Different Health Insurance Deductible Plans

When looking through the health insurance policy or when comparing plans, you may see different types of deductibles.

Here is what it all means:

- Comprehensive deductible. This means the deductible applies to all medical services .

- Noncomprehensive deductible. This deductible does not apply to certain medical services, such as routine checkups and physicals. The plan will cover those services whether youve met your deductible or not.

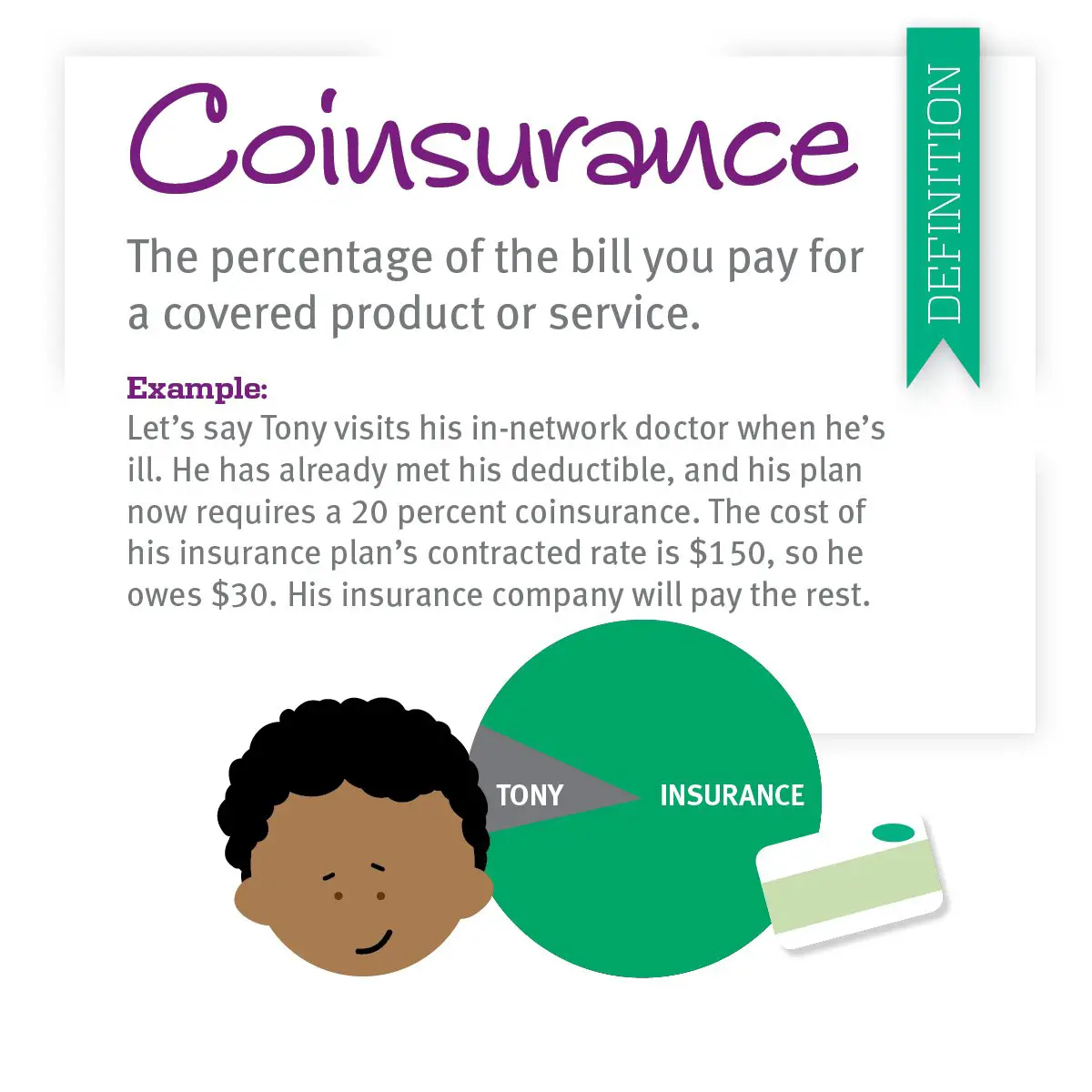

- In-network and out-of-network deductibles. These deductibles will match up with your plans network of approved healthcare providers. If you seek healthcare out of network, you may have higher deductibles, coinsurance amounts, and copays.

