Best Long Term Care Insurance Of 2022

Get the latest reviews on the country’s top long term care insurance services. We rate the best Long Term Care services to give you a better look into what each company offers.

- Best for ages from 50-69 years

- Established in 1976, A+ Rated

- Nations leader in Long-Term Care insurance

- We also specialize in Short-Term Care, Critical Care, and Life/LTC Hybrids

- Access to all companies to compare quotes

- Monthly Cash Benefits are paid when home care is provided by spouse, family or friends

- Planning Today for a Secure Tomorrow

- Receive quotes from an ample selection of insurers

- Find the plan that’s best suited to your needs

- Average premiums round out at $200 a month, but there are options for $100/month available.

- Best for ages from 50-69 years

- Established in 1976, A+ Rated

- Nations leader in Long-Term Care insurance

- We also specialize in Short-Term Care, Critical Care, and Life/LTC Hybrids

- Access to all companies to compare quotes

- Monthly Cash Benefits are paid when home care is provided by spouse, family or friends

- Planning Today for a Secure Tomorrow

How We Chose The Best Long

To select the best long-term care insurance companies of 2022, we considered the customer satisfaction ratings from J.D. Powers 2021 Individual Life Insurance Study.

We also looked into financial strength as evidenced by A.M. Best’s ratings for each company, along with the number of complaints filed against them with the National Association of Insurance Commissioners .

Balance Needs And Costs

Most long-term care insurance policies have a set number of years the maximum benefit is available. Each type of long-term care coverage may have different features which may appeal depending on coverage needs.

Choosing a policy is all about balancing costs and needs. Think about what is going to be sufficient coverage for you that would help protect you to the extent possible within the boundaries of whats affordable. Consider consulting with a financial professional to help determine if long-term care insurance would be appropriate for your needs.

Recommended Reading: Starbucks Insurance Benefits

Theres A New Insurance In Town

As traditional LTC insurance sputters, another policy is taking off: whole life insurance that you can draw from for long-term care. Unlike the older variety of LTC insurance, these hybrid policies will return money to your heirs even if you dont end up needing long-term care. You dont run traditional policies risk of a rate hike, because you lock in your premium upfront. If youre older or have health problems, you may be more likely to qualify, says Stephen Forman, senior vice president of Long Term Care Associates, an insurance agency in Bellevue, Wash.

What Age Should You Buy Long

Theres no single best age to buy long-term care insurance, but to avoid being hit with exorbitant expenses, its important that you start shopping around now.

Some people shop based on the principle of the early bird getting the worm and while thats wise, it can be a bit disadvantageous to be too eager. Enroll in a policy in your 40s or early 50s, and yes, you will pay lower premiums. However, youll be paying them for nearly two decades before you file a claim. Instead, wait until the sweet spot the ideal time to start paying for a long-term care policy, assuming you are in good health, is around the age of 60 to 65.

This sweet spot will entitle you to low premiums that are still affordable each month coupled with a total premium savings. Plus, it wont be so late that you have to worry about not qualifying.

Also Check: Does Kroger Offer Health Insurance To Part Time Employees

Your Policy Might Not Cover The Care You Need

Sometimes insurance companies deny a claim. I know, shocking, right? So one downside to long-term care insurance is the chance you file a claim for care and your carrier refuses to pay for it. However, this can be prevented by making sure you get the right policy. Working with an independent insurance agent who knows what you need based on your potential circumstances will help offset this risk.

What To Consider In A Long Term Care Policy

Where to get a policyYou can buy LTC policies from an insurance agent, financial planner or insurance broker. You might also find coverage through an employer, or possibly a state partnership program.

Long-term care insurance is complicated. If the employer has a group rate, that is probably the best deal. Otherwise, I’d recommend an insurance specialist who understands product differences, says Power.

About a third of employers offered long-term care insurance in 2018, up from 22% in 2017, according to The Society for Human Resource Managements 2018 Employee Benefits survey. Some offer it as a voluntary benefit while others cover some or all of the premium cost.

You may even be able to buy it through a family members employer, if your own doesnt offer it. Many employers that offer the benefit allow spouses, parents, grandparents and sometimes siblings of their employees to buy coverage through their programs, according to a recent article from the Society for Human Resource Management.

Sawyer worked with an insurance broker that she found online, who helped her purchase a three-year long-term care policy from MassMutual.

I may not have gotten as good a rate as my friend who bought it in her 40s, Sawyer says, but she is satisfied to have an annual premium of $1,800. Nobody wants to write a check for $1,800, but its worth it for the peace of mind, because of the benefits later, she says.

