How Do You File A Farm And Ranch Insurance Claim

The actual process of filing a claim is straightforward, and similar to filing claims for other sorts of insurance: You call or fax your insurer’s contact center. Nowadays, most companies also offer a facility on their websites to initiate the process.

As a minimum, you should be ready to provide the following information:

- Policy number

Are Quad Bikes Expensive To Insure

The premium costs of quad bike insurance depend on a number of factors, including: Age of the driver vehicle insurance tends to be cheaper the older you are. Where the quad bike is stored keeping it in a garage would likely be seen as safer than on the road, therefore at a lower risk of theft or damage.

State Farm Life Insurance Riders

While State Farms life insurance policies are comprehensive, a suite of add-ons let you tailor your policy and add even more protection:

- Accelerated death benefit. Pays some benefits if youre diagnosed with a terminal illness.

- Accidental death benefit. Provides an extra payment if you die from an accident.

- Critical illness benefit. Get a portion of your death benefit every month if you become chronically ill.

- Child. Provides coverage for your child, instead of buying a separate policy.

- Disability income benefit. Provides a monthly stipend to cover living expenses if you become disabled and cant work.

- Estate protection. Offsets estate taxes if your life insurance policy is included in your estate.

- Guaranteed insurability. Lets you buy more insurance at specific times without taking a medical exam.

- Long-term care benefit. Pays some of the death benefit for long-term care costs.

- Level term. Keeps your benefit amount the same during your policys term.

- Spouse. Provides coverage for your spouse, instead of purchasing a separate policy.

- Waiver of premium. Waives your premiums if you suffer a disability, chronic illness or injury.

Read Also: What Health Insurance Covers Birth Control

State Farm Life Insurance Reviews Are Mixed

Despite being in business for nearly a century, State Farm isnt accredited with the Better Business Bureau . Though the BBB and Trustpilot give this company a low star rating amid a high number of complaints. However, most reviews are centered around its home and car insurance products. Over at JD Power, State Farm ranks top of the list for customer satisfaction.

| AM Best financial rating | |

| Customer reviews verified as of | 30 June 2021 |

Average Cost Of Treatments

If you’re trying to decide whether pet insurance is worth it, you should consider the cost of treatments without insurance. To help you calculate whether pet insurance is a good investment for you, we looked at treatment costs for the top 10 dog and cat ailments.

According to data based on average claims from PetFirst holders, the most common dog treatments cost $252.75 on average, while the most common cat treatments cost $266.79.

Keep in mind that even some of the more common issues, such as treating parvo in puppies, can be quite expensive the average claim is over $900. And serious afflictions like cancer are rarer, but treatment is also much more costly chemotherapy alone can cost $5,000 to $10,000.

| Rank |

|---|

You May Like: What Is The Best Health Insurance In Alabama

State Farm Franchise Start

Technically, the State Farm franchise start-up fee is non-existent. Thats because legally speaking, the company and insurance is generally not a service or good covered by the Franchise Act.

In fact, instead of getting money from you, the company would help you train to become an agent. If the agency sells office equipment to you, they do so at a discounted price. Hence, their objective is to help you save. You could always opt to buy what you need from other providers.

Bodily Injury Liability Coverage

Bodily injury liability coverage, often referred to as BI coverage, pays for the costs associated with injuries for which you are legally liable.

- This means that your actions caused injury to another person and you were found legally responsible for those injuries.

- Your BI coverage will pay for bills associated to those injuries, such as:

- Medical expenses,

- Repair to the living room wall you crashed through, or

- Removal of the knocked over tree.

Those are just a few of the bills and costs that could be covered. Also, if you are sued, liability coverage will pay your defense and court costs.

Recommended Reading: Are Abortions Covered By Health Insurance

Know When Your Hobby Turns Into A Business

If you’ve recently become a farmer or rancher, you may assume that your insurance isn’t going to change much. Your homeowner policy served you well enough in the past, and all that’s changed is you’ve gotten a home with more land. But life’s not like that.

The moment the income you derive from your home’s land and other resources exceeds the “incidental income” threshold laid down in your homeowners policy, the game changes. In the eyes of your insurer, you’re now a business, and there’s a high chance things you thought were covered no longer are.

For example, that expensive stable block that used to be insured under your home policy when you kept only your own horses in it is unlikely to be covered once that threshold is breached. And other outbuildings and equipment may also be unprotected. Worse, you may have acquired new and different levels of liability by becoming an enterprise, and those may now be uninsured.

