Do Salaried Employees Receive Overtime

Yes. Employees who are paid by salary are entitled to overtime. An hourly wage can be calculated to determine the overtime pay per hour.

For example: an employee who earns a salary of $450 per week and is expected to work a 40-hour week is paid $11.25 per hour. Overtime is paid at 1 ½ times the regular wage rate. Using this example, the employee would earn $16.87 per hour for overtime.

| To calculate an employees hourly wage: |

| Salary earned per week ÷ Total Hours = Hourly Wage |

| $11.25 × 1.5 = $16.87 Hour of overtime |

Average Cost Of Employer

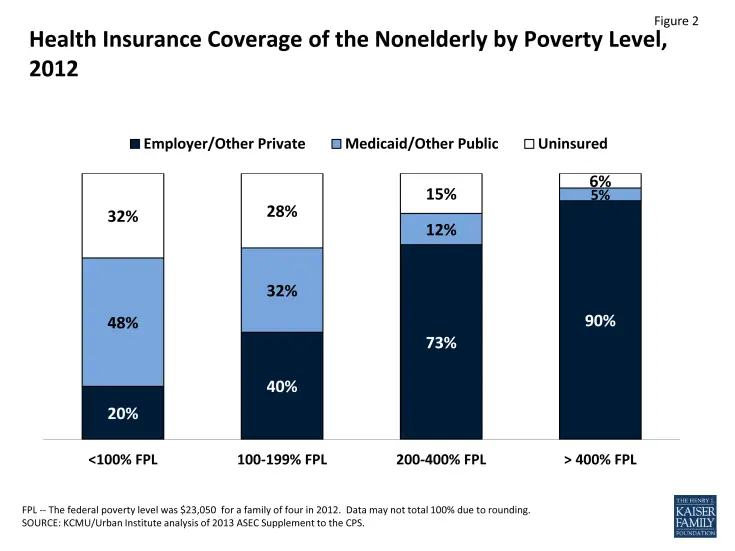

According to researchpublished by the Kaiser Family Foundation in 2019, the average cost ofemployer-sponsored health insurance for annual premiums was $7,188 forsingle coverage and $20,576 for family coverage. The reportalso found that the average annual deductible amount for single coverage was $1,655 forcovered workers.