Daily benefit amount

Read our guide to caring for aging parents.

You May Like: Insurance Lapse Between Jobs

Will I Need Long

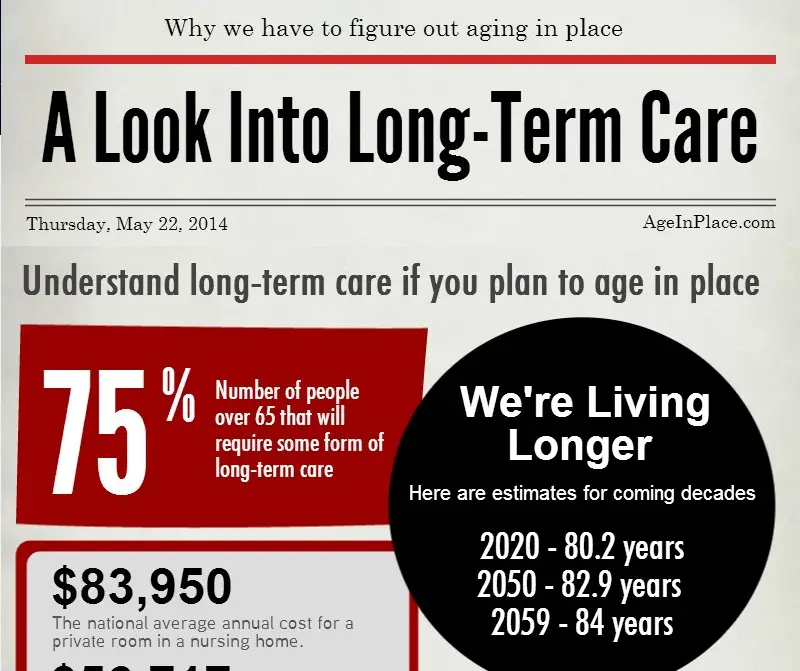

Its hard to know for certain whether youll need long-term careassistance with daily activities such as bathing, dressing, and eating for people experiencing physical or cognitive declinebut statistics suggest most of us will.

According to LongTermCare.gov, about 70% of people ages 65 and older will need long-term care at some time in their liveswomen more so than men . For some, this care might be required only for a few months, but others may need it for several years or longer.

Combined Life Insurance And Long

Some life insurance companies include a long-term care rider that can be added to their life insurance policies. For example, if you buy a cash value insurance policy, the insurer may make five times your cash value available for long-term care benefits, if you qualify. The exact multiple depends on your age and health at the time you buy the policy. Often, these policies are bought with a single lump-sum premium.

Medical underwriting on hybrid life and long-term care insurance policies is usually strict, and it’s difficult to qualify for, compared to either individual policy. If you are considering purchasing a hybrid life insurance with long-term care policy, apply for it when you are still in good health.

Read Also: Starbucks Benefits For Part Time

What Shows Up In Your Family Health History

What have longevity and health been like for your grandparents, parents, aunts, uncles, and siblings? Has anyone needed care later in life? Who was there to assist them? What if they had needed care? How would it have affected the family?

Today, many families are scattered across the country, making it difficult to rely on relatives for care. It can also be physically demanding to care for someone, and your family members might not be capable of providing the help needed. Long-term care insurance helps reduce the burden of care that may otherwise fall on loved ones.

