Insurance Audit: 3 Steps

Our philosophy is this â you should always buy the minimum amount of insurance you need to sleep well at night.

Doing that will save you hundreds, if not thousands of dollars, over the course of a year because some insurance is a waste of money.

So hereâs the question: Are you ready to start saving?

If youâd like to cut your insurance costs right away, here is a 3 step process to do just that.

What Are Average Health Insurance Costs

In the U.S., 55% of people receive health insurance through their employer, and 20% receive insurance coverage through government assistanceeither through Medicaid or Medicare according to the U.S. Census Bureau. Some peoplesuch as those who are self-employedchoose to purchase insurance privately, says Peter Kongstvedt, M.D., a health care expert and author based in Virginia. There are also 8% of people in the U.S. with no health insurance coverage at all.

The average health insurance cost for a single person who received health insurance through their employer in 2020 was $7,040 a year, according to data compiled by the Kaiser Family Foundation. The average cost of health insurance for a family in 2020 was $21,342 a year. These numbers represent what someone pays for a health care premium. A premium is the amount you pay each month to the health insurance provider, Dr. Kongstvedt says.

A premium is different from a deductible. A premium is what you pay up front , regardless of if you get health care or not. A deductible is something you pay in plans if you actually receive health care, Dr. Handel explains. For example, if the deductible for your health insurance plan is $1,000 a year, youll need to cover the other medical bills beyond that amount, he adds.

Health Insurance If Youre Pregnant

All health insurance plans that count as qualifying health insurance cover pregnancy and childbirth-related services. Maternity care and childbirth are one of the 10 essential benefits required on qualifying health plans under the ACA. These services are covered even if you became pregnant before your coverage starts.

Having a child counts as a qualifying event for a special enrollment period in which you can enroll in a new plan or switch plans.

Maternity care and childbirth are also covered by Medicaid and CHIP. If you qualify for Medicaid and CHIP and are pregnant, you can apply at any time during the year through your state agency or marketplace.

Read Also: Does Uber Offer Health Insurance

How Much Will Private Health Insurance Cost In Retirement

Many Canadian retirees wonder, Should I take health insurance? and How much does retiree health insurance cost? The answers often depend on the health care services you need to pay for and where you live in.

If insurance costs less than the money youd have to pay, then it could definitely be worth having private health insurance. So, before taking out any health insurance for retirees in Canada, its important to do the math.

Health care insurance for retirees can range from just over $100 to over $400 per month. The price varies depending on your age, province and the extent of the coverage you may need. For example, cheaper options have a limit for prescription and dental costs and you have to pay a deductible .

Medical insurance options for early retirees are probably more attractive, given that they usually dont qualify for any financial assistance before 65. Is it worth having private health insurance if youre under 65 and spending thousands on prescription drugs? Probably, but again, it is important to do the math before signing up for any plan.

What Does Medicare Cover

Medicare, to the uninitiated, is the term for single-payer universal healthcare in Canada. It is not the same thing as Medicare in the United States.

Medicare covers most things in Canada and allows most Canadians access to publicly funded hospitals and other institutions.

However, there are parts of the system which are not accessible to those without private insurance or deep pockets.

Most provinces and territories in Canada do not cover dental visits or dental work. If a complex dental procedure must be performed in the hospital, Medicare may cover this. However, typically, they do not cover anything that takes place in a dentist’s office.

Medicare does not cover optometry beyond a yearly eye exam. If the exam determines you need glasses or contacts or other vision aids, this is also not covered under the universal healthcare system.

Psychological care is also not covered or severely limited in scope. This creates a huge burden on society by forcing patients to pay out of pocket or through a third party insurance plan. In June of 2021 when this article was updated, Canadians aged 15-24 are reporting staggering declines in their mental health in the wake of the Covid 19 pandemic.

Canada’s Medicare does not pay for prescription drugs if they are administered out of a hospital setting. If you’re hospitalized, you may receive medication in the hospital free of charge. If you go to an outpatient facility and a doctor prescribes you medication, you must pay out of pocket.

