Understand And Avoid Health Care Reform Tax Penalties

OVERVIEW

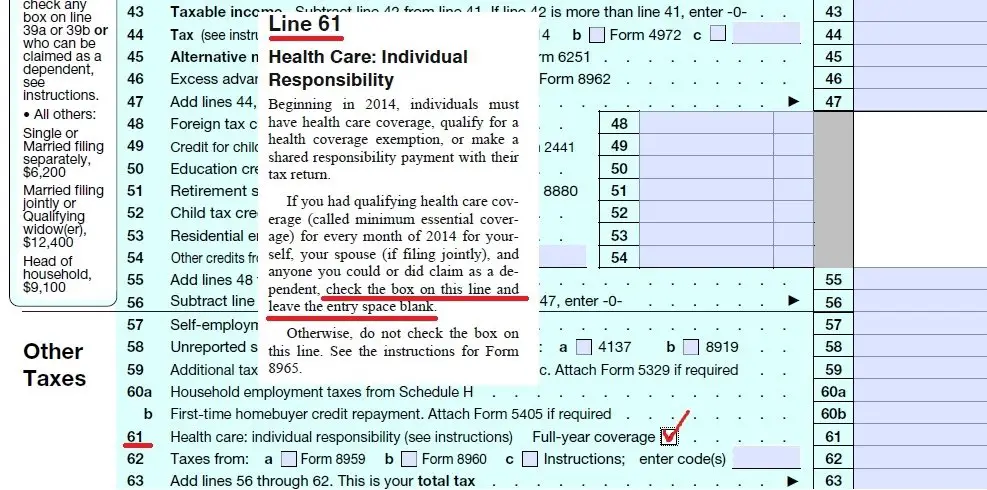

The Affordable Care Act has brought new options for health care coverage to millions of previously uninsured Americans. While you can still choose not to purchase health insurance, that decision may come at a cost, for tax years 2014 through 2018. Eligible taxpayers who remain without insurance may be required to pay penalties, though there are exemptions for which you may qualify.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Group Health Insurance Vs Individual Health Insurance

Group Health Insurance: Generally, if you work for a company that offers its own health benefits, they have purchased a plan through a broker that will have lower rates for the same coverage than you would be able to buy on your own. The reason for that is the insurance company assumes less risk by covering many people.

Individual Health Insurance: This is coverage purchased by an individual or family with no contribution from an employer. Individual premiums tend to be higher for the same coverage because the risk is only on that individual or family group.

Need coverage? Enter your zip code above and compare online quotes now!

Does Internal Revenue Service Still Need Health Insurance

A. The specific required which calls for most Americans to preserve health insurance coverage still exists. However beginning with the 2019 tax obligation year, there is no more a fine for non-compliance with the specific required. So practically, the regulation does still need a lot of Americans to preserve health insurance insurance coverage

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Don’t Miss: How Long After Quitting Job Health Insurance

Enroll In A Qualified Health Plan

You can buy something like short-term health care in 2020 or sign up for insurance if you have a qualifying life event. If you do so, the penalty will be reduced because it is calculated on a month-to-month basis. For example, the penalty is larger if you did not have insurance for 12 months versus eight months.

If you miss the Open Enrollment period, you may be able to enroll during the special enrollment period if you have a Qualifying Life Event, such as losing health insurance, having a baby or moving to California.

In preparation for the 2021 tax season, collect the documents that demonstrate you had appropriate health insurance coverage. Check the mail for Forms 1095-A, 1095-B and 1095-C that show whether you and the members of your household had health coverage during the year. To receive this paperwork, you may need to contact your human resources department or health insurance provider.

If you are an employee with employer-sponsored health insurance coverage, you will receive a statement from your employer that indicates you were covered for part of the year or for the entire year.

Documentation Individuals Can Gather In Advance

You are not required to send the IRS information forms or other proof of health care coverage when filing your tax return. However, its a good idea to keep these records on hand to verify coverage. This documentation includes:

- Form 1095 information forms

- W-2 or payroll statements reflecting health insurance deductions

- Records of advance payments of the premium tax credit

- Other statements indicating that you, or a member of your family, had health care coverage

If you are expecting to receive a Form 1095-A, Health Insurance Marketplace Statement, you should wait to file your income tax return until you receive that form.

You might not receive a Form 1095-B or Form 1095-C from your coverage providers or employer by the time you are ready to file your tax return. You can prepare and file your returns using other information about your health insurance. You should not attach any of these forms to your tax return.

While your employer may be able to assist you in verifying your coverage, most employers are not required to provide documentation specific to your health care coverage.

Form 1095-A, Health Insurance Marketplace Statement

You may receive more than one Form 1095-A if anyone in your household switched plans or reported life changes – such as getting married or having a baby – after their coverage began, or if you had more than one policy covering people in the same household. You will get a Form 1095-A, even if you only had Marketplace coverage for part of the year.

You May Like: Starbucks Health Insurance Plan

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents youll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: Starbucks Open Enrollment 2018

How To Apply For An Exemption For 2018 And Earlier

Depending on the type of exemption you qualify for, you will need to submit an application to Healthcare.gov or request the exemption from the Internal Revenue Service when you file your taxes. .

- Federal Health Insurance Marketplace : Go to HealthCare.gov to determine which exemption to request. Print out, complete and mail the federal Application for Exemption. The completed form and any supporting documents should be mailed to:Health Insurance Marketplace – Exemption Processing465 Industrial Blvd.London, KY 40741

- IRS: Information for claiming an exemption through the IRS when you file your taxes can be found at www.irs.gov.

MNsure uses the federal Health Insurance Marketplace to process exemption applications. The federal government will notify you if you qualify for an exemption. If you apply to HealthCare.gov and qualify, you will receive an exemption certificate number that you’ll need for your federal income tax return you file for the year of the exemption. For questions about the status of your application or your eligibility for an exemption, visit HealthCare.gov, or call the Health Insurance Marketplace Help Center at 800-318-2596. TTY users should call 855-889-4325. If you have questions about how to get a copy of and where to submit the application form, call the MNsure Contact Center at 855-366-7873 or 651-539-2099.

You May Like: Does Medical Insurance Cover Chiropractic

Effects On Insurance Premiums

The elimination of the individual mandate penalty in 2019 contributed to higher individual market premiums for 2019, because insurers expected that the people likely to drop their coverage after the penalty was eliminated would be healthy, whereas sick people will tend to keep their coverage regardless of whether there’s a penalty for being uninsured.

The penalty’s original purpose was to encourage healthy people to join the risk pool, as a balanced risk pool is necessary for any health insurance product to function.

According to rate filings for 2019 plans, average premiums would have for 2019 if the individual mandate penalty had remained in place .

The primary reason average premiums increased instead of decreasing for 2019 was the elimination of the individual mandate penalty, along with the Trump administration’s efforts to expand access to short-term health plans and association health plans.

Those plans appeal to healthier individuals, so their expansion has the same effect as the penalty repeal, in terms of reducing the number of healthy people who maintain ACA-compliant individual market coverage. Note that although average benchmarkpremiums decreased slightly in 2019, overall average premiums did increase that year.

But because the ACA’s premium subsidies adjust to keep coverage affordable even when premiums increase, the majority of people who buy health plans in the exchanges have continued to do so.

Individual Mandate Exemptions: Still Important If You Want A Catastrophic Plan

Although there is no longer a federal penalty for being uninsured, the process of obtaining a hardship exemption from the individual mandate is still important for some enrollees. If you’re 30 or older and want to buy a catastrophic health plan, you need a hardship exemption.

You can obtain the hardship exemption from the health insurance exchange , and you’ll need the exemption certificate in order to enroll in a catastrophic health plan. These plans are less expensive than bronze plans, although you can’t use premium subsidies to offset their cost, so they’re really only a good choice for people who don’t qualify for premium subsidies.

Although there is no longer a federal penalty associated with the individual mandate, you still need to obtain a hardship exemption from the mandate if you’re 30 or older and you want to buy a catastrophic health plan.

Don’t Miss: How Long Do Health Benefits Last After Quitting

Amounts That Are Not Taxed

You do not need to report certain non-taxable amounts as income, including the following:

- amounts that are exempt from tax under section 87 of the Indian Act

- most lottery winnings

- most gifts and inheritances

- amounts paid by Canada or an allied country for disability or death of a war veteran due to war service

- GST/HST credit and Canada child benefit payments, including those from related provincial or territorial programs

- family allowance payments and the supplement for handicapped children paid by the province of Quebec

- compensation received from a province or territory if you were a victim of a criminal act or a motor vehicle accident

- most amounts received from a life insurance policy following someone’s death

- most types of strike pay you received from your union, even if you perform picketing duties as a requirement of membership

- NoteIncome earned on any of the above amounts is taxable.

Why Do I Need Health Insurance

Its important to have health insurance even if you are young and in good health, because accidents and unexpected illness can have a serious impact on your finances. For example, a broken leg can cost you thousands of dollars, even if no surgery is needed. In addition, most health insurance plans give you access to preventive serviceslike shots or screening testsfor free.

Don’t Miss: Minnesotacare Premium Estimator

How Big Were The Penalties

The IRS reported that for tax filers subject to the penalty in 2014, the average penalty amount was around $210. That increased substantially for 2015, when the average penalty was around $470. The IRS published preliminary data showing penalty amounts on 2016 tax returns filed by March 2, 2017. At that point, 1.8 million returns had been filed that included a penalty, and the total penalty amount was $1.2 billion an average of about $667 per filer who owed a penalty.

Although the average penalties are in the hundreds of dollars, the ACAs individual mandate penalty is a progressive tax: if a family earning $500,000 decided not to join the rest of us in the insurance pool, they would have owed a penalty of more than $16,000 for 2018. But to be clear, the vast majority of very high-income families do have health insurance.

Today, the median net family income in the United States is roughly $56,500 For 2018, the penalty for a middle-income family of four earning $60,000 was $2,085 . This is far less than the penalty a more affluent family would have paid based on a percentage of their income.

The penalty could never exceed the national average cost for a bronze plan, though. The penalty caps are readjusted annually to reflect changes in the average cost of a bronze plan:

The maximum penalties rarely applied to very many people, since most wealthy households were already insured.

Absence Of Medical Services

Contrary to popular belief, health providers are not required by law to provide medical services to individuals without insurance. Only emergency departments are legally bound to provide care.

The National Center for Chronic Disease Prevention and Health Promotion reports that six in 10 Americans have been diagnosed with a chronic health condition, such as high blood pressure, high cholesterol, or being overweight or obese. A study by the Transamerica Institute revealed that 66% of the uninsured suffered from a chronic illness. Ninety percent of the nation’s $3.8 trillion in annual healthcare expenditures are from citizens coping with chronic diseases and mental health issues.

Don’t Miss: Eligibility For Aarp

How To Avoid The Penalty And Afford Insurance

You are no longer subject to a penalty for not having insurance, a provision of the Affordable Care Act that was struck down by a judge. However, insurance can help you access health care services and avoid major medical bills.

f paying for insurance is a struggle for you, you may be able to get help from the government. This money is called a subsidy. To get it:

For instance, you’ll likely be able to get money if you make up to about $50,000 a year for one person or about $103,000 for a family of four. These income amounts are based on the federal poverty guidelines and will change every year.

How much financial help you get depends on how much money you make a year. The less you make, the more help you get.

There are two subsidies available. They immediately lower your costs. You donât have to pay first and get the money later.

Show Sources

When Do I Receive My Form 1095 Document

The deadline for the marketplace to provide you with a Form 1095-A is Jan. 31. The deadline for insurers, companies and government agencies to deliver forms 1095-B and 1095-C has been extended to March 4. It is important to note that having a Form 1095 document may help you calculate deductions, but it is not necessary to complete a filing. This means you do not need to wait for one of these documents to arrive to fill out your tax return.

Don’t Miss: Does Starbucks Have Health Insurance

Preventative Care And Early Intervention

When you dont have insurance, you may avoid getting treated for minor issues which can escalate into bigger problems quickly. Preventive medicine and quick treatment are the best ways to avoid expensive hospital stays.

If you have insurance, then you wont need to worry about this as much. Additionally, if you put off going in for treatment and wind up developing a serious medical condition, you may have a difficult time finding health insurance after you have not had any for so long.

No More Tax Penalties

In 2018, the ACA tax penalty was $695 for adults and $347.50 for children, or 2% of ones annual income, whichever amount was more. However, on December 22, 2017, when President Trump signed the Tax Cuts and Jobs Act, it repealed the ACA-related tax on Americans who refuse to purchase health insurance.

As of 2019, Americans without health insurance are not taxed by the government. However, individuals and families who choose to go without health insurance do so at their own risk.

Don’t Miss: How To Enroll In Starbucks Health Insurance

Exemptions For Unaffordable Coverage Through Mnsure

You can claim this exemption based on coverage being unaffordable for the months in 2018 when you did not have coverage when you fill out your 2018 tax return, which was due in 2019.

You can claim this exemption using the federal Form 8965. You will need to use the following information from MNsure to complete this form:

- The premium amount for the lowest cost 2018 bronze plan that would have covered all members of your household seeking an exemption and

- The premium amount for the second-lowest cost 2018 silver plan that would have covered all members of your household seeking an exemption.

This information is easy to find using the instructions below.

NOTE: If you are applying for an exemption for unaffordable coverage from your employer, you do not need any information from MNsure. You will need to follow the directions on the federal exemption application to submit information about your employer’s plan. You can claim this exemption when you file your taxes using the federal Form 8965.

An Example Of Premium Deductions

Some employers ask their employees to pay a significant portion of their premiums each month. If you find yourself in that situation, coupled with a relatively low salary and other significant medical expenses, you may be able to deduct your premiums.

In this example, the employee has a $30,000 AGI. Her portion of her employer group premiums is $400 per month or $4,800 per year. She has an accident, and between all of her out of pocket expenses for medical care, prescriptions, and other items, she incurs a final tally of $5,000. This adds up to a total of $9,800 for the year.

Ten percent of her AGI is $3,000. This means she can deduct everything about this, or $6,800. This is how premiums can play into a tax deduction.

You May Like: Can You Add A Boyfriend To Your Health Insurance

Are There Affordable Options

There are several ways that you can obtain affordable health insurance. If you are under 26 years old, you may be able to get coverage with your parents health insurance plan.Or, you might be able to get coverage through a spouse or domestic partner. Other consumers should explore health insurance offered by their employer, or even independent health insuranceplans that may be available outside of the Obamacare marketplace exchanges.

However, the most affordable and accessible option may be through your states Obamacare exchange. These exchanges are websites set up to assist you in finding health insurance plans that are right for you. The cost of these plans varies significantly, and a tax credit can significantly lower your premium if you qualify.

When youre choosing a plan, you may want to consider a high-deductible health plan , which offers lower monthly premiums but charges higher deductibles. If you do choose this option, you could set up a Health Savings Account . An HSA is an account into which you can save pre-tax dollars that you can spend on medical payments, including copays and deductibles.