Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.

What Does And Doesn’t It Cover

Health insurance is designed to cover you for non-routine tests and treatment for acute conditions that start after your policy begins. Therefore many chronic and pre-existing conditions are excluded as standard.

The exact range of medical treatments covered will vary based on the policy and the price you pay, though here are some examples:

- Tests or surgery as an inpatient

- Hospital accommodation and nursing care

- Consultations, tests and therapy as an outpatient

- Medicine or drugs not available on the NHS

Basic plans usually cover essential treatments, whereas comprehensive cover can also include specialist therapies or medicines. Typical conditions that are covered include musculoskeletal problems , digestive system conditions , cancer, heart and circulatory diseases and eye and ear conditions .

If your tests lead to a diagnosis of a chronic condition, the initial tests are usually covered, but the long term treatment isnt. For example, if you developed symptoms of diabetes and your GP referred you to a specialist to diagnose the issue, your policy should cover this. However if you are then diagnosed with diabetes, any treatment, mediation or check-ups would no longer be covered, and would instead pass to the NHS.

Different Levels Of Coverage

Okay, stay with me here. I’m almost done with this marathon investigation into all things health insurance. I looked at the different types of plans, but theres a little more to it before we put a bow on all this.

When it comes to marketplace health care plans, there are four different levelsbronze, silver, gold and platinum. Think of them like medals at the Olympics. These tiers give you different options on how much your plan will actually pay out versus how much youll pay. Also keep in mind they dont reflect quality of care.14

Generally speaking, plans with a lower monthly premium will mean a higher deductible, and vice versa.

Bronze is one step up from a catastrophic plan. They give you lower monthly costs, but more out-of-pocket expenses.

Silver offers lower deductibles and out-of-pocket costs than Bronze, but youll pay more in monthly premiums. And depending on your income, silver plans also come with discounts called cost-sharing reductions where the provider could cover costs up to the 90% mark.

Gold plans have high monthly premiums but low deductibles, coinsurance and out-of-pocket costs.

Platinum is the highest monthly premium out there, with the lowest out-of-pocket costs. This type of coverage means youre really putting all your eggs in that big monthly premium basket! But having a lower deductible means your insurance company will start covering those crazy health care expenses a lot sooner.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

How To Find An Affordable Plan That Meets Your Needs

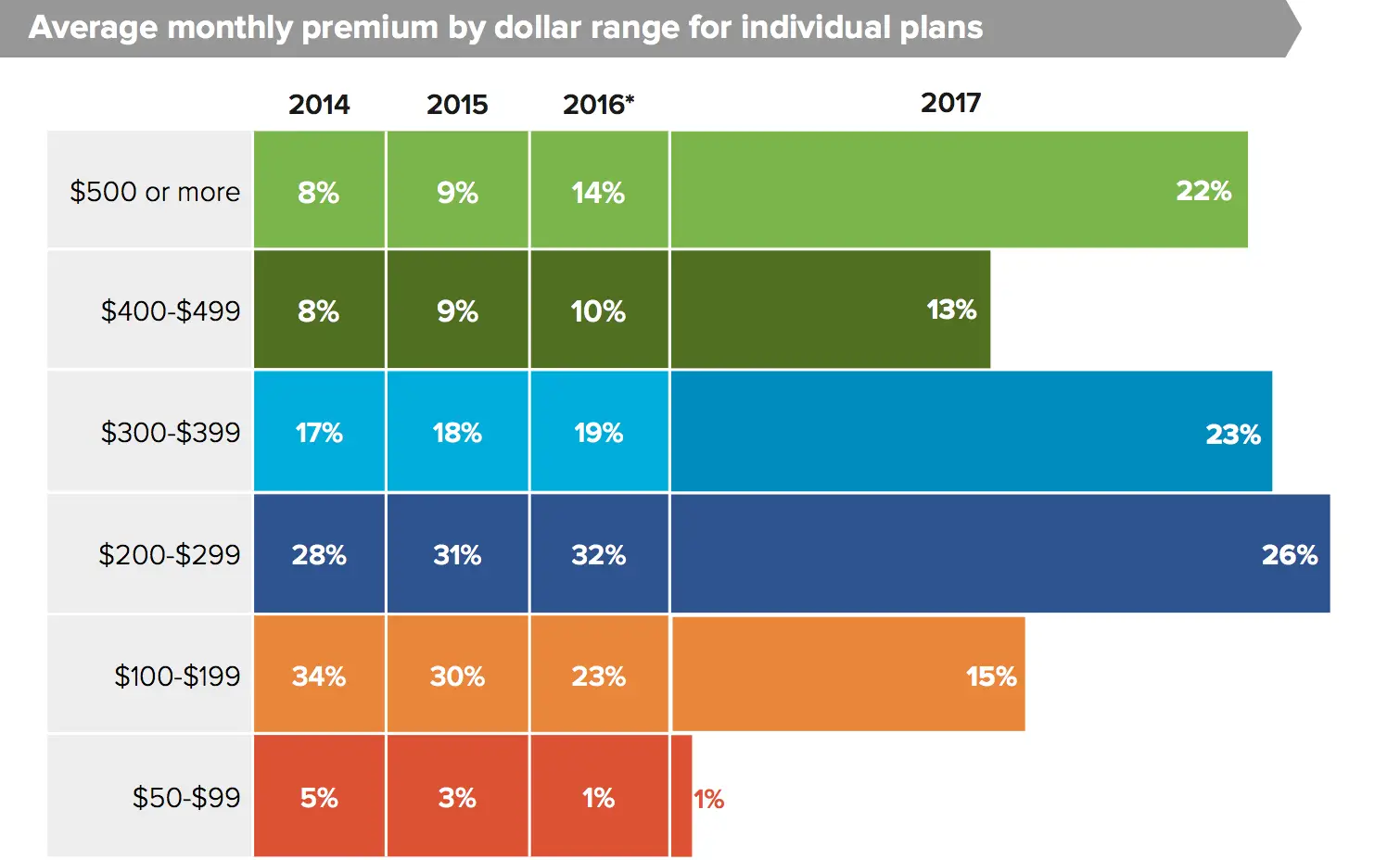

Among eHealth customers who bought ACA individual health insurance, more than 75% chose Bronze or Silver plans. Your state may host an exchange for comparing and purchasing ACA plans or it may use the federal exchange at Healthcare.gov. Keep in mind, you arent limited to the exchange.

The licensed insurance brokers at eHealth can help you find the best health plan to meet your health coverage needs and your budget. They will listen to your priorities in health coverage and use their expertise to match your needs with health insurance options both on and off the exchange.

How Can I Use Hsa Funds

HSA withdrawals to cover qualified medical expenses are tax free. This gives them a major advantage over IRAs or 401s, which require taxes to be paid on withdrawals.

If you are younger than 65 and you withdraw the money for other purposes, you will owe a 20 percent tax penalty. However, if you are older than 65, withdrawals for other purposes are taxed the same as withdrawals from other qualified retirement savings accounts, such as 401s.

Qualified health expenses include things not covered by Original Medicare, such as dental care and hearing aids. Some Medicare Advantage Plans offer extra benefits that Original Medicare doesnt offer, such as vision, hearing, and dental.

HSA funds can also be used to cover specific health insurance premiums:

- Long-term care insurance

- Health care continuation coverage

- Health coverage while receiving unemployment compensation

- Medicare and other health coverage if you are 65 or older

To get the most out of your HSA for retirement savings, you should contribute the maximum possible. If you can avoid it, dont use your HSA funds for medical expenses before retirement. Consider this money earmarked for your retirement health care costs.

Also, shop around for HSA administrators that allow you to invest the money in high-quality, low cost options.

Also Check: Starbucks Health Insurance

What Does Typical Private Health Insurance Cost

As a starting point for this article, we wanted to find out prices for a ‘typical’ buyer – we got quotes for a 33 year old, living near Oxford*, from the four largest UK Health Insurers BUPA, AXA, Aviva and Vitality. This gave us prices between £26 and £48 per month or £312 and £576 per year.

These quotes are much lower than the average above, as we quoted for a younger individual with no family and low cover options.

Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2019:

- $1,655: Average general annual deductible for a single worker, employer plan

- $2,271: Average annual deductible if that single worker was employed by a small firm

- $1,412: Average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from Healthcare.gov., Plan Year 2020 |

|---|

| Bronze |

| $1,430 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Changing From Family Plan To Single Plan

A single plan is simple enough to figure out with COBRA. It gets a bit more complicated if you need to switch from a family plan to a single plan. This can happen if you get divorced or turn 26 and are no longer eligible for coverage on your parents plan.

In instances like these, the HR officer will look up the rate for single coverage on the same health plan you are currently enrolled in. To calculate the COBRA cost, the HR officer will have to determine:

- What you would have been contributing to an individual plan. If you are a family member , your contribution would typically be higher than the employee . In some cases, dependents may be responsible for the entire amount if the employer does not contribute to family coverage.

- What the company would have been contributing toward that premium. If you are the employee , the amount should be clear-cut. If you are the dependent, the contribution can vary depending on the employer.

After adding these two figures together, you would add another 2% to calculate your total COBRA premium costs.

Catastrophic Health Insurance Plans

For qualifying Americans under the age of 30, catastrophic plans are available to provide what can be considered last-resort health insurance. Catastrophic plan premiums are lower than even Bronze tier plans. However, you pay more for visits and prescriptions due to high deductibles, which are $8,550 for the year in 2021.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Medications And Vet Visits

- $35$500 per month

The price of medications changes based on your setters health and whatever types of issues their experiencing. All dogs require a monthly heart wormer and flea and tick medicine that is fairly cheap. Buying from a trusted breeder is also going to help you avoid genetic diseases that might make the medication prices go up.

The Effect Of Different Hospitals On The Cost Of Private Health Care Insurance

The amounts a UK hospital charges to treat you can vary by hospital – use of their equipment, facilities and accommodation can be charged at different rates. As with the price of many services, it is typical for hospitals in larger UK cities to be more expensive than rural hospitals.

Insurers try to keep this situation fair for all concerned.

First, they negotiate with hospitals to ensure that prices do not rise out of control – they may even do deals to get preferential rates that should then result in lower premiums.

Second, they put the hospitals into different groups – each insurer calls their groups different things but they amount roughly to a group of the cheapest hospitals, a middle set and a group of the most expensive hospitals.

You then choose which set you want to be treated at, paying more if you want to be covered at the more expensive hospitals. This ensures that people living near cheaper hospitals are paying less for their health cover.

The flip side to this is that if you live near a large city, you might find your closest hospital is in your insurer’s most expensive category. This can have an effect on the amount you pay.

For example, Vitality’s lowest category includes “all of the hospitals in the UKs largest hospital groups, BMI Healthcare, Nuffield Health, Spire Healthcare, Aspen and Ramsay Health Care”.

Their top level includes all private hospitals in the UK and all NHS private patient units.

You May Like: Can I Go To The Er Without Health Insurance

Deductibles Copays And Coinsurance

Premiums are set fees that must be paid monthly. If your premiums are up to date, you are insured. The fact that you are insured, however, does not necessarily mean that all your healthcare expenses are paid for by your insurance plan.

- Deductibles. Deductibles, according to Healthcare.gov, are “the amount you pay for covered healthcare services before your insurance plan starts to pay.” But it’s important to understand that some services can be fully or partially covered before you meet the deductible, depending on how the plan is designed.ACA-compliant plans, including employer-sponsored plans and individual/family plans, cover certain preventive services at no cost to the enrollee, even if the deductible has not been met. And it’s quite common to see plans that partially cover certain servicesincluding office visits, urgent care visits, and prescriptionsbefore the deductible is met.Instead of having the enrollee pay the full cost of these visits, the insurance plan may require the member to only pay a copay, with the health plan picking up the remainder of the bill. But other health plans are designed so that all servicesother than the mandated preventive care benefitsare applied towards the deductible and the health plan doesn’t start to pay for any of them until after the deductible is met. The cost of premiums is often closely tied to deductibles: you will generally pay more for an insurance policy that has lower deductibles, and vice versa.

What Is The Average Cost Of Non

What do you pay if your income exceeds the 400% FPL ? The average national monthly non-subsidized health insurance premium for one person on a benchmark plan is $462 per month, or $199 with a subsidy. Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. Actual cost varies based on your age, location, and health plan selection,

Take a closer look. In a recent eHealth ACA Index report, we tracked costs and shopping trends among ACA plan enrollees who bought non-subsidized health insurance at ehealth.com during the nationwide open enrollment period for 2020 coverage.

