How Much Is Family Health Insurance Per Month

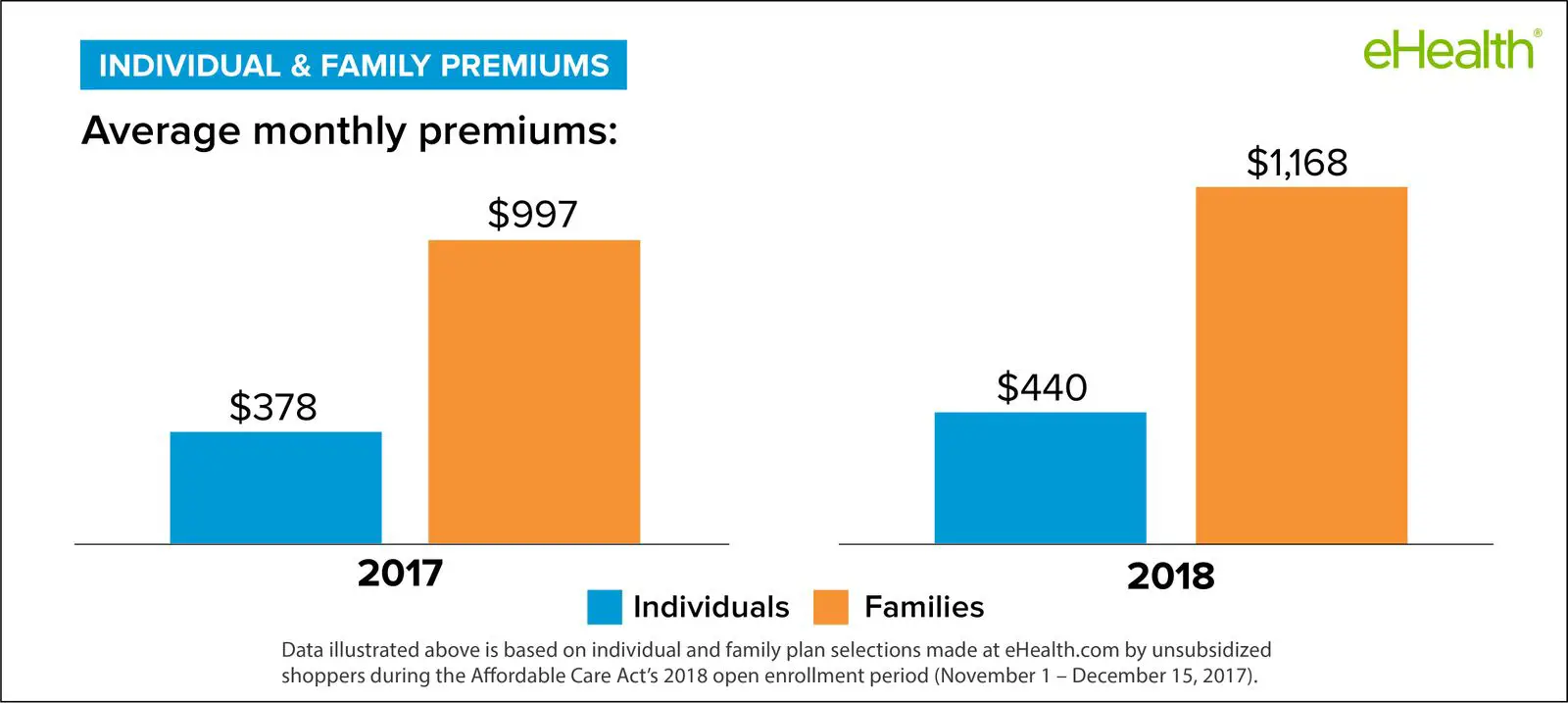

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

Average Cost Of Health Insurance For A Single Male

The average cost of health insurance for men in 2020 was $438 per month without a subsidy, per eHealth data. Note that this research focuses on those who buy insurance through the marketplace.

The premium you pay for health insurance will also depend on the type of plan you select. Consider options like HMO vs. PPO when you make your choice.

