Best For Telehealth Care: Cigna

Cigna

Cigna has excellent financial strength ratings, and out-of-network approvals are not required. It has excellent telehealth services available to members.

-

Out-of-network care available without a referral

-

Telehealth services

-

Limited coverage area

Cigna is a global health insurance provider and offers private health insurance in 10 U.S. states: Arizona, Colorado, Florida, Illinois, Kansas, Missouri, North Carolina, Tennessee, Utah, and Virginia. It has an A financial strength rating from AM Best. Referrals for out-of-network care may or may not be required depending on your plan. The greatest savings are realized by using an in-network provider.

Plan options, deductibles, and co-pay options vary by state. High-deductible plans are available along with HSA plan options. Policyholders can search plan network doctors, estimate costs, check claims status, and get insurance ID cards all online.

There are several attractive member benefits, including access to a home delivery pharmacy, health information helpline, rewards programs, flu shot information, and the Cigna telehealth connection program, which allows you access to board-certified telehealth providers, including Amwell and MDLIVE.

Read the full Cigna insurance review.

Cigna Health Insurance: Best Health Insurance Provider For Telehealth

Cigna Health Insurance performs well when compared to many of its competitors, with average premiums, clear and intuitive websites and apps and a good range of added benefits, particularly their commitment to telehealth. The lack of complete nationwide coverage could be a drawback for some people.

However, Cigna performs well in the states within which it has a presence, and has a consistently high level of customer satisfaction. That alone makes it worth considering for potential customers in those specific regions. Cigna’s financial health is similarly reassuring.

These Investment Companies Have The Best Customer Satisfaction

Investment Company

See ACSIs full Finance, Insurance and Health Care Report.

You might assume that the coronavirus pandemic has something to do with the scores. But the ACSI report says, the pandemic alone did not drive the entire wave of dissatisfaction. Instead, it amplified trends already present in the earlier portion of the survey period.

Also Check: Can I Get Health Insurance In Another State

When Is Open Enrollment For Health Insurance For 2021

The open enrollment period for health insurance depends on whether you’re buying a Medicare plan, a policy from an employer, or an option from the HealthCare Marketplace.

The enrollment period for the HealthCare Marketplace runs from November 1 to December 15. The enrollment period for those newly eligible for Medicare is a seven-month window after turning 65. After that, the annual enrollment period is from October 15 to December 7.

Those who buy insurance from an employer should ask their HR department about the enrollment period because private companies can set their own deadlines.

Who Are The Top 5 Health Insurance Companies

Based on Insure.com’s customer satisfaction survey, the five top-rated health insurance companies for 2021 are:

- Kaiser Permanente

- Florida Blue

- UnitedHealthcare

Insure.com’s ninth annual Best Health Insurance Companies survey asked more than 2,200 people about their health insurance companies.

We asked their thoughts about their health insurer overall and drilled down into subjects like:

- Claims

- Whether they recommend the company

- Whether they plan to renew with the insurer

For instance, you want to make sure the insurer pays claims promptly. Otherwise, you might get unexpected medical bills. And customer service can allay your fears when youre having issues with your plan.

Make sure to check out whether members recommend plans and if they expect to renew coverage. Those are key markers to show a persons satisfaction with their company and plan.

You May Like: Does Amazon Have Health Insurance

Best For Global Coverage: Cigna

Cigna Health Insurance

It’s not surprising that a company that sells a product called Global Health Advantage would lead our list for international coverage. This global health service company has 17 million medical customers worldwide served by a global network of 1.5 million healthcare professionals with access to doctors in 30+ countries. It has more than 70,000 employees. Cigna followed on the heels of Aetna and CVS Health in 2018 by partnering with Express Scripts, the nation’s largest pharmacy benefit manager, in a deal aimed at lowering costs and improving care.

In the U.S., four private Cigna plans were top-rated in NCQA. Although Cigna was a top performer in customer satisfaction in Illinois/Indiana, Virginia, New Jersey, and Ohio in the 2021 U.S. Commercial Member Health Plan Study by J.D. Power, it was ranked among the worst in its industry for member satisfaction by the American Customer Satisfaction Index in 2020.

