What Is A Health Insurance Tax Credit

A health insurance tax credit, also known as the premium tax credit, lowers the cost of your health insurance. This discount can be applied every month, or you can receive the credit as a refund on your federal income taxes.

The credit, implemented under the Affordable Care Act , is designed to help eligible families or individuals with low to moderate incomes pay for health insurance. Premium tax credits are only available if you enroll in a qualifying insurance plan through the federal marketplace or a state marketplace. A key exclusion is that those who sign up for Catastrophic coverage do not qualify for health insurance tax credits.

Tax credit amounts do not vary by state. For example, you would receive the same tax credits in New York as you would in Arizona.

How Do I Determine If I Qualify For Obamacare Subsidies

According to an analysis completed by Covered California, 922,000 consumers will be eligible for a health insurance subsidy in 2020.

If you think you may be one of these consumers, below are some factors that will impact whether or not you qualify:

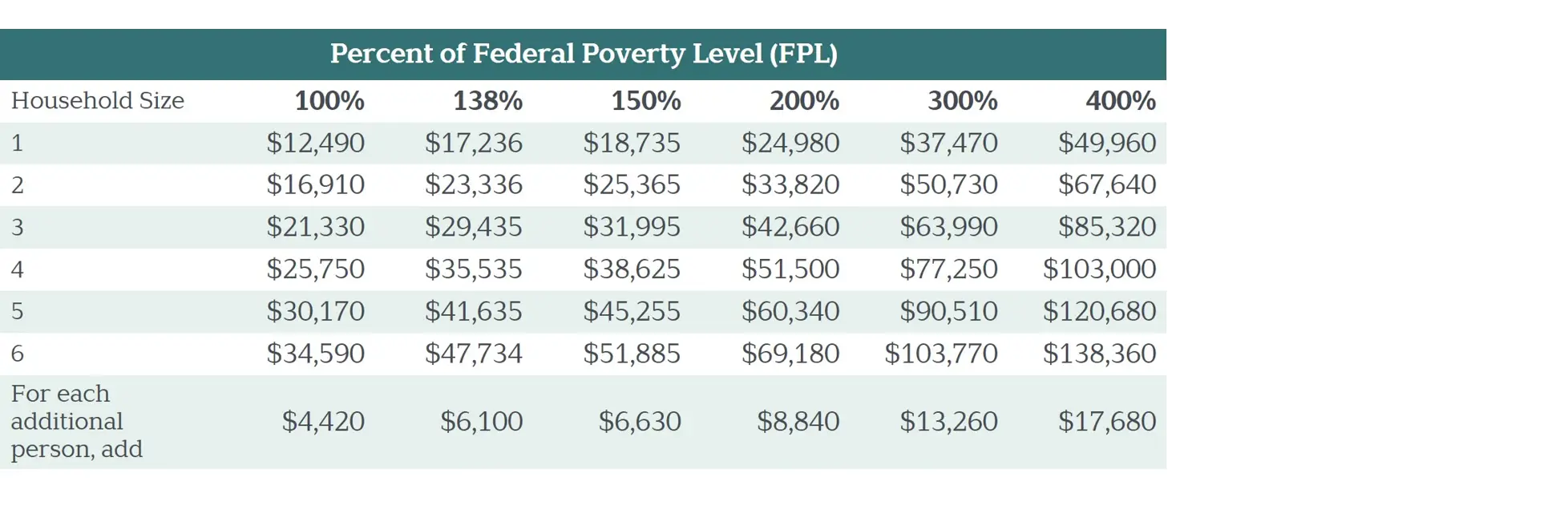

- Your income. The most significant factor in determining if you qualify for an insurance subsidy is your total household income. The subsidies are based on the amount you expect to earn in the coming year. If that amount is between 100 and 600 percent of the federal poverty line then you will likely qualify.

- Your household size. As your family size increases so does the income threshold to qualify for a subsidy. For example, you would not qualify for a subsidy as an individual making $75,000 per year, but you would if you had a family of four at the same income level.

- Where you live. You may be eligible for a larger subsidy if you live an area that is more expensive for health insurance.

The end of the open enrollment period is coming! Do not run the risk of a penalty for failing to get health insurance. With Affordable Care Act subsidies, health insurance may cost less than you think. Contact a licensed agent today to help you determine if you are eligible.

How Do I Get Access To Medicaid Or The Childrens Health Insurance Program

Getting access to affordable Medicaid coverage or coverage provided by the Childrens Health Insurance Program requires going through the standard application process. Because both government-managed programs offer more financial assistance than the subsidies granted for health insurance premiums, there is not a discount provided to participate in either program.

