What Newlyweds Should Know About Health Insurance

Navigate your new health insurance options and set yourself up for a lifetime of happiness and health.

Congratulations on your new marriage ! Besides a lifetime of domestic bliss, there is another exciting, if not exactly romantic, benefit to your new status: The option to enroll in health insurance coverage or change your health plan.

In most cases, individuals and families can only purchase a new health plan once a year during open enrollment. However, marriage or domestic partnership is considered a qualifying life event. That means you and your new partner â as well as any children in your new family â can now qualify for a special enrollment period to get or change coverage.

Understanding Your Choices

If one of the members of the couple already has health insurance through an employer, you may be able add a spouse, partner or dependents to that employer-sponsored plan. Remember: Small businesses and part-time employers are not legally required to offer health insurance. Large employers are legally obligated only to offer coverage to employees and their dependents â but not their spouse or partner.1

Keep in mind that if your household size or income has changed due to your union, your eligibility for financial help may also change. As with any other life change, if you are already enrolled in a health plan through Covered California, youâll need to report it.

Consider All Your Options

You May Like: Can I Stop My Health Insurance Anytime

How Can I Lower Retirement Health Care Costs

As daunting as these expenses seem, there are some things you can do to mitigate their effect and lessen the risk that they will derail your retirement.

For example, following doctors orders and making small changes can reduce your overall costs.

According to the HealthView report, if a 45-year-old man with high blood pressure does as instructed by his doctor, he can lower his annual health care costs and extend his life.

By taking medication as prescribed and maintaining a healthy level of physical activity, this individual could save an average of more than $3,600 in annual pre-retirement out-of-pocket healthcare costs, the report states. He can also expect to increase his actuarial longevity by more than two years.

Retirement planning is also important when it comes to health care costs. Make sure you include these costs in your budget and consider how you will cover them.

One option is to dedicate the income from an annuity solely to out-of-pocket health care expenses.

If you have the option of using a health savings account , consider maximizing your contributions for use in retirement.

What Does The $315000 Include

About 15% of the average retirees annual expenses will be used for health care-related expenses, including Medicare premiums and out-of-pocket expenses.

Obviously, that figure comes with caveats because ultimately what a retiree will spend depends on when he or she retires and where they live, their overall health, and that great mystery of how long they will live.

Fidelitys estimate assumes both members of the couple are enrolled in traditional Medicare, which between Medicare Part A and Part B covers expenses such as hospital stays, doctor visits and services, physical therapy, lab tests and more, and in Medicare Part D, which covers prescription drugs.

The calculation takes into account monthly premiums, standard Medicare cost-sharing provisions, expenses that arent covered by Medicare like vision or hearing aids, as well as prescription drug out-of-pocket costs.

It does not include other health-related expenses, such as over-the-counter medications, most dental services, and long-term care.

Also Check: Part Time Starbucks Benefits

Don’t Forget About Health Care Costs

Many retirees and people getting ready to transition out of the workforce forget to budget for healthcare when they estimate their expenses in retirement. Why? Their employer is often picking up the majority of the tab and the remaining cost comes out of their paycheck. They think they need the same amount of take-home pay that they currently have, but they forget that they will now be responsible for paying their health care premiums in addition to the out-of-pocket costs.

If your modified adjusted gross income as reported on your IRS tax return from two years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount . IRMAA is an extra charge added to your premium.

How Much Health Insurance Premiums Cost If You Retire Early

Retiring early: How much your health insurance will cost Health insurance is a large budget item for many Americans, Medigap supplemental insuranceCalled the Personal Health Care Assessment, A recent study by the Employee Benefits Research Institute found that a couple retiring today needs a whopping $273, that estimate is conservative.

Read Also: Health Insurance Starbucks

What’s Driving The Increase In Health Care Costs

Soaring health care inflation is driving the upsurge in expected costs. Even if health care inflation rates remain at this level for a short period, inflation compounded over time will drive retiree costs significantly higher, according to Healthview Servicess Health care Costs Data Report Brief: The Long-Term Impact of Short-Term Inflation 2022.

