How To Choose The Right Family Health Insurance Plan

For choosing the right family floater insurance plan, one requires beingdiligent towards the familys needs. Here are some points which should be considered by the person who wants to buy a family floater health insurance plan:

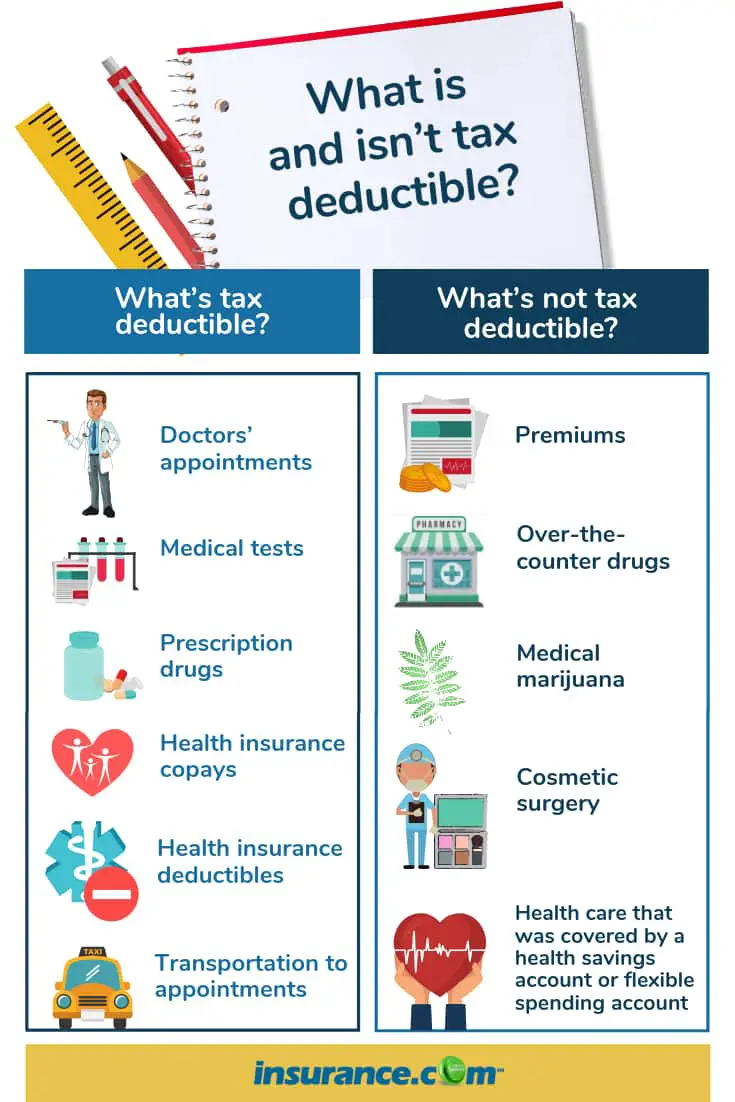

- Check whether the insurer offers co-payment Co-payment is when the policyholder pays the certain part of the total claim Know the deductible: Deductible is the amount that one requires paying from his/her pocket in case of a claim. The remaining amount will be paid by the insurer.

- Know room limit: Also called the capping amount, room limit is the amount up to which the health insurance plan will pay for your hospital room in case of hospitalization.

If you are looking for a hassle free way of insuring the health of the entire family, consider buying a family floater health insurance policy.

To know more about our Health Insurance Plans and its benefits

Can I Add A Parent To My Health Insurance

Adding a parent to your health insurance policy is possible if your health insurer allows parents as dependents. The plan will be cross-checked if your parent falls under the eligibility criteria, depending on the type of policy covering you.

However, some policies dont allow you to add parents to your health insurance plan, so you will likely have to purchase separate plans. Some health insurance policies are specifically designed for older people and that too at the cost of paying very affordable premiums. Shop around and look for suitable health insurance plans that cover your parents.

In majority terms, adding a parent to your health insurance policy is not possible, only a few insurers may allow you to do that if their plan is flexible enough.