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

You May Like: Starbucks Health Insurance

How To Keep Healthcare Costs Low

Premiums arent the only kind of healthcare expense that has become more expensive. Prescription drug prices have gone up as well. So what can Americans do to avoid spending so much money on medical costs?

If youre not getting insurance through your job or a program like Medicare, comparing insurance plans within your states healthcare exchange is one of the best ways to find coverage thats more affordable. Finding out whether you qualify for the premium tax credit is also a good idea since itll lower your monthly health insurance payment if you claim it throughout the year. If you claim the credit when you file your taxes, you can reduce the size of your income tax bill.

If you need prescription drugs, you can save money by buying generic brands instead of brand name products. If you can buy medications in bulk and have them mailed to you, that might reduce your healthcare costs as well. You could also try putting money in an account with tax benefits that you can tap into when you need money to pay medical bills.

Another option is to consider enrolling in a high-deductible insurance plan. Your premiums will be lower. But if you get sick or youre seriously injured, you might have to cough up a lot of cash before your insurer pays for anything.

Related Article: How Much Should You Pay for an Insurance Deductible?

Different Levels Of Coverage

Okay, stay with me here. I’m almost done with this marathon investigation into all things health insurance. I looked at the different types of plans, but theres a little more to it before we put a bow on all this.

When it comes to marketplace health care plans, there are four different levelsbronze, silver, gold and platinum. Think of them like medals at the Olympics. These tiers give you different options on how much your plan will actually pay out versus how much youll pay. Also keep in mind they dont reflect quality of care.14

Generally speaking, plans with a lower monthly premium will mean a higher deductible, and vice versa.

Bronze is one step up from a catastrophic plan. They give you lower monthly costs, but more out-of-pocket expenses.

Silver offers lower deductibles and out-of-pocket costs than Bronze, but youll pay more in monthly premiums. And depending on your income, silver plans also come with discounts called cost-sharing reductions where the provider could cover costs up to the 90% mark.

Gold plans have high monthly premiums but low deductibles, coinsurance and out-of-pocket costs.

Platinum is the highest monthly premium out there, with the lowest out-of-pocket costs. This type of coverage means youre really putting all your eggs in that big monthly premium basket! But having a lower deductible means your insurance company will start covering those crazy health care expenses a lot sooner.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

How Can You Save Money On Health Insurance Costs

If the cost of health insurance seems too steep for you, there are ways you can minimize the costs.

Under Obamacare, you may qualify for a subsidy, or premium tax credit that lowers the amount of money you must pay each month if your income falls below a certain level.22 If you are eligible for a subsidy, the amount you qualify for is based on how your income compares to the federal poverty level.

You can also purchase supplemental health insurance, which can cover some of your out-of-pocket costs such as deductibles and coinsurance.23

If you are self-employed and have a high deductible health plan , you can open a health savings account or a medical savings account 24 that lets you save pre-tax dollars to pay for qualified medical expenses.25

Factor in ALL Costs Before Deciding

When choosing a plan, factor in ALL costsnot just your monthly premiums, but also your out-of-pocket costs both before and after you meet your deductible.

Factors Affecting The Cost Of Your Health Insurance

As you can see, health insurance is expensive. However, depending on your situation, what you actually pay for health insurance could be significantly less than what it actually costs.

But on the other hand, you could be paying more than the national average. To help you make sense of your health insurance premiums, here is a breakdown of all the different factors that affect how much you pay.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Why Is Life Expectancy In The Us Lower Than In Other Rich Countries

The graph below shows the relationship between what USA as a country spends on health per person and life expectancy in that country between 1970 and 2015 for a number of rich countries.

The US clearly stands out as the chart shows: Americans spend far more on health than any other country in the world, yet the life expectancy of the American population is shorter than in other rich countries that spend far less.

What are the best places for healthcare globally?

Individual Health Insurance And Health Reimbursement Arrangements

Group and individual health insurance plans are popular choices but theres another option that can benefit employees and employers called a health reimbursement arrangement that is growing in popularity and works in conjunction with individual health insurance.

HRAs allow employers to reimburse employees, tax-free, for healthcare, including individual health insurance premiums and qualifying out-of-pocket medical expenses.

With an HRA, employers set their own budgets by offering an allowance amount for each employee. Employees win big on flexibility by being able to choose their own individual health insurance plan thats tailored to their specific needs.

Lets take a look at two of the most popular HRAs which are the qualified small employer HRA and the individual coverage HRA .

You May Like: Starbucks Healthcare Benefits

Five Factors That Shape Health Insurance Premiums For Americans

Some Americans may pay significantly more or less for health cover due to factors such as:

- State laws these can dictate what health insurance must cover and affect competition. For instance, a 2017 Maine law instructs insurers to compensate customers who find a better deal on certain services. On the flipside, some states have certificate-of-need laws that may decrease competition.

- Your employers size larger employers tend to have access to cheaper cover. Those who dont have access through their employer will often pay more.

- Geography health insurance can be cheaper in cities than in remote locations.

- Plan type preferred provider organizations tend to cost the most, while high-deductible health plans cost the least.

- Personal factors such as age.

What are the best places for American expats to live abroad?

Find out more here

How Much Is The Penalty For Not Having Health Insurance

The penalty for not carrying health insurance is the individual shared responsibility payment. You pay the fee for every month you and your dependents don’t have insurance. You pay the fee when you file your taxes. The maximum amount you pay is the higher of either of:

- 2.5% of your total household income but no more than the total premium for a Bronze plan under the Affordable Care Act

- $695 per adult in your home and $347.50 per child with a maximum of $2,085 per household

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

What Are The Average Premiums By Age Group

People aged 55-64 pay the highest premiums by far. Their premiums exceed consumers aged 18-24 by 227%. Luckily, the increase is gradual. Consumers in the 25-34 age range pay only 35% more than those in the 18-24 bracket. When you jump from the 45-54 age bracket to the 55-64 bracket, you see the largest increase of 45%.

Average Health Insurance Cost By Age

Age plays a big role in the cost of a premium for health insurance generally, younger people have lower premiums, as they are seen as less risky and less likely to require more medical care.

Often, the starting point for an insurance rate is based on that of an individual who is 21 years old. According to ValuePenguin, the average health insurance premium for a 21-year-old was $200 per month. This is also an average for a Silver insurance plan — below Gold and Platinum plans, but above Bronze plans.

How does the breakdown of premiums by age look? Slowly in small increments, the average premium will increase. Ages 21-24 were all consistent at $200, but at 25 the premium goes up to $201 — about 1.004 x $200.

Slowly the amount it goes up increases. At 26 the average premium is 1.024 times the base premium, up to $205. By the age of 30, though, it has gone up for an average premium to $227, or 1.135 x $200.

Going through the list of ages, this pattern is pretty consistent. The average premium for a policyholder at 35 years is $244, 1.222 times the base rate at 40, it’s 1.278 times that rate to bring the average premium up to $256.

From here, though, the premiums start going up at higher rates. The average health insurance premium for a policyholder at 45 is $289, up to 1.444 times the base rate, and by 50, it’s up to $357, which comes out to 1.786 x $200.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Keep Costs Down Stay In Network With Provider Finder

One way to help keep your health insurance costs down is to use only doctors, hospitals and other health care professionals in your plan’s network. If you go out of network, you might have to pay the entire bill. Not all plans have the same network. The best way to find in-network providers is byregistering or logging into Blue Access for MembersSM, our secure member website, for a personalized search based on your health plan and network using our Provider Finder®tool.

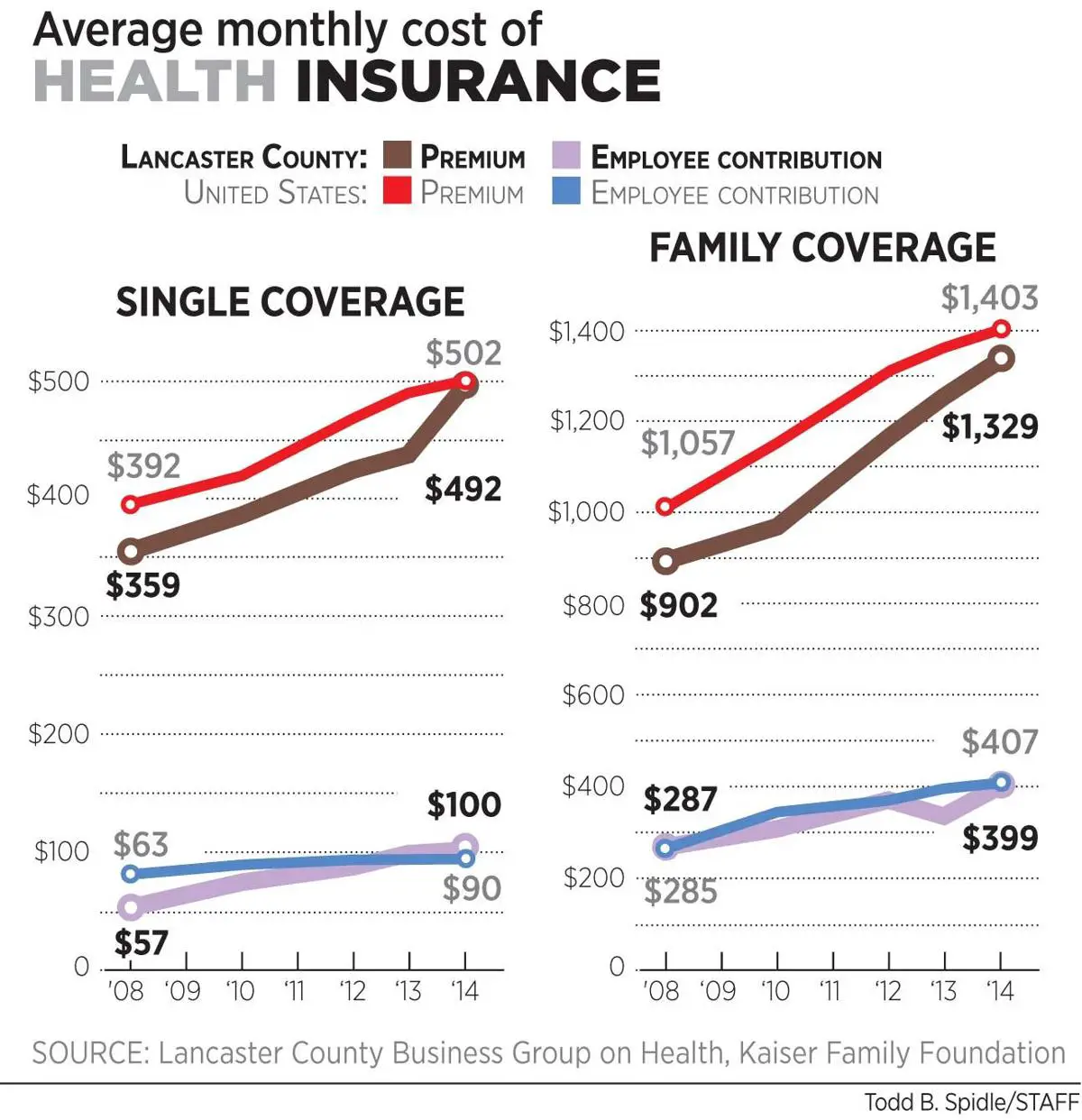

Here’s How That Breaks Down

According to eHealthInsurance, for unsubsidized customers in 2016, “premiums for individual coverage averaged $321 per month while premiums for family plans averaged $833 per month. The average annual deductible for individual plans was $4,358 and the average deductible for family plans was $7,983.”

That means that, last year, the average family paid $9,996 for coverage alone, and, if they met their deductible, a total of just under $18,000.Meanwhile, an average individual spent $3,852 on coverage and, if she spent another $4,358 to meet her deductible, a total of $8,210.

These figures do not take into account any additional co-insurance responsibility she might have. In addition to co-pays and deductibles, an increasing number of plans now require co-insurance payments, which require that, even once you meet your deductible, you continue paying some percentage of all costs until you hit your out-of-pocket maximum.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

How To Find An Affordable Plan That Meets Your Needs

Among eHealth customers who bought ACA individual health insurance, more than 75% chose Bronze or Silver plans. Your state may host an exchange for comparing and purchasing ACA plans or it may use the federal exchange at Healthcare.gov. Keep in mind, you arent limited to the exchange.

