Top 10 Most Expensive States For Health Insurance

| State | |

|---|---|

| $566 | +1.85% |

Our map demonstrates the extent to which geographic location drives pricing for health insurance premiums. The most expensive state is West Virginia, where on average it costs a 40-year-old applicant $712 each month. By contrast, that same applicant would only need to pay $335 in New Hampshire, less than half as much. Not only that, but the price of insurance year-to-year varies across the country too, dropping by almost 20% in Iowa but rising almost 10% in Indiana. The states with the highest populations also tend to see the highest prices, like New York and California .

What explains the dramatic differences? Why does it cost so much more for health insurance in some states than others? The simplest explanation is that some Americans are healthier than average, and a major factor is location. West Virginia is widely seen as the epicenter for the opioid epidemic, and it is also the most expensive for insurance. By contrast, Colorado has one of the lowest rates of obesity in the U.S., and their health premiums only $377.

All of which is to say, it pays to shop around for health insurance. If you are in the market for coverage, a good place to start is with our health insurance cost guide.

About the article

Average Premium Tax Credits For Marketplace Insurance

The average premium tax credit for the United States is $371 per month. Alaska had the highest premium tax credit at $976. New York had the lowest average tax credit at $230. The government makes these payments on your behalf. It’s to help make your insurance premiums more affordable. The credits are based on your total household income. The credits operate on a sliding scale.

