Who Qualifies For Cost

Families earning between 100% and 250% of the FPL can have the health insurance provider lower or cover more out-of-pocket costs when health services are received. In 2021, that means individuals earning between $12,760 to $31,900 per year. For a family of four, that would be between $26,200 and $65,500.

Cost sharing reductions are available only to qualified people who purchase silver plans.

What Percentage Of Your Paycheck Should Go To Health Insurance

Medical expenses should be a top budgeting priority, with out-of-pocket costs on the or nearly 7 percent of pretax income, according to the Bureau of Labor Statistics. Fixed Premium: This is the set amount you pay for your health insurance. receipts from your insurance company and healthcare providers and going

Florida Blue Health Insurance

Florida Blue is a subsidiary of Blue Cross, a nationwide health care provider. Florida Blue offers PPO plans, which give you the most freedom to choose your doctors and health care service providers.

This can be beneficial if you have a chronic condition or longstanding relationship with a health care provider and you dont want to begin treatment with a new doctor.

Florida Blue offers subsidiaries to help you reduce the cost of health care if youre living on a fixed income.

Florida Blues ACA-compliant plans also include free preventive care like physicals, vaccines and mammograms.

# of Healthcare Providers

Read Also: Where Can I Purchase Affordable Health Insurance

Florida Health Insurance Laws

In 2014, the Affordable Care Act made it so that insurance companies cannot consider these factors when pricing your policies:

- Pre-existing conditions: Before the ACA, insurance companies were able to charge higher rates based on pre-existing conditions. Now, insurance companies cannot charge higher rates to people with pre-existing conditions.

- Gender: A 2004 Health Services Research study found that women historically pay more for health care. But with the ACA, insurance companies cannot charge men and women different premiums for the same plan.

- Insurance and medical history: Insurance companies used to be able to analyze your medical history and past insurance coverage. Those with medical problems or lapses in insurance were often charged much higher premiums, if they were able to get coverage in the first place.

According to the Centers for Medicare & Medicaid Services, insurance companies must provide Florida residents with some coverage for these services:

- Mammograms

- Use of drugs for cancer treatment

- Dental anesthesia

- Mastectomy

- Autism spectrum disorders

Find the full list of benefits and how they vary based on small group, large group, and individual coverage here.

Health Insurance For 55 And Older

Contents

More than fifty percent of US citizens did not have life insurance in this year. Buying life insurance for people over 50 can be more challenging than it is for younger people.

As you reach the age of 50, it can become more difficult to find suitable policies and make premium plans less accessible. Weve reviewed and rated vendors based on factors such as price, coverage limits, benefits, and ease of application process to make our best decisions.

Read on to find out which companies made our list of the best life insurance companies for people over 50.

Also Check: Can I Buy Dental Insurance Without Health Insurance

Florida Dental And Vision Plans

Dental and vision insurance plans, underwritten by Golden Rule Insurance Company, have no age limit restrictions.4 They offer coverage for the dental and vision services many medical insurance plans dont include.

From Miami to Orlando, Tampa to Jacksonville, explore these Florida health insurance options and more that may be available now.

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers canât refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or âdonut holeâ can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

You May Like: Can I Get Health Insurance In Another State

Cheap Health Insurance For Students

Students often have additional health insurance options. Many universities and colleges provide free health insurance to students through a school-sponsored plan. These policies typically provide health insurance for most on-campus medical services, but you may lose the coverage if you become a part-time student or transfer schools.

Another option for some students is to purchase a student health plan. These health insurance policies are designed for full-time students between the ages of 17 and 29. Plans can be bought through most large health insurance companies and are paid either by an annual or semiannual premium. A student health plan can be a great cheap medical insurance option because you will not lose your coverage if you decide to transfer to a different school.

Comprehensive Long Term Care

Sunshine Health is the largest Comprehensive Long Term Care managed care organization in Florida. We offer comprehensive physical and behavioral health services and programs to support our members ability to age in place and remain independent for as long as possible. Long Term Care is for Medicaid enrollees 18 years and older who require a Nursing Facility level of care. This doesnt mean members must reside in nursing homes. We help members stay in the community whenever possible with long-term services and supports. We help can help members transition from nursing facilities into a home setting of their choice.

