Do Copays Count Toward My Health Insurance Deductible

Many plans also let you access certain healthcare services at a more affordable price before youve met your deductible. They do this by charging a copay or flat fee, rather than the full cost. As of 2016, the most common services covered this way were primary care doctor visits and generic drugs. However, these types of medical services, where youre only charged a copay, typically do not count towards your deductible.

Other Types Of Deductibles

So far, this article has covered annual deductibles, which are the most common. However, some health plans have more than one type of deductible. These may include:

- Prescription deductible: This applies to prescription drugs and is in addition to whatever deductible the plan has for other medical services. After it is met, the coverage usually switches to copays for lower-tier prescriptions, and coinsurance for the more expensive, higher-tier prescriptions.

What Happens After I Meet My Deductible

BY Anna Porretta Updated on January 21, 2022

After you pay your annual deductible, your insurance starts paying its portion of the cost of covered care you receive for the rest of the year. Depending on the service, the health care provider, and your insurance, your portion of the cost of care covered by the plan after youve met your deductible may be a copayment or coinsurance amount.

Also Check: Does Starbucks Offer Health Insurance To Part Time Employees

How You Save Money Before You Meet Your Deductible

Insurance companies negotiate discounts with health care providers, and as a plan member youll pay that discounted rate. People without insurance pay, on average, twice as much for care.

This means when you use a network provider you pay less for the same services than someone who doesnt have coverage even before you meet your deductible.

-

Sometimes these savings are small. If youre insured and use a network provider, you may pay $25 for a flu shot instead of the $40 someone without coverage pays.

-

In other cases the savings can be big. If use a network provider, you may pay $85 for an office visit instead of the $150 someone without coverage pays. Savings can be even higher for more expensive services.

So even if you dont reach your deductible during the year, you can save a lot of money on your covered medical services just by being enrolled in an insurance plan.

Q Do I Need To Notify The Ministry If My Baby And I Are Leaving The Province

You should contact the Ministry of Health and Long-Term Care with any change of address for both you and your baby. If you move to a location outside Ontario, you should inform the ministry of your new address and the date of the move as soon as possible. To inform the ministry of your move, you can either :

- Obtain a for you and your baby. Complete and sign the form and return it by mail. Forms are available from your local ServiceOntario Centre or from .

- Send a letter to your local ServiceOntario centre. You must include your names, health numbers, telephone number, current address, new address including postal code, and the effective date of the move for yourself and child.

Recommended Reading: Does Starbucks Have Health Insurance

How Can Your Deductible Vary

Your deductible varies based upon several factors. The plan that you choose is the most common reason that a deductible might vary. Different plans will have different deductible amounts. However, there are other things to be aware of as well. For example, you might have a deductible that only applies to certain types of services. For example, you may have to meet a deductible only on your prescription medication. That means that you have to pay for your own medication for a period of time until you meet the threshold, after which you may or may not have to pay an additional co-pay whenever you pick up medication.

Another factor to consider is that your deductible can vary based upon the number of people covered in your plan and the person that is using the benefit. For example, with some health insurance plans, your deductible might apply to the entire family while others will apply to each individual person within the family. This is definitely something you want to understand beforehand, prior to your signing up for that particular health insurance plan. Make sure that you get all of the information you can before you decide on which plan to have because you cant change it until the next window.