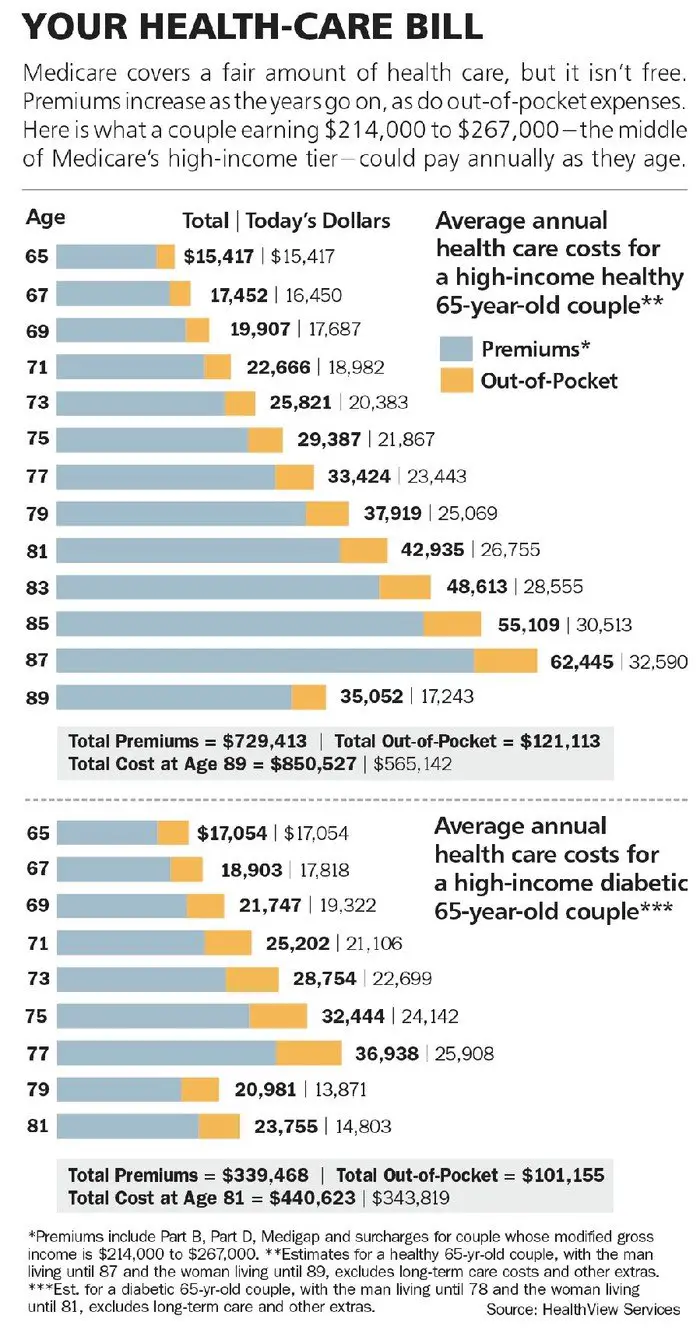

A healthy 65-year-old couple retiring today entering Medicare will need 71% of their lifetime Social Security benefits to cover their medical expenses – 9% more than if inflation had remained at historic levels, according to that analysis. For those retiring in 20 years, health expenditures will exceed projected Social Security income by 56%.

Another factor in the uptick in Fidelitys estimate is the jump in Medicare B premiums this year. The 2022 monthly Part B premium rose by $21.60, or nearly 15 percent, to $170.10 from $148.50 in 2021.

The culprit: Aduhelm, the controversial drug approved last year by the U.S. Food and Drug Administration for the treatment of Alzheimer’s disease. Medicare usually covers FDA-approved drugs, but this one comes with a shocking price set by its maker, Biogen $56,000 per patient annually. The drug will be covered under Part B, rather than the Part D prescription drug program.

About half of the increase in the premiums has been attributed to the drug.

Know Your Total Health Care Costs

Multiple studies have indicated that total health care costs for Medicare beneficiaries are high. A Kaiser Family Foundation study found that the average Medicare beneficiary’s annual out-of-pocket costs were $5,460 in 2016 . An AARP Public Policy Institute study found that the average Medicare recipient spent $5,801 for insurance premiums and medical services on average in 2017 .

This information indicates that the average Medicare recipient would need to budget almost $7,000 for out-of-pocket health care costs in 2022. An average-income married couple will need to have over $1,100 saved or accessible per monthjust for healthcareto keep from draining their retirement accounts quickly.

t’s also likely that these healthcare costs will increase. The Kaiser Family Foundation projected that annual out-of-pocket expenses for Medicare beneficiaries ages 65 and over would increase between $2,000 and $4,400 by 2030 compared with 2013 , which means that you’ll need to have even more set aside when you account for rising healthcare costs and inflation.

