Eligibility For Marketplace Health Insurance And Premium Tax Credits

Not everyone is eligible for Marketplace health insurance, and some of those that are may not be eligible for premium tax credits to reduce or eliminate the cost of coverage.

To qualify, you:

- Must reside in the United States

- Must hold U.S. citizenship or be a U.S. national

- Cant be incarcerated

In addition to being eligible for a plan, Marketplace health insurance is designed for people who dont already have qualifying health coverage. If you have qualifying health coverage, you may be able to get a plan, but wont qualify for premium tax credits youll have to pay full price.

Qualifying health coverage is any health care plan that meets ACA standards, and can include:

- Independent health insurance purchased outside the Marketplace

- Medicaid

- Small Business Health Insurance Program Marketplace plans

- TRICARE

Medicare enrollees cant buy Marketplace health insurance to supplement their coverage, and cant purchase Marketplace dental coverage.

Greater Choice Off Exchange

The No. 1 reason for buying off-exchange is greater choice, says Peter Freska, a benefits consultant with The LBL Group in Los Alamitos, CA.

Health insurance companies can and do offer lots of health plans that aren’t available through the exchanges.

Under the Affordable Care Act, all plans must offer 10 essential benefits, inside and outside exchanges. But if you’re looking for a specific set of benefits beyond that, shopping off-exchange could give you a wide range of choices and opportunity to better tailor a policy to your needs.

Key Takeaways

- If you are ineligible for government subsidies, you may find the widest choice for health insurance plans outside your states health insurance exchange.

- Off-exchange health provider networks tend to be broader than those found within state exchanges.

- Prescription drug coverage benefits can be more robust outside health insurance exchange plans.

- This guide provides access to a list of best health insurers, based on actual policyholders or results.

How Will I Know If Im Eligible For Assistance To Purchase Health Insurance Outside Of Va

VA cant make this determination. If you use the Marketplace, you will find out if you can get lower costs on your monthly premiums for private health insurance plans. Remember, if you are enrolled in a VA health care program, you dont need to take additional steps to meet the health coverage requirements under the health care law.

Recommended Reading: Can A Pregnant Woman Get Health Insurance

What About Healthcare Cost Sharing Ministries

A health care sharing ministry is an organization that facilitates sharing of health care costs among individual and families who have common ethical or religious beliefs. A health care sharing ministry is not actual insurance, is not regulated by the Department of Insurance, does not use actuaries, does not accept the risk or make guarantees, and does not purchase reinsurance policies on behalf of its members.

While members of these plans are exempt from paying the tax penalty for not having health insurance, there is still a significant risk to these plans. Because these plans are not actual insurance and because of the significant risk we do not endorse these plans.

A Health Insurance Broker Or Agent

A health insurance broker or agent is a trained professional who can help you navigate the wide range of insurance options and enroll in the best health insurance plan for you. An agent may work for a single health insurance company while a broker will represent several companies at once. You dont pay any fees when working with agents or brokers, as theyre paid on commission for selling you a plan.

To find a broker or agent, you can use the federal governments Find Local Help tool to set up in-person, phone or email appointments. You can also enter your phone number or email address to be contacted by an agent or broker to talk about plan choices. Agents and brokers must be licensed in their states to sell health insurance and are often required to act in the best interest of the customer.

Read Also: How To Understand Health Insurance Plans

Private Health Insurance Plans Outside The Marketplace

Did you know that private health insurance plans can be purchased all year round?

Find Affordable Health Insurance In Your Area!

Despite President Trumps best efforts since taking office, the Affordable Care Act is still in place and doesnt appear to be going anywhere anytime soon. So, if youre looking to enroll in a new health insurance plan through the marketplace, youll have to wait until the Open Enrollment Period. However, anyone who wishes to purchase private health insurance online, from an insurance broker, or directly from a health insurance company can do so at any time throughout the year.

For many people, especially under recent laws, private insurance plans are the better option and provide many additional benefits compared to marketplace plans, which is why well now present you with everything you need to know about purchasing private insurance.

Why You Should Purchase Health Insurance

If you find yourself in one of the above situations and lack health insurance coverage, it’s important to enroll in an individual plan as soon as possible.

Even though you’re not required to have insurance, you cannot predict when an accident will occur that will require medical attention. Even a minor broken bone can have major financial consequences if you’re uninsured.

If you purchase insurance through the Health Insurance Marketplace, you may be eligible for income-based premium tax credits or cost-sharing reductions. The Health Insurance Marketplace is a platform that offers insurance plans to individuals, families, and small businesses.

The Affordable Care Act established the marketplace as a means to achieve maximum compliance with the mandate that all Americans be enrolled in health insurance. Many states offer their own marketplaces, while the federal government manages an exchange open to residents of other states.

While you may not be able to afford the same kind of plan an employer would offer you, any amount of coverage is more advantageous than going without. In the event of a major accident or a long-term illness, you will be prepared.

