How Does Group Health Insurance Work Between Jobs

Typically, the Group Insurance Scheme provided by your employer ends on the last working day of the employee. However, some companies in the country provide group insurance coverage for employees and pay the premium in full or partially. However, can the group insurance cover be transferred or converted to an individual health insurance policy in case you want to change jobs, or you have been laid off?

The Insurance Regulatory and Development Authority of India states that an employee can convert the group cover to an individual health insurance plan with the same insurance company after completing the required formalities.

That being said, the insurance provider has the full right to decide on the terms and conditions of the new policy. This option of switching from group insurance to individual insurance is offered only by a few insurance companies and employers. Hence, you need to check with your employer if there is an option to remain with the same insurer, except that it will be converted to an individual insurance plan.

You may have to pay an extra premium and may have to provide a medical certificate to change over from group to individual health insurance. Please note that this process is not mandatory, and it is the insurance companys decision to offer the conversion or not.

Do I Need Private Health Care Coverage When Travelling Within Canada

The portability criterion of the Canada Health Act requires that the provinces and territories extend medically necessary hospital and physician coverage to their eligible residents during temporary absences from the province or territory. This allows them to travel or be absent from their home province or territory and yet retain their health insurance coverage. Within Canada, the portability provisions are generally implemented through a series of bilateral reciprocal billing agreements between the provinces and territories for hospital and physician services. This generally means that your provincial/territorial health card will be accepted, in lieu of payment, when you receive hospital or physician services in another province or territory because the rates prescribed within these agreements are host-province/territory rates. These agreements ensure that Canadian residents, for the most part, will not face point-of-service charges for medically required hospital and physician services when they travel in Canada because the province or territory providing the service directly bills your home province/territory.

Find Out When Your Coverage Actually Ends

The first thing you need to do is figure out when your current health insurance coverage ends. Depending on how you get your insurance, your coverage may not end when you think it does.

If you currently have a plan outside of your job, your plan will likely end at the end of the month which you last paid for. This makes sense and is fairly easy to control. Simply pay for the plan until you dont need it anymore.

However, if youre losing coverage from a job, your health insurance end date may vary.

I personally thought Id lose my health insurance the day I left my job. Instead, my insurance extended through the end of the month that I left regardless on which day of the month I quit.

Check with your human resources or benefits department to see how your employers health insurance works. If that doesnt work, try calling your health insurance company directly.

Read Also: What Is Amazon Health Insurance

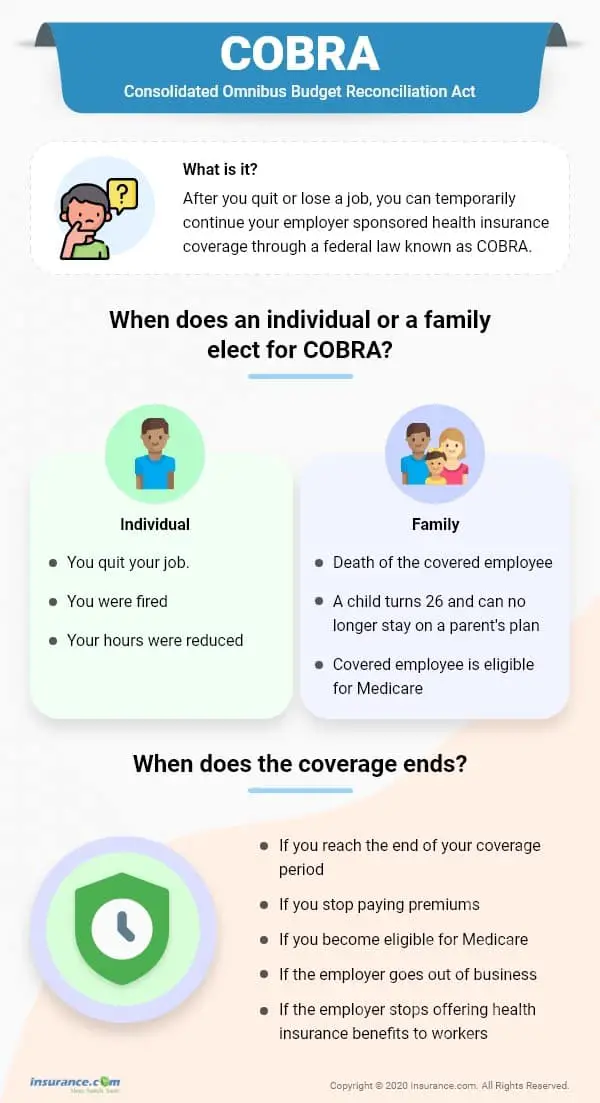

Cobra To Continue Existing Coverage

COBRA, which stands for the Consolidated Omnibus Reconciliation Act, allows you and your family to temporarily continue group health coverage when you would otherwise lose it. You retain the same benefits and provider networks you already have when you elect COBRA.

To qualify for COBRA, you must be enrolled in your employers health plan and experience a qualifying event that would cause you to otherwise lose that coverage. Qualifying events for covered employees include:

- Termination of employment for any reason other than gross misconduct.

- Reduction in the number of hours of employment.

There are additional qualifying events for the spouse and dependent children of covered employees.

This option tends to be a fit for those who want to keep the coverage they already have, regardless of cost. Some reasons you might prefer to elect COBRA include having met or paid into your plan deductible for the year, wanting to continue care through your existing in-network healthcare providers, or not wanting to switch plans because you like the one you have.

You want to look into COBRA alternatives if you cant afford the premiums or will be moving out of your plan network after becoming unemployed.

Cost: Typically your full premium plus a 2% administrative fee. The amount cannot exceed 102%.

Enrollment: To elect COBRA, you have at least 60 days from either the date you were provided with your COBRA election notice or the date you would lose coverage, whichever is later.

Review Your Insurance Options When Switching Jobs

There can be two situations. First, you can switch the Group Health Insurance Plan to Individual Insurance. Second, you can buy private health insurance for you and your family. Here are some questions to ask before you quit the current job for a new opportunity:

-

Do you have a personal health insurance plan apart from the group insurance provided by the current employer?

-

Does the current group insurance plan provide coverage when you are no longer employed with the respective employer?

-

Is your personal health insurance policy coverage sufficient enough to cover you and your family during medical emergencies?

-

Will a short-term or long-term health insurance plan help during the period of unemployment?

-

Can you be covered under your spouses health insurance plan?

Also Check: How To Register For Health Insurance

Do I Need To File A Tax Return If I Don’t Have Income But I Do Have Healthcare

If you receive premium tax credits, then you must file tax returns, even if your income level wouldn’t normally require a tax return. In other words, if you don’t pay full price for your healthcare coverage, then you will need to file tax returns regardless of your income. You will know whether you use premium tax credits to pay for healthcare, because you will receive an IRS Form 1094-A.

Group Insurance From Organizations

This is often an overlooked source of low-cost health insurance. For example, those who are members of University Alumni Associations can obtain a few insurance choices. These organizations don’t help pay premiums, but the plan rates can be lower because of the group discount.

Ask organizations that you’re a member of if they offer a group health plan, or research those that do so and join. You might even ask your current organizations to offer a group health plan. They may not realize that they could do this for their members.

Be sure to ask any organization you contact if the plan is ACA-compliant.

Recommended Reading: Will Health Insurance Pay For Weight Loss Surgery

How Do I Get Health Insurance If I Lose My Job

There are many ways to get health insurance if you lose your job. The first is COBRA, which allows you to keep your previous employer’s insurance plan but can be expensive. Becoming unemployed also qualifies you for a special enrollment period, which means you can purchase any new insurance policy for up to 60 days after you lose your job. In some states, short-term health coverage is an affordable option that can keep you insured for up to 364 days while you look for new work.

How K Health Can Help

Did you know you can get affordable primary care with the K Health app?

to check your symptoms, explore conditions and treatments, and, if needed, text with a doctor in minutes. K Healths AI-powered app is HIPAA compliant and based on 20 years of clinical data.

K Health articles are all written and reviewed by MDs, PhDs, NPs, or PharmDs and are for informational purposes only. This information does not constitute and should not be relied on for professional medical advice. Always talk to your doctor about the risks and benefits of any treatment.

K Health has strict sourcing guidelines and relies on peer-reviewed studies, academic research institutions, and medical associations. We avoid using tertiary references.

You May Like: Do Veterans Get Free Health Insurance

What Happens To My Health Insurance When Changing Jobs

Just the Essentials

- Its important to maintain health insurance when changing jobs.

- HIPAA laws help you transfer your health insurance coverage from one employer to the next.

- COBRA helps you avoid lapses in health insurance coverage.

- A short-term health insurance policy could be your best alternative to COBRA.

Best Provider Network: Unitedhealthcare

Thanks to UnitedHealthcares expansive provider network, youll never be far from the care you need.

-

Works with more than 1.3 million doctors and 6,500 hospitals

-

Good variety of plan types

-

Save by bundling coverage

-

No special enrollment period for some policies

-

Expensive premiums

-

Coverage available for a maximum of only three years

With UnitedHealthcares network of more than 1.3 million physicians and 6,500 hospitals in the U.S., theres a good chance you wont have to be concerned about your current doctor not accepting your new insurance. UnitedHealthcare offers short-term medical plans in every state and is the largest health insurance provider in the country, making it an easy choice for the best provider network in our review.

There are a dozen different individual and family UnitedHealthcare policies to choose from. Plans are geared toward those who are facing unemployment or simply dont need insurance for an extended period of time. Full health coverage is available for a maximum term of only three years through the TriTerm program, a plan designed to offer a more prolonged solution than traditional short-term insurance. You may be able to get a discount by combining a health plan with supplemental coverage like dental or vision.

Read Also: Does My Health Insurance Cover Therapy

How Much Does Short

The average cost of short-term health insurance for a single person is $124 a month compared to $456 for an unsubsidized ACA-compliant plan. We found plans with coverage more suited to the concept of catastrophic plans for as low as $60 a month. It can be confusing due to the lack of consistency in plan coverages, but it is recommended to shop and compare the options line by line.

Enroll In Your Partner’s Insurance

Does your spouse or partner have health insurance at their job? You may be able to join that plan.

Your spouse or partner can ask for a “special enrollment.” That way, you can join the plan without waiting for the annual open enrollment period. Open enrollment typically lasts for only a few weeks each fall.

If you make a request for special enrollment within 30 days of losing your old coverage, the policy will take effect on the first day of the next full month.

Also, if you have children who were covered under your old policy, they can be included in the special enrollment request.

However, you can’t ask for special enrollment if you’ve decided to use COBRA.

Recommended Reading: How Much Do Kaiser Employees Pay For Health Insurance

What Do I Do If My Address Changes Or If I Lose My Health Card

The provinces and territories, rather than the federal government, are responsible for the administration of their health insurance plans, which includes issuing, cancelling or renewing health cards. You should call or email your provincial/territorial Ministry of Health- the phone numbers and websites are located inside the back cover of the current Canada Health Act Annual Report.

What Might Cause Me To Lose Job

You can lose job-related coverage for a number of reasons, such as:

-

If youre laid off or quit

-

If your hours are reduced

-

If your employer no longer offers health coverage

-

If your employer stopped offering health coverage and switched to an Individual Coverage Health Reimbursement Account

-

If youre a dependent and the subscriber for your plan qualifies for Medicare

-

If youre a dependent and the subscriber for your plan dies

-

If youre a dependent and you get legally separated or divorced

-

If you turn 26 and no longer qualify as a dependent on a parents employer-sponsored plan

Don’t Miss: What Is Evolve Health Insurance

Implications For Health Savings Accounts

If you have a Health Savings Account or are interested in having one, you’ll want to be aware of the implications of having separate health insurance plans.

In 2022, you can contribute up to $7,300 to a health savings account if you have “family” coverage under an HSA-qualified high deductible health plan . Family coverage means at least two members of the family are covered under the plan . If you have an HSA-qualified plan under which you’re the only insured member, your HSA contribution limit in 2022 is $3,650.