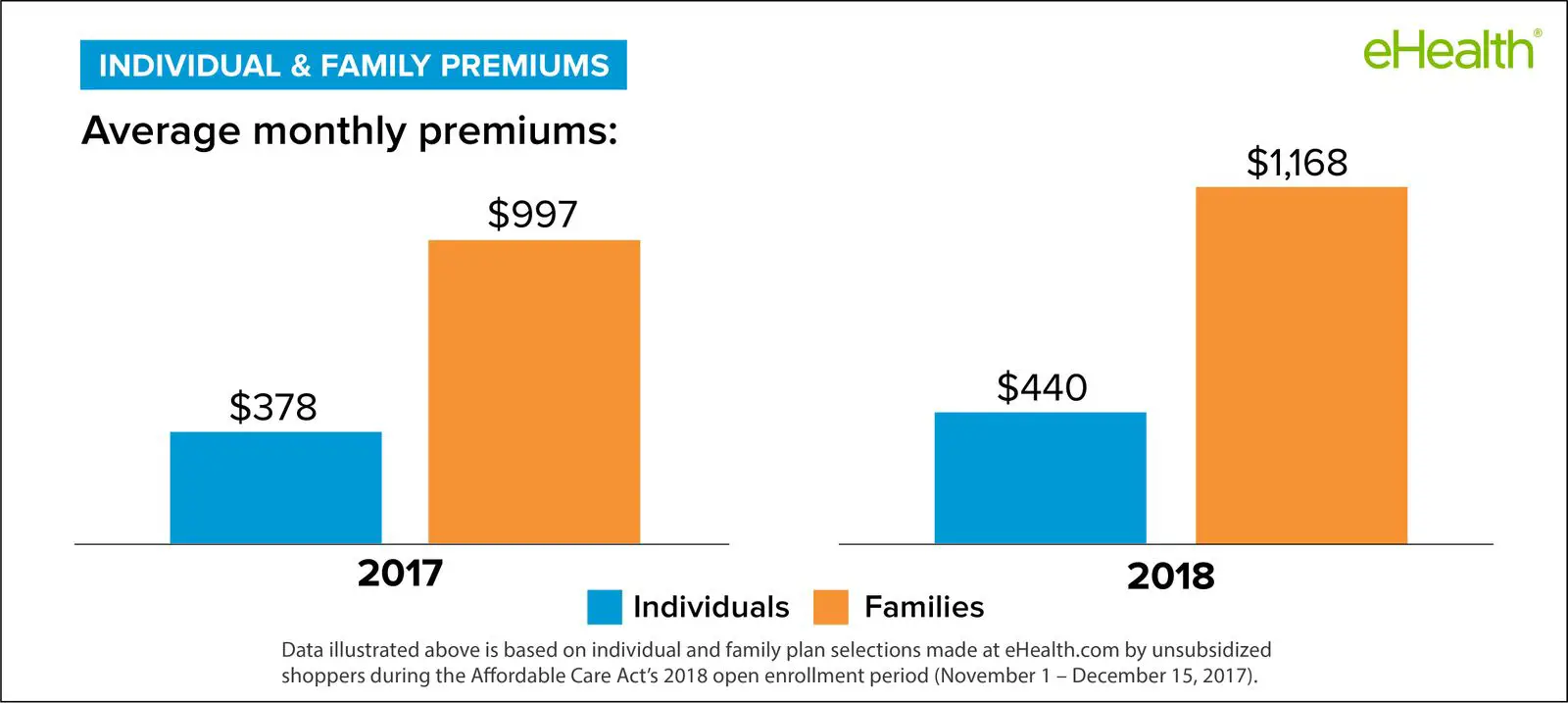

Health Insurance Categories: Determine Your Insurance Coverage

The key categories of health insurance are often divided into five groups. Each group is distinguished by a different ratio of financial responsibility between the insurer and the insured. The categories are:

The more insurance pays for medical expenses, the higher the monthly premium. Some people opt for a category such as Bronze or Catastrophic if they dont anticipate many medical expenses. For those who frequently visit the doctor, foresee a big medical event or require a number of medications, a category such as Silver, Gold or Platinum may be a better fit.

Don’t Miss: How Much Are Employers Required To Pay For Health Insurance

When Do I Sign Up For Medicare

The initial enrollment period spans three months before to three months after your 65th birthday. You can sign up for Part A any time during or after your initial enrollment period. If you sign up for Part B after this period, and you dont have group coverage through your or your spouses employer, you will face a late enrollment penalty. If you are covered under a group plan, youll be able to enroll in Medicare up to 8 months after that coverage ends.