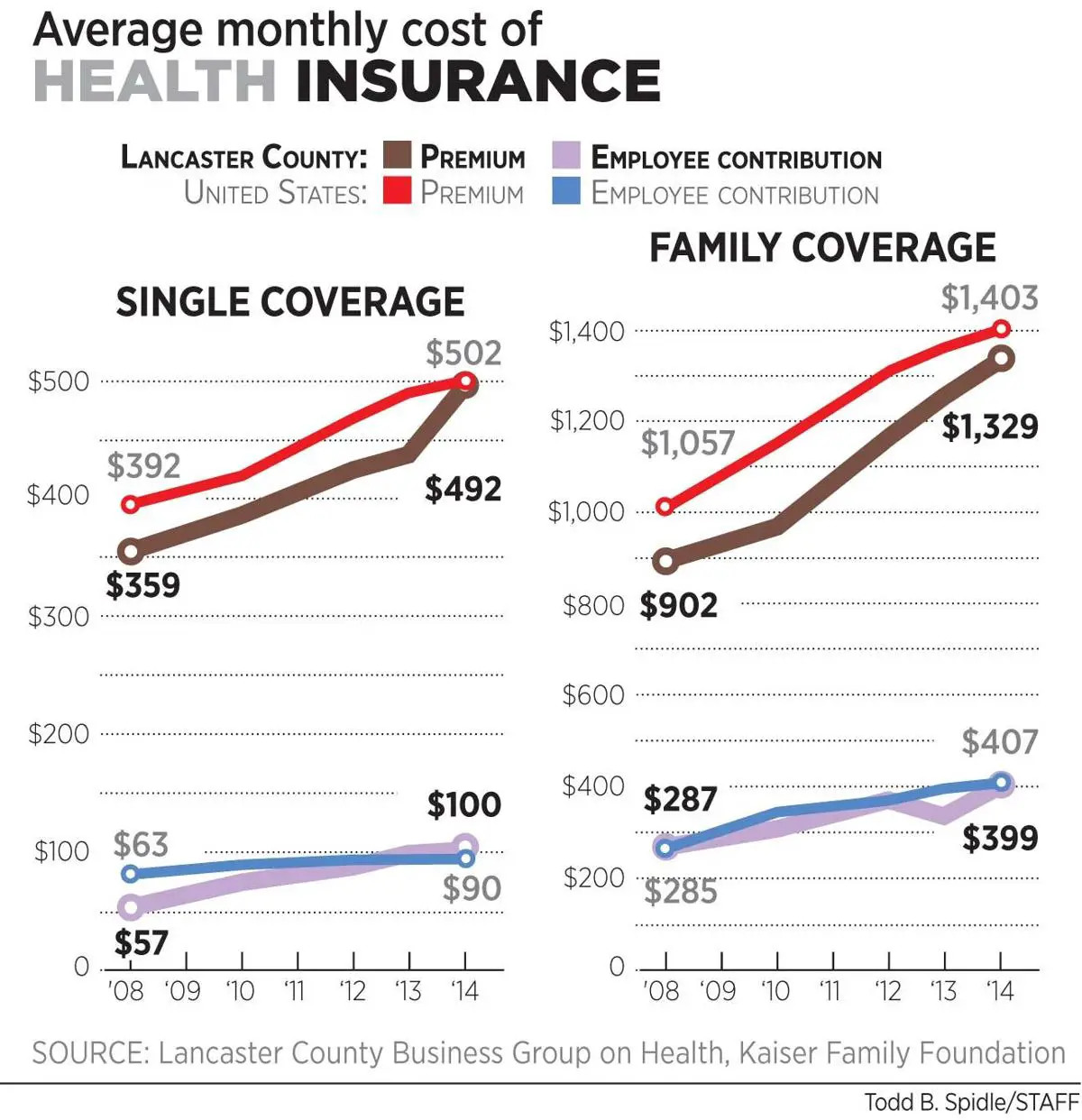

Overall, despite growth in premiums over time, the average cost of employer-sponsored health insurance has remained relatively stable in the health insurance market.

Employer-sponsored coverage is health insurance offeredthrough your job. Also known as employer-provided health insurance, this mayinclude coverage for current workers, as well as retirees. Typically, youremployer may offer a choice of group health plans to eligible workers and coverspart of the premium cost. Employer-provided health insurance remains the mostcommon type of health coverage in the U.S., according to the KaiserFamily Foundation.

Recommended Reading: Does Colonial Life Offer Health Insurance

How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

Recommended Reading: When An Insurer Issues An Individual Health Insurance Policy

How Much Does Group Health Insurance Cost

When an employer provides health insurance coverage to employees, the business purchases a plan to cover all eligible employees and dependents. This type of coverage is commonly called a group health insurance plan or a fully-insured plan.

According to the Kaiser Family Foundation , in 2021, the average cost of employee health insurance premiums for family coverage increased by 4% from the previous year to $22,221. The average annual premiums for an individuals plan also increased 4% to $7,739.

Many employers also changed their offerings on telemedicine, mental health coverage, and wellness programs following the COVID-19 pandemic. Although these numbers vary by company and provider, the average insurance costs continue to rise year over year.

What Is The Average Cost Of Health Insurance

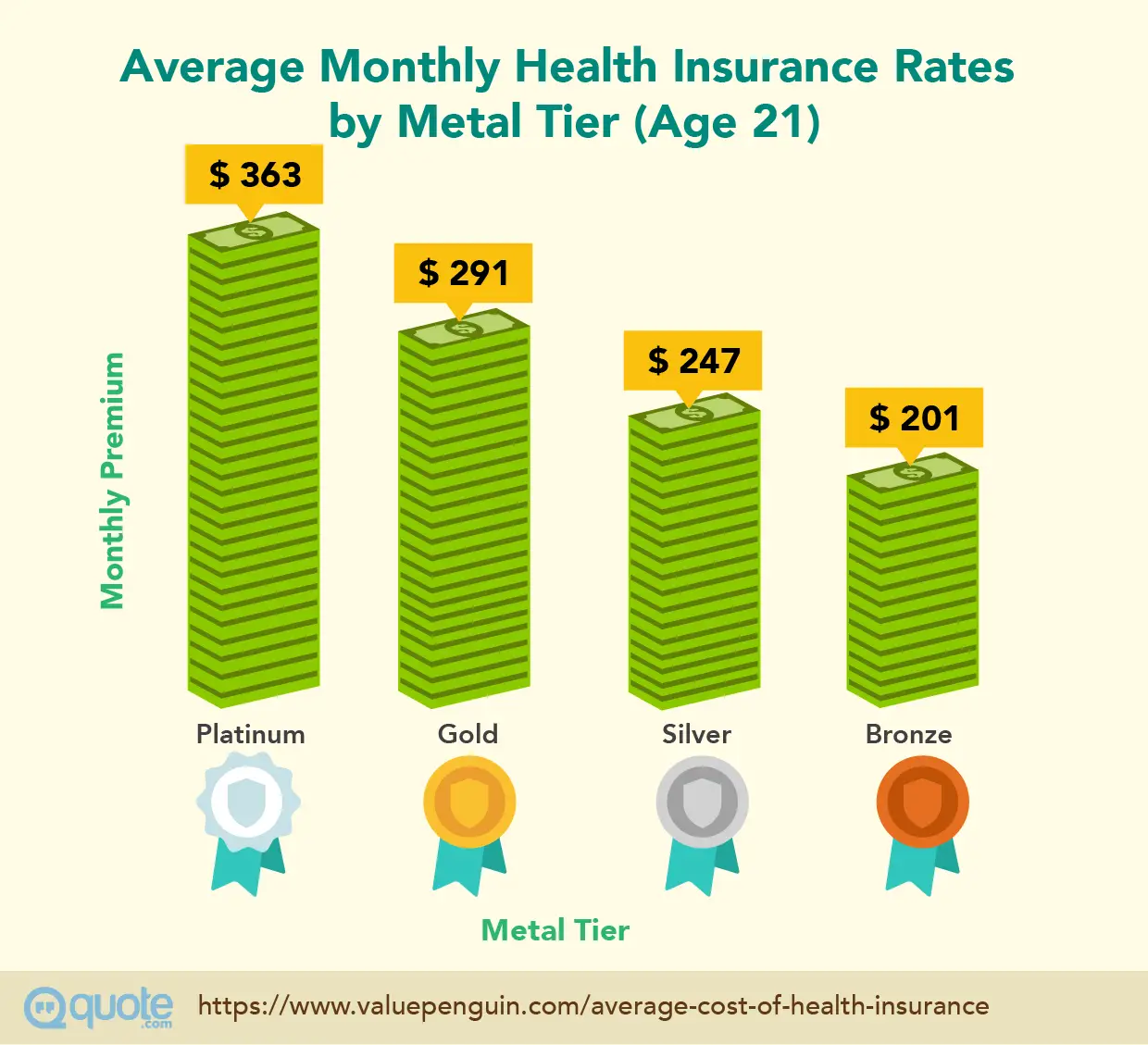

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

Don’t Miss: A Good Health Insurance Plan

Employment Benefits And Payments From Which You Do Not Deduct Ei Premiums

Note

Enter an X or a check mark in the EI box only if you did not have to withhold EI premiums from the earnings for the entire reporting period.

Employment

Even if there is a contract of service, payments for the following types of employment are not insurable and EI premiums do not have to be deducted:

- Casual employment if it is for a purpose other than your usual trade or business. For more information about casual employment, go to Casual employment.

- Employment when you and your employee do not deal with each other at arms length. There are two main categories of employees who could be affected:

- Related persons: individuals connected by a blood relationship, marriage, common-law relationship, or adoption. In cases where the employer is a corporation, the employee is considered related to the corporation when they are related to a person who either controls the corporation or is a member of a related group that controls the corporation. However, these individuals can be in insurable employment if you would have negotiated a similar contract with a person with whom you deal at arms length.

- Non-related persons: an employment contract between you and a non-related employee can be non-insurable if it is apparent from the circumstances of employment that you were not dealing with each other in the way arms length parties normally would.

Find The Best Health Plans For Your Employees And Budget

There are endless ways to assemble health plans to ensure exactly the right balance of cost-effectiveness, quality and simplicity.

HealthPartners offers a range of health plan choices for employers in Minnesota, Wisconsin, Iowa, North Dakota and South Dakota, making it easy to find the right fit for your employees and your business.

Recommended Reading: How Much To Budget For Health Insurance In Retirement

Factors That Affect The Cost Of Health Insurance

If youre looking at health insurance as the way to go, what affects the amount you end up paying? The numbers we talked about earlier are just averages, so some companies pay more and some pay less than that. What causes that fluctuation? These are some of the factors that affect the cost of group insurance:

- Employee demographics. If you have a bunch of super young employees with no chronic health problems, your insurance is probably pretty cheap. But if you have older employees or employees with chronic disease, your premiums will go up, unfortunately.

- Location.Where you live affects how much you pay in insurance. If there are more health insurance options in your area, theres more competition, and you can expect lower premiums.

- Group size.How many people work at your company? Thats going to determine how many employees youre covering and how much youre paying.