The licensed insurance brokers at eHealth can help you find the best health plan to meet your health coverage needs and your budget. They will listen to your priorities in health coverage and use their expertise to match your needs with health insurance options both on and off the exchange.

The Cost Of Employee Provided Health Care Plans

Due to many Canadians needing supplemental insurance, many buy into the plans provided by their employers. However, it’s not only clear how much is being paid into these plans.

Due to factors such as automated payroll processing, many workers don’t even bother to look at this. The truth is though, the costs add up. And, with up to 65 percent of Canadians having some type of private insurance, it’s important to know what this is costing.

The insurance plans offered by employers vary in price and quality. This is true for any product in the free market. The health plan provided by an employer is chosen at their discretion, with the employee having no choice in the matter.

It’s important to note, workers may be able to save hundreds of dollars per month just by going out and comparing costs.

Read Also: Starbucks Part Time Insurance

How Do Health Insurance Subsidies Work In The Usa

A health insurance subsidy provides government assistance to contribute to the cost of cover in the USA, the Affordable Care Act provides a sliding scale of support to US citizens and legal residents earning four times the federal poverty level or less.

In 2021, the federal poverty level is $12,880 for an individual, so individuals earning less than $51,520 may be entitled to subsidised health insurance.

Applications are made through the government-run health insurance marketplaces in each state. Changes to incomes may affect eligibility, so applicants sometimes need to pay subsidies back if circumstances change.

Health Insurance In Alberta Cost: Explained

Canada spent 11.4 percent of the total Gross Domestic Production health care in 2009. This put it on the higher end of the OECD countries. This likely has to do with the lower unit cost of health care in this country.

On average, $1,200 is paid for an MRI in the US, while in Canada it costs $824. It also has to do with the lower administrative costs. For example, Alberta doctors spent approximately $22,205 annually dealing with single payer agencies, compared to $82,975 spent by American doctors dealing with the private insurance companies, Medicaid and Medicare.

Also Check: Starbucks Health Care Benefits

How Much Does Health Insurance Cost

10 Minute Read | October 14, 2021

The average individual in America pays $452 per month for marketplace health insurance.1 But costs for health insurance coverage vary widely based on many factors.

Maybe you just turned 26 and are off your parents plan . Or maybe youre facing a job loss and need to replace your former employers coverage. Or youre just looking for other options besides your employers plan. No matter your situation, youre wondering: How much does health insurance cost?

Everyone knows health insurance is expensive. It can pretty quickly suck the life out of your monthly budget. But just how expensive is it? And why is it so costly? Are there ways you can pay less?

Well, youre in the right place! Ill walk you through everything you need to know about health insurance costs, what all those terms mean and what factors make up that hefty price tag.

What Is The Cheapest Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats the most affordable for everyone. But finding the right plan for your needs is easy with HealthMarkets. Our free FitScore® technology helps you shop, compare and apply for a healthcare plan in minutes. We can even check to see if you may qualify for a tax credit. To get a better look at what plans could cost you and your family, get started now.

46698-HM-1120* Subsidy amounts are based on a 40-year-old nonsmoker making $30,000 per year.

References:

You May Like: Does Starbucks Provide Health Insurance

Average Premium Tax Credits For Marketplace Insurance

The average premium tax credit for the United States is $371 per month. Alaska had the highest premium tax credit at $976. New York had the lowest average tax credit at $230. The government makes these payments on your behalf. It’s to help make your insurance premiums more affordable. The credits are based on your total household income. The credits operate on a sliding scale.

The Private Health Insurance Rebate

Get up to 33.413% back on premiums when you qualify for a private health insurance tax return. This rebate can generally be claimed as an upfront reduction on your premiums or as a refund through your annual tax return. The deduction percentage youre entitled is calculated on your age and expected taxable income for the financial year.

Take note: Rebate percentages are adjusted yearly on the 1st of April.

Read Also: Part Time Starbucks Benefits