Who Does The Individual Mandate Apply To And Who Is Exempt

Almost all U.S. citizens who did not have health insurance between 2010 and 2018 may still owe a penalty fee next year or in the future based on the individual mandate. This fee comes in the form of an extra tax you must pay for the time you didnt have coverage. People who qualify for a health coverage exemption for past years includes anyone who:

- Was incarcerated.

- Had an income that was so low that filing a tax return was not a requirement.

- Were members of a Native American tribe.

- Had a religion that objects to having health insurance.

- Belonged to a healthcare sharing ministry.

- Was in the U.S. illegally.

- Qualified for a hardship exemption.

- Paid more than a certain percentage of their income to their health insurance. The IRS set the exact percentage each year.

You can also visit HealthCare.gov to learn more about exemptions from the individual mandate and how to apply for an exemption if you qualify.

Starting in 2019, though, you do not have to pay any kind of penalty fee or tax if you do not have coverage, regardless of whether or not you qualify for an individual mandate exemption. However, there are a few states that still enforce the individual mandate which well talk about below.

Am I Covered For Emergency Care Outside Of Canada

Doctor Bills Manitoba Health and Seniors Care will pay for emergency doctors services outside of Canada at a rate equal to what a Manitoba doctor would receive for a similar service.

Hospital Bills Emergency hospital care is paid on an average daily rate established by Manitoba Health and Seniors Care.

You may be charged more than the amount paid by Manitoba Health and Seniors Care for services provided outside Canada.

The difference above the covered amount may be substantial and is your responsibility.

Bring or mail your original bill to the Out-of-Province Claim Section at Manitoba Health and Seniors Care within 6 months of receiving care. If you have made payments on your bills, Manitoba Health and Seniors Care requires a receipt showing the amount paid. If you do not include your receipt, Manitoba Health and Seniors Care will pay the hospital or doctor directly.

For more information contact:

Manitoba Health and Seniors Care300 Carlton Street Business hours: Monday to Friday 8:30 to 16:30 For more information call: 204-786-7303Toll free: 1-800-392-1207 Ext. 7303TDD/TTY: 204-774-8618TDD/TTY Relay Service outside Winnipeg: 711 or 1-800-855-0511

NOTE: The in-person Registration and Client Services Office at 300 Carlton St., Winnipeg will be temporarily closed to the public to support social distancing efforts. Services will be available by telephone or email. More information can be obtained here.

Other Options For People Who Can Get Employer

Depending on your situation, you may still be able to get Medi-Cal if you are offered employer-sponsored coverage. Also, some family members may find that buying an individual plan on Covered California is cheaper than the plan the employer offers, even without government subsidies, or that an individual plan may provide coverage for services that are not covered by the employer-sponsored plan.

Also Check: What Is The Best Affordable Health Insurance

California Allocated $295 Million To Provide Additional Premium Subsidies

California enacted legislation in 2019 to create a temporary state-based premium subsidy for Covered California enrollees with household income up to 600% of the poverty level .

Californias budget bill included an appropriation of $295 million to cover the cost of the subsidy program, with 75% of that money allocated for enrollees who dont get any federal subsidies and 25% allocated for enrollees who earn between 200 and 400% of the poverty level . The state-based premium subsidies were also addressed in S.B.78, which clarifies that the subsidies arent available after 2022.

Covered California reported that 486,000 had already enrolled in plans with financial assistance under the new state-based premium subsidies as of December 12, 2019. The exchange estimated that a total of 922,000 people would be eligible for the state-based premium subsidies. In February 2020, Covered California reported that about 47% of applicants with income between 400 and 600% of the poverty level had qualified for the state-funded subsidy, and the average subsidy amount for those households, covering 32,000 consumers, was $504 per household per month.