- Healthcare inflation factors. Unfortunately, health insurance costs seem to keep rising . That will boost how much youre paying.

- Type of plan you purchase.Deductibles, copays, out-of-pocket maximums . . . they all affect how much you pay.

When Should You Get Health Insurance

Health insurance only works when you have it. Consider your lifestyle. Do you live risk-free or do you like to live life on the edge? Adventurous? Or a home body? Do you have a chronic health condition that requires treatment? Do you have a family to care for? These are things to keep in mind when considering whether you should get health insurance:

In general, how health insurance works is similar across plans, but depending on your needs, the details of your medical coverage can vary. Make sure to learn about your particular health plan or any plan youre considering enrolling in.

Dont Miss: How Much Does It Cost For Health Insurance

Read Also: What’s The Cheapest Health Insurance

Understanding Employer Health Insurance Cost

Eden Health Team

Over half of all Americans receive their healthcare through employer-sponsored health insurance programs. Due to the spiraling costs of healthcare, its becoming more difficult to find a plan that maximizes coverage at an affordable price.

When deciding on the right health plan for you, its important to consider the average cost of employer health insurance and whether a group plan is the best deal.

Who Receives Coverage Through Public Health Insurance In Belgium

- Employees and self-employed workers: upon commencing work in Belgium, all foreign nationals must join the state health insurance scheme or present evidence of private insurance. The same rules apply to self-employed workers in Belgium.

- Spouses and children: employees with Belgian health insurance cover automatically receive cover for children up to the age of 18 and dependent spouses .

- Students: EU students receive coverage through the state health insurance system of their home country. Non-EU students should check whether their country has an agreement with Belgium. Those who dont qualify for cover must purchase their own.

You May Like: Can You Purchase Health Insurance Outside Of The Marketplace

Average Employee Medical Premium $6797 For Family Coverage In 2020

Ninety-four percent of all civilian workers who participated in their employers medical plans in March 2020 had to contribute part of the premium for family coverage. Annual employee contributions averaged $6,797. In March 2010, 88 percent of employees had to contribute for family coverage, and annual employee contributions averaged $4,524.

Average annual employee medical premiums for civilian workers required to contribute to employer plans, March 2010 to March 2020| Year | |

|---|---|

| 1,665 | 6,797 |

Employers paid 67 percent of medical premiums for family coverage plans in March 2020, with an average annual contribution of $13,717.

These data are from the National Compensation Survey Benefits program. For more estimates on medical premiums, see Employee Benefits in the United States March 2020 and Medical care premiums in the United States. Premium contributions are published in monthly amounts and were multiplied to produce the annual estimates.

RELATED SUBJECTS

Who Needs Health Insurance In Belgium

Residents in Belgium generally sign up to state-sponsored schemes for health insurance. This allows them to claim partial reimbursements of medical costs in Belgium and other European countries.

To cover their personal share of medical care , some residents also sign up for supplementary private insurance in Belgium.

Also Check: Can Hsa Be Used For Health Insurance Premiums

What Can You Expect To Pay For Health Insurance Deductibles

The average health insurance deductible for an ACA marketplace plan is slightly more than $5,000.

Most ACA plans are either Bronze or Silver plans, which have deductibles that are often over $2,000. You may find a lower deductible plan, such as $1,000 or less, on the Gold tier, but those health plans come with higher premiums.

Guide To Providing Health Care Benefits To Employees

Find Cheap Health Insurance Quotes in Your Area

If your business has over 50 employees, you are legally required to provide health insurance to employees due to the Affordable Care Act . If you have fewer than 50 employees, you’ll need to make the decision whether to offer your employees health care benefits. We examined every major decision point to help you make the right decision for your business.

Recommended Reading: What Is The Cheapest Health Insurance In Florida

Explore Your Medicare Options

In most cases, as long as youve worked at least 10 years and paid Medicare taxes during those years, youre eligible for Medicare starting at age 65. If youre permanently disabled or have end-stage renal disease, you can qualify for Medicare before age 65.

Medicare has the following parts:

- Part A covers inpatient hospital care, limited care in a skilled nursing facility, hospice care, and some home health care.

- Part B covers other aspects of health care, including outpatient care, doctor care, and durable medical equipment. You pay a monthly premium for Part B.

- Part D covers prescriptions, and its benefits are accessed by purchasing Part D plans through private insurance companies.

