What Is The Difference Between An Hra And An Hsa Insurance Plan

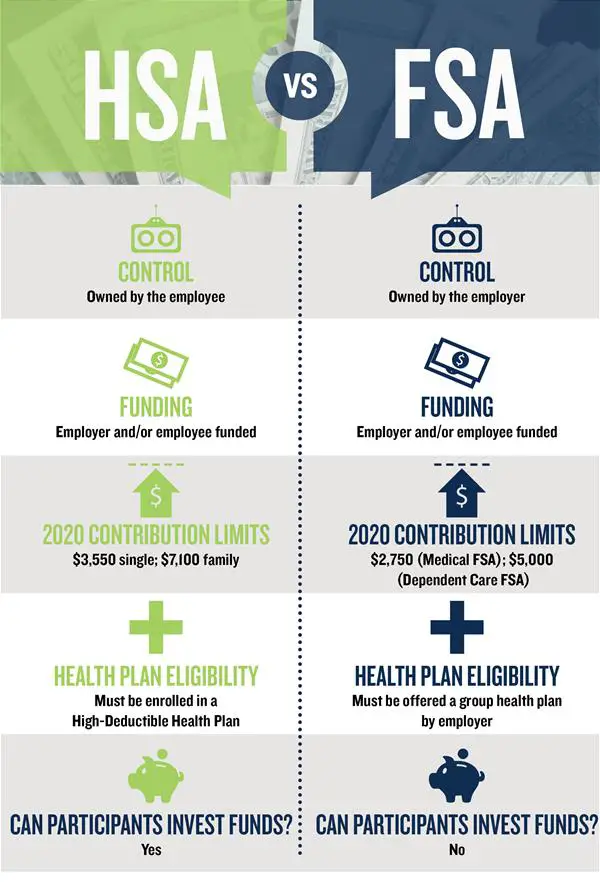

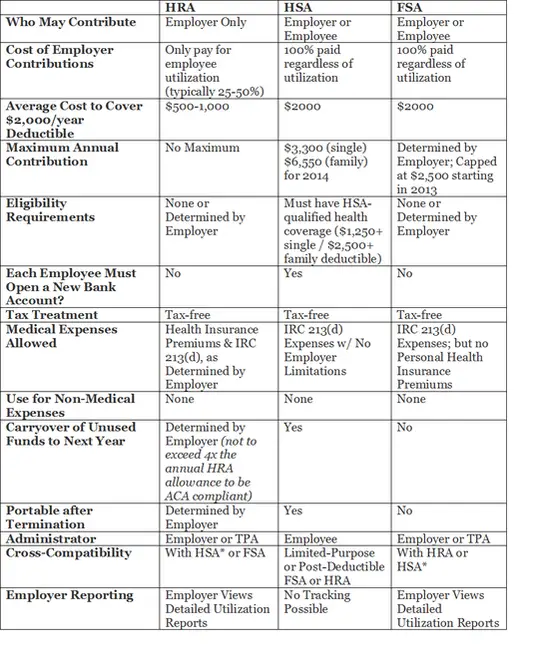

The difference between an HRA and an HSA insurance plan is that the employer owns and funds an HRA insurance plan and the employee owns a tax-advantaged HSA insurance plan. This means if an employee with an HRA plan leaves their employer, any remaining amount in the HRA defaults to the employer. However, employees take an HSA insurance plan along with them when changing employers.

How Does A Health Reimbursement Arrangement Work

HRA limits are set by the IRS every year. In 2021, the employer contribution limit for small business HRAs is $5,300 for individuals and $10,700 for families.

The key to understanding how HRAs work is in the R – reimbursement. Because an HRA is considered a “notional arrangement,” you will not receive funds from your HRA until you show a receipt for a qualified expense. This means that employers will reimburse funds from an HRA after an employee makes a qualified medical expense.

Most HRAs follow the same usage structure:

Employees Submit Proof Of Incurred Expenses

Next, after employees have made their purchases, theyll submit documentation showing proof of the incurred expenses theyre submitting for reimbursement.