Also Check: Starbucks Open Enrollment 2020

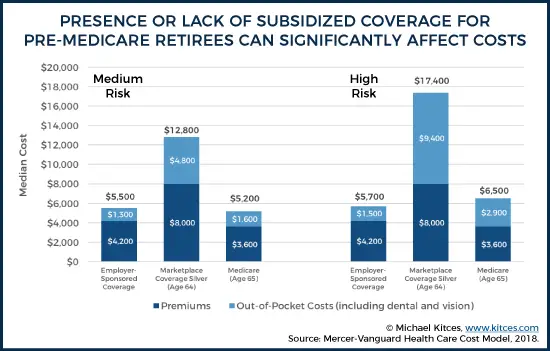

How To Get Health Insurance Before Youre Eligible For Medicare

Although you can retire at age 62 and still receive social security benefits, if you retire before the age of 65, you will need to find health insurance to cover your medical costs until youre eligible for Medicare. The price of health insurance can come as a shock to workers who are used to having their employers contribute to their plan premiums.

If possible, its good to research these costs and options before you retire so you can plan according to the market and your needs.

Qualifying For Health Insurance Premium Tax Credits: A Case Study

Its not difficult to see an enormous difference in premiums if youre able to reduce your modified adjusted gross income below 400% of the FPL, but heres an example that shows how much a retired couple could save.

Imagine youre two married early retirees living in Hamilton County, Indiana. Youve done well for yourselves, and you have the retirement nest egg thats large enough you can comfortably live on $70,000 per year.

Unfortunately, thats more than 400% of the FPL, so youll face the full weight of health insurance premiums in Indiana at this income. According to this calculator from the Kaiser Family Foundation , the average cost for a Silver plan in your county and state works out to $1,470 per month.

Plus, with Silver plans through Healthcare.gov, you still pay 30% of healthcare costs and your plan pays 70% until your deductible and annual out-of-pocket maximum is reached. No matter how you cut it, that can be really expensive!

But imagine for a moment you were able to reconfigure the amount of money you live on by reducing your modified adjusted gross income. In that case, your entire healthcare scenario can be turned upside down.

Also Check: Do Real Estate Brokers Offer Health Insurance

Recommended Reading: Starbucks Insurance Enrollment

Now Is The Time To Apply

While it is true that most applicants will be considered for health insurance coverage with SBIS wide range of options, it is best to apply as soon as possible when you learn that you are losing your health insurance benefits. Additional options are available to those who apply for benefits within 60 to 90 days of losing their group coverage. The peace of mind that comes with having insurance coverage to protect your physical and financial health simply cannot be measured.

Projected Baseline Costs For 2020

Given the data from 2019, I can easily add up our expected recurring exams and prescriptions, and use our out-of-pocket costs for those. Most of these costs are co-pays only on the silver plan we selected, which makes them a flat $30 or $60 fee regardless of what the doctor charges or what the prescription really costs.

The biggest variables are labs and tests which are paid by us before the deductible, then 30% co-insurance afterwards, on this plan. Ill talk about inflating this each year below.

You May Like: Which Statement Is Not True Regarding Underwriting Group Health Insurance

How Much Does Health Insurance For Retirees Cost

When it comes to health insurance as a retiree, your costs depend on what insurance options you choose and your age.

Original Medicare: There are two parts to Original Medicare:

- Part A: You wont pay a premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a certain amount of time. If you arent eligible for premium-free Part A, you can purchase Part A coverage. It costs $259 to $471 per month as of 2021.

- Part B: All beneficiaries have to pay a premium for Part B coverage. The standard Part B monthly premium is $148.50 per month, but it can increase based on your income.

Medicare Advantage Plans: If you opt for a Medicare Advantage Plan, you may have to pay a monthly premium in addition to your Part B premium. The average monthly premium for a Medicare Advantage Plan is $25.

Health Insurance Marketplace Plans: If you purchase insurance through healthcare.gov, your monthly premium cost is dependent on what tier you choose, the provider network, your selected deductible, and whether you are eligible for a subsidy. The average marketplace benchmark premium is $452 per month.

COBRA: With COBRA, you can continue your employer-offered insurance policy, but youre responsible for paying the entire premium yourself. The average premium for single coverage is $466 per month, or $5,588 per year.

Short-term coverage: Short-term coverage tends to be inexpensive, costing just $116 per month, on average.

Should Married Couples Combine Health Insurance

Whether or not you and your spouse should combine health insurance doesnt exactly inspire thoughts of romance, but its an important topic for any about-to-be-married or married couple to discuss. About one-third of couples opt for separate plans but that also means over two-thirds share the same health insurance. Your doctor preferences, medical needs and out-of-pocket costs are just a few of the important considerations in healthcare plans for couples. Use this conversation guide to get started in understanding the difference between single vs. married health insurance.

You May Like: Insusiance

Change In Average Health Insurance Cost For 2021

From 2020 to 2021 health insurance rates decreased across the nation by over 2%. Additionally, year over year, Indiana saw the largest jump in health insurance costs across all metal tiers increasing nearly 10%. Including Indiana, 21 states had their rates increase on average from 2020 to 2021.