Recommended Reading: What Type Of Insurance Is Health Partners

How To Buy Private Health Plan Even If You Dont Qualify For Assistance

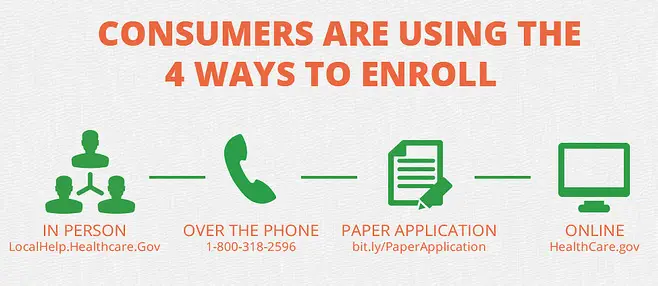

If you dont qualify for lower costs based on your income, you can still get coverage 4 ways according to HealthCare.gov:

- Directly from an insurer. Although you cant buy insurance direct from the insurer, you can use their site to shop for plans. You can contact any health insurance company and see plans available in your area. Many have websites that let you compare all plans available from that company. You can take a look at the advertisers on our site or use the HealthCare.Gov Plan Finder website, which presents information about private health plans available outside the Marketplace. Insurers generally wont allow you to actually enroll in a plan through them, but they can assist you in understanding the plans they offer.

- With the help of an insurance agent or broker. Agents usually work for a single health insurance company. Brokers sell plans from a number of companies. They can help you compare plans based on features and price and complete your enrollment. You dont pay more to use an agent or broker. Theyre paid by the insurance company whose plans they sell.

- From an online health insurance seller. These online services offer health plans from a number of insurance companies. They let you compare prices and features and then enroll with the insurance company.

- Through the Health Insurance Marketplace. You can apply and enroll through the Marketplace whether or not you qualify for lower costs based on your income.

Do I Have To Use The Marketplace To Get A Marketplace Plan

The only way to get a marketplace plan or cost assistance is through your states Health Insurance Marketplace. That being said, some major brokers and providers can help you find out if you qualify for subsidizes and some can help you enroll in a marketplace plan. So in some cases you have your choice between getting help from your states marketplace or from an outside broker or agent. The benefit to choosing an agent outside the marketplace is that they can present other non-marketplace plan options too.

Also Check: Can You Buy One Month Of Health Insurance

How To Find Private Insurance Plans

When it comes to finding private insurance plans, you generally have a few different options. Your first option is to contact a local insurance broker to discuss the various plans they offer. Alternatively, you could also browse and purchase a private insurance plan through a health insurance providers website. While both of these options are viable, the problem is that it can be quite difficult to directly compare each insurance policy and decide which one is the right fit for your needs and your budget.

Life Changes That Can Qualify You For A Special Enrollment Period

Important: If you had a change more than 60 days ago but since January 1, 2020

If you qualified for a Special Enrollment Period but missed your deadline to enroll in coverage because you were impacted by the COVID-19 emergency, you may be eligible for a Special Enrollment Period.

If you or anyone in your household lost qualifying health coverage in the past 60 days OR expects to lose coverage in the next 60 days, you may qualify for this Special Enrollment Period through the application.

If you had a life event other than a loss of coverage more than 60 days ago and missed your Special Enrollment Period, contact the Marketplace Call Center at 1-800-318-2596 for more information.

Read Also: Is It Required By Law To Have Health Insurance

Affordable Care Act Standards

Employer-based health insurance must meet ACA standards. If you have a job-based plan, you can still purchase Marketplace health coverage. However, if your employers health care plan meets ACA standards, youll have to pay the entire premium for a Marketplace plan.

The ACA requires employers to offer affordable health insurance, defined as less than 9.83% of your income for the lowest-cost self-only coverage. This standard doesnt apply if you enroll in a family plan, or one offered by your spouses employer. For example, if youre single and only buy job-based coverage for yourself, the lowest-cost available plan must be less than 9.83% of your income. But if youre married and enroll in family coverage, the rate can exceed that percentage.

The ACA also requires qualifying health coverage to pay at least 60% of covered health care costs. If you arent sure if your job-based health insurance meets ACA standards, ask your employer to complete the Marketplaces Employer Coverage Tool. If the employers plans dont meet ACA standards, you may qualify for premium tax credits for a Marketplace plan.

Short Term Medical Insurance Stm

Due to recent changes in the law, these plans are now able to be purchased for 36 months at a time in many states.

STM plans are low-cost alternatives to the expensive ACA options. They are 100% real health insurance with large PPO networks. There are many benefit levels available to suit all budgets. While these plans do not cover pre-existing conditions and typically offer very little in the way of prescription coverage, they provide maximum premium savings.

Don’t Miss: Can I Sign Up For Health Insurance

What Is A Non

Non-ACA Plan is a very generalized term that people use to describe anything that is not compliant with the ACA. The problem is that a lot of plans that arent actual insurance get lumped in like faith-based cost-sharing plans which are not insurance. There are also a lot of new plans from carriers that no one has ever heard of pushing plans that sound like the greatest thing since sliced bread. None of these have passed our sniff test and as a result, the only non-ACA plan that we recommend is Short Term Medical Insurance . Due to recent changes in the law, these plans are now able to be purchased for 12-36 months at a time.