Also Check: Can You Get Health Insurance Immediately

Can I Buy Affordable Health Insurance At Any Time

You may be able to buy short-term health insurance coverage at any time, but plans offered in conjunction with the ACA can only be purchased during open enrollment unless you qualify for a special enrollment period. Special enrollment periods can include any time you add a member to your family, move to a new coverage area, or experience another eligible life event.

MediGap coverage also has its own open enrollment period that starts during the month you first turn 65 and lasts for six months provided you are already enrolled in Medicare Part B. You may not be able to buy MediGap coverage after this time, or you may have to pay more for coverage.

Cheapest Health Insurance Plan By County

As we mentioned above, Silver plans are where we advise the average consumer to begin their shopping process. To help you, weve listed the cheapest Silver health plan for each Florida county, as well as sample prices for families of different sizes.

These premium estimates are unsubsidized. Depending on your income, you will likely see even lower prices once you account for the tax credits.

| County |

|---|

Also Check: How To Sign Up For Health Insurance

You Have More Insurance Options For Your Health Than You Think Florida

If youre self-employed or without insurance from your employer in other words, youre looking for individual or family health insurance in Florida you might be looking for Affordable Care Act insurance, what’s often called Obamacare. However, we want to make you aware of the whole range of individual and family insurance products we have available in your state.

Selecting A Health Insurance Policy That Works For You

When deciding between multiple health insurance plans, its a good idea to compare quotes from different providers to ensure youre getting the best deal. The Health Insurance Marketplace allows you to quickly and easily compare quotes from providers and compare information like premiums, deductibles, copays, and covered services.

Once youve decided on a plan, the next step is to enroll in a policy. Youll have to select your chosen policy on the Marketplace and pay your first premium before coverage goes into effect. To pay your premium, youll typically be redirected to the health insurance companys website. Customers will receive their health insurance card within a few weeks after signing up for a policy. Once your coverage has gone into effect, you can begin to take advantage of your health insurance coverage by making appointments to address any medical issues or concerns. Some plans even have other perks to take advantage of, like free gym memberships.

You May Like: Can I Stop My Health Insurance Anytime

Find Cheap Health Insurance Quotes In California

We compared quotes for health plans and concluded that the Silver 70 EPO and Silver 70 HMO were the most affordable Silver plans in most counties of California. Note that in California, there are many companies where you can buy individual health insurance, but they may not all be available in your county.

You May Like: Whatâs The Penalty For Not Having Health Insurance In California

How Do I Choose The Most Affordable Medical Insurance

The most affordable health insurance depends on your household income. The cheapest option is to enroll in Medicaid if your income falls below 138% of the federal poverty level. Medicaid is a federally funded health insurance program that provides health care benefits to low-income individuals. For those not eligible for this option, the most affordable solution may be through your state marketplace, as well as off-exchange plans, including short-term health insurance policies.

It’s important to note that the cheapest health insurance plan may not always be the right policy for you. Therefore, to find the best value coverage, you should evaluate your medical needs before buying a health insurance policy.

You May Like: How Much Do I Have To Pay For Health Insurance

Health Insurance Coverage For Multiple Years

TriTerm Medical Insurance,2 underwritten by Golden Rule Insurance Company, is short term health insurance that offers coverage for preventive care, doctor office visits, and prescriptions.

- Apply once for insurance coverage terms that equal one day less than 3 years.

- $2 million lifetime maximum benefit per covered person on most plans.

- Eligible expenses for preexisting conditions are covered after 12 months on the plan.

Types Of Health Insurance Florida Plans

Open Registration. In certain regions, the bulk of affordable health care choices are market-based policies. Many countries also direct health insurance surveys on the healthcare.gov market.

The new open registration was held from 1 November 2018 until 15 December 2018. Few states have expanded open registration and you can also register in many forms if the open registration is over.

- In the last 60 days, youve missed insurance care.

- Someone got married in your household.

- You have or had a dependent.

- Also, you have had the kid.

- If you have been divorced or split lawfully and have lost your health benefits.

If you dont apply to all of those life events, or you just want to buy coverage in the market without investing, you have choices. You will choose to partner with a health care provider who can deliver both in the market or through private arrangements.

Lifecare policies for private people. There are likely to be restricted opportunities in certain parts of the country for private health care policies, but some decent alternatives do exist, depending on where you live. The provisions of ACA or the state mandates can be fulfilled by commercial health care programs.

