Average Cobra Insurance Rate

As a covered employee, the company covers the 90% of the insurance plan and the remaining 10% is deducted in the monthly salary. Under COBRA, the covered employee must pay the 100% COBRA health insurance premium plus the 2% administrative charges. Therefore, the COBRA insurance can be expensive to continue but there are a lot of available options in the insurance market to choose from.

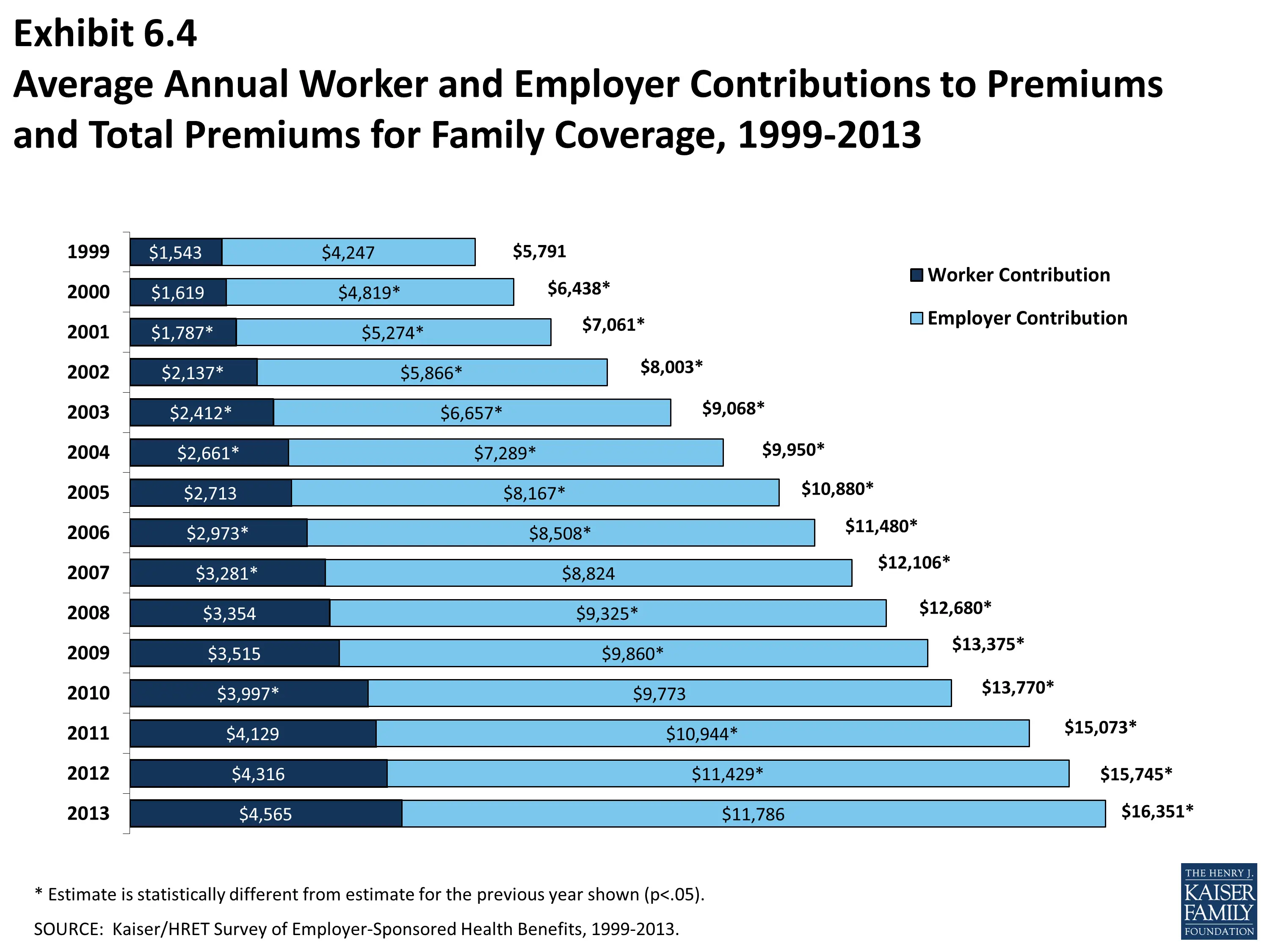