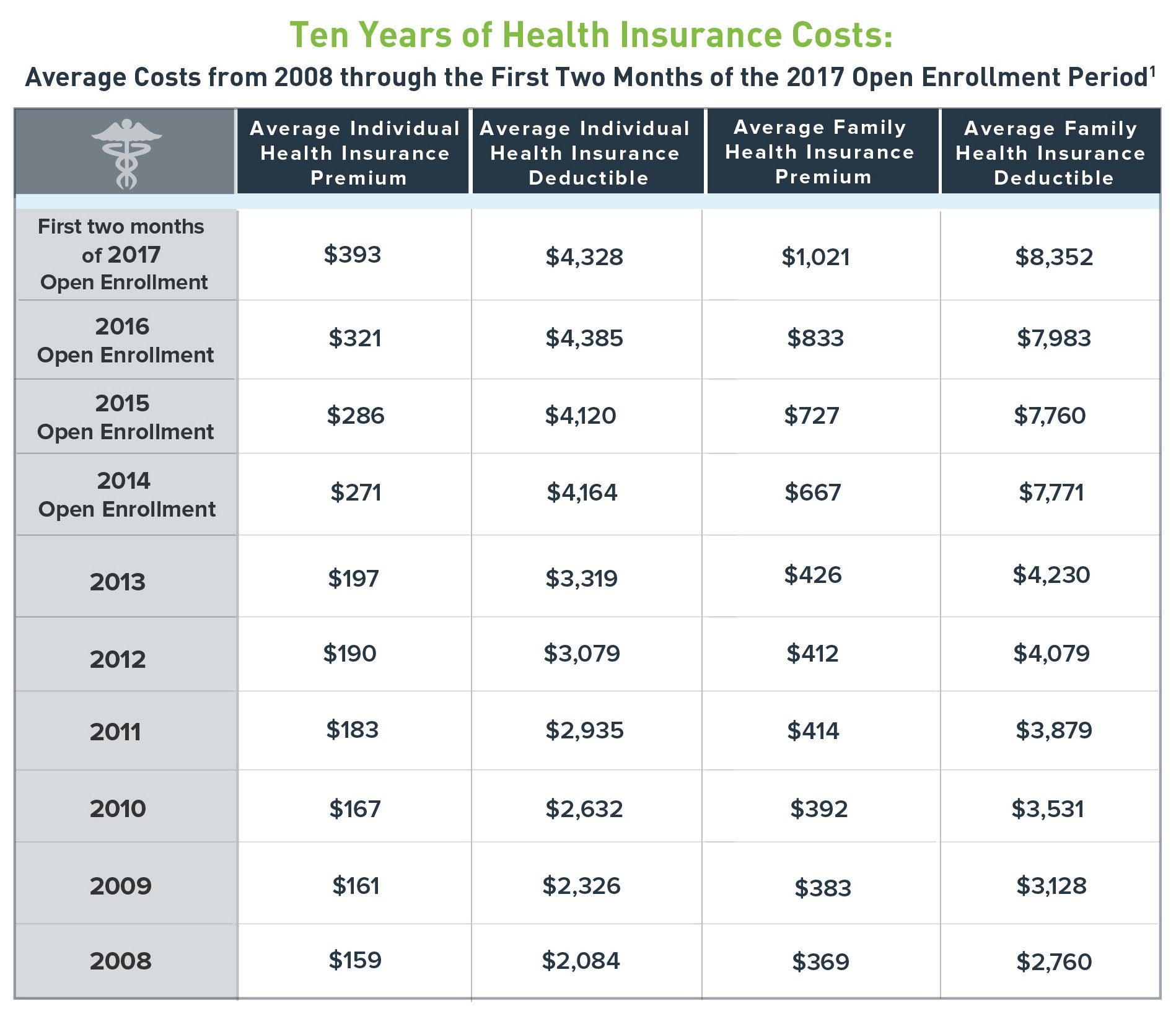

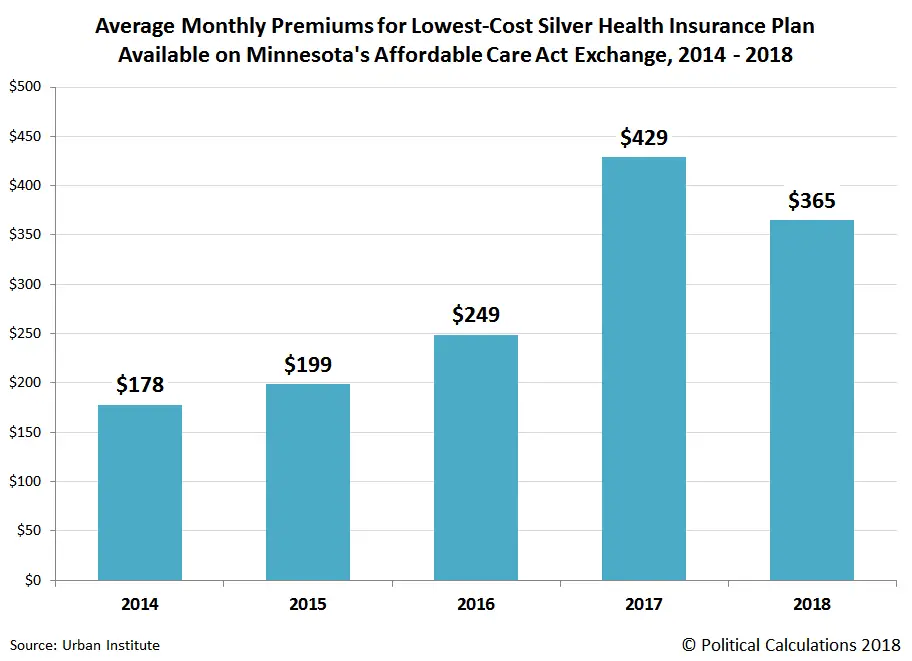

How Premium Costs Have Changed In Recent Years

In recent years, healthcare costs have kept rising for both individuals and families in the U.S. This is also true for monthly and annual insurance premiums. The average yearly premium for a family has increased by 22% since 2015 it’s increased by 55% since 2010.

Healthcare spending in the U.S. grows each year. Projections estimate yearly annual spending of nearly $6 trillion by 2027, compared to $3.8 trillion in 2019.

You May Like: Do Children Need Health Insurance

The Costs Of Individual Vs Family Plans

The Affordable Care Act offers some subsidies to make health insurance more affordable, but not everyone qualifies.