CHIP allows households with higher incomes to receive financial assistance to pay for the health insurance needed by children. Medicaid requires much lower income standards, which might disqualify a household that would otherwise qualify for the financial assistance provided by CHIP.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Getting Started In The Marketplace

To get started, visit HealthCare.gov or your state’s version of it. Either way, you’ll get a quick side-by-side comparison of the plans available to you.

The database allows you to choose from four tiers of health insurance: Bronze, Silver, Gold, and Platinum. Bronze plans are the least expensive but require the highest copays and deductibles. Platinum plans are the most expensive, and they may have more bells and whistles than you want or can afford.

During the enrollment process, you’ll learn whether you’re eligible for the Advanced Premium Tax Credit or a cost-sharing reductionand if so, you’ll find out how much you can save. If you do qualify for savings, you must buy your plan through the Marketplace.

What Happens If I Decline My Health Insurance Through My Employer

If you decline individual health insurance through your employer, you can enroll in an Obamacare plan through the Marketplace. Although you most likely will not qualify for any subsidies or other financial assistance. You will only be able to qualify for cost savings if the following applies:

1. Your employer-sponsored health plan doesnt meet the minimum value standard.

If your employer-provided plan does not include substantial coverage , it doesnt meet the standards. And if it doesnt pay for at least 60% of covered medical costs, it wont either.

2. The cheapest plan through your employer costs more than a certain percentage of your household income.

And again, that plan must meet the minimum value standard. This number is 9.83% and each year the IRS issues an update on this percentage. This calculation is made using your portion of the monthly premium that covers you, the employee. This does not include premiums for others in your family.

Most job-based health insurance plans are deemed to be affordable and found to meet the minimum value standard. But if your employer-sponsored plan isnt, you may qualify for a Marketplace subsidy depending on your income level.

A reminder: You can only enroll in a Marketplace plan during the annual Open Enrollment period, unless you qualify for a Special Enrollment Period. Grab our free guide to enrolling in Marketplace insurance for more information.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Health Insurance Marketplace Subsidy Calculator

Premium Assistance for Health Insurance Coverage

This insurance subsidy calculator illustrates health insurance premiums and subsidies for people purchasing insurance on their own in new health insurance exchanges created by the Affordable Care Act . Affordable healthcare plans are now more standardized and simplified. Generous subsidies abound and reduce the cost of the policy, allowing those who could not afford health insurance in the past to be able to receive affordable healthcare coverage.

There are a number of policies to choose from in the Health Insurance Marketplace. You can choose a plan with a lower monthly payment with a higher deductible, or you can go with a plan that has a higher monthly premium, but a much lower deductible. WNC Health Insurance is here to help you discover your right fit.

Middle-income individuals under the age of 65, who are not eligible for coverage through their employer, Medicaid, or Medicare, can apply for tax credit subsidies available through the NC Health Insurance Marketplace.

How Do I Know If I Qualify

To receive help covering your health insurance, you have to meet a few requirements:

-

Income: Your estimated annual income largely determines the subsidy type and amount youll receive. Its very important to calculate this number correctly for maximum savings, so be sure to follow our nifty income estimator guide.

-

Family size: The government takes into account how many people your household income has to support this includes your spouse and any children you claim as dependents on your taxes. In 2020, a single person would have to make less than $31,225 to receive a subsidy, but a family of four could make up to $64,375.

-

Filing status: If you are married, youll have to file your taxes jointly to qualify for a subsidized health plan. Couples who file separately are not eligible. This is because the government allocates subsidies on a household level and reconciles those amounts at tax time. When you file separately, its too difficult to ensure you got an accurate subsidy amount.

-

Citizenship status: You do not have to be a U.S. citizen to qualify for subsidized health care. Immigrants with green cards, employees or students with visas, and refugees can all apply. Get the full list of eligible immigration statuses here.

-

Location: How much you pay for health insurance depends on where you live. Since the cost of living, local legislation, and number of insurance providers vary from state to state, so will your subsidy.

Read Also: Starbucks Benefits For Part Time

How Saving Money Might Make You Eligible For Subsidies

Premium subsidies in the health insurance exchange are only available if your MAGI doesn’t exceed 400% of the poverty level. For a single person in 2021, that’s $51,040 for a family of four, it’s $104,800 .

Note that for premium subsidy eligibility the prior year’s poverty level numbers are always used, since open enrollment for a given year’s coverage is conducted before the poverty level numbers for that year are determined . So when we talk about premium subsidy eligibility for 2021, we’re looking at the enrollees’ projected 2021 income, versus the federal poverty level numbers for 2020.

These income levels certainly extend well into the middle class, but if you find yourself with an income that’s just slightly too high for premium subsidies, you could end up paying a very significant chunk of your income for your health insurance.

This is where it’s helpful to understand that pre-tax contributions you make to retirement accounts will reduce your MAGI, as will contributions to a health savings account .

You’ll want to consult with a tax professional if you have questions about your specific situation. Just keep in mind that contributions to things like an HSA or traditional IRA will reduce your ACA-specific MAGI, even though they don’t reduce other types of MAGI calculations.

What If The Health Insurance Through My Employer Is Too Expensive

Many people run up against the problem of their employer-provided health insurance seeming way too expensive. Especially when it includes covering their entire family. Unfortunately, if the costs are still underneath approximately 9.5% of your annual household income, it is still affordable by legal standards, and you still arent eligible for subsidies through the Marketplace.

If you find it cost-prohibitive to ensure your children through your job-based health plan, you may have other options. Depending on your income level, you might be able to get them coverage separate from yours through the Childrens Health Insurance Program . CHIP is the federal program that matches federal dollars with state dollars to provide healthcare for low-income families who earn too much to qualify for Medicaid. Children who live in a household where the household income meets the qualifications can enroll in CHIP. And this is true even when parents get or accept an insurance benefits offer from their employer.

You can see if you or your family qualifies for Medicaid or CHIP by entering your zip code and income information here.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

What Exactly Is A Silver Plan

In the exchanges, insurers offer Bronze, Silver, Gold andin a few areasPlatinum plans. . All must cover the ACAs essential health benefits, and cannot refuse to cover you or charge you more because you suffer from a pre-existing condition.

The difference between the four tiers is their actuarial value. Bronze and Silver plans tend to have lower premiums, with higher co-pays and deductiblesup to a maximum of $8,550 in out-of-pocket costs in 2021 After an enrollee hits the out-of-pocket limit, the insurer pays for all essential benefits, as long as the patient stays in-network.

Gold and Platinum plans premiums are higher, but deductibles, copays, and total out-of-pocket exposure on those plans are often lower. Silver plans pay roughly 70% of enrollees expected healthcare costs, and generally have premiums that are higher than Bronze plans, but lower than Gold plans.

Its important to understand, however, that because the cost of cost-sharing reductions has been added to Silver plan rates in many states, you may find that there are Gold plans in your area that are less expensive than silver plans. Shop carefully!

Explaining Health Care Reform: Questions About Health Insurance Subsidies

Health insurance is expensive and can be hard to afford for people with lower or moderate income, particularly if they are not offered health benefits at work. In response, the Affordable Care Act provides for sliding-scale subsidies to lower premiums and out-of-pocket costs for eligible individuals.

This brief provides an overview of the financial assistance provided under the ACA for people purchasing coverage on their own through health insurance Marketplaces .

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Who Qualifies For An Aca Subsidy

Eligibility for health insurance subsidies depends on income. However, because of the negative economic impact produced by the COVID-19 pandemic, you might qualify for a health insurance subsidy is you received unemployment benefits in 2021.

Income-based eligibility for a health insurance subsidy requires a household to earn an income that is no more than 100 percent of the federal poverty level. For states that have expanded Medicaid coverage, the income qualification for a health insurance subsidy is 136 percent of the federal poverty level.

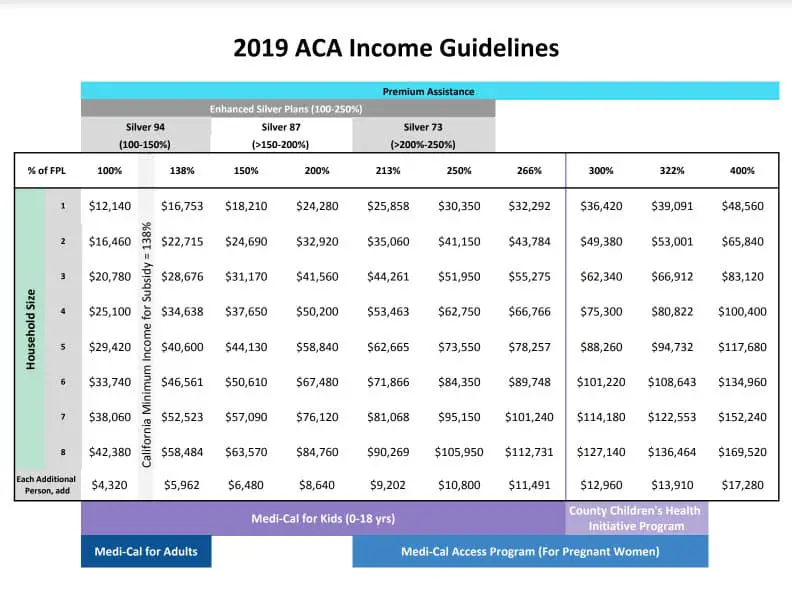

Aca Subsidies Obamacare Subsidies In 2019

Obamacaresubsidies are granted by the federal government. The government offers twosubsidies. First, there is the Advanced Premium Tax Credit, which reduces thecost of your premium. Second, there is the Cost Sharing Reduction subsidy. Thisreduces your deductible, copays, and coinsurance. The amount you get depends onyour family size and income level.

Also Check: How Much Is The Er Without Insurance

Understanding The Aca’s Premium Tax Credit Health Insurance Subsidy

The Affordable Care Act includes government subsidies to help people pay their health insurance costs. One of these health insurance subsidies is the premium tax credit which helps pay your monthly health insurance premiums.

Despite significant debate in Congress over the last few years, premium subsidies continue to be available in the health insurance marketplace/exchange in every state. And the American Rescue Plan has made the subsidies larger and more widely available for 2021 and 2022.

The premium tax credit/subsidy is complicated. In order to get the financial aid and use it correctly, you have to understand how the health insurance subsidy works. Here’s what you need to know to get the help you qualify for and use that help wisely.

American Rescue Plan: No Subsidy Cliff In 2021 Or 2022

For 2021 and 2022, Section 9661 of the American Rescue Plan simply caps marketplace health insurance premiums at no more than 8.5% of household income. This applies to people with household incomes of 400% of the poverty level or higher for people with lower incomes, the normal percentage of income that has to be paid for the benchmark premium has been reduced across the board.

If your household income is more than 400% of the poverty level and the benchmark plans premium would already be no more than 8.5% of your income in 2021 or 2022, you wont qualify for a premium subsidy . This is more likely to be the case for younger enrollees in areas of the country where health insurance is less costly than average.

But if the full-price cost of the benchmark plan would be more than 8.5% of your income, youre eligible for a premium subsidy in 2021 and 2022 . So for some people, especially older enrollees in areas of the country where health insurance is particularly costly, subsidy eligibility in 2021 and 2022 extends well above 400% of the poverty level.

You May Like: Does Starbucks Have Health Insurance

Answer A Few Easy Questions To Calculate Your Subsidy Eligibility In Seconds

By Hal LevyHealthcare Writer

How do you get help paying for health insurance and health coverage? It depends on how much you earn. In 2022, youre eligible for Obamacare subsidies if the cost of the benchmark plan costs more than a given percent of your income, up to a maximum of 8.5%. The cut-off threshold increases on a sliding scale depending on your income. The discount on your monthly health insurance payment is also known as a Premium Tax Credit , also known as an Advance Premium Tax Credit .

2022 health plans are measured against your projected income for 2022 and the benchmark plan cost. You qualify for subsidies if you pay more than 8.5% of your household income toward health insurance.

In 2021, premiums for new enrollees have averaged about $30 less per person per month, or 25%. For subsidized enrollees, the median deductible has dropped by 90% from $450/yr to just $50. If you already enrolled in an ACA plan and got a subsidy, you can change your plan and get the added savings through August 15th in most states.

If you decide to keep your current plan, you will receive a refund for the subsidy difference at tax time next year for the first 8 months of the year for September December, those enrolled via the federal exchange will see their additional subsidies automatically subtracted from their premium due amount.

Learn More About Obamacare Subsidies

How Do You Figure Out Your 2022 Obamacare Subsidy?

Subsidies, or premium tax credits, are based on three things: Your income, the list price of the benchmark plan, and how much the Affordable Care Act requires you to pay toward your health insurance.

The actual subsidy is the difference between the benchmark plan and your expected contribution.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

How Will The Marketplace Check My Income

The Marketplace will check the income you reported on your application and compare it to what the IRS has on file for you. This is called income verification. The Marketplace does this by electronically asking the Internal Revenue Service database and other databases if what you reported is the same as what they have on file. The IRS will not share your personal tax data with your Marketplace. They will just tell the Marketplace if the income you reported does or does not match what they have on file for you.

The IRS information comes from your latest income tax return. When you apply for coverage in 2015, thats probably going to be your 2013 tax return. If your income has changed since then, your reported income may not match the data on file.

- If your estimated income is the same as or more than what is on file, the Marketplace will consider it to be verified.

- If your estimated income is lower than what is on file or if the Marketplace cannot find any electronic data on your income , the Marketplace may ask you to provide more information to prove that your guess is accurate. You will have 90 days to get this done. You will get health insurance and temporary tax credits while you are waiting. If you dont prove your income is what you say it is, your tax credits may end or change to match the information in the electronic files.