You can or in person at your local Social Security office.

How To Cancel Your State Farm Car Insurance

Like most major insurance providers, State Farm is actually pretty fair when it comes to cancelling your coverage. You can either cancel in person, by mail or by phone – and tell them that you wish to cancel your policy. They’ll usually ask for a reason, try to sell you on an extension, and will ultimately cancel your policy unless you say otherwise.

Cancellation is free, and State Farm does not charge any additional early cancellation fees.

Recommended Reading: Who Owns Aetna Health Insurance

What Happens If Your House Is Destroyed By An Earthquake

After an earthquake, you still have your mortgage even if you no longer have your home. Earthquake insurance usually pays for damage to the structure, temporary living expenses and personal property replacement. But you may still have hardship because of the deductible, and because payment might not come immediately.11 sept. 2019

Understanding Health Insurance Exchanges

If your health insurance isn’t covered through an employer, you could get coverage through a marketplace.

As the provisions of the Patient Protection and Affordable Care Act went into effect, one significant change arose in the way consumers can obtain health insurance. If a worker’s employer does not offer a health care plan, he or she can buy it directly from a Health Insurance Exchange .

You May Like: Does Health Insurance Cover Vision

Does State Farm Cover Windshield Cracks

Yes, State Farm will pay for windshield replacement or repair services for customers who have comprehensive coverage, though a deductible will apply unless state laws or policy details say otherwise. Comprehensive insurance from State Farm covers windshields damaged by weather, vandalism and theft, among other things.25 jui. 2021

Farm Insurance Property Coverage

Loretta Worters goes on to expand on some of the common risks farm and ranch insurance can cover:

Some of the coverages are similar to what any business needs to protect itself.

But other coverages that are different that a farmer should be concerned about is farm equipment insurance, which provides coverage for farm equipment like tractors, threshers and combines. So if there is a fire or other natural disaster, you will be able to replace them.

There’s also farm structure insurance which protests various structures on your property such as barns, silos, pens, dairy parlors, even corral fencing. There’s also crop insurance, which reimburses you if you lose a large portion of your crops to winds, drought, hail or extreme temperatures. And also livestock insurance in case your cows, sheep, goats or pigs are killed by severe weather, an accidental shooting, electrocution or if they are killed in transit.

You May Like: What Is The Cost Of Supplemental Health Insurance

How Do Farm Tags Work

Registration and Licensing Requirments: Farm plates can be used only in connection with the farm or for transportation of the farmer and the family members. This includes transportation for personal use. The farmer can loan the farm-plated vehicle to others and receive payment in kind or in services, but not money.7 oct. 2013

State Farm Renters Insurance Review: Pros & Cons Pricing And Features

Studenomics Score: 4.5 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

We know that it can be difficult to find a renters insurance policy that offers you the perfect coverage that you need for your lifestyle on a budget that you can afford.

State Farm Renters Insurance Review

It turns out that State Farm Renters Insurance has policies that you can customize on any budget so that you and your personal belongings are always covered.

Are you considering insuring yourself with State Farm Renters Insurance? We dug deep to see what we can find out more about State Farm Renters Insurance. Keep on reading to see our reviews of the State Farm Insurance Renters Insurance.

Highlights:

Address: One State Farm Plaza, Bloomington, IL 61710

Also Check: Where Can You Get Affordable Health Insurance

Why Should You Consider More Rather Than Less Liability Insurance

While most states require drivers to carry basic liability insurance, which offers the minimum coverage limits required by law, its a good idea to purchase higher coverage limits than your state requires.

Why? Lets say you were distracted while backing out of a parking space and you didnt see a car behind you that happened to be driving by. And then you hit that car, slightly injuring the driver and her passenger.

After an investigation, youre determined to be at fault for the accident. Your auto liability coverage will pay for the damage to the car you hit as well as for the medical bills from the injuries sustained by the driver and the passenger, including pain and suffering, and lost wages.

If the damages you cause exceed the liability limits you have chosen, you could find yourself personally liable for all of the costs due that exceed the amount your insurance policy can pay. If youre unable to pay those bills, it could result in garnished wages, liens against owned assets and even court fees.

To fully understand the difference between minimum liability coverage and the amount of coverage you may actually need, contact a State Farm agent.

