How Do Employers Pay For Health Insurance

There are usually two components to a health insurance policy: the employer and employee. Employer-sponsored plans will generally offer coverage options that do not cost the employee more than nine hundred dollars for the employee’s part alone. The employee’s family income should not exceed 5%. According to federal law, this is what is meant by affordable coverage.

Why Should I Get Germany Travel Medical Insurance

There are three reasons why you should get travel insurance when travelling to Germany:

- It is for your own good. Germany has one of the best healthcare systems in the world, and some of the best doctors. Moreover, medical care in Germany is quite cheap compared to the GDP. Still, healthcare is cheap and affordable only for German and other EEA citizens. Third-country nationals who find themselves in a health emergency may have to pay unbearable amounts of money. When you have health insurance, your provider takes care of that, and you do not need to worry about anything else. Moreover, if you lose your passport, luggage, or something similar, what can always happen on a trip, you will be covered.

- Because you need it to apply for a visa to enter Germany for short stays. If you need a visa to Germany, you need health insurance too. Your health insurance must cover not just Germany but the whole territory of Schengen. Without it, your application will be rejected immediately.

- You will enter the Schengen Area through a country that asks you to present your travel insurance at the port of entry.

Health Insurance policies for foreigners travelling to Germany that fulfil Germany Visa requirements can be purchased online from AXA Assistance, Europ Assistance or DR-WALTER.

Popular Tourist Destinations In Germany

Top tourism destinations in Germany, which we recommend you to visit:

- Of course, the capital of Germany is the first thing you need to see. With its Brandenburg Gate, the Rebuilt Reichstag, Berlin Wall Memorial and Checkpoint Charlie, Charlottenburg Palace and Park and much more places, Berlin is a tourist magnet.

- The Castle of Neuschwanstein. One of Europes most popular tourist destinations is the fairy tale castle of Neuschwanstein. Did you know that Walt Disney was inspired by this castle for the Sleeping Beauty Castle?

- Dresden. Fully recuperated from the World War II bombings, Dresden is now a stunning city with many cultural institutions. Before WWII the city was called the Jewel Box.

- Cologne. The pretty cathedral of Cologne and numerous other attractions gather thousands of tourists every year in this city. The 2,000-year-old city has buzzing nightlife and a cultural scene.

- Rothenburg ob der Tauber. A 13th-century city that looks like it has gotten straight out of a fairytale with its medieval centre.

Also Check: How Much Do You Pay For Health Insurance

Travel Health Insurance Cost To Usa

If you know anything about the U.S. healthcare industry, you may be aware of the rising costs of medical care. Without adequate travel insurance coverage, medical issues can lead to serious financial problems. Theres no need to put yourself and your family at risk. In most instances, travel health insurance will take care of basic healthcare costs. When you sign up for travel insurance, you are securing coverage for countless health benefits, including hospitalization, doctor visits, prescription drugs, tests, x-rays, and even the acute onset of pre-existing conditions .

So How Much Does Visitor Insurance Cost? It depends on several factors. In this article, we will break down the cost of coverage, from premiums and deductibles to policy maximums and treatment payments.

In general, visitor health insurance will cost less if you:

The premium depends on your age, the coverage duration, medical maximum, deductible amount, and plan type. When you choose low maximum coverage, your monthly or weekly premium will be much less than it would be if you wanted a limit of $100,000 or more. In the case of a serious medical emergency, $25,000 may only get you so far. You could end up owing tens of thousands of dollars should you fall ill or suffer a major injury that requires surgery.