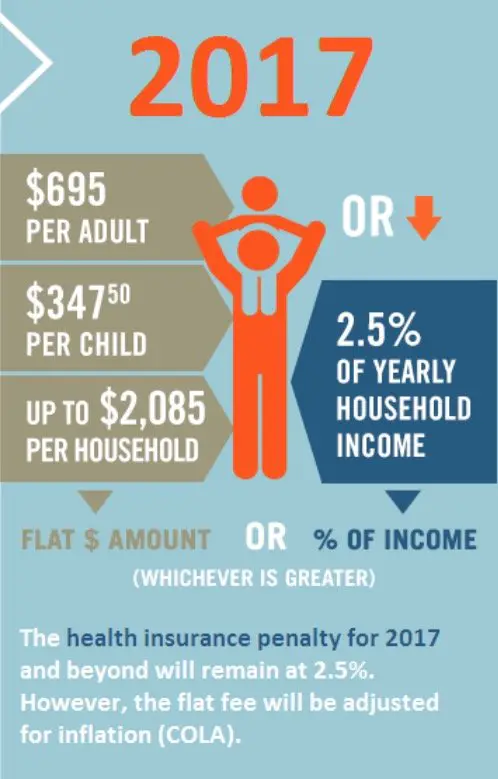

What Is A Health Insurance Penalty

Health insurance tax penalties were introduced at the federal level with the Affordable Care Act, or Obamacare. This meant that all taxpayers across the country were required to obtain health insurance coverage or pay a tax penalty. The federal law was repealed and coverage was not mandatory in the state of California in 2019. However, California has now introduced a new state mandate for individual health care in 2020.

You May Like: Can You Have Double Health Insurance

Am I Eligible For The Northern Patient Transportation Program

You may be eligible for northern transportation subsidy to help pay for transportation costs if you live north of the 53rd parallel in Manitoba and are required to travel long distances for specialty medical care.

The Northern Patient Transportation Program subsidizes medical transportation costs for eligible Manitoba residents in the north to obtain medical or hospital care not available in their home community. Subsidies may include costs for an essential escort .

Program eligibility is limited to Manitoba residents who live:

- north of the 53rd parallel from the Saskatchewan boundary to the west side of Lake Winnipeg

- north of the 51st parallel from the east side of Lake Winnipeg to the Ontario boundary

- on Matheson Island, when ground travel is not possible by winter road or ferry

Travel must be approved a physician and meet program eligibility. Patients who have coverage from an insurer or funder are not eligible for this medical travel subsidy. Examples include:

- Employers

- Manitoba Public Insurance

- Non-insured people

To process a transport request or for questions about the program, please contact your local office:

Thompson NPTP office

California Law Requires You To Have Health Insurance

Unless you qualify for an exemption, you will be required to pay a tax penalty if you go without health insurance in California.

Even though the federal tax penalty for being uninsured has gone away, California passed its own law imposing a tax penalty for state residents. The California law took effect on January 1, 2020.

To avoid the California tax penalty, you must have what California considers “minimum essential coverage” or prove your eligibility for an exemption.

Also Check: What Health Insurance Is Available In Nc

Penalty For No Health Insurance

Just what are the tax penalties for not having health insurance in 2020? At the federal level, you wont be required to pay a dime. However, if you live in any of the following states, here are the penalties you may be facing:

California Health Insurance Penalty –

If you are a resident of the state of California, and dont have health insurance in 2020, you can expect a tax penalty of $695 per adult and $347.50 per child, or 2.5% of your annual income. Whichever is higher.

Massachusetts Health Insurance Penalty –

If you are a resident of the state of Massachusetts, and dont have health insurance in 2020, you can expect a tax penalty anywhere between $264 to $1,524. If you make under $18,210 a year, you will be exempt.

New Jersey Health Insurance Penalty –

If you are a resident of the state of New Jersey, and dont have health insurance in 2020, you can expect a tax penalty anywhere between $695 and $4,500. The amount you owe will depend on the size of your family and tax bracket you fall under.

Rhode Island Health Insurance Penalty –

If you are a resident of the state of Rhode Island, and dont have health insurance in 2020, you can expect a tax penalty of $695 per adult and $347.50 per child, or 2.5% of your annual income. Whichever is higher.

