Look At The Type Of Provider Network

Do your current pharmacies, hospitals, and providers fall within your plans network? An insurance plan will specify if they offer in-network coverage. Going to an out-of-network provider may mean youll pay out of pocket for services.

Read through your plan documents or give your provider a call to determine if your specialist provider or pharmacy is included in your plans network. If you have providers you prefer and want to be sure you get to see them, choose a program that offers out-of-network coverage.

How Do I Choose A Good Health Insurance Plan

There is no such thing as a perfect health insurance plan.

Everybody has different individualized needs and the best plan for you will depend on what your individual circumstances are.

And just as those circumstances may change over time, so will the plan that is best for you.

You should always compare different plans to figure out which one will be right for you.

Here are a few things that will help to know when comparing different plans.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Health Insurance Portability And Accountability Act

HIPAA addresses the concern that:

- People can face lapses in coverage when they change or lose their jobs

- Health coverage providers often exclude benefits for preexisting health conditions for new enrollees

HIPAA requires state-licensed private insurers to accept certain people leaving group health coverage into the individual market regardless of their health status and without any exclusion period for pre-existing medical conditions. However, in most states, if eligible people are guaranteed access to coverage in the state’s high-risk pool, private insurers are not required to sell coverage to them.

HIPAA also prohibits state-licensed private insurers from considering the health status of a member when determining the members eligibility for group coverage.

Don’t Miss: Burger King Health Insurance

When Should You Get Health Insurance

Health insurance only works when you have it. Consider your lifestyle. Do you live risk-free or do you like to live life on the edge? Adventurous? Or a home body? Do you have a chronic health condition that requires treatment? Do you have a family to care for? These are things to keep in mind when considering whether you should get health insurance:

In general, how health insurance works is similar across plans, but depending on your needs, the details of your medical coverage can vary. Make sure to learn about your particular health plan or any plan youre considering enrolling in.

What Doesn’t Health Insurance Cover

Health insurance plans typically won’t cover procedures or treatments deemed medically unnecessary, including:

- Cosmetic procedures

- Off-label prescriptions

- New medical technologies

If you’re denied coverage for a procedure or treatment your doctor says is necessary, you can appeal your insurer’s decision. Sometimes, insurers may approve coverage upon further review of your case, including any supporting documentation your doctor can provide.

Pro tip:

Some health care services require preapproval or prior authorization from your insurance provider before care is given . Typically, your doctor will start the approval process and provide any additional information your insurer needs to review. Preapproval can be required for hospital stays, specialty drugs, and other complex treatments.

Also Check: How Long After Quitting Job Health Insurance

Ahps Expand Your Range Of Healthcare Options

AHPs must have meaningful and substantive member representation. Employer members must actively exercise control over the plans benefits and governance, even if they dont run the day-to-day workings of the plan.

Its important to have more choices in the unfriendly health insurance market. In theory, making AHPs larger can efficiently distribute risk and bring down costs for everyone. Granted, thats something weve heard in each round of American health reform, with little success.

Where Can I Get Health Coaching And Other Special Support

Does your health insurance provider support you outside the doctors office? When youre selecting a plan, ask about programs that help you achieve your health goals. For example, some plans will connect you to one-on-one coaches with expertise in smoking cessation, weight loss, infertility, sleep problems, stress reduction or condition management.

Recommended Reading: How Much Does Starbucks Health Insurance Cost

Are Employers Required To Offer Healthcare Coverage

The Affordable Care Act made it mandatory for businesses with more than 50 full-time employees to offer health insurance plans to their workforce. Since 99% of all businesses in the U.S. are small businesses, the act essentially targeted those corporations that could afford this perk. These corporations are known as Applicable Large Employers .

Small businesses with fewer than 50 full-time employees are not required to provide a healthcare plan. As a result, personal Health Savings Accounts have become popular. Contributed funds are not subject to federal taxes.

Because every U.S. adult was required to hold a basic level of healthcare insurance under the shared responsibility provision of the ACA, many small businesses elected to sponsor healthcare coverage anyway.

Those employers were incentivized through the tax credit for small employer health insurance premiums. However, when the penalty for not possessing basic coverage was removed in 2019, many employees were left without employer-sponsored health insurance.

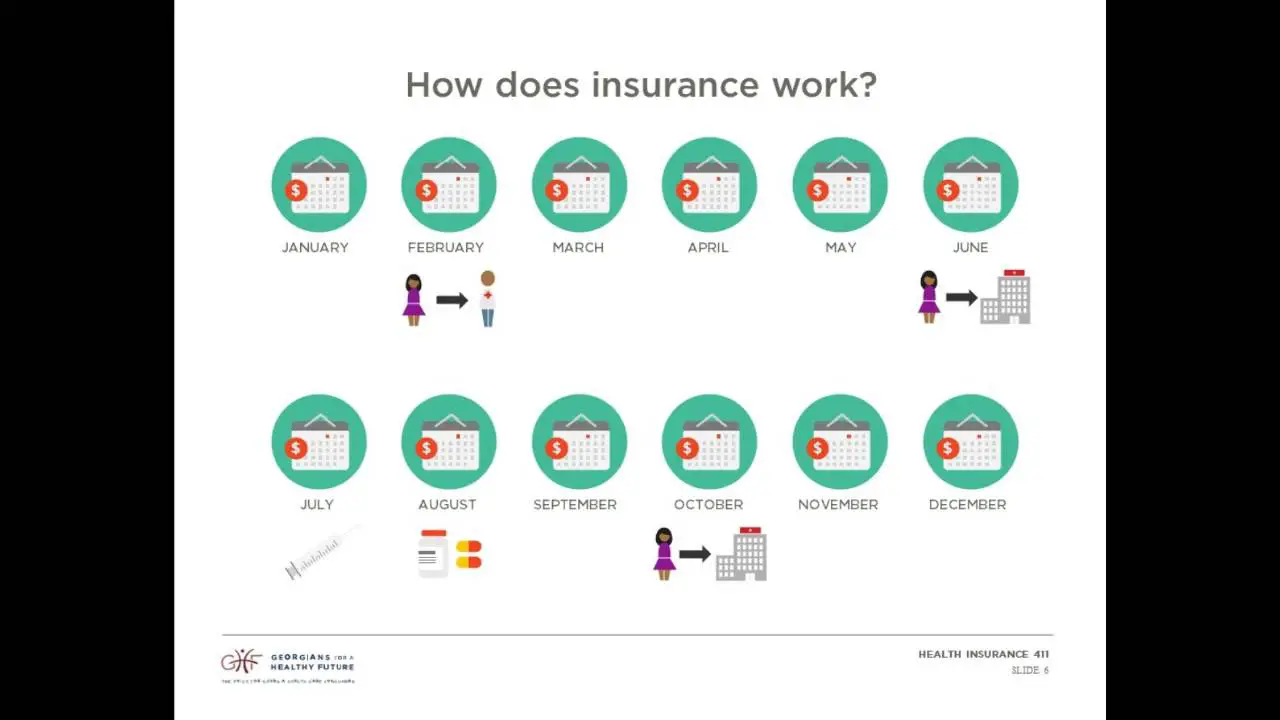

Do You Get A Refund If You Dont Make A Claim

When you pay for insurance for many years, you may start to wonder why youve been paying so much when you have never had a claim. Some people may even feel like they should get their money back when they havent had a claim. Thats not how it works. Insurance companies collect your money and put it aside for payouts when there are claims.

This is the concept of “shared risk”. The thought is that the money paid out in claims over time will be less than the total premiums collected. You may feel like you’re throwing money out the window if you never file a claim, but having piece of mind that you’re covered in the event that you do suffer a significant loss, can be worth its weight in gold.

Don’t Miss: When Does Health Insurance Stop After Quitting Job

Premium Vs Claims Payments

Consider this example to help you see how premium and claims payments differ.

Imagine you pay $500 a year to insure your $200,000 home. You have 10 years of making payments, and youve made no claims. That comes out to $500 times 10 years. This means you’ve paid $5,000 for home insurance. You start to wonder why you are paying so much for nothing. In the 11th year, you have a fire in your kitchen, which must be replaced. The company pays you $50,000 to get your kitchen fixed.

If the insurance company gave everyone back their money when there was no claim, they would never build up enough assets to pay out on claims. Even the $5,000 you paid them over 10 years doesnt cover your $50,000 loss. If you have even one loss, you become unprofitable to the company. Because insurance is based on spreading the risk among many people, it is the pooled money of all people paying for it that allows the company to build assets and cover claims when they happen.

Where Can You Buy Health Coverage

In the United States, you can get health insurance through:

- A plan offered by your job or your spouses job

- Your parents plan, if youre under 26 years old

- A health insurance companys website

- Your state health insurance marketplaces

- The federal Health Insurance Marketplace

- Online insurance brokers

- The Veterans Administration or TRICARE

Recommended Reading: Starbucks Benefits Package

Association Health Plans Faqs

Q-1. Does the recent U.S. Department of Labor Association Health Plan Rule, 83 FR 28912, preempt New Yorks regulation of associations or multiple employer welfare arrangements ?

A. No. The AHP Rule has no impact on, and does not preempt in any way, state regulation of insurance coverage issued to or by associations or MEWAs, or to individuals therein. For more information on the regulation of AHPs in New York, see Insurance Circular Letter No. 10 , available at https://www.dfs.ny.gov/insurance/circltr/2018/cl2018_10.htm.

Q-2. Does the Department of Financial Services regulate insurance coverage sold to MEWAs?

A. Yes. DFS regulates the insurance coverage sold to MEWAs.

Q-3. Is an AHP considered a MEWA under the Employee Retirement Income Security Act ?

A. Yes. The AHP Rule expressly states that an AHP is a type of MEWA.

Q-4. May an AHP sponsor fully-insured coverage to its members in New York?

A. Only under certain specified circumstances. For a group or association of employers to sponsor a group health plan in New York, the group or association must meet specific requirements to be a recognized group under the Insurance Law. For example, Insurance Law § 4235 and require that an association be in active existence for at least two years and be formed principally for purposes other than obtaining insurance coverage for its members. In addition, the insurance coverage issued to the association is subject to DFS approval and oversight.

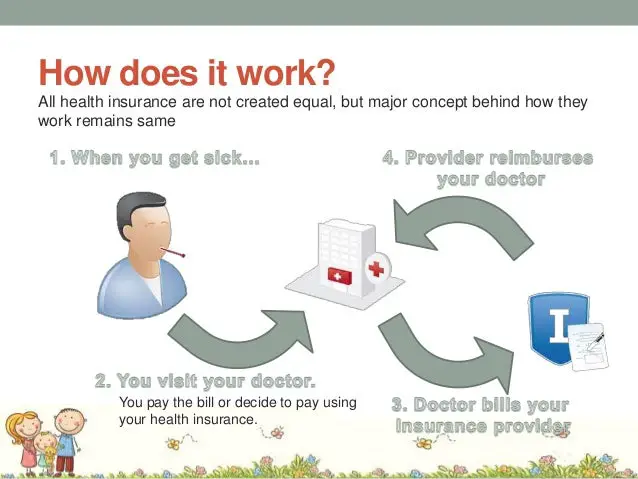

How Health Insurance Payments Work

Your premium, or how much you pay for your health insurance each month, covers some or all of the medical care you receive everything from prescription drugs and doctors visits to health improvement programs and customer service.

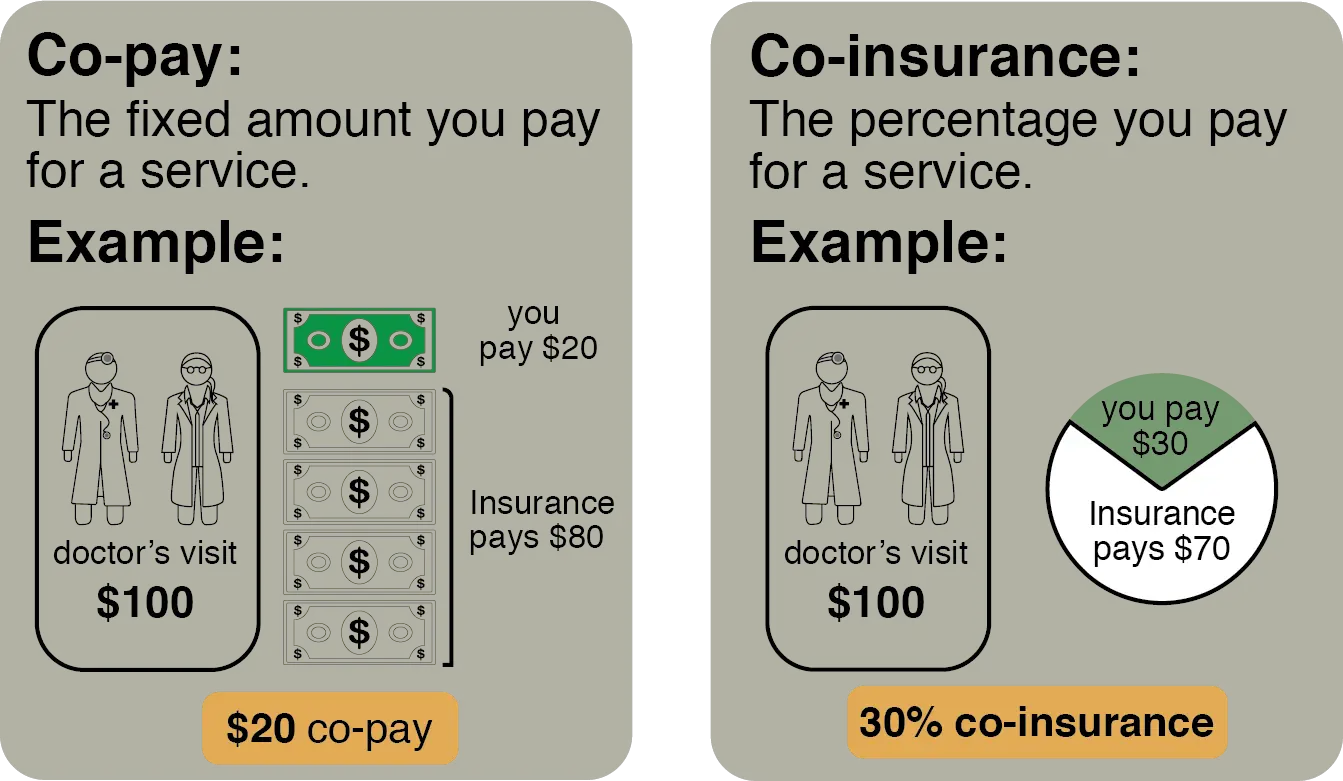

Most people choose a health insurance plan based on monthly cost, as well as the benefits and medical services the plan covers. But there are other factors to consider as well, like what you will be required to pay when you see a doctor or visit a health care facility.

These out-of-pocket payments fall into various categories and its important to know the differences between them:

You May Like: Does Insurance Cover Chiropractic

What Is Health Insurance And How Does It Work

Finding the right health insurance plan is hard work. There are so many options to choose from and factors to compare premiums, copays, deductibles, doctor networks. How are you supposed to make sense of it all?

It helps to start with a basic understanding of what health insurance is. Knowing how health insurance works, the various costs of an insurance policy, and the different types of health insurance can help you determine which plan is right for you.

How Do I Buy Health Insurance

For most people, the easiest way to buy insurance is through the workplace. Under the ACA, any company with at least 50 full-time employees must provide a health plan or pay a penalty to the IRS.

If you work for a company this size or larger, visit the human resources department to ask about your insurance options. You can enroll when you first join the company or during its annual open enrollment period.

If you work for a smaller company or are self-employed or unemployed, the easiest way to get health insurance is to buy a plan on the health insurance marketplace. Go to HealthCare.gov to find out when and how to sign up. The site can also tell you whether you qualify for subsidies or Medicaid.

Don’t Miss: Umr Insurance Arizona

Half Of Americans Get Health Insurance Through Their Employer

Over 50% of Americans get health insurance through their employers, according to the U.S. Census Bureau. When you can get insurance through your work, its usually cheaper than buying from somewhere else because your employer pays part of your monthly premium. If youre one of the almost ten million self-employed Americansor you dont have access to job-based insurance because youre a part-time employee or unemployedyoure stuck finding your own coverage .

You can buy health insurance online from state and federal marketplaces, like HealthCare.gov. Youll even potentially have lower monthly paymentsthanks to federal tax creditsif you meet certain income requirements. If you make too much to qualify for lower monthly premiums, you can also get coverage directly from health insurance companies, private enrollment websites, and in-person agents and brokers. For a breakdown of how to choose who to buy your insurance from, check our post on getting health insurance after open enrollment.

Name Brand Vs Generic

When a drug is first invented, it is usually released by a manufacturer as a brand name product. After the patent expires, other manufacturers are able to release their own copies using the same active ingredient. This is known as a generic drug, which are usually lower cost than the brand name version.