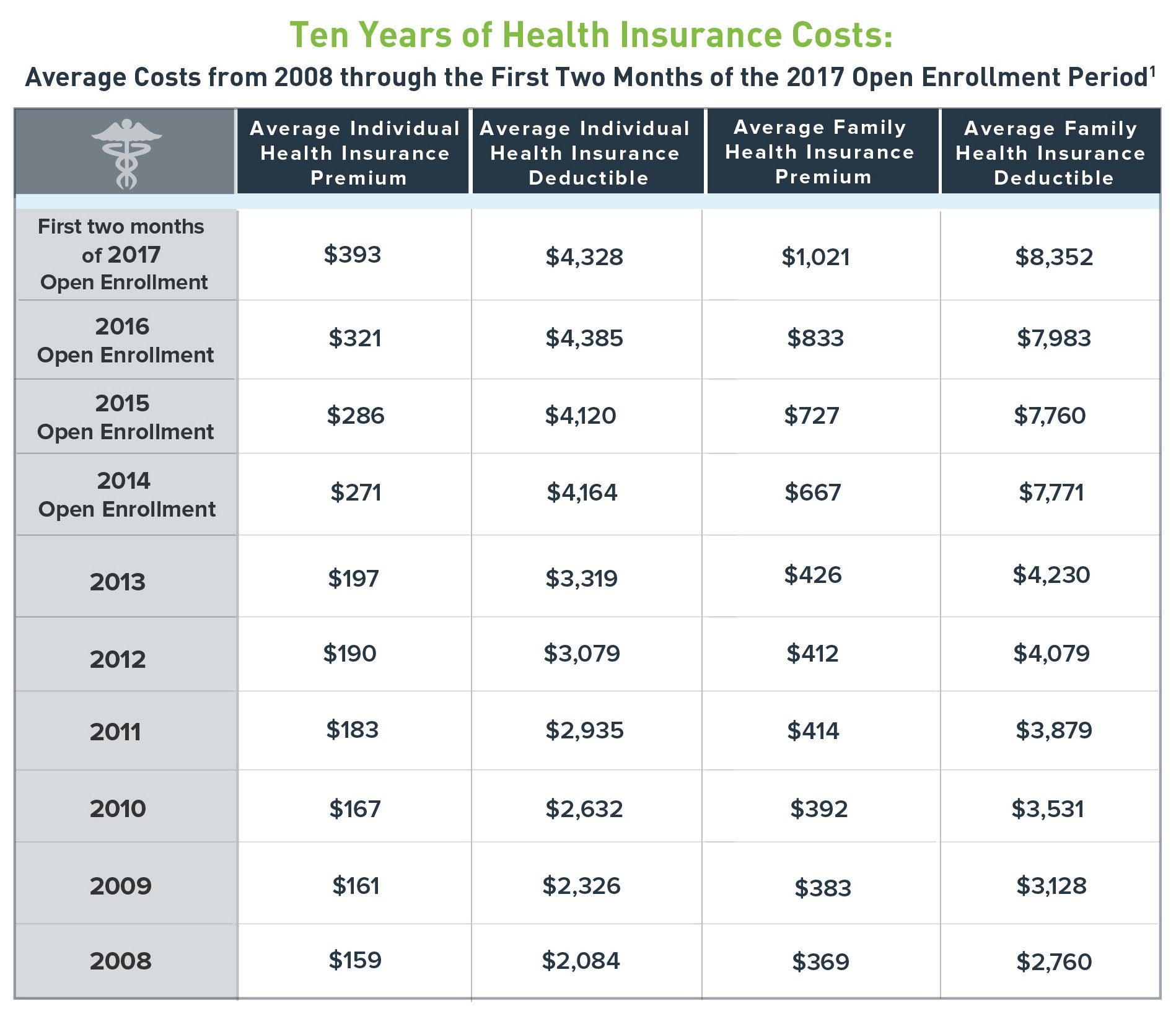

Heres a look at how deductibles and premiums may vary according to your selections.

Learn More About Visitor Insurance In Usa

- Review tips for traveling safe and finding Insurance For Travelers With Medical Conditions. This post explains what is typically covered and what is excluded from these plans.

- Practical tips for obtaining Visitor Medical Insurance Covering Diabetes and high blood sugar level conditions. This post contains great advice for diabetics, including best practices for protecting themselves while traveling.

- Learn what is covered by Visitors Health Insurance for High Blood Pressure Conditions. By planning ahead, individuals with high blood pressure can protect themselves from high medical expenses.

- A detailed and relevant post about Visitors Insurance For Parents Visiting USA provides valuable insight into what is covered and what is excluded from visitors health insurance.

Also Check: Does Health Insurance Cover Allergy Testing

How Much Does Full Employee Benefits Cost

When all employee benefits are factored in, the average total compensation is $37 per employee. This is the hourly rate of 73. Employers paying employee benefits for state and government workers pay an average of $19 per employee. In addition to their average salary and wage of $32, they were paid $82 per hour. The hourly wage is 62 dollars.

What Is Visitor Medical Insurance

Visitor medical insurance is a form of short-term travel medical insurance policy that tourists or visitors can purchase to get protection for illnesses or injuries that may occur while they are traveling or living outside their country. These plans provide inpatient and outpatient benefits like coverage for hospitalization, intensive care, urgent care and even prescription drugs. The plan excludes coverage for maternity, pre-existing conditions or preventive care.