You May Like: What Health Insurance Does Starbucks Offer

Choose A Plan With A High Deductible

A deductible is the amount you pay for health care services before your health insurance begins to pay. A plan with a high deductible, like our bronze plans, will have a lower monthly premium.

If you dont go to the doctor often or take regular prescriptions, you won’t pay much toward your deductible. But that could change at any time. That’s the risk you take. If youre injured or get seriously ill, can you afford your plan’s deductible? Will you end up paying more than you save?

How Much Does Health Care Cost In Retirement

According to a report by HealthView Services Financial, a healthy 65-year-old couple retiring in 2019 can expect to spend more than $387,000 for retirement health care costs, not including long-term care.

This projection is based on the current value of the U.S. dollar and includes Medicare premiums, the costs of supplemental insurance and other out-of-pocket expenses for a man whose life expectancy is 87 and a woman whose life expectancy is 89.

Estimated annual health care costs, not including long-term care, for an average, healthy 65-year-old couple retiring in 2019

| Year |

|---|

Don’t Miss: Part Time Starbucks Benefits

Costs Of Public Health Insurance In Germany

How much does it cost for health insurance per month?

Social security contributions for public healthcare insurance is set at 14.6% of an employees gross salary, made up of a 7.3% contribution from the employer and 7.3% contribution from the employee. Each public healthcare provider is also allowed to charge an additional contribution of up to 1.7% which is paid by the employer.

The amount charged is capped at wages of 4,538 a month, which means the most anyone will pay is 360 a month . Everyone also pays a compulsory nursing care contribution of 3.05% , which is again shared by the employer and employee.

How Changing Your Excess Affects The Price Of Private Health Cover

As with every type of insurance, UK private health insurance policies use an excess to help control claims.

The insurer’s thinking is that if you have to pay the first part of a claim, then you’ll be more careful about incurring a claim at all and only really do it when you have to. Their fear without an excess would be that people would claim regularly as there would be no cost to them.

Excesses are typically charged either per year or per claim . Make sure you know which you have as the per claim excess will often work out more expensive.

All insurers give some degree of flexibility on the excess you have on your policy – for example, Vitality let you choose whether you have a per year or a per claim excess and what amount you’d like.

The excess can also have a material impact on cost – a high excess makes things cheaper.

For example, BUPA health insurance costs roughly £34 per month with a £500 excess for our 33-year-old example, but it leaps up to £52 per month for a zero excess. Read a review of Bupa health insurance here.

While hiking up the excess can make for attractive premium levels, buyers should remember that adding a high excess not only means more to pay when you have a big claim, it also means that you will be wholly responsible for claim amounts under the excess you choose.

You can compare UK prices for private health policies, and compare their excess levels, using Activequote.com, which allows a detailed comparison of health policies online.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Mental Health & Psychiatric Add

Many Health Insurance providers offer mental health insurance cover as an additional extra that you can add to your policy that either offers full or partial cover for private mental health treatment.

As standard many private medical insurance policies dont include mental health cover, you would pay an additional premium to add this to your policy.

The types of mental health treatment covered are typically categorised as inpatient psychiatric treatment or outpatient mental healthcare and therapies. Adding this to your policy will see premiums increase by about 10% .

Digging Deeper For Pricing Information

For more details, we consulted the 2020 Health Insurance Exchange Premium Landscape Issue Brief linked to the bottom of the press release. It reveals that 27-year-olds buying silver plans will see their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In fact, the benchmark plan premium for a 27-year-old in 2020 is a whopping $723 in Wyoming. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Mexicos 2020 benchmark plan premium for a 27-year-old is the lowest in the nation at $282.

All of these numbers only apply to the 38 states whose residents buy plans through the federal exchange at Healthcare.gov. Residents of California, Colorado, Connecticut, Idaho, Maryland, Massachusetts, Minnesota, Nevada, New York, Rhode Island, Vermont, Washington, and Washington, D.C. buy insurance through their state’s exchange.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees