How Does A Qsehra Work

The details of a QSEHRA are fairly straightforward. In 2020, a small business can contribute up to $5,250 to an employee-only QSEHRA, and up to $10,600 if the employee has family members who also have minimum essential coverage. The amount is prorated monthly if the employee doesn’t have coverage under the QSEHRA for the full year. Therefore, in 2020, the monthly limit is $437.50 for a single employee and $883.33 for an employee with covered family members.

These amounts are indexed annually and employers aren’t required to contribute the larger amount for employees with families. They can if they choose to, but it’s also permissible for the employer to give everyone the same amount, based on self-only coverage. It’s also permissible for the employer to set a lower QSEHRA limit, as long as it’s done consistently across all eligible employeesfor example, contributing 80% of the annual limit, instead of 100%.

If the QSEHRA will make the employee-only premium for the second-lowest-cost silver plan in the exchange no more than 9.78% of the employee’s household income for 2020 , the QSEHRA is considered affordable employer-sponsored coverage and the employee is not eligible for a premium subsidy in the exchange.

How Do I Apply For A Premium Tax Credit Or Csr

When you apply for a health insurance plan, the Marketplace, will show you eligible reductions. Make sure to report your income accurately any mistakes are usually caught at tax time and may result in a surprise bill.

Or, contact a GoHealth licensed insurance agent to help you check for all the subsidies that you are eligible for our consultations are free.

Purchase Of Individual Coverage By Families Not Offered Group Plan

Price Elasticity

Estimates of the price elasticity of demand for individual insurance by families in California who do not have access to group coverage are given in . . Our overall elasticity estimate of 0.2 to 0.4 is similar to those found in earlier studies. But we find significant differences in the price elasticities between younger and older families =4.2, p< .05 in Census data, 2=10.7, p< .05 in NHIS data), the self-employed and others =2.9, p< .10 in Census data, 2=3.3, p< .10 in NHIS data), and by poverty group=117.03, p< .05 in Census data, 2=136.81, p< .05 in NHIS data). The price elasticities and the income elasticity estimates did not differ significantly between the CPS and SIPP data =4.8, p> .10), so we present the pooled estimate. The elasticity estimates for some of the subgroups were statistically higher from the NHIS data than the point estimates made from the Census data, but the general pattern of results was very similar.. We also explored whether price response differs when premiums are high or low. We found a statistically significant greater response when the minimum offer premium was less than $45 per month than at higher premiums in all datasets. However, the effect was very small. The elasticities shown in are estimates at higher premium levels at lower premium levels, the overall elasticity increases from .20 to .25 in the Census data the increase in the NHIS data is from .44 to .46 and was not statistically significant.

You May Like: Can I Have Dental Insurance Without Health Insurance

Health Savings Accounts Get Mixed Reviews

The country is largely split over the question of whether health savings accounts are a wise coverage solution on a large scale and whether HSAs help or hurt the nations health care system.

Proponents of HSAs argue that people tend to be more careful with their own health care costs when theyre paying part of the bills themselves. So instead of going to a doctor for every cough, cut, or cramp, HSA users would have an incentive to be less wasteful with their health care spending, and maybe even take the time to shop around.

They say that the cumulative effect will be a nation of health consumers whose behavior would lower health care costs, while injecting price and quality competition into the medical marketplace. And tax advantages, they say, could lure the uninsured into lower-cost, high-deductible plans, reducing the ranks of the uninsured and possibly even nudging them into healthier lifestyles.

Critics of HSAs argue that health savings accounts benefit the young and healthy, while those with regular medical problems or who are older may end up paying more if they select an HDHP/HSA combination, because they tend to drain their savings with more frequent up-front medical expenses.

Applying For Obamacare Subsidies

You can apply for Obamacare subsidies through the government-run health insurance Marketplace in your state or through qualifying licensed agents, and private online Marketplaces that cooperate with the government marketplace. A good source for meeting all your insurance coverage needs is eHealth. We offer you online tools to help you determine if you are eligible for Obamacare subsidies and Marketplace plans available where you live. We also have licensed agents to help you find insurance plans that meet your needs and budget. With 24//7 support and a wide selection of plans available, you can rest assured eHealth is here to help you find and maintain the best plans for you and your family.

Keep in mind the government makes the final determination on your eligibility for a subsidy. While you can shop through eHealth to select a plan, the subsidy comes through the government-run marketplace. If you are ready to begin comparing plans, check out all of your individual and family health insurance options with eHealth.

Don’t Miss: Do You Have To Have Health Insurance In Florida

Policy Options For Improving Financial Assistance

Several legislative proposals introduced in the previous Congress would significantly improve the ACAs subsidies, reducing both premiums and out-of-pocket costs for subsidized consumers. H.R. 5155, introduced by Representatives Frank Pallone, Richard Neal, and Bobby Scott , would significantly increase both premium tax credits and cost sharing assistance, lowering net premiums for subsidized ACA consumers to closer to Massachusetts levels. The bill would also extend subsidies to people above 400 percent of the poverty line.

Legislation introduced by Senator Elizabeth Warren would make similar changes. Other proposals would make more limited but targeted improvements, for example lowering premiums for young adults . All of these proposals would advance the goals of expanding coverage and making premiums and out-of-pocket costs more affordable for those who are already insured.

| Appendix Table: Non-Elderly Uninsured, by Income, 2017 |

|---|

| State |

How Much Money Will I Get

The exchange will calculate your premium subsidy amount for you. But if you want to understand how that calculation works, you have to know two things:

Your subsidy amount is the difference between your expected contribution and the cost of the benchmark plan in your area.

See an example of how to calculate your monthly costs and your subsidy amount at the bottom of the page. But know that the exchange will do all of these calculations for youthe example is just to help you understand how it all works, but you don’t have to do these calculations to get your premium tax credit! If you’re in a state where the state-run exchange hasn’t yet updated its calculations to account for the American Rescue Plan’s additional premium subsidies, you can use the Kaiser Family Foundation’s calculator.

Recommended Reading: What Is Aetna Health Insurance

Health Insurance Through Covered California Is More Affordable Than Ever

Thanks to the American Rescue Plan, Californians will get more help paying for their plan from the federal government, and even more Californians qualify for the new savings.

Before the American Rescue Plan, California helped people who made too much money qualify for the premium tax credit with a state subsidy. But the American Rescue Plan expanded who can get this help, covering everyone who has been receiving the California state subsidy.

What this means for you: You can get even more financial help now, and if you didnt qualify for financial help before, you may qualify now.

Ninety percent of people who have enroll with Covered California get financial help, and you could be one of them. You could even qualify for low-cost or free health coverage through Medi-Cal. Even if youve checked before, check again, because more than a million people could see more savings.

Heres How Aca Subsidies Work In A Nutshell

If you think you qualify for subsidies, apply for insurance through the government-sponsored marketplace . Subsidies are only available through the exchange.

Estimate how much income you think youll have for the year and youll receive a subsidy based on your income level and other factors. This subsidy is actually an estimated amount that the government pays to the insurance company on your behalf.

Next year when you file your taxes, you may have to pay back some or all of the subsidy if it turns out you made more income than you estimated or otherwise dont qualify.

You May Like: How To Stop Health Insurance

Will The Government Pay For My Health Insurance

Not all of it! The government will not pick up the entire tab, but if you enroll in a Covered California health plan, depending on how much money you make, you may qualify for a subsidy that may cover a considerable portion of your monthly premiums. If you make less than 138% of the Federal Poverty Level in California, you qualify for Medi-Cal . If you make over that amount but less than 400% of the federal poverty level based on your household income and number of dependents, then you may be eligible for an up-front subsidy 1. View Covered California income limits to determine if you quality.

Basically, the government will pay for part of the premium and you will pick up the rest. The amount the government pays initially is dependent on your estimate of what your annual income is expected to be during the year that you apply for health insurance.. If at tax time the next year, it turns out that you made less money than predicted, then you will get a tax credit. If you made more, then your taxes will increase to make up for the governments overpayment on your subsidy. Whether or not you get a subsidy from the government is based on several things: your household income, number of dependents and you being on a Covered California exchange plan.

Find Cheap Health Insurance Quotes In Your Area

A health insurance tax credit can reduce your monthly health insurance cost. It’s only available for those who purchase insurance through the marketplace, and you must meet income criteria to qualify.

You can sign up for a health insurance tax credit during open enrollment or when you have a qualifying life event, such as getting married, having a baby or moving. If you own a small business with fewer than 25 employees, you may also qualify for government subsidies, which can help pay for your employees’ health insurance.

Also Check: How To Apply For Low Cost Health Insurance

Employers And Employees Making Sense Of Qsehra

There are several important takeaways to keep in mind if you’ve got a small business and you’re considering a QSEHRA benefit for your employees, or if you’re considering a job offer that includes a QSEHRA instead of group health insurance:

- QSEHRA benefits are capped at a flat-dollar amount. If an employer offers the maximum benefit, it’s likely to cover a substantial portion of the premiums for younger employees, but may leave older employees with significant after-QSEHRA premiums.

- If employees have incomes that are high enough to make them ineligible for premium subsidies in the exchange , then any QSEHRA benefit offered by an employer will be beneficial to the employees, since they would otherwise have to pay full price to buy their own coverage .

- If employees have an income that would make them eligible for premium subsidies in the exchange, will the QSEHRA benefits strip away their subsidy eligibility? If so, employers and employees need to understand that if the QSEHRA is set up so that family members can also have their benefits reimbursed, nobody in the family will be eligible for premium subsidies, even if they only end up getting a small portion of their premiums reimbursed via the QSEHRA. In some cases, this could result in a family losing out on a significant amount of premium subsidies in the exchange, making the QSEHRA a net negative for them.

