Adding An Internationally Adopted Child

If you are covered under a self-administered account, you need to complete an MSP Account Change Request .

If you are enrolled under a group plan administered by an employer, union or pension office, you need to complete a Group Change Request .

Your form must be submitted with photocopies of documents that support the childs name and immigration status in Canada. If the child has been granted Canadian citizenship, provide a copy of his/her Canadian citizenship card or Canadian passport. Otherwise, if Citizenship and Immigration Canada has issued the child a Confirmation of Permanent Residence document that indicates the adoptive parents names, a copy of this document is usually sufficient. If the child either holds a Confirmation of Permanent Residence document that does not include this information, or holds a different immigration document, two items are required:

- A copy of the childs current immigration document, for example his/her Confirmation of Permanent Residence, Permanent Resident Card , or Temporary Resident Permit, and

- A letter from the Director, Adoption Branch, Ministry of Children and Family Development, to Immigration, Refugees and Citizenship Canada, stating that the Ministry has no objection to the adoption .

If the child is being adopted from the United States and arrives in B.C. before an immigration document has been issued, include a note to this effect and a copy of the letter described previously, with your completed form.

Other Eligible Adult Individuals

NEREs and employees currently represented by AFSCME, MCO, MSEA, UAW Local 6000, and SEIU Local 517 M may enroll one OEAI and their dependent into a State of Michigan health plan only. Coverage does not extend to dental or vision plans for OEAIs or their dependents. To be considered eligible, the following criteria must be met:

OEAI and dependent enrollment is only available upon initial hire or during the annual Insurance Open Enrollment period. If the criteria for enrollment of an OEAI or the OEAI’s dependent child are no longer met, the employee must notify the MI HR Service Center within 14 calendar days. The employee will be responsible for paying taxes associated with enrolling an OEAI and the OEAIs dependents. Review the OEAI tax implications document for additional tax information.

Ad& D: Accidental Death And Dismemberment

This accidental death and dismemberment policy covers you if you lose a limb or die accidentally

If you already have a life insurance policy that covers accidental death, death by disease, death by chocolate, whatever kind of death you can come up with, why would you need additional coverage for an accidental death?

Hint: You dont. Not only are these policies cheap, theyre also worthless because of the long list of conditions the insurance company says it wont payout for. Buyer beware: The devil is in the details, and AD& D policies are chock-full of those details!

And dont be fooled into AD& D even if the insurance rep says youre covered if you dont die but just lose a limb or something. If you have long-term disability insurance in placeand we hope you do because its just as important as getting term life insuranceyoud be covered for income lost because of an injury or disability anyway.

How much long-term disability insurance do you need? We say get as much coverage as you canaround 6070% of your income. Because this is the amount of your salary you bring home on a normal day

Read Also: What Jobs Give You Health Insurance

Some Health Benefits May Remain After A Divorce

You and your children may still have access to some of your ex-spouses health benefits after a divorce.

Tassey says if you and your ex had been contributing to a health savings account, you still may be able to use your share of the money in that account to pay health care premiums or for qualified health care expenses.

Also, even though your ex-spouse is no longer eligible for your health plan, your children are still eligible.

More Resources:

Get Started With The Help Of Mywellmark

When deciding if having two health insurance plans is right for you, its helpful to consider health care costs for the future. You can also look back to see what youve spent on health care in the past. For Wellmark Blue Cross and Blue Shield members, its easy with the help of myWellmark. myWellmark puts your personal health care information at your fingertips, giving you a clear look into your health care usage and benefits. Log in or register for myWellmark Opens New Window today!

Dont Miss: Does Health Insurance Cover Birth Control Pills

Also Check: How To Get Life And Health Insurance License In Texas

Tricare Coverage For Military Families And Parents

TRICARE is a healthcare program for U.S. service members and their family members. With TRICARE, if you have a dependent parent or parent-in-law and are on active duty for more than 30 days, your dependent parents or parents-in-law can get care in military hospitals and clinics. They also can enroll in TRICARE Plus, which is a primary care program offered at some military hospitals and clinics.

What Are The Coordination Of Benefits Rules For Your Plan

Typically, if you have a plan through your employer, that will be the primary payer for you. But, how the plans coordinate may differ once a plan determines they will pay second. The method a secondary health insurance plan uses to coordinate payment may not result in the payment of leftover out-of-pocket costs after the primary plan has already paid. Thats why its important to know both plans specific rules before choosing to enroll.

