Standard Health Insurance Product Availability:

With several types of health insurance policies available in the market, the IRDAI has mandated all insurance companies to offer a standard health insurance plan. This health insurance product is named Arogya Sanjeevani. However, with different health and insurance companies offering the product, the IRDAI has said that the insurers name will follow Arogya Sanjeevani nomenclature. The basic health insurance plan is available from 1 April 2020.

Standard Insurance Company Information

Standard Life has been in business for over 50 years. Today they are one of the top insurance providers for the senior population. In 2010, the companys net assets totaled $513 million, liabilities totaled $290 million, and their capital and surplus funds totaled $223 million. These numbers support their claims of being a financially stable and secure company for which you can feel comfortable investing.

What Is A Drawback Of Joining A Primary Care Membership

The biggest limitation is that its not insurance or a replacement for it, Consumer Reports points out. Because just a narrow range of services are covered, youll still need to maintain regular health insurance for any specialized treatments or catastrophic care. This arrangement does not have the same consumer protections required by insurance regulators.

Don’t Miss: Starbucks Health Care Benefits

Is It Possible To Combine Health And Dental Insurance In Bc

It is possible to combine health and dental insurance in BC. In fact, it is standard practice for benefit providers across Canada.

If you are covered by another extended health and/or dental plan, you can combine plans to maximize your overall coverage and reduce or even eliminate your out-of-pocket costs.

We recommend you obtain an extended health plan while you are healthy as most times coverage will not apply to pre-existing conditions. To shop for combined health and dental insurance try HelloSafe’s insurance comparison tool.

Taking Out Health Insurance For Someone Else

You can take out health insurance for the following people without their permission:

- your children under the age of 18

- anyone placed under your guardianship or tutorship.

In other cases you must have a written declaration from the person you wish to insure. If that person is unable to give permission, you can act as his or her attorney and sign the application yourself.

Don’t Miss: How Long Do I Have Insurance After I Quit

How Do I Get Health Insurance In Bc

Even if you are already enrolled in MSP, there is another step to take to be sure you have comprehensive health coverage.

You know that MSP public health insurance will cover you for the basics, but have you considered what is not covered?

A private health insurance plan will make sure you are covered for many additional unforeseen medical needs.

Our Promise To Our Customers

We’re dedicated to providing you with an exceptional shopping experience at no expense to you. For each plan, we offer the lowest attainable pricing, as well as no additional costs, an unrivaled selection, and more.

Receive a personalized phone consultation or an instant online quote

No need to wait. Receive a fast quote and instant coverage. No medical exam required.

You May Like: Starbucks Health Insurance Benefits

The Rand Health Insurance Experiment

In an experimental study conducted between 1975 and 1982, about 4,000 participants between 14 and 61 years were randomly assigned to health insurance plans that differed in the amount of patient cost sharing required, ranging from free care to major deductible plans . Participants received a lump-sum payment at the beginning of the study to compensate them for their expected out-of-pocket costs if they were in cost-sharing plans. Participants were studied for a three- to five-year period. While persons in plans with any cost sharing had significantly fewer physician visits and hospitalizations than persons in a free-care plan, no difference was found overall between plans with any amount of cost sharing and those with no cost sharing. Free care did result in better outcomes for adults with hypertension, as discussed earlier in this chapter, and in improved visual acuity. This experiment demonstrates both the sensitivity of health care utilization in the general population to cost sharing and the relative insensitivity of short-term health outcomes for the general population to cost sharing.

Missing The ‘standard’ Cut

If you are an average person with a normal life expectancy, you probably will qualify for standard rates.

Some people may not qualify for standard rates because of health conditions such as diabetes but will still be eligible for coverage. In cases like this, the insurance company assigns a table rating. Some companies use numbers, such as 1, 2 and 3, and some use letters, such as A, B and C. Each higher table rating typically adds another 25% to the standard rate. Thus a table rating of C means a standard rate plus 75%.

Sometimes an insurer might attach a temporary extra charge, known as a flat extra. A cancer survivor, for instance, might qualify for standard rates plus a $5 flat extra per $1,000 of coverage for five years. On a $500,000 policy, that would mean an extra $2,500 a year in addition to the standard rate for the first five years.

Recommended Reading: Why Do Doctors Hate Chiropractors

What Is Health Insurance

Health insurance is a contract that requires an insurer to pay some or all of a person’s healthcare costs in exchange for a premium. More specifically, health insurance typically pays for medical, surgical, prescription drug, and sometimes dental expenses incurred by the insured. Health insurance can reimburse the insured for expenses incurred from illness or injury, or pay the care provider directly.

