How The Deductible And Out

ExampleGabriels plan has a $1,500 deductible, and a $2,500 out-of-pocket max

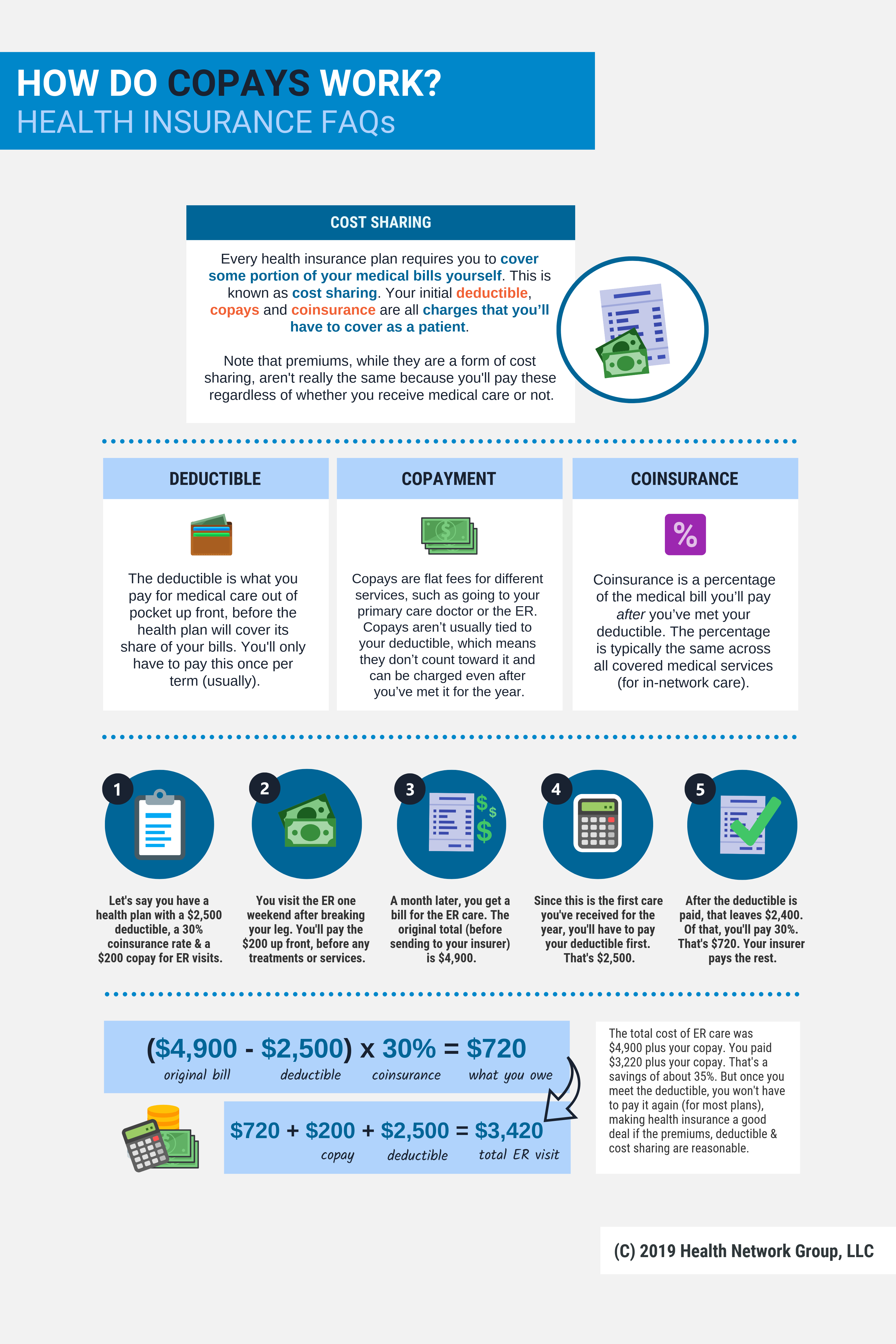

For most plans, until you reach your deductible, you pay for all of your medical care.When you go to the doctor, you may be asked for a co-pay. After your visit, you mayreceive a bill in the mail for the rest of the charges. Many plans do not count the co-payand co-insurance you pay toward the deductible.

Once you have paid enough bills to equal the amount of your deductible then, youwill only pay for the co-pay or co-insurance for all your covered medical services.

Once you have paid enough co-pays, co-insurance, or bills equal to the amount ofthe out-of-pocket max, you will not need to pay anything more for the rest of the year.

What Is Open Enrollment For Health Insurance

Unlike other products, health insurance can’t be bought or exchanged whenever you feel like changing your coverage. For most people, the only chance you have to change your insurance coverage is during the “open enrollment period.” If you don’t take advantage of open enrollment, you’ll only be able to change health insurance coverage with a qualifying life event.

A Business Owner Who Has Employees

If you start a business and you have employees, you might be required to offer them health insurance. Even if its not required, you might decide to offer health insurance to be a competitive employer that can attract qualified job candidates. In this situation, you will be required to purchase a business health insurance plan, also known as a group plan.

Recommended Reading: Can You Have Health Insurance And Medicaid

Health Insurance In The United States

|

|

Health insurance in the United States is any program that helps pay for medical expenses, whether through privately purchased insurance, social insurance, or a social welfare program funded by the government. Synonyms for this usage include “health coverage”, “health care coverage”, and “health benefits”.In a more technical sense, the term “health insurance” is used to describe any form of insurance providing protection against the costs of medical services. This usage includes both private insurance programs and social insurance programs such as Medicare, which pools resources and spreads the financial risk associated with major medical expenses across the entire population to protect everyone, as well as social welfare programs like Medicaid and the Children’s Health Insurance Program, which both provide assistance to people who cannot afford health coverage.

In addition to medical expense insurance, “health insurance” may also refer to insurance covering disability or long-term nursing or custodial care needs. Different health insurance provides different levels of financial protection and the scope of coverage can vary widely, with more than 40% of insured individuals reporting that their plans do not adequately meet their needs as of 2007.

An Overview Of Private Health Insurance

The US healthcare market offers plenty of private health insurance options for people living in the country. The health insurance plans differ in coverage and pricing which means that everyone can find a plan that suits their needs. That being said, most plans that provide full-coverage are expensive and the majority of people cannot afford it.

Read Also: How To Get Affordable Health Insurance

Cost Of Short Term Health Insurance In The Usa

The cost of an international health insurance plan varies greatly.

Short-term travel medical plans start at about $1.50 per day and can cost more than $10 per day for older clients or more comprehensive coverage.

Global medical plans widely vary in available options. The more affordable catastrophic coverage that only covers worst-case scenarios is good for travelers on a budget. On the other end of the spectrum, comprehensive medical plans may include physician visits, hospitalization, prescription drugs, lab services, and chronic disease management.

The most affordable global medical plan we offer ranges from $400 to $500 a year, while the most expensive but comprehensive ones can reach as high as $30,000 to $40,000 a year.

Travel Medical Insurance For Visitors To The Us

If you are an expatriate living in the United States, it is highly recommended that you purchase additional medical coverage throughout your stay in the country. You want to ensure you are covered in case of an accident, a medical emergency, or sudden repatriation.

Make time to research if you will need travel insurance before entering the country. You must also research if the insurance needs to come from your home country, the US, or both.

If you plan to stay in the US for less than a year, a travel medical insurance plan may be enough to cover your needs. This is also an excellent option for younger travelers who need basic medical coverage for emergencies.

Most travel medical insurance plans provide coverage for accidents and illnesses, saving you from large medical expenses associated with doctor check-ups and hospital visits in the US. At the same time, this type of insurance will give you access to pharmaceutical care and translation services, should they be required.

For more information on travel insurance plans, see:

If you are an immigrant or an international citizen living in the US, it is recommended to get a global medical plan. We have guides that will help you choose the best international health insurance plan for your needs.