Read Also: Do Real Estate Brokers Offer Health Insurance

How Much Does Visitor Health Insurance Cost

There is no one-size-fits-all cost for visitor health insurance plans. It differs for limited and comprehensive plans. The details like your age, the number of days you need coverage for, the deductible, and the policy maximum, determine the amount of your premium.

The premium for Visitor Health Insurance USA Cost varies from $52-$136 per month. The limited benefit plans are all cheaper than the comprehensive plans.

Many of these plans offer an extension or an upgrade like sports injuries. You can opt for them according to your special needs.

The quick procedure lets you start the coverage plan from the next day of application and confirmation. You can also choose a future date to initiate coverage while applying.

Medical emergencies are expensive in the USA, even for a minor injury. It can easily disrupt your whole budget for traveling. But opting for health insurance can go a long way to bring you peace of mind.

Factors That Affect the Price of a US Visitor Visa Health Insurance

The amount of premium for your travel health insurance depends on the following factors-

1. Age of the applicant-

Age often becomes an indicator of how much a person is prone to medical emergencies. The premiums are usually higher for older travelers, as they may be at increased risk for health-related problems.

2. Area of coverage-

The location of your visit also impacts your premium. You might be charged a higher premium if you are traveling to the USA, compared to another part of the world.

What Is The Best Visitor Insurance In Usa

Best Visitors Insurance for USA Best Comprehensive Plans for People Age 70 and Under. CA-G. Cover America Gold Insurance. Underwriters: Sirius International. Best Limited Coverage Plans for People Age 70 and Under. CA. ChoiceAmerica Insurance. Popular Coverage Plans for People Between the Ages of 70-79. PP. Patriot Platinum Insurance.

Read Also: How Much Does Health Insurance Cost In Ct

How Much Money Do Small Businesses Spend On Health Insurance

Several studies show that small businesses spend an average amount on health insurance, according to a report by the Kaiser Family Foundation, of which employers contribute $6,297, or 84 percent. Employers contributed $13,618 or 67% towards family coverage, which amounts to $20,438, or $20,538, for single coverage.

Fixed Plan Travel Insurance

As mentioned previously fixed plans are like the budget option. You take this product if you want a cheaper option without minding the cut of some of the value-added services. The plan typically requires a deductible before the insurance disburses the agreed amount. The plan also only pays out a fixed amount per expense type. For example, a doctors appointment warrants a specific amount, and a visit to an emergency room warrants a different amount. The deductible could be paid per expense or as a set amount at the start of every active period.

These plans have a lower maximum limit when compared to a comprehensive plan, but you pay less. The plan might not cover every and any medical expense type. Make sure you visit an approved medical facility or else you might not be able to claim any expenses from your service provider. A fixed plan doesnt necessarily cover travel-related expenses like lost luggage and travel interruption expenses.

Some medical facilities may not deal with insurance providers, but your provider may still approve the facility and the expense type. Pay the expense and then claim it from your insurance provider by following the prescribed claim procedure.

A fixed plan is probably your best option if you want to spend the least amount of money on insurance. The plan can still cover a whole range of medical emergencies and will definitely help a good deal when you need to cover some health-related expenses on your trip abroad.

Don’t Miss: Do Active Duty Military Pay For Health Insurance

Visitor Guard: #1 Visitor Insurance In Usa

We provide comprehensive health insurance for visitors to USA. We help you find customized insurance solutions specific to your travel schedule and needs, as well as provide you with advice on travel security and health concerns overseas. Visitor Health insurance USA is a type of travel medical insurance plan that enables travelers to get coverage for illness or injury that occurs during their stay abroad.

Visitor Guard® offers a broad spectrum of various comprehensive and affordable universal plans for visitor health insurance for visitors to the USA. Weve got your back for all your travel healthcare needs and Visitor Insurance in USA.

Health Insurance For Visitors To Usa

For A Healthier, Well Protected Travel

Have you ever been in a situation where you want to plan a vacation but cant because of your health problems? If yes, then great. You have reached the right spot. Visitor Guard® is one of the best visitor health insurance companies that will help you get and stay covered for your travel needs.

Travelling can be stressful enough without including uncertainty as to how you will find health coverage abroad. Whether youre traveling in the USA or taking an international trip, Visitor Guard® is a leading health insurance provider that can help. Our plans offer the Best Visitor Health Insurance USA to international visitors.

Travel anywhere in the world with peace of mind and our health insurance plans to keep you safe.

You May Like: Are Daca Recipients Eligible For Health Insurance

Does Travel Insurance Cover Trip Cancellation

It depends on the travel policy, but you can opt for a policy that covers trip cancelation if you want. Plans like the Safe Travel USA Trip Protection can provide you coverage for trip cancelation. People eligible for this plan have to be non-US citizens traveling to the USA and other foreign countries from their home countries, and they have to be below the age of 80 years. Safe Travel USA Trip Protection policy provides coverage for trip cancellation, trip-interruption, emergency medical, and post-departure travel protection. It includes a pre-existing medical condition waiver. While applying, you can even opt for the optional upgrades like emergency accident and sickness medical expenses, AD& D, athletic sports coverage, and home country/follow-me-home coverage. It Provides complete trip protection for the cancellation of trip costs for up to a maximum of $25,000, and the trip-interruption benefit covers 150% of the trip for up to a maximum of $37,500. The policy covers up to $1,000,000 in primary emergency medical coverage.

Visitors Health Insurance Insurance Exclusions And Warnings

Exclusions

Refer to the plan document to view exclusions.

Geographic Restrictions

State Restrictions We cannot sell to persons domiciled in Maryland, Washington, New York, South Dakota, and Colorado.

Country Restrictions We cannot sell to persons domiciled in Cuba, Islamic Republic of Iran, Syrian Arab Republic, United States Virgin Islands, Gambia, Ghana, Nigeria, Sierra Leone, and Democratic Peoples Republic of Korea .

Destination Restrictions For International Travel Coverage, we cannot cover trips to Antarctica, Islamic Republic of Iran, Syrian Arab Republic, Cuba, and Democratic Peoples Republic of Korea .

Important Information Regarding Your Coverage

Please be aware this coverage is not a general health insurance plan, but an interim, limited benefit period, travel medical program intended for use while away from your home country.

This brochure is intended as a brief summary of benefits and services. It is not your plan document. If there is any difference between this brochure and your plan document, the provisions of the plan document will prevail. Benefits and premiums are subject to change.

It is your responsibility to maintain all records regarding travel history and age and provide necessary documents to Seven Corners to verify your eligibility for coverage.

Don’t Miss: Is Family Health Insurance Cheaper Than Individual

What Does Germany Travel Insurance Cover

If you are already planning to get travel insurance for Germany, you should know that there are very specific things that the insurance covers. It does not automatically cover every incident in which you involve.

Most German travel health insurance providers cover the following:

- Emergency medical expenses. Any unforeseen accident or illness that requires emergent treatment during the trip in Germany for up to the amount you have been covered with. Note that exempt from this are:

- Pre-existing medical conditions.

- Unexpected incidents due to extraordinary situations, such as terrorism, war, civil unrest.

- Alcohol-related incidents. If you hurt yourself or someone else while under the influence of alcohol on your holiday in Germany, your insurer will not probably cover your expenses.

- Accidents or injuries that occur during adventure or winter sports.

How To Find The Best Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Note: The coronavirus pandemic has disrupted existing and future travel plans, and turned greater attention to trip insurance. Read our take on specific information concerning travel insurance and COVID-19, or see our comprehensive guide to managing your finances during COVID-19.

Booking travel always carries some degree of uncertainty. Travel insurance provides a safety net so you can step out with confidence. Insurance is designed to cover the big financial risks you dont want to bear alone. You may not need travel insurance for inexpensive trips, but it can provide a sense of security when you prepay for pricey reservations, a big international trip or travel during the COVID-era, which can be unpredictable.