Cigna sells medical plans in 13 states and dental plans in all 50, plus D.C. It sells individual plans on healthcare.gov in 313 counties across 13 states. Cigna also expanded its Medicare Advantage plans in 2020 to reach a total of 369 counties across 23 states, adding coverage in 5 new states for 2021.

Health Insurance Companies Rated By Moneyland

Also in August 2019, Moneyland published a survey on customer satisfaction with basic health insurance. In contrast to the Comparis survey, in which customers were somewhat more satisfied than in the previous year, this study found a decline in customer satisfaction. Especially in the area of value for money, policyholders are dissatisfied, which is attributable to rising health insurance premiums.

The approximately 1,500 customers surveyed rated the checkouts in various categories such as:

- Goodwill in payments

- Speed of disbursements

- Customer service opening hours

The four best health insurance companies achieve a very good rating. Another seven are good. Visana and Groupe Mutuel are only enough for two health insurance companies to achieve a satisfactory result. In the eyes of the customers, Assura is only sufficient.

The top-rated health insurance companies are:

The health insurance companies achieve the highest satisfaction in the category of friendliness of employees. The insured are also satisfied with the correctness and clarity of the accounts, but also with the accessibility. The health insurance companies, on the other hand, can improve in the price-performance ratio, in the fairness of refunds and in the field of customer information.

Read Also: Where To Find Health Insurance

Cut The Health Insurance Costs With The Right Deductible

Not only can you reduce your health insurance expenses by switching to a cheaper provider. You can also significantly cut costs by changing the deductible. With the highest deductible of CHF 2,500, the premiums are considerably lower than with a regular franchise of CHF 300.

In the canton of St. Gallen , insured persons with the highest deductible in the EGK standard model without accident cover pay only CHF 313.70 per month instead of CHF 439.20, for example. Calculated over the year, this results in savings of more than CHF 1,500.

Which Health Insurance Company Has The Highest Customer Satisfaction

Find California HMO, PPO and Medical Group ratings report card for 2020-2021. Both Kaiser Permanente HMO Plan of Southern California and Northern California received the highest ratings for Quality. Sharp Health Plan HMO received the highest ratings for member satisfaction. The lowest rating went to Aetna PPO.

Recommended Reading: What To Do When You Lose Health Insurance

What Are The 10 Best Insurance Companies

The 10 best insurance companies are:

- State Farm: Best car insurance company overall

- Geico: Best car insurance company for price

- American Family: Best for auto discounts

- Auto-Owners: Best car insurance company for customer happiness

- Progressive: Best auto insurance company for young adults and college students

- State Farm: Best home insurance company overall

- American Family: Best home insurance company for customer satisfaction

- Travelers: Best homeowners insurance company for price

- AAA Life Insurance: best life insurance company

- Kaiser Permanente: Best health insurance company

Insure.coms Best Insurance Companies Survey 2021 identifies the best auto, home, health and life insurance companies based on what 3,725 number of policyholders have to say about their experiences. Our team of experts, with more than 35 years of combined industry experience, also identified who has the best insurance for various homeowner and driver profiles and those looking for specific customer service features. Here youll find:

- A summary of the best of the best.

- Tips from Insure.com Senior Consumer Analyst Penny Gusner on how to buy the best insurance coverage.

- Links to the complete survey rankings and expert analysis for each type of insurance.

Aetna: Best Health Insurance Company For Value

Aetnas unrivaled history as a top-rated health insurance company puts it in good stead, both in terms of reputation and financial robustness. Both of these factors mean that the health insurance polices offered to customers rate especially well when it comes to value for money.

The quotes received from Aetna regularly came in at a much better price than its main competitors, and its savings plans are also a boon for people looking to manage their healthcare expenses more effectively.

There isnt too much in the way of downsides, though one small caveat is that Aetna has fewer short-term healthcare policy options than some of the others featured in our guide to the best health insurance companies.

You May Like: Do Real Estate Brokers Offer Health Insurance

How To Determine The Best Health Insurance Plan

Buying health insurance can be an arduous and confusing process, especially when there are so many options and costs to consider.

There are a few questions to ask yourself if you want to make the search a bit easier. They include:

Depending on whether you are choosing an employer-based plan or shopping on the Marketplace, you may also want to compare PPO vs. HMO options. You should also consider whether you need a plan that also provides dental and/or vision coverage.