- Prescription drug deductible. Some insurance plans have a separate deductible for prescription drugs.

- Individual deductible. This is the amount you, as an individual insured person, must spend before your plan will start to pay for your healthcare claims.

- Aggregate deductible. Some family insurance plans have this type of collective deductible. Any money that is spent on a member of the family for healthcare will go towards the collective family deductible.

- Embedded deductible. With this type of family deductible, each member of the family has an individual deductible, as well as a collective deductible. Each person will get their benefits as soon as their deductible is met. As soon as the family deductible is met, the insurer pays for all the members.

Low Or High Annual Deductible: Which One Is Better

As stated earlier, health insurance deductibles vary from one policy to another. This is why it is pertinent to compare policies carefully. Higher annual deductibles are generally evened out by lower premiums or cost-sharing.

The inverse is true for lower annual deductibles as they have high premiums and out of pocket expenses. Some health insurance policies, such as HMOs, don’t have any sort of deductibles. These policies are called zero-deductible policies.

Zero-deductible policies generally have comparably higher premiums, with the inverse being true for high deductible policies.

A zero-deductible policy is best suited to those that have multiple prescriptions or frequently see doctors. This is because such a policy can suit their coverage and budget requirements.

Conversely, for people that are healthy and don’t frequently use medical services, a higher deductible plan would make more financial sense. The higher deductible would be offset by low premiums, which could mean you pay much less in the long run.

How Do Copays Deductibles And Coinsurance Work Together

Suppose you are single with a health insurance plan that has a $3,700 annual deductible, a $40 copay for a doctor visit, 20% coinsurance and a $6,500 out-of-pocket maximum. You visit the doctor and pay $40 to see them. The doctor says you need surgery you are hospitalized for three days, and receive a bill for $30,000. How does payment work?

Your copay didn’t count toward your deductible, so you must pay the first $3,700 of the bill out of pocket to meet your deductible. Now your coinsurance applies, so you have to pay 20% of the remaining $26,300 up until your total spending reaches the out-of-pocket maximum of $6,500. In this case, you’ll pay $2,800 of the remaining bill . Your insurance pays the rest of the hospital bill. Total cost: $6,500.

After you leave the hospital, you have to fill several prescriptions, which would normally have a copay of $40 each. However, because you’ve reached your out-of-pocket maximum, your health insurance pays all of your covered health expenses for the rest of the year, so you owe nothing for the medication.

Also Check: What Is Cigna Health Insurance

Choosing The Best Health Insurance Policy

The deductible and out-of-pocket max are two very important factors when deciding which health insurance plan is right for your needs.

In general, you’ll pay more each month to get better cost-sharing benefits, such as lower deductibles, lower out-of-pocket maximums, and lower copayments or coinsurance. These higher monthly costs may be worth it if you’re expecting to need significant medical care in the upcoming year.

Choosing a plan with lower monthly payments can be good for those who are young and healthy, but it means higher deductibles, higher out-of-pocket maximums, and paying higher copayments or coinsurance for health services.

Comparing health insurance quotes can help you optimize how much you pay each month versus the policy’s yearly deductible amount, cost-sharing benefits and out-of-pocket maximum.

Deductible vs. out-of-pocket max vs. coinsurance

Different Kinds Of Health Insurance Deductibles

There are two types of health insurance deductibles, explains Dr. Johnston: individual and family. âAn individual deductible means that the health insurance plan only covers one individual, and theyâre responsible for their single deductible. A family deductible, on the other hand, is for anyone with more than one person on their plan and is broken into two common types: aggregate and embedded,â she says.

With an aggregate deductible, your family has to pay the deductible until the insurance company has collected your entire family deductible. With an embedded deductible, however, your plan starts to pay as soon as one member of your family meets their individual deductible.