It is often included in employer benefit packages as a means of enticing quality employees, with premiums partially covered by the employer but often also deducted from employee paychecks. The cost of health insurance premiums is deductible to the payer, and the benefits received are tax-free, with certain exceptions for S corporation employees.

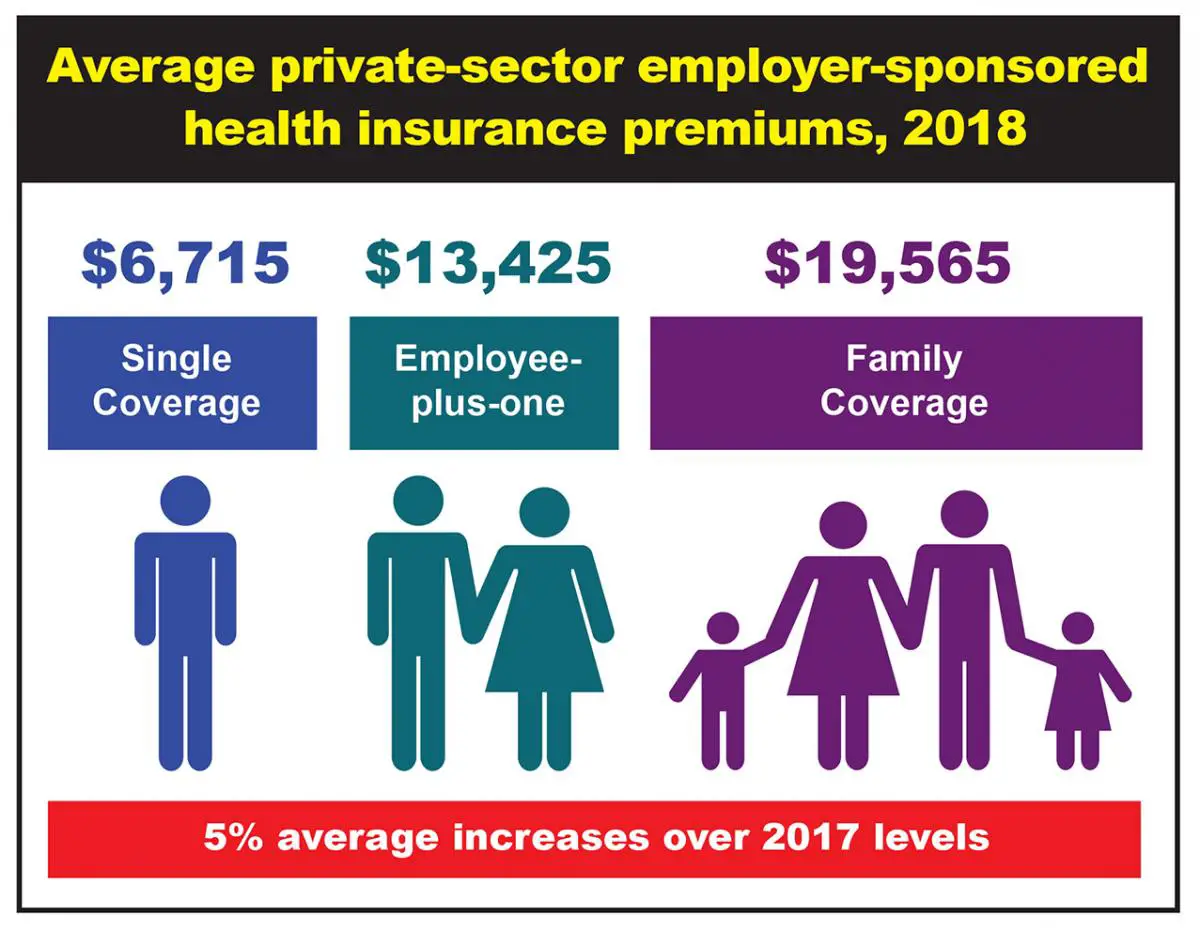

Employee Health Insurance Premiums

If you work for a large company, health insurance might cost as much as a new car, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. Kaiser found that average annual premiums for family coverage were $21,342 in 2020, which was nearly identical to the base manufacturer’s suggested retail price of a 2022 Honda Civic$22,715.

Workers contributed an average of $5,588 toward the annual cost, which means employers picked up 73% of the premium bill. For a single worker in 2020, the average premium was $7,470. Of that, workers paid $1,243, or 17%.

Kaiser included health maintenance organizations , PPOs, point-of-service plans , and high-deductible health plans with savings options in arriving at the average premium figures. It found that PPOs were the most common plan type, insuring 47% of covered employees. HDHP/SOs covered 31% of insured workers.

| Average Employee Premiums in 2020 |

|---|

| Employee Share |

| $104 |

Of course, whatever employers spend on their workers’ health insurance leaves less money for wages and salaries. So workers are actually shouldering more of their premiums than these numbers show. In fact, one reason wages may not have risen much over the past two decades is because health costs have risen so much.

Which type of plan employees choose affects their premiums, deductibles, choice of healthcare providers and hospitals, and whether they can have a health savings account , among many choices.

Don’t Miss: Asares Advanced Fingerprint Solutions

How To Get Better Life Insurance Rates

You cant control some factors, such as your family medical history, but you can make other changes to get more affordable life insurance.

-

Quitting smoking will get you the most bang for your buck. Smokers pay two to three times or more what nonsmokers pay for life insurance. Youll need to abstain from tobacco for at least a year to qualify for nonsmoker rates at most companies.

-

Losing weight if youre overweight or obese can also help you qualify for better rates and can potentially improve your blood pressure and cholesterol readings, which also will pay off in better rates.

-

Shopping around is critical because life insurance rates vary widely by company.

A good independent agent can help you navigate the rates from different insurers, particularly if you have a risk factor, such as a history of cancer, that would make it hard to qualify for the best rates.

NerdWallets life insurance comparison tool can help you get life insurance quotes.

Be Prepared Before You Buy

Identify Your Current Healthcare Needs

Assess if you have any pre-existing conditions or will need specific doctors, services, or prescription drugs.

Look Closely for Changes

Donât automatically renew the option you had before. If you buy a plan on your own, shopping on the marketplace each year gives you a chance to find a better deal. And many employers make changes from year to year, so itâs best to review your options.

Take Advantage of Wellness Incentives

Find out if your employer offers a wellness program that includes money-saving incentives for healthy behaviors such as exercising regularly or not smoking.

Tax-Free Savings

In addition to your health insurance coverage, you may be eligible to open a Flexible Spending Account or a health savings account . And donât forget about dependent care savings accounts.

Shop Around

Donât make a decision or purchase a health plan after a single phone call or website visit. Compare policies and the financial help you may qualify for.

Check with Your State Insurance Department

Check with your state insurance department to make sure your agent and insurance company of interest are licensed within your state.

Monthly Premiums and Out of Pocket Costs

Recommended Reading: Does Starbucks Offer Health Insurance To Part Time Employees

Saskatchewan: Government Of Saskatchewan

Covered services:

Standard Insurance Company Contact Information

Standard Life and Accident Insurance is headquartered, along with its parent company, American National, in Galveston, Texas. If you would like to contact the company for more information, you can do so via phone or mail. You can also complete the online contact form to have a customer service representative contact you.

Standard Life Mailing Address:

Life Insurance Division Phone Number: 519-5819Health Insurance Division Phone Number: 350-1488Claims Phone Number: 265-2393Marketing and Sales Phone Number: 290-1085

Also Check: Do Starbucks Employees Get Health Insurance

Pre And Post Hospitalisation Charges

Pre hospitalisation expenses such as diagnosis expenses, and doctors fees etc. can be covered by a health insurance plan.

Expenditures post-release such as medication, routine check-ups, injections, etc. are also reimbursed by most insurance companies. Compensation funds against the same can be extracted as a lump sum amount, or by producing respective bills.

According To Irdai The Policy Will Be Named As Arogya Sanjeevani Policy Succeeded By The Name Of The Insurance Company The Regulator Said No Other Name Is Allowed In Any Of The Documents

- Health insurance policy to take care of basic health needs of insuring public

- To have a standard product with common policy wordings across the industry

- To facilitate seamless portability among insurers

Also read:1. Minimum and maximum sum insured:2. Eligibility:3. Policy period:4. Modes of premium payment:5. Grace period for premium payments:6. Expenses to be covered:7. Free look period: 8. Co-pay:9. Cumulative bonus :10. Specific waiting period for certain disease:isease which will have a waiting period of 24 monthsB. Disease which will have a waiting period of 48 months:What you should do

