What Is Section 125

Home » What is Section 125?

My friend shared this little experience she had as a little girl playing softball.

She was on 2nd base, ready to run. Her teammate hit the ball, and she tore off for 3rd as the ground ball made its way between 2nd and 3rd base.

She jumped over the ball!

At the same time, the ball hit a rock, popped up, and knocked her in the ankle. Wow, did that hurt!

But it didnt deter her. Soon she was standing on 3rd base. Triumphant!

Untilthe umpire told her she was out!

She was in disbelief. It wasnt her fault the ball popped up. She still made it to base before the 3rd baseman had the ball and tagged her out. What in the world!

Her problem was she didnt know the rules. And the rules said, if the ball touches a runner, the runner is out!

Man, was she bummed! She had to comply with the rules. She was out!

The stakes are much higher for a business that finds itself out of compliance with government rules regarding their group health plan.

More than leaving 3rd base and heading to the dugout, they face fines and fees. They can lose the option of using pre-tax dollars on qualified expenses. It can be a real problem.

And just like my friend in the little story above, not realizing you are out of compliance doesnt protect you from the consequences of being out of compliance.

As an Employee Benefits Advisor at Baily Insurance Agency, I often find that businesses dont realize their group health plan is out of compliance.

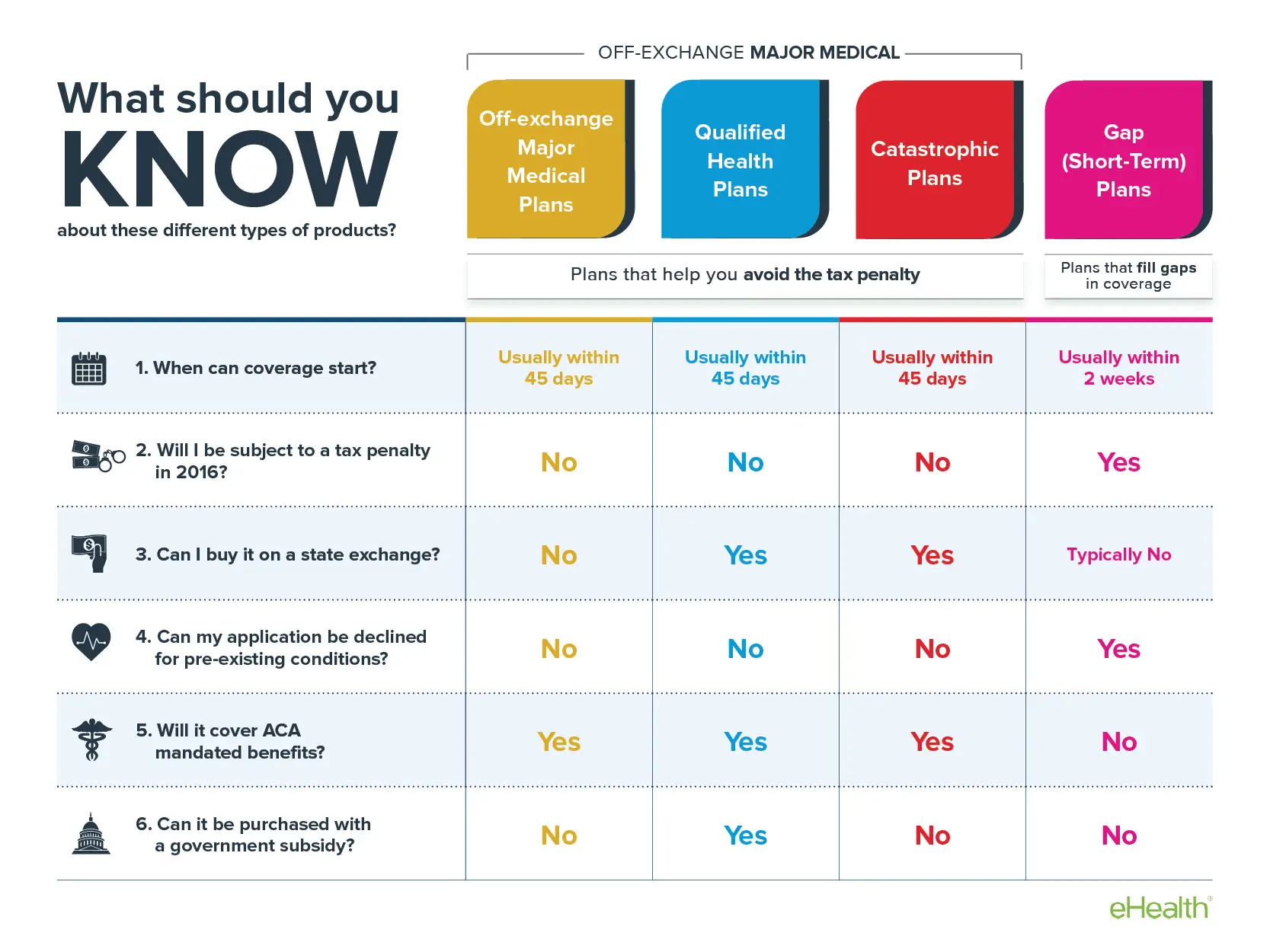

Who Is Eligible For Obamacare And Off

Technically everyone is eligible for Obamacare plans and Off-Exchange plans. The real question is – who is eligible for a subsidy tax credit? – which can only be used to reduce the costs of Obamacare plans. Note that even if you are not eligible for a subsidy tax credit, you are still allowed to purchase an Obamacare plan at the full price.

What Is A Health Insurance Premium

A health insurance premium is the amount typically billed monthly that policyholders pay for health coverage. Policyholders must pay their premiums each month regardless of whether they visit a doctor or use any other healthcare service.

Health insurance through Medicare, the health insurance marketplace, or an employer will almost always require consumers to pay a premium although enrollees may qualify for financial help for Medicare or marketplace policies depending on their income level. Medicaid typically requires small or no premiums.

Don’t Miss: How Much Does Private Health Insurance Cost In California

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

Q My Baby Was Born In Hospital Or At Home Attended By A Registered Midwife How Do I Get A Health Card For My Baby When He Or She Is Born

There is a special registration process for babies born in Ontario birthing hospitals and for babies born at home attended by a registered midwife.

Immediately after the birth of your baby, hospital staff or a registered midwife will give you an Ontario Health Coverage Infant Registration form to complete. Babies born in an Ontario birthing hospital or at home and attended by a registered midwife will be provided with an infant registration form. Tourists, transients or visitors are not eligible for OHIP coverage.

This form requests information regarding your baby such as the babys name, birth date and mailing address. Information is also requested regarding the parent/guardian who is completing the form. You will be asked to confirm that :