Vermont Health Insurance Penalty –

Washington DC Health Insurance Penalty –

Shopping For Individual Insurance

Shopping for health insurance can seem overwhelming. Think about what is important to you. Start by asking these questions:

What are the costs?

- How much are the monthly premiums?

- Is there a deductible?

- How much are the co-pays and/or co-insurance?

- What is the plan’s out-of-pocket maximum ?

Which doctors and other providers can I see?

- Is there a network? How large is it?

- Can I see any provider in the network?

- Is my current doctor in the network? If I need to choose a new doctor, are there doctors in my area accepting new patients?

- Will I need a referral from my doctor to see a specialist?

- Does the plan have hospitals and pharmacies near me?

- Do I need pre-approval from the plan for certain services?

- If I travel often, what kind of care can I get away from home?

What are the covered benefits?

- What services does the plan pay for? What is not covered? Are the services that I need covered?

-

How much will I need to pay for my prescriptions?

- Are there any limits on the number of visits for some kinds of care?

What is the quality?

- The California Department of Insurance can tell you how a company ranks in complaints. You can find out how long it takes to reach a real person when you call the company and how many complaints the company gets. We have a PPO Report Card with quality information about PPOs. Call 1-800-927-4357 or go to www.insurance.ca.gov.

- The California Office of the Patient Advocate has information on health insurance and provider quality, at www.opa.ca.gov.

You May Like: Can I Be On My Parents Health Insurance

Penalty For No Health Insurance 2020 In California

When Obamacare passed, it came with a tax penalty for those who could afford health insurance but didnt get it. The tax penalty was eliminated in 2017 by the Trump administration, but the state of California has reinstated it for 2020. California residents who do not have health insurance in 2020, will have to pay a tax penalty in 2021. Read our blog to learn more.

Information & Documents To Have On Hand

Here’s the information to gather before you visit Covered California to apply for health insurance:

- Birth dates, Social Security numbers, and addresses for everyone in your household applying for coverage.

- Proof that you are a U.S. citizen, U.S. national, or “lawfully present” in the United States.

- Employer and income information for each member of your household. Include all income sources, such as your earnings from work, pensions, alimony, rental property, and other income. If you have a job, gather together pay stubs or W-2 forms. If youre self-employed, have last years tax return handy, as well other records that can help you estimate your yearly income.

- Your estimated household income for the coverage year.

- Policy numbers and any Plan ID numbers for current health insurance plans covering you or other members of your household.

- If you or anyone in your household is eligible for job-based health insurance, information about the plan costs and coverage for each available plan.

- A good idea of your budget for health insurance, so you know how much you can afford to spend each month. This will help you choose the best plan from among those offered to you.

Finally, keep a list of any questions you want answered before you sign up for a health insurance plan. To get answers to many basic questions or for information on signing up for a plan, see How Do I Sign Up for Obamacare in California?

You May Like: How To Switch Your Health Insurance

Was Health Insurance Mandatory For The Entire Year

For all years after the ACA went into effect until Jan. 1, 2019, health insurance was mandatory for the entire year. Youll only pay a penalty, though, for any months of the year before 2019 that you were uninsured. So, if you did have coverage for some of the year, the penalty fee will only apply to the non-covered months. Technically, you dont have to have health insurance all 365 days a year to avoid the tax penalty. If you have coverage for even just one day of a month, the IRS considers this as having minimum essential coverage for the entire month.

In addition, you could also qualify for a short coverage gap exemption. You will qualify for this exemption if your lack of health insurance coverage was for a period of less than three months. However, this coverage only applies to the first gap each year, so if you lack health insurance more than once during a calendar year, the exemption will only cover the first gap. For example, if you do not have insurance in May and then again in September, you will only be exempt for May and have to pay the penalty for your second gap.