Recommended Reading: How Long Can Your Child Stay On Your Health Insurance

How Many Times Do You Pay An Insurance Deductible

Insurance is a financial product where a consumer pays an insurance company a fee called a premium in exchange for the promise of financial compensation if certain losses or expenses arise. Although you have to pay premiums to purchase and maintain insurance coverage, you may also have to pay deductibles when you make an insurance claim before your insurance carrier will give you compensation. The number of times you have to pay deductibles when making claims depends on the specific terms of your insurance policy.

How Do You Argue Medical Bills

How to Contest a Medical Bill Get an Itemized Copy of Your Bill. Talk to Your Medical Provider. Talk to Your Insurance Company. Dispute a Medical Bill With the Collection Agency. Work With a Medical Advocate. Negotiate a Medical Bill With Your Medical Provider. Avoid Future Problems by Reviewing Your Insurance.

You May Like: Can Unmarried Couples Be On The Same Health Insurance

What Metal Tier Has No

When buying a policy through the health insurance marketplace, no-deductible plans can be found in all metal tiers, including Bronze, Silver, Gold and Platinum.

The general rule of thumb is that Gold and Platinum plans have lower deductibles than Silver or Bronze plans. However, we have recently seen new plans added in some locations, including Bronze and Silver policies with zero deductible. These plans are categorized in a lower tier because of a different aspect of coverage, such as a high out-of-pocket maximum, a limited network, high coinsurance or something else.

For example, when comparing select policies for no-deductible health insurance in Texas, the copay for an in-network X-ray is $70 with a Gold plan, $80 with a Silver plan and $140 with a Bronze plan.

Get Help From Family And Friends

Also Check: What Do Expats Do For Health Insurance

What Are The Types Of Health Insurance Deductibles

Okay, so deductibles can come in different forms depending on the type of insurance plan you have! And your plan could have more than one type of deductible, which is another reason to check to see if theyre the right ones for you.

Here are the different types of health insurance deductibles:

Comprehensive deductible: A comprehensive deductible is a deductible amount that applies to and includes all of the medical coverages in your health insurance plan. Once youve met this comprehensive deductible, your plans coinsurance will take effect.

Non-comprehensive deductible: A non-comprehensive deductible means that not all of the medical coverages in your insurance plan will have a deductible applied to them. Your plan could provide some health services without you having to eat into your deductible. Woo-hoo! Again, check to see if the coverages without a deductible are beneficial to you.

Individual or family deductibles: Your family members might have individual deductibles, or the plan could just have one family deductible. This type of deductible can be met by all or just one member of your family. And once you meet this deductible, coinsurance kicks ineven if its for a family member who didnt need health care up until this point.

Okay, you may be confused about all these different deductibles! But heres the takeaway: Look at the fine print of your health insurance plan to see what types of deductibles apply to it and decide if they work best for your situation.

Things To Know About Deductibles In The Health Insurance Marketplace

IMPORTANT: This page is out-of-dateGet the latest information here.

Deductibles, premiums, copayments, and coinsurance, are important for you to consider when choosing a health insurance plan. You can compare health plans and see if you qualify for lower costs before you apply. Most people who apply will be eligible for help paying for health coverage.

Here are 6 important things to know about deductibles:

Also Check: What Is The Average Monthly Cost Of Health Insurance

Is There A Deductible For Medicare Part D

Yes, there usually is. Medicare Part D is coverage for prescription drug costs. It’s an optional extra for Medicare and is available through private insurers, although you can sign up for it through the Medicare.gov website.

The insurers who offer Part D coverage can be located via the Medicare.org website’s Medicare Plan Finder.

What Is The Difference Between A Deductible And A Copay

Depending on your health plan, you may have a deductible and copays.