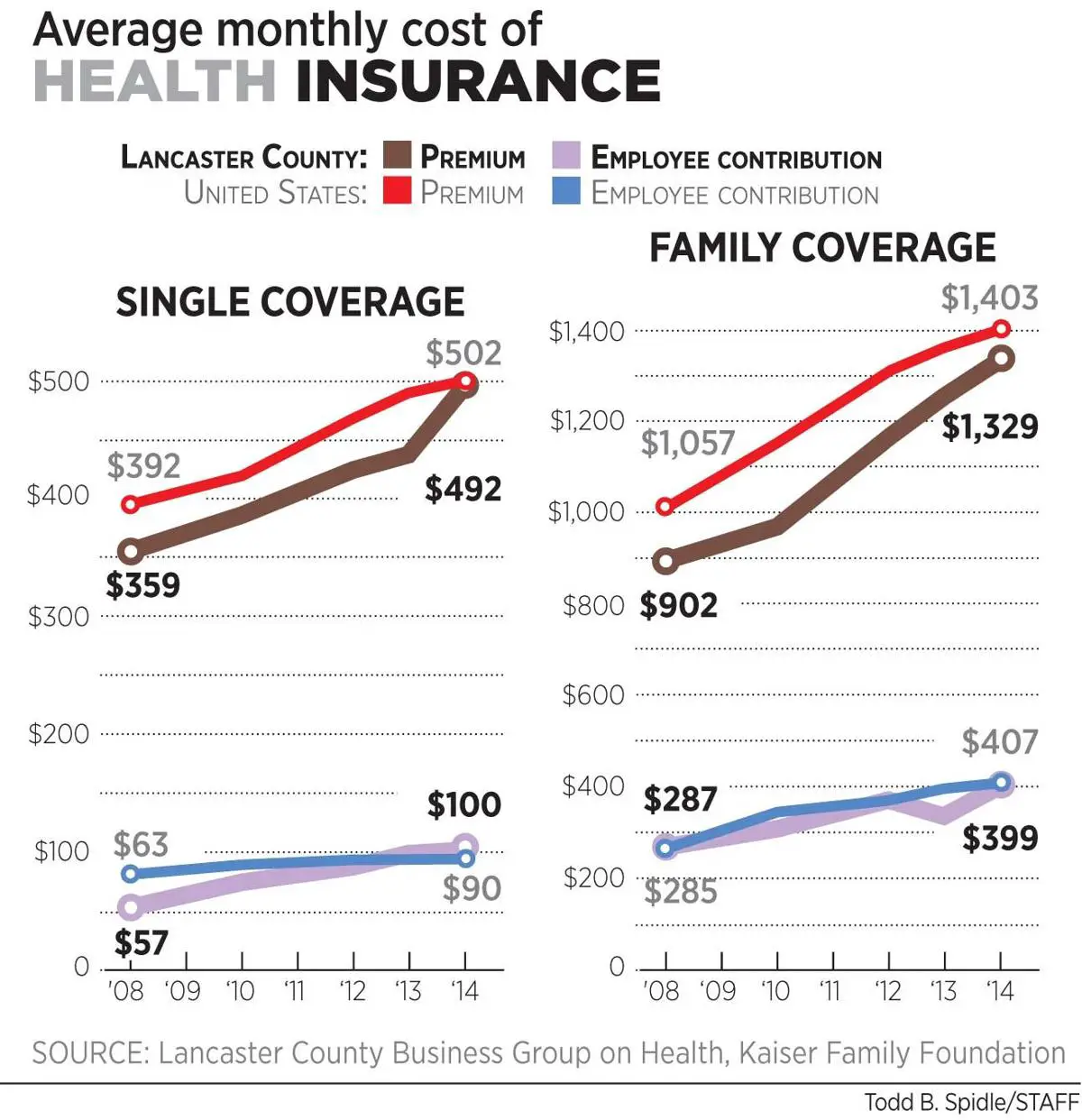

Under a private insurance company, the average employer-sponsored coverage is around $1,137 per month for family coverage and $410 per month for an individual coverage which is according to the report provided by the Kaiser Family Foundation . Meanwhile, if the employee is subsidized, the average COBRA insurance rate is at $398 per month for a family plan and $144 for an individual plan.

But on their 2017 employer health benefits survey, the average annual premiums for employer-sponsored health insurance is about $6,690 for single coverage and $18,764 for family coverage . For the overall average for all plan types, the average annual premium is around $6,024 for single coverage and $17,581 for family coverage.

Meanwhile, for employers with low-income workers, the average annual premium is around $1,213 for single coverage and $5,714 for family coverage. Also for the deductibles, according to the survey, covered employees pay an out of the pocket during claim with an average of $1,505.

How Much Does Health Insurance Cost In The Usa

Date Published:

How much does health insurance cost? The cost of health insurance in the USA is a major talking point for Americans and visitors alike here, we explore the averages of health insurance costs and factors impacting policy fees. The USAs healthcare system is unlike many others, so we look at why the cost of average American healthcare insurance seems to be rising and how other nations compare.

Key takeaways:

- Age, geography, employer size and plan type all influence the cost

- Healthcare costs in the USA are partly due to administrative factors

- Fees are going up, with plan trends contributing

- Almost half of American adults were underinsured in 2020

- Voluntary health payments are higher in Switzerland than the USA, though Americas costs are among the worlds highest

- On the flipside, American expats abroad often find they pay less for insurance overseas

Change In Average Health Insurance Cost For 2022

From 2021 to 2022, health insurance rates across the nation increased by less than 1%. South Dakota saw the largest year-over-year jump in health insurance costs for a 40-year old on a silver plan increasing just over 23%. Including South Dakota, 27 states had their rates increase on average from 2021 to 2022.

Year-over-year rates decreased the most in Georgia, South Carolina and Nebraska, which all fell by more than 10% . Overall, 21 states experienced a decrease in health insurance premiums. Two states Idaho and Virginia saw no year-over-year change.

| State |

|---|

Don’t Miss: What Does Health Insurance Cost An Employer

What Are The Types Of Health Insurance Costs

Within the health insurance arena, there are a number of costs not paid by insurance, also known as out-of-pocket costs. Those costs include premiums, deductibles, coinsurance and copayments.

But what exactly is a premium? How about a deductible? And whats the difference between a high deductible plan and a low deductible plan? Its important to understand the ins and outs of how these costs work before you choose a plan.

Get Help Paying For Your Health Insurance Costs

Did you know that under the Affordable Care Act, you might be able to get assistance paying for your health insurance costs? You may qualify for one or both of these options:

- Cost-sharing assistance. This is a discount that reduces the amount you have to pay toward your deductible, copays and coinsurance. To use this discount, you must buy a Silver plan.

- Premium tax credit.This credit goes toward your premium and reduces the amount you pay every month.

To get help paying for your health insurance costs, you must:

- Not qualify for a government-sponsored program or an employer-sponsored health insurance plan.

- Not be claimed as a dependent on someone else’s tax return.

- Purchase a plan on the Health Insurance Marketplace.

- Have an income within a certain range for your household size.

See if you qualify for thepremium tax credit. You can alsoapply online to get your official results.

Don’t Miss: Do I Need A Health Insurance Broker

Total Out Of Pocket Costs

What people do see is their out-of-pocket expenses. Changes to supplemental insurance programs over the past years have impacted deductible rates as well as items covered.