Report: #1 Investment Company For Customer Satisfaction

2020 has been a wild ride for most investors, and a new study indicates the relationship between investment companies and their customers has taken a hit.

A report just released by the American Customer Satisfaction Index Finance, Insurance and Health Care Report indicates that most major U.S. investment companies have seen their ratings from customers decline in the last year, some as much as 5%.

Recommended Reading: How To Add Dependent To Health Insurance

What You Need To Know To Choose

- Consider the monthly premium price. Medicare supplement insurance is highly regulated insurers must offer essentially the same coverage for each of the 10 types of Medicare supplement policies. Make sure you can handle the monthly expenses and you are comfortable with the value.

- Calculate the total out-of-pocket costs. Include your monthly premium and an estimate of Part D drug coverage, which Medicare supplement plans dont include.

- Check out incentive benefits. Some insurers offer Medicare supplement customers incentives such as a discount on dental, hearing or vision insurance purchases. They may also have free or discounted gym plans.

- Consider these issues. The most popular is Plan F, but it is no longer available to new enrollees. Plan G and Plan G high deductibles are similar, but they dont cover the Medicare Part B deductible, which Plan F does. They do cover Part B excess charges, which can be an advantage if the healthcare provider you pick charges more than Medicare allows. Another popular feature available in Plan G and some of the other plans is coverage of foreign travel emergencies.

- Evaluate customer service. Good customer service is what sets Medicare supplement plans apart. Asking friends and neighbors who subscribe is a way to rate customer service in your area.

Numerous supplemental plans from which to choose

Ten basic Medigap policies exist, each with different benefits.

Will My Policy Be Cancelled If I File A Claim

Your policy will not be cancelled for filing one claim. If you have a history of filing a lot of claims, your provider might cancel your policy. In general, filing more than two claims in the past five years is considered a lot by insurance providers.

To share feedback or ask a question about this article, send a note to our Reviews Team at .

Don’t Miss: Is It Required By Law To Have Health Insurance

Top Health Insurers Ranked For Customer Satisfaction

Amid a tumultuous time for the healthcare industry due to the global COVID-19 pandemic, the top 25 health insurance companies remained in tight competition when it came to member satisfaction, according to new research released by Verint.

The range for satisfaction scores from highest to lowest was just under nine points out of a possible 100, suggesting that all the top 25 health insurers are highly competitive, according to the Verint Experience Index: Health Insurance 2021 report, which surveyed health insurance members from June through July 2021.

United HealthCare ranked first with a SAT score of 84.1. Humana came in second with 83.4 while Kaiser Foundation Health Plan came in third with 82.8.

The report shows what drives member satisfaction, with perceived value having the most important impact on satisfaction for the vast majority of the top 25 U.S. health insurers evaluated. Other impacts to member satisfaction varied across the board, including enrollment, services, provider availability, digital experience, and claims.

Other key findings from the report indicated:

The 2021 health insurance edition ranks the omnichannel experiences of the top health insurance providers in the U.S. Top companies were determined by the National Association of Insurance Commissioners rankings based on market share.

Download the free Verint Experience Index: Health Insurance report to learn more about the rankings and research.

Blue Cross Blue Shield

Two companies Blue Cross and Blue Shield provided healthcare services in the early 1900s. In 1982, they joined to form one giant company, Blue Cross Blue Shield .117

With headquarters in Chicago,118 the parent company licenses 35 independent, locally operated companies including some of the largest healthcare insurers in the U.S., like Anthem and Independence Health Group to provide BCBS insurance to their customers.119 Through the BCBS network, approximately 110 million consumers in all 50 states have coverage.120

Also Check: How Much Is Private Health Insurance In Spain

Molina: Best Health Insurance Company For Small Budgets

Molina Healthcare is generally very well regarded thanks to its focus on helping underserved populations and lower-income customers. It also runs good wellness services that complement its healthcare offerings, with discounts on weight loss and smoking cessation programs, for example.

Molinas insurance is available to residents of 15 states, meaning that the network is slightly more limited compared to nationally-available polices. However, premium levels of customer satisfaction levels make it an attractive proposition where it is available. Molina operates a number of physical clinics and health centers in the states where it does operate.