On its own, Medicare has significant gaps, so many retirees opt for additional coverage. The two primary options if you dont have access to employer health coverage are:

If you want to purchase a Medicare supplement, its best to do so when you start Medicare Part B, as you have a special open enrollment period. Some retirees delay enrolling in Part B if they have access to coverage through a working spouse. After your open enrollment, you may have to answer health questions and go through medical underwriting.

If you want to purchase a Medicare Advantage plan, you can enroll or change plans in the fall of each year. You can also switch Medicare Advantage plans from January 1 to March 31 each year. You can shop for both types of plans through your states Health Insurance Marketplace.

How Health Insurance Works

Health care is expensive. Health care costs are increasing every year. Without health insurance it would be difficult for most people to afford their health care bills.

Health insurance is a way for people to:

- Protect themselves from extreme financial medical care costs if they become severely ill

- Ensure that they have access to health care when they need it

Recommended Reading: How To Apply For Kaiser Health Insurance

Taking The Next Steps

Compare any plans that you can receive from your partner, state marketplace, or broker to the plan offered by your employer before enrolling in health insurance. If youre going to go without any coverage during your employer-sponsored plans waiting period, look into a temporary short-term health plan.

Also Check: What Does Health Insurance Cost For An Individual

Are Employers Required To Provide Health Insurance

Small employers of less than 50 employees are not required to offer health insurance. Still, large employers with more than 50 or more full-time employees must provide minimum essential coverage to at least 95 percent of the workforce and their dependents. Otherwise, the employer will face a tax penalty. For 2021, the penalty is $338.33 a month or $4,060 annually for each employee who declines an offer of coverage and obtains a Premium Tax Credit while purchasing health insurance on a state or federal exchange.

Read Also: What Is Cost Sharing In Health Insurance

If You Want To Cancel Your Marketplace Plan

- If you plan to end your Marketplace coverage and are not already enrolled in your employers health coverage: Check with your employer to see if you are eligible to enroll in your employers health coverage this time of year.

- If you end all health coverage and dont replace it: You may have to pay a fee for 2018 plans and earlier. There are also important health and financial risks if you dont have health coverage. Learn more about the risks and costs of not having health coverage.

- If your financial assistance ends for your Marketplace plan: You may be eligible for a special enrollment period to change to another Marketplace plan without financial assistance.

You May Like: How Much To Employers Pay For Health Insurance

How Much Do Employer Health Insurance Plans Cost

The answer largely depends on the plan chosen by an employer. Average costs differ depending on the type of plan. If we factor in all plans, such as HMO, PPO, and POS, we can take an average for all plans.

The lions share of the premiums is typically shouldered by the employer. Lets take a look at how much health insurance is through employers on average.

Don’t Miss: How To Choose Health Insurance

Look For Prescription Drug Discounts

Pharmacy and prescription coverage a tremendous impact on overall insurance premiums, Berzins said.

In addition to saving money on insurance costs by seeking generic drug alternatives within an insurance plan, Berzins recommends investigating whether the insured can get direct discounts. Contact the pharmaceutical company directly for possible coupons or discounts.

Tip: Check out our roundup of the best health insurance and employee benefit providers to find insurers for healthcare, dental and vision.

What Are The Requirements Of Employer Health Benefits

First and foremost, it may come as a surprise but not all businesses are required to provide health insurance to their full-time employees. In fact, employers with fewer than 50 full-time or equivalent employees do not have to offer health benefits, and larger organizations with 50 or more full-time employees can likewise take health insurance out of the benefits package provided they dont mind paying a tax penalty amounting to $343.33 a month or $4,120 per year per employee .

Of course, if you dont offer any kind of health insurance, youre probably going to have a hard time attracting and retaining reliable talent. As such, most employers with a full-time workforce choose to make health insurance a part of the benefits package. But once you decide to offer it, be aware that you may be on the hook to cover more. Carriers in most states require that employers cover at least 50% of the premium employee health insurance cost.

Factors of Employer Health Insurance Cost

When estimating employer health insurance costs, there are a number of different factors to consider. Take a look at you business and your workforce, and see how they measure up in each of these categories:

Don’t Miss: Does Short Term Health Insurance Cover Pregnancy

Can You Drop Your Employer

Unlike individual health insurance, there are specific rules governing the cancellation of job-based health insurance. It can only be canceled within the companys open enrollment period or both you and your employer may incur tax penalties in accordance with Section 125 of IRS code.

There is one exception. You may cancel your participation in an employer group health plan if you have a qualifying life event. This could be a change in hours or loss of a job, a new baby, marriage, or divorce.

You can also cancel coverage if you lose your job, but then you have to worry about alternate coverage. That is where COBRA insurance could help.