This documentation must include:

- The name of the item or service

- The cost of the item or service

- The name of the vendor

- The date of purchase

Invoices, receipts, or an explanation of benefits from an insurer or healthcare provider typically satisfies this requirement. Depending on the item thats being requested for reimbursement, a doctors note or prescription may also be necessary. Keep in mind that this information is subject to HIPAAs privacy rules and must be handled carefully if you are self-administering an HRA.

Read Also: What Is The Worst Health Insurance Company

How Hra Plans Are Funded

HRA plans are funded solely by employer contributions. Contributions from an employee are not allowed within the structure of HRA plans.

Often employers will save money by getting cheaper health insurance plans and then put some of this money into HRA accounts for the employees.

Some employers, however, keep their same health insurance plans and add HRA plans for the employees as an additional benefit. Either way, the important thing to know is that you do not have to contribute in any way to an HRA plan.

Hras Can Cover Insurance Premiums Deductibles And More

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Health reimbursement arrangements are benefits that some employers offer their employees to help with healthcare expenses. Theyre a way for companies to reimburse workers for these costs, and reimbursements are generally tax-free when used for qualified medical expenses.

Since January 2020, the government has allowed employers to offer their employees two types of HRAs. The first is called an individual coverage HRA, and companies can only offer it if they don’t offer group health insurance.

Employees can use these HRAs to buy their own comprehensive health insurance with pretax dollars either on or off the Health Insurance Marketplace. Individual coverage HRAs can also reimburse employees for qualified health expenses such as copayments and deductibles.

How much employers contribute to employees individual coverage HRAs is up to the employers, except that all workers in the same class of employees must receive the same contribution. Workers who are older or who have dependents may receive more.

Also Check: Do I Need Health Insurance If I Am A Veteran

Who Can Offer An Hra

Because there are HRAs available for employers of all sizes, virtually anyone can offer an HRA!

Heres a brief look at the requirements for each type of HRA:

- Qualified small employer HRA : Your organization must have fewer than 50 full-time employees and cannot offer group coverage. A QSEHRA is a great fit for a small business ready to offer their first health benefit or frustrated by annual cost increases and limited employee flexibility with their group plan.

- Individual coverage HRA : Available to organizations of all sizes, an ICHRA is a great choice for employers who want a customizable benefit to offer employees in different classes different benefits. Keep in mind that with an ICHRA, you cannot offer employees in the same class a choice between group coverage and an ICHRA. For employers with employees in many states, an ICHRA is often a great solution.

- Group coverage HRA : Organizations offering a group health insurance plan qualify. Employees must be enrolled in the group health plan in order to participate in this type of HRA. A GCHRA is best for employers who want to level-up their existing group health insurance policy to better recruit and retain top talent.

Can An Hra Be Used To Pay Health Insurance Premiums

Yes, since the federal government gives employers wide latitude for determining the amount and type of medical expenses that can be covered, employer-funded Health Reimbursement Account plans can be used to pay health insurance premiums and long-term care insurance, should employers allow it.

You might also like

Join us for a panel discussion with thought leaders from BambooHR and Zane Benefits as we explore how optimizing your benefits helps you recruit and retain the best people for your organization.

Read Also: What To Do When You Lose Your Health Insurance

Who Should Get An Hsa

You may be asking yourself, who do HSAs make sense for? Generally speaking, you should open an HSA account if youre comfortable with having an HDHP. These plans have high deductibles. So it may be harder to pay it off before your insurance kicks in. However, these plans typically carry lower monthly premiums. This serves as a plus for both you and your employer.

With that said, HSAs tend to suit people better who dont expect many health expenses. In this case, HSAs can be extremely beneficial. You will save money for healthcare costs over time and when you get sick, you can make tax-free withdrawals for qualified medical expenses. And when youre thinking about what can you deduct at tax time, youd be ahead of the game. You can deduct your contributions from your federal taxable income. On the upside, you have until April 15 of the following year to contribute toward the maximum and claim it as a deduction.

The HSA maximum contribution for 2018 stands at $3,450 for individual coverage and $6,900 for family coverage. That increases in 2019 to $3,500 for single coverage and $7,00 for family coverage. And if youre age 55 or older, you can make additional contributions of $1,000 per year. In fact, many experts suggest using HSAs as part of your holistic retirement planning strategy.

Benefits Of Health Reimbursement Arrangements

HRAs can be used to pay for qualified medical expenses, which include prescription medications, insulin, an annual physical exam, crutches, birth control pills, meals paid for while receiving treatment at a medical facility, care from a psychologist or psychiatrist, substance abuse treatment, transportation costs incurred to get medical care, and much more. Employees can also use HRAs to buy their own comprehensive individual health insurance with pretax dollars through the aforementioned individual coverage HRA .

Employees can use the money in their HRAs to cover their spouse’s and dependents’ allowed medical, dental, and vision costs.

You May Like: How To Cancel Health Insurance Aetna

How Is Affordability Determined

If applying for coverage through HealthCare.gov, employees will provide information about their individual coverage HRA offer when completing an application for Marketplace coverage, including the HRAs start date and their employer’s contribution amount. The Marketplace will determine if the offer meets requirements for affordability, which will help determine an employees eligibility for the premium tax credit. Prior to submitting a Marketplace application, employees can also use the HRA affordability tool for an estimate of their individual coverage HRAs affordability.

Can I Have An Hsa And An Hra

Yes, you can have both. However, in order to have both an HSA and an HRA you must:

- Have an HSA qualified HDHP

- Not be covered under other health insurance that is not an HDHP

Additionally,your HRA must be compatible with your HSA. This typically means that you willhave to be eligible for reimbursement under a limited purpose HRA.

A limited purpose HRA means that in the years that contributions are made to your HSA, the HRA can only be used to reimburse:

- Health insurance premiums

Don’t Miss: Does Nar Offer Health Insurance

Is An Hsa Or An Hra Better

Todecide which plan is right for you, take a look at your health insurance needsand budget.

you are an employee, consider what would best suit your health care and budgetary needs.

Ifyou are someone with a small business who is considering what would be the bestfor your employees, its important to understand that employee benefits like these arebusiness taxesby opting for an HRA for your employees.

If you need more advice on which is right for you, eHealths licensed agents can help figure out which option best suits your specific set of needs.

Hra Funding And Portability

The health reimbursement arrangement is funded solely by the employer, which also decides the maximum annual contribution for each employees HRA. Employers determine how much to contribute to employees HRAs, except that all workers in the same class of employees must receive the same contribution, as noted above. Workers who are older or who have dependents may receive more.

Any HRA money that is unspent by year-end may be rolled over to the following year, although an employer may set a maximum rollover limit that can be carried over from one year to the next. Furthermore, if an employee is terminated or leaves the company to work for another firm, the HRA does not go with them. That makes it different from an HSAhealth savings accountwhich is portable.

You May Like: Are You Required To Have Health Insurance In California

Hra Meaning: What Is An Hra

Keely S.

HRA meaning: an HRA stands for health reimbursement arrangement. It’s set up between employers and their employees to reimburse for medical expenses and/or insurance premiums tax-free. The purpose of an HRA is for employers to help their employees afford rising healthcare costs. Perhaps that clues you into the HRA meaning, but we want to dive into the details of HRAs so you can understand how they could benefit your business and how they’re paving the way for a shift in the way we think about employer-sponsored benefits.

While they’ve been around for a while, HRAs are gaining traction recently among businesses of all sizes due to regulatory rule changes that make them more accessible, flexible and easy to use. An alternative to traditional group plans, these 401 style benefits put the power in the employees’ hands, shifting the risk from the employer and offering more personalization and choice for workers. There are also an effective recruitment and retention strategy.

What Are Premium Subsidies

The Affordable Care Acts premium subsidies technically premium tax credits were designed to help Americans purchase their own health insurance. They became available as of 2014, and for most people who enroll in coverage through the exchange/marketplace, the premium subsidies cover the majority of the monthly premiums.

- The ACA premium subsidies are tax credits, but they can be taken upfront, paid directly to your health insurance company each month, to offset the amount you have to pay in premiums . The premium subsidy is then reconciled on your tax return, to make sure that the correct amount was paid on your behalf.

