Understanding Health Insurance Costs

Having insurance doesnt mean your health care will be free. Youll still pay a monthly rate, or premium. Members may also pay copayments or other out-of-pocket fees or have to meet deductibles every year before insurance coverage kicks in.

Different factors can affect your health insurance costs. Its important to understand what these costs are before selecting a plan.

Choose Your Health Plan Marketplace

Most people with health insurance get it through an employer. If youre one of those people, you wont need to use the government insurance exchanges or marketplaces. Essentially, your company is your marketplace.

If your employer offers health insurance and you wish to search for an alternative plan in the exchanges, you can. But plans in the marketplace are likely to cost a lot more. This is because most employers pay a portion of workers insurance premiums and because the plans have lower total premiums, on average.

If your job doesnt provide health insurance, shop on your states public marketplace, if available, or the federal marketplace to find the lowest premiums. Start by going to HealthCare.gov and entering your ZIP code during open enrollment. Youll be sent to your states exchange if there is one. Otherwise, youll use the federal marketplace.

You can also purchase health insurance through a private exchange or directly from an insurer. If you choose these options, you wont be eligible for premium tax credits, which are income-based discounts on your monthly premiums.

How To Choose The Right Health Insurance Plan

Every time you look for a health insurance plan, you wonder which is the best health insurance plan? How to choose the best health plan online? What coverage should it have? To answer all your queries lets read more to decode the hacks to get the right health insurance plan.

Get yourself adequate sum insured

If you are residing in the metro cities then the cost of treatment is high hence for an individual your sum insured should ideally range between 7 lacs to 10 lacs. If you are looking for a family cover to insure your spouse and kids a sum insured that ranges between 8 lacs to 15 lacs suits best on floater basis. It should be adequate to cover more than one hospitalisation that may happen in a year.

Affordability

If you wish to pay low premiums for health insurance plan then co-pay your hospital bills. You end up sharing the medical expenses with your health insurer hence you do not have to pay a heavy premium.

Vast Network of Hospitals

Always check if the insurance company has a wide list of network hospitals. If the nearest hospital or medical facility is listed by the insurance company it will help you avail cashless treatment. At HDFC ERGO, we have a huge network of 10,000+ cashless network hospitals.

No Sub-limits Help

Check Waiting Periods

Trusted brand

Protect Your Family Against Coronavirus Hospitalization Expenses

Don’t Miss: Does Health Insurance Cover Breast Pumps

Choosing A Health Insurance Plan Is Complicated Rather Than Stick With The Status Quo Follow These Tips To Make A More Informed Choice

Choosing the right health insurance plan each year is an anxiety filled, complicated and overwhelming process.

You get a couple of weeks or, if youre lucky, a few months to go over multiple options either provided through your employer or on the federal marketplace.That means sorting through terms like deductible, co-insurance and HSA that even experts have a hard time comprehending.

So you might just go with what you had last year, even if it might mean you end up spending more money than necessary or leave yourself open to a huge financial risk in the event of an unforeseen emergency.

We cant make the process any less complicated.But the Kansas News Service spoke with a few experts for tips.

Avail Of Cashless Treatment Across Leading Network Hospitals

The health insurance plans in India, nowadays, also offer cashless claim facilities across any of the leading hospitals in the country. In cashless treatment, you do not have to take care of treatment costs out of your pocket. Instead, your health insurance provider directly settles the hospitalization expenses with the hospital on your behalf.

To avail of cashless treatment benefits, however, you have to seek admittance at any of the network hospitals as prescribed under your health insurance policy. Furthermore, you may have to fill out a pre-authorization form and provide your health insurance card to avail of the cashless treatment facility

You May Like: How Much Is Private Health Insurance In New York

Delhi Cm Promises Free Health Care Pind Clinics For All In Punjab

At a public meeting in Ludhiana, while announcing six guarantees in the health care sector, the Delhi chief minister Arvind Kejriwal promised free and best treatment for every resident, free medicines, tests and surgeries, a health card for every resident. He also said that there will be pind clinics in every village and ward clinics in every city, complete revamp of the government hospitals and free treatment for road accident victims.

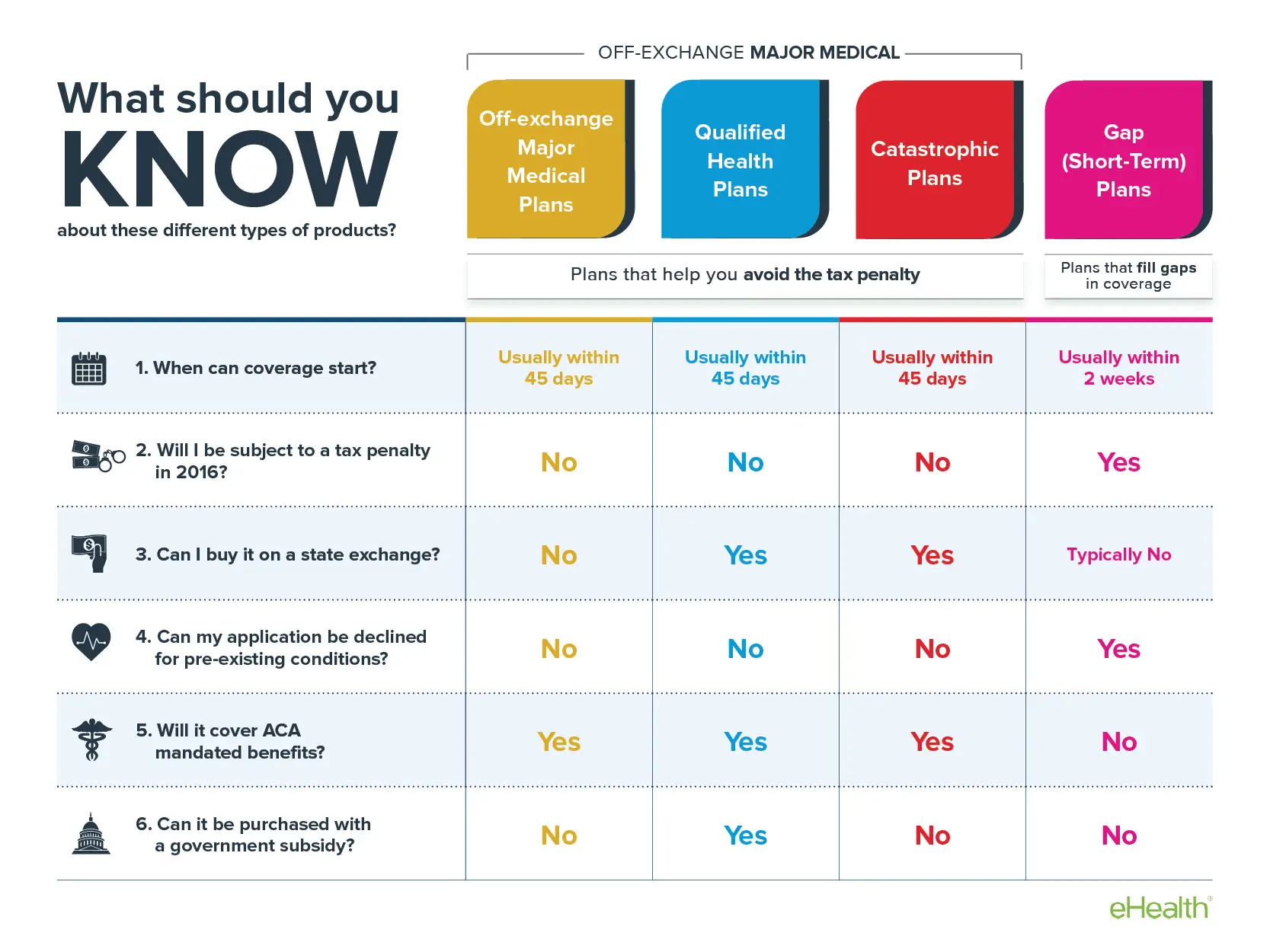

Beware Of Unlicensed Health Plans

When choosing a health plan, it is important to consider the differences between your options. Some plans provide more generous coverage, while others could leave you responsible for high medical bills. Shopping for health insurance can be overwhelming, but remember, if the plan sounds too good to be true, it probably is.

Discount Plans

Do not buy a discount plan as an alternative to health plan coverage. Discount plans charge a monthly fee in exchange for access to health care services at a reduced fee. These plans are not insurance and do not make any payments when you need health care services. Instead, they allow you to get a discount off of some of your medical charges. Discount plans may look like a cheap health plan, but they are not health insurance and they do not meet your Massachusetts “individual mandate” requirement for health coverage. You should check with your doctor or local pharmacist to ask whether you will receive any real savings before you give your money or your personal information to anyone offering health care discounts.