You Probably Wont Qualify For Marketplace Savings

If you have an offer of job-based coverage and enroll in a Marketplace plan instead, you probably wont qualify for a premium tax credit and other savings even if your income would qualify you otherwise.

Youd have to pay full price for a Marketplace plan even if you dont enroll in the insurance your employer offers.

FYI

If you have an offer of job-based insurance, the only way youll qualify for savings on a Marketplace plan is if your employers insurance offer doesnt meet minimum standards for affordability and coverage. Most job-based plans meet these standards.

“Affordable” plans and the 9.61% standard

A job-based health plan is considered “affordable” if your share of the monthly premiums for the lowest-cost self-only coverage that meets the minimum value standard is less than 9.61% of your household income.

You may pay more than 9.61% of your household income on monthly premiums if youre enrolled in your employers spouse or family coverage. But affordability is determined only by the amount youd pay for self-only coverage.

The minimum value standard

A health plan meets the minimum value standard if it pays at least 60% of the total cost of medical services for a standard population and offers substantial coverage of hospital and doctor services.

In other words, in most cases a plan that meets minimum value will cover 60% of covered medical costs. Youd pay 40%.

Most job-based plans meet the minimum value standard.

Read Also: Can Aflac Replace Health Insurance

How Buying Private Health Insurance Works

Some Americans get insurance by enrolling in a group health insurance plan through their employers.

Medicare provides health care coverage to seniors and the disabled, and Medicaid has coverage for low-income Americans.

Medicare is a federal health insurance program for people who are 65 or older. Certain young people with disabilities and people with end-stage renal disease may also qualify for Medicare. Medicaid is a public assistance healthcare program for low-income Americans regardless of their age.

If your company does not offer an employer-sponsored plan, and if you are not eligible for Medicare or Medicaid, individuals and families have the option of purchasing insurance policies directly from private insurance companies or through the Health Insurance Marketplace.

Where Can I Buy Private Health Insurance

A good place to start looking for coverage is the Health Insurance Marketplace created in 2014 by the Affordable Care Act . On the marketplace for your state, you can look through the details of private health insurance plans, and compare the cost and benefits of each. If your state does not have its own marketplace, use Healthcare.gov.

Recommended Reading: How Long Can I Get Cobra Health Insurance

If You Want To Cancel Your Marketplace Plan

- If you plan to end your Marketplace coverage and are not already enrolled in your employers health coverage: Check with your employer to see if you are eligible to enroll in your employers health coverage this time of year.

- If you end all health coverage and dont replace it: You may have to pay a fee for 2018 plans and earlier. There are also important health and financial risks if you dont have health coverage. Learn more about the risks and costs of not having health coverage.

- If your financial assistance ends for your Marketplace plan: You may be eligible for a special enrollment period to change to another Marketplace plan without financial assistance.

Enroll In Qualifying Health Coverage

Under the terms of the Affordable Care Act, private insurance plans must still meet all of the minimum coverage requirements. This means that they must provide coverage of pre-existing conditions, have no cap on annual benefits and provide free preventative care. However, not all private insurance plans meet the minimum essential coverage requirements, in which case you would still have to pay the individual mandate penalty since your insurance doesnt meet the minimum requirements. For this reason, it is essential that you check with the insurance provider to make sure that any plan youre considering provides at least the minimum level of coverage required under the health care law.

Recommended Reading: Does Health Insurance Cover Baby Formula

Changing To A Marketplace Plan

If you have job-based coverage, you might be able to change to a Marketplace plan. But you probably wont qualify for a premium tax credit or other savings. As long as the job-based plan is considered affordable and meets minimum standards, you wont qualify for savings. Most job-based plans meet these standards.

Learn about changing to a Marketplace plan.

What Are Government Subsidized Health Plans

Low-income individuals and households with minor children may qualify for CHIP. The CHIP program covers children under 19 and their parents or primary caregivers. Texas CHIP charges only a $50 enrollment fee and minimal co-pays. For those who qualify, CHIP offers the lowest cost, comprehensive insurance plan in Texas.

Alternatively, some Texas children qualify for Medicaid.

Texas declined to expand Medicaid to cover adults.

The Marketplace offers a health insurance resource that has helped millions of Americans obtain health insurance. Despite this, millions more fall through the cracks of this system. Those who cannot qualify for Marketplace subsidies may find the plans offered there unaffordable. Thankfully, there are other options. Many Texans either qualify for CHIP or can find more affordable plans that are ACA-compliant or non- ACA-compliant on the private market.

Don’t Miss: Does Colonial Life Offer Health Insurance

What Is The Affordable Care Act

The Affordable Care Act, also known as the health care law, was created to provide more Americans with access to affordable health insurance, improve the quality of health care and health insurance, and reduce health care spending in the U.S.

The Health Insurance Marketplace helps individuals find health coverage. On the Marketplace, some people may be eligible for lower costs on health premiums and out-of-pocket costs based on their income.