Average Annual Premium For Long

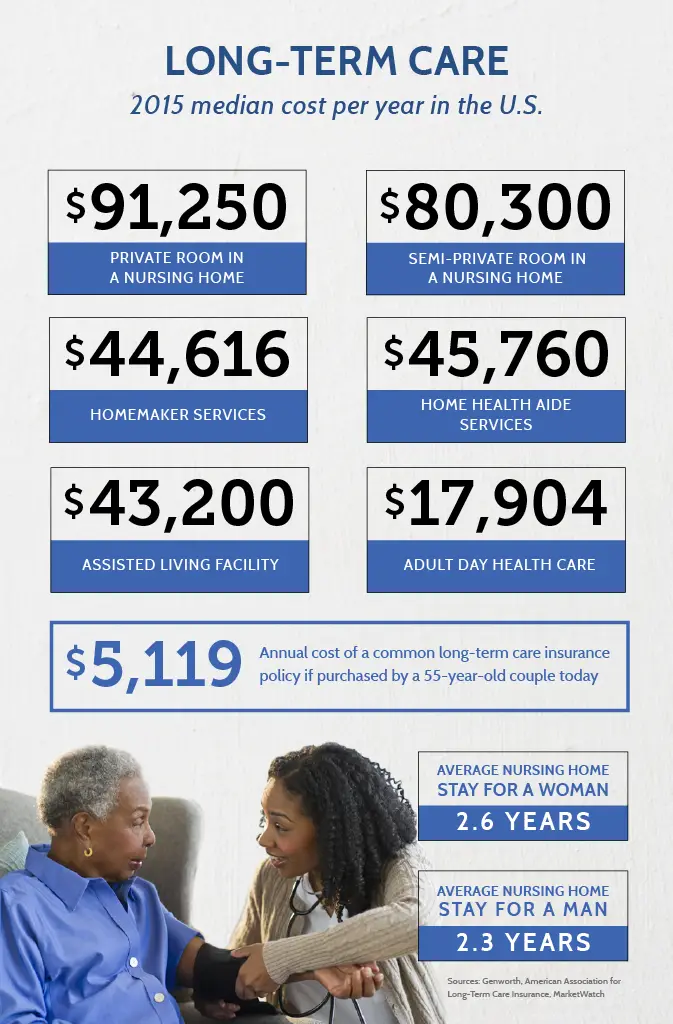

The monthly rates below are for an initial pool of benefits equal to $164,000 at age 55. The value of benefits at age 85 totals $386,500.

| Age 55 |

| $3, 100 |

The key here is that the rates focus on health. The best rates are for those with preferred health status, meaning they are in good overall health at the time they reach 65.

When a person has some health issues, long-term insurance rates change significantly. Thats because there is a higher likelihood that the individual will need to use their long-term care insurance sooner.

You May Like: Starbucks Benefits For Part Time Employees

Tax Advantages Of Hybrid Policies

With these types of policies, the amounts spent on care are subtracted from the policys death benefit. The remaining amount goes tax free to the policyholders heirs, which can help with estate planning and reducing death taxes. As of 2022, the federal estate tax does not kick in unless your estate is worth $12.06 million or more, which affects less than 0.01% of estates.

What affects the middle class is that untaxed retirement account assets, such as those in a 401, 403, or traditional IRA, are taxable to the heir who receives them, unless the heir is a spouse.

The Setting Every Community Up for Retirement Enhancement Act of 2019 eliminated what was called the “stretch IRA,” a financial planning tactic that allowed some beneficiaries to stretch their required minimum distributions over their life expectancy and extend the tax-deferred status of an inherited retirement account. Under the SECURE Act, certain non-spouse beneficiaries of inherited retirement plans must take distribution of all amounts held in the plan by the end of the 10th calendar year following the year of the retirement account owner’s death.

When Should I Buy Long

Due to the cost of premiums, people often put off investing in long-term care insurance for as long as possible. There’s a tradeoff between avoiding the expense over many years and locking in lower rates, which are usually cheaper the younger you buy it. Experts recommend looking for insurance between the ages of 60 and 65 to balance these factors.

You May Like: Starbucks Health Coverage

How Much Does Long Term Care Insurance Cost In 2022

Written By Licensed Agent Sa El | February 13, 2022

One of the most significant factors to consider when looking for long-term care insurance is the costs involved.

That’s why:

Before you decide on a policy, you should shop around and work to understand the variables involved.

There is no way to make a smart purchasing decision if you don’t have an idea of what the costs should be. Today, we’ll give some brief background on long-term care insurance, and then answer the most crucial question how much does long-term care insurance cost on average?

Do You Lead A Healthy Lifestyle

Believe it or not, being healthy may mean that you are more likely to need care. The healthiest people are often the ones who end up needing long-term care assistance later in life, whereas heart problems or cancer may take the unhealthy ones sooner.

One of the benefits of long-term care insurance, if you are a healthy person, is that it can allow you to stay in your home and maintain your independence longer. Most policies issued today cover the cost of in-home care, which can provide someone to help with many of the activities of daily living, such as cooking and cleaning. Usually, you must require assistance with two out of the six activities of daily living for your long-term care benefits to begin.

Recommended Reading: Does Insurance Cover Baby Formula

What Kind Of Care Might You Need

What if you break a hip later in life? What if your mind remains fully alert, but you need help cooking, cleaning, and dressing, and you do not want to move in with a family member? Who would help, and how would you pay for their help?

Nursing home costs averaged around $290 per day in California. If you have sufficient assets to cover these costs, then you do not need long-term care insurance. If you do not have sufficient assets, without long-term care insurance, you will end up spending down the funds you have before you see whether you qualify for Medicaid. Long-term care insurance buys you time and enables you to afford quality care.

Bofa Picks Top Luxury Stocks

“Health care expenses can be difficult to project, especially when you are decades away from retirement,” says Scott Thoma, principal and investment strategist for Edward Jones.

According to a recent report from financial firm HSBC, 76% of people surveyed see illness and health care costs as the biggest obstacles to overcome in retirement. Even if you’re healthy, 61% say a partner’s illness could also derail retirement plans. The survey of more than 18,000 workers and retirees in 17 countries found that 67% of those currently employed have no ideal what they’ll spend on healthcare in retirement. Yet advisors suggest that some of the best insurance against long-term health care needs isn’t insurance at all.

“Retirement can often invigorate and remind people of the importance of healthy lifestyle choices, but it is equally as important to consider adopting a healthy lifestyle in advance of retirement,” says Michael Schweitzer, global head of sales and distribution at HSBC.

Kibler suggests the following courses of action for those individuals:

“Nearly all major life events have financial implications,” said Bill McManus, director of strategic markets for Hartford Funds. “It’s easier to plan for and reach those financial goals when we can anticipate events, such as sending a child to college. However, it’s just as important to plan for the unexpected.”

Also Check: Minnesotacare Premium Estimator Table

There Are Several Type Of Long

A typical, traditional LTCI policy will pay a predetermined amount for each service for instance, $100 a day for nursing home care. There generally will be a limit to the benefits you receive, either based on a number of years or a dollar amount. A plan that offers pooled benefits will set a total dollar amount for the various services you receive.

New types of LTCI policies are growing in popularity, extending beyond the traditional use it or lose it type, many of which have experienced premium increases.

One alternative is hybrid life and long-term care insurance. This type of policy combines long-term care insurance with permanent life insurance and provides more options:

- If you need long-term care, you can tap the policy benefit.

- If you die before needing long-term care, the policy has a life insurance benefit.

- If you decide you need the money for something else, you can typically receive a cash value that can be roughly equal to or less than the total premiums paid.

- Contract terms and premiums are guaranteed not to change.

Another alternative is a universal life insurance policy with a LTCI rider. This option might be right for you if youre interested in a meaningful death benefit for your beneficiaries in the event LTCI isnt needed.

You Wont End Up On The Street

You wont be on the street without long-term care insurance. If you are poor or become poor, you will qualify for Medicaid. Medicaid is the safety net. Medicaid is funded by state funds and covers basic nursing home costs.

Unlike Medicare, it covers housing costs. And there is no limit on the duration of coverage. Those costs will be covered for life. This is not a small program. Medicaid covers half of all nursing home residents in the U.S.

Also Check: Evolve Health Products

Waiting Period For Long

Few people purchase long-term care insurance policies that provide full benefits from the very first day you have a qualifying disability. The vast majority of policies impose an elimination period, or waiting period, during which you are responsible for costs out of your own savings. A 90-day elimination period is common, but you may be able to select your own elimination period based on your own budget and the amount of savings you have available.

However, if you purchase a home care benefit, some policies will provide a benefit for home care from the first day it’s needed. Also, some insurance companies will shorten the elimination period if you use their case management service.

The longer the elimination period you choose, the more affordable your long-term care insurance premiums will be. The shorter your elimination period, the lower the risk to your savings, but the higher your premiums will be, all other things being equal.

Generally, the long-term care insurance policy will pay reimbursement or indemnity benefits directly to you, depending on the type of policy you have. It wouldn’t pay benefits directly to care providers, unless you or your power of attorney elect to assign the benefit over to the nursing home or other facility.

Improvements In Ltc Insurance

In response to pressure from consumer groups, embarrassing media exposure, and increased competition from other insurers joining the market, LTC policies have improved somewhat in recent years. These improvements include clearer terms and conditions, which give consumers a better idea of what to expect for their money. Many policies now offer extended coverage to include some types of assisted living residences in addition to regular nursing facilities. A number of policies permit elders to use a pool of benefit funds for either home care or residential long-term care, rather than only for one or the other. Requirements to qualify for benefits have also loosened somewhat, and policies now routinely permit the policy holder to “step down” to lower levels of coverage, for a lower premium, if continuing to pay for the higher benefits becomes too financially burdensome.

Recommended Reading: Do Substitute Teachers Get Health Insurance

Reasons To Not Buy Long

Disability is measured in how many Activities of Daily Living a person cannot do. ADLs are the activities we do daily without even thinking. Things like brushing teeth, showering, or getting dressed.

A lot of nursing home residents need help with much of their self-care. Those are the examples in our mind when fearing the dependence of life in a nursing home. Of paid care, less than 20% is for nursing homes.

Although 2/3 of us may need help with long-term care at some point, many of us will need help with only 1 ADL. Those folks get thrown into the mix of long-term care statistics.