On the other hand, a non-dependent child health insurance is given to children if theyre under the age of 26 on their parents plan.

Does Adding Additional Drivers Increase Insurance

Does Additional Driver Insurance Increase Your Rates? You can expect your auto insurance premiums to change if you add a driver to your policy. The change might not be an increase in your rates. In fact, it might bring your premiums down significantly, depending on the primary and secondary drivers on your policy.

Don’t Miss: Starbucks Health Plan

Who Is Considered A Dependent Independent Health Agents

8 days ago However you cannot include a dependent on your health plan if he/she is on Medicare. When can I enroll a dependent on my health insurance? You

If you dont enroll your family member during the PIE, you can enroll him or her during Open Enrollment. You may also enroll your family member in your medical

7 days ago Children · Are they related to you? Your biological child, stepchild, adopted child, or foster child in your care could qualify as a dependent on

If my child under the age of 26 loses their own personal or employer-based coverage, can I add the child to

What Qualifies Someone As A Dependent

First and foremost, a dependent is someone you support: You must have provided at least half of the persons total support for the year food, shelter, clothing, etc. If your adult daughter, for example, lived with you but provided at least half of her own support, you probably cant claim her as a dependent.

Recommended Reading: Insusiance

Can I Extend My Health Insurance To Cover My Parents And Siblings

Normally, parents own the best insurance policies and add coverage for their children. But, what would happen if a child had a better insurance policy? Can I cover my parents and sibling with my health insurance policy?

Parental Insurance

Parents might work for many years at a company and gradually accrue very good health insurance coverage. They might have more wealth and be able to afford better car or homeowners insurance. Teenagers are added to parents car insurance policies for a number of good reasons.

Teenagers dont have jobs, income or cars. They use their parents vehicle while learning to drive. Therefore, adding the children to a parents insurance policy only makes sense.

As more adults stay at home due to bad economic conditions, they are trying to stay on their parents insurance policies for a longer period of time. This only makes sense since the parents still probably pay for many of their childrens expenses.

Household Insurance

If you have a great healthcare policy, it only makes sense to extend healthcare benefits to other members of your family. Families share expenses, so why shouldnt they share insurance coverage? You want your loved ones to be happy too.

A good example is a contagious disease. If one family member gets it, others might get it too. With preventative healthcare, you can protect all of your family members.

Great Jobs, Great Insurance

Dependent Status

Can I Put My Parents On My Health Insurance

Lucy Lazarony

Heres a switch. Now it is time to take care of Mom and Dad. There are some insurance companies that will allow you to add a parent as a dependent to your health plan. And they may require that youve already listed your parent as a dependent on your taxes.

According to Healthcare.gov, the website for the Health Insurance Marketplace, dependent parents can be included in your household, as long as you already claim your parents as tax dependents. So the first step to getting healthcare for a parent is claiming them as a dependent on your taxes. To learn more about claiming dependents, check out Publication 501.

Already claiming a parent as a dependent on your taxes? Reach out to your current insurance company and find out if you will be able to claim a parent as a dependent on your plan. You wont know unless you ask. Be sure to tell the insurance company that you already claim your parent as a dependent on your taxes. If they allow parent dependents, you should be all set. But they may have their own dependency requirements that you will have to meet as well, such as a parent living with you and you providing for him or her financially.

Don’t Miss: What Benefits Does Starbucks Offer Employees

What Is A Voluntary Deductible In A Motor Insurance Policy And Can My Motor Insurance Claim Be Rejected Kiran Rege

Voluntary deductible is an amount voluntarily opted by the insured to be deducted at the time of claim. The insured is provided with a discount in the premium payable based on the amount selected. For instance, on voluntary deductible amounts ranging from Rs 2,500 to Rs 5,000, the discount amounts can range anywhere between 20% and 35%. The discount will be subject to maximum amounts ranging from Rs 750 to Rs 2,500. In case the claimed amount is within the opted voluntary deductible, then there will be no payment done.

