The Effect Of Insurance Deductibles On The Cost Of Health Care

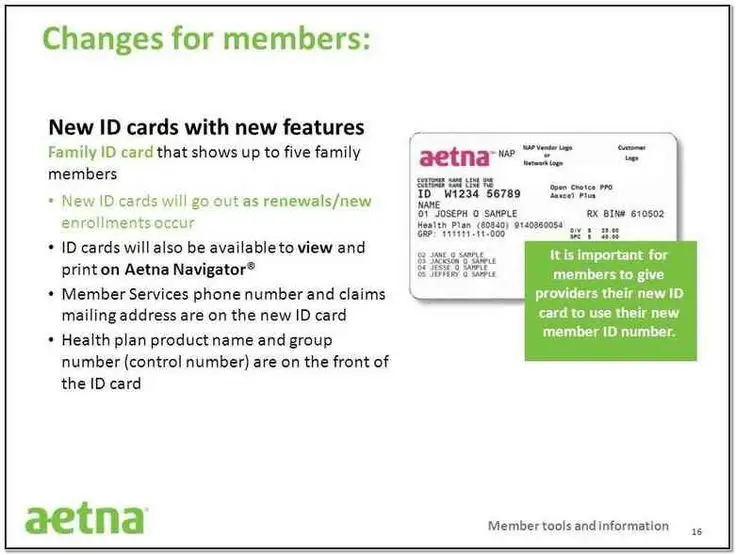

ID residents insured through group, individual and medicare health plans generally have a deductible. Deductibles define the amount of the medical expenses the insured person must pay before the insurers coverage begins to pay the medical bills. The deductible amount depends on the insurance plan. Generally speaking, individual insurance has larger deductibles than other plans. Deductibles have the effect of increasing the cost of the insurance for people that file insurance claims. For example, a person on an individual plan paying the average price of $3,901 with a relatively common $6,000 deductible has an effective price of nearly $10,000, if they use their insurance.

Cheapest Health Insurance Plan By County In Idaho

The cheapest health insurance in Idaho can be impacted by where you live inside Idaho as well. The cheapest counties to live in are Washington, Boise, Gem, and Payette. The SLHP Silver 5000 is the cheapest plan for these counties, with costs as follows:

- Individual, Aged 40 Years: $480

- Couple, Aged 40 Years: $959

- Average Payments: $450

Overall, Clark is the most expensive county in the region. The most affordable health insurance in Idaho for Clark is the Engage Silver Option 2 plan. It costs $551 for individuals aged 40, $1,102 for couples aged 40, and $527 is the average cost for people.

Tips For Reducing Health Insurance Costs

Shopping and doing the research to find the best health insurance are important, because your situation and medical expenses play large roles in what you get out of your health insurance plan.

- A health savings account may help you save money on your medical spending if you have a qualifying high-deductible plan to go with it.

- Compare the out-of-pocket costs for different plans. Out-of-pocket costs may include deductibles, copays, and coinsurance.

- Create a checklist of what is important for you or your family, and compare how each plan fits with what you are looking for.

- Make sure your plan allows you access to the providers you want. If you choose a plan with a limited provider network, you may find it harder not to rack up additional costs for using out-of-network providers.

- If both you and your spouse have access to health insurance, consider using coordination of benefits to leverage your coverage and potentially reduce costs.

- If you foresee costs, such as those related to mental health needs or pregnancy in the near future, review your health insurance options with your family’s needs and plans in mind. Some health insurance plans may have better coverage for pregnancy and childbirth than others.

Don’t Miss: Is It Too Late To Change Health Insurance

Regence Blue Shield Of Idaho

Regence Blue Shield has over 161,000 members and over 10,000 network providers in the Gem State.

You can expect free preventive care for services such as annual physicals and vaccinations. Choose among the companys POS plans. You can opt for an HDHP with an HSA if youre looking for a low monthly premium.

Dont want to drive to the doctor? No problem. The company has MD Live, so you can talk with a doctor on video or the phone, which is handy while traveling. Regence Blue Shield even has coverage for prescription home delivery.

If youre looking for everything under one roof, you can add dental and vision coverage, too.

Your Health Idaho Offering More Than 160 Health Insurance Plans

BOISE, Idaho Do you need health insurance? Open enrollment is now underway on an option that could save you money. If you don’t have health insurance through your employer and you don’t qualify for Medicaid or Medicare, you can enroll for medical and dental coverage through Your Health Idaho, the state health insurance exchange.

Executive Director Pat Kelly says because of enhanced subsidies you could save big on a plan for you or for you and your family. But time is of the essence. The Your Health Idaho open enrollment period ends December 15. Kelly explained what the exchange has to offer and how it can save people money on insurance premiums.

“So what we’re really excited about this year are enhanced tax credits,” Kelly said. “These enhanced tax credits are delivering savings more than we’ve ever seen before. In fact, many of the people that are currently enrolled are seeing discounts upwards of 36% over what they saw in previous years. That’s tremendous savings for people. Not only that, but many people who have been ineligible in prior years are eligible this year.”

Your Health Idaho is offering 164 medical plans and 17 dental plans from nine insurance carriers. The plans are in three tiers bronze, silver and gold.Here’s one example: A family of four in Ada County making $85,000 a year would pay $0 per month for a bronze plan, $428 per month for a silver plan and $503 per month for a gold plan.

You May Like: Can You Opt Out Of Health Insurance At Any Time

What Is The Extended Cobra Health Insurance Benefit For A Qualified Disabled Beneficiary

When the qualified beneficiary has been certified by the Social Security Administration by the 60th day of COBRA coverage, an additional 11-month extension is added. This only applies to people who are only eligible for 18 months of COBRA coverage.

The employer must offer COBRA coverage for a minimum of 18 months .

One drawback when extending coverage is that when an individual elects COBRA continuation coverage, they become responsible for the full cost of the policy. Employers are allowed to charge an additional 2% administration fee, bringing the total cost of the policy to 102% of the actual premium.

But this amount may be increased to 50% making the total COBRA cost 150% of the policy premium during the additional 11 months when COBRA coverage is provided due to a former workers disability.

What Are My Options For Health Insurance If Im Pregnant

Some states prohibit divorce while a spouse is pregnant. Other states will allow a person to file for divorce while pregnant but will not allow the divorce to be finalized until after the baby is born.

In most states, the father of the pregnant spouse is the husband unless established through paternity testing. Other states will consider the unborn child to be the husbands legally, even if the biological father is someone else.

As you can see, it can be quite confusing and complicated.

All of these factors can have an impact on who is responsible for health insurance while a woman is pregnant and getting a divorce.

During pregnancy, a court may order that a spouse contributes to healthcare costs until the birth of the child.

After the birth of the child, costs for healthcare can be factored into child support and custody issues.

If there are any disagreements regarding who is responsible for healthcare during pregnancy, it is best to consult an attorney and seek direction from the courts.

Read Also: What Is Private Health Insurance

Protect Your Health Affordably

Choosing a health insurance plan prior to the ACA meant endlessly comparing plans and reading about whats covered and what isnt. Now, permanent health insurance plans must offer at least the ACAs 10 minimum essential benefits. However, this regulation only applies to ACA-compliant plans. Make sure you thoroughly read whats covered and what isnt before you choose a short term health insurance plan or a gap coverage plan.

If I Stop Paying For My Insurance Would That Be Considered Involuntary Loss Of Coverage Making Me Eligible To Switch Coverage During The Special Enrollment Period

No. Your loss of coverage must have been involuntary on your part . Additionally, the coverage you lost must have provided what the law considers “minimum essential coverage.” This means that it must have met the coverage requirements of the Affordable Care Act. Losing your dental plan or a short-term health insurance will not qualify you to go out and shop for a new major medical health insurance plan outside of open enrollment.

Don’t Miss: What’s The Cheapest Health Insurance I Can Get

Can I Get Help Paying For Health Insurance

If you’re going to buy insurance through a state or government health insurance marketplace , financial help may be available. See our to see if you qualify for a government subsidy.

Subsidies are based on your best estimate of your household’s modified adjusted gross income for the year. If your income increases, you may have to pay the government back for any portion of the subsidy you received that you were not eligible for. This reconciliation will take place when you file your government tax return. Also note that if your income changes substantially, you may qualify for a Special Enrollment Period and may be eligible to go back to the exchange and apply for new coverage.

Small Business Health Insurance Tax Credits

Small businesses with up to 25 full-time equivalent employees may qualify for a tax credit for offering employee health benefits. The credit is broken in to two phases. Phase 1 includes a tax credit worth up to 35% of a small businesss health insurance costs. Phase 2 includes a tax credit up to 50% of a small businesss health insurance costs.

Don’t Miss: What Percentage Of Health Insurance Do Employers Pay 2020

What Can I Do Through A Health Insurance Marketplace

A marketplace or exchange allows you to:

- Shop for health insurance offered by well-known insurance companies.

- Choose from health plans grouped by metallic levels: Bronze, Silver, Gold, and Platinum. The different plans will offer you choices in:

- How much you’ll pay for insurance

- How much you’ll pay out of your own pocket for medical care and prescription drugs

- Networks of participating doctors, hospitals, labs, and other health care providers

Idaho Health Insurance: Find Affordable Plans

See how you can get affordable health insurance in Idaho, including marketplace plans, Medicare, and Medicaid.

Reviewed by: Tammy Burns, insurance and healthcare consultant.

Idaho Health Insurance: Find Affordable Plans

- IX.

There are several ways for people in Idaho who need affordable health insurance to obtain it. Employers provide health insurance for employees and their families. However, you can opt to purchase plans on the states health insurance marketplace: Your Health Idaho. Or you can buy off-exchange plans from a broker or an insurance agent, purchase a short-term insurance plan, or a cost-sharing plan. If you are at least 65 years old , you may be eligible for Medicare. Finally, low-income adults and children in Idaho may be eligible for Medicaid.

This guide explains affordable health insurance options available in Idaho in detail.

Don’t Miss: How Much Does It Cost For Health Insurance

Health Services Use By Idaho Residents

The tables below show the frequency with which residents use health services. The data are collected from insurance company filings with the state insurance department. The number of enrollees on which data was collected is as follows: Group insurance, 236,650 Individual insurance, 144,912 and Medicare Advantage, 78,661. Idaho does not have a Medicaid managed care program. For that reason there are no numbers in the Medicaid section of the charts below.

Finding The Best Health Insurance In Idaho

The best health insurance for you will depend on the availability of plans in your area, as well as your health and financial situation. Expanded Medicaid is available in Idaho, which means that anyone with a household income of less than 138% of the federal poverty level would be able to apply for the program. You may also qualify if you are over 65 or have a health condition.

When evaluating health plans, you should begin by comparing policy premiums and out-of-pocket maximums to determine what is affordable for your situation. Typically, if you expect to have moderate to high medical expenses throughout the year, you should purchase an upper-tier policy with a smaller deductible but more expensive premiums.

Gold: Best if you expect high medical costs

Gold metal tier policies are the most expensive health insurance plans in Idaho in terms of monthly premiums. However, these plans can be cost-effective if you have a lot of medical costs due to the lower deductibles and out-of-pocket maximums. For example, if you needed to have a prescription filled monthly for an expensive drug, then you would reach the low deductible level quickly and begin coinsurance or copays with your insurance provider.

The cheapest Gold plan in Idaho is Confident Care Gold 1 from Molina Healthcare. Compare all tiers in Idaho above.

Silver: Best for affordable premiums and average deductibles

Bronze: Best for low-income and healthy applicants

Recommended Reading: Is It Illegal To Go Without Health Insurance

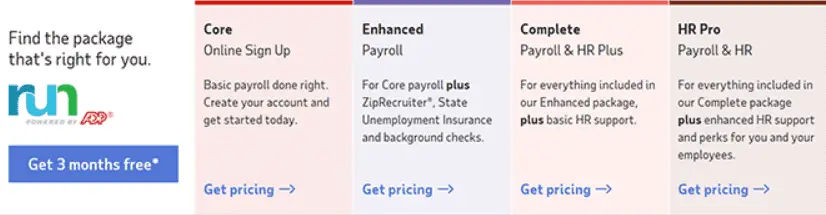

Small Business Health Insurance Reform

Are you ready for health care reform in 2014?

Today, employers are more stressed than ever. Heres why:

The business environment is uncertain,

Employer-sponsored health insurance costs increase annually, and

New fees and penalties take effect next year, and most employers dont fully understand how this will affect their financials.

It is time for employers to examine the specifics of healthcare reform, and start thinking strategically vs. emotionally. Change is hard. However, employers that educate themselves and plan ahead can avoid severe financial impacts.

The more change and disruption your business can embrace, the more cost savings you will be able to realize over the long term. In order to embrace this change, you must be familiar with the key aspects of ACA. For many small businesses, the solution to healthcare reform is simple: Offer a Business Expense Account for Healthcare. A new vehicle, called a Healthcare Reimbursement Plan , allows employers to get out of the health insurance business, and simply give select employees monthly allowances to spend on their own health insurance policy in a state health insurance exchange.

Listed below are key ACA components to consider when choosing small business health insurance.

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you must do to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

Also Check: Do You Need Health Insurance To See A Dermatologist

Can I Apply For Small Business Health Insurance In Idaho

Yes. If your Idaho-based business has up to 50 full-time employees, you can apply for coverage with Idahos Small Business Health Options Program via a certified agent or broker.

To use the Idaho SHOP Marketplace, you must offer coverage to all your eligible full-time employees. However, if you wait to apply after the open enrollment deadline, then at least 70% of eligible employees must enroll in your SHOP plan.

What If My Employer Does Not Have 20 Employees But I Still Want To Explore The Option Of Cobra Coverage

COBRA rules only apply to employers with 20 or more persons, but many states have similar requirements known as Mini-COBRA laws. Employees separating from service from smaller employers should check to see what options are available to them under their state law. These rules can vary widely from state to state.

Read Also: Do I Need Pet Health Insurance

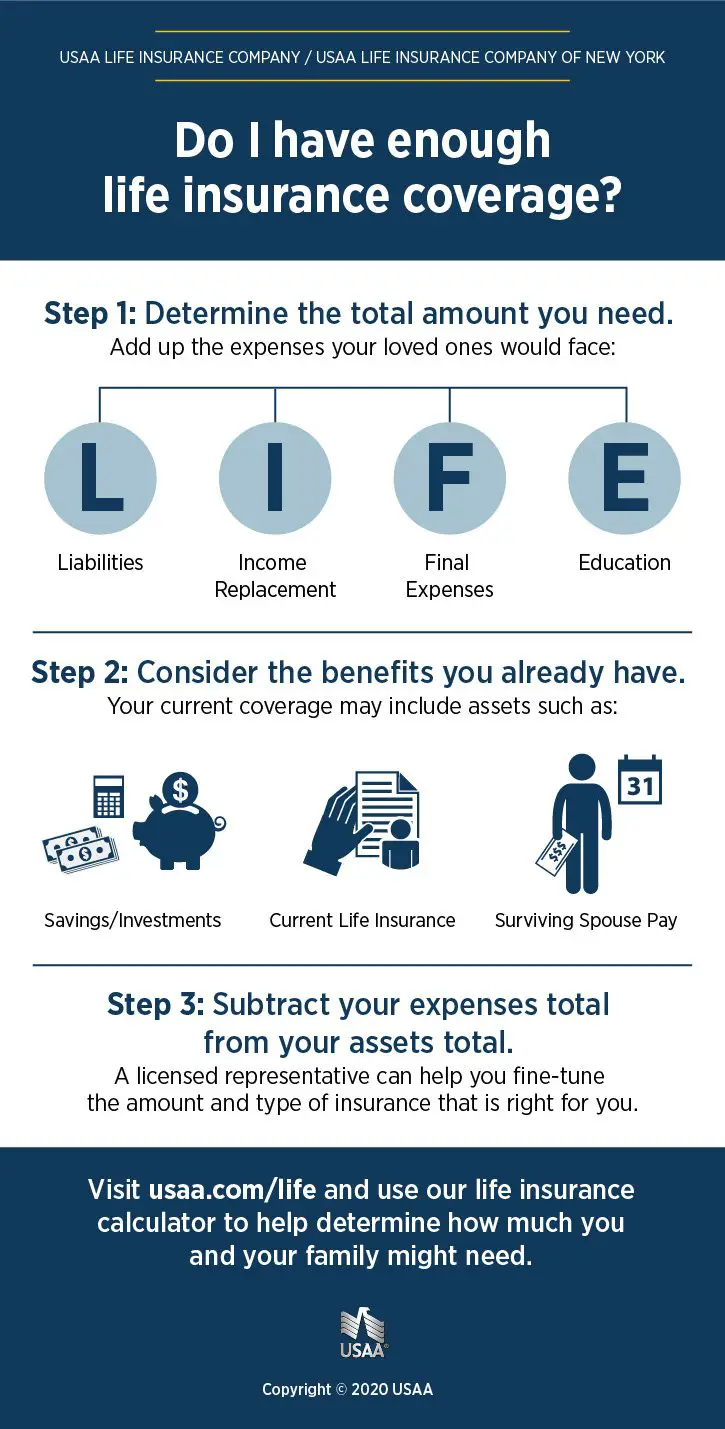

How Many Types Of Insurance Do I Need

I contacted the Insurance Information Institutes Mark Friedlander for help. Aside from health insurance, he identified a few key kinds of coverage young adults like me typically purchase . Im going to break his recommendations into three absolute must-haves and three maybe-should-haves.

MUST No. 1: homeowners or renters insurance

Homeowners policies cover peoples houses, garages, sheds and personal items in the event of a wide variety of perils including fire, theft, windstorm, hail, explosion, vandalism, civil disturbances and other losses, Friedlander says. Renters insurance which I have for my New York City apartment functions along those lines, as well. Both typically include personal liability coverage, which can help with medical bills if someone gets injured on my property, and expenses if my home becomes unlivable due to the “perils” Friedlander listed.

Depending on location, I may also want to add on earthquake and/or flood insurance. And I should get on it: Prices for flood insurance through the Federal Emergency Management Agency, or FEMA, are going up for most people.

MUST No. 2: life insurance

It’s more than a catchy lyric in a Taylor Swift song its a way to financially provide for my loved ones when I die.

Life insurance is having a moment because of COVID-19, especially among young adults like me. A study released this past spring found that 48% of millennials are planning to buy life insurance in the next year.

Find Cheap Health Insurance Quotes In Your Area

Health insurance premiums have risen dramatically over the past decade. In the past, insurers would price your health insurance based on any number of factors, but after the Affordable Care Act, the number of variables that impact your health insurance costs decreased significantly.

In 2021, the average cost of individual health insurance for a 40-year-old across all metal tiers of coverage is $495. This represents a decrease of close to 2% from the 2020 plan year.

Recommended Reading: How To Enroll In Cigna Health Insurance