How Much Does Health Insurance Cost In The Usa

How much does health insurance cost? The cost of health insurance in the USA is a major talking point for Americans and visitors alike here, we explore the averages of health insurance costs and factors impacting policy fees. The USAs healthcare system is unlike many others, so we look at why the cost of average American healthcare insurance seems to be rising and how other nations compare.

Key takeaways:

- Age, geography, employer size and plan type all influence the cost.

- Healthcare costs in the USA are partly due to administrative factors.

- Fees are going up, with plan trends contributing.

- Almost half of American adults were underinsured in 2020.

- Voluntary health payments are higher in Switzerland than the USA, though Americas costs are among the worlds highest.

- On the flipside, American expats abroad often find they pay less for insurance overseas.

Healthcare Costs Based On Age And State

Healthcare costs vary based on your age and the state you live in. As you might expect, younger, healthier adults pay the least for healthcare coverage, but even for younger adults, the cost of coverage varies greatly based on location.

In 2021, the average cost of a monthly health insurance premium in the U.S. is $541 per month. The average annual deductible is $5,940. In some places, the cost varies greatly from the national average. In West Virginia, the average premium is $831 with a deductible of $8,540 in next-door Maryland, the average is only $344 with a $4,122 deductible.

Age is another big factor when it comes to the costs of health insurance. Take a look at this breakdown by age for the average monthly healthcare premium without subsidies:

- 18 and under: $224

- 55-64 years: $771

Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.

OHIP provides full coverage for many medical necessities.

OHIP covers part or all of:

- Doctor visits

- Cosmetic procedures

- Immunizations for travel

Services not covered under OHIP are expensive and can bring on a massive financial burden when you are least able to deal with them. We highly recommend getting a private insurance plan.

It can help you not only access better care when you need it but also offer peace of mind that you will be covered for large, unexpected expenses that will avoid out-of-pocket costs.

Recommended Reading: Starbucks Health Insurance Cost

How Much In Monthly Premiums Can You Expect To Pay With Obamacare

What you pay each month also depends on the plan you select. A Kaiser Family Foundation national analysis of marketplace plans for a 40-year-old person found that the average premium for a benchmark silver plan in 2022 is $438. The price ranges from $309 in New Hampshire to $762 in Wyoming.

Thanks to the American Rescue Plan Act of 2021, there is new financial assistance for ACA premiums in 2022. These savings will make ACA healthcare plans more affordable than ever. Generous subsidies mean that 4 out of 5 people will be able to find a plan that costs $10 or less per month.

The KFF analysis applied nationwide to all metal tiers, except platinum, found:

Average 2022 marketplace premium for a 40-year-old without subsidies

| Plan Category | |

|---|---|

| Average lowest-cost gold premium | $462 |

Families earning 100% to 400% of the federal poverty level and sometimes more will qualify for savings on monthly premiums.

According to KFF, the 2022 subsidies fully cover the cost of a benchmark silver plan for consumers with incomes up to 150% of the federal poverty level. These consumers also receive extra savings that greatly reduce deductibles and copays to costs similar to platinum plans.

A subsidy also known as premium tax credit is based on your estimated income in a coverage year. If your actual income is higher or lower, your premium tax credit could be adjusted.

You can estimate your costs using this ACA Health Insurance Marketplace Calculator.

How Much Health Insurance Coverage Do You Need

CNBCTV18.com

While buying health insurance, one is often in a fix about the amount of coverage one should go for. A conservative estimate should be at least Rs 5 lakh, considering the rising medical costs.

Given the rising medical costs and inflation, it is important to be prepared for any unforeseen expenses due to medical emergency. The best way to do so is by purchasing a health insurance policy. However, when it comes to getting a policy, the biggest question is how much should be the size of the health cover. Similarly, its always confusing to select a medical insurance that meets all your requirements apart from covering critical diseases.

Here are a few things to help you decide on a suitable insurance policy for your medical emergencies.

How much health insurance do you need?

The coverage need and cost of your health insurance plan will depend on your needs. The cost of premium for the insurance policy could vary depending on whether you want to get an individual policy or a family floater that covers your loved ones as well. If you want to include senior citizens in the policy, then you will need to consider the cost of treatment for their existing ailments too before deciding the coverage.

Dont Miss: Starbucks Pet Insurance

Don’t Miss: Minnesotacare Premium Estimator Table

The Average Cost Of Health Insurance For Job

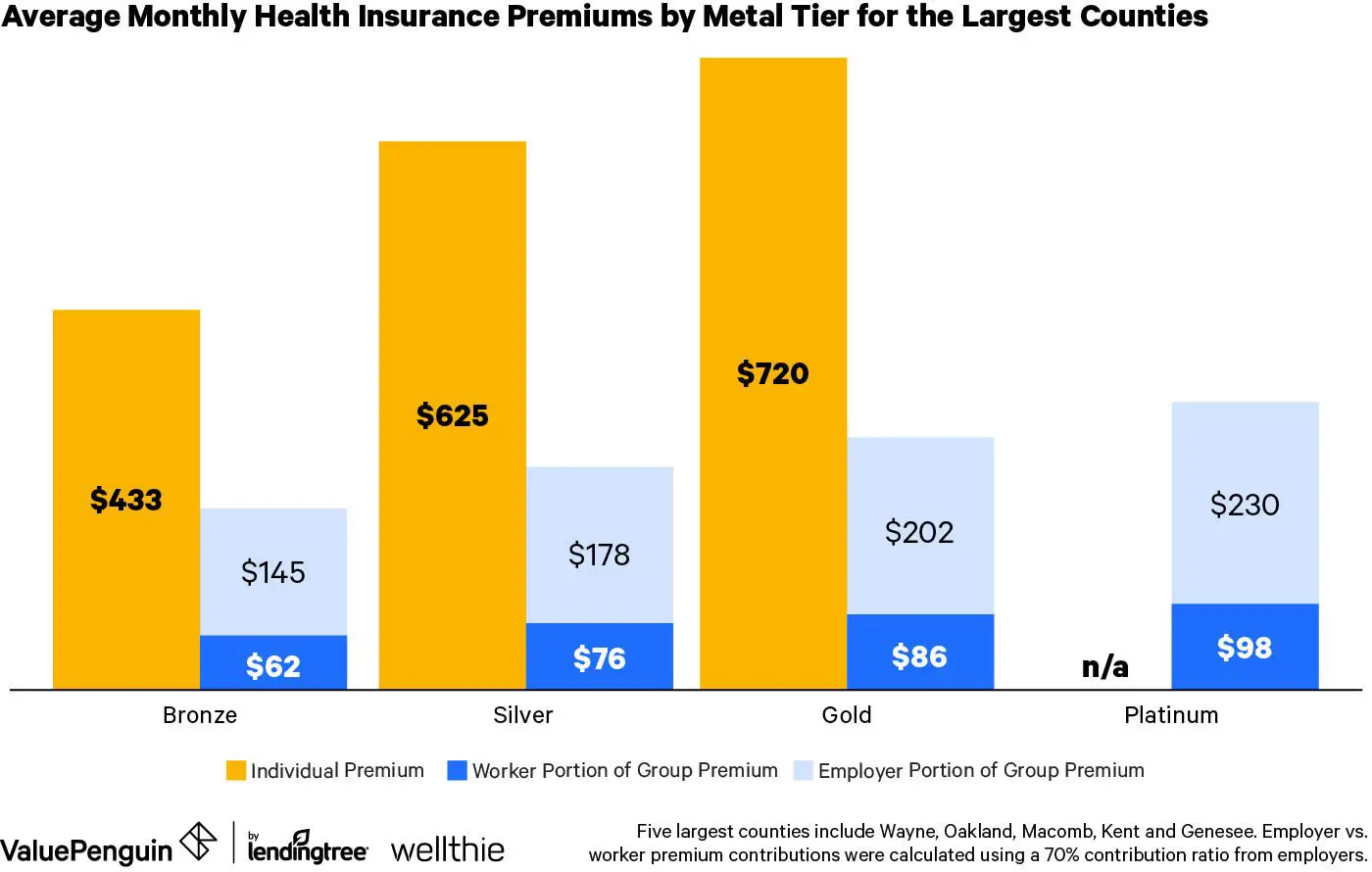

The health insurance marketplace is just one way to get health insurance coverage. According to the Kaiser Family Foundation, most Americans get health insurance through a job or from the government via Medicare, Medicaid or military benefits.

Job-Based Insurance

In 2021, the Kaiser Family Foundation reported that the total cost of family coverage through employers averaged $22,221, with employees paying $5,969 of that. Individual deductibles averaged $1,669, though employee costs vary by type of plan, family or individual coverage and size of the company.

Medicare

Medicare is the government-run insurance program that covers nearly all Americans 65 and older. Original Medicare also known as Medicare Parts A and B covers hospital stays and medical care, respectively, and has set costs. Most people pay no premium for Part A but do pay a deductible and coinsurance, or a share of costs for longer-term facility stays. Part B premiums are $170.10 per month , and the 2022 Part B deductible is $233. Once you meet that deductible, you typically pay 20% of the bill for Medicare-approved charges.

Some Medicare enrollees choose to get prescription drug coverage or join a comprehensive managed care plan that combines all their Medicare benefits . Parts C and D are optional. Offered by private companies, costs for these coverages vary by carrier, plan and geography.

Medicaid

How Much Does Health Insurance Cost Per Month In Each State

The national average health insurance premium for a benchmark plan in 2021 is $452, according to the Kaiser Family Foundation. A benchmark plan is the average premium for each states second lowest cost silver plan.

The following data reflects the national average, and each states average, but does not include any reduction in cost from subsidies. Rates will vary by area.

Recommended Reading: Starbucks Medical Insurance

How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

Do Us Citizens Living Abroad Have To Buy Health Insurance

Americans who live abroad, or who spend a large proportion of their time overseas, often find theyll need a separate health insurance policy for this.

One option is to buy local insurance, but this wont cover you for trips home and you may find there are language barriers if you need to make a claim.

International health insurance is a popular alternative for American expats living overseas. With William Russell, English-speaking customer service representatives handle every stage of your claim from our UK offices, so youre in safe hands.

Read more about the difference between travel, local and international health insurance with our FAQ guide.

Recommended Reading: Kroger Employee Discount Card

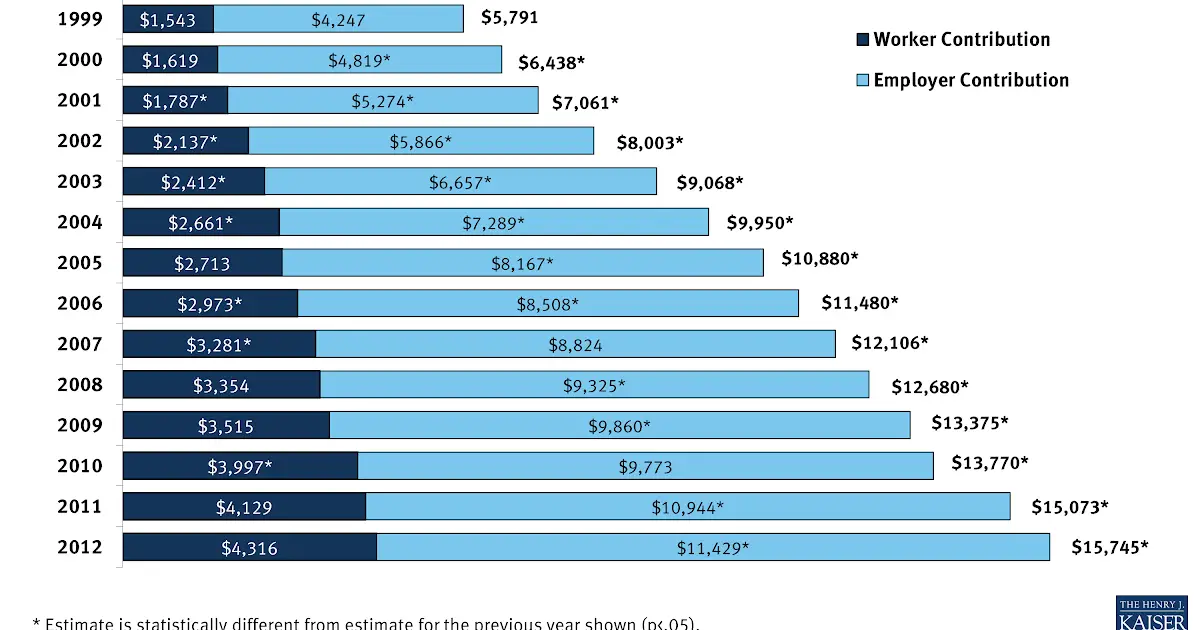

Is Health Insurance Getting More Expensive

It certainly feels like it. And its true that over the last decade, health care costs have risen significantly. The average family is paying 55% more in their premium in 2020 versus 2010 according to the Kaiser Family Foundation.5 And that number is up 22% since 2015.6 But premiums have only risen 4% when comparing 2020 against 2019.7

Health care costs also change based on where you live. In some states theyre up, in other places theyre lower.

