How To Look Up Plan Premiums

1. Open MNsure’s plan comparison tool — on the first page, click the Continue button.

2. Under “Which Coverage Year” select the year for which you are seeking information. Note: if you pick a year prior to the current coverage year, a date picker will appear. Enter the start Date for your exemption.

43. Under “Where do you live” enter the ZIP Code of your residential address. Your county of residence will appear. If there is more than one county for your ZIP code, select your county of residence.

4. Under “Who is in your household and do they need coverage?” enter the following information for each person in your household applying for the exemption:

- Birthdate

- Tobacco Use. If you use tobacco, you need to enter your household information two separate times in order to search for the correct premium using the correct Tobacco Use status. To get the lowest cost bronze plan premium: check the box to indicate “Yes” for Tobacco Use. To get the second-lowest cost silver plan premium: leave the checkbox unchecked to indicate “No” for Tobacco Use.

- Leave Native American, and Pregnant? checkboxes unchecked as these cannot be used in this premium calculation.

- Make sure the Needs Coverage checkbox is checked.

5. Skip the financial help section and click Browse Plans button on bottom right.

6. Skip the Tell Us about Your Health Care Needs page and select Skip to View Plans button.

7. Under the “Health Plans” tab, the medical plans available to you will display.

How Long Can You Go Without Health Coverage

Under Obamacare, you could go without coverage for a maximum of 2 consecutive months without having to pay a tax penalty. Essentially, if you had coverage for at least 10 months, you dont have to worry.

However, President Trump decided to switch up the rules just a bit. Now, you can go without health insurance for 3 consecutive months before you become liable for a tax penalty. Not a bit change, but can be significant for those who are struggling to find affordable health insurance.

Absence Of Medical Services

Contrary to popular belief, health providers are not required by law to provide medical services to individuals without insurance. Only emergency departments are legally bound to provide care.

The Transamerica Center for Health Studies released a report revealing that 62% of Americans have been diagnosed with a chronic health condition, such as high blood pressure, high cholesterol, or being overweight or obese. The study also found that only 56% of uninsured Americans could afford to pay for their routine health expenses.

Don’t Miss: Starbucks Insurance Part Time

Individual Mandate Penalty Was Eliminated But Employer Mandate Penalty Remains In Place

Although the GOP tax bill that was enacted in late 2017 repealed the individual mandate penalty starting in 2019, it did not make any changes to the employer mandate. Large employers that dont offer coverage, or that offer coverage that doesnt provide minimum value and/or isnt affordable, continue to face penalties if their employees obtain subsidized coverage in the exchange.

Read answers to other questions about health reform, and penalties, and small business.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Exemptions From The Insurance Requirement

Though most people are required to have health insurance, several groups are exempt from the requirement to obtain coverage, including but not limited to:

- people who are uninsured for less than 3 months of the year

- people who would have to pay more than 8% of their income for health insurance

- people with incomes below the threshold required for filing taxes.

- members of a federally recognized tribe or anyone eligible for services through an Indian Health Services provider

- members of a recognized health care sharing ministry

- members of a recognized religious sect with religious objections to insurance, including Social Security and Medicare

- people who are incarcerated, and not awaiting the disposition of charges

- people who are not lawfully present in the U.S.

- people who qualify for a hardship exemption

Coloradans who want to apply for an exemption should submit the appropriate form to the federal government to receive an exemption code. Then Coloradans will need to provide the exemption code into the Connect for Health Colorado website to gain access to catastrophic health plan options.

Get more information about how to apply for an exemption to the individual mandate in Colorado.

You May Like: Does Starbucks Offer Benefits

Do I Still Need Health Insurance

Even though the tax penalty for not purchasing health insurance is gone, health insurance is still a necessity. Fortunately, there are plenty of coverage options available, including government subsidies for Las Vegas, Nevada, residents with tight budgets. Your Nevada Insurance Enrollment health insurance agent can help you find an affordable health insurance plan that provides you with coverage and protection for when the unexpected happens.