6 Best Credit Cards for 2021: Your Ultimate Guide

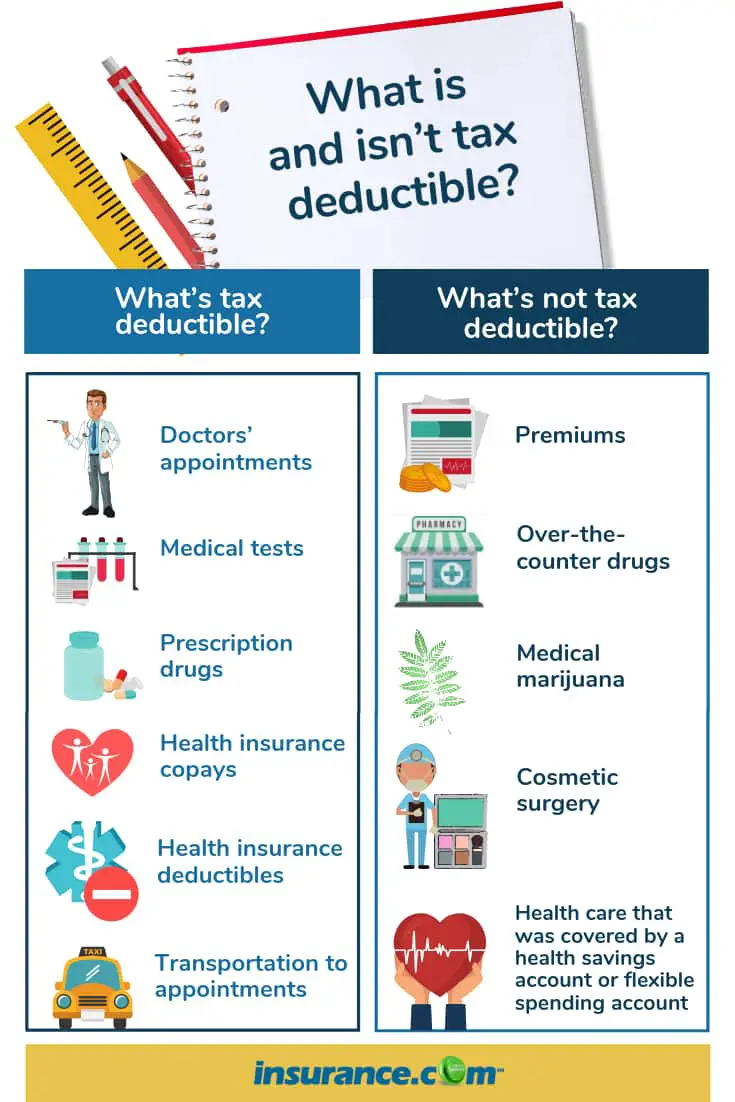

Insurance premiums can be thought of as the service charge of a health policy excluding other payments consumers have to pay such as deductibles, copays, and other out-of-pocket costs.

How Can Your Deductible And Out

Choosing a high-deductible plan is one way for young, healthy or low-risk people to save on health insurance because they will spend less on monthly bills and are less likely to have high medical costs. If you have significant medical needs, choosing a plan with a low deductible and out-of-pocket maximum can help you pay less overall because even though you’ll pay more each month, you’ll get better cost-sharing benefits.

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Recommended Reading: Umr Insurance Arizona

What Doesnt Count Toward The Deductible

Healthcare expenses that arent a covered benefit of your health plan dont count toward your deductible even though youve paid for them. For example, if your health insurance doesnt cover orthotic shoe inserts, then the $400 you paid for a pair of orthotics prescribed by your podiatrist doesnt count toward your deductible.

Similarly, if your health plan doesnt cover out-of-network care, any amount that you pay for out-of-network care will not be counted towards your deductible.

If your health insurance requires a per-episode deductible, or a deductible each time you get a particular type of service, as well as an annual deductible, money you pay toward the per-episode deductible might not count toward your annual deductible.

If you have separate deductibles for in-network and out-of-network care, the amount youve already paid toward your in-network deductible doesnt count toward your out-of-network deductible. Depending on your health plans rules, the amount youve paid toward your out-of-network deductible likely wont count toward your in-network deductible, either.

You May Like: What Is The Best Health Insurance Coverage

Health Insurance Deductibles: Only Part Of Your Costs

Deductibles are only part of the expenses you face with health insurance policies in addition to your monthly premiums. Remember that your deductible is the amount you must spend each year on covered health care expenses before your insurance starts to pay some of the costs. In general, the lower the health insurance deductible, the more expensive the policy and vice versa.

You’re also required to cover the following:

- Copayments or copays.These are set amounts that you pay for specific covered health care expenses. For example, you might have a $10 primary care copay and a $40 copay for specialists. You don’t need to meet your deductible first.

- Coinsurance. Once you meet your deductible, you’ll be responsible for part of your health care costs, and your plan will pay the rest. This is called coinsurance. You continue to pay coinsurance until you meet your out-of-pocket maximum for the year.

An out-of-pocket maximum is the most you’ll pay for covered health care expenses in one year. Once you reach that out-of-pocket maximum, your plan pays 100% of covered expenses.

Although most plans require insured individuals to pay copays and coinsurance, there are plans that don’t. These plans usually come with higher premiums and lower deductibles.

Recommended Reading: Starbucks Health Insurance Eligibility

How Do I Know If Ive Met My Deductible

Your health insurance company website will likely allow you to log in and view your deductible status. Check the back of your insurance card for a customer service number and call to confirm your deductible status. If you are enrolled in Medicare, visit mymedicare.gov and click on my deductible status from the claims menu.

Things To Know About Deductibles In The Health Insurance Marketplace

IMPORTANT: This page is out-of-dateGet the latest information here.

Deductibles, premiums, copayments, and coinsurance, are important for you to consider when choosing a health insurance plan. You can compare health plans and see if you qualify for lower costs before you apply. Most people who apply will be eligible for help paying for health coverage.

Here are 6 important things to know about deductibles:

Recommended Reading: Starbucks Health Coverage

How Health Insurance Deductibles Work

Understanding what a deductible is, how it works, and when you have to pay it is part of using health insurance wisely.

The following is an example of expenses with an annual deductible that’s $1,000:

In January, you get bronchitis. You see the healthcare provider and get a prescription.

- Total bill after your insurer’s network discount = $200.

- You pay $200.

- Your health insurance pays $0.

- $200 is credited toward your deductible.

- $800 is remaining before the deductible is met.

In April, you find a lump in your breast. The lump turns out to be non cancerous youre healthy.

- Total bill for doctors, tests, and biopsy = $4,000.