Also Check: How To Get Insurance Between Jobs

Buying Health Insurance If You’re Self

If you just became self-employed after leaving a full-time W-2 job, you can use COBRA to continue your previous employer’s coverage until you’re able to find a new plan. If it’s not open enrollment, you should also be able to qualify for a special enrollment period to shop on the HealthCare.gov marketplace or your state’s equivalent. These plans are usually more affordable than COBRA plans.

Make sure your premiums are affordable, as your monthly income may be variable. Your health insurance premiums are also tax-deductible sometimes, so don’t forget that come tax time.

Learn more about health insurance for freelancers.

Heres How The New Program Could Affect Different People

If you already bought health insurance on Healthcare.gov for all or part of 2021:

You can choose to stick with the plan you have, or switch to a new one. Your plan might renew automatically, but its important to go back to Healthcare.gov and explore your options.

That includes people who have had the same plan since the start of the year, and people who bought insurance under the special enrollment period that began in February.

If you didnt go back in spring or summer to see if you could get a mid-year cost reduction, you may be especially surprised when you look at options for 2022.

Make sure you look at all the options available in your area, and that you consider whether plans have high deductibles, which is the amount youll have to pay for care before your insurance kicks in, except for preventive services that are covered at no cost to you.

From the front page of Healthcare.gov, click Log in to renew/change plans

Then, go into the Plan Compare section of the site and check to see if any doctors, hospitals and health systems that you prefer to go to actually participate in the new plan, before you finalize your choice. Look at whether the plan covers any medications you take.

Once youve looked at all your options, you can either confirm that you want the same plan youre already in, or choose a new one.

You May Like: What Benefits Does Starbucks Offer Employees

How Much Does Managing Chronic Illnesses Cost Without Health Insurance

Because it can be so expensive to manage a chronic illness, those without insurance have been found to seek treatment far less than those with insurance. The ADA, for example, found 60% fewer doctor visits and 52% fewer medications in people with diabetes without insurance. But that comes with a price: 168% more visit to the ER than a person with insurance.

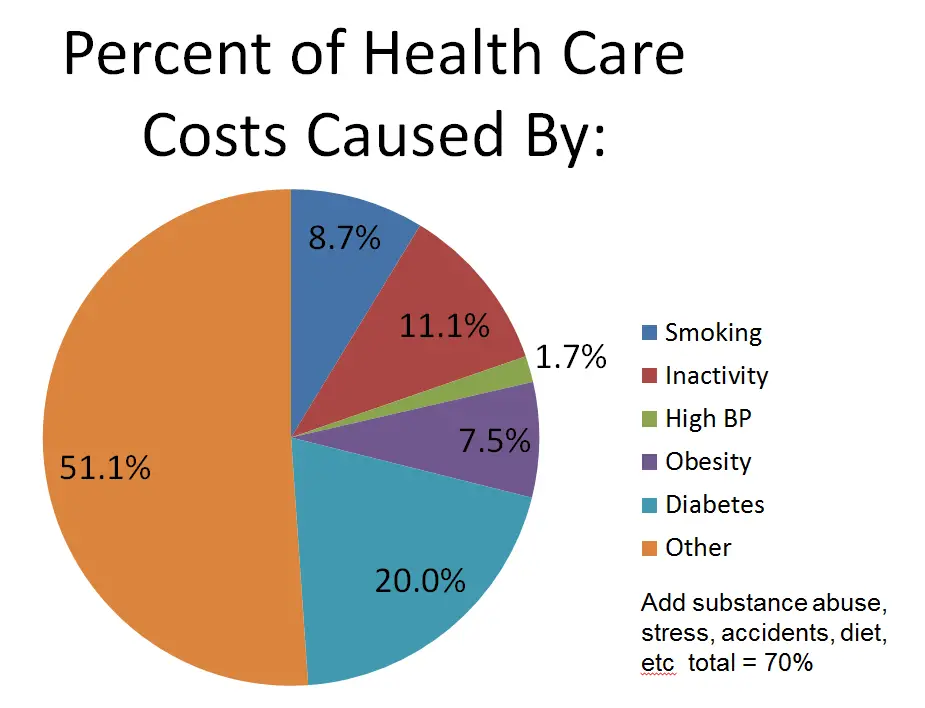

For those suffering from depression, the costs are just behind diabetes as the second most costly condition, according to the American Psychological Association. Another 21% of medical expenses are directed toward obesity-related illnesses. As you can see, chronic illnesses can be expensive.