Who Can Be Added As A Dependent On My Health Insurance Plan

When you purchase a health insurance plan for yourself, you can get coverage that extends to your dependents likewise, if youre an employer covering your workers, you can provide coverage for any dependents they have. If youre planning on purchasing a family health insurance plan to cover your dependents, its important to make sure you know theyre eligible to join your family health insurance plan before you make your final purchase.

Recommended Reading: Starbucks Health Insurance Eligibility

Repaying Health Insurance Benefits

There are good reasons to notify your employer of a divorce once its final. If you dont, you could face repercussions.

First, you could be liable for any benefits the health plan pays for your ex.

If you dont tell them and there is a claim, the insurance company can try and recover the cost of the claim from you, Tassey says.

Legally, you would have to reimburse your health plan.

Your ex-spouse will become liable for all medical expenses from the date of the divorce unless he or she opts for continued coverage through COBRA, Jurney says.

Second, there could be tax implications. An exs coverage cant be paid for with pre-tax dollars.

The value of the health coverage provided to the ex-spouse is taxable to the employee, to the extent it is not paid for with post-tax dollars, says Sonkin.

How To Make A Relative A Military Dependent

How can I make my minor sister, nephew, cousin, or foster child a dependent? To seek dependent status for a minor child for whom you have legal custody or Is the person your qualifying child or the qualifying child Was the person your brother, sister, half brother, half vacation, medical care, etc.

Recommended Reading: Kroger Health Insurance Part-time

Eligible Employees And Dependents

In other words, an eligible employee cant be denied coverage based on previous medical Dependents include spouses, children, and in some cases, What is MCHP? · Who is eligible for MCHP? · Benefits for children include: · How do I apply? · Can I apply for my grandchild , if they live Annuity Plan/401k · Contact · Health & Welfare > Frequently Asked Questions Q. Can I add my brother/sister/ parent/significant other to my coverage?

Can You Add Your Parents To Your Health Insurance

While the AffordableCare Act mandates that children be eligible for coverage under their parentsinsurance till 26, there isnt a similar protection for parents. Health plans typicallycount spouses and children as dependents, but generally dont include parents.However, the rules vary by plan and location, so always double check with yourplan.

If youre interested in getting health coverage for your parents, contact your health plan to find out if you can add them to your plan. Your parents must, generally, be claimed as tax dependents.

If your health insurance wont allow you to add your parents, you can enroll them in a separate health plan, either through the Marketplace or Medicare . If you have questions about their eligibility or would like help finding coverage for your parents, eHealths team of trusted health insurance experts can go over your options.

You May Like: Starbucks Benefits Part Time

Consider Other Health Insurance Options

If your siblings dont qualify as dependents and cant enroll in a parents plan, they may have other options available. Depending on their income and their states regulations, they may qualify for Medicaid. Medicaid provides health insurance to those with low incomes. If they are enrolled in a college or university, they may qualify for student health insurance.

Depending on their age and income, they may also qualify for a lower-cost catastrophic health insurance plan. With catastrophic coverage, they pay low monthly premiums and have a high deductible. Some preventative care is also covered under a catastrophic plan. For information, they should check the health insurance marketplace in their state.

Your Sibling Must Be Your Legal Dependent

In order to add your brother or sister to your health insurance plan, he or she must be your legal dependent. In other words, your sibling must reside in your home and you must be his or her primary caretaker he or she relies on you financially and you provide the care that your sibling needs to maintain a quality of life. For example, if your sister is disabled and you are her primary caretaker, you would be permitted to add her to your health insurance plan.

Read Also: Does Uber Offer Health Insurance

Adding People To Your Policy Faq

Will my partner or dependant have waiting periods?expand_moreexpand_less

It depends on what cover they’ve held previously. If they’ve been covered under another Bupa policy, you’ll need to let us know their previous policy number so we can carry across any waiting periods already served. If they were covered with another health fund, we’ll need a copy of their clearance certificate to honour their previous cover. If the level of cover they move to is higher than their previous cover waiting periods apply to any new services or higher limits and benefits. They can access their previous entitlements until these are served.