- You pay $800.

- You pay any copayments or coinsurance your health plan requires.

- Your health insurance pays the rest of the bill.

What Is An Annual Deductible For Health Insurance

When you buy a health insurance plan, you have to pay an annual deductible. Depending on your plan, it may be low or high. What happens if you canât pay it?

This article discusses what an annual deductible for health insurance is, the difference between annual deductibles and per-episode deductibles. You will also learn about no deductible policies, out of pocket expenses, Health Savings Account, and what to look out for when shopping for health insurance.

An annual deductible is a set sum you are required to pay every year towards your healthcare expenses before your health insurance policy fully kicks in to pay. An annual deductible has a validity period of a year and resets once the calendar year ends.

The information in this article is accurate as it has been collated from reputable sources such as the various states’ Department of Insurance, Healthcare.gov website, numerous health insurance providers, and health insurance industry watchers.

Also Check: Starbucks Open Enrollment

Optimize Your Deductible And Out

Those limits are high and would be difficult for most Americans to pay. Youre more likely to meet your deductible and out-of-pocket maximum if you have a chronic condition, or need several prescription drugs or other expensive care. If that sounds familiar, these guidelines can help you save on your care:

-

Stay in your plan’s provider network whenever possible. Only in-network services count toward your deductibles and out-of-pocket maximums in most plans.

-

Know what your plan covers. If any medical need, from a brand-name medication to outpatient surgery, isnt covered by your policy, the money you spend on it is not going to count toward your deductible or out-of-pocket maximum.

-

Before getting any care besides a primary physician visit, such as an imaging exam or specialist visit, check your policy to verify whether you need prior authorization. If you do, the doctor referring you for that care should obtain the authorization on your behalf.

-

Plan your medical expenses whenever possible, such as when youre having a baby, a scheduled surgery or an imaging procedure.

-

Use free preventive care services as outlined in your policy. Getting preventive care now can also lower costs down the road by catching and treating a health problem before it gets out of hand.

Ultimately, choosing health care is a financial decision just like everything else you pay for. Learning about health insurance before your bills come can save you a lot of money over time.

How Do Prescription Drug Deductibles Work

When it comes to prescriptions, many plans have just one combined deductible that applies to both your medical services and prescription drug costs. However, some health insurance plans will separate them into two different deductibles. Its important to check your plan details to see how your health coverage is set up. That way, you can plan your medical costs appropriately.

READ MORE: What To Do When Your Health Insurance Doesnt Pay For A Medical Service

In the past, some pharmaceutical companies offered programs or coupons to help pay towards the cost of expensive drugs. These coupons counted towards a patients deductible. However, in 2018, many insurance companies started to change their policies, and unfortunately these coupons may no longer count towards your deductible. If you are using or have been prescribed a drug with a financial assistance program, you should check your plan details to find out whether this assistance will count towards your deductible or not.

Recommended Reading: What Health Insurance Does Starbucks Offer

What Does No Charge After Deductible Mean

This means that once you have paid your deductible for the year, your insurance benefits will kick in, and the plan pays 100% of covered medical costs for the rest of the year. After youve reached this limit, you will not have copayments, coinsurance, or other out-of-pocket costs.

In most health insurance plans, the health insurance carrier usually only pays 100% of covered medical costs once youve reached your out-of-pocket maximum. This threshold is a similar idea to your deductible, except usually higher meaning you have to spend more money on covered medical costs before reaching it.

Platinum And Gold Plans:

These plans usually have no deductibles associated with them. However, the monthly premiums tend to be much higher than a Silver or Bronze plan. Individuals and families chose these plans because they may need to use their plan more regularly. The monthly premiums are higher but there is never a concern of needing to meet a deductible before a procedure.

You May Like: Does Starbucks Provide Health Insurance

Try To Work Out A Payment Plan

See A Physical Therapist

Sports injuries, carpal tunnel syndrome, tendonitis. These are just a few of the many conditions that physical therapy can help. But the cost can really add up, saysKaty Votava, Ph.D., president and founder of Goodcare.com, a consulting firm that helps consumers navigate the financial aspects of their healthcare coverage. Because of the high cost of PT, she says many people minimize their visits or avoid them altogether. Assuming your insurance plan covers physical therapy, your appointments should be more affordable once your deductible is metmaybe $0 maybe a co-pay, but either way much easier on your bottom line.

Don’t Miss: Starbucks Partner Health Insurance

What To Know To Save On Health Care

Meredith Mangan is a senior editor for The Balance, focusing on insurance product reviews. She brings to the job 15 years of experience in finance, media, and financial markets. Prior to her editing career, Meredith was a licensed financial advisor and a licensed insurance agent in accident and health, variable, and life contracts. Meredith also spent five years as the managing editor for Money Crashers.

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

Health insurance deductibles can be complicatedespecially when comparing health insurance plans or figuring out how much your current one will pay for a given expense. Although deductibles generally work in the same way regardless of what type of coverage they apply to, there are several different types of deductibles in health insurance.