Health care sharing ministry plans.

| Limited Time Offer | Pay First, Read Later |

| Beware of high pressure sales tactics that tell you a low monthly price is a limited time offer and will expire in a day or two.There is no such thing as a limited time offer or “special” in health insurance. | Beware of companies that will not provide any written information about the health plan unless you pay first. |

Remember: Stop. Call. Confirm.

You May Like: How Much Is Travel Health Insurance

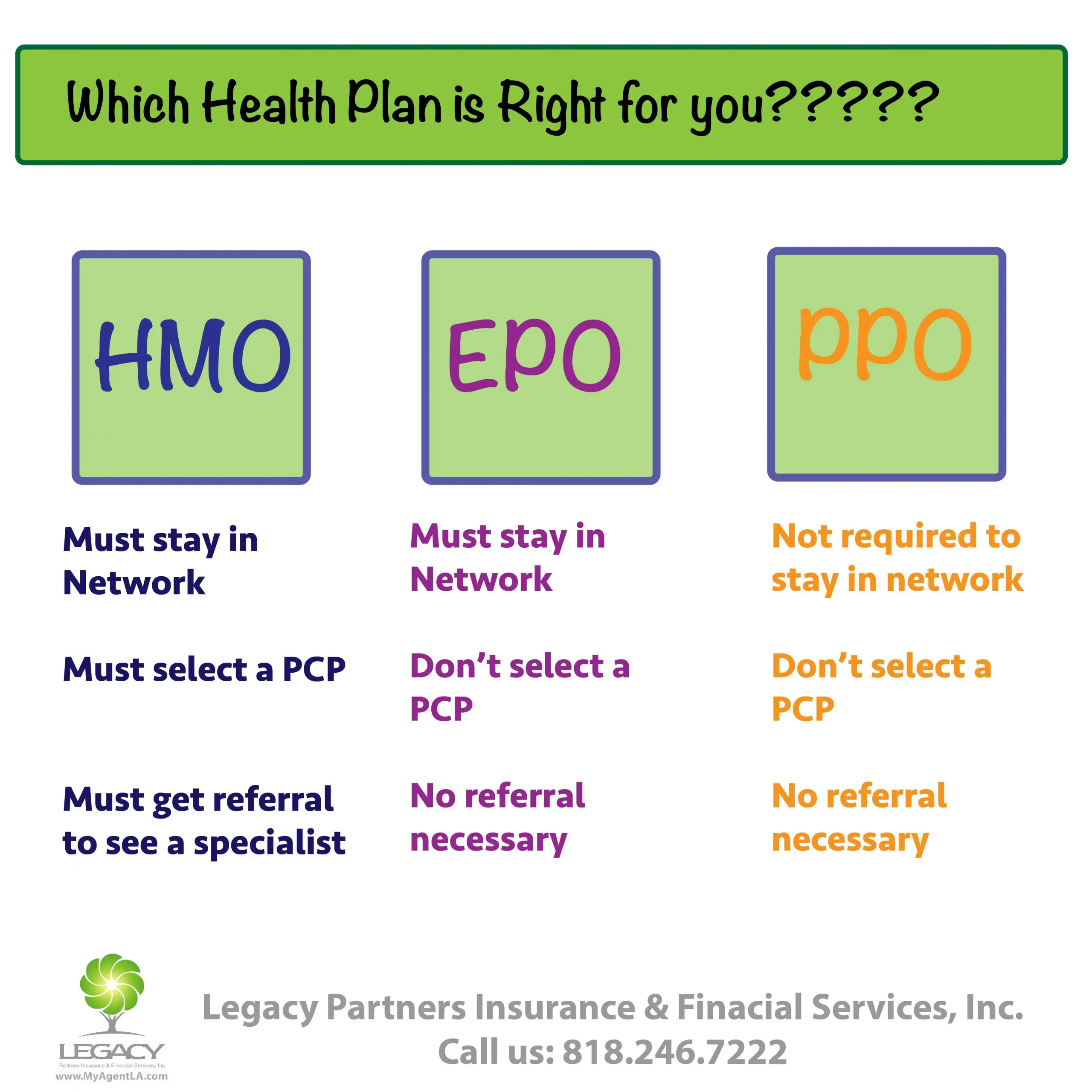

What Is An Epo

A type of managed care health insurance, EPO stands for exclusive provider organization. EPO health insurance got this name because you have to get your health care exclusively from healthcare providers the EPO contracts with, or the EPO wont pay for the care. As is the case with other health plans that require you to stay within their provider networks, EPOs will pay for out-of-network care in emergency situations.

Like their cousins, PPOs and HMOs, EPO health plans have cost-containment rules about how you get your health care. If you dont follow your EPOs rules when you get healthcare services, it won’t pay for the care.

An EPO health plan’s rules center around two basic cost-containment techniques:

Ok So Maybe I Do Need It How Can I Get It

There are many different ways to buy health insurance, and the costs and benefits vary widely for each one. You’ll need to see which options are available to you, given your health needs, age, and job status. You’ll probably have to wade through a lot of health care buzzwords, too.

Here are some ways you might get insurance:

Page two

You May Like: What Causes Health Insurance Premiums To Increase

What Exactly Is Health Insurance

Health insurance is a plan that people buy in return for coverage on all kinds of medical care. Most plans cover doctors’ appointments, emergency room visits, hospital stays, and medications.

The idea behind insurance is simple: Medical care can be expensive. Most people can’t pay for it all out of their own pockets. But if a group of people gets together, and each person pays a fixed amount every month , the risk is spread out over the whole group. Each person is protected from high health care costs because the burden is shared by many.

Look For Additional Benefits

Given that the insurance market is fairly competitive, different policies offer various benefits. No-claim bonuses and the restoration of your sum insured are some of the most popular ones. You should always check whether your chosen insurance policy will provide these benefits. Always look for policies that offer you additional benefits.

Don’t Miss: How To Get Health Insurance Fast

How Do You Get Health Insurance

Your employer may offer you a health plan as part of your job. They work with the insurance company to design the health plans they offer you. Your employer may also choose to add certain programs and services to your benefits, as well.

If you dont get a plan through your employer you can buy one on your own through a state or federal health exchange. You can also buy one directly through a health insurance company, like Cigna. Youll find a variety of plan options to help meet your specific needs.

Significant Tax Saving Benefits

To promote awareness and access to comprehensive health insurance plans to the masses, the government offers significant tax-deductions on the premium paid towards the health insurance policy.

Accordingly, the premium paid towards your health insurance policy is eligible for tax deduction under Section 80D as per income tax act 1961. The quantum of tax deductions under your medical insurance plan is as below:

a) If you purchase health insurance coverage for your spouse, children and yourself, you can save up to Rs 25,000 as tax deductions.

b) By including your parents under your health insurance coverage, you can avail of additional tax deductions up to Rs. 25,000, to take your total tax savings up to Rs. 50,000

c) In case your parents are ageing 60 years or above, the total amount of tax savings may increase up to Rs. 75,000

d) You can also avail of a deduction of Rs. 5000 towards payment of preventive health check-up of your spouse, dependent children, parents and yourself.

|

Covered Individuals |

Don’t Miss: Do I Have To Offer Health Insurance To All Employees

If Youre Buying For A Family

You should also be aware that your plan may have a family deductible in addition to individual deductibles for each family member. Individual deductibles are lower than the family deductible. Once an individual hits their individual deductible, their health insurance plan kicks in just for them. But once the family deductible is met, health insurance kicks in for every member of the family, regardless of whether or not an individual has reached their deductible.

What About An Hdhp With A Health Savings Account

A high-deductible health plan can be any one of the types above HMO, PPO, EPO or POS but follows certain rules in order to be HSA-eligible. These HDHPs typically have lower premiums, but you pay higher out-of-pocket costs, especially at first. They are the only plans that qualify you to open an HSA, which is a tax-advantaged account you can use to pay health care costs. If youre interested in this arrangement, be sure to learn the ins and outs of HSAs and HDHPs first.

» MORE: HSA vs FSA: Whats the difference?

Recommended Reading: Does Aarp Offer Health Insurance

Why Is The Type Of Insurance Plan Important

The type of plan a person has dictates how they will approach getting the treatment they need and how much money they will need to pay on the day they receive it.

In 2003, the U.S. Congress introduced a new option: the Health Savings Account . It is a combination of an HMO plan, a PPO plan, an indemnity plan, and a savings account with tax benefits. However, in plan year 2020, a policyholder must pair this type with an existing health plan that has a deductible of over $1,400 for individuals or $2,800 for families.

HSAs can top up coverage, extending existing plans to cover a wider range of treatments. If an employer pays for an HSA on behalf of their employees, the payments are tax-free. An individual can build up funds in the HSA while they are healthy and save for instances of poor health later in life.

However, people with chronic conditions, such as diabetes, might not be able to save a large amount in their HSA, as they regularly have to pay high medical costs for the management of their health concern.

These plans often carry very high deductibles, meaning that although premiums can be lower, people often end up paying the full expenses of any required medical treatment.

There is more overlap as plan types evolve. The distinctions between policy types are becoming more and more blurred.

How To Select The Best Health Insurance Plan In India

You should consider the following factors to choose the best health insurance in India:

- Sum Insured

- No Claim Bonus

- Waiting Period

A health insurance premium calculator will take these into factors and estimate a suitable coverage and premium rates for your financial profile. Apart from this, the health insurance claim settlement ratio is another crucial factor you should consider.

Also Check: Can I Have Two Health Insurance

You Will Be Required To Get Pre

Your EPO will likely require you to get permission for some services, especially those which are most costly. If a particular service requires pre-authorization and you dont get it, your EPO can refuse to pay. The services which require authorization are elective and not emergency services though, so a small time delay will not be life-threatening.

Pre-authorization helps your EPO keep costs down by making sure you really need the services you get. In plans like HMOs that require you to have a primary care physician, your PCP is responsible for making sure you really need the services you get. Since your EPO likely doesnt require you to have a PCP, it uses pre-authorization as a mechanism to reach the same goal: the EPO only pays for things that are truly medically necessary.

EPO plans differ as to what types of services must be pre-authorized. Most require pre-authorization for things like MRI and CT scans, expensive prescription drugs, surgeries, hospitalizations, and medical equipment like home oxygen. Your EPOs Summary of Benefits and Coverage should tell you more about the pre-authorization requirement, but you should expect that any expensive service will need to be pre-authorized.

How Much Should A Health Insurance Plan Cost

Thanks to the Affordable Care Act, there are only five factors that go into setting your premium:

-

Your age

-

Whether or not you use tobacco

-

Individual v.s. a family plan

-

Your plan category

Health insurance companies are not allowed to take your gender or your current or past health history into account when setting your premium.

Health insurance premiums on the Affordable Care Act’s marketplaces haveincreased steadily due to many different circumstances, including political uncertainty as well as the cost of doing business. Additionally, while average premiums for the benchmarksecond-lowest-cost Silver plan have fallen slightly since 2018, costs vary widely by state and insurance market.

Over 9 million people â or 84% â who got health care through marketplaces received tax credit subsidies in 2020, further reducing the actual cost of health insurance.

When it comes to figuring the cost of health insurance, however, you need to look at more than just the monthly premium. As we mentioned in the sections above, health insurance is only one part of your total spending on health care services. In fact, if you frequently visit a doctor and you buy a plan with a high deductible and low monthly premium, it’s likely that you’ll spend more money overall than if you bought a plan with higher premiums, a lower deductible, and lower copayments and coinsurance payments.

You May Like: What Is The Best Travel Health Insurance

You Don’t Have To File Claims

You dont have to hassle with bills and claim forms when you have EPO health insurance since all of your care is provided in-network. Your in-network healthcare provider bills your EPO health plan directly for the care you receive. Youll just be responsible for paying your deductible, copayment, and coinsurance.

Gold Silver Bronze Or Catastrophic Coverage

The best way to shop for health insurance is to get a better understanding of the individual and family plans that are available. The Affordable Care Act requires all plans to be organized by the level of coverage they offer. Theres also a catastrophic coverage plan available for people under 30, or for those who qualify for a special exemption. All plans cover the same essential health benefits the difference is what you pay in monthly premium and out-of-pocket costs when you need care.

The following chart helps you decide what type of health plan is best for you based on how much you are willing to pay towards your premium each month, and the cost youll pay when you receive care. For example, a gold health plan may be best for you if you use a lot of health care services, are able to pay more in monthly premiums, and want to pay less when you receive care.

| Gold |

|---|

Read Also: What Is Temporary Health Insurance