Don’t Miss: How To Get Insurance Between Jobs

Private Health Insurance Plans

According to U.S. Census data, more than half of Americans get their health insurance through their employers. Another 12% have private insurance they bought on their own. Types of private health care plans include:

- Fee-for-Service. Fee-for-service is the simplest form of health insurance. Your insurer pays your health care provider a fee for each service you receive with no restrictions. Its the easiest type of plan to use, but it also has the highest monthly premiums.

- Health Maintenance Organizations . An HMO is the lowest-cost and most restrictive type of plan. It only covers care from in-network providers. It also requires you to have a primary care physician who approves any care you receive.

- Preferred Provider Organizations . A PPO also has a care network, but it lets you see providers outside the network for a higher fee. You can also see doctors other than your PCP without a referral. PPOs have higher premiums than HMOs.

- Point-of-Service Plans. A POS plan is like a PPO but with more of a focus on primary care. It doesnt allow you to see any other doctor without approval from your PCP.

- High-Deductible Health Plans . An HDHP can be any type of plan with a high deductible. HDHPs have much lower premiums than other plans but much higher out-of-pocket costs. To help offset these costs, you can often pair them with a health savings account that lets you pay for health care with pretax dollars.

The 10 Essential Benefits Every Health Insurance Plan Must Provide

The Affordable Care Act, also known as Obamacare, made covering certain health care services a requirement for all health insurance plans available to consumers. These required services are known as the 10 health essential benefits. These 10 categories of services are:

-

Ambulatory patient services

-

Hospitalization for surgery, overnight stays, and other conditions

-

Pregnancy, maternity, and newborn care

-

Mental health and substance use disorder services

-

Rehabilitative and habilitative services and devices

-

Laboratory services

-

Preventive and wellness services, as well as chronic disease management

-

Pediatric services, including dental and vision coverage for children

Note that these are categories of services, and that the specific services offered within these categories may differ from state to state. Typically states require that plans offer more services to their customers, rather than restricting services you would expect to find under these categories. State, federal, and private exchanges will show you exactly which services each plan covers before you apply.

One thing private health insurance is not required to cover is durable medical equipment , such as wheelchairs and ventilators. Because many people rely on this life-saving devices, be sure to get a health insurance plan that offers coverage for DME.

Recommended Reading: Asares Advanced Fingerprint Solutions

Expand Your Range Of Healthcare Options

AHPs should have significant and considerable member representation. Employers should effectively practice control over the planâs advantages and administration, regardless of whether they run the everyday workings of the plan.

Its critical to have more options in the unfriendly medical coverage market. In principle, making AHPs bigger can effectively distribute risk and cut down costs for everybody. Truly, that is something weve heard in each round of American health reform, with little achievement.

Read Also: 8448679890

Alternatives To Health Insurance

Many countries have adopted universal healthcare. That’s where the government pays for healthcare, just like it pays for education and defense. It’s like expanding Medicare or Medicaid to everyone. When Canadians go to the doctor or the hospital, the government picks up most or all of the bill. The downside is that it may take a long time to see a specialist or receive a non-emergency operation. On the other hand, no one has to worry about dying from a disease because they can’t afford treatment.

When Hillarycare tried to implement universal healthcare in America, the medical profession and health insurance companies defeated it. Obamacare was initially presented as universal healthcare, but different interest groups and politicians led to that goal being changed.

Access to healthcare has become part of today’s American Dream. Research has found that the higher your income, the better your health, on average. As a result, income inequality has led to healthcare inequality.

Don’t Miss: Does Kroger Offer Health Insurance To Part Time Employees

What Exactly Is Health Insurance And Why Do I Need It

Health insurance is your first line of defense against any impending medical bills should anything ever happen to you or your loved ones. Even before COVID-19 struck, over 30 percent of American households were burdened with medical debt, Stanford University reports. The average total among these households was $2400 in debt. This financial burden can cause extreme strain on a familys ability to make ends meet.

Its also worth mentioning that having a secure health insurance plan can provide peace of mind and a sense of stability for those insured. By opting to go without a health insurance plan, you risk the possibility of suffering an accident or falling gravely ill without a strong support system to expedite your recovery.

Additionally, medical providers can also outright refuse to care for uninsured guests. It is essential for many of these clinics that they can guarantee their patients will actually be able to pay for any costs incurred during their stay. Only emergency services are bound by law to accept patients regardless of insurance status. Although health insurance is no longer legally required by federal law, these are the reasons why having a health insurance plan is strongly recommended by practically every medical professional in the US.