In 2020, health insurance premiums for unsubsidized individual customers were $456 per month on average, while family premiums averaged $1,152 per month. The average individual deductible was $4,364 the family deductible averaged $8,439.

Over the course of a year, the average health spending for a family of four in the U.S. was $25,011 in 2020. This figure includes spending on monthly premiums. It also includes meeting the deductible.

What Is The Cheapest Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats the most affordable for everyone. But finding the right plan for your needs is easy with HealthMarkets. Our free FitScore® technology helps you shop, compare and apply for a healthcare plan in minutes. We can even check to see if you may qualify for a tax credit. To get a better look at what plans could cost you and your family, get started now.

46698-HM-1120* Subsidy amounts are based on a 40-year-old nonsmoker making $30,000 per year.

References:

Don’t Miss: How Much Does Private Health Insurance Cost In California

How Much Does A Health Insurance Plan Cost

Whats the average cost of health insurance? Across the U.S., Americans pay wildly different premiums annually or monthly for health insurance. While these premiums arent determined by gender or pre-existing health conditions, thanks to Obamacare, numerous other factors impact what you pay. We explore those factors below to assist you in understanding how much you might pay for health insurance.

What Is An Out

There is a limit for how much you will have to spend on your health care costs in a year. This is called the out-of-pocket maximum, or OOPM. Your coinsurance, copay, deductible and other in-network essential health benefits apply to the OOPM. Your premium does not count toward the OOPM.

You May Like: What Is Employer Group Health Insurance

How Much Does An Individual Health Insurance Policy Cost

While the cost of individual health insurance has increased by 123 percent for single coverage since 2008 , individual health insurance remains more affordable on average than group coverage through a company.

According to data gathered by AARP, the average health insurance cost for single coverage premiums in 2020 is $388 per month. For family coverage, the cost for premiums in 2018 is $1,520 per month.

The Importance Of Affordable Employer

Understanding the average cost of employer-sponsored health insurance can help small business owners explore coverage options for themselves, their families, and their employees.

According to an of small business owners, the top two most important factors for small employers when choosing a group health plan are affordable monthly premiums and out-of-pocket costs.

Source: eHealth 2018 Small Business Health Insurance Report

Don’t Miss: Can You Add Spouse To Health Insurance

Average Pet Insurance Costs

How much you pay for pet insurance varies greatly. Monthly premiums can range from as low as $10 to higher than $100, though most pet owners can expect to pay between $30 and $50 per month for a plan with decent coverage.

Your pet’s age, species and breed, as well as where you live and the coverage package you choose, all factor into your insurance rates.

The average cost of pet insurance is higher for dogs 60% more expensive than cats for accident and illness policies. Older animals and larger animals also face higher pet insurance rates, as these groups tend to have the most health issues.

The average cost of pet insurance for dogs has been increasing while the cost for cats fluctuates. Rates have decreased by as much as 7.2% and increased by up to 25.9% in the past five years, depending on the type of policy.

Five-year increase in average pet insurance rates

| Pet |

|---|

| -7.2% |

What Does Health Insurance Cost On The Exchange

The average individual policy on the exchange costs $393 per month. The average family policy costs $1,021 per month. Looking back over the past 5 years, individual policies increased 106%. Family policies increased 147%.