Things To Know About Obamacare Subsidies

Anyone who is curious about their Obamacare subsidy eligibility need to know the following facts:

- Your eligibility for subsidies is based on your income in the year in which you are covered by your health plan not on your income as reported on last years tax return. This means that you must estimate your income when applying for subsidies.

- If you earn more than expected during the year, you may be required to pay back some or all the subsidy dollars that were applied on your behalf to your monthly health insurance premiums.

- If you earn less than expected during the year, you may be due additional subsidy assistance, which may be applied when you file your taxes for the year.

Don’t Miss: How To Get State Health Insurance In Ct

Understanding The Aca’s Premium Tax Credit Health Insurance Subsidy

The Affordable Care Act includes government subsidies to help people pay their health insurance costs. One of these health insurance subsidies is the premium tax credit which helps pay your monthly health insurance premiums.

Despite significant debate in Congress over the last few years, premium subsidies continue to be available in the health insurance marketplace/exchange in every state. And the American Rescue Plan has made the subsidies larger and more widely available for 2021 and 2022.

The premium tax credit/subsidy is complicated. In order to get the financial aid and use it correctly, you have to understand how the health insurance subsidy works. Here’s what you need to know to get the help you qualify for and use that help wisely.

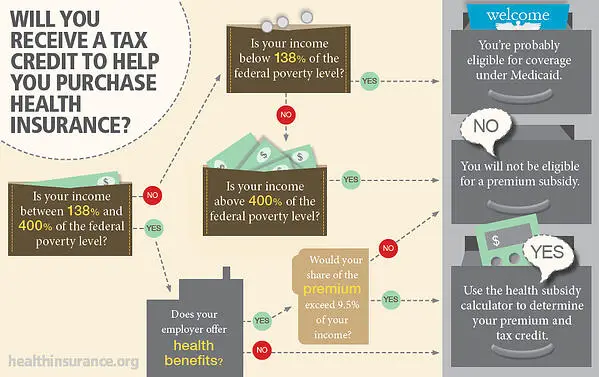

You May Qualify For A Subsidy If All Of The Following Are True:

- Your employer doesnt offer affordable health insurance to you. In this case, affordable insurance means at least 60 percent of covered benefits or the premiums would cost you no more than 9.5 percent of your annual household income after tax credits are applied.

- You purchase insurance coverage through a government-sponsored marketplace.

- Your annual household income is between 100 and 400 percent of the federal poverty level, depending on your specific states requirements.

You May Like: Does Cigna Health Insurance Cover International Travel

What Is The Income Limit For Aca Subsidies

The income limit for ACA subsidies for individuals is between $12,880 and $51,520 families of four with a household income between $26,500 and $106,000 can also qualify as of 2021 poverty guidelines.2 Essentially, your household income should be between 100% and 400% of the Federal Poverty Level . In other words, in order to qualify for the tax credit, your household income must be one to four times the FPL.3

However, there are other criteria that must be met to qualify for ACA subsidies:

- You cant be eligible for health insurance coverage through Medicare, Medicaid, the Childrens Health Insurance Program , or any other form of public assistance.

- You must be a U.S. citizen or have proof of legal residency.

- You must file a joint tax return, if youre married

- You cant have access to affordable health insurance through an employer. The government considers insurance affordable if the employees contribution is less than 9.83% of their household income . The employers plan must also offer the same benefits as the governments bronze level plan.4

See If You’re Eligible For Financial Help

Use our Shop and Compare Tool to see how much you can save. Were updating our system, so you might not see the new increased savings until sometime in April. But if you apply now, youll still get the increased financial help!

Some families get a thousand dollars a month in savings, even those making up to $154,500 a year. Even an individual earning close to $75,000 may qualify for financial help.

For more information about the new state subsidies, please review the design documents, which have more details about the program.

Read Also: What Is Private Health Insurance

What’s In It For You: Stephanie Ruhle Breaks Down How Much You Could Be Getting In Covid Relief

For example, a single person who makes $30,000 annually will pay $85 per month in premiums on average under the new law for a silver-level plan instead of $195, according to an analysis by the Center on Budget and Policy Priorities. A family of four making $75,000 will pay $340 rather than $588 per month for similar coverage, the analysis found.

Everyone benefits from the changes, said Tara Straw, a senior policy analyst at the center, including people with incomes above 400 percent of the poverty level who were previously not eligible for premium tax credits.

An older customer not yet in Medicare with an income just over 400 percent of the federal poverty level in some states would be paying 20 percent to 30 percent of their income toward their health care premium, she said. Now that will be capped at 8.5 percent.

At the other end of the income spectrum, people with incomes up to 150 percent of the poverty level will owe nothing in premiums. Under the ACA, they had been required to pay up to 4.14 percent of their income as their share of the premium cost.

Steps to take now:

When: 2021

Who benefits: Anyone who has received or has been approved to receive unemployment insurance benefits in 2021.

Step to take now: