Medical Expense Tax Credit

You can claim the cost of certain medicines, devices and treatments to get a medical expense tax credit.

You can claim these expenses for yourself, your spouse or common-law partner, or your children.

You may get the tax credit for expenses such as:

- changes you made to your home or car to make it more accessible

- accessible computer software

- braille printers

You usually need a prescription to claim disability supports.

You may get the disability supports deduction even if youre not eligible for the disability tax credit.

How Does The Health Care Tax Credit Work

When you apply for health insurance, the marketplace will estimate the tax credit using information you provide about your family, projected household income, and other factors such as whether anyone you are enrolling is eligible for other types of coverage. For example, you will need to provide your modified adjusted gross income plus that of every other member of your family.

Most people use all or some of their tax credits in advance to lower their monthly premium. In other words, the marketplace factors the tax credit into their monthly insurance bill when they apply for a policy.

Even though the credit is not usually a lump sum that you apply for at tax time every year, you still have to file a tax return that includes Form 8962: Premium Tax Credit. If not, you may not qualify for a tax credit in future years. By mid-February, you should receive an annual form 1095-A in the mail, with the necessary information about your insurance policy, premiums, and advanced payment of tax credits.

The health care tax credit is refundable, meaning if the amount of the credit is more than the amount of taxes you owe, you can receive the difference as a refund.

Health Coverage Tax Credit Vs Premium Tax Credit

Health coverage tax credits also lower your health insurance costs, but they’re not related to premium tax credits. HCTCs are refundable tax credits that pay 72.5% of the qualified health insurance premiums for eligible individuals and families. You would pay the remaining portion of the premium.

Eligibility for the HCTC differs from the health care tax credit mentioned above, as those credits depend on your income and family size. If you decide to claim HCTCs, then you’ll fill out Form 8885 .

You may be eligible if you meet one of the following requirements:

- You are in a Trade Adjustment Assistance program because of a qualifying job loss.

- You are between 55 and 64 years old and receive payments from the Pension Benefit Guaranty Corp.

If you receive the HCTC, then you’ll receive a Form 1099-H that outlines your disbursements. You can’t claim both the health coverage tax credit and the premium tax credit for the same health insurance coverage during the same months.

The HCTC program ended on Dec. 31, 2021. If Congress extends the program, the IRS will implement the change and notify affected participants.

Recommended Reading: Do I Need Pet Health Insurance

What Is An Example Of A Tax Credit

A tax credit is a dollar-for-dollar reduction of the income tax you owe. For example, if you owe $1,000 in federal taxes but are eligible for a $1,000 tax credit, your net liability drops to zero. Therefore, if your total tax is $400 and claim a $1,000 earned income credit, you will receive a $600 refund.

What Is An Advance Premium Tax Credit

An advance premium tax credit, or APTC, is the name for a premium tax credit when it is paid in advance each month to an enrollees insurance carrier. The alternative is to pay full-price for health insurance through the exchange/marketplace and then claim the premium tax credit from the IRS when you file your taxes.

You May Like: Do You Have To Get Health Insurance

Medical Expenses You Can Claim

To know for whom you can claim medical expenses, see How to claim eligible medical expenses on your tax return.

You can claim only eligible medical expenses on your tax return if you, or your spouse or common-law partner:

- paid for the medical expenses in any 12-month period ending in 2021

- did not claim them in 2020

Generally, you can claim all amounts paid, even if they were not paid in Canada.

For all expenses, you can only claim the part of the expense that you or someone else have not been and will not be reimbursed for. However, the expense can be claimed if the reimbursement is included in your or someone else’s income and the reimbursement was not deducted anywhere else on the tax return.

Does The Premium Tax Credit Have To Be Paid Back

Normally, people who under-estimate annual income and receive too much advanced premium tax credit during the year are required to repay some or all of the excess when they file their federal tax return for that year. However, the requirement to repay excess APTC resumed for the 2021 tax year and beyond.

Also Check: Does My Health Insurance Cover Abortion

Is It A Good Idea To Use Tax Credit For Health Insurance

The premium tax credit helps lower-income Americans pay for health insurance but, if youre not careful, you could end up owing money at tax time. Getting a lump sum at year end can help you save on taxes, but most elect to have advance sums applied to monthly premiums potentially altering their tax burden.