Uninsured Tax Filers Were More Likely To Get An Exemption Than A Penalty

Although there were still 33 million uninsured people in the US in 2014, the IRS reported that just 7.9 million tax filers were subject to the penalty in 2014 . According to IRS data, 12 million filers qualified for an exemption.

The number of filers subject to the ACAs penalty was lower for 2015 , as overall enrollment in health insurance plans had continued to grow. The IRS reported in January 2017 that 6.5 million 2015 tax returns had included individual shared responsibility payments. But far more people12.7 million tax filersclaimed an exemption for the 2015 tax year. For 2016, the IRS reported that 10.7 tax filers had claimed exemptions by April 27, 2017, and that only 4 million 2016 tax returns had included a penalty at that point.

A full list of exemptions and how to claim them is available here, including a summary of how the Trump administration made it easier for people to claim hardship exemptions .

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

The Fee For 2018 Plans And Earlier

- You may owe the fee for any month you, your spouse, or your tax dependents don’t have qualifying health coverage . See all insurance types that qualify.

- You pay the fee when you file your federal tax return for the year you dont have coverage.

- In some cases, you may qualify for a health coverage exemption from the requirement to have insurance. If you qualify, you won’t have to pay the fee. Learn about health coverage exemptions.

Who Does The Individual Mandate Apply To

The individual shared responsibility mandate, commonly referred to as a tax penalty, applied to U.S. citizens of all ages, including children. Anyone who claimed a child as a dependent on their federal tax return would be responsible for paying a tax penalty if that child didnt have proper health insurance coverage.

There were a few exemptions available for people who met certain criteria. Members of certain religious sects that were opposed to accepting any health insurance benefits, including those issued by the state or federal government, could file for an exemption from the individual mandate, as could those whose projected income made purchasing health insurance impossible or those who were ineligible for Medicaid.

Also Check: Does Starbucks Have Health Insurance

Dont Have Health Insurance Whats The Worst That Could Happen

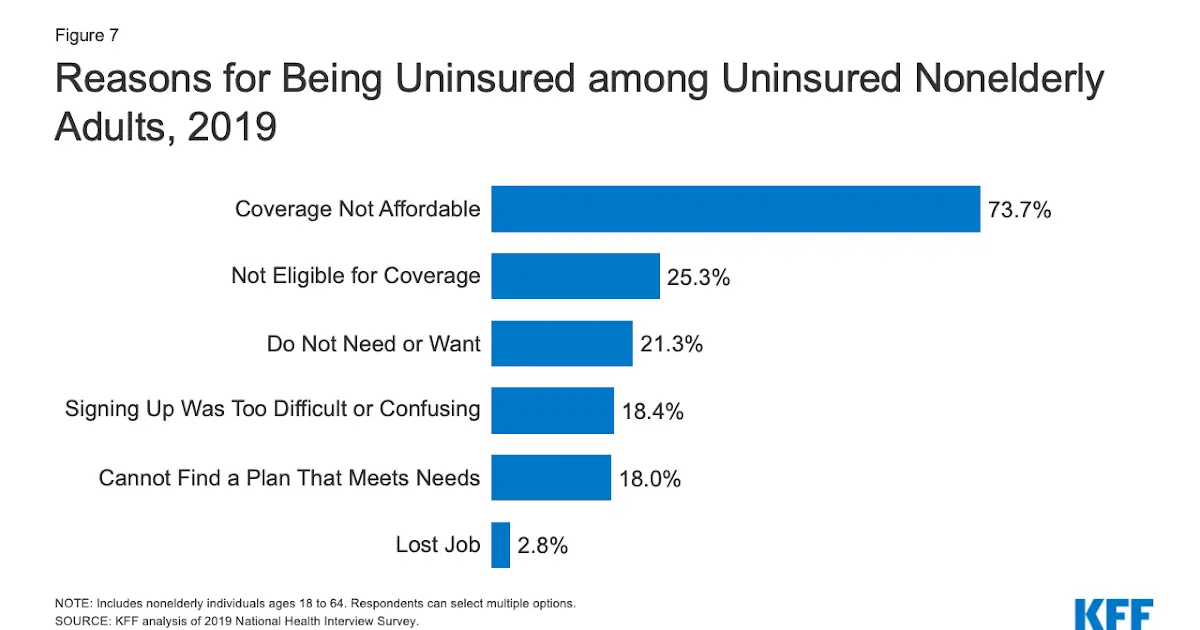

While the number of uninsured Americans has dropped, many people still dont have any type of healthcare insurance coverage. The passage of the Affordable Care Act allows millions to choose a government-subsidized healthcare plan. However, many consumers are ineligible for subsidies, and many of those who qualify have chosen not to participate.

