Tax Penalty For No Health Insurance Ma

President Trump left no doubt what he wanted his GOP allies to focus on, diverting to the TV cameras before he entered a private huddle of Senate Republicans. “Let me tell you exactly what my message is: The Republican Party will soon be known as the party of health care, ” the president said. “You watch. ” Nearly 14 months later, reminded of that day, Sen. John Cornyn broke into a knowing laugh, fully aware that Trump’s “party of health care” declaration went nowhere. Within days, Republicans gave up on trying to draft a replacement for the Affordable Care Act, and after some hesitation this month, the Trump administration plowed ahead with its effort to get the Supreme Court to rule the 2010 law unconstitutional even as no substitute is being drafted on Capitol Hill. Now faced with a viral pandemic that has driven more than 36 million workers to file unemployment claims in eight weeks, Republicans find themselves heading into an election season still lacking any health plan.

What Is An Insurance Penalty

In 2014, a mandate was implemented in the United States for individuals and employers to have health insurance as part of Obamacare. Most individuals who were legal residents or U.S. citizens were required to purchase qualifying health insurance or else they would need to pay a tax penalty. While this tax penalty has been rescinded at the federal level, some states are now implementing their own penalties for individuals without health insurance.

Many individuals already have qualified health insurance coverage through an employer or a public program, such as Medi-Cal or Medicare. Those without health insurance coverage from a public program or their employer will need to purchase their own insurance from a private insurance company or a federal- or state-run health benefits exchange.

Tax credits or subsidies may be available through health benefit exchanges to lower-income families. As a California resident, you should carry insurance throughout the year with no gaps in coverage of 90 days or more. Otherwise, you may face a tax penalty when you file your tax return.

You May Like: What Happens When A Universal Life Insurance Policy Matures

Is There Still A Fine For Not Having Health Insurance

Ever since 2019 there is no government based punishment for not having medical coverage. However, there are still certain states and locales that have established their own health care coverage commands. The federal charge punishment for not being joined up with medical coverage was disposed of in 2019 due to changes made by the Trump Administration. Therefore, if you do not have health insurance and are worried about paying a fine, do not be stressed out any more. You do NOT have to pay any fine or penalty for not having health insurance in 2020.

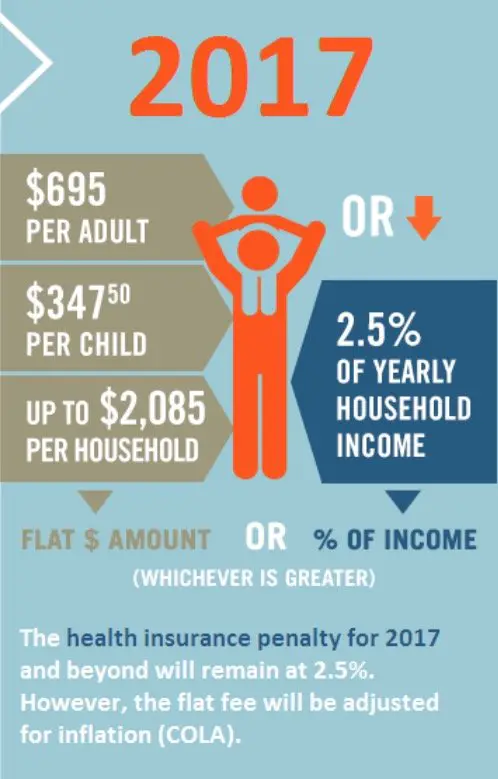

The earlier expense punishment for not having medical coverage in 2018 was $695 for adults and $347.50 for youngsters or 2% of your yearly salary, whatever that sum turned out to be. This punishment was intended to shield the individuals from avoiding medical coverage and not having the option to take care of their clinical costs in case of injury or sickness.