It’s important to understand that although HDHPs can provide family coverage, HSAs cannot be jointly owned. So even if your whole family is on one HDHP and making the family contribution amount to a single HSA, it will be owned by just one family member.

If you and your spouse want to have your own HSAs, you can each establish one and split the total family contribution between the two accounts .

If one of you has an HSA-qualified plan and the other has a health insurance plan that isn’t HSA-qualified, your HSA contribution will be limited to the self-only amount.

How Do You Get Health Insurance Between Jobs

The first thing to find out is when your previous employer is stopping your coverage. It may:

- End your coverage immediately.

- Wait until the end of the month.

- Cover you for months, especially if you were laid off.

You can begin to plan what to do next once you know when your previous employer is going to stop coverage.

If youre starting a new job, find out from the new employer when that coverage begins. You may find that youll only be without insurance for days or a few weeks. In that case, you may decide to go without health insurance temporarily or get a short-term health plan.

Also Check: How To Cancel Cobra Health Insurance

How We Chose The Best Health Insurance For The Unemployed

Our analysis looked at 30 health insurers nationwide to identify the best companies based on the benefits they offer to those facing unemployment. We chose insurers with widespread geographic representation who provide flexible policies geared toward individuals with short-term insurance needs. Since financial strain is a main concern during periods of unemployment, we weighed policy pricing heavily by comparing quotes from five sample markets. Finally, we evaluated accessibility to care, including the number of in-network providers and the availability of telehealth services.

How Do I Write A Letter Of Resignation

At the very least, a should contain the following. This is the current date. Name and location of the company. Resignation statement. Give the date of your final day. A two-week notice period is required. Your position title. Thank you for taking the time to read this. A request for assistance during the changeover phase.

Don’t Miss: Can I Upgrade My Health Insurance At Any Time

How Much Does Cobra Cost

While you are employed, your employer typically pays the majority of the premium for your group health plan. Under COBRA, you pay your current premium plus your former employers portion. In 2019, employers paid an average of $599 per month for an individual employees insurance. That means a worker who loses their job and doesnt need additional coverage for their family might have to pay around $599 a month if they elected to get COBRA. The good news is that there are options to get access to quality, affordable care that doesnt necessarily cost $599 per month.

How Can You Buy Short

Short-term health insurance is available through quotes you can obtain by phone or directly on an insurance company’s website. Online marketplaces and insurance agencies also have websites that provide quotes with various insurers , making it easy to find options. Some examples include eHealth and Agile.

Short-term coverage always has been known as a lower-cost health insurance option. Still, with many tax credits available for lower-income individuals, it is important to consider all your options. Check if you qualify for a special enrollment period, and be sure and check what you can get in the ACA marketplace first. Even some zero-premium Bronze ACA plans are available for low-income enrollees in parts of the country.

Don’t Miss: How Far Back Does Health Insurance Cover

What Are The Alternatives To Cobra When I Leave My Job

COBRA isnt your only option when you lose your employer-sponsored plan. Depending on your situation, you may qualify for other health benefits:

- Join your spouse/partners employer-sponsored plan. Leaving your job triggers a special enrollment period that allows you to join your spouse/partners plan. Even if your spouse isnt enrolled in their employers plan, your job loss allows you both to sign up outside the usual open enrollment period within 30 days. Find out how qualifying life events, like marriage or having a baby, affect your health coverage.

- Choose a plan through the health insurance marketplace at healthcare.gov. You dont need to wait until Open Enrollment in the fall if you have a qualifying life event, such as leaving a job. You have 60 days to choose a plan, and your benefits will start the first day of the month after you lose your insurance.

- Enroll in a trade/professional group plan. You may be able to find plans with lower premiums through nationalorganizations that offer benefits for independent workers, such asthe National Association for the Self-Employed or the Freelancers Union . No proof of self-employed status is required.

- Low- and moderate-income families may be eligible for the Childrens Health Insurance Program . If you earn too much to qualify for Medicaid, you may be able to get your kids low-cost coverage through CHIP, which is jointly funded by states and the federal government. You can find more information on healthcare.gov.