In 2018, according to a report by the U.S. Census, 8.5 percent of people, or 27.5 million adults , did not have health insurance at any point during the year. Census findings showed that the uninsured rate and number of uninsured increased from 2017 .

As of 2019, individuals and families without insurance are no longer taxed, due to the repeal of the tax-penalty portion of the Affordable Care Act.

Ri Health Insurance Mandate

Health insurance is a requirement in the state of Rhode Island.If you go without continuous health coverage, you might pay a penalty when you file your taxes in 2021. See below for more information about the health insurance mandate and how it might affect you.

Better yet, sign up for coverage through HealthSource RI today to avoid a tax penalty later.

COVID-19 Hardship ExemptionIf you are looking for more information about exemptions from the penalty fee, please see the exemptions section below. Additionally, the State of Rhode Island recognizes that the COVID-19 pandemic has brought about unusual and unanticipated circumstances for many individuals. As a result, HealthSource RI filed a regulation expanding its criteria for qualification for the Hardship Exemption to include a COVID HARDSHIP, which can be claimed on an individuals RI Personal Income Tax return by using code 19. Filers who may claim this exemption DO NOT need to file an exemption application with HealthSource RI.

This exemption is valid for use ONLY for the months of April 2020 through December 2020 and may be claimed directly if the taxpayer attests that, due to a direct impact of the COVID-19 pandemic, the following statements are true:

1) The individual lost minimum essential coverage during the 2020 calendar year, and

2) The individual suffered a hardship with respect to the capability to obtain minimum essential coverage during the subsequent months in the 2020 year.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

What Is An Insurance Penalty

In 2014, a mandate was implemented in the United States for individuals and employers to have health insurance as part of Obamacare. Most individuals who were legal residents or U.S. citizens were required to purchase qualifying health insurance or else they would need to pay a tax penalty. While this tax penalty has been rescinded at the federal level, some states are now implementing their own penalties for individuals without health insurance.

Many individuals already have qualified health insurance coverage through an employer or a public program, such as Medi-Cal or Medicare. Those without health insurance coverage from a public program or their employer will need to purchase their own insurance from a private insurance company or a federal- or state-run health benefits exchange.

Tax credits or subsidies may be available through health benefit exchanges to lower-income families. As a California resident, you should carry insurance throughout the year with no gaps in coverage of 90 days or more. Otherwise, you may face a tax penalty when you file your tax return.

You May Like: What Happens When A Universal Life Insurance Policy Matures

Exemptions For Unaffordable Coverage Through Mnsure

You can claim this exemption based on coverage being unaffordable for the months in 2018 when you did not have coverage when you fill out your 2018 tax return, which was due in 2019.

You can claim this exemption using the federal Form 8965. You will need to use the following information from MNsure to complete this form:

- The premium amount for the lowest cost 2018 bronze plan that would have covered all members of your household seeking an exemption and

- The premium amount for the second-lowest cost 2018 silver plan that would have covered all members of your household seeking an exemption.

This information is easy to find using the instructions below.

NOTE: If you are applying for an exemption for unaffordable coverage from your employer, you do not need any information from MNsure. You will need to follow the directions on the federal exemption application to submit information about your employer’s plan. You can claim this exemption when you file your taxes using the federal Form 8965.

