Why Does Us Health Care Cost So Much

Uwe E. Reinhardt is an economist at Princeton.

In my previous blog post, I showed that America suffers from excess spending in its health care system. Here I will discuss one factor that drives up that spending: indefensibly high administrative costs.

To review: Excess health spending in this context refers to the difference between what a country spends per person on health care, and what the countrys gross domestic product per person shouldpredict that that country would spend. The word excess here should not be taken as excessive unless one could demonstrate that what the other O.E.C.D. nations spend is appropriate and what we spend is ipso facto wasteful.

The United States spends nearly 40 percent more on health care per capita than its G.D.P. per capita would predict. Given the sheer magnitude of the estimated excess spending, it is fair to ask American health care providers what extra benefits the American people receive in return for this enormous extra spending. After all, translated into total dollar spending per year, this excess spending amounted to $570 billion in 2006 and about $650 billion in 2008. The latter figure is over five times the estimated $125 billion or so in additional health spending that would be needed to attain truly universal health insurance coverage in this country.

What Does Private Health Insurance Cover

One of the frustrations with private health insurance is that the insurance companies that provide the cover have made it unnecessarily complicated. Firstly, there are different levels of cover you can buy which can broadly be described as basic, intermediate and comprehensive, each offering varying levels of cover. Next, you will need to choose an excess you would be willing to pay should you make a claim and finally, when it comes to applying, you will have to choose between applying on a full medical underwriting basis or a moratorium basis. We explain all of these options in more detail in our article How to compare the best insurance policies in the UK. Below, we have provided a summary of the main features of a private health insurance policy:

- Specialist referrals at your request

- Speedy consultation, diagnosis and treatment

- Access to top surgeons and hospitals

- Likely to get a private room with ensuite facilities

- Access to specialist drugs and treatment that may not be available on the NHS

- Physiotherapy

What Does Private Medical Insurance Offer

Private medical insurance can offer a lot of benefits:

-

According to the NHS website, the maximum time for non-urgent, consult-led treatment is 18 weeks from the day your appointment is booked . According to recent data from the NHS published in January 2021, 84.4% of people were seen by a specialist within two weeks of an urgent referral for suspected cancer and 94% of people began first definitive treatment within 31 days of receiving a cancer diagnosis. Private health insurance offers the chance to reduce wait times or avoid them entirely which could identify and treat diseases or illnesses quicker and allow for faster treatment.

-

Typically when getting treatment on the NHS, youre assigned a hospital and appointment time. With private health insurance, youre offered the luxury of choosing your appointment time, your specialist and hospital preferences. This means that you can fit your treatments around your schedule, and pick a time that suits you.

-

As some cutting-edge treatments are too expensive to be deemed cost-efficient on the NHS, some private medical insurance will cover the cost.

-

Usually, patients on the NHS will be given a bed in a shared room with other patients. Most patients with private medical insurance will benefit from a private room, free parking, a-la-carte menus and en suite facilities.

Private medical insurance provides comfort, security and privacy to any medical experience that could potentially be an upsetting and troublesome time.

Also Check: Can I Be Fined For Not Having Health Insurance

And Why We Get Less Bang For Our Bucks

The pressure on our sprawling healthcare system in the U.S. has never been greater. Massive federal cash influxes have sought to shore up hospitals sagging under the weight of the testing and treatment burden and the related temporary cessation of elective surgery and regular medical care.

Long before this crisis, the U.S. led other industrialized nations in high spending on healthcare and getting a low bang for the buck in terms of health outcomes and the percentage of the population served.

As of 2020, life expectancy in the U.S., for example, is 77 years, while it ranges from 80.7 to 83.9 in 10 other high-income countries. And only 91.4% of the population in the U.S. has health insurance, compared to 99% to 100% of the population in the other industrialized countries examined.

Does Changing Your Underwriting Affect The Cost Of Private Health Insurance

When you take out health insurance, its important to make sure that youve got the right amount of cover to suit your needs.

Whether you decide to choose full medical or moratorium underwriting, the cost of changing your underwriting will vary from person to person.

The implication on cost can be quite small for a young person with no pre-existing medical conditions in comparison to an older person who has suffered from several health conditions.

You can read more about the different underwriting methods with our guide to health insurance for people with pre-existing medical conditions.

Also Check: Can I Be On My Parents Health Insurance

Some Vaccines Covered Better Than Others

Unlike the flu and pneumonia vaccines, which are fully covered as preventive services under Medicare Part B, the shingles shot and other recommended vaccinations are covered as prescription drugs under Medicare Part D and Medicare Advantage plans.

Some of those plans provide better coverage than others, but nearly all of them divide their formularies, or list of covered drugs, into tiers according to cost. Drugs in Tier 1 and 2, mainly lower-priced generics and “preferred brand-name” drugs, have lower co-pays than more expensive “nonpreferred brands” in Tier 3 or 4.

Consumer Reports found that many Part D plans categorize the shingles vaccine, Zostavax, as an expensive Tier 3 or 4 drug. Only one pharmaceutical companyMerckmakes the shingles shot, and there’s currently no generic version.

That means if you haven’t met your annual deductible, you’ll likely wind up paying full price for the shot, which is about $217. But depending on your plan, even after the deductible is met, consumers may have to pay a significant part of the shingles vaccine costup to $100.

Many healthcare providers haven’t set up billing systems to file claims through prescription drug plans. So if you’re vaccinated at your doctor’s office, you might be required to pay the full shingles vaccine cost up front and then file to be reimbursed by your insurance.

Americans Challenges With Health Care Costs

For many years, KFF polling has found that the high cost of health care is a burden on U.S. families, and that health care costs factor into decisions about insurance coverage and care seeking. These costs also rank as a top financial worry. This data note summarizes recent KFF polling on the publics experiences with health care costs. Main takeaways include:

Don’t Miss: Does Health Insurance Cover Braces

Your Insurer Spends A Lot On Marketing

Your insurance providers marketing costs may impact what you pay for health insurance even more than the administrative ones discussed above.

After all, it isnt unusual for large insurers to spend many millions of dollars on advertising and other marketing efforts.

Well, the monthly premiums you pay for your health plan help them cover those expenses. Which is another way of saying: if your health insurance is expensive, you might be able to blame, at least partially, your providers marketing department.

Overall Costs Of Healthcare

Healthcare costs have risen dramatically in the United States over the past several decades. According to a study by the Peterson Center on Healthcare and the Kaiser Family Foundation , U.S. healthcare spending rose nearly a trillion dollars from 2009 to 2019, when adjusted for inflation.

The study reported that U.S. healthcare spending during 2019 was nearly $3.8 trillion, or $11,582 per person. By 2028, these costs are expected to climb to $6.2 trillionroughly $18,000 per person.

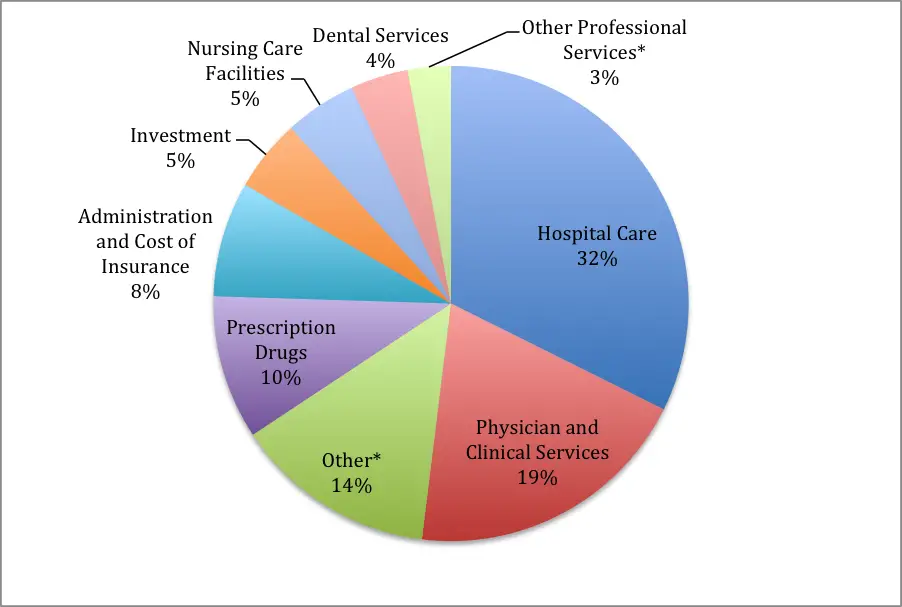

Where does that money go? According to the U.S. Centers for Medicare and Medicaid Services , 2019 healthcare spending can be broken down into 10 categories:

- Hospital care

- Disease prevalence or incidence

- Medical service utilization

The authors found that service price and intensity, including the rising cost of pharmaceutical drugs, made up more than 50% of the increase. Other factors, which comprised the rest of the cost increase, varied by type of care and health condition.

A more recent study by the Peter G. Peterson Foundation pinned the blame for rising prices on the same top three drivers identified by the American Medical Association : population growth, population aging, and rising prices.

Also Check: How To Get Marketplace Health Insurance

Is Dental Insurance Included

For many insurers, dental issues are typically excluded from UK health insurance policies. Bupa, for example, doesnt include dental cover in its private health insurance instead, it has a separate dental product that can be bought independently from its health cover.

If dental insurance is important to you, its worth comparing policies from dental insurance providers to make sure you can find the right cover for you.

Read our guide to the best dental insurance policies to make sure you get the right level of cover.

Irina Wells

Irina is a former content marketing executive for ManyPets. She has contributed to a number of personal finance sites, including Loot Financial Services and Claro Money.

This article was written by ManyPets. We were not paid to write it but we will receive commission if clicking on a link to one of the named insurers results in a reader taking out a policy with that insurer. We also charge for advertising space so a particular insurer may be highlighted in the article and, where insurers are listed, it can dictate where they appear in the list.

How Much Do Healthcare Costs Rise Each Year

According to the American Medical Association , healthcare costs are rising by about 4.5% a year. Spending on healthcare in the United States increased by 4.6% in 2019to $3.8 trillion across the country, or $11,582 per person. This growth rate is in line with 2018 and slightly faster than what was observed in 2017 .

Read Also: When Are Employers Required To Offer Health Insurance

The Newer The Tech The More Expensive

Medical advances can improve our health and extend our life, but they can also lead to an increase in spending and the overutilization of expensive technology.

According to a study by the Journal of the American Medical Association8 , Americans tend to associate more advanced technology and newer procedures with better care, even if theres little to no evidence to prove that theyre more effective.

This assumption leads both patients and doctors to demand the newest, and often most expensive, treatments and technology available.

Heres How The New Program Could Affect Different People

If you already bought health insurance on Healthcare.gov for all or part of 2021:

You can choose to stick with the plan you have, or switch to a new one. Your plan might renew automatically, but its important to go back to Healthcare.gov and explore your options.

That includes people who have had the same plan since the start of the year, and people who bought insurance under the special enrollment period that began in February.

If you didnt go back in spring or summer to see if you could get a mid-year cost reduction, you may be especially surprised when you look at options for 2022.

Make sure you look at all the options available in your area, and that you consider whether plans have high deductibles, which is the amount youll have to pay for care before your insurance kicks in, except for preventive services that are covered at no cost to you.

From the front page of Healthcare.gov, click Log in to renew/change plans

Then, go into the Plan Compare section of the site and check to see if any doctors, hospitals and health systems that you prefer to go to actually participate in the new plan, before you finalize your choice. Look at whether the plan covers any medications you take.

Once youve looked at all your options, you can either confirm that you want the same plan youre already in, or choose a new one.

Don’t Miss: Do Real Estate Brokers Offer Health Insurance

The Affordable Care Act Of 2010

In 2010, President Barack Obama signed into law a little something known as the Patient Protection and Affordable Care Act .1 It took a few years to phase everything in, but by 2014 most of the main parts of the law were in force. The purpose of the new law was to help as many Americans as possible to have access to health insurance, many for the first time in their lives.

The results of the law were mixedand are still hotly debated. On the plus side, millions of people were newly covered for health insurance. That much is clear, since the law required every health insurance company in America to accept anyone as a customer, regardless of their preexisting conditions.

But heres the part where the math kicks in and blurs the picture a bit. Traditionally, health insurance premiums were lower for customers who were young and healthy, but higher for those with preexisting conditionswhich makes sense in terms of the higher cost to cover someone who uses a lot of health care. But when the ACA became law, it stopped insurance companies from charging higher premiums to customers with preexisting conditions. Companies were now required to offer the same premiums to a person with a history of cancer or heart attacks as they would to someone in perfect health with no history of illness.

At that point, two big changes hit insurance companies at once:

What Does It Cover

Like all insurance, the cover you get from private medical insurance depends on the policy you buy and who you buy it from.

The more basic policies usually pick up the costs of most in-patient treatments such as tests and surgery and day-care surgery.

Some policies extend to out-patient treatments such as specialists and consultants and might pay you a small fixed amount for each night you spend in an NHS hospital.

You May Like: Do Illegal Aliens Get Health Insurance

Why Is Healthcare So Expensive

A new study by Yale professor Zack Cooper lifts the lid on the Byzantine pricing system in U.S. healthcare by examining how much privately insured patients really pay for procedures. Cooper spoke with Yale Insights about why costs are so high and how he thinks policy responses can fix the broken healthcare market.

- Assistant Professor of Health Policy, Yale School of Public Health

Q: You co-authored a working paper, The Price Aint Right? Hospital Prices and Health Spending on the Privately Insured, that analyzed an enormous set of data that had never been publically available. What was the data and how did you get it?

The negotiated transaction prices paid by private insurance companies to healthcare providers have been treated as commercially sensitive data and therefore have been largely unavailable to researchers. But three of the five largest insurers in the nation, Aetna, United, and Humana, made a database of health insurance claims data available for research through a nonprofit called the Healthcare Cost Institute.

The data covers 2007 to 2011 and more than 88 million unique individuals, or nearly one in three individuals in the U.S. with private health insurance. While it is anonymized, the data are incredibly granular. Basically, we have claims-level data for 1% of GDP each year.

Q: What do we know about why healthcare in the U.S. is so expensive? Where has the data for that come from in the past?

Q: Where does the additional money paid to providers go?

What Is The Minimum Health Insurance Premium

The minimum health insurance premium you will have to pay depends on which plan you go for, but if youre a non-smoker and are in good health, you can expect it to be around £30.

This means that as soon as you turn 16, youll be able to receive any treatment needed privately without having to worry about paying an enormous bill at a later date. Before this age, your parents may opt to include you in their policy.

Health insurance premiums range from low to high depending on how comprehensive a plan you want. If youre just looking for major medical coverage for yourself, then a cheap option is available these plans typically only cover situations like accidents or hospitalization, making them ideal if youre young and healthy.

However, if youre older or suffer from a pre-existing condition, then inpatient cover alone not be enough and so more expensive health insurance policies might be required. One thing worth mentioning is dental care.

As stated above, one of the main benefits of getting private healthcare coverage when turning 16 is avoiding large bills down the line however, unfortunately, teeth are generally excluded from general cover, so many people end up missing out on regular checkups, etc.

Also Check: How To Get Low Health Insurance

Does The Cost Of Private Medical Insurance Go Up

Generally the cost of your healthcare premiums will go up as you age, and will also increase with inflation. They may also rise if youve had to claim recently. But if youve made lifestyle changes, such as youre now in a healthy weight and stopped smoking, you may be able to get a cheaper quote. Some people find simply switching provider brings down their premium.