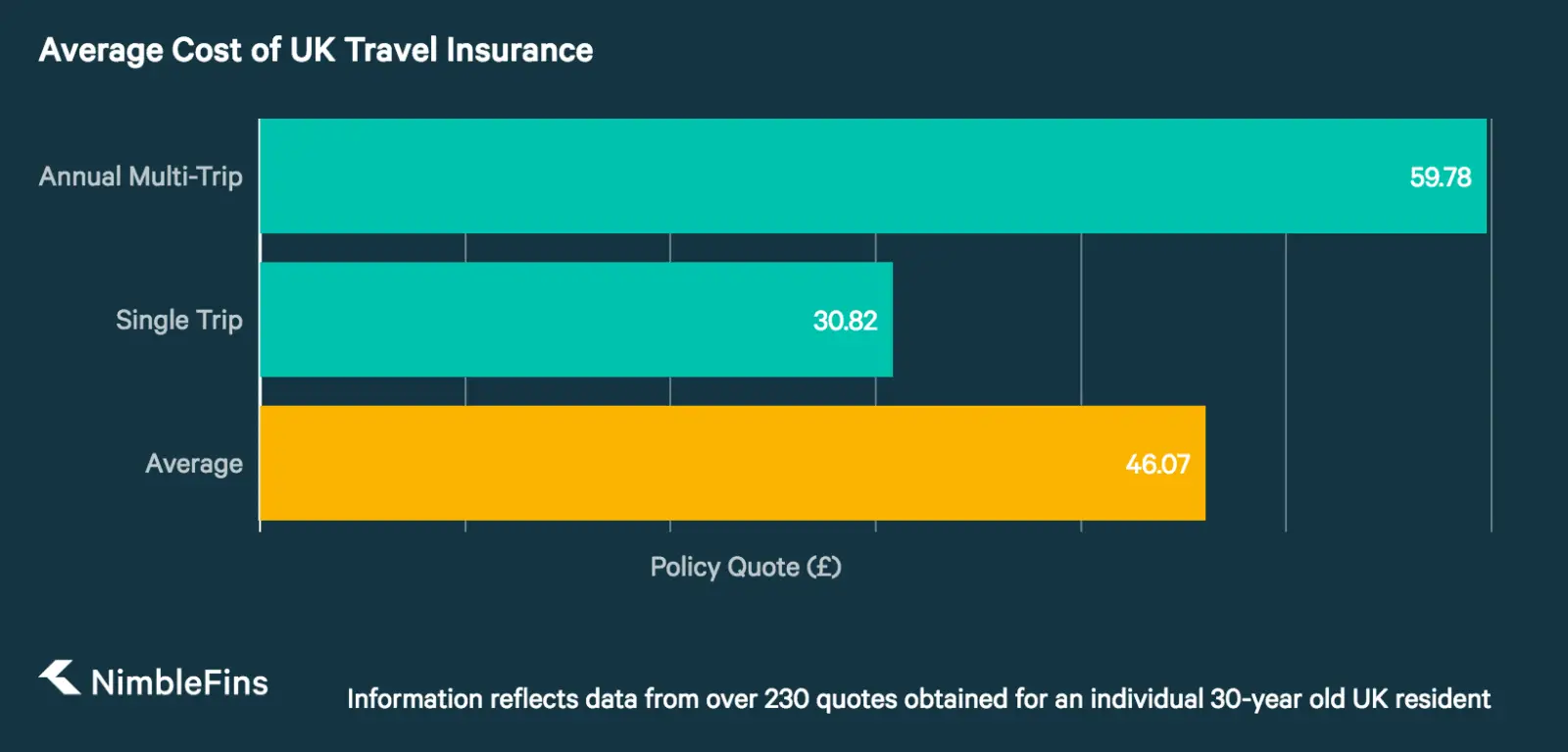

According to insurance comparison site SquareMouth, for the 12-months ended April 2021, travelers spent an average of $234 on travel insurance for trips ranging from two to three weeks, representing just over 6% of the average trip cost.

Read Also: What Is The Difference Between Life Insurance And Health Insurance

Health Insurance For Non

The standard of medical care in the United States is high compared to its neighbors, thus the higher cost associated with it. Aside from this, public healthcare is provided only to a portion of the population. This is why most people, including the locals, have private health insurance coverage in America.

The federal Medicare program is available only to retirees. The Medicaid program, on the other hand, is reserved for the poorest citizens in the country. If you are an expatriate in the US, you will not qualify for either of these programs.

Your employer will usually give insurance that extends coverage to immediate family members. However, this is often not enough to shoulder the cost of the expensive healthcare service in the country. As with most immigrants, it is highly recommended that you purchase international health insurance to make sure you are protected in emergencies.

Immigrants in the USA: According to US Customs, to obtain an immigration visa, you must show proof that you are covered by an approved health insurance provider. Family or employment-based policies are usually the types of plans accepted. The policy should be valid within 30 days of entering the US territory unless you have proven that you have enough money to cover any foreseeable medical cost.

Does Visitor Insurance Cover Maternity

Visitors insurance is not under the Affordable Care Act compliant. And benefits like preventive care, pre-existing conditions, and maternity coverage are typically not included in this kind of insurance. However, there are plans that provide some benefits for the acute onset of certain pre-existing conditions, and cover the complications of pregnancy in the first 26 weeks. Review your certificates carefully or talk to our agent to clarify all your doubts.

Also Check: When Does Health Insurance Enrollment Start