What Are Average Health Insurance Costs

In the U.S., 55% of people receive health insurance through their employer, and 20% receive insurance coverage through government assistanceeither through Medicaid or Medicare according to the U.S. Census Bureau. Some peoplesuch as those who are self-employedchoose to purchase insurance privately, says Peter Kongstvedt, M.D., a health care expert and author based in Virginia. There are also 8% of people in the U.S. with no health insurance coverage at all.

The average health insurance cost for a single person who received health insurance through their employer in 2020 was $7,040 a year, according to data compiled by the Kaiser Family Foundation. The average cost of health insurance for a family in 2020 was $21,342 a year. These numbers represent what someone pays for a health care premium. A premium is the amount you pay each month to the health insurance provider, Dr. Kongstvedt says.

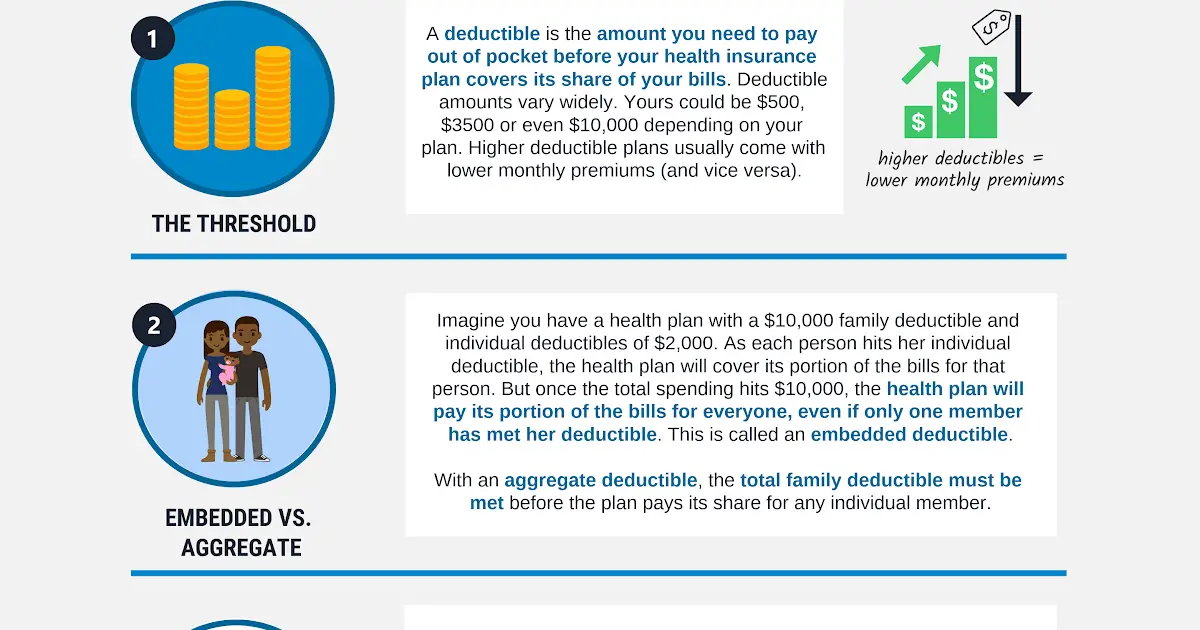

A premium is different from a deductible. A premium is what you pay up front , regardless of if you get health care or not. A deductible is something you pay in plans if you actually receive health care, Dr. Handel explains. For example, if the deductible for your health insurance plan is $1,000 a year, youll need to cover the other medical bills beyond that amount, he adds.

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

How Much Is Health Insurance By Family Size

Not surprisingly, the more people in your family are covered by your health insurance plan, the more youre likely to pay in premiums.

The average cost for a 40-year-old couple is $954 per month or double the cost for an individual in that age range. But adding kids isnt quite as linear. A 40-year-old couple with one child under age 14 would pay an average of $1,230 per month, and a family of five would pay around $1,782.

To estimate the average family’s health insurance cost, MoneyGeek used national averages by age and added the premiums together. Actual family premiums may vary.

Average Health Insurance Premiums by Family Size

Scroll for more

- Couple w/ Three Kids $1,782

It seems logical that families would stick together on health insurance its convenient and easy to do so. And together, youre more likely to meet the out-of-pocket maximum, after which you shouldnt have to pay out-of-pocket costs for covered services.

But some families might be better off on separate plans.

For example, if one spouse can get low-cost coverage through their job, but that plan may not be open to family members , it may make sense for that spouse to use their employer-provided insurance while the rest of the family uses a Marketplace plan.

Or, if one partner has more medical needs and higher costs, they may benefit from paying more for more coverage. But if the other partner has few health needs, they may be better off in a high-deductible plan just for themselves.