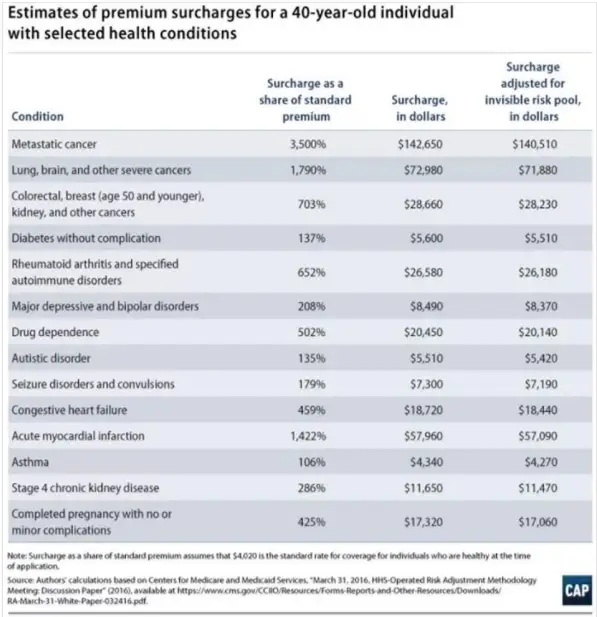

Pre-existing conditions can also play a big part in how much you pay for health care. Your condition may prevent you from being able to get supplemental coverage. Most often, however, it means there are exclusions in your health plan or higher deductibles. Both of these mean higher costs to you.

Average Costs For Health Insurance In Canada

When you add it all up, health care costs quite a bit. The Fraser Institute’s 2016 report broke down the cost of public health insurance for a family of two adults and two children on an income scale.

The 10% of Canadian families with the lowest incomes, earning an average of $14,028, paid an average of $443 in premiums. The 10% of families at the top end of the scale earned $281,359 and paid an average of $37,361.

It’s the middle ground that has created a bit of controversy over the Fraser Institute’s numbers. In 2016, they pegged that average on that scale as being a family earning $60,850 who paid $5,516 in premiums. An individual earning $42,914 paid $4,257 in premiums.

A year later they said the average family of four earning the average 2017 salary of $127,000 would pay nearly $12,000 in premiums. The actual math on the two figures was not that far off, but there was a lot of political posturing and controversy over whether a median income or average income was a more meaningful measure and more representative of the country and actual spending.

Also Check: What Happens If My Health Insurance Lapses

Average Health Insurance Cost By Age And State

Healthcare has been one of the biggest talking points in politics over the past several decades. Health costs and the ability of the average person to afford them have been at the forefront of many presidential and Congressional debates — from arguments for and against the Affordable Care Act to the rise in insurance premiums to growing support for Medicare for All plan.

Many factors determine health insurance rates and premiums and what’s offered. Individuals seeking healthcare may have options provided by an employer or may get health insurance through the ACA. Depending on a person’s income and health, he may have several options to choose from or may only be able to qualify for certain plans.

With this in mind, what does the average health insurance cost?

What Determines The Price Of Your Health Insurance

Now that you understand the average costs of health insurance and how to qualify for a subsidy, the question you may have is: What is going to make the price of my health insurance go up or down?

Factors that will impact your cost of health insurance may include:

- Whether you qualify for a subsidy or not

- Your age

- What out-of-pocket costs your health insurance plan will require, and whether there is a maximum

- Whether you have coverage available from your domestic partner’s or spouses employer

- The type of plan you have

You May Like: Can You Change Your Health Insurance Plan After Open Enrollment

How A Health Reimbursement Arrangement Can Save You Money On Your Premiums

Group and individual health insurance plans are popular choices. But to save even more money on your group or individual health insurance premiums, you can implement a health reimbursement arrangement . HRAs are growing in popularity, and can coordinate with both individual and group health insurance policies.

HRAs allow employers to reimburse employees, tax-free, for qualifying out-of-pocket costs and, sometimes, individual health insurance monthly premiums.

With an HRA, employers set their own budgets by offering an allowance amount for each employee. After submitting, reviewing, and verifying their expense, employers reimburse them up to their allowance amount.

Employers can control the rising cost of health insurance, and employees can choose the medical care and provider network tailored to their specific needs.

The Difference Between Hospital Policy Tiers

- Gold: Most comprehensive policy, covering 38 clinical categories. Generally, the most expensive hospital plan that includes pregnancy and birth-related services. Monthly, you can expect for monthly premiums to start at $195.