- The child has a primary place of residence in Ontario.

- The child will be physically present in Ontario for at least 153 days in any twelve-month period to retain health coverage.

The bottom of the form is detachable and should be retained by you. It is pre-printed with a health number assigned to your baby. You should keep this record and use it until you receive the babys plastic Ontario health card.

Also Check: Can I Go To The Er Without Health Insurance

Consumer Guide To Understanding Health Insurance

Many of the requirements discussed in this guide do not apply if your employer “self-funds” its health benefits plan. This Self-fund means that the employer pays your health claims from its own funds and does not pay premiums to an insurance company. The employer decides the plan coverage, including employee eligibility, covered benefits and exclusions, employee cost-sharing and policy limits. Federal law exempts these self-funded plans from state insurance laws, so these plans do not need to include state mandated benefits. You can ask your employer if your health plan is self-funded.

Get Coverage For New Technology

In cases where a new technology provides additional benefits vs. the older technology, consumers try several things to get the insurance company to pay. Many insurance companies require doctors to “prove” why the costlier procedure or product is more beneficial. Additionally, an insurance company may pay a specific amount for a procedure and the patient can pay the difference to get the new technologyin other words, partial coverage is available. The first step in this process is to discuss the coverage with the insurance company, determine what will be covered, and have an agreement with the physician for the total cost and what will be required to be paid by you.

Recommended Reading: Can I Get Health Insurance If I Lose My Job

Q Do I Need To Cancel My Ohip Coverage If I Plan To Move To A Location Outside Ontario

You should contact the Ministry of Health and Long-Term Care with any change of address. If you move to a location outside Ontario, you should inform the ministry of your new address and the date of your move as soon as possible. To inform the ministry of your move, you can either :

- Obtain a Change of Information and return it by mail. Forms are available from your local ServiceOntario Centre or from the Forms Online

- Send a letter to your local ServiceOntario Centre. You must include your name, health card number, telephone number, current address and new address including postal code.

The ministry will end your OHIP coverage based on the information that you provide.

What Is A Typical Premium

Premiums vary significantly from plan to plan. For people who buy their own coverage in the marketplace, the average full-price premium in 2020 was $575/month, although it varies considerably depending on the metal level of the plan, the insurer thats offering the policy, the geographical area, and the age of the enrollee. And very few marketplace enrollees pay full price for their coverage. As of 2020, 86% of enrollees were receiving premium subsidies, which averaged $491/month offsetting the majority of the average premium. And thanks to the American Rescue Plan, subsidies are considerably larger in 2021, and available to more people, making coverage more affordable than its been in past years.

According to the Kaiser Family Foundation , the 2020 average total premium for employer-provided coverage for a single employee was $623/month. Of that amount, the average worker paid $124/month and the average employer paid $519/month. For family coverage, the total average premium was $1,779/month, but again, employers pay the bulk of that: the average employee with family coverage has to pay just $466/month in premiums, while the employer covers the rest.

But this varies considerably from one employer to another. And although large employers are required to ensure that coverage is affordable , that only applies to coverage for the employee it does not count the cost of coverage for family members.

You May Like: What Does Long Term Health Care Insurance Cover

Q Do I Need To Notify The Ministry If My Baby And I Are Leaving The Province

You should contact the Ministry of Health and Long-Term Care with any change of address for both you and your baby. If you move to a location outside Ontario, you should inform the ministry of your new address and the date of the move as soon as possible. To inform the ministry of your move, you can either :

- Obtain a Change of Information for you and your baby. Complete and sign the form and return it by mail. Forms are available from your local ServiceOntario Centre or from Forms Online.

- Send a letter to your local ServiceOntario centre. You must include your names, health numbers, telephone number, current address, new address including postal code, and the effective date of the move for yourself and child.

How Does Health Insurance Work

Health insurance works to help lower the amount you would otherwise have to pay for high cost medical care. This is typically how a health plan works, but they can vary:

- You pay a premiumusually monthly. This is a fee for having the health plan.

- Most health plans have a deductible. A deductible is how much you must pay out of your pocket for care until your health plan kicks in to share a percentage of the costs.

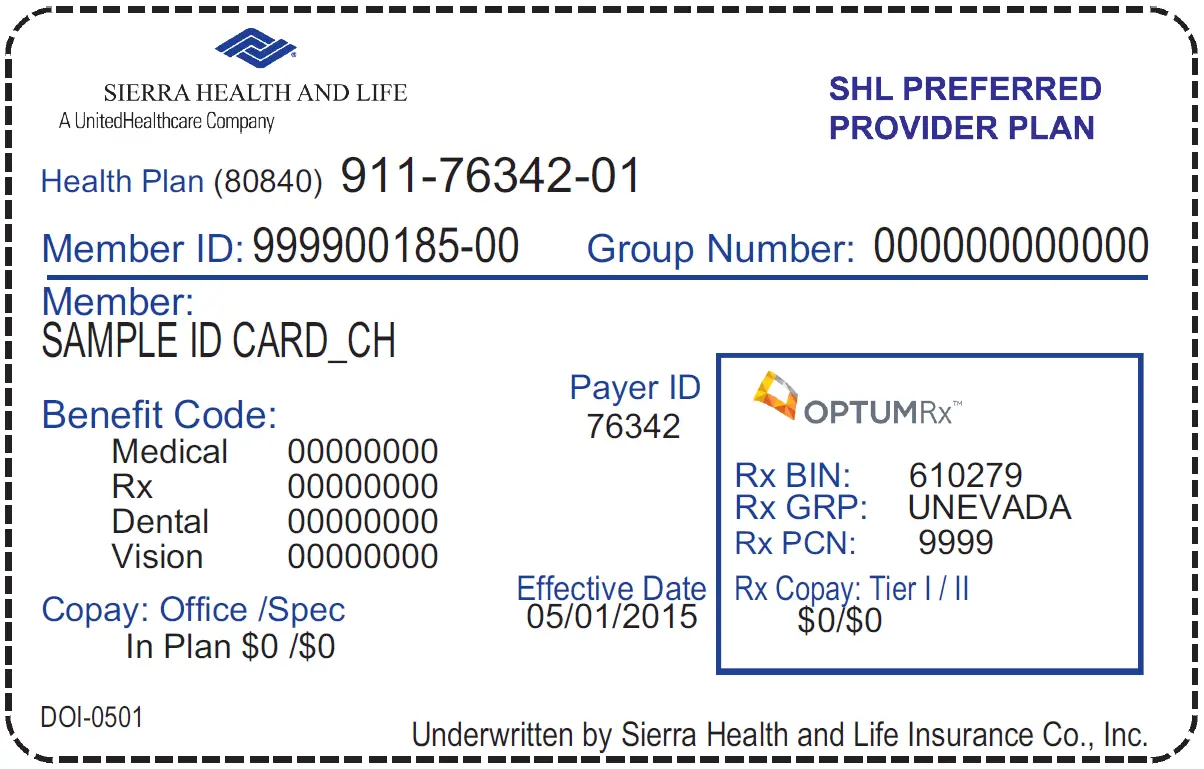

- Once you meet your deductible and your plan kicks in, you start sharing costs with your plan. For example, your health plan may pay 80% of your medical costs and you may pay 20%. This is called, coinsurance. Most insurance ID cards show your deductible and coinsurance.