Is It Covered By Medicare Or Aca

Medicare or Affordable Care Act plans may pay for services like emergency air transport if no other form of transport is available, and if it meets the rules for being medically necessary. But this might be subject to a deductible and to the co-insurance clause of your plan, so you would still end up paying part of the costs out of pocket.

Don’t Miss: Can I Be On My Parents Health Insurance

Who Can Get State Farm Gap Insurance

State Farms Payoff Protector benefit isnt an insurance product that can be purchased by customers without a loan contract from State Farm Bank. It also has different rules and restrictions depending on where a customer lives. For more information about State Farm Banks Payoff Protector benefit, call the company directly at 877-SF4-BANK .

How To Decide If You Need Full Coverage

You should consider your cars value and your location when deciding if you need full coverage. If you own your car outright but its particularly valuable, your full coverage premium is likely a good investment compared to the cars worth.

Similarly, even if you could afford to repair or replace the vehicle, its smart to keep full coverage if you live in an area with frequent collisions or thefts. After all, full coverage usually refers to a policy that includes collision and comprehensive coverage in addition to the states minimum required insurance.

If you are trying to save on your premium but cannot drop full coverage, you might be able to raise your deductible, as long as it isnt dictated by your insurer or lender. But bear in mind that you should always choose a deductible that youll be able to afford in the event of a claim.

What happens if you don’t keep full coverage on a financed car?

If you dont keep full coverage on a financed car, you could be held responsible for paying for the vehicle in its entirety in the event of theft or an auto accident. You could also lose the car to the lender you signed a contract with if you dont keep full coverage on your financed car.read full answer

Ultimately, its best to keep full coverage on a financed car until you own it outright. Only then can you choose the level of car insurance coverage you want, as long as it meets your states minimum requirements.

Does State Farm offer gap insurance?

Also Check: How Do I Know If I Have Private Health Insurance

State Farm Pet Health Insurance Pricing Coverage & More

Prepare for unexpected vet bills

State Farm is an insurance company providing auto, home,rental and medical pet insurance. For many people, its the ultimate answer toaccessing discounts by bundling different policies together. State Farms pet insurance is through a partnership with Trupanion, asmall pet insurance company that sells its own individual pet insurancepolicies as well.

Some consider State Farm to be more expensive than otherinsurers. Whatever annual premium is agreed upon at the outset, the rates arefixed for the life of the policy, so you may end up paying less than other companies’ policies in the long term. The pricing per month for dogs is between $36 and$100 for most breeds. Some breeds known to carry genetic illnesses may be moreexpensive. Cats premiums are between $23 and $57 per month.

Deductiblesare agreed upon by the consumer and State Farm at the time of product purchase.Deductibles can range up to $1,000. The higher the deductible, the lower themonthly cost. Conversely, the premium is higher with lower deductibles. Thegood news is that once a deductible has been paid for a new illness or injury,you will not have to pay it again for that condition. Other new illnesses orinjuries will carry their own deductibles which will be the same amount as thepolicy-wide deductible.

Included in itscoverage is non-routine:

- Diagnostic tests

Requesting A Policy Change

Thinking about making a change? Your State Farm agent would be happy to assist you. But you can also initiate a change yourself.

Pick from two simple options if you need to file a health insurance claim.

- Take your bill to your State Farm agent’s office.

- Call our Health Response Center at 866-855-1212 to request a claim form.

Don’t Miss: Is Health Insurance Mandatory In New York

How Does Farm And Ranch Insurance Work

Every farm and ranch is unique, and each comes with its own particular challenges and risks. That’s why agriculture insurance policies usually allow high levels of customization. Loretta L. Worters, who is Vice President of Communications at the Insurance Information Institute explains:

Farm policies tend to be highly customized: there’s barebones farm insurance policy, and then you add options based on the property you have on the farm and the liability protection you need. Because of the individual nature of each farm or ranch, the type of ranch, animals or not, makes the determination of the policy.

So you have to assess the risks you face, and decide on the ones you can afford to insure — or can’t afford not to insure — and the ones you’re comfortable shouldering yourself.

That’s a difficult process, even for the most experienced and savvy agriculturalist, which is why many farmers and ranchers work closely with specialist insurance professionals, who can provide help and advice at each step.

Rocky Mountain Insurance Information Association executive director Carole Walker says, “Farm/ranch insurance is complicated, and a very thorough evaluation of all risks and exposures is necessary to determine proper coverage. Work with an agent and company that fully understand this specialist area of insurance. It takes some time, but it’s well worth the effort.”