The Costs Of Health Insurance

Kaiser Family Foundation reviews all healthcare providers and in 2020 reported the average health insurance premium is $462 per month.

Of course, when you add a family to the mix, the insurance premiums are even greater and it continues to rise. While employers will cover most of the premiums for single employees, they do not take on those costs when it comes to a spouse or children. The National Conference of State Legislators reported single employees paid 18% of the costs of insurance premium but for family coverage, the employees paid 29%.

Read Also: Evolve Health Products

If The Prognosis Looks Grim It Might Be Time To Search For A New Job

Question: Whats worse than getting sick? Answer: Getting sick and getting stuck with a huge bill. Health insurance is supposed to prevent both of those thingsthe getting sick and the huge bill. But thats not the case with all plans and providers, which vary wildly.

Thats why an employers health insurance benefits can add a lot to the appeal of a job. About 151 million Americans rely on employer-sponsored coverage. According to a 2016 Monster U.S. poll, over 86% of 10,624 respondents say that affordable health insurance is important when deciding whether or not to take a new job, compared to only 8% who dont think its important and 5% who dont feel strongly either way.

But dont wait until youre looking for a new job to evaluate a companys health benefitsreview your employers health insurance benefits every year, especially since the costs are on the rise. Remember, those costs affect your compensation considerably, and you want to make sure your employers contributions are generous.

With open enrollment season upon us, now is the ideal time to reevaluate just how beneficial your heath benefits really are. Read on to find out if your companys plan offerings would pass a fitness test.

When Is Insurance Not Required

Now consider regular health and dental expenses not covered by provincial healthcare. This includes such events as a teeth cleaning, obtaining prescriptions and vision checkups.

The probability of these types of events occurring for the average person is likely to be moderate-to-high, but the cost of such occurrences are considered to be relatively low. Remember that insurance, as defined above, is designed to protect you against the risks of the unknown. Yet, these regular health and dental expenses are generally expected. So why is health and dental insurance actually considered to be “insurance”?

This is a fundamental question that is not actively considered by many Canadians rather,big insurance companies market the message that small-to-medium sized businesses should purchase traditional insurance plans in order to responsibly “cover” these types of costs.

Yet, this is simply not the case. In fact, if one examines the premiums paid by an average small business for this type of “insurance,” one will find that the costs of the coverage outweighs the out-of-pocket costs of paying for these expenses by oneself.

Keep in mind that most traditional plans don’t even pay for the entire amount of typical additional health and dental expenses . In addition, these plans generally possess severe restrictions or simply don’t cover every form of moderate-to-major type of expense, such as laser eye surgery and orthodontics.

Read Also: Which Statement Is Not True Regarding Underwriting Group Health Insurance

Is Your Health Insurance Worth It 5 Questions To Ask Yourself

If youre a private health insurance member, youre probably all too familiar with both the rising cost of premiums each year and the constant internal battle of is private cover really worth it?

Its certainly frustrating dishing out your hard-earned cash for something that you dont necessarily see a return from in the short term. Especially if youre fit and healthy and cant even remember the last time you even had a cold.

So as the second premium rate rise in just six months looms on April 1st and premiums creep up again, this time by an average of 2.74 per cent, it could be time for you to finally sit down with your private health insurance over a glass of wine, look it dead in the eye and say is this really working?

Here a few questions prompts to get the conversation started.

Discover The Better Way To Save Costs On Medical Expenses In Canada:

Paying for your medical expenses out-of-pocket is using your after-tax dollars. That’s why there is a more efficient and cost-effective method available to incorporated businesses to pay for all health and dental related expenses using pre-tax dollars. This tax plan is called a Health Spending Account. It is an alternative to health and dental insurance which allows business owners to pay for 100% of their medical expenses with before-tax money .