Best For Online Care: Unitedhealthcare

UnitedHealthCare

UnitedHealthcare has excellent financial strength ratings and has a network of PPOs across the nation. Its online health care services are excellent.

-

Online health care services

-

Average or less-than-average overall customer satisfaction ratings in 2021 J.D. Power Commercial Member Health Plan Study

UnitedHealthcare has an A financial strength rating from AM Best and is a part of UnitedHealth Group, which is the largest health insurer in the U.S. It offers individual insurance that meets the Affordable Care Act requirements for essential care.

A real standout feature for UHC members is the access to online care, including the ability to order prescriptions online, speak with a nurse via a hotline, and participate in online wellness information. Members can also go online 24/7 to find doctors and set up appointments, file claims, and even speak with a doctor through a mobile device. It even has a mobile app, so you can use these resources on the go.

UHC is a great choice for people who want the option to manage their health care electronically. HMO and PPO plans are available with access to HSAs and FSAs. Member discounts are available for a variety of health related products and services including: hearing aids, vision services , and smoking cessation programs.

They also have an extensive preferred provider network of over 1.3 million physicians and other health care professionals. UHC also offers Medicare Advantage HMO and PPO plans.

Also Check: Is It Legal To Marry For Health Insurance

Capital Bluecross Ranks Highest Among Other Health Insurers In American Customer Satisfaction Index

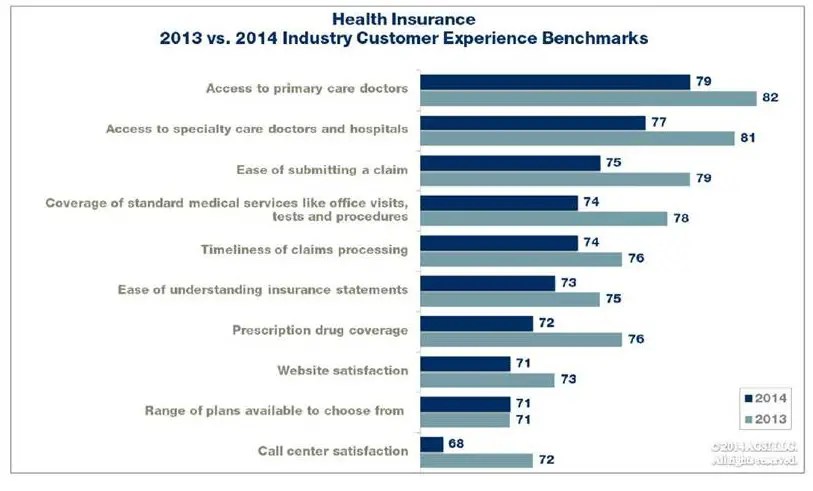

HARRISBURG Capital BlueCross scored higher than all health insurance companies tracked in the 2014 American Customer Satisfaction IndexTM , the only national cross-industry benchmark of customer satisfaction of its kind. The company also scored higher than the ACSI industry averages for several other consumer service industries.

The ACSI, developed at the University of Michigans Ross School of Business, provides an independent perspective of customer satisfaction that quantifies customers perceptions of their experience with a product or service. Capital BlueCross score is based on a random sample of the companys current customers.

Capital BlueCross is focused on providing our customers with excellent service and an exceptional experience, said Gary D. St. Hilaire, Capital BlueCross president and CEO. Were empowering customers with innovative products, services, resources, and tools to help them live healthy and get the most value from their health plan. Were breaking new ground with our Capital Blue health and wellness retail stores, where we are engaging consumers of every age and at every stage of their journey to better health. We couldnt be more pleased about earning the top spot among health insurers, and a high ranking across other consumer industries, in this widely recognized customer satisfaction index.

Three main factors make up an ACSI score:

Find Cheap Health Insurance Policies In Your Area

The best health insurance company for you will depend on your health situation and budget. But it’s not always about the price tag. Some health insurers offer cheap coverage but offer less-than-stellar customer service or a limited provider network.

To help you shop for the best deal, we looked through premium costs, customer service, provider networks and the financial strength of the top health insurance companies. Here’s what we found.

You May Like: Can You Add Spouse To Health Insurance