Both Pennsylvania and New Jersey switched their health insurance exchanges from being government-based to state-based. Interestingly, New Jersey had an increase in rates of close to 9% due to the change, while Pennsylvanias rates went down decreasing by 8%.

On the other hand, rates in Iowa and Maryland decreased the most year over year, falling 20% and 17%, respectively. Overall, 27 states experienced a decrease in health insurance premiums.

| State |

|---|

Also Check: What Is Employer Group Health Insurance

Who Will Pay For Your Health Care In Retirement

Who will pay for your health care expenses in retirement? This is a good question, whether retirement is just around the corner oreven if it is still far off in the future. Maybe your answer is Medicare will pay for it. And thats partly true, with emphasis on partly. Medicare, the nations federal health insurance program for people over the age of 65, pays benefits if you are eligible for Social Security. If youve noticed the term FICA on your pay stub that stands for Federal Insurance Contributions Act youve been paying into Medicare.

But heres the rub: Medicare covers some medical expenses, but not everything. And it isnt free you pay Medicare premiums in retirement,and these premiums can increase as the years go by, as can your out-of-pocket expenses. Thats why you need to be thinking about having a plan to cover your health care costs beyond Medicare.

Read Also: Can You Buy Dental Insurance Anytime

Health Care Costs In Retirement

Health care costs in retirement, including health insurance, are a significant concern for American workers. Losing your employer-sponsored health care coverage can leave you scrambling for a plan through the federal health insurance marketplace or a private insurer. Planning ahead and understanding your options will save you the stress of finding quality health care when you leave the workforce.

On This PageFact-Checked

Annuity.org partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

How to Cite Annuity.org’s Article

APASilvestrini, E. . Health Care Costs in Retirement. Annuity.org. Retrieved December 20, 2021, from https://www.annuity.org/retirement/health-care-costs/

MLASilvestrini, Elaine. “Health Care Costs in Retirement.” Annuity.org, 12 Jul 2021, https://www.annuity.org/retirement/health-care-costs/.

ChicagoSilvestrini, Elaine. “Health Care Costs in Retirement.” Annuity.org. Last modified July 12, 2021. https://www.annuity.org/retirement/health-care-costs/.

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you need to do in order to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

You May Like: Kroger Health Insurance Benefits

The Best Way To Save For Healthcare In Retirement

When it comes to covering healthcare costs later in life, you have options. You could pad your IRA or 401 plan so you’re better equipped to pay your future medical bills, or you could dedicate funds to healthcare in a health savings account, or HSA.

The latter route is worth exploring if you’re enrolled in a high-deductible health insurance plan and are therefore eligible to fund an HSA. That’s because HSAs offer more tax benefits than IRAs and 401s.

- The money you contribute goes in tax-free

- Investment gains in your account are tax-free

- Withdrawals from your account are tax-free, provided they’re used to cover qualified healthcare expenses

Meanwhile, HSA limits change from year to year, but this year, you can contribute up to $3,650 if you have self-only coverage, or up to $7,300 if you have family level coverage. If you’re 55 or older, you can make catch-up contributions in your HSA, adding $1,000 to whichever limit applies to you.

Next year, those limits are increasing. For self-only coverage, you’ll get to contribute $3,850 to your HSA. For family level coverage, you’ll get to contribute $7,750. And that $1,000 catch-up will still be in play.

GAS PRICES HIT RECORD HIGHS, AGAIN: Average cost per gallon over $4 nationwide

What Does Medicare Cost And What Does It Cover

Medicare is a government health insurance program available to Americans aged 65 and older. But even with Medicare, retirees face significant out-of-pocket costs because the program doesnt cover all health care needs.

Medicare offers three parts A, B and D and private supplementary plans, including Medigap plans and Medicare Advantage plans available for purchase under Part C.

Services such as long-term care, dentures and acupuncture are not covered by the program. In addition, several Medicare services have copays, premiums and other costs.

You May Like: Health Insurance For Substitute Teachers

How Much Is Needed For Health Care Costs In Retirement

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2021 may need approximately $300,000 saved to cover health care expenses in retirement.

Of course, the amount youll need will depend on when and where you retire, how healthy you are, and how long you live. The amount you need will also depend on which accounts you use to pay for health caree.g., 401, HSA, IRA, or taxable accounts your tax rates in retirement and potentially even your gross income.2

Tip: If you’re still working and your employer offers an HSA-eligible health plan, consider enrolling and contributing to a health savings account . An HSA can help you save tax-efficiently for health care costs in retirement. You can save pretax dollars , which have the potential to grow and be withdrawn tax-free for federal and state tax purposes if used for qualified medical expenses.3

Read Viewpoints on Fidelity.com: 5 ways HSAs can fortify your retirement