Small Business Health Insurance Options

Thanks to the ACA, small business owners can buy health insurance for their employees through approved insurance companies with the Small Business Health Options Program . Getting insurance through the SHOP Marketplace allows employers to offer health plans from multiple insurance companies and qualifies them for the Small Business Health Care Tax Credit, which can help with the cost of providing coverage.

Small business owners can also work with an insurance broker who conducts all plan research and comparisons to find the best plan for your business at no additional charge.

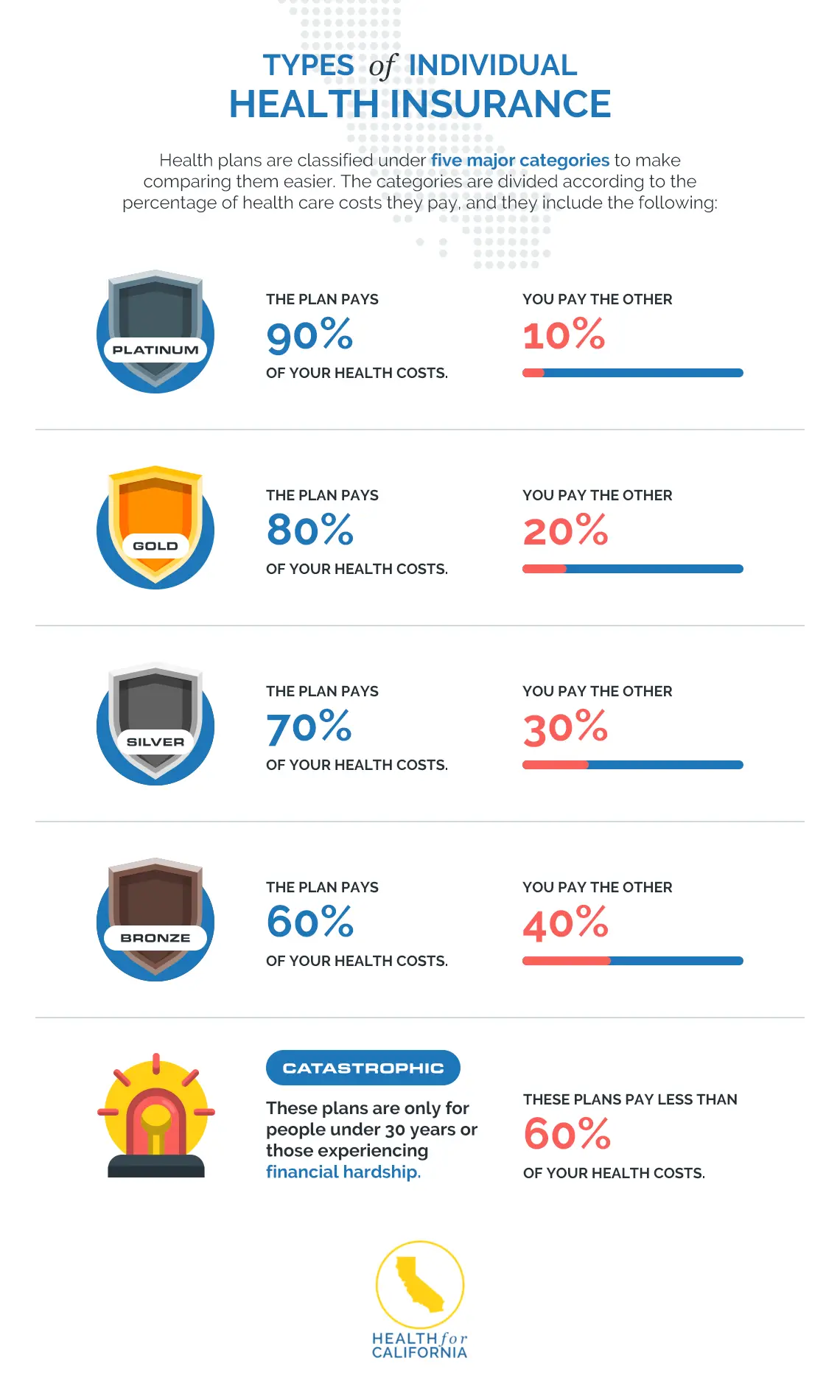

Group plans for small businesses are organized by metal tiers: bronze, silver, gold and platinum. Each tier features different premiums, deductibles, copays and out-of-pocket limits, catering to people who prefer to pay higher monthly premiums for more extensive coverage and those whod rather pay a lower monthly premium and risk higher coverage costs in the event that they need to seek care. Employers have flexibility in which type of plans they choose to offer their employees.

What Are Preferred Provider Organizations

PPOs typically offer you a large network of participating providers so you have a lot of doctors, hospitals, and other health care professionals and facilities to choose from. You may also choose to see providers from outside of the plans network, but you will pay more out-of-pocket.

Choosing a primary care provider is not required with these types of health plans, and you can see specialists without a referral.

Blue Cross Blue Shield: Best Health Insurance Company Overall

Reasons to avoid

The expansive nature of the Blue Cross Blue Shield network works both for and against the company. The vast amount of resources available to customers and its accessibility across all 50 states is a huge plus, and the health insurance provider goes to some lengths to make its customer-facing operations as easy to use as possible.

The fact that customers will be serviced by the local healthcare partner does mean that experiences can vary significantly depending upon which state they live in. These regional differences are definitely a factor in choosing the best health insurance for you, but in general, the fact that Blue Cross Blue Shield is accepted at such a large number of medical facilities is the winning factor. This makes it our top pick when it comes to best health insurance providers.