- Silver: A mid-level hospital policy covering 29 clinical categories, including dental surgery and heart-related services. Premiums for a Silver Hospital policy usually begin at $139 monthly.

- Bronze: An affordable policy covering 21 clinical categories. Generally, excludes joint replacements, as well as services for the back, neck and spine. Policies in this tier usually start at $112 per month.

- Basic: The cheapest hospital plan that covers you for accidents and helps you avoid paying the Medicare Levy Surcharge and LHC loading. Typically you can expect to pay around $101 per month for a Basic policy.

Read Also: What To Do If You Lost Your Health Insurance

Section : Cost Of Health Insurance

The average annual premiums in 2021, are $7,739 for single coverage and $22,221 for family coverage. Over the last year, the average premium for single coverage increased by 4% and the average premium for family coverage increased by 4%. The average family premium has increased 47% since 2011 and 22% since 2016.

This graphing tool allows users to look at changes in premiums and worker contributions for covered workers at different types of firms over time:

PREMIUMS FOR SINGLE AND FAMILY COVERAGE

Figure 1.1: Average Annual Premiums for Covered Workers, Single and Family Coverage, by Plan Type, 2021

Figure 1.2: Average Annual Premiums for Covered Workers, Single and Family Coverage, by Firm Size, 2021

Figure 1.3: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Firm Size, 2021

Figure 1.4: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Region, 2021

Figure 1.5: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Industry, 2021

Figure 1.6: Average Annual Premiums for Covered Workers With Single Coverage, by Firm Characteristics, 2021

Figure 1.7: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Characteristics, 2021

Figure 1.8: Average Annual Premiums for Covered Workers, by Firm Characteristics and Firm Size, 2021

PREMIUM DISTRIBUTION

PREMIUM CHANGES OVER TIME

How To Estimate Your Annual Total Cost

Because theres no way to be sure what medical expenses youll have in a year, its impossible to predict the exact annual cost of care. However, you can get an idea of your estimated total cost of care.

First, youll need to determine the expected care for you and each family member on your plan. For instance, if you expect to have few visits to the doctor with occasional prescription drugs and no expected hospital visits, you might expect a low level of care. But if you think youll have more frequent doctor visits with lots of prescription drugs and at least one expected hospital visit, you might expect a high level of care.

Once you have an idea of the level of care youll need, youll be better suited to find the annual total cost for each of your plan options. If youre searching for plans on the Health Insurance Marketplace, you can enter your level of expected care and the Marketplace will show you estimated total yearly costs for each plan. If youre working with a licensed insurance agent, they can also help you estimate your total cost.

With a better idea of which plan is suited to your expected level of care, you can feel more comfortable in determining which is best for your needs and budget.

Recommended Reading: Does Health Insurance Cover Nicotine Patches

Student Health Plans: Private Insurance Plans That Are Good For Students

Student health plans represent another way for college students to access health insurance. Some insurance companies offer these plans for students between the ages of 17 and 29, allowing students to pay premiums annually, or semiannually in some instances. Unlike a school-based plan, these plans travel with you wherever you study in the United States.

If you start at one university and then transfer to another university, the coverage transfers with you.

You May Like: What Do You Need To Get Health Insurance

Tips For Finding Healthcare Coverage

With the rising costs of healthcare, how can Americans save on healthcare and the cost of insurance? Be diligent, and do your research to compare plans. That way, you can get the most comprehensive health coverage you can afford.

If your employer offers health insurance and pays for a large portion of the premium, it is a great option to think about. If not, shop the health insurance exchange for affordable coverage. Check to see whether you qualify for any subsidies to help offset the cost of health insurance. Health savings accounts can also help you pay for out-of-pocket expenses such as co-pays and deductibles.

Finally, if you have a catastrophic accident or illness, ask the hospital for help with a payment plan. Many hospitals will reduce their charges for those who are unable to obtain insurance.