- Preventive care is typically covered 100%1. This includes things like your annual check-up, a flu shot, vaccinations for kids, certain wellness screenings, and more. .

- You save money when you stay in-network. Network providers agree to give lower rates to the insurance companys customers. You can usually find a list of network providers on your health insurance website, or by calling and asking them for a list of in-network providers. This is a key part of how health insurance works to help keep your costs low.

- Your health insurance may also come with extra no-cost programs and services. This may include health and wellness discounts for services and products, incentive programs where you can earn cash awards and other prizes for completing healthy activities, and more.

You May Like: How To Find Personal Health Insurance

How Do I Know Which Services Are Covered

If you already have an insurance plan and want to keep it, review your benefits to see which services are covered. Your plan may not cover the same services that another plan covers. You should also compare your plan with those offered through the Health Insurance Marketplace. The Health Insurance Marketplace is a service that helps you shop for and compare health insurance plans. It is operated by the federal government.

Why Should I Consider Off

Off-Exchange plans may provide you with additional options compared to available Obamacare plans. If you are not eligible for a subsidy, or only eligible for a small subsidy amount, Off-Exchange plans may still be an affordable option for you.

A second reason for considering Off-Exchange plans is that your favorite doctor may only accept a plan which is available as an Off-Exchange plan. We recommend researching provider networks when considering health insurance plans. We provide links to official provider directories, or doctor lookups, on Health Plan Radar.

In addition, some health insurance companies have been leaving the Obamacare plan market, but they may still offer Off-Exchange plans. Your preferred insurance company may still offer plans on the Off-Exchange market.

You May Like: How To Apply For Health Insurance In Wisconsin

What Documents Should I Bring When I Register

When applying for a new health card, you must bring three original documents to prove your OHIP-eligible citizenship/immigration status, your residence in Ontario, and your identity.

If you are a member of a military family, refer to the fact sheet Military Family Members and the Military Family Member Document List.

If you have questions about what documents to bring with you when you register for OHIP coverage, contact ServiceOntario INFOline at 1-866-532-3161 or visit your local ServiceOntario Centre.

What Are The Different Types Of Health Insurance

There are different types of health insurance plans to fit different needs. Some types of health insurance include government plans like Affordable Care Act plans which can also be called Marketplace or Exchange plans Medicare plans and Medicaid plans. Before you choose a plan during open enrollment, it may help to review the various types of plans to get a better understanding of which type of health insurance may work best for you.

You May Like: How Do You Pay For Health Insurance

Choosing A Health Insurance Plan

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

How To Shop For Private Insurance

If youre not covered through your employer, or not eligible for financial assistance through a state-funded program, you will likely have to buy private insurance for individual or family through a private health insurance provider, such as Independence Blue Cross.

You may be able to purchase a plan on the Pennsylvania Insurance Exchange , which has replaced healthcare.gov.

Start by finding out which private health insurance carriers are available in your area. Independence Blue Cross serves the Philadelphia and southeastern Pennsylvania regions . See if private health insurance plans from Independence are available in your ZIP code.

Shopping for private health insurance is much easier when you know what questions to ask. When it comes to health coverage, everyone has different needs and preferences. We can help you figure out what type of plan you want, how to find a balance of cost and coverage, and what other benefits you should consider.

Recommended Reading: How To Qualify For Government Health Insurance

Get Ready To Choose Well

Use the Enrollment Readiness checklist below to help you plan and think through your choices.

1. Estimate the medical, dental and vision care expenses you and your family may have next year.

2. Research your plan options below.

3. Choose the best options and make changes in People First.

Benefits

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

How Do Health Insurance Payments Work

You choose a health insurance plan based on the cost of the plan and the services and benefits it covers. For most health plans, you pay a fixed amount each month, known as a premium. In addition to your premium, you may also pay each time you receive care medical care or have a prescription filled. These payments are often called cost-sharing, or out-of-pocket costs, and come in the following types:

Also Check: What Do You Need To Get Health Insurance

Q Do I Need To Do Anything With A Deceased Person’s Health Card Or Health Coverage

The health card of a deceased person must be returned to the Ministry of Health and Long-Term Care. You will need to complete a Change of Information and then mail it with the health card of the deceased person to the ministry. You should include a copy of the death certificate. Copies of this form are available by :

- Visiting your local ServiceOntario centre.

- Printing a copy of the form through Forms Online.

- Contact ServiceOntario INFOline at toll-free: 1-888-376-5197 or 416-314-5518

Alternately, you can send a letter to your local ServiceOntario centre providing the deceased person’s name, date of birth, sex and health number. Enclose a photocopy of the death certificate and the actual health card.