You May Like: Where Can You Get Affordable Health Insurance

Also Check: What Is The Best Travel Health Insurance

Which Dependents You Can Add To Your Group Health Insurance Policy

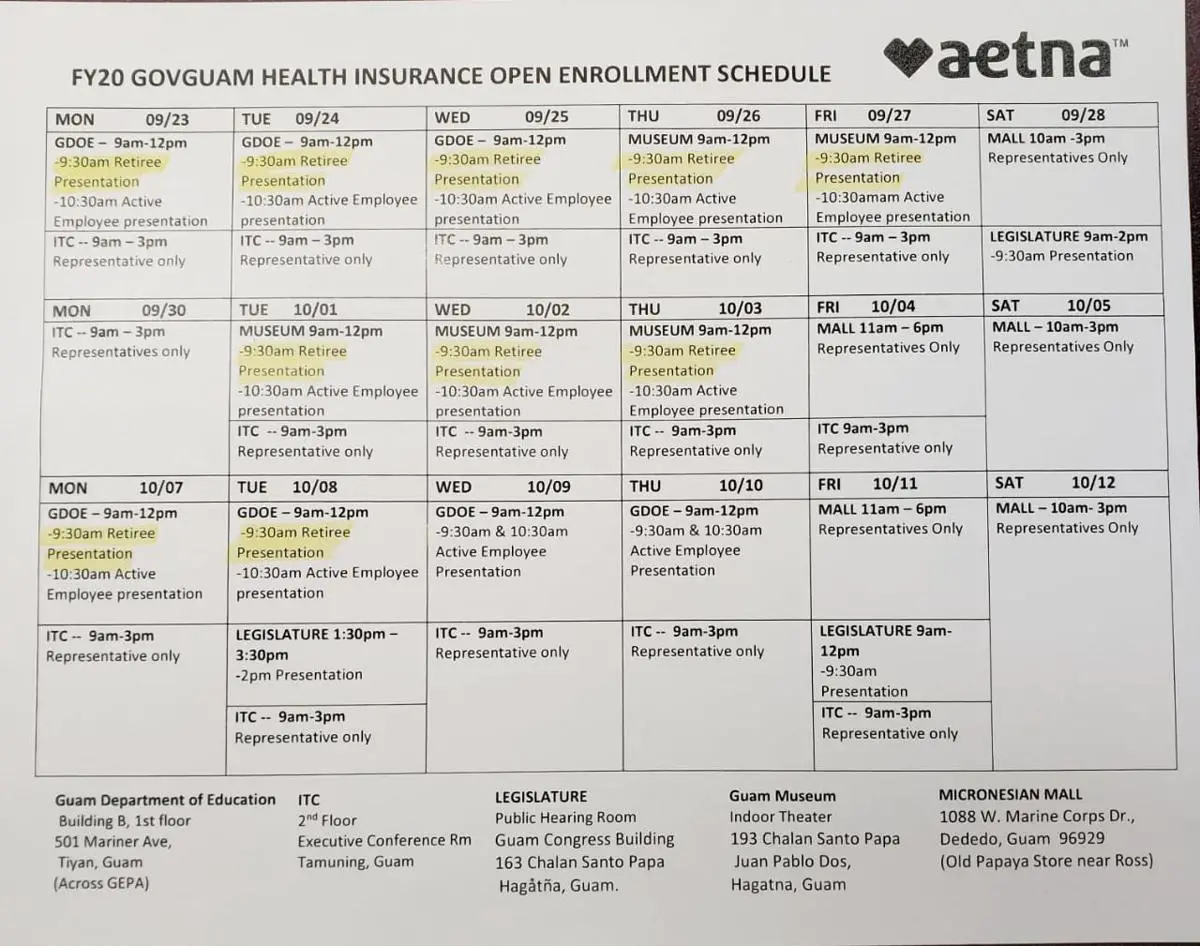

Open enrollment for employee health insurance plans begins in November. You may wish to add dependents to your current policy as you care for your loved ones. Here are the details about who you can add to your group health insurance policy.

- Spouse

Many group health insurance plans allow you to add your spouse to your plan during open enrollment or within 30 days after your marriage. You may also add a same-sex spouse if your state legalizes same-sex marriages and your plan allows this provision.