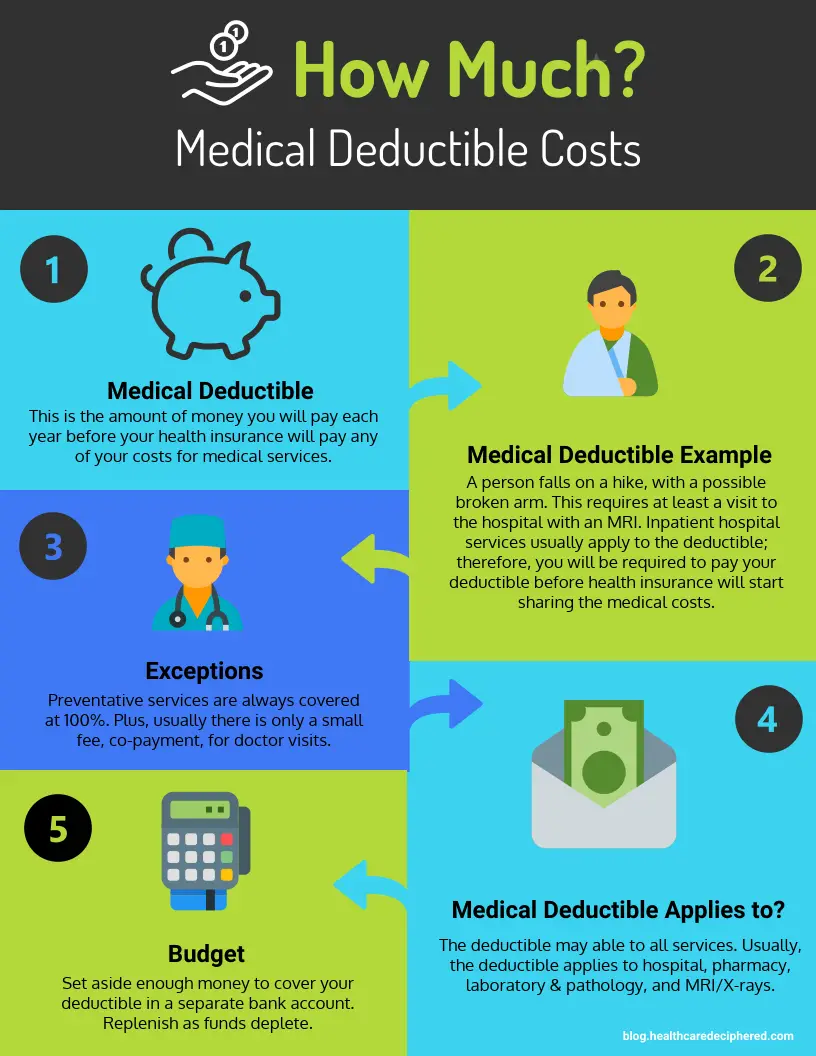

A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services. If your plan includes copays, you pay the copay flat fee at the time of service . Depending on how your plan works, what you pay in copays may count toward meeting your deductible.

You May Like: Where Is Health Insurance Free

What Is A Deductible

A deductible is the amount you pay for health care services before your health insurance begins to pay.

How it works: If your plans deductible is $1,500, youll pay 100 percent of eligible health care expenses until the bills total $1,500. After that, you share the cost with your plan by paying coinsurance.

How To Apply The Percentage Threshold

This 7.5% rule is typically disadvantageous mathematically, unless you have significant other medical expenses in addition to your insurance premiums. You can include these in the deduction to help you get over the 7.5% threshold.

As an example, you could not deduct your premiums in 2020 if your AGI was $60,000, and you paid $4,500 in health insurance premiums over the course of the tax year because 7.5% of your AGI works out to $4,500. You didnt pay anything in excess of that figure.

But youve spent a cumulative total of $7,500 if you additionally paid $3,000 in additional uninsured medical expenses. This is $3,000 more than your 7.5% threshold, so you can claim the entire $3,000 as an itemized tax deduction.

You May Like: Can I Have Health Insurance In Two Different States

How Do Copays Work With Deductibles

A copay is a common form of cost-sharing under many insurance plans. Copays are a fixed fee you pay when you receive covered care like an office visit or pick up prescription drugs. A deductible is the amount of money you must pay out-of-pocket toward covered benefits before your health insurance company starts paying.

Explore Cheaper Health Care Options

Theres usually more than one way to treat a given healthcare problem. Are you using the least expensive treatment option that will work for you?