Read Also: Starbucks Insurance Plan

How Big Were The Penalties

The IRS reported that for tax filers subject to the penalty in 2014, the average penalty amount was around $210. That increased substantially for 2015, when the average penalty was around $470. The IRS published preliminary data showing penalty amounts on 2016 tax returns filed by March 2, 2017. At that point, 1.8 million returns had been filed that included a penalty, and the total penalty amount was $1.2 billion an average of about $667 per filer who owed a penalty.

Although the average penalties are in the hundreds of dollars, the ACAs individual mandate penalty is a progressive tax: if a family earning $500,000 decided not to join the rest of us in the insurance pool, they would have owed a penalty of more than $16,000 for 2018. But to be clear, the vast majority of very high-income families do have health insurance.

Today, the median net family income in the United States is roughly $56,500 For 2018, the penalty for a middle-income family of four earning $60,000 was $2,085 . This is far less than the penalty a more affluent family would have paid based on a percentage of their income.

The penalty could never exceed the national average cost for a bronze plan, though. The penalty caps are readjusted annually to reflect changes in the average cost of a bronze plan:

The maximum penalties rarely applied to very many people, since most wealthy households were already insured.

Health Insurance Penalty Exemption

Ever since the beginning of 2019, for which taxes were to be filed by July 15, 2020, the penalty for not having health insurance is no longer in effect. You no longer have to pay the shared responsibility payment or the mandate. Therefore, if you do not have any medical coverage in 2020, you dont even need a health insurance penalty exemption, because you will be charged with no penalty.

However, some individual states do have a small penalty for not having health insurance. In order to be exempted from your states individual penalty, you can get registered in a health insurance plan during the open enrollment period. In the event that you lose your coverage in the year, you may fit the bill for an uncommon enlistment period. Or then again, depending upon which state you live in, you might have the option to register and apply for a short term health care coverage to help fill any inclusion gaps you may face consistently.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Is There Still A Fine For Not Having Health Insurance

Ever since 2019 there is no government based punishment for not having medical coverage. However, there are still certain states and locales that have established their own health care coverage commands. The federal charge punishment for not being joined up with medical coverage was disposed of in 2019 due to changes made by the Trump Administration. Therefore, if you do not have health insurance and are worried about paying a fine, do not be stressed out any more. You do NOT have to pay any fine or penalty for not having health insurance in 2020.

The earlier expense punishment for not having medical coverage in 2018 was $695 for adults and $347.50 for youngsters or 2% of your yearly salary, whatever that sum turned out to be. This punishment was intended to shield the individuals from avoiding medical coverage and not having the option to take care of their clinical costs in case of injury or sickness.

There is no punishment for not having an Affordable Care Act health inclusion in 2020 except if you live in a state like New Jersey or Massachusetts where it is commanded by the state. Along these lines, momentary clinical plans will be incredibly mainstream in 2020 on the grounds that they give admittance to bigger PPO networks at lower costs than ACA Bronze plans.

The Situation Might Not Be As Bad As You Think

Why might the situation not be as bad as you think? Glad to reply. In the past years, for every month that went by without owning health insurance, a fine would be issued. However, the situation is finally seeing an end with the new governmental law.

This states that starting in 2019, there will be no more federal penalties for health insurance. In the past, the number of penalties would go higher with every year that went by.

You May Like: Starbucks Dental Benefits

Health Insurance Penalty Calculator

Thankfully, the internet is a wonderful place fool of many tools that make our lives easier. If you still arent sure how to calculate what your health insurance penalty for 2017 may be, you can use our simple health insurance tax penalty calculator.

There is step by step directions that will easily allow you to calculate your tax penalty, just make sure you know what year you are filing for, your household income, how many people in your household, and how many months you were uninsured for.

What Are My Options For Complying With Obamacare

You have 3 options and two of them involve a penalty:

- Get no insurance and pay a penalty for no health insurance at tax time.

- Get cheap insurance and pay a penalty at tax time.

- Enroll in a qualified health plan. This option does not have to be through Covered California to avoid the penalty, but it does have to be a Covered California plan in order to qualify for a government subsidy.

- Enroll in a Health Care Sharing Plan, which is exempt from the penalty and my offer lower premiums than traditional health insurance.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees