Do Small Businesses Have To Pay For Health Insurance

Small businesses dont need to offer health insurance to employees under the ACA. In 2018, only businesses with fifty or more employees are required to provide full-time equivalent employees and their family members or other dependents with minimum essential health care coverage.

Why Did Employers Start Offering Health Insurance

To combat inflation, the 1942 Stabilization Act was passed. Designed to limit employers freedom to raise wages and thus to compete on the basis of pay for scarce workers, the actual result of the act was that employers began to offer health benefits as incentives instead.

How Much Does Employer Health Insurance Cost A Small Business

Only companies with at least 50 full-time employees and that qualify as an ALE, or applicable large employer, risk a penalty if they dont offer qualified group health insurance.

The IRS defines an ALE in great detail. These are some examples of ALE qualification besides the minimum number of employees:

- The IRS bases qualification on the average employee census for each month of the previous year.

- An ALE has to pay a penalty if at least one employee gets a tax credit for their own individual insurance from the Marketplace.

- To keep from paying a penalty, the plan has to meet government standards for affordability and value.

Don’t Miss: What Is A Health Insurance Plan

Employers Particularly Those With Younger Leaders Dont See The Logic In Providing Healthcare

Unless you grew up in this system, it doesnt make a lot of sense. Health insurance is important and impacts peoples ability to access the care that they need for their specific family and health situations. Why should something so personal and important be tied to where you happen to work?

When employers make decisions about health insurance plan designs, they are balancing the needs and wants of a diverse employee population with a few, limited, one-size-fits-all options.

Each year, employees must go through the often-confusing process of open enrollment. As the overall costs of healthcare have risen, so too has the employees share of costs. As employees enroll in benefits, they are often left feeling that they are spending more of their income on insurance that doesnt provide as much value as it used to. That can have a negative impact on employee job satisfaction ratings.

Providing health insurance to employees places a financial burden on employers, as well. Cost-sharing falls primarily on employers, with a Kaiser Family Foundation report finding that in 2019, the average employer paid $7,188 per employee for single coverage and $20,576 per employee for family coverage.

Employee Health Insurance: How Much Should The Employer Pay

Health insurance is a benefit most full-time employees expect, but businesses struggle to find the right balance between cost and benefit.

By: Sean Peek, CO Contributor

There are several ways that small businesses can offer employee health insurance benefits in an affordable manner.

Health insurance is a standard benefit that many full-time employees expect from their employers. However, for many businesses, this often means devising the best way to offer this benefit while keeping costs as low as possible.

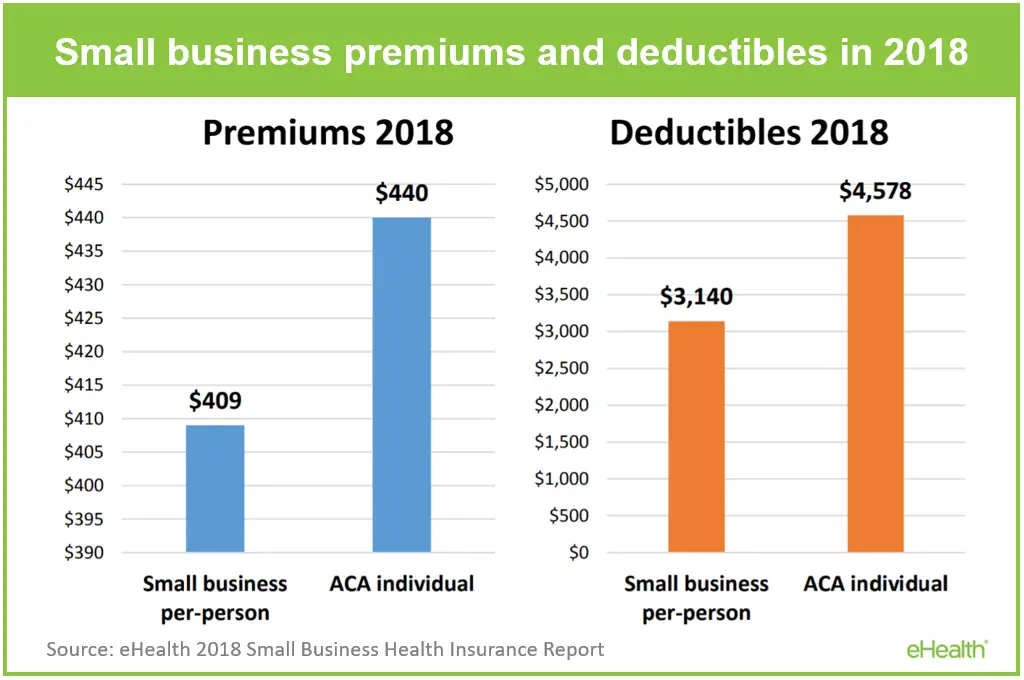

Reports have indicated that 2018 employer health insurance costs are up 5% from 2017, so its crucial to find a plan that not only works for your employees, but for your businesss long-term health as well.

If youre looking to provide health insurance to your employees, or you want to change your existing offering, its important to understand the various plans and costs associated with the process.

You May Like: What Is The Cheapest Health Insurance In Florida

How Many Small Businesses Offer Employer

When considering the costs of health coverage for employees, small business owners may wonder how common it is to provide an employer-sponsored plan.

According to the KFF survey, 57 percent of all firms offered health benefits, while 71 percent of firms with 10 to 199 workers offered health coverage in 2019. The percentage was lower for very small groups, with the survey noting that only 47 percent of firms with 3 to 9 workers offered health coverage to their employees.

Source: Kaiser Family Foundation 2019 Employer Health Benefits Survey

Given that only about half of small businesses offeremployer-provided health insurance, companies that do offer this popular employee benefit have a competitive advantage. Offeringhealth insurance may be one way to stand out from other employers whilecontributing to a companys recruiting strategy and employee benefits package.

Overall, the KFF survey notes that trends in the employer-providedhealth insurance market have been moderate over the past several years.Premiums have increased annually, but in the low to mid-single digits,and cost sharing, especially for deductibles, has meaningfullyincreased over time.

Factors That Determine Your Employer Health Insurance Costs

Many factors go into determining a business health insurance cost. Employers must take these factors into account when researching different employee health plans.

Average Employee Age: An older workforce will command higher premiums. This is simply because younger people are less likely to make a significant claim for healthcare costs.

Location: Healthcare costs differ by state, as does the general cost of living. However, geographical healthcare costs cannot be determined by the general health of a town, city, or states population.

Tobacco Usage: In most states, insurers can add tobacco surcharges for those employees who smoke. There are just a few states that outright ban tobacco surcharges on employer health insurance plans.

Family Size: When family plans are offered, employer health care costs rise as insurers are permitted to increase premiums based on family size. The larger your family, the more youll pay under these plans.

Under the terms of the Affordable Care Act , insurers are not able to factor in the medical histories of enrollees, gender, medical claims history, or the industry the business operates in.

Don’t Miss: How Do I Get A Health Insurance Card

The Most Common Option: State Or Federal Online Marketplaces

These marketplaces, including the federal Small Business Health Options Program, or SHOP, are typically available to small businesses with 50 or fewer full-time equivalent employees. Marketplaces in California and Colorado are open to businesses with 1-100 employees.

A calculator to figure out your full-time equivalent count is available here. Just be warned that a full-time employee is one who, in the past calendar year, averaged just 30 hours a week in a month. And oddly, while you have to count part-time workers hours toward your full-time tally, you dont have to offer them health insurance, even if you have more than 50 workers.

The online marketplaces offer a set number of plans from private insurance companies that are geared to the pocketbooks of small businesses.

A small business can enroll any time during the year as long as enough of its employees participate in its plan or have coverage elsewhere. A calculator for that is here. Otherwise, your small business can sign up during open enrollment between Nov. 15 and Dec. 15 any year.

Changing From Family Plan To Single Plan

A single plan is simple enough to figure out with COBRA. It gets a bit more complicated if you need to switch from a family plan to a single plan. This can happen if you get divorced or turn 26 and are no longer eligible for coverage on your parents plan.

In instances like these, the HR officer will look up the rate for single coverage on the same health plan you are currently enrolled in. To calculate the COBRA cost, the HR officer will have to determine:

- What you would have been contributing to an individual plan. If you are a family member , your contribution would typically be higher than the employee . In some cases, dependents may be responsible for the entire amount if the employer does not contribute to family coverage.

- What the company would have been contributing toward that premium. If you are the employee , the amount should be clear-cut. If you are the dependent, the contribution can vary depending on the employer.

After adding these two figures together, you would add another 2% to calculate your total COBRA premium costs.

Don’t Miss: What State Has The Cheapest Health Insurance Rates

What Is Individual Health Insurance

Individual health insurance is just another term for private coverage as opposed to a group plan . Its simply the kind you get on your own, even if youre including family members on your plan.

You might be looking for individual health insurance for a couple different reasons. If your employer doesnt offer it, if its too expensive or if youre retiring before the age of 65. Youll also need it if you work part time, youre unemployed or self-employed.

Plans offered in the marketplace are also examples of individual health insurance.

Now . . . lets dig into the numbers.

Do Employers Have To Cover Family Members

With a group insurance plan, employers usually offer coverage to legal spouses and dependent children.

The ACA requires you to provide dependent coverage to age 26. If you do not, you might have to pay a penalty. You can choose to cover dependents over 26 years old, but you are not required to.

Employers are not obligated to pay premiums for dependents. However, you can contribute towards premiums for dependents. Or, you can require employees to pay the full premium cost for dependents.

You are not required to cover your employees spouses. Some companies decline coverage when a spouse can receive insurance from their own employer. Or, they might charge the employee more to cover the spouse.