Dont expect subsidies for programs bought outside the state or healthcare.gov, though.

Healthcare.gov Metal Plans

| Plan category | |

| 10% | 90% |

Out-of-pocket understanding limits

EPO, HMO, and PPO intermediate selection in Health Insurance Florida

Don’t Miss: How Much Does Usps Health Insurance Cost

Can You Get A Health Plan For Free

Many people pay nothing if they qualify for the Affordable Care Acts premium tax credit subsidy. This tax credit is taken in advance to lower the amount of each monthly health premium you must pay, although it goes straight to the insurer.

You must apply for the subsidy and purchase a plan through your states health insurance exchange, also known as the Health Insurance Marketplace.

The amount you receive will depend on the household income that you disclose when you apply. You must make between 100% and 400% of the federal poverty level to qualify.

The American Rescue Plan allows more households, including those with incomes over 400% of the poverty level, to qualify for subsidized health plans through the Marketplace in 2021 and 2022. You may be eligible for tax credits in these years that lower the cost of your health plan, even if your income was too high in prior years.

You must file a tax return at the end of the year to reconcile your income with the tax credit you received. You may have to pay back some of the tax credit that lowered your costs if you ended up with more income than you thought you would have at the time you first applied.

You won’t have to pay back any excess tax credit you received in 2020 because the IRS has waived this rule for just this one tax year.

The Marketplace will send the credit directly to your insurer to be applied to your monthly plan premium. You may not have to pay out of pocket at all for health care costs in some cases.