Recommended Reading: Starbucks Health Care Benefits

How Do Health Insurance Subsidies Work In The Usa

A health insurance subsidy provides government assistance to contribute to the cost of cover in the USA, the Affordable Care Act provides a sliding scale of support to US citizens and legal residents earning four times the federal poverty level or less.

In 2021, the federal poverty level is $12,880 for an individual, so individuals earning less than $51,520 may be entitled to subsidised health insurance.

Applications are made through the government-run health insurance marketplaces in each state. Changes to incomes may affect eligibility, so applicants sometimes need to pay subsidies back if circumstances change.

Medium To High Level Pricing Plans

If you are in need of a plan that covers a little more but still within a certain budget, you can usually find something that is both affordable and fairly comprehensive. For instance, there are plans that will share the cost of prescription drugs and other treatments like physiotherapy.

There are plans that offer a lot of coverage as well, including prescription drugs, dental, massage therapy, medical equipment and much more, but expect to pay accordingly. If you need a lot of medical services, items or drugs, this may be the best option for you.

If you previously had a company group plan and wish to have an individual plan of your own, there are plans that will accept you, even with pre-existing conditions. You are guaranteed coverage if you apply within 6090 days of losing your previous coverage.

Recommended Reading: Kroger Health Insurance Benefits

What Is The Cheapest Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats the most affordable for everyone. But finding the right plan for your needs is easy with HealthMarkets. Our free FitScore® technology helps you shop, compare and apply for a healthcare plan in minutes. We can even check to see if you may qualify for a tax credit. To get a better look at what plans could cost you and your family, get started now.

46698-HM-1120* Subsidy amounts are based on a 40-year-old nonsmoker making $30,000 per year.

References:

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021 . If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 . If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259 . |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203 . After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Read Also: How To Keep Insurance Between Jobs

How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

Would Insurance Be Cheaper Through An Employer

It’s no surprise that employer-sponsored health insurance is often cheaper than marketplace plans.

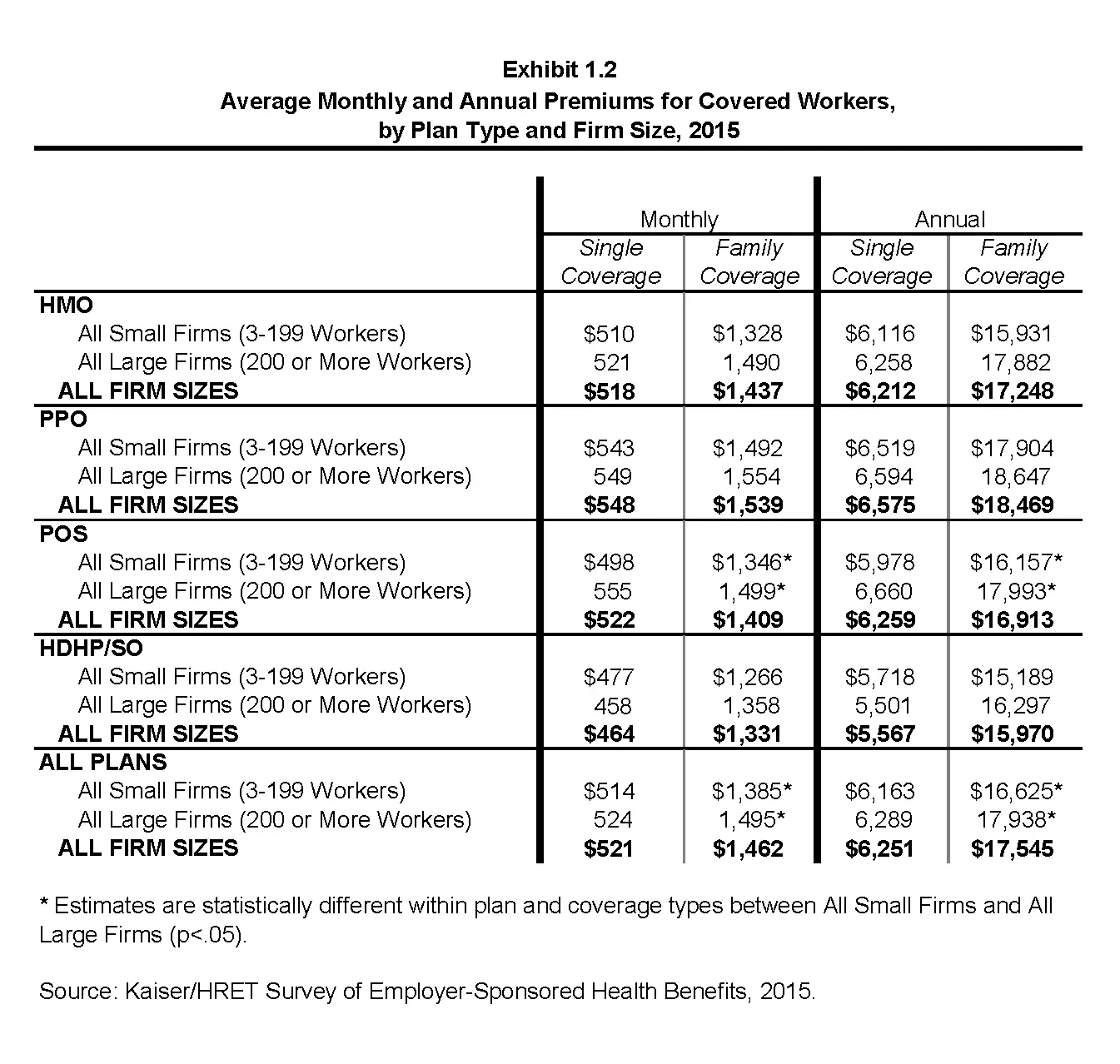

According to the Kaiser Family Foundation, covered workers kick in 17% of the cost of single coverage. That works out to an average of $101 for HMO plans and $111.25 for PPO plans. Compare that to the eHealth data, which showed that the average cost for a single person of any gender was $456.

Costs vary from state to state. For instance, in Hawaii, the average is $718 per year for the worker, but in Massachusetts, the worker may pay $1,793 per year. This is at the high end of the cost scale. Below is the state-by-state breakdown from the Kaiser Family Foundation to see the differences by region.

Per the Census, 55.4% of Americans got their insurance through their employer in 2019.

Also Check: Starbucks Insurance Enrollment

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you need to do in order to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

Cheap Health Insurance For Students

Students often have additional health insurance options. Many universities and colleges provide free health insurance to students through a school-sponsored plan. These policies typically provide health insurance for most on-campus medical services, but you may lose the coverage if you become a part-time student or transfer schools.

Another option for some students is to purchase a student health plan. These health insurance policies are designed for full-time students between the ages of 17 and 29. Plans can be bought through most large health insurance companies and are paid either by an annual or semiannual premium. A student health plan can be a great cheap medical insurance option because you will not lose your coverage if you decide to transfer to a different school.

Read Also: Shoprite Employee Benefits

Do Us Citizens Living Abroad Have To Buy Health Insurance

Americans who live abroad, or who spend a large proportion of their time overseas, often find theyll need a separate health insurance policy for this.

One option is to buy local insurance, but this wont cover you for trips home and you may find there are language barriers if you need to make a claim.

International health insurance is a popular alternative for American expats living overseas. With William Russell, English-speaking customer service representatives handle every stage of your claim from our UK offices, so youre in safe hands.

Read more about the difference between travel, local and international health insurance with our FAQ guide.

How Much Does Group Health Insurance Cost

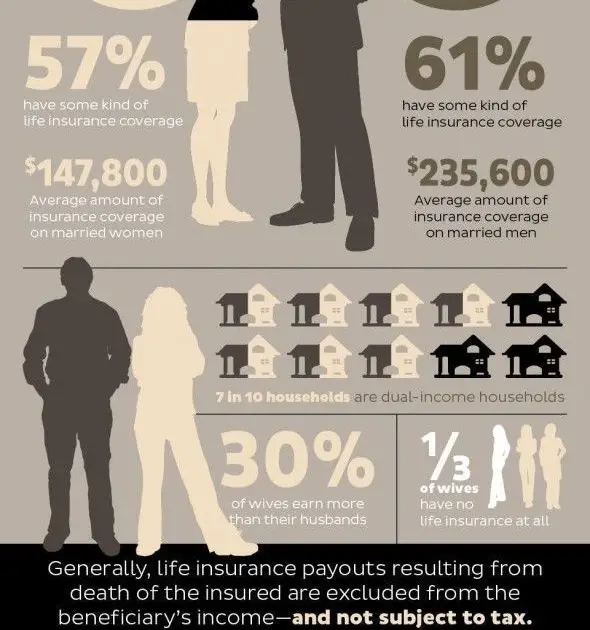

About 157 million people are covered by employer-based health insurance. But how much do companies pay for employee health insurance?

For a look into trends and costs over the years, the Kaiser Family Foundation conducts an annual survey.

In their recent findings, in 2020, the average monthly premiums for group health insurance increased from previous years to:

- $622 for individual coverage

- $1,778 for family coverage

Since 2019, average employer-sponsored individual premiums increased 4% and family premiums increased 4%. Moreover, the average premium for family coverage has increased 22% over the last five years and 55% over the last ten years.

Don’t Miss: Umr Insurance Arizona

What Is Individual Health Insurance

While many people get their health insurance through a group plan sponsored by their employer or union, others buy it themselves. If you are buying your own health insurance, you are purchasing an individual plan, even if you include family members on the plan. If this sounds like what you need, let eHealth show you all of your individual and family health insurance options, and use our free quote comparison tool to find an affordable plan that meets your needs.

Asa result of the Affordable Care Act , people can purchase individualhealth insurance through a government exchange or marketplace , or they can buy health insurance from privateinsurers. You may be restricted to purchasing health insurance through agovernment exchange to certain times of the year. Usually you can purchasehealth coverage from a private insurance company anytime.

ACAplans are a good starting place to understanding individual health insuranceoptions. ACA health plans are categorized by metals. You can learn more aboutthe metallic plans: Bronze, Silver, Gold, and Platinum.

How Much Does Health Insurance Cost

In 2022, the average cost of health insurance is $541 a month for a silver plan. However, costs will vary by location. Insurance is expensive in West Virginia and South Dakota, averaging more than $800 a month. States with cheaper health insurance include Georgia, New Hampshire and Maryland, averaging less than $375 a month.

Recommended Reading: Starbucks Benefits For Part Time Employees

How Much Is Family Health Insurance Per Month

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

The Average Cost Of Health Insurance By Plan Types

There are four types of health plans you can choose on the Marketplace, with varying degrees of flexibility and cost:

- Health Maintenance Organization : HMOs tend to have lower premiums but require you to use a specific set of providers and get referrals to specialists for covered services, except in emergencies. Silver HMOs average $473 per month.

- Exclusive Provider Organization : Somewhere between an HMO and a PPO, EPOs typically require that you use the health plans in-network providers, but you dont always need referrals to see specialists. EPO Silver plans average $508 per month.

- Preferred Provider Organization : PPOs tend to be more expensive than HMOs but typically offer a broader range of providers. You usually dont need to get a referral to see specialists for covered services. On the Marketplace, Silver PPO plans have an average premium of $517.

- Point of Service : POS plans tend to be the most flexible at an increased financial cost. You can usually get care outside of the health plans provider network, though youll likely pay more for those services. POS Silver plans have an average monthly premium of $534.

Average Health Insurance Premiums by Plan Type – Silver Plans

Scroll for more

- $534

Don’t Miss: Substitute Teacher Health Insurance

Find Cheap Health Insurance Quotes In Your Area

Health insurance premiums have risen dramatically over the past decade. In previous years, insurers would price your health insurance based on a multitude of factors. However, the number of variables have decreased significantly with the Affordable Care Act.

In 2022, the average cost of individual health insurance for a 40-year-old on a silver plan is $541. This represents an increase of nearly 1% from the 2021 plan year.

Average Costs For Health Insurance In Canada

When you add it all up, health care costs quite a bit. The Fraser Institute’s 2016 report broke down the cost of public health insurance for a family of two adults and two children on an income scale.

The 10% of Canadian families with the lowest incomes, earning an average of $14,028, paid an average of $443 in premiums. The 10% of families at the top end of the scale earned $281,359 and paid an average of $37,361.

It’s the middle ground that has created a bit of controversy over the Fraser Institute’s numbers. In 2016, they pegged that average on that scale as being a family earning $60,850 who paid $5,516 in premiums. An individual earning $42,914 paid $4,257 in premiums.

A year later they said the average family of four earning the average 2017 salary of $127,000 would pay nearly $12,000 in premiums. The actual math on the two figures was not that far off, but there was a lot of political posturing and controversy over whether a median income or average income was a more meaningful measure and more representative of the country and actual spending.

You May Like: Evolve Health Insurance Company

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

Plans Through Your Employer

This page features plans you can buy for yourself and your family. If you are looking for plans you might get through your employer, we can help get you there.

* Based on internal data for 2021. Final premium amount is after any applicable subsidy, based on household size and income, from the Federal government is applied.

** 2021 Special Enrollment Period for Marketplace Coverage Starts on HealthCare.gov Monday, February 15, Centers for Medicare & Medicaid Services, March 12, 2021, .

*** Four in Ten New Consumers Spend $10 or Less Per Month for HealthCare.Gov Coverage Following Implementation of American Rescue Plan Tax Credits, June 14, 2021, .

2 Plans may vary. Includes eligible in-network preventive care services. Some preventive care services may not be covered, including most immunizations for travel. Reference plan documents for a list of covered and non-covered preventive care service.

4 The downloading and use of the myCigna Mobile App is subject to the terms and conditions of the App and the online store from which it is downloaded. Standard mobile phone carrier and data usage charges apply.

5 Referrals are required for residents of Illinois.

- I want to…

Don’t Miss: Asares Advanced Fingerprint Solutions