According to the Kaiser Family Foundation, most small businesses pay part of their employees family plans. Compared to single plans, small employers usually pay the same amount or more:

- 45% provide the same dollar contribution for single and family plans

- 45% make a higher dollar contribution for family plans than single plans

- 3% vary their approach with the class of the employee

- 7% take a different approach

On average, small businesses contribute more to single coverage but less for family coverage than large companies do. Employees of small firms pay $1,021 for single coverage vs. the large firm cost of $1,176. Small firm employees pay $6,597 for family coverage vs. the large firm cost of $4,719.

You May Like: Will Health Insurance Go Down

The Two Types Of Hras That Business Owners Need To Know About

Lets look at them briefly.

The individual coverage HRA has several advantages over traditional group plans that may be appealing to some employers. For instance, the reimbursement model gives employers greater ability to control costs and provides employees with more options to choose from. Key advantages of the ICHRA include:

- Works for businesses of any size

- Can reimburse both premiums and expenses

- Note the reimbursement limits

Regulatory Changes Have Opened Up New Possibilities

Weve already seen the need for more flexibility in health benefits with the introduction of the Individual Coverage Health Reimbursement Arrangement . ICHRAs are designed to allow employers of all sizes to give employees pre-tax dollars to use to buy the insurance coverage that best fits their needs on an individual basis, instead of offering group coverage under the Affordable Care Act . By making a defined contribution toward coverage, employers can control rising healthcare costs and get out from under the administrative burden of administering health benefit programs while still giving employees greater flexibility, by allowing them to choose their coverage from a much wider array of options. This is very similar to the shift we saw in retirement benefits, from pension funds to 401ks.

The factors above have all led to increased discussion around the shift away from employer-sponsored health insurance. And consumers are showing theyre ready for the change, with data revealing that 41% of consumers say they think health insurance should be decoupled from employment. As business leaders look ahead to the next couple of years, with their employees as their guide, we have an opportunity to meet the moment and reimagine what health insurance looks like.

Also Check: How Do Subsidies Work For Health Insurance

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

Read Also: What Is The Most Affordable Health Insurance

How Buying Private Health Insurance Works

Some Americans get insurance by enrolling in a group health insurance plan through their employers.

Medicare provides health care coverage to seniors and the disabled, and Medicaid has coverage for low-income Americans.

Medicare is a federal health insurance program for people who are 65 or older. Certain young people with disabilities and people with end-stage renal disease may also qualify for Medicare. Medicaid is a public assistance healthcare program for low-income Americans regardless of their age.

If your company does not offer an employer-sponsored plan, and if you are not eligible for Medicare or Medicaid, individuals and families have the option of purchasing insurance policies directly from private insurance companies or through the Health Insurance Marketplace.

Your Parents Or Spouses Health Insurance Plan

Many employers allow a person to add spouses and children to their health insurance plans.

This is a great option for stay at home parents, children that havent found jobs yet or even a spouse between jobs.

An employer does not have to subsidize coverage for family members even if they subsidize coverage for their employees.

That means:

The additional cost to add a spouse or child to a policy could be much different than the premium for the employee only.

A spouse or child can be added during the plans annual open enrollment period.

If you lose coverage due to a qualifying event, you may be able to get health insurance from your spouse or your parents during the year, too.

Your spouse or parent can inquire with their companys HR department to see what options they have. If youre trying to qualify for insurance through a qualifying event, act fast.

Qualifying events may only allow you to make changes for 30 days. This can be different from marketplace health insurance.

Recommended Reading: What Is The Average Monthly Cost Of Health Insurance

How Much Do Companies Pay For Employer Health Insurance

A number of small business owners fear that offering employer health insurance will hurt their bottom line. For instance, they worry that paying a share of premiums will hurt profits or even force them to reduce the number of workers they must cover. On the other hand, an eHealth survey found that many employers believed a small business health plan benefited their business by reducing turnover and keeping employees healthy.

Before any small business owners can weigh the pros and cons of providing group medical benefits, they should understand all of the costs and benefits of their choice to provide employer health insurance or not. Also, some employers may pay higher taxes or miss tax credits if they fail to offer qualified group health plans.

How Do Health Insurance Companies Determine Employer Costs

Age, gender, tobacco use, family size, claim history, business size understand which factors impact health insurance costs.

No account yet? Register

Studies show that 56% of small businesses offer health insurance to at least a portion of their employees. Whether youre part of that group or intend to be at some point you should know the factors that drive employer premiums. This will help you effectively manage your costs.

Assuming the health insurance plan is fully insured, how does the insurer arrive at the employers rates?

The first thing to understand is that if your business is a small employer/group, the insurance company must follow the Affordable Care Act , plus applicable state regulations when calculating the cost of health insurance.

You May Like: Can Federal Employees Keep Their Health Insurance After Retirement

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.