Don’t Miss: Does Health Insurance Cover Baby Formula

Check Out The Health Insurance Plans From Icici Prudential Life Here

Link:

ICICI Pru iProtect Smart

* This benefit is payable, on first occurrence of any of the covered 34 illnesses. The Critical Illness Benefit is accelerated and not an additional benefit which means, the policy will continue with the Death Benefit reduced by the extent of the ACI Benefit paid. Premium payment on account of ACI Benefit will cease after payout of ACI Benefit and the future premiums payable under the policy for death benefit will reduce proportionately. If ACI Benefit paid is equal to the Death Benefit, the policy will terminate on payment of the ACI Benefit. In case of incidences covered under accidental Permanent Disability as well as Critical Illness, benefits shall be paid out under both the options. In case no ACI Benefit is triggered within the ACI Benefit term, then ACI Benefit will terminate and premiums corresponding to it will not be payable. However you would be required to pay premiums for all other Benefits to keep the policy in force. The ACI Benefit for Angioplasty is subject to a maximum of `5,00,000. On payment of Angioplasty, if the ACI Benefit is more than `5,00,000 the policy will continue for other CIs with ACI Benefit reduced by Angioplasty payout. The future premiums payable for the residual ACI Benefit will reduce proportionately.

*For further details, please refer to the information provided in the product brochure. ICICI Pru iProtect Smart UIN 105N151V06.

Best For Telehealth Care: Cigna

Cigna

Cigna has excellent financial strength ratings, and out-of-network approvals are not required. It has excellent telehealth services available to members.

-

Out-of-network care available without a referral

-

Telehealth services

-

Limited coverage area

Cigna is a global health insurance provider and offers private health insurance in 13 U.S. states: Arizona, Colorado, Florida, Georgia, Illinois, Kansas, Mississippi, Missouri, North Carolina, Pennsylvania, Tennessee, Utah, and Virginia. It has an A financial strength rating from AM Best. Referrals for out-of-network care may or may not be required depending on your plan. The greatest savings are realized by using an in-network provider.

Plan options, deductibles, and co-pay options vary by state. High-deductible plans are available along with HSA plan options. Policyholders can search plan network doctors, estimate costs, check claims status, and get insurance ID cards all online.

There are several attractive member benefits, including access to a home delivery pharmacy, health information helpline, rewards programs, flu shot information, and the Cigna telehealth connection program, which allows you access to board-certified telehealth providers, including Amwell and MDLIVE.

Read the full Cigna insurance review.

Recommended Reading: Does Kroger Give Employee Discounts

Best For Medicare Advantage: Aetna

Aetna

An impressive 36 Aetna Medicare Advantage plans sold in 30 states, plus the District of Columbia, received top NCQA ratings in 2021, with Connecticut and Maine being standouts. In 2020, Aetna Medicare Advantage Prescription Drug plans were made available in 264 new counties across the country, providing millions more Medicare beneficiaries access to an Aetna plan.

The insurer also sells Medicare supplement plans in all 50 states. In addition to these, they also offer a combination dental, vision, and hearing supplemental Medicare product in many states.

In the private arena, Aetna is a large provider of employer-based health insurance. A total of five Aetna plans serving Iowa, Pennsylvania, Wisconsin, and Rhode Island made the top NCQA ranks in 2021, and the 2021 J.D. Power U.S. Commercial Health Plan Study ranked Aetna plans second-highest in Ohio, Maryland, and Virginia. In addition, Aetna’s pricing seems to be lower than many competitors’ pricing.

In November 2018, Aetna became part of CVS Health Company, and synergies between the two are beginning to emerge. For example, Aetna medical plan subscribers with high blood pressure can get a free home monitor at CVS. Chronic disease monitoring may also be available at CVS stores.

Factors That Drive Health Insurance Costs

On an individual level, there are certain factors that affect health insurance costs. The predominant factors are:

- Location: The state you live in or even your zip code can affect health insurance rates.

- Age: Health insurance becomes increasingly expensive as you get older.

- Smoking: The ACA permits insurers to charge smokers more for health insurance. The difference in cost between a smoker and non-smoker can be as high as 50%, although this amount often varies by state and some states prohibit the practice.

You May Like: Starbucks Employee Health Insurance

Best Large Provider Network: Blue Cross Blue Shield

Blue Cross Blue Shield

BCBS members have access to plans through health maintenance organizations , exclusive provider organizations , and preferred provider organizations .

BCBS health care organizations offer nationwide coverage, and six of its companies were included in the top 15 best health insurers by Insure.com. Of those six, the ones that have AM Best ratings for financial strength received an A or better.

-

No matter where you live, there is a health care facility provider who accepts BCBS in your state.

-

There are many policy options and there is a plan available no matter how much coverage you may want.

-

Customers have rated various BCBS companies less than 3.5 stars on Consumer Affairs. The complaints include difficulty in getting medical procedures approved, coverage denials, and limited PPO choices.

The Blue Cross Blue Shield Association offers private health insurance coverage in the United States and over 170 countries. Over 110 million Americans have their health insurance through a BCBS organization. There are 35 BCBS independent health insurance companies in the U.S., and most have an AM Best financial strength rating of A .

The HMO plans offer the most comprehensive plans at the greatest savings but limit doctor choices to those inside the HMO. The EPO plan uses select provider networks and incorporates policies that promote and manage member health care. On the other hand, the PPO plans offer more flexibility with a great number of participating doctors.

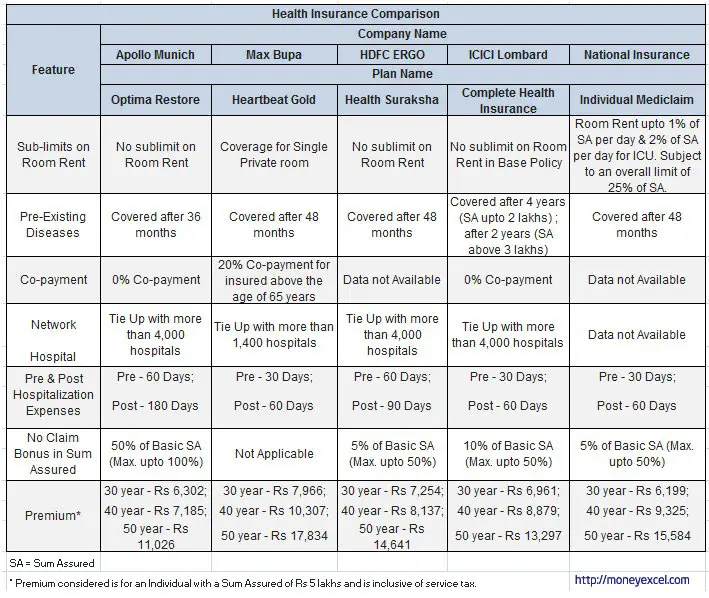

Is There Any Specific Parameter To Find Out The Best Health Insurance Plan

No, there is no such parameter that decides the best health insurance plans. Selecting the best health insurance policy amongst a plethora of choices can be confusing which is why the policies that offer you factors like health insurance riders, benefits, coverage, network hospitals and more can be considered the best health insurance policy. Also, you should pay attention to the claim settlement ratio of the company you are purchasing the policy from.

Don’t Miss: Starbucks Health Insurance Cost

What Are Health Insurance Plans

Health insurance plans reimburse insured customers for their medical expenses, including treatments, surgeries, hospitalisation and the like which arise from injuries/illnesses, or directly pay out a certain pre-determined sum to the customer. A health insurance policy offers coverage for any future medical expenses of the customer.

This is an agreement between the insurance company and the customer where the former agrees to guarantee payment/compensation~ for medical costs if the latter is injured/ill in the future, leading to hospitalisation. In most cases, insurance companies have tie-ups with a network of hospitals, thereby ensuring cashless treatment for patients there.

How To Find The Health Insurance Plan Thats Right For You

Choosing a health plan can be complicated. We can help you understand how to compare Marketplace plans and choose one thatâs right for you.

Here are some important things to consider when choosing a plan:

-

Plan category: There are 5 categories of Marketplace insurance plans: Bronze, Silver, Gold, Platinum, and Catastrophic. The health plan category you choose determines how you and your plan share the costs of care.

-

Monthly premiums: This is the amount you pay your insurance company for your plan whether you use medical services or not. Monthly premiums are important, but theyâre not all you need to think about.

-

Out-of-pocket costs: Itâs important to know how much you have to pay out of your pocket for services when you get care. You pay these out-of-pocket costs in addition to your monthly premiums.

-

Type of insurance plan and provider network: Different plan types provide different levels of coverage for care you get inside and outside of the planâs network of doctors, hospitals, pharmacies, and other medical service providers.

-

Benefits: All plans sold through the Marketplace provide the same essential health benefits, cover pre-existing conditions and offer free preventive services.

Now that you know what to look for you can preview plans and prices in your area and apply online. It takes most people 20 minutes or less to apply.

But remember that you only have a few days left to enroll in 2014 coverage â open enrollment ends March 31.

Don’t Miss: How To Keep Insurance Between Jobs

Applying For Health Insurance Doesn’t Have To Be Confusing Here’s A Handy Glossary

Whether you’re aging out of your parent’s plan and picking one for the first time, or you’re in a plan that no longer works for you and you’re ready to switch things up, or you’re uninsured and want to see if you have any workable options, there’s good news. Asking yourself a few simple questions can help you zero in on the right plan from all those on the market.

Here are some tips on where to look and how to get trustworthy advice and help if you need it.

Important Information About This Website

finder.com.au is one of Australia’s leading comparison websites. We compare from a wide set of banks, insurers and product issuers. We value our editorial independence and follow editorial guidelines.

finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don’t cover every available product or service.

Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn’t a substitute for professional advice. You should consider whether the products or services featured on our site are appropriate for your needs. If you’re unsure about anything, seek professional advice before you apply for any product or commit to any plan.

Where our site links to particular products or displays ‘Go to site’ buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money here.

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Don’t Miss: Evolve Health Insurance Company

Health Insurance For 55 And Older

Contents

More than fifty percent of US citizens did not have life insurance in this year. Buying life insurance for people over 50 can be more challenging than it is for younger people.

As you reach the age of 50, it can become more difficult to find suitable policies and make premium plans less accessible. Weve reviewed and rated vendors based on factors such as price, coverage limits, benefits, and ease of application process to make our best decisions.

Read on to find out which companies made our list of the best life insurance companies for people over 50.

I Am A Cancer Patient How Do I Choose The Best Health Insurance Policy For Me

A cancer policy is specifically designed to meet the insurance needs of a cancer patient. However, if you are already suffering from cancer, you will not be covered under a cancer specialist policy.

On the contrary, if you have cancer in your family history, or you might feel that you may get this unfateful disease due to your lifestyle, it is better to be prepared in advance. Along with your standard health plan, you can buy the best cancer specific policy that will protect you as well as your finances during such dreadful times.

Read Also: Can You Buy Dental Insurance Anytime

How To Apply For Medicaid

You can apply online on your state Medicaid website. If you dont want to use the online portal, you can refer to your state website to see if a paper application is available. You can also visit the Health Insurance Marketplace at healthcare.gov to check your eligibility and apply.

Below are a list of items you will need to apply for Medicaid:

-

Birth certificate, passport, or other documents that show proof of citizenship

-

State ID, drivers license, and other documents that show proof of age and identity

-

Recent pay stubs and tax returns

-

Utility bills or rent to prove your residence

-

Medical records if applying for disability

After you complete your application, you will receive your letter of eligibility. This will let you know if you are eligible for Medicaid. You can appeal the decision if you receive notification that you dont qualify.

How To Find An Affordable Plan That Meets Your Needs

Among eHealth customers who bought ACA individual health insurance, more than 75% chose Bronze or Silver plans. Your state may host an exchange for comparing and purchasing ACA plans or it may use the federal exchange at Healthcare.gov. Keep in mind, you arent limited to the exchange.

The licensed insurance brokers at eHealth can help you find the best health plan to meet your health coverage needs and your budget. They will listen to your priorities in health coverage and use their expertise to match your needs with health insurance options both on and off the exchange.

Read Also: Kroger Health Insurance Part-time

If Your Employer Offers Health Insurance

Most people with health insurance get it through an employer. If your employer offers health insurance, you wont need to use the government insurance exchanges or marketplaces, unless you want to look for an alternative plan. But plans in the marketplace are likely to cost more than plans offered by employers. This is because most employers pay a portion of workers insurance premiums.

Match Your Consumption To Your Deductible

Many experts recommend high-deductible plans for healthy people who rarely visit the doctor, since premiums for these plans are lower. But high-deductible plans also can be a good fit for people who need a lot of health care, says Carolyn McClanahan, a physician and certified financial planner in Jacksonville, Florida.

Parents of young children or people who have chronic health conditions often spend so much on care that they can easily meet a higher deductible, McClanahan says. Many high-deductible plans qualify for tax-advantaged health savings accounts, as well.

These plans arent a good fit, however, for people who would put off necessary care rather than pay out of pocket. If you dont have enough savings to cover medical costs until the deductible is satisfied, consider spending more for a lower-deductible plan.

Just dont pay an extra $500 to lower your deductible by $250, as many people did in that first study. If youre allowed to choose different deductibles for the same plan, multiply the difference in premiums by 12 to get your yearly cost and compare that to the difference in deductibles.

Also Check: Starbucks Benefits For Part Time Employees

How Does Small Business Health Insurance Work

The Affordable Care Act defines a small business as a group of no more than 50 full-time employees , though some states define it differently. California, for instance, categorizes small businesses as employers of no more than 100 FTE. Small business owners arent legally required to provide health insurance to their workers, but there are rules for those who do.

A small business owner enrolls in a group health insurance plan offered by a private insurance company and then offers their employees the opportunity to enroll in that plan. The employer pays part of their employees monthly premiums, and the employees are typically responsible for their deductibles, copays and services not covered by the plan.