- Dependent Children

You may add biological children to your health insurance policy even if they dont live with you. If you give birth to or adopt a child or if your child loses insurance coverage through Medicaid or CHIP, you have a 30-day window to add that dependent to your group health insurance plan.

- Spouses Children

You may add stepchildren to you health insurance plan if theyre under the age of 26. You may add them during open enrollment seasons or within 30 days of your marriage.

- Grandchildren

You may add a grandchild to your coverage if you have legal guardianship of that child and they reside with you. If a dependent child or dependent adult child on your current health insurance plan has a baby, you may also be able to add your grandchild to your policy. However, most states do not have this provision, so be sure to read your policy for details.

Paperwork Required to Add Dependents

Next Post

What Is The Parent Healthcare Act

The Parent Healthcare Act, Assembly Bill 570, is a new law in California that allows some adult children to add their parents and stepparents as dependents on their own insurance plan. This is applicable to people who dont qualify for other assistance programs and/or subsidized health insurance because of their illegal immigration status.

Starting in year 2023, this new law will now allow for more than 3 million Californians to get affordable health insurance who otherwise would have been paying out of pocket for their medical expenses. Just as federal regulations allow for parents to claim their children as dependents on their insurance coverage, the Parent Healthcare Act will allow the same in reverse.

The California Department of Insurance estimates approximately 15,000 adults will use this law once it goes into effect.

Recommended Reading: How To Put Someone On Your Health Insurance

Give Notice Of Divorce Within 30 Days

If you change your marital status, youre required to give your health plan notice in a timely manner, Matthew Tassey, past chairman of the Life and Health Insurance Foundation for Education , says. Timely is usually within 30 days.

Once your divorce is final, the ex-spouses coverage is likely terminated immediately.

However, some plans will let you stay on until the end of the month following the date of the divorce, Tassey notes.

How Do You Determine Which Health Insurance Is Primary

Determining which health plan is primary is straightforward: If you are covered under an employer-based plan, that is primary, Mordo says.

If you also were covered under a spouses plan, that would be secondary, he adds.

In certain situations, seniors who are 65 and still working may be covered under their employers plan and eligible for Medicare.

Depending on the size of the employer, Medicare can be primary or Medicare can be secondary, Mordo says.

If the employer has 20 or more employees, the employers health plan will be primary, and Medicare will be secondary.

Don’t Miss: Can Aflac Replace Health Insurance

If An Adult Child Is On A Parents Health Plan And Has A Baby Can The Baby Be Added To A Health Plan

A handful of states mandate that grandchildren must be eligible dependents, according to the Council for Affordable Health Insurance.

But youre more likely to find that the coverage isnt extended to the baby. Instead, the childs parent will have to get a plan for the child. Some options include a health insurance marketplace plan, Medicaid or Childrens Health Insurance Program plan.

Medicaid and CHIP are federal/state programs that cover low-income people, including children. Check with your state about eligibility.

Who Can You Add To Your Health Plan

Why you can trust Insure.com

Quality Verified

At Insure.com, we are committed to providing honest and reliable information so that you can make the best financial decisions for you and your family. All of our content is written and reviewed by industry professionals and insurance experts. We maintain strict editorial independence from insurance companies to maintain our editorial integrity, so our recommendations are unbiased and are based on a comprehensive list of criteria.

Insights:

You can typically add your spouse and children to a health insurance plan, but its ultimately up to your employer or health plan.

Health insurance is a valuable commodity and getting added to a family members health plan can be vital to both your health and wallet.

However, who you can add to your health insurance is limited. Common questions people have are:

- Can I add my parents to my health insurance?

- How long can you stay on your parents health insurance?

Lets look at those questions and other common questions about who you can add to your health plan.

Key Takeaways

Recommended Reading: How Much Is Short Term Health Insurance

Requirements For Adding Your Children As Dependents

If you have children, theyre probably the first people that come to mind when talking about dependents. Generally speaking, you can include any child who fits the following criteria:

- Age: Your child has to be under the age of 26.

- Relationship to You: For a child to qualify as your dependent, he or she needs to be your biological child, your stepchild, your adopted child, or a foster child you are taking care of. If your child has other sisters, brothers, half sisters, half brothers, or children of their own, you can also include them on your health insurance plan.