There is no punishment for not having an Affordable Care Act health inclusion in 2020 except if you live in a state like New Jersey or Massachusetts where it is commanded by the state. Along these lines, momentary clinical plans will be incredibly mainstream in 2020 on the grounds that they give admittance to bigger PPO networks at lower costs than ACA Bronze plans.

You May Like: Asares Advanced Fingerprint Solutions

Tax Penalty For No Health Insurance 2019

Most Republicans wanted to move on from the issue, but many GOP strategists blamed the loss of the House majority in the 2018 midterms on that failed repeal effort. In March 2019, that prompted Trump’s “party of health care” declaration, which most GOP senators promptly ignored. Braun said he appreciated the White House push and there were some early ideas that could have provided a modest platform for fixing some key issues, but too many powerful Republicans did not want to confront the issue. “It was mostly our party that was, you know, I think a little beholden to the health-care industry, ” said Braun, who suggested too many Republicans were in “cahoots” with parts of the industry. Republicans are heading into an election with almost every GOP candidate claiming to support guarantees of coverage for those with preexisting conditions, as the administration is trying to gut the entire ACA, including those same protections. “It still put us in a clumsy position to be credible on health-care issues, because we weren’t really behind it, ” Braun said.

Of A Federally Recognized Native American Tribe

The federal mandate allowed American Indians and Alaska Natives to file for exemptions based on their special status. Today, some states, such as New York, do not offer the same type of exemption, but they do have special arrangements and subsidies for healthcare services for these specific groups of people.

Recommended Reading: Evolve Health Products

What Is An Exemption From The Tax Penalty

The tax penalty is assessed for each month that a person is not covered. It is pro-rated, so that a person who is not covered for only a single month would pay 1/12th of the tax that would be due for the full year. For example, the minimum tax per person for failing to get coverage would be $57.92 per adult and $28.96 per child for each month of 2020.

Rhode Island Individual Mandate

- Effective date: January 1, 2020

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalty on residents who go without health insurance but can afford it

- Provides state subsidies to help lower income residents afford health insurance

The penalty for failure to have ACA-compliant health insurance is the same as it would have been under the federal individual mandate. It will cost a family $695 for each uninsured adult and $347.50 for each uninsured child or 2.5% of the household income, whichever amount is greater. Penalties also increase annually with inflation. However, the maximum a household can be penalized cant be greater than the total annual premium for an average bronze plan in Rhode Island.

Rhode Island allows for exemptions in certain situations. And, as of December 31, 2020, Rhode Island expanded its eligibility criteria to include a COVID hardship exemption. This new exemption recognized the impact that the pandemic may have had on residents ability to afford and get health insurance. If you live in Rhode Island, you may be eligible to file a hardship exemption if, as a result of the COVID pandemic:

- You lost minimum essential coverage in 2020, or

- You experienced a hardship that made you unable to get minimum essential coverage in 2020.

Don’t Miss: Starbucks Health Insurance Eligibility

What Was The Purpose Of The Individual Mandate

The idea behind the individual mandate was to protect against whats known as adverse selection in the United States insurance market. That means without a mandate, a high percentage of the people who enroll in health insurance plans know they are going to utilize a lot of healthcare services. For example, the elderly and people with existing health conditions.

Since these kinds of people are expensive to insure, pre-ACA, insurance companies would either deny health benefits to those with pre-existing conditions or charge higher premiums based on age and medical history. The ACA not only made it illegal for insurance companies to deny coverage to those with pre-existing conditions, but used the individual mandate to make the pool bigger for who is insured. In other words, the individual mandate ensures that healthy people also get healthcare coverage. This lets health insurance companies lower insurance premiums for everybody.

Combined with the cost-savings and tax credits built-in to the ACA, the individual mandate changed the healthcare system by allowing more people to be insured at a smaller expense. And with everyone insured, American taxpayers werent footing as many medical bills belonging to those who were uninsured and could not pay for their care.

How Much Will I Owe If I Didnt Have Health Insurance

Up through December 31, 2018, lets say you could afford health insurance by chose not to buy it. If thats the case, you may pay a penalty fee on your federal taxes. This might come up in three different scenarios:

Starting with the 2019 plan year, the Shared Responsibility Payment no longer applies. This is important to note when you file your taxes. However, this does not apply to the states that have their own individual health insurance mandate.

Its best to check with your state to find out whether you might be subject to any penalty fees. Another option can be to check with your accountant. California, the District of Columbia, Massachusetts, New Jersey, Rhode Island, and Vermont have their own individual mandates.

Recommended Reading: Does Insurance Cover Baby Formula

Is There A Penalty For Not Having Health Insurance

Too often, people learn that the personal penalty for not having health insurance is the exorbitant healthcare bills. If you fall and break your leg, hospital and doctor bills can quickly reach $7,500for more complicated breaks that require surgery, you could owe tens of thousands of dollars. A three-day stay in the hospital might cost $30,000. More serious illnesses, such as cancer, can cost hundreds of thousands of dollars. Without health insurance, you are financially responsible for these bills. Two-thirds of people who file for bankruptcy indicate that medical bills contributed to their financial situation, according to a 2019 study.

The Affordable Care Act increased the number of people with insurance and lowered those who couldnt afford to pay their health bills. While the federal health insurance coverage mandate and shared responsibility payment was in effect, from 2014 through 2018, the number of people in the United States who got health insurance increased by around 20 million.

Since 2019, there is no federal penalty for not having health insurance, says Brad Cummins, the founder and CEO of Insurance Geek. However, certain states and jurisdictions have enacted their health insurance mandates. The states with mandates and penalties in effect are:

- California

- Preventive and wellness services

- Pediatric services

There are a variety of health plans that meet these requirements, including catastrophic and high deductible plans.

What If Im Required To Carry Insurance For An Ex

You can go to court and seek a modification in the terms that were put forth in your settlement. Be prepared to thoroughly document why you are not able to meet the original terms, or you may be found in contempt of court.

You may also be able to tap into state-sponsored health insurance for your children. It is often offered with billing on a sliding scale based on your ability to pay.

Recommended Reading: Insusiance

What You Need To Know About Tax Penalties For Uninsured Californians

Posted: November 30, 2021

Youre protected against high medical bills and unexpected health care costs when you have health insurance. Since the Affordable Care Act came into law in 2010, qualified health insurance plans need to provide a certain amount of coverage.

Preventative care needs to be covered without you paying out-of-pocket. Plans also need to have an out-of-pocket maximum to keep healthcare costs under control.

The ACA also introduced the concept of a tax penalty if a person doesnt purchase an insurance plan. Since the rules about health insurance tax penalties have changed since the law went into effect, its essential to understand what you might have to pay if you decide health insurance isnt for you.

Is The Affordable Care Act Still In Effect For 2021

ACA Has Not Been Repealed or Replaced, & Lawsuit Doesnt Affect Enrollment in 2021 Plans. Despite the ever-present headlines about health care, the Affordable Care Act remains the law of the land. And as noted above, the American Rescue Plan has expanded the ACAs subsidies to make them larger and more widely available Apr 26, 2021.

Don’t Miss: Starbucks Open Enrollment

Do You Qualify For An Aca Exemption

If you qualify, you will not owe the tax penalty. Examples of these include having a gross income below the minimum for filing a tax return, experiencing general hardship as homelessness, foreclosure, a death of a close family member, or unpaid medical bills, or being a resident of a state that did not expand Medicaid. Some ACA exemptions have to be claimed or reported when you file taxes, while others are automatic.

If you do not qualify, you are allowed a single period of three months without ACA coverage.

If you are recently unemployed but expect to find employment in the next couple of months, you can go without health insurance without the penalty.

Will Unvaccinated People Have To Pay More For Health Insurance

Angela Underwoods extensive local, state, and federal healthcare and environmental news coverage includes 911 first-responder compensation policy to the Ciba-Geigy water contamination case in Toms River, NJ. Her additional health-related coverage includes death and dying, skin care, and autism spectrum disorder.

You May Like: Starbucks Health Coverage

Individual Mandate Penalty Was Eliminated But Employer Mandate Penalty Remains In Place

Although the GOP tax bill that was enacted in late 2017 repealed the individual mandate penalty starting in 2019, it did not make any changes to the employer mandate. Large employers that dont offer coverage, or that offer coverage that doesnt provide minimum value and/or isnt affordable, continue to face penalties if their employees obtain subsidized coverage in the exchange.

Read answers to other questions about health reform, and penalties, and small business.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Is There A Fine For Not Having Health Insurance

The Affordable Care Act, also called ObamaCare, went into effect in 2010. In the law, there was an Individual Mandate written in, which made it a requirement for all Americans to carry a health insurance plan or else theyd be penalized by the federal government during that years tax season. In December 2017, the new tax legislation repealed the tax penalty so that for the year 2019, there was no federal tax penalty. However, a few states had their own Individual Mandate in place and plan to have it in place next year too.

Don’t Miss: Starbucks Benefits For Part Time

Group : Businesses Employing 31 Or More Full

If a business employs 31 or more Full-Time employees and 50 or more Full-Time-Equivalent Employees, then the employer is subject to penalty if atleast one employee receives a tax subsidy in the Individual Health Insurance Exchange. An easy way to calculate the penalty is to subtract 30 from the # of Full-Time Employees and multiply the result by $2,000.

Here are three real-life examples*:

A business that employs 31 Full-Time Employees and 50 Full-Time-Equivalent Employees pays a tax penalty of $2,000 per year .

A business that employs 50 Full-Time Employees and 100 Full-Time-Equivalent Employees pays a tax penalty of $40,000 per year .

A business that employs 500 Full-Time Employees and 5000 Full-Time-Equivalent Employees pays a tax penalty of $940,000 per year .

*All examples assume at least one employee is receiving a tax subsidy in the individual health insurance exchange.

Originally published on January 8, 2013. Last updated July 7, 2015.

Get Health Insurance Today With Help From Health For California

Whether its open enrollment or youre eligible for a special enrollment period, signing up for a health insurance policy means you can avoid paying the tax penalty in California. It also means youll have access to the health care and treatments you need without having to pay a lot out-of-pocket.

Health for California can help you decide which type of insurance plan is right for you and can help you get the subsidies youre eligible for. Contact us today for a quote.

Not sure how Obamacare affects your health care plans in California? Learn how the ACA works in California, including benefits, costs and enrollment.

Read Also: How To Keep Insurance Between Jobs

Enroll In A Qualified Health Plan

Enrolling in a qualified health insurance plan is the best way to avoid penalties at tax time. Individuals have the option to purchase short-term health insurance or to sign up for a policy if they have a qualifying life event. Penalties will be reduced for each month that a person has insurance as they are calculated on a month-to-month basis. The more months that a person goes without health insurance, the higher the penalty.

Individuals who have health insurance should start preparing now for the 2021 tax season by gathering their health insurance coverage documents, such as Forms 1095-A, 1095-B, or 1095-C, which should arrive in the mail. Employees who receive healthcare coverage from their employer should receive a statement that indicates that they were covered for part of the year or the whole year.

How Much Do I Pay If I Am Penalized

It depends, as the penalty is adjusted for inflation. For the 2016 tax year, the tax penalty for no health insurance was equal to 2.5% of your adjusted gross income , or $695 per adult and $347.50 per child, up to a maximum of $2,085, whichever is higher. The Obamacare penalty is currently under review with the new Presidential administration in place, so there may be changes as of this writing. However, it is recommended to assume that the health insurance penalty is still in force for the 2017 tax year. Speculation aside, it is recommended that you get healthcare coverage regardless of whether or not there is no health insurance penalty in place for your own protection.

Don’t Miss: Does Starbucks Offer Health Insurance