Don’t Miss: What Is The Average Cost Of Health Insurance Per Month

Introduction To Healthcare Systems In America

Envisage International and InternationalStudentInsurance.com have created an informative 6-minute video providing an overview of the US healthcare system. It addresses the challenges of navigating the health care system and some tips for taking care of yourself. While it was designed for students, the information contained in the article is relevant to any visitor or emigre to the US. The video provides advice and tips for preparing to come to the US, examples of costs for specific medical treatment in the US, finding a provider, and an overview of terms.

Their site offers more information specifically for students at this link: Overview of US healthcare for students.

Health Coverage For People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply.

-

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease . Learn about eligibility, how to apply and coverage.

-

Affordable Care Act Marketplace offers options to people who have a disability, dont qualify for disability benefits, and need health coverage. Learn about the .

Also Check: How Much Is Health Insurance In Idaho

State And Federal Regulation

Historically, health insurance has been regulated by the states, consistent with the McCarran-Ferguson Act. Details for what health insurance could be sold were up to the states, with a variety of laws and regulations. Model acts and regulations promulgated by the National Association of Insurance Commissioners provide some degree of uniformity state to state. These models do not have the force of law and have no effect unless they are adopted by a state. They are, however, used as guides by most states, and some states adopt them with little or no change.

However, with the Patient Protection and Affordable Care Act, effective since 2014, federal laws have created some uniformity in partnership with the existing state-based system. Insurers are prohibited from discriminating against or charging higher rates for individuals based on pre-existing medical conditions and must offer a standard set of coverage.

Dropped By Your Existing Insurer

Although the ACA prevents insurers from canceling your coverageor denying you coverage due to a preexisting condition or because you made a mistake on your applicationthere are other circumstances when your coverage may be canceled. Its also possible that your insurance may become so expensive that you cant afford it.

Also Check: When Do You Pay Deductible For Health Insurance

There Are Two Types Of Health Insurance:

- Taxpayer-funded: funded by federal and state taxes examples are Medicare, Medicaid and Childrens Health Insurance Program

- Private-funded: provided primarily through employer-sponsored plans examples are Blue Cross and Blue Shield plans, non-Blue commercial plans, HMOs and self-funded employer plans

Taxpayer-funded health insurers are funded by state and federal taxes. Examples include:

Private health insurance is primarily funded through benefits plans provided by employers.

- 160 million individuals are insured through employer-sponsored health insurance

- About 15 million individuals buy health insurance on their own

Examples include:

- Blue Cross and Blue Shield health insurance companies

- Non-Blue commercial health insurance companies

- Health Maintenance Organizations

- Self-funded employer-sponsored benefit plans

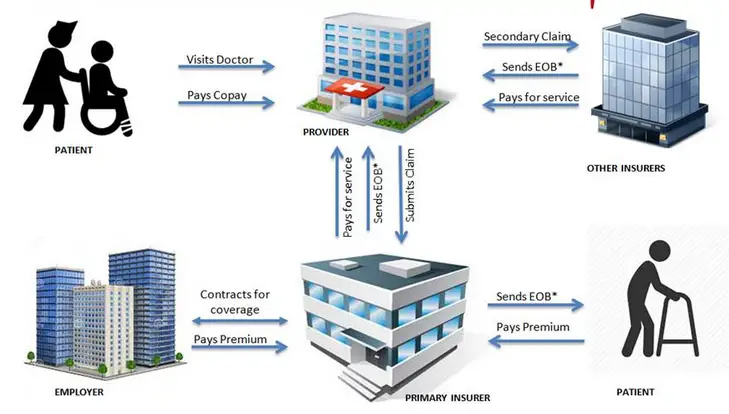

To receive health insurance, employees choose to participate in their employer-sponsored plan. They pay a premium. In return, they receive an insurance card that gives them access to the doctors, hospitals and other health care providers that are part of the insurance plan.

Why Is Us Healthcare So Expensive

Because there are no government regulations on the prices for healthcare procedures, private insurance companies, various medical institutions, and pharmaceutical companies can allow themselves to drive up the prices for their services to what they deem appropriate. People also tend to do more tests and choose more costly procedures, while the medical staff in the US tends to get higher wages.

Recommended Reading: How To Get Massachusetts Health Insurance

Talk To The Department Of Insurance

We are the state agency that regulates the insurance industry. We also work to protect the rights of insurance consumers.

Contact the California Department of Insurance :

- If you feel that an insurance agent, broker, or company has treated you unfairly.

- If you have questions or concerns about health insurance.

- If you want to order CDI brochures.

- If you want to file a request for assistance against your agent, broker, or insurance company.

- If you are having difficulty opening a claim with your insurance company.

- To check the license of an agent, broker, or insurance company.

How Much Americans End Up Paying

In 2014, individual healthcare costs averaged over $9,000 per person. This figure is a total cost from the system and consists of individual payments in the form of copayments and deductibles.

If you are faced with extremely high medical costs for severe or prolonged illnesses, medical costs can be deducted from your personal income tax. While users of government programs such as Medicaid pay low costs, their options for treatment are often limited.

Also Check: How Does Health Insurance Work

Shopping For Individual Insurance

Shopping for health insurance can seem overwhelming. Think about what is important to you. Start by asking these questions:

What are the costs?

- How much are the monthly premiums?

- Is there a deductible?

- How much are the co-pays and/or co-insurance?

- What is the plan’s out-of-pocket maximum ?

Which doctors and other providers can I see?

- Is there a network? How large is it?

- Can I see any provider in the network?

- Is my current doctor in the network? If I need to choose a new doctor, are there doctors in my area accepting new patients?

- Will I need a referral from my doctor to see a specialist?

- Does the plan have hospitals and pharmacies near me?

- Do I need pre-approval from the plan for certain services?

- If I travel often, what kind of care can I get away from home?

What are the covered benefits?

- What services does the plan pay for? What is not covered? Are the services that I need covered?

-

How much will I need to pay for my prescriptions?

- Are there any limits on the number of visits for some kinds of care?

What is the quality?

- The California Department of Insurance can tell you how a company ranks in complaints. You can find out how long it takes to reach a real person when you call the company and how many complaints the company gets. We have a PPO Report Card with quality information about PPOs. Call 1-800-927-4357 or go to www.insurance.ca.gov.

- The California Office of the Patient Advocate has information on health insurance and provider quality, at www.opa.ca.gov.

Healthcare After The Affordable Care Act

The ACA did not fundamentally change the structure of the US healthcare system, the debate continues over the effectiveness of the Act to cut costs and increase coverage. By many measures, individual costs, mainly in the form of a significantly higher level of deductibles, increased dramatically for a significant percentage of people.

At the same time, drug coverage increased, and charges were eliminated for basic checkups and other wellness services. Individuals declined to purchase coverage or receive generous employer-provided health insurance faced tax penalties until very recently.

Recommended Reading: Can I Change My Health Insurance Plan After Open Enrollment

Common Health Insurance Terms

Deductibles, premiums, network, claims, benefits what do all these words actually mean? Health insurance practically seems to have a language of its own. To make it easier, you can check out our list of common terms and get quick definitions that help explain what they mean in everyday language.

How The Us Healthcare System Works

For promoting and maintaining fitness, preventing and treating illness, decreasing unnecessary disability and premature death, and ensuring health equality for all Americans, the public need access to comprehensive, high-quality health care services. But how does the healthcare system really work? Is it really accessible to the public? How important is health insurance? To be able to understand the healthcare environment that we have at present, we must think about at American healthcare history. As they say, history repeats itself, and it rings true when it comes to Americas efforts to provide affordable healthcare to its people.

History of the US Healthcare System

Read Also: How To Qualify For Low Income Health Insurance

Why Do I Need Health Insurance

The main reason you need health insurance in the U.S. is to protect your health and your wallet.

Without insurance, emergency medical bills can leave you in a mess of debt, or worse, the high cost could force you to forgo treatment.

This can be a disaster for a lot of people in the U.S. who are already living paycheck to paycheck.

But emergency medical expenses arent the only reason you need it.

Even planned expenses can become overwhelming without a good insurance plan.

For example, if you take prescription medication, it can cost thousands of dollars each month without insurance!

Medicaid And Childrens Health Insurance Program

Medicaid is a state-run program that

- helps with medicals costs for people with low income

- offers additional benefits that are not covered by Medicare.

Each state has its own set of eligibility rules that might include your:

- disability or state of health

- immigration status.

Keep in mind that in most cases you are eligible to receive Medicaid after holding residency in the US for five years.

Childrenâs Health Insurance Program has similar rules regarding eligibility. It covers healthcare costs for children under 19 years of age.

About half of the states in the US can provide Medicaid and CHIP for immigrant children and pregnant women.

Also Check: Does Health Insurance Cover Chiropractic Services

Effects On Health Of The Uninsured

From 2000 to 2004, the Institute of Medicine‘s Committee on the Consequences of Uninsurance issued a series of six reports that reviewed and reported on the evidence on the effects of the lack of health insurance coverage.

The reports concluded that the committee recommended that the nation should implement a strategy to achieve universal health insurance coverage. As of 2011, a comprehensive national plan to address what universal health plan supporters terms “America’s uninsured crisis”, has yet to be enacted. A few states have achieved progress towards the goal of universal health insurance coverage, such as Maine, Massachusetts, and Vermont, but other states including California, have failed attempts of reforms.

The six reports created by the Institute of Medicine found that the principal consequences of uninsurance were the following: Children and Adults without health insurance did not receive needed medical care they typically live in poorer health and die earlier than children or adults who have insurance. The financial stability of a whole family can be put at risk if only one person is uninsured and needs treatment for unexpected health care costs. The overall health status of a community can be adversely affected by a higher percentage of uninsured people within the community. The coverage gap between the insured and the uninsured has not decreased even after the recent federal initiatives to extend health insurance coverage.

Compare Ppos Epos And Hmos

Why would I choose a PPO?

You have a doctor you like and want to keep your doctor. You want the freedom to see providers out of your network even if you have to pay more. You want to see specialists and other providers without having to get referrals or pre-approvals.

Why would I choose an EPO?

You do not want to use a primary care physician and do not want to get referrals to see specialists. You also don’t mind staying within the policy’s network of physicians.

Why would I choose a HMO?

You want to have a primary care doctor who can help you decide what care you need and how to get it. Often HMOs have fixed co-pays for certain services, so you don’t have to worry about getting a bill for a percentage of the cost of care.

Don’t Miss: Do I Need Health Insurance Between Jobs

How Does Us Health Insurance System Works

It can be very expensive to have health insurance for the states of the US. The cost of a single visit to the doctors clinic can move around a hundred dollars and there is a stay of three to four days, then it will be around tens of thousand dollars and even more than that as per the kind of care offered. Moreover, it does not suit the budget of some people to pay such a large amount when they get sick and especially it is not in our hands as when we get ill or injured and how much care is needed in such health conditions. Health Insurance in US States provides an avenue to minimize the cost to more reasonable as well as affordable amounts.

The accessibility to healthcare providers is influenced as the cost is controlled by health insurance companies. Healthcare provider includes physicians, hospitals, laboratories, pharmacies as well as other entities. A contract or an agreement is done between the insurance companies and the providers to support the services to the patients at a favorable pricing policy. The insurance company is not entitled to pay the amount to the patients if the provider is not on their specified list but it would pay a small amount of money to the patient in some exceptional cases. This is an important concept that needed to be understood by people if you belong to the US.

About the author:

Tejas Maheta is the Founder of techiegenie.com and a tech geek. Besides blogging he love reading books, Learning new things, and Hanging out with friends.