major life event, like a marriage, divorce, the birth of a child, or the loss of a job. An event that qualifies you for Special Enrollment is known as a qualifying life event. So if you currently have a full-time job and decide to quit in order to freelance, you will qualify for Special Enrollment.

Read Also: How Does Health Insurance Work Through Employer

Applicable Percentages Increased For 2019 To The Highest Theyve Ever Been

For 2019, the applicable percentages went back up again, and were the highest they had ever been. Even though the applicable percentages increased again for 2021 , they were still lower than they were in 2019.

But as described below, people who were subsidy-eligible and whose income hadnt increased since 2014 were paying less in after-subsidy premiums in 2019 than they were paying in 2014 , due to the annual growth in the poverty level since 2014.

The details for 2019s applicable percentages are in Revenue Procedure 2018-34. For 2019 coverage, people who were eligible for premium subsidies paid between 2.08% and 9.86% of their income for the second-lowest-cost silver plan, after subsidies.