- As of early 2021, 86% of all marketplace enrollees were receiving premium subsidies. The average full-price premium was $575/month at that point, and the average subsidy covered $486 of that.

- Premium subsidies became larger a few months into 2021, when the American Rescue Plan was enacted:

- Full premium subsidies became available in 2021 for people receiving unemployment compensation.

Recommended Reading: How Much Is Good Health Insurance A Month

What Is The Difference Between An Hra And An Hsa

An HRA is an arrangement between an employer and an employee allowing employees to get reimbursed for their medical expenses, while an HSA is a portable account that the employee owns and keeps with them even after they leave the organization. With an HRA, the employee only gets paid when they incur an eligible expense, while an HSA is pre-funded each month regardless of whether or not they spend the money.

Is An Hra Right For Me

Everyone’s healthcare situation is unique, and if you have the opportunity to take advantage of an HRA, consider it. An HRA is a good way for employees to save money on health expenses that they would have to spend their own money on.

Interested in learning about other tax-advantaged accounts? Learn more about similar accounts, such as a Healthcare Flexible Spending Account or a Health Savings Account at the Lively Blog.

Don’t Miss: Does Health Insurance Cover Dental Anesthesia

What Is An Individual Coverage Health Reimbursement Arrangement

An individual coverage health reimbursement arrangement is a new type of health reimbursement arrangement in which employers of any size can reimburse employees for some or all of the premiums that the employees pay for health insurance that they purchase on their own. ICHRAs were created under regulations issued by the Trump administration in 2019, and became available as of 2020.

ICHRAs represent a departure from previous ACA implementation rules that forbid employers from reimbursing employees for individual market premiums. QSEHRAs, which became available in 2017, allow small employers to reimburse employees for individual market premiums. But ICHRAs allow this for employers of any size, and they offer more flexibility in terms of how much an employer is allowed to reimburse an employee.

Accessible To All Employers

Traditional group health insurance coverage isnt the best option for many employers because of its complexity, unpredictable costs, and strict requirements. An HRA is a more accessible alternative that isnt subject to annual rate hikes and has no participation or minimum contribution requirements. Employers simply set a monthly benefit allowance and employees use their allowance on any qualified medical expense they choose.

Also Check: What Is The Tax Fine For No Health Insurance

Who Should Get An Hra

If your employer offers an HRA, you should definitely consider opening an account. These are entirely employer-funded. So you dont have to shed a dime off your paycheck. And youd have a medical emergency fund at your disposal in case something happens.

You may not get any tax benefits yourself. In fact, your employer ends up getting the tax break. But this arrangement encourages more employers to offer these accounts to their employees. And its one of those rare examples of free money in the workplace. The only other one that comes close is whether your employer offers a company match on its 401 plan.

And even though you dont need to pair an HRA with an HDHP, you still have to link it with a group health plan as determined by your employer.

Qualified Small Employer Health Reimbursement Arrangement

A Qualified Small Employer Health Reimbursement Arrangement is a health coverage subsidy plan for employees working for businesses that employ less than 50 full-time workers. Also known as a small business HRA, a QSEHRA can be used to offset health insurance coverage or repay medical expenses that would be otherwise uncovered.

The yearly limits are set by the Internal Revenue Service . For 2021, a company with a QSEHRA can reimburse individual employees for up to $5,300 per year and employees that have families for up to $10,700 per year . The money that is reimbursed is tax-free for the employees and tax-deductible for the employers.

Recommended Reading: How To Buy Your Own Health Insurance

Questions And Answers About Individual Coverage Hras And Safe Harbors

The proposed regulations under Code section 4980H that were issued on September 30, 2019 provide safe harbors for determining whether an offer of an individual coverage HRA pursuant to the June 2019 final rules is an offer of minimum value, affordable coverage for purposes of the employer shared responsibility provisions. These regulations are proposed to apply for periods beginning after December 31, 2019. Under the proposed regulations, which may be relied upon for periods during any plan year of an individual coverage HRA beginning before the date that is six months following the publication of any final regulations, an individual coverage HRA that is considered affordable under the applicable safe harbor provides minimum value. Proposed Treas. Reg. § 54.4980H-5.