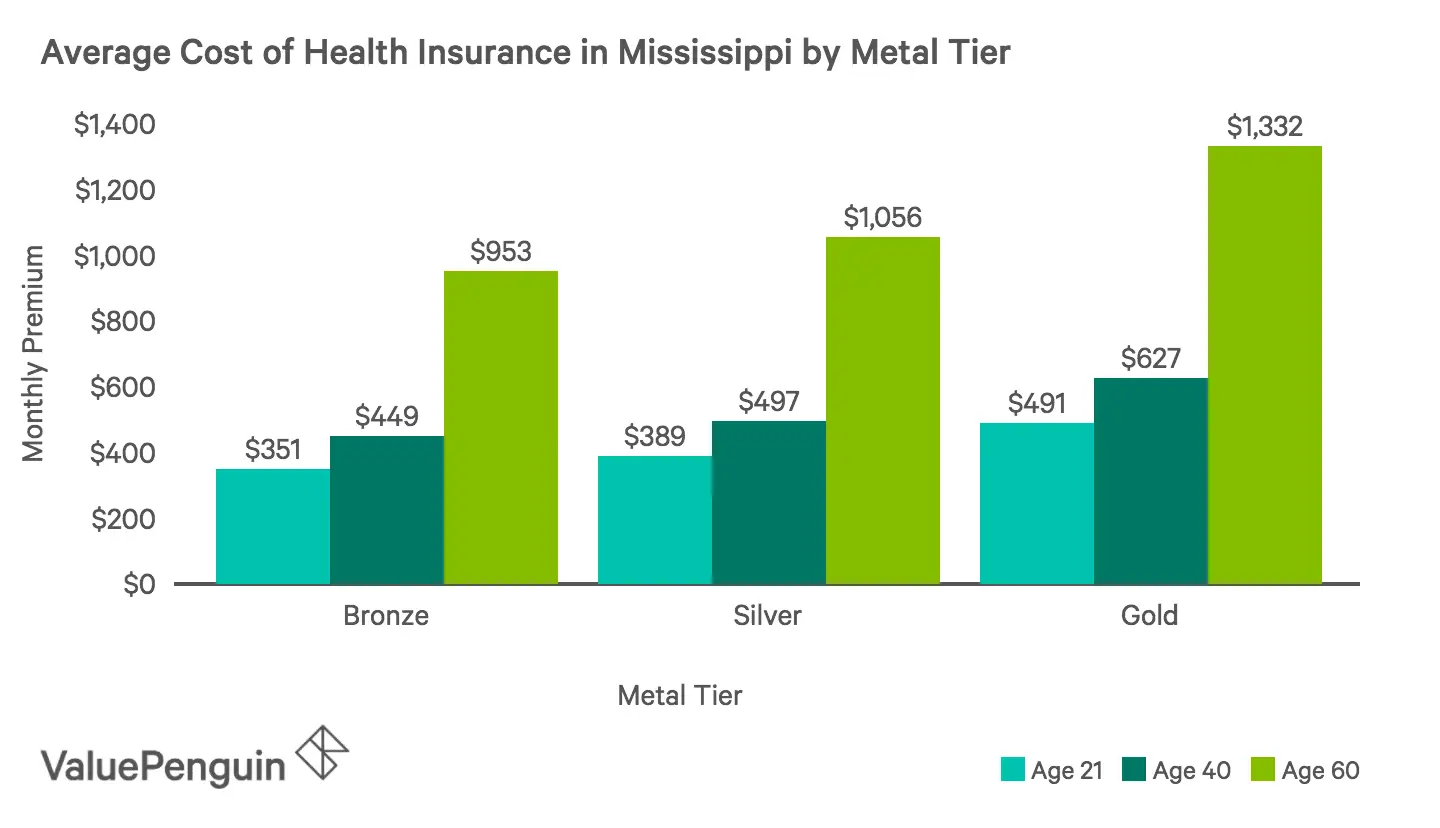

Consumers have the choice of many plans, each with a different premium. Catastrophic, bronze, silver, gold, and platinum are the choices. Catastrophic plans offer the lowest premiums. Platinum plans are the top of the tier . The lower the premium, the higher the annual deductible, though. This means more cash out of your own pocket.

Recommended Reading: Can I Have Two Health Insurance

How Much Does Average Health Insurance Cost In The Usa

Health insurance means different things to people across the world the USAs system is known for several distinguishing features, including a high relative cost to the individual and a lack of universal coverage.

You may be wondering why the cost of healthcare insurance seems to be rising and how the picture compares to other nations. In a country that spends nearly $4 trillion on healthcare yet finds coverage varies widely, theres a lot to weigh up.