What Is The Most Affordable Health Insurance In Florida

Cheapest Health Insurance Providers in Florida

You May Like: Do You Need Health Insurance To Go To Planned Parenthood

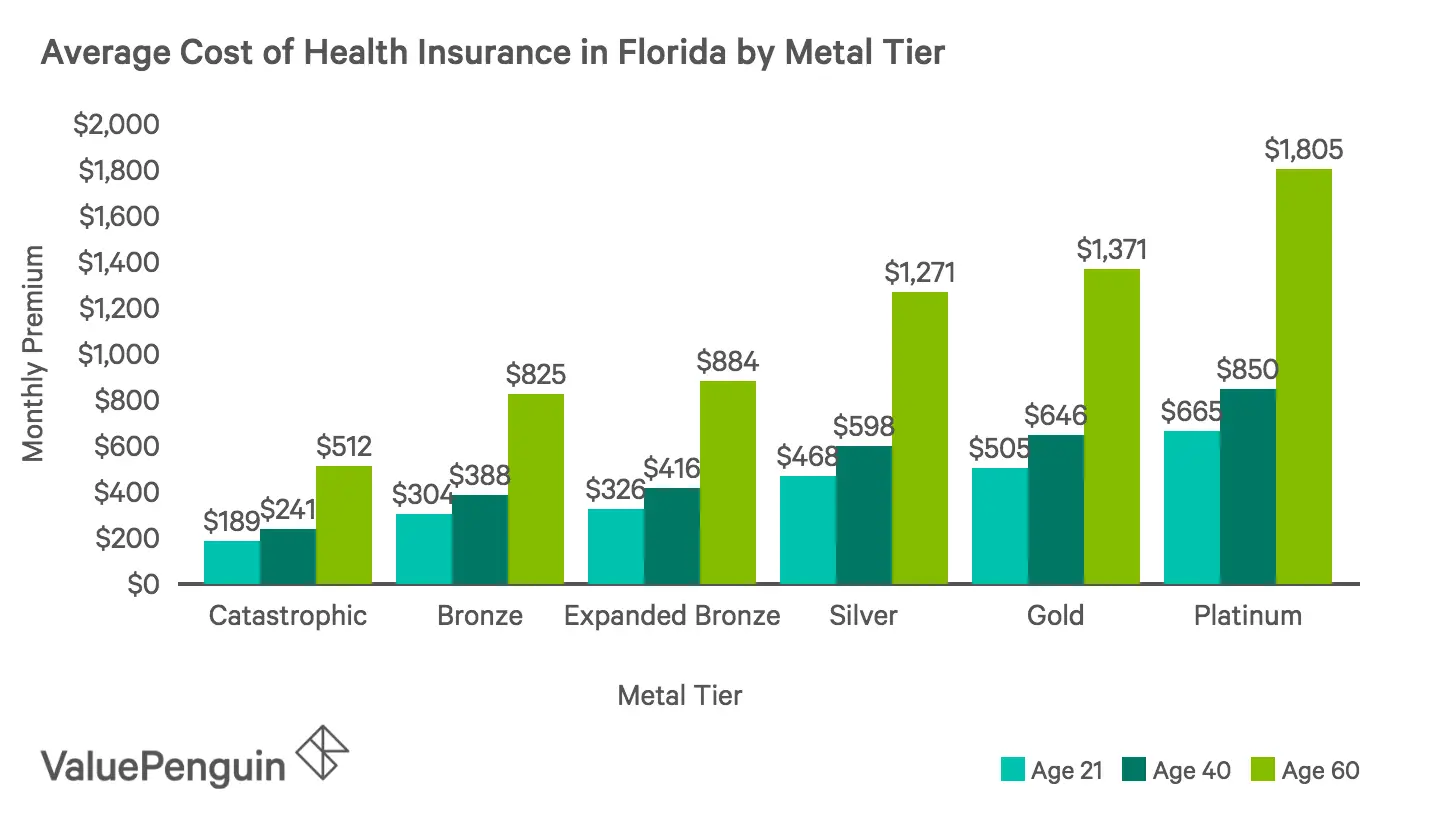

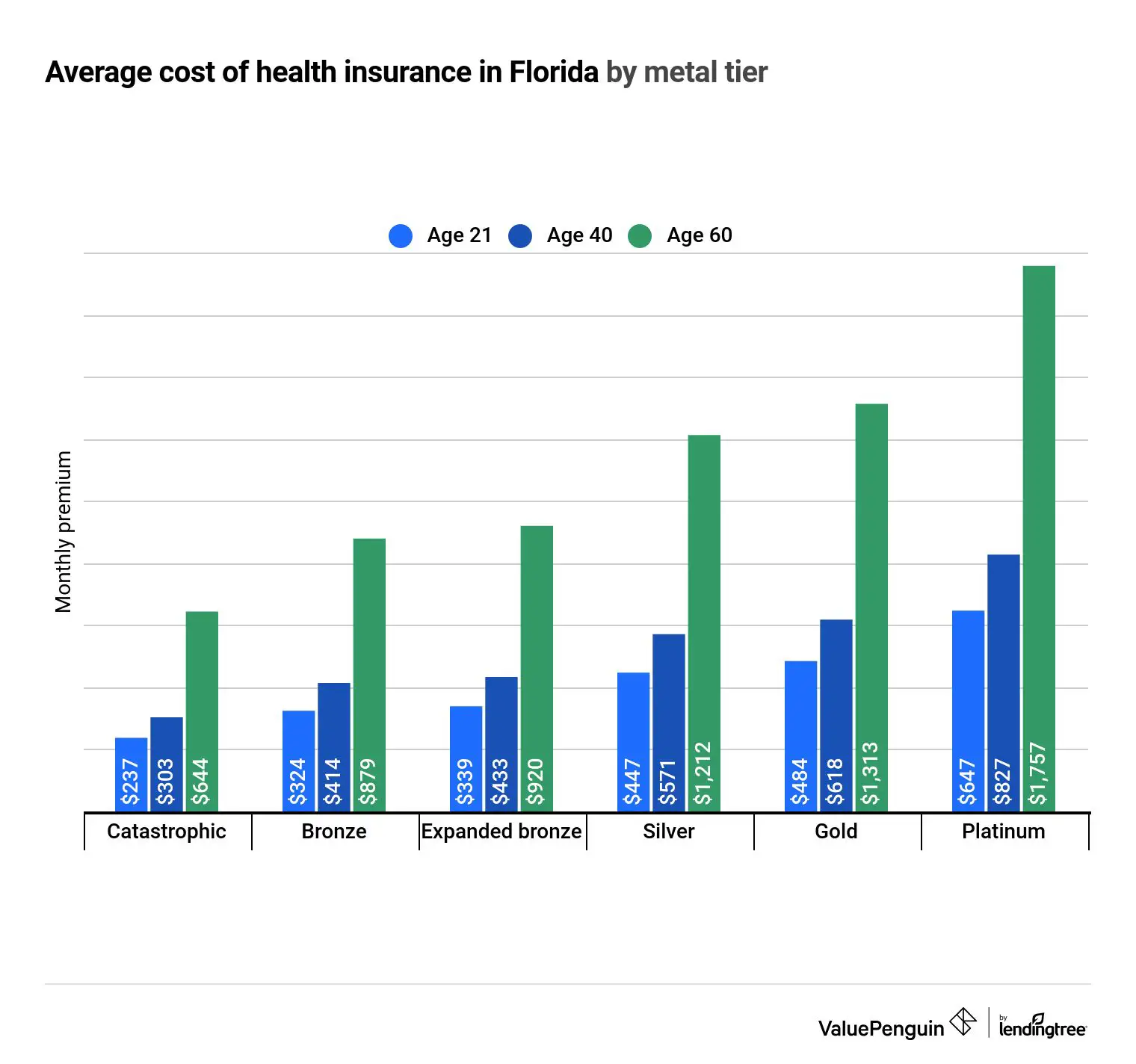

Cheapest Health Insurance By Metal Tier

We compared the health insurance plans available on the Florida marketplace and identified the cheapest policy in each metal tier to help you find the best option for your chosen level of coverage. Aside from the level of coverage you choose, one of the most significant factors in determining health insurance rates is the age of each person insured.

Aetna: Best Health Insurance Company For Value

Aetnas unrivaled history as a top-rated health insurance company puts it in good stead, both in terms of reputation and financial robustness. Both of these factors mean that the health insurance polices offered to customers rate especially well when it comes to value for money.

The quotes received from Aetna regularly came in at a much better price than its main competitors, and its savings plans are also a boon for people looking to manage their healthcare expenses more effectively.

There isnt too much in the way of downsides, though one small caveat is that Aetna has fewer short-term healthcare policy options than some of the others featured in our guide to the best health insurance companies.

You May Like: When Does New Health Insurance Start

Read Also: Are Abortions Covered By Health Insurance

What Happens If I Still Can’t Afford To Buy Health Insurance

If you cannot purchase insurance, it will be extremely difficult to find Healthcare options in your area. Many doctors don’t accept patients without insurance and hospitals have the tendency to charge higher rates to customers without insurance. In emergency situations, you will be treated, but you will have little protection from the bills that the hospital charges you.

How Much Does Health Insurance Cost In Florida

If youre looking for your best health insurance plan in the state of Florida, you can find many affordable options on the Florida health insurance marketplace. In 2020, the average cost of health insurance is $554 per month for a 40-year-old. This is a decrease of 4% from 2018 when the monthly cost was $575.