If you feel like youre drowning in sky-high health insurance costs, there are some ways to save money on health insurance. Dont give up hope. You always have options, even if it just helps your budget a little. There are also some ways to save on health care costs your insurance doesnt cover.

And if youre trying to cut costs while paying off debt, or youre just starting to budget and barely making ends meet, you might want to choose a high-deductible and lower-premium plan that will kick in if you have serious medical issues or an accident. This allows you to focus on your necessities before you tackle an expensive health care plan.

Core Provisional Plan Coverage

They are also required to provide medically required physician services rendered by medical practitioners. There is no legal provision that the services all be rendered by a doctor. In fact, practitioners make up the majority of caregivers.

The law also requires that the provinces and territories extend medically necessary hospital and physician coverage to eligible residents traveling through reciprocal agreements with other provinces. These agreements protect Canadians from being presented with a bill for services in case of an accident or illness.

You May Like: How Much Does Starbucks Health Insurance Cost

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for

How Much Does Private Health Insurance Cost In Ontario

Our experts were quoted $168.26 per month with Blue Cross for a 41-year old with no pre-existing conditions for full comprehensive hospital, dental and prescription drug coverage. Cost varies depending on the level of coverage you choose.

Other factors that may affect premiums would include:

- Age

Don’t Miss: What Is Evolve Health Insurance

Find Cheap Health Insurance Quotes In Your Area

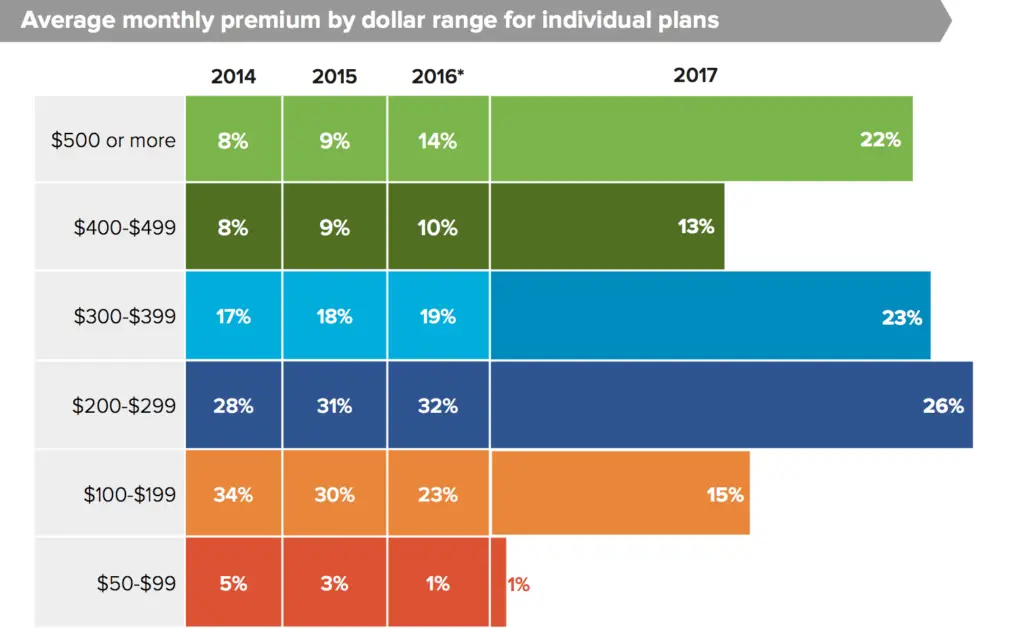

Health insurance premiums have risen dramatically over the past decade. In previous years, insurers would price your health insurance based on a multitude of factors. However, the number of variables have decreased significantly with the Affordable Care Act.

In 2022, the average cost of individual health insurance for a 40-year-old on a silver plan is $541. This represents an increase of nearly 1% from the 2021 plan year.