- Length of Residency: A child only qualifies as your dependent if they have lived with you for at least six months.

- Income Contribution: Although your child can be your tax dependent while working and contributing to their own expenses, they cannot be their own primary source of support. This means a childs income must be less than half of the cost of their support expenses to qualify as your dependent.

- Tax Filing: A child cannot be your dependent if they file a joint tax return that year.

- Other Claims: A child cannot be claimed as a dependent by more than one household. So, regardless of your relationship, if someone else claims your child as a dependent, you cannot.

If I Get Married Can I Add My Spouses Child To My Health Plan Is There A Timeframe In Which Enrollment Must Take Place

A stepchild is an eligible health plan dependent up to the age of 26. If your coverage is through an employer group plan that provides benefits to children, you will be given at least 30 days to enroll the new dependent. An eligible child can be a biological child, adopted child, stepchild or foster child.

The federal rule states you have âat least 30 daysâ but an employer could give you a longer period of time, says Rich Gisonny, senior consultant at Towers Watson in White Plains, NY.

This gives employees a reasonable period of time to make a decision and complete the enrollment.

However, an employerâs plan doesnât have to cover children. Gisonny says thereâs no mandate that an employer must cover an employeeâs family.

Key Takeaways

- You can add your stepchild to your employer-based health insurance plan. For this, you will get 30 days to enroll the new dependent.

- Some individual health insurance plans let unmarried couples and any legal dependents be on the same health plan as long as they are living together.

- When a divorce takes place, one of the spouses is usually removed from the health plan by the other who carries the plan through work.

Read Also: When Did Health Insurance Start In The Us

How To Add A Parent To Your Health Plan

Health plans that allow parents to be added to a plan likely require that you meet certain conditions, like claiming them as dependents on your federal income tax return. In order to declare one or both parents as dependents, you must meet the following requirements:

-

Your parents must be a citizen or residents of the United States

-

Your parents must have a taxable income of $3,700 or less annually

-

Your parents cannot be someone else’s legal dependent

-

Your parents cannot file a joint tax return

-

You must have paid for half of their financial needs, such as food, housing and more

Most insurance providers allow you to add dependents to your plan during the open enrollment period, which typically runs from November until the end of the year. The marketplace’s special open enrollment period runs through August 15th as a response to the COVID-19 pandemic. You may also make changes to your plan outside the open enrollment period if you have a qualifying event.

Affordable Care Act Changed Pregnancy Coverage Rules

Most people who have maternity coverage get it through an employer-sponsored plan.

Under the Affordable Care Act, new health plans must cover a wide range of preventive-care services without charging a deductible, copayment or co-insurance.

All individual and small group health plans are required to cover pregnancy and maternity care services, which are part of the so-called 10 âessential benefits.â Among those services are a variety of pregnancy-related screenings, such as testing for gestational diabetes, as well as breastfeeding supplies and support.

Federal law prohibits those plans from denying coverage or charging higher premiums for people with preexisting conditions, including pregnancy.

Key Takeaways

- Affordable care act ensures that all individual and small group health plans offer coverage for pregnancy, as well as maternity care services.

- According to federal law, there is not the requirement for health plans to offer maternity coverage to dependent children.

- If you are pregnant and do not have coverage for maternity services or childbirth, you can buy a Medicaid or childrenâs health insurance plan.

- Most people get maternity coverage through an employer-sponsored plan.

You May Like: How Much Does Health And Dental Insurance Cost Per Month

What Do Health Care Reforms Mean For Young Adults

For young adults, health insurance plans or health care reforms are usually focused on providing protection for young adults against the continuous rising costs of health care. While there are many proposed reforms to try to provide this, not much is being done to help parents with insurance coverage for their children.

Many young people aged 19-26 have lost their jobs during this economic crisis and have no insurance or very expensive plans. Because of this, many young people are turning to their parents for help in getting affordable health insurance. While children are allowed to stay with their parents under the age of 26, many are finding that they are not able to stay on their parents health care plans once they turn 19 or 20. This is causing some problems because these ages cannot be covered under most health care reform plans.

According to new health insurance plan reforms, children will be covered up to the age of 19. However, this is not always the case with parents plans. The only way for young adult children to remain on a parents health care insurance is if they are full-time college students or are disabled. This leaves many young adults without health care coverage when they hit these ages and are no longer eligible to stay on their parents plans.