Also Check: Can You Add Your Mom To Your Health Insurance

Types Of Health Insurance Plans

There are multiple types of health insurance plans. The type of plan you choose will dictate how much you pay, whether you need a referral to see a specialist and which health care providers you may see. Lets go over the 3 most common types of health insurance plans: HMOs, PPOs and POS plans.

- Health maintenance organization plans: HMO plans require that you only see doctors, specialists and care providers within the organizations network. You cannot see any health care providers outside of the network and you must get a referral to see a specialist. HMOs are the most affordable type of plan, but they give you the least amount of freedom to choose which care providers you see.

- Preferred provider organization plans: PPO plans offer a network of doctors and specialists but do not require that you see them. Youll pay an additional fee if you see a health care provider outside of your network. You dont need a referral to see a specialist with a PPO plan. PPO plans are usually more expensive than HMO plans.

- Point-of-service plans: POS plans are a mix between an HMO and a PPO. You can see doctors and specialists out of your network with a POS plan like a PPO. However, youll still need a doctors referral to see a specialist like you would with an HMO. POS plans can allow you to see the care providers you want with lower rates than PPOs.

Average Cost Of Health Insurance By Family Size In Texas

The cost of a health insurance plan in Texas will vary based on your chosen policy, household income and the size of your family. Each family member added to your policy will increase your monthly health insurance premiums by a certain amount based upon their age.

For instance, children ages 14 and younger cost $305 to add to a Silver plan in Texas, whereas a 40-year-old adult costs an additional $509 to insure. A family of five would pay $610 more per month for a health plan than a family of three.

| Family size | |

|---|---|

| Family of five | $1,933 |

Adults are assumed to be 40 years old. Sample rates are based on the average cost for a Silver plan in Texas.

Read Also: How Do I Know If I Have Private Health Insurance