No Matter How You File Block Has Your Back

Read Also: Are Daca Recipients Eligible For Health Insurance

Getting Started In The Marketplace

To get started, visit HealthCare.gov or your states version of it. Either way, youll get a quick side-by-side comparison of the plans available to you.

The database allows you to choose from four tiers of health insurance: Bronze, Silver, Gold, and Platinum. Bronze plans are the least expensive but require the highest copays and deductibles. Platinum plans are the most expensive, and they may have more bells and whistles than you want or can afford.

During the enrollment process, youll learn whether youre eligible for the Advanced Premium Tax Credit or a cost-sharing reductionand if so, youll find out how much you can save. If you do qualify for savings, you must buy your plan through the Marketplace.

Senate Passes Sweeping Climate Health And Tax Package Putting Democrats On Cusp Of Historic Win

WASHINGTON Senate Democrats narrowly passed a sweeping climate and economic package on Sunday, putting President Joe Biden and his party on the cusp of a big legislative victory just three months before the crucial November midterm elections.

After a marathon overnight Senate session, the 51-50 vote was strictly along party lines, with all Republicans voting no and all Democrats voting yes. After Vice President Kamala Harris cast the tie-breaking vote, Democrats stood and applauded.

The legislation, called the Inflation Reduction Act, now heads to the House, which plans to return from its summer recess on Friday, pass the legislation and send it to Bidens desk for his signature.

“Its been a long, tough and winding road, but at last we have arrived. I know its been a long day and a long night. But weve gotten it done today,” Senate Majority Leader Chuck Schumer said on the Senate floor before the final vote.

“After more than a year of hard work, the Senate is making history. I am confident the Inflation Reduction Act will endure as one of the defining legislative feats of the 21st century.”

Recommended Reading: Does State Farm Offer Health Insurance

How Much Is A Tax Credit Worth

Tax credits directly reduce the amount of tax you owe, giving you a dollar-for-dollar reduction of your tax liability. A tax credit valued at $1,000, for instance, lowers your tax bill by the corresponding $1,000. Tax deductions, on the other hand, reduce how much of your income is subject to taxes.

What Does The Inflation Reduction Act Not Do

Although the Inflation Reduction Act is a dramatically scaled-back version of 2021s Build Back Better Act , the bills extension of the current ARP subsidy enhancements is identical to the ARP subsidy enhancement extension that was in the Build Back Better Act.

But there were some additional Build Back Better Act subsidy provisions that are not included in the Inflation Reduction Act: The Inflation Reduction Act will not close the Medicaid coverage gap that still exists in 11 states. It will not reinstate the temporary unemployment-related subsidies that were available in 2021. And it will not change the way affordability is determined for employer-sponsored health coverage.

You May Like: What Is The Best Private Health Insurance

What Forms Should You Use On Your 2021 Taxes

There are different forms that you will use to report your health insurance on your 2021 taxes. It is important to note that these forms will vary, based on:

Form 1095-A, Health Insurance Marketplace Statement. This form is used if you have purchased health insurance from a government-sponsored or private marketplace. The form will include the information that you need to complete Form 8962, which is used to receive a premium tax credit. Additionally, you will need to complete Form 1095-A for each insurance policy that you had for 2021. Our staff can help you with questions you may have about the Form 1095-A when you work with eHealth to purchase your health insurance.

Form 1095-B, Health Coverage. Your health insurer will typically send you this form to show that you and your family had health coverage throughout all or part of 2021.The form is not typically included in your tax return however, it does contain vital information that will help you to fill out your taxes properly.

Form 8941, Credit for Small Employer Health Insurance Premiums To calculate the credit. For detailed information on filling out this form, see the Instructions PDF for Form 8941.

Will I Qualify For The Subsidy

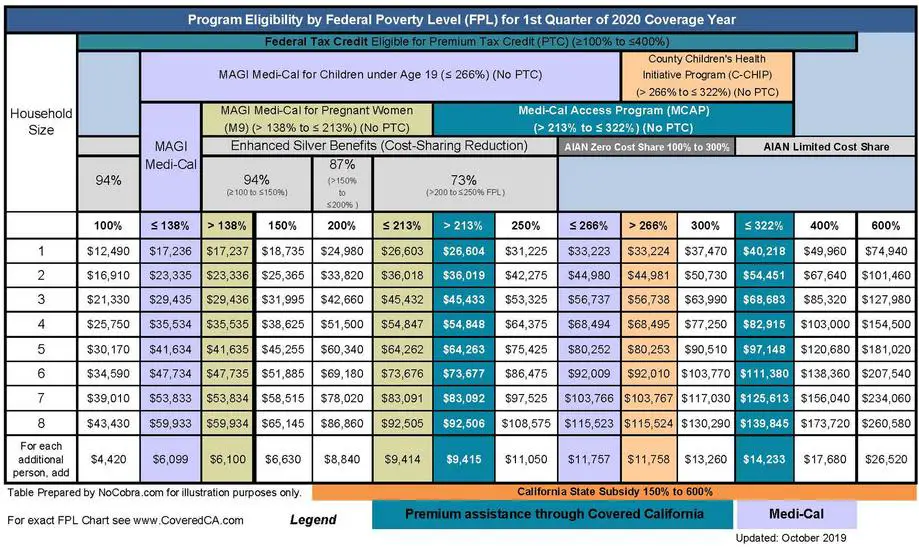

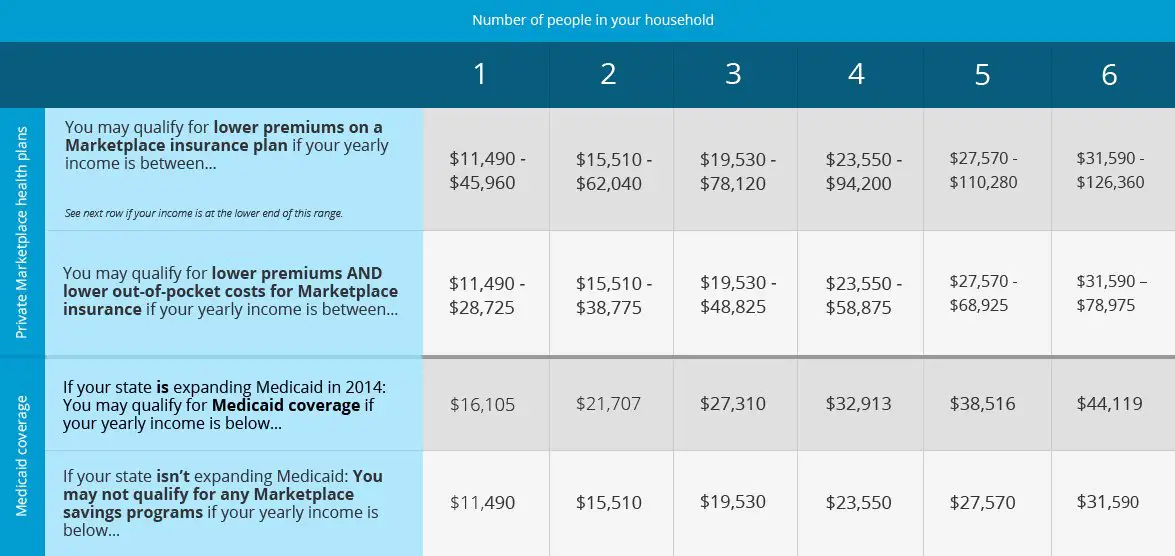

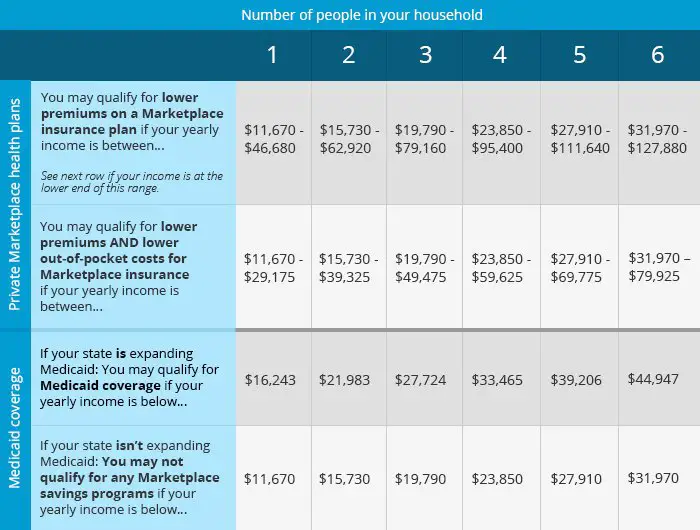

Prior to 2021, the rule was that households earning between 100% and 400% of the federal poverty level could qualify for the premium tax credit health insurance subsidy . Federal poverty level changes every year, and is based on your income and family size.

You can look up this years FPL here, and this article explains how income is calculated under the ACA.

But the American Rescue Plan has changed the rules for 2021 and 2022 : Instead of capping subsidy eligibility at an income of 400% of the poverty level, the ARP ensures that households with income above that level will not have to pay more than 8.5% of their income for the benchmark plan.

If the benchmark plan costs more than 8.5% of income, a subsidy is available, regardless of how high the income is. So the ARP accounts for the fact that full-price health insurance premiums are much higher in some areas than in other areas, and are higher for older enrollees. Subsidies are available in 2021 and 2022 to smooth out these discrepancies. But if a household earning more than 400% of the poverty level can pay full price for the benchmark plan and it wont cost more than 8.5% of their income, there is still no subsidy available.

- Household of one: 138% of FPL is $17,774, and 100% of FPL is $12,880

- Household of four: 138% of FPL is $36,570, and 100% of FPL is $26,500

But even if you meet the income qualifications, you may still be ineligible for a subsidy. That would be the case if:

You May Like: How To Choose A Health Insurance Broker

How Does The Tax Credit Work For Health Insurance

Find Cheap Health Insurance Quotes in Your Area

A premium tax credit can reduce your monthly health insurance cost. It’s only available for those who purchase insurance through a state or federal health insurance marketplace, and you must meet income and family size criteria to qualify. You’ll learn if you are eligible when you apply for a marketplace health insurance plan.

If you own a small business with fewer than 25 employees, you may also qualify for government subsidies, which can help pay for your employees’ health insurance.

If You Already Have A Marketplace Plan

You can also wait until you file and reconcile your 2021 taxes next year to get the additional premium tax credit amount. But, we recommend you update your application and review your plan options. You may be able to choose a plan with lower out-of-pocket costs for the same price or less than what youre currently paying.

Note: If you didnt update your application by early August, we tried to automatically apply these savings for you, starting September 1, 2021. We werent able to do this for everyone, so the only way to be sure you get these savings is to log in, and update your application yourself.

You May Like: How To Find Personal Health Insurance

Can I Get A Tax Credit If I Get Insurance From An Employer

In general, people who get insurance through an employer probably wonât use a state Marketplace. And the Marketplace is the only place where this kind of financial aid is available.

Some people, though, may want to buy a health plan through a Marketplace even though an employer offers affordable insurance. In that case, the employee will not be eligible for tax credits or subsidies, even if the familyâs income falls within the ranges listed above.

In some cases, an employerâs plan may not be affordable enough. If either of the statements below is true for you, you may enroll in a health plan in a state Marketplace:

- None of the health plans available from your employer covers at least 60% of your average health care costs.

- The cost of enrolling in a plan from your employer would cost more than 9.6% of your annual income.

If one of these statements is true and you do enroll, you may be eligible for a tax credit if your household income falls within the eligibility ranges listed above.

Read Also: Where To Get Health Insurance When Unemployed

How Does It Work

Participants in the HCTC program may select either of the following credit options:

- Yearly credit: You pay 100% of your premium for the entire year and then the IRS will either issue a refund to you or a credit against your federal taxes owed for 72.5% of your premium.

- Monthly credit: You pay 27.5% of your monthly premium to the IRS. The IRS adds the remaining 72.5% of your monthly premium, and pays your health plan administrator 100% of your monthly payment. This lowers your out-of-pocket payments for your monthly premiums.

NOTE: You may be able to change health care plans to receive the HCTC benefit.

Don’t Miss: Is Health Insurance Mandatory In New York

Who Qualifies For Premium Tax Credits

To qualify for a premium tax credit, you must meet the following requirements:

- Have a household income between 100% and 400% of the federal poverty level .

- File a tax return with a filing status thats not married filing separately.

- Arent eligible to be claimed as a dependent on someone elses tax return.

In addition, you or a family member must:

- Have had health insurance through the Marketplace for at least one month.

- Not be able to get affordable coverage through your employer.

- Not qualify for health insurance through a government program such as Medicaid, Medicare, or TRICARE.

How Do I Qualify For Health Insurance Tax Credit

Health care tax credit eligibility Generally, youll need to be earning an income of $140,000 or less as an individual, or $280,000 or less as a family to be eligible for the rebate. Everyone listed on the health insurance policy needs to be eligible to claim Medicare in order to receive the health care tax credit.

Don’t Miss: When Does Health Insurance Start