Across the United States, Americans pay wildly different premiums monthly for health insurance. The average annual cost of health insurance in the USA is $7,470 for an individual and $21,342 for a family as of July 2020, according to the Kaiser Family Foundation a bill employers typically fund roughly three quarters of.The cost to each person can vary a lot, however, based on factors such as age, geography, employer size and the type of plan theyre enrolled in. While these premiums are not determined by gender or pre-existing health conditions, thanks to the Affordable Care Act, a number of other factors impact what you pay.

Of course, not all companies offer health benefits to employees 44% of firms did not offer insurance to staff in 2020.

Insurance costs are rising in 2021.

Find out what’s driving up prices

What Does Private Health Insurance Cost

The average premium for UK private health insurance is £1,435 per year . But you might pay much less than that for health insurance depending on the two factors that influence the cost.

Or use our article to find out the best health insurance policies.

ActiveQuote. calculated the average based on nearly 8,000 health insurance sales through its website in the second half of 2017 and the months to May 2018. It says that prices have risen slightly this year the average premium in the second six months of 2017 was £1,414 and £1,455 in the first half of 2018.

Read on to learn more about:

Don’t Miss: Can I Stop My Health Insurance Anytime

Average Cost Of Pet Insurance: 2021 Facts And Figures

Find the Cheapest Pet Insurance Quotes in Your Area

The average monthly cost of pet insurance is $48.78 for dogs and $29.16 for cats for plans that cover both accidents and illnesses.

After obtaining quotes from 11 of the largest pet insurance companies, we found that the average monthly cost of a pet insurance plan ranges from about $25 to $70 for dogs and $10 to $40 for cats.

Factors That Affect Premiums

Many factors that affect how much you pay for health insurance are not within your control. Nonetheless, it’s good to have an understanding of what they are. Here are 10 key factors that affect how much health insurance premiums cost.

The coverage offered by employers contributes to several of the biggest factors that determine how much your coverage costs and how comprehensive it is. Lets take a closer look.

Also Check: How To Get Health Insurance For My Small Business

What Is Individual Health Insurance

While many people get their health insurance through a group plan sponsored by their employer or union, others buy it themselves. If you are buying your own health insurance, you are purchasing an individual plan, even if you include family members on the plan. If this sounds like what you need, let eHealth show you all of your individual and family health insurance options, and use our free quote comparison tool to find an affordable plan that meets your needs.

Asa result of the Affordable Care Act , people can purchase individualhealth insurance through a government exchange or marketplace , or they can buy health insurance from privateinsurers. You may be restricted to purchasing health insurance through agovernment exchange to certain times of the year. Usually you can purchasehealth coverage from a private insurance company anytime.

ACAplans are a good starting place to understanding individual health insuranceoptions. ACA health plans are categorized by metals. You can learn more aboutthe metallic plans: Bronze, Silver, Gold, and Platinum.

What Does Typical Private Health Insurance Cost

As a starting point for this article, we wanted to find out prices for a ‘typical’ buyer – we got quotes for a 33 year old, living near Oxford*, from the four largest UK Health Insurers BUPA, AXA, Aviva and Vitality. This gave us prices between £26 and £48 per month or £312 and £576 per year.

These quotes are much lower than the average above, as we quoted for a younger individual with no family and low cover options.

Recommended Reading: Does Colonial Life Offer Health Insurance

Total Out Of Pocket Costs

What people do see is their out-of-pocket expenses. Changes to supplemental insurance programs over the past years have impacted deductible rates as well as items covered.

Pre-existing conditions can also play a big part in how much you pay for health care. Your condition may prevent you from being able to get supplemental coverage. Most often, however, it means there are exclusions in your health plan or higher deductibles. Both of these mean higher costs to you.

Keep Costs Down Stay In Network With Provider Finder

One way to help keep your health insurance costs down is to use only doctors, hospitals and other health care professionals in your plan’s network. If you go out of network, you might have to pay the entire bill. Not all plans have the same network. The best way to find in-network providers is byregistering or logging into Blue Access for MembersSM, our secure member website, for a personalized search based on your health plan and network using our Provider Finder®tool.

Recommended Reading: Can I Go To The Er Without Health Insurance

Average Cost Of Employer

According to researchpublished by the Kaiser Family Foundation in 2019, the average cost ofemployer-sponsored health insurance for annual premiums was $7,188 forsingle coverage and $20,576 for family coverage. The reportalso found that the average annual deductible amount for single coverage was $1,655 forcovered workers.

Overall, despite growth in premiums over time, the average cost of employer-sponsored health insurance has remained relatively stable in the health insurance market.

Employer-sponsored coverage is health insurance offeredthrough your job. Also known as employer-provided health insurance, this mayinclude coverage for current workers, as well as retirees. Typically, youremployer may offer a choice of group health plans to eligible workers and coverspart of the premium cost. Employer-provided health insurance remains the mostcommon type of health coverage in the U.S., according to the KaiserFamily Foundation.

Source:Kaiser Family Foundation 2019 Employer Health Benefits Survey

Here’s How That Breaks Down

According to eHealthInsurance, for unsubsidized customers in 2016, “premiums for individual coverage averaged $321 per month while premiums for family plans averaged $833 per month. The average annual deductible for individual plans was $4,358 and the average deductible for family plans was $7,983.”

That means that, last year, the average family paid $9,996 for coverage alone, and, if they met their deductible, a total of just under $18,000.Meanwhile, an average individual spent $3,852 on coverage and, if she spent another $4,358 to meet her deductible, a total of $8,210.

These figures do not take into account any additional co-insurance responsibility she might have. In addition to co-pays and deductibles, an increasing number of plans now require co-insurance payments, which require that, even once you meet your deductible, you continue paying some percentage of all costs until you hit your out-of-pocket maximum.

Read Also: What Is The Health Insurance For Low Income

How Can I Lower My Life Insurance Rates

Your overall medical history may be out of your hands, but you can take steps to potentially lower your premium.

- Quit smoking. Kicking the habit could cut your premium in half and improve your health.

- Cut down on drinking. If you enjoy more than a drink a day, you could cut back on alcohol for lower rates.

- Get in shape. Insurers consider weight and exercise habits an important part of your risk. A lower BMI typically leads to cheaper rates.

- Consider major life changes. Look at your coverage after changes like becoming a new parent. You can also ladder policies based on debt, like a 30-year term policy for your mortgage and a 15-year policy to get to retirement.

- Look for discounts. Talk with your insurer about lowering premiums with a joint policy or other savings opportunities.

How long will I have to pay premiums?

If you have a term life policy, youll need to pay premiums for the length of the term to maintain coverage. This could be 1, 5, 10, 15, 20, 25 or 30 years.

With permanent policies like whole life, youll have to pay premiums for your entire life otherwise, youll lose coverage. But once youve accumulated enough cash value, you can use it to pay your premiums.

The Significance Of Subsidies

The good news is that many individuals who buy marketplace health insurance plans will pay lower premiums through advance premium tax credits, otherwise called subsidies. In 2019, 88% of persons who enrolled at Healthcare.gov were eligible for advance premium tax credits.

Insurance subsidies are credits that the government applies to your health insurance premiums every month to make them affordable. Fundamentally, the government pays part of your premium directly to your health insurance carrier, and you are responsible for the rest.

You may take your advance subsidy in one of three ways: equal amounts every month more in some months and less in othersbeneficial if your income is irregular or as a credit against your income tax liability when filing your yearly tax return, which could imply you owe less tax or get a bigger refund. Subsidies are designed to make premiums affordable based on your income and household size.

Your credit depends on your estimated income for the year, so in the event your income or household size changes during the year, it is a good idea to update your information at Healthcare.gov quickly so your premium credits can be adjusted accordingly. That way, you would not have any unpleasant surprises at tax time, nor will you pay higher premiums than you want to throughout the year.

Also Check: How To Become A Health Insurance Broker In California