Don’t Miss: Does Insurance Cover Baby Formula

Can You Get Health Insurance With A Pre

Since insurance companies are for-profit businesses, those with pre-existing conditions are more costly customers. These companies profit off people not making claims, and health issues tend to be costly for them. To avoid the high payouts, most standard health plans require you to answer medical questions, and some will even need a medical exam depending on those answers.

Guaranteed health insurance plans are a special kind of policy that does not require a medical exam and can cover pre-existing conditions. The problem is they dont offer as much drug coverage as other plans.

Some useful tips if you are applying with a pre-existing condition:

-

Apply after a period of good health. Your insurability improves during these times.

-

Have regular check-ups. Those that monitor their condition regularly are rated more positively.

-

Staying at a job for an extended period will rate you more favourably when applying for individual coverage if your employer does not provide it

-

Ask your doctor to speak with an insurance provider on your behalf to weigh in on your health and the potential risks

-

Advocate for yourself, and keep trying!

Ultimately, health insurance is always worthwhile, but its a balance between finding a price point that works and advocating for benefits at your employer.

Health Insurance Helps Secure Your Financial Future

For many young adults like yourself, paying for your own health insurance coverage is something new and may seem like its not important. But the opposite is actually the case. Having good health insurance is one of the most crucial pieces to your financial plan. Its vital to your financial health by helping protect you from financial calamity. In fact, having the right kind and the right amount of health insurance is one of the smartest money moves you can make.

Also Check: How To Enroll In Starbucks Health Insurance

How Much Does A Primary Care Visit Cost With Health Insurance

Preventative care means insurance often covers 100% of your annual checkup at the doctor. Outside of that visit, the average cost of visiting a doctor for a checkup with health insurance is a $10 to $40 copay. The rest of your visit will be covered by insurance for which you are paying the average $462 per month.

This means it costs more than $5,500 a year to see a doctor just once and copays for additional visits. Some insurance has deductibles, meaning you will pay out-of-pocket until you reach the limit. For example, if you have a $1,000 deductible, you will pay copays and additional costs until you reach that limit. After that, all costs are covered by the insurance company.

Who Gets Personal Health Insurance

Generally, the people who purchase personal health insurance value the group benefits they had when they were working.

William and Maureen are retiring soon and have always had health insurance. They take prescription medications for ongoing medical conditions, know theyre going to need expensive dental care in the future and use a lot of paramedical services such as massage or physiotherapy. They also plan to vacation out of the country.

They know the government wont cover all their healthcare costs, and that their healthcare costs will be more than the premiums for a personal healthcare plan. They also wont want to worry about qualifying for coverage or purchasing travel insurance separately.

Recommended Reading: Asares Advanced Fingerprint Solutions

Am I Paying For Cover I Dont Even Need

You can have your cake and eat it too, meaning you can keep your private health insurance but save yourself some money at the same time.

All you need to do is review your policy regularly to make sure youre not paying for things you dont need. There are health insurance comparison services available that can help you work through what a suitable level of cover looks like for you across a range of policies and funds*.

You could be paying a bucket load for things like obstetrics when you really arent on the baby making page of your life right now. So it can pay, quite literally, to shop around and review your policy to make sure youre not paying for things you dont need.

You may even be able to opt for a higher excess in an effort to reduce your monthly premiums if you think its unlikely youll be admitted to hospital anytime soon.

So there you have it five conversation starters to have with yourself on whether your private health insurance is really worth it for you.

Whatever you decide, before ditching your cover all together, consider checking out if you can first save money on your current policy.

Its not an urban legend, it is possible to find a similar level of cover with a different fund that could be kinder to your bank account.

So Will You Save Find Out Fast

- Use this quick tool to see if your income puts you in the range to save on an insurance plan. You’ll also find out if you’re in the range for Medicaid in your state. It’ll take about a minute.

- If you can spare a few more minutes, you can preview 2022 plans and see how much you’d pay for them based on your income. You don’t have to create an account or give us your name to check plans out.

Recommended Reading: Kroger Health Insurance Benefits