If I Dont Qualify For An Exemption How Do I Avoid The Penalty For No Health Insurance 2020

The best way to avoid the health insurance penalty is to obtain coverage as soon as possible during the open enrollment period, which began on October 15, 2019 and will continue through January 15, 2020.

If you already have a plan, the open enrollment period is still a good time to review your current policy and compare coverage options in case you discover an option that better suits your needs.

Also Check: Can I Get Health Insurance If I Lose My Job

Am I Exempt From The California Health Insurance Requirement

Under certain conditions, you won’t have to pay the California tax penalty for being uninsured. You’re automatically exempt if you don’t have to file a California income tax return. And you won’t face a penalty if the premium payments for the lowest-cost plan on the exchange is more than 8.24% of your household income for the year. Additional exemptions include:

- You lack coverage for fewer than three consecutive months of the year.

- You are enrolled in limited scope Medi-Cal coverage.

- You are a U.S. citizen who lived abroad during the tax year.

- You are not a legal U.S. resident.

- You are a member of a health care sharing ministry.

- You are a member of a religious group that is conscientiously opposed to accepting health care benefits, including Social Security and Medicare, and you obtain a certificate of exemption.

- You are a member of a federally recognized Indian tribe.

- You are in jail or serving a prison sentence.

You may also apply for a hardship exemption from Covered California. Hardship exemptions are decided on a case by case basis, but they may cover situations such as homelessness, domestic violence, bankruptcy.

You can claim some exemptions on your California state tax return but must apply for others through Covered California. For more information, see Covered California’s Penalty and Exemptions page.

What If I Already Have Health Insurance

If you used the marketplace to purchase a plan last year. Most people who purchased their 2020 insurance plan from an online marketplace will be able to automatically renew their coverage for 2021. While automatic renewal sounds convenient, it has serious downsides:

- If your insurer decides to cancel your current plan, you could be switched to another plan without warning. The new plan may cost you more or change your eligibility for financial assistance.

- Automatic re-enrollment could mean you aren’t getting the right subsidy package. That could leave you facing higher monthly premiums now or — if you take more assistance than you’re eligible for — a big tax bill later.

- You may miss out on a better deal or better coverage if you don’t compare all available plans to your current plan.

While allowing yourself to be automatically re-enrolled is better than going without insurance, it’s best to take advantage of open enrollment and research your options. Shop around and evaluate new plans and costs. Even if you decide to stay with the plan you have, you can use open enrollment to confirm your personal information and ensure you’re getting the right amount of financial aid.

Be sure to check with your current insurance provider before canceling a health insurance policy you may have to wait until the end of your current policy year to make a change.

Keep in mind that if you buy a plan through the exchange:

Recommended Reading: How Do I Know Which Health Insurance I Have

The New Subsidy Program: A Buffer To The California Health Insurance Mandate

Under California health insurance law, California rolled out a new tax subsidy program in 2020. The tax subsidy program serves to help lower the cost of health insurance for low and middle-income Californians.

Previously, those who made above 400% of the federal poverty line were not eligible for premium tax credits. In 2020, those who make between 400 to 600% of the FPL are eligible for subsidies. This means that a family of four with an annual income of around $150,000 per year may be eligible for subsidies.

This program is meant to limit how much a Californian will pay for their health insurance premium as a percentage of their income, according to Covered California.

No Mandatory Health Insurance: Disadvantages

It takes a very savvy healthcare consumer to score discounts from providers, not all of whom will necessarily go along with such requests. Normally, insurance companies, not individuals, are the ones negotiating with hospitals and doctors to lower prices for large member groups.

The main drawback when health insurance isn’t mandatory, however, is the risk you assume when choosing the self-pay route. The downside of going health insurance-free could be substantial if you end up needing expensive medical care and you don’t have the money to pay for it from savings or your monthly income.

“You’re one major accident or illness away from falling into long-term debt, as medical bills can be quite excessive out of pocket,” Steiner says.

Also Check: How To Get Health Insurance As A Real Estate Agent