The Costs Of Individual Vs Family Plans

The Affordable Care Act offers some subsidies to make health insurance more affordable, but not everyone qualifies.

In 2021, health insurance premiums for unsubsidized individual customers were $645 per month on average, while family premiums averaged $1,852 per month. The average individual deductible is individuals was $4,490 the family deductible averaged $8,620.

Over the course of a year, the average health spending for a family of four in the U.S. was $22,221 in 2021. This figure includes spending on monthly premiums. It also includes meeting the deductible.

Also Check: Does Insurance Cover Baby Formula

Average Health Insurance Costs

With so many different variables impacting how much health insurance will cost a person on a monthly or yearly basis, we’re better off breaking things down instead of giving one general number.

So what are some of the biggest factors in determining how health insurance costs can vary? Certainly, the type of plan someone has and the tier of the plan she has to go a long way. Medical history — not to mention whether the person is a smoker — can play a role in whether insurers give a higher rate. Someone in need of insurance for a family is going to have a higher premium than someone seeking an individual plan.

Two factors that can also play a large role in healthcare rates and premiums is how old someone is and where he lives.

How Do I Find Exact Pricing For Health Insurance

The great news is that you have options, and there are now many independent health insurance agents selling these policies in Texas. Insurance For Texans, as an independent insurance agent, can help you evaluate the pros and cons of each of these options. With some quick information, we can get preliminary pricing so that you can quickly evaluate if these options will work for you and how to best maximize your situation. To get exact pricing, you will need to do some underwriting. But that is one of the things that we excel at!

You May Like: Substitute Teacher Health Insurance

What Is Health Insurance

To define what health insurance is, two elements come into play, according to Ben Handel, Ph. D., an associate professor of economics at University of California, Berkeley who specializes in health economics: One is protection against financial risk, he says. This is because of deductibles in health insurance plans. Handel explains that a deductible is the amount of money a person pays before their insurance plan starts to pay. Once that deductible is reached, that person will not have to pay for any other medical costs. Those without health insurance do not have access to a deductible, which means there is no cap or ceiling to their medical costs.

The second component is that it forms a network of health care providers and drug formularies, Handel says. This means health insurance curates what kind of care a person is able to access. This includes which doctors can treat you, what hospitals and clinics you can visit and what prescription drugs you can get for an affordable price.

Health insurance offers protection from devastating medical costs, such as surgeries, hospital stays and emergency care, as well as access to a care network, but it comes at a cost.

The Average Cost Of Health Insurance By Age

Most people need more health care as they age, and health insurance rates go up for older people to cover those expected costs.

In MoneyGeeks analysis which does not account for tax credits or other subsidies the average premium for an 18-year-old was $324 per month compared to $642 for a 50-year-old and $970 for a 60-year-old. However, older people may be eligible for higher subsidies if they have low incomes, such as if theyve retired or scaled back their working hours.

Average Health Insurance Premiums by Age

Scroll for more

- $970

Recommended Reading: Can You Add A Boyfriend To Your Health Insurance

Getting Health Insurance Outside Of Open Enrollment

Outside of the open enrollment period, you can only sign up for a new plan if you have a qualifying life event. For instance, if you lose your job, you could then sign up for a new plan through the marketplace. If you get married or have a baby, that would allow you to buy a new plan. Even moving to a new county may count.

Individual Versus Family Plans

An individual plan has one member, or just one person covered by the plan. Family plans cover two or more members.

Your plan’s deductible and out-of-pocket maximum are based on whether you have an individual or family plan.

The deductible and out-of-pocket maximum for a family plan is usually double of an individual plan. So if the deductible for a plan is $2,000 for a family, it’s $1,000 for an individual. If the out-of-pocket maximum for an individual plan is $6,000, it will be $12,000 for a family, no matter how many people the plan covers.

You May Like: Starbucks Health Insurance Benefits

Stay On Track With Yearly Doctor Visits

Did you know that seeing your doctor for regular preventive care can pay off? Heres how it may help detect issues early when health conditions are typically more treatable.2

So, if its time for a checkup, take time to schedule it now. Preventive care includes all your regular doctor visits that means any of your annual checkups and screenings. You can prepare for your preventive visits and get a list of screenings you might need too.