Don’t Miss: What Benefits Does Starbucks Offer Employees

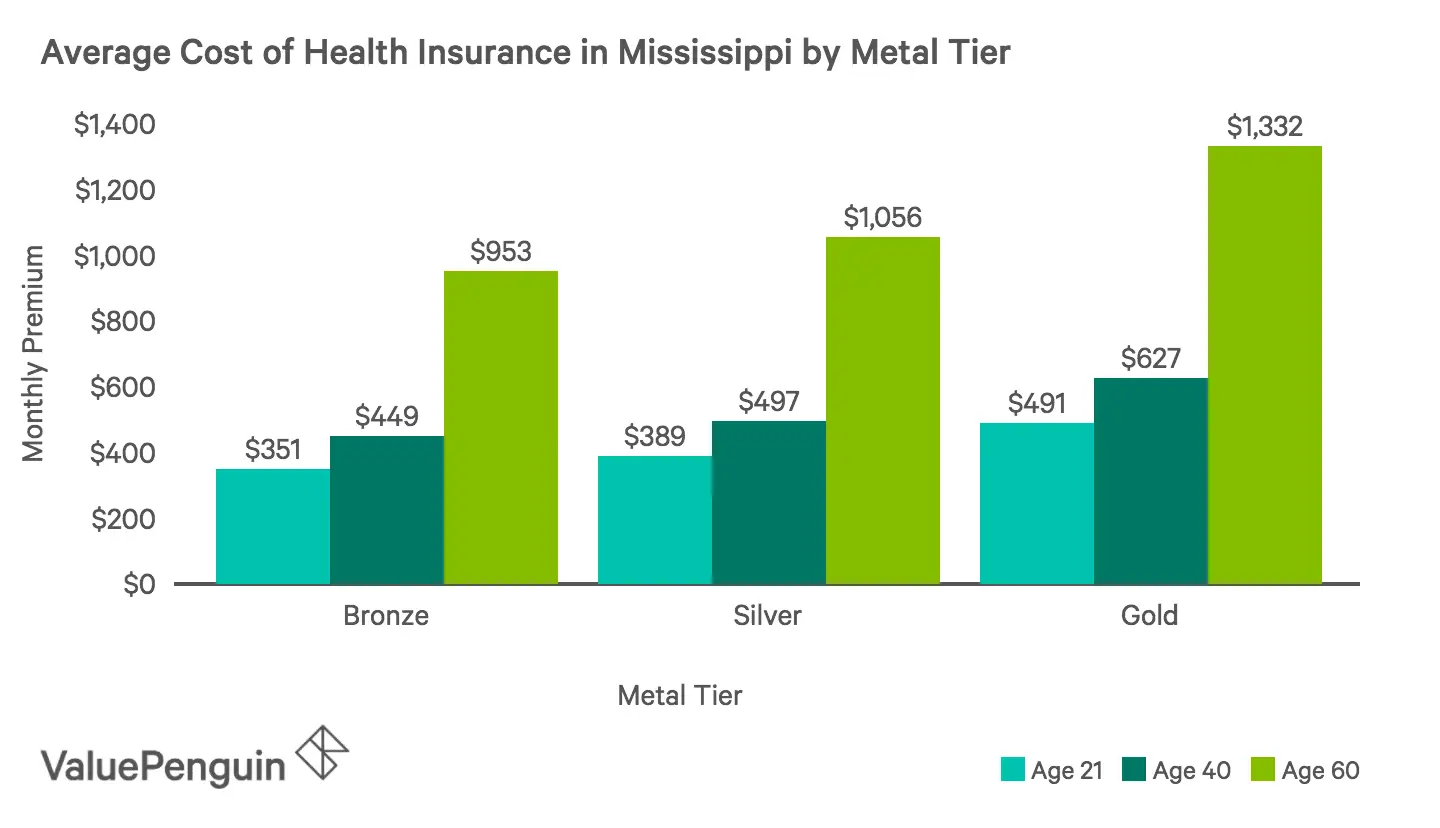

Individual Health Insurance Premiums On The Exchanges

The federal insurance plan marketplace at HealthCare.gov, aka Obamacare, is alive and well in 2021, despite years of its political foes’ efforts to kill it. It offers plans from about 175 companies. Some 12 states and the District of Columbia operate their own health exchanges, which basically mirror the federal site but focus on plans available to their residents. People in these areas sign up through their state, rather than the federal exchange.

Each available plan offers four levels of coverage, each with its own price. In order of price from highest to lowest, they are labeled platinum, gold, silver, and bronze. The benchmark plan is the second-lowest-cost silver plan available through the health insurance exchange in a given area, and it can vary even within the state where you live. It’s called the benchmark plan because it’s the plan the government usesalong with your incometo determine your premium subsidy, if any.

The good news is prices are going down a bit. According to the Centers for Medicare & Medicaid Services , the average premium for the second-lowest-cost silver plan decreased by 4% on HealthCare.gov from 2019 to 2020 for a 27-year-old. Six states experienced double-digit percentage declines in average second-lowest-cost silver plan premiums for 27-year-olds, including Delaware , Nebraska , North Dakota , Montana , Oklahoma , and Utah .

Where Can I Receive Care

One way that health insurance plans control their costs is to influence access to providers. Providers include physicians, hospitals, laboratories, pharmacies, and other entities. Many insurance companies contract with a specified network of providers that has agreed to supply services to plan enrollees at more favorable pricing.

If a provider is not in a plans network, the insurance company may not pay for the service provided or may pay a smaller portion than it would for in-network care. This means the enrollee who goes outside of the network for care may be required to pay a much higher share of the cost. This is an important concept to understand, especially if you are not originally from the local Stanford area.

If you have a plan through a parent, for example, and that plans network is in your hometown, you may not be able to get the care you need in the Stanford area, or you may incur much higher costs to get that care.

Read Also: Starbucks Pet Insurance

I Have A Chronic Condition What Types Of Health Insurance Are Best For Me

Chronic conditions could require regular medication and more frequent doctor appointments, even costly hospital stays and/or surgeries. Consider a health plan that helps minimize out-of-pocket costs based on what you anticipate for doctor care, specialist visits, prescription medications, etc.

A little bit of time spent planning will help you in choosing the right types of health insurance.

What Are Exclusive Provider Organizations

An EPO offers you a network of participating providers to choose from. Most EPO plans do not include coverage for out-of-network care except in the case of an emergency. This means that if you visit a provider or facility outside the plans local network, you will likely have to pay the full cost of services yourself.

Depending on the plan, you may or may not be required to choose a primary care provider . If you want to see a specialist in your network, you dont need a referral from a PCP.

Don’t Miss: Do Part Time Starbucks Employees Get Benefits

How Does Health Insurance Work In Ontario

In Ontario, healthcare costs are covered by a mixture of universal public insurance known as OHIP and by private insurance from providers like Manulife, Sun Life, Canada Life or Blue Cross.

Individual health insurance helps pay medical expenses incurred from illness or injury. It can also cover some everyday medical costs like dental, vision and prescriptions. On top of access to universal public health insurance through Ontarios OHIP, one may obtain additional health insurance through ones employer or buy it independently.

Concerning health care for Indigenous peoples, including First Nations, Inuit and Métis, the federal, provincial and territorial levels of government share jurisdiction. The Canadian health system allows Indigenous peoples to access health services. Indigenous Services Canada directly provides services for First Nations and Inuit that supplement the health coverage provided by the government, including coverage such as primary health care.

About the Ontario Health Insurance Plan

OHIP, or the Ontario Health Insurance Plan, is Ontarios public health insurance. It covers many emergency and preventative medical care costs. It is funded through payroll deduction taxes and transfer payments from the federal government.

Many people are aware of the basics covered by OHIP, such as doctor visits and emergency health care. However, costs that are not covered can sometimes cause confusion, frustration and surprise expenses.

Do I Have To Have Health Insurance

Yes. Massachusetts has something called an “individual mandate.” Under this law, if you live in Massachusetts and are age 18 or older you must have health insurance.

To meet the rules, you will need a health plan that meets these “minimum creditable coverage” standards:

- Covers prescription drugs (may have deductible of up to $250 per individual/$500 per family

- Covers regular doctor visits and check-ups before any deductible

- Caps the annual deductible at $2,000 for an individual or $4,000 for a family

- If you have a deductible or co-insurance on core services, caps out-of-pocket spending for health services at $5,000 for an individual or $10,000 for a family each year

- Does not cap total benefits for a sickness or for each year and,

- Does not cap spending for a day in the hospital.

If your religion does not allow you to heave health insurance, you can file a sworn statement with your Massachusetts income tax return.

You May Like: Insusiance

Minimum And Maximum Sum Insured:

The standard health insurance policy offers to cover both individuals as well as family floater plans. You can purchase a cover of minimum Rs.1 lakh while Rs. 5 lakh is the maximum amount. The sum insured between Rs.1 lakh and Rs.5 lakh will be in multiples of 50,000.

Also, read:Health Insurance Plans For Family