While switching to a less expensive treatment option wont make your deductible any smaller, the deductible will come due over a longer period of time and in smaller chunks. For example, if you have a $3,000 deductible and are getting a treatment costing $700 per month, switching to a treatment costing $400 per month will lower your monthly expenses. Youll still end up paying the entire $3,000 deductible before your health insurance begins to pay. But, with the cheaper treatment, youll spread that deductible over eight months rather than five months, making it easier to manage.

Can you get the care at a free clinic or a community health center that will care for you regardless of your ability to pay? Some of these places will care for you for free, will charge you based on your income, or will accept what your health insurance pays as payment in full. Check to see if there is a community health center near you.

You May Like: What Is A Good Cheap Health Insurance

How Do Deductibles Work

Chronic conditions Low deductible plan]

On the other hand, if you typically need regular health care, have a large family or chronic condition, you may prefer a low deductible plan.

ON-SCREEN TEXT:

You’ll pay more for your premium each month, but less for your health care expenses with your lower deductible. Paying more each month can help you save on out-of-pocket costs and may help you better manage your budget. Now that you know more about deductibles, you can make the most of your benefits with the type of plan that best fits your needs.

ON-SCREEN TEXT:

So you can experience what care can do for you.

What Do I Need To Know About Deductibles

Deductibles are characterized as being expensive and requiring an annual payment. In an insurance policy, the deductible is the amount paid out of pocket by the policyholder before an insurance provider will pay any expenses.

To make it easy to understand, we will describe a deductible to define the number of claims an insured can be expected to bear the cost of.

For many, paying parts of the cost of a claim to reach the years deductible percentage is easy to achieve. When this percentage is met, they reap the benefit of having their health insurer start to pay post-deductible benefits.

Read Also: Is It Legal To Marry For Health Insurance

Other Types Of Deductibles

So far, this article has covered annual deductibles, which are the most common. However, some health plans have more than one type of deductible. These may include:

- Prescription deductible: This applies to prescription drugs and is in addition to whatever deductible the plan has for other medical services. After it is met, the coverage usually switches to copays for lower-tier prescriptions, and coinsurance for the more expensive, higher-tier prescriptions.

Payments Of Premiums For Private Health Services Plans

As a rule, premiums that are paid to private health services plans including medical, dental and hospitalization plans are considered to be eligible medical expenses by the Canada Revenue Agency. Furthermore, any premium, contribution or other consideration including sales and premium taxes that you pay to a private health services plan for yourself, your spouse or your minor children, is an eligible medical expense.

However, the plan you make the payments to must qualify as an eligible private health services plan. When changes were made a few years back, the CRA adopted a less restrictive position regarding which plans are considered eligible. They now consider a plan to be eligible as long as all or substantially all of the premiums paid under the plan relate to medical expenses that are themselves eligible for the Medical Expense Tax Credit. The plan must also be an insurance plan, instead of another form of contract. To be considered as substantial, the CRA refers to approximately 90 percent or more.

Previously, the CRAs position was that 100 percent of the premiums had to be paid to be considered as eligible medical expenses. The rule now means that plans that offer some non-eligible benefits can still be considered eligible, if these benefits are less than 10 percent of the total benefits.

Plans that are paid by an employer and most mandatory provincial health plans are not eligible to be claimed as health expenses.

You May Like: What Qualifies For Self Employed Health Insurance Deduction

Situations Where You Don’t Have To Pay Your Deductible

According to economical.com, There are several situations where you are not required to pay a car insurance deductible these include:

- If an insured driver hits you

- If a second party files a claim that is against your liability coverage

- If you chose to go for a no deductible option when buying an insurance policy

- If you have free repairs on glass claims

If any of these instances occur to you during your claim period, then you will not be eligible for deductible car insurance. If the driver is deemed to be at fault, the insurance company will pay for the repair, but you will not be required to pay your deductible, according to HPM Insurance. However, if an uninsured driver hits you, the deductible will apply to your uninsured motorist vehicle.

Car insurance deductibles do not apply to a liability claim. In this case, you are not required to pay any insurance deductible since the insurer will cover for the damages and injuries caused by another driver.

Some states offer their residents the option of selecting a $0 deductible on their comprehensive car insurance. In case of an accident, you will be compensated adequately.