Don’t Miss: Can I Cancel My Health Insurance

How Much Does Life Insurance Cost

Individual life insurance quotes depend on many factors, which influence your risk. A healthy 35-year-old male getting a term life insurance policy can expect to pay about $30.42 in monthly premiums for a 20-year, $500,000 policy as of April 2022, while a 35-year-old female with the same term length and policy amount may pay $25.60. Generally, term life insurance is more affordable than whole life insurance because whole life lasts longer and has an additional savings feature.

More than 50% of Americans overestimate the cost of insurance and put off buying a life insurance policy as a result. In a study by LIMRA, a research, consulting, and professional development organization for financial services, and Life Happens, a nonprofit focused on providing unbiased education around insurance options, 44% of millennials estimated that a 20-year term policy would cost $1,000 or more per year. By contrast, the actual cost of the policy was approximately $165/year.

The following are sample rates of a 20-year policy for a 35-year-old male non-smoker with a Preferred health rating in other words, somebody with a very good health or minor health conditions.

To see up-to-date life insurance pricing trends month over month, check out our price index.

Are You Exempt From The Lhc Loading With An Extras Policy

If youre looking to avoid paying the Medicare Levy Surcharge or Lifetime Health Care loading , Extras cover by itself wont cut it. Youll need a Hospital policy and your Extras cover to be exempt from paying these extras. Fortunately, many health insurers offer packaged policies that combine extras and Hospital cover, so you can get the coverage you need without having to take out two separate policies.

Also Check: Is Christian Healthcare Ministries Health Insurance

What Is The Cost Of An Emergency Room Visit

If you become ill and in need of emergency care, American healthcare prices will start adding up right away. An ambulance to take you to the hospital will start at $400. If you need tests, typical additional costs are $100 – $500. Should you need to spend the night, an additional charge of $5,000 might be added to your bill. With medications to treat your illness, the total cost of an emergency room or ER visit could be $6,000 or more!

What Are The Costs Of Common Lab Tests Without Insurance

If a doctor is trying to diagnose your medical problem, common lab tests are important. But this is another area where the cost of healthcare in the US is high. An MRI scan will cost from $500 and up to, if not beyond, a costly $7,850+. A blood test, one of the most frequent lab tests, could be a seemingly low $40 but can ramp up to a staggering $3,000+. A cholesterol test at a walk-in clinic can be $50 to $130+ and $40 to $75+ for an at-home kit. An X-ray can cost between $200 but might also creep up to $3,000+ or more, depending on the circumstances.

Don’t Miss: Does My Health Insurance Cover Gym Membership

What To Keep In Mind While Shopping For Family Health Insurance

Family health insurance costs can vary significantly, depending on your circumstances and preferences. While there is no tax penalty for not having health insurance in 2020, it is still important to get your family covered to protect yourself from unexpected healthcare costs that can be substantial in some situations.

To find family coverage thats right for your family and your budget, take a look at eHealths family health insurance options by state. eHealth can help you navigate all of these cost variables and find an affordable plan for you and your family.

How Much Is Health Insurance For A Family Of 3 Or 4 Annually

Deductibles are just another expense associated with family medical insurance that you should be prepared to pay.

This is the sum of money you pay out-of-pocket for medical expenses before your health insurance kicks in and pays the rest.

In most cases, after youve hit this threshold, your insurance will normally cover the remainder of any covered treatment that you obtain for the remainder of the calendar year.

In contrast to individual health insurance policies, family health insurance plans may have an individual deductible and a family deductible.

Remember that it is not true for all policies, so make sure to read the fine print of your plan before purchasing it and educate yourself on how deductibles function under your selected plan.

In order for your health insurance to kick in and begin paying for your medical bills, you must first reach either the individual or family deductibles.

In 2021, the average yearly deductible for family health insurance premiums was around $8,439, according to the Bureau of Labor Statistics.

Additional Premiums For Family Health Insurance

You should expect to spend additional expenses in addition to your premium and deductible when you have family health insurance. There are several other expenditures to consider, including the following:

Options For Lowering The Cost Of Health Insurance For A Family Of Three Or Four

Read Also: How Much Is Aflac Health Insurance