If your partner has been without cover for more than 60 days before they’re added to your policy, we won’t be able to recognise the waiting periods they served on their previous policy.

Please contact us if you need to confirm what waiting periods apply for the people you’re adding to your policy, or before commencing any treatment.

Will adding my partner or dependants increase my premiums?expand_moreexpand_less

Adding people to your policy will increase your premiums if it changes from:

- single to any other family type.

- single parent to couple, family, family plus, or single parent plus.

- couple to family .

- couple or family to family plus.

Can I add people to my level of cover?expand_moreexpand_less

Most levels of cover we offer are available for all family types.

The levels of cover we offer for singles and couples only are:

I Am A Final Year Bcom Student And I Also Drive A Taxi On Part

You can certainly opt for health insurance for yourself and your mother. Few health insurance plans will also allow you to cover your sister in same policy or your sister may require to get covered in a separate policy as certain plans do not allow siblings in the same policy. You may opt for a health insurance plan that covers hospitalisation, pre and post hospitalisation expenses, day care treatment, ambulance charges, hospitalisation daily cash allowance, no claim bonus on renewals. Opt for a plan that provides cashless hospitalisation benefit and should be renewable lifelong. You may log on to websites of various insurance companies for your health insurance as well as general insurance needs where you may also get online discount in the premium.

Also Check: Insurance Lapse Between Jobs

Can I Add My Girlfriends Child To My Health Insurance

If you plan on marrying your girlfriend any time soon and has a child, you will have to think about their health insurance needs. Adding your girlfriends child to your plan isnt that easy, but it isnt impossible.

You will have to sign an affidavit, submit some documents, and prove your relationship too. The best way to do so is to contact the HR of your company and ask them what benefits your girlfriends child receives on your plan, and if thats even possible. Dont hide the truth because if any misleading information is later on exposed, you could lose the whole insurance.

Who Can You Add To Your Health Plan Insurecom

Dec 2, 2021 Can I add my parents to my health insurance plan? Health plans typically limit the definition of dependents to a spouse and children. Even if a

Sep 19, 2018 Adding family members to your health insurance is a pro-active, preventative action. You might not use all of the benefits, so why not share

Jun 12, 2018 If a man gets a woman pregnant but does not marry her or live with her, then the man can still cover his child on his health insurance.

Find out if you qualify for lower costs on Marketplace health insurance coverage at How do I know which dependents income to include on my application?

When you enroll for Self and Family, you automatically include all eligible I will immediately notify OPM and my health benefits carrier if the child

Read Also: Eligibility For Aarp

Requirements For Adding Your Children As Dependents

If you have children, theyre probably the first people that come to mind when talking about dependents. Generally speaking, you can include any child who fits the following criteria:

- Age: Your child has to be under the age of 26.

- Relationship to You: For a child to qualify as your dependent, he or she needs to be your biological child, your stepchild, your adopted child, or a foster child you are taking care of. If your child has other sisters, brothers, half sisters, half brothers, or children of their own, you can also include them on your health insurance plan.

- Length of Residency: A child only qualifies as your dependent if they have lived with you for at least six months.

- Income Contribution: Although your child can be your tax dependent while working and contributing to their own expenses, they cannot be their own primary source of support. This means a childs income must be less than half of the cost of their support expenses to qualify as your dependent.

- Tax Filing: A child cannot be your dependent if they file a joint tax return that year.

- Other Claims: A child cannot be claimed as a dependent by more than one household. So, regardless of your relationship, if someone else claims your child as a dependent, you cannot.

Can I Extend My Health Insurance To Encyclopediacom

Sep 19, 2018 Adding family members to your health insurance is a pro-active, preventative action. You might not use all of the benefits, so why not share Jun 12, 2018 One of the most difficult questions that human resources representatives have to answer is who can